SEA Group Deep Dive Report

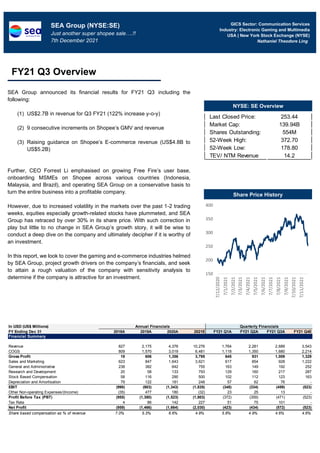

- 1. SEA Group announced its financial results for FY21 Q3 including the following: (1) US$2.7B in revenue for Q3 FY21 (122% increase y-o-y) (2) 9 consecutive increments on Shopee’s GMV and revenue (3) Raising guidance on Shopee’s E-commerce revenue (US$4.8B to US$5.2B) Further, CEO Forrest Li emphasised on growing Free Fire’s user base, onboarding MSMEs on Shopee across various countries (Indonesia, Malaysia, and Brazil), and operating SEA Group on a conservative basis to turn the entire business into a profitable company. However, due to increased volatility in the markets over the past 1-2 trading weeks, equities especially growth-related stocks have plummeted, and SEA Group has retraced by over 30% in its share price. With such correction in play but little to no change in SEA Group’s growth story, it will be wise to conduct a deep dive on the company and ultimately decipher if it is worthy of an investment. In this report, we look to cover the gaming and e-commerce industries helmed by SEA Group, project growth drivers on the company’s financials, and seek to attain a rough valuation of the company with sensitivity analysis to determine if the company is attractive for an investment. GICS Sector: Communication Services Industry: Electronic Gaming and Multimedia USA | New York Stock Exchange (NYSE) Nathaniel Theodore Ling SEA Group (NYSE:SE) Just another super shopee sale….!! 7th December 2021 FY21 Q3 Overview NYSE: SE Overview Share Price History In USD (US$ Millions) Annual Financials Quarterly Financials FY Ending Dec 31 2018A 2019A 2020A 2021E FY21 Q1A FY21 Q2A FY21 Q3A FY21 Q4E Financial Summary Revenue 827 2,175 4,376 10,276 1,764 2,281 2,689 3,543 COGS 809 1,570 3,019 6,481 1,118 1,350 1,680 2,214 Gross Profit 18 606 1,356 3,795 645 931 1,009 1,329 Sales and Marketing 623 847 1,643 3,621 617 854 928 1,222 General and Administrative 238 382 642 755 163 149 192 252 Research and Development 20 58 133 793 129 160 217 287 Stock Based Compensation 58 116 290 500 102 112 123 163 Depreciation and Amortisation 79 122 181 248 57 62 76 - EBIT (990) (903) (1,343) (1,835) (348) (334) (459) (523) Other Non-operating Expenses/(Income) (35) 477 180 (32) 23 25 13 - Profit Before Tax (PBT) (955) (1,380) (1,523) (1,803) (372) (359) (471) (523) Tax Rate 4 86 142 227 51 75 101 - Net Profit (959) (1,466) (1,664) (2,030) (423) (434) (572) (523) Share based compensation as % of revenue 7.0% 5.3% 6.6% 4.9% 5.8% 4.9% 4.6% 4.6% 150 200 250 300 350 400 7/12/2020 7/1/2021 7/2/2021 7/3/2021 7/4/2021 7/5/2021 7/6/2021 7/7/2021 7/8/2021 7/9/2021 7/10/2021 7/11/2021 Last Closed Price: 253.44 Market Cap: 139.94B Shares Outstanding: 554M 52-Week High: 372.70 52-Week Low: 178.80 TEV/ NTM Revenue 14.2

- 2. Founded in 2009, SEA Group (NYSE:SE) is a holding company (Fig 1) that operates three key businesses: (1) Garena – A global game developer and publisher that provides users to popular and engaging mobile/PC online games, specifically curated and personalised for the target markets of focus. Garena also licenses and publishes games developed by third parties (Fig 2).Game monetisation is primarily generated via a “freemium” model; Users will top up in-game currencies to purchase in-game virtual items and season passes. Garena tracks its growth in revenue from the Quarterly Paying Users (QPU), who generally spend a set amount of money on a monthly basis in order to enjoy a more personalised game playing experience (Fig 3). User acquisition and retention is promoted via e-sports competitions – each tournament is estimated to bring about 300K viewers and 2M hours viewed on average.. (2) Shopee – A marketplace platform fronting e-commerce (deeper focus on high margin categories such as fashion, health and beauty, home and living, and baby products) between buyers and sellers across Southeast Asia, with subsequent expansion into other demoraphic regions such as Latin America. Shopee is supported by integrated payment, logistics, fulfilment, and other value-added services (affiliate marketing, live-steaming, gamification elements, etc) (Fig 4). Occasionally, Shopee has mentioned that it conducts outright sales on specifc goods to meet buyers’ demands, enabling the company to offer better product assortment. Shopee charges a take rate off the GMV via (a) Transaction fees – A charge to all Shopee sellers on successful orders (b) Service fees – A charge to sellers who are participating in Coins Cashback and Free Shipping Programme (c) Commission fees – A charge to sellers using ShopeeMall. Shopee has extra revenue streams via marketing and campaigns, SEO optimisation, etc. Due to the lack of granular data, we’ll approximate Shopee’s revenue as a blended take rate off the GMV transaction on the platform (Fig 5). Business Overview Fig 1: SEA Group’s History Fig 2: Garena’s Portfolio - 200 400 600 800 1,000 1,200 1,400 0 200 400 600 800 2019Q1 2019Q2 2019Q3 2019Q4 2020Q1 2020Q2 2020Q3 2020Q4 2021Q1 2021Q2 2021Q3 Game QAUs (Million) Game QPUs (Million) Revenue Generated (US$M) Fig 3: Digital Entertainment Breakdown Fig 4: Example of Value-added Services

- 3. (3) SeaMoney – SEA Group’s digital financial services business that was launched less than 2 years ago. SeaMoney currently offers mobile wallet services, payment processing, credit related digital financial offerings, and other finanical services. Revenue is primarily generated via commissions to third-party merchants and interest from borrowers with respect to the consumer credit business (loans and potentially BNPL – Buy Now Pay Later). SeaMoney is naturally a strategic play and a necessary product launch as Sea Group continues to create a sticky platform around Garena and Shopee – as an internal wallet helps to offer methods to purchase goods/in-game items and retain monetary value within the eco-system. Further, provision of financial services allows further launches of various financial services into loans, financing, and payments, due to the nature of the business and access to customer data to create profiling, etc (Fig 7). However, due to the lack of granular data in Sea Group’s financial statements, we’ll lump the take rate of SeaMoney’s transactions into the e-commerce revenue segment. Further analysis on each revenue stream will be conducted on Sea Group’s competitive positioning since this segment of the report establishes a high- level overview on what the company does and specific metrics that are tracked over time. Corporate Governance First, SEA Group possesses a strong and diverse pool of key management staff and directors within the board – notably in gaming, technology, venture building, and operations. Further, certain individuals sitting on the Board of Directors (Ren Yu Xin, Chris Zhi Min) come from significant competitors such as Tencent and Lazada/Alibaba, thus they are able to provide a wealth of expertise to navigate SEA Group through its unchartered terrain in the near to long run (Annex A). Next, SEA Group enjoys a diversified base of institutional shareholders (T. Rowe Price, J.P Morgan, Tiger Global Management, Capital Research and Management) with less than 10% equity concentration, preventing a possibility of price crashes via sudden selloffs (Fig 8). Lastly, Forrest Li (CEO) possesses close to 9% of the Company despite the current trajectory and state of the company. Such high weightage and “skin- in-the-game” shows more promise on his intrinsic motivation to scale the company into the elusive US$1T valuation mark. - 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 0 2 4 6 8 10 12 14 16 18 2019Q1 2019Q2 2019Q3 2019Q4 2020Q1 2020Q2 2020Q3 2020Q4 2021Q1 2021Q2 2021Q3 GMV (US$B) Blended Take Rate (%) Fig 5: E-commerce Breakdown - 5.0 10.0 15.0 20.0 25.0 30.0 35.0 40.0 Total Payment Volume (US$B) SeaMoney QPUs (Million) Fig 6: SeaMoney Breakdown Fig 7: Mobile Wallet Marketing Strategy Institutional Shareholders % T. Rowe Price Group 6.1% Capital Research And Management 5.1% Sands Capital Management 3.7% Garena ESOP Program 2.7% Fmr Llc 2.5% J.P. Morgan Asset Management 1.9% Tiger Global Management 1.9% Baillie Gifford & Co 1.7% Jennison Associates 1.3% Goldman Sachs Group 1.1% Li, Xiaodong 8.3% Fig 8: Significant Shareholders

- 4. On a macro-overview, the e-commerce and gaming industries are expected to grow at a 14.3%/12.6% CAGR of up to US$234/314B in 2026 respectively (Fig 9). To determine the industry drivers, we factor SEA Group’s position in its operating landscape (predominantly Southeast Asia) and unique dynamics applicable only to SEA Group that will chart the growth of the industries of focus in the long run. (1) Rising mobile penetration rates Mobile penetration rates in Southeast Asian countries exceed 50%, with some slightly advanced countries peaking in the 70-80% regions (Fig 10). Further, most individuals in Southeast Asia have indicated preference to own mobile phones instead of laptops/computers due to convenience and affordability (most consumers across Southeast Asia have access to affordable Android phones such as Oppo, Huawei, Vivo, and OnePlus – a smartphone can start as low as $150-$300). Therefore, most platforms (B2C services) catered towards customers are built around the accessibility of a smartphone: e- commerce, online ordering, mobile payments, digital banking, mobile gaming, and more. Additionally, countries in Southeast Asia are ranked amongst the top 10 in mobile hours used on a global scale – Thailand (5.13 hours/day), Philippines (4.58hours/day), Indonesia (4.35hours/day), Malaysia(4.02hours/day), Vietnam (3.12hours/day), and Singapore (2.58hours/day). Extended duration spent using mobile phones is crucial and beneficial to transition consumers into adapting the usage of e-commerce, receiving marketing materials from mobile sources (live mobile streaming, social media marketing), and exploring mobile versions of computer games (for example, the Multiplayer Online Battle Arena (MOBA) transitioned from PC games such as H1Z1 to a proliferation of mobile games such as COD Mobile, Free Fire, PUBG, etc). Therefore, increasing mobile penetration rates in Southeast Asia creates growth opportunities for SEA Group to tap into e-commerce, gaming, and financial services. (2) Progressive venture funding in logistics and infrastructure within SEA Capital and infrastructure spending are required to support the growth of e- commerce and distribution in Southeast Asia. For example, fulfilment across archipelagos for Indonesia and Philippines remain to be challenging without the proper development of logistics infrastructure. The venture market has picked up on these apparent trends on the infrastructure side of things and funding has been deployed to strategic industry segments – logistics and e- commerce have received over US$5B in funding across various sub segments, and subsequent funding remains robust in the long run (Fig 11). Peering deeper into the landscape, we’re able to identify various sub- segments within e-commerce/logistics that will play a huge role towards e- commerce’s continued growth (Fig 12): (a) 3PL deliveries (Lalamove, Ninjavan, J&T Express) - Tech-enabled start-ups that provide deliveries across a myriad of goods upon demand, also adjusting for delivery volume. MSEs can ride on this tech enabled logistics wave to sell goods with deliveries that they had no prior access to (since incumbent B2B logistics couriers cater only for a minimal fixed volume of parcels to be delivered) (b) 4PL deliveries (Locad, Kargo) – Asset-light business model that emulates a “cloud” logistics delivery service. These start-ups partner Industry Overview - 50 100 150 200 250 300 350 2021 2026 E-commerce Gaming Fig 9: SEA Industry (US$B) Source: Mordor, Bain, Temasek - 40.0% 80.0% 120.0% Brunei Malaysia Singapore Thailand Philippines Vietnam Indonesia Cambodia Laos Myammar Fig 10: Mobile Penetration Rate (%) - 500 1,000 1,500 2,000 2,500 3,000 3,500 Fig 11: Venture Funding (US$M) Source: Statista Source: Vertex Ventures

- 5. with fleets, warehouse operators, and facility managers to maximise supply chain movement and turnover time. Users can scale up/down their delivery volume accordingly and will only pay for the exact service they require. This concept is highly relevant to Southeast Asia since the ten countries have proximity to one another yet these countries or even neighbouring cities have differing seasonal trends (this is opposed to Europe for example, where countries across the region are shut for Christmas and New Year’s, thus allowing for a predictable change in demand/supply of goods). • Further improvement via investment into the logistics space is necessary for e-commerce to grow further due to difficulty in (1) shipping goods to rural archipelagos, (2) managing return policies on dilapidated routes, and (3) supporting dynamic and rapid changes in tastes and preferences. (c) E-commerce enablers (SellinAll, iStoreiSend) – Plays a function of an intermediary that helps brick-and-mortar natives transition into online sales. E-commerce enablers have expedited their traction/top-line growth with Covid-19 acting as a catalyst, physical store owners have been recognising the need to diversify their revenue streams. Further, a seller will be able to manage multiple marketplaces from a centralised platform. (d) Cross-border trade and fulfilment agencies (1Exports) – Start-ups operating in this domain help to facilitate export compliance and facilitation, as cross-border trade around Southeast Asia seem overlooked – each country has its own rules and regulations to follow (general export controls, documentation). (3) Rising middle income population According to USASEAN Business Councill and Asian Development Bank, ASEAN’s economy is projected to grow at a consistently rate of 5.5% over the next 20-30 years and become the 4th largest economy by 2050 (Fig 13). Substantiated by progressive stability in the political climate, growth opportunities, investments towards SEA countries, and remittances back to home countries from abroad, the middle class is expected to triple from 91M to 334M in 2030. As such, we can expect quality of life to increase as consumers increase their average order value when consuming various goods and services, translating to further growth in the e-commerce/gaming industries. Assuming the basket size each e-commerce purchase across countries will eventually catch up to Singapore’s value, we can expect Gross Merchandise Value (GMV) of e-commerce to quadruple. Competitive Positioning I believe that Shopee’s competitive position can be potentially anchored on: (1) A mobile-first marketing strategy – providing an end-to-end online shopping experience directly on the mobile application. Further, most promotional campaigns are distributed through social media applications or even within the application itself (Fig 14). (2) Hyper-local approach – Shopee understands that each country within Southeast Asia possesses distinct characteristics and challenges, thus piquing consumers’ attention will differ accordingly (Fig 15). The company has partnered with local banks and logistics operations for each country to cater to local demands. Further, advertisements often include local influencers and celebrity ambassadors to promote upcoming sale events. This strategy has propelled Shopee’s growth as 60% of respondents in Ecomeye’s survey affirmed that they trust celebrity endorsers for their purchasing decisions. Fig 12: Venture Funding Landscape Fig 13: GDP vs Urbanization Growth Fig 14: Shopee’s Selling Formulae

- 6. (3) Unique target markets and client profile – Shopee has conducted expansion towards onboarding MSMEs. Although these clients may not bring about a large amount of GMV transactions on the platform and thus may not bring about decent unit economics, I opine it to be the right client profile for Shopee to target. MSMEs contribute to 60% of a country’s labour face and 40% of a country’s GDP on average. Supporting the growth of MSMEs will allow Shopee to cement its position as a dominant marketplace platform in SEA. Moreover, due to the company’s relative success in SEA, Shopee has continued its expansion in LATAM – its geographical profile is largely similar to SEA (requiring hyper-localised marketing distribution, diverse cultures, and characteristics amongst countries, MSMEs contribute a large amount of the country’s GDP, etc). Other marketplace platform incumbents such as Lazada, Pinduoduo, JD.com, and Amazon do not have a large footprint in LATAM, presenting an excellent opportunity for SEA to cement its position as a market leader. However, SEA Group has strong competitors targeting similar industry segments. We shall take a deeper dive into the categories and attempt to sieve out any highlights/lowlights SEA Group may have. 1. Gaming Notable companies include Tencent and Valve (more on developing PC games) Even though Tencent is a strategic investor of Garena, there can be a cannibalisation of revenue as other game developer companies such as Riot Games, Supercell and Epic Games compete directly with Garena on its suite of products – first person/third person/hero shooter MOBAs. For simplicity purposes and due to the extend of Tencent’s investments on a huge number of the game developer companies, I’ll consolidate all these competitors under Tencent. From Fig 16, we can identify the relative saturation in the MOBA segment of gaming, despite MOBA being one of the most popular game genres amongst casual gamers. Further, MOBAs have been gravitating out of first-person/third-person shooter player setting and moving into an “action-role” type of game play. A notable example is Pokémon Unite, a new action role MOBA that was released by Timi Studios (Tencent subsidiary) at Sep 2021. (Fig 17) The mobile game has amounted to over 30 million downloads, awarded “Best Game on Google Play”, and amassed 2,600 streamers broadcasting over 300,000 hours of view time (ranked 122 currently). A benchmark comparison will be that its figures have surpassed Maplestory’s, a popular MMORPG game with a 15-year history. As consumers’ taste and preference are evolving with time, one should not ignore upcoming genres in game production, thus dictating the success/failure of Garena’s current pipeline of games. 2. E-commerce Notable companies operating in the same market segment and geographical regions include Amazon, Lazada, Tokopedia, Bukalapak, and BliBli.com. Despite relative stiff competition, Shopee stands as the market leader for e- commerce within SEA, being able to knock off Lazada from its reigns not too long ago (Fig 18). In summary, we compare the three bigwigs in their services amongst differing segments, identifying Shopee to lead in product differentiation apart from minor shortfalls such as lack of advanced parcel tracking and product return timeline (Fig 19). Another key thing to note (not established in the table below) is the lack of trustworthy electronic sellers in Shopee. For Singapore at least, Lazada has been associated as the go-to when purchasing higher end consumer products, whereas Shopee is more popular with ad-hoc purchases on Fig 15: Hyper Local Marketing Strategy Fig 16: Gaming Competitors Fig 17: Pokemon Unite Gameplay Shopee 49% Tokopedia 20% Lazada 19% Bukalapak 4% Blibli 3% Tiki 2% Sendo 1% Zalora 1% Qoo100 1% Shopee Tokopedia Lazada Bukalapak Blibli Tiki Sendo Zalora Qoo100 Fig 18: E-commerce Traffic Breakdown Source: ASEAN Council

- 7. perishables. This is largely due to the quality of sellers onboarded, with more sellers on Shopee selling knock-off goods from prominent brands. Highlights (1) Reaping the benefits from low-hanging fruits Breaking out of the norm which corporates tend to pursue for high average order value (AOV) and high margin segments, SEA Group has benefitted from pursuing the lower hanging fruits due to the unique economic situation of SEA and LATAM. Despite earning revenue from lower margin businesses, SEA Group compensates the downside with an even higher sales volume – eventually netting higher revenue gain than to try and expand its revenue pursuits in developed economies. We can identify great examples of these low-hanging fruits via: (a) Extended focus into MSMEs across geographical regions Shopee has emphasized a huge amount of focus in supporting MSMEs across various countries. For example, Shopee has offered to digitize over 100,000 MSMEs in Malaysia, providing up to RM3,000 per business – this is not including similar offerings in other countries such as Brazil and Indonesia (Fig 20). I opine this to be a smart move by the company, since MSMEs contribute roughly 8-10% of the country’s GDP. Additionally, local consumers are fiercely loyal towards MSMES due to strong cultural roots and affordable pricing that most MNCs are unable to compete with. We can refer these outcomes to most international companies attempting to penetrate Southeast Asia – Subway/KFC/Starbucks in Vietnam and Walmart/7-11 in Indonesia - and failing terribly. Navigating sales in Southeast Asia is tricky as one must account for the economic situation, cross religious and cultural beliefs, location tradition, and lifestyle. Fortunately, Shopee has figured out the willing formulae and will be attempting to replicate the same success in LATAM, which encompass the same dynamics as SEA. (b) Entry-level games to cater for a target audience On the gaming side, Garena’s launch of Free Fire as a “low-quality” MOBA caters towards developing economies with entry level smart phones – sufficient to run Free Fire and enjoy the MOBA aspects of gaming. The game’s popularity has skyrocket in the developing countries of Garena’s focus, and the trend is highly like to remain. This goes to show us how important product market fit is and being able to understand your customer profile and Highlights/Lowlights Fig 19: Bigwig Competitive Landscape Fig 20: E-commerce Campaign, Malaysia

- 8. constraints. Should Garena have remained its stand to push COD Mobile to other countries, receptiveness wouldn’t be that high due to the high specific requirements to run the game; Apple and Samsung phones would be the only devices able to run COD Mobile. (2) Building services around an eco-system To wrap up the whole eco-system, the launch of SeaMoney aims to onboard the unbanked and underbanked population across developing countries. By entrenching a larger population within the eco-system (a prime example will be Grab, Fig 21), the turnover of money increases and this will drive up the revenue of Sea Group. Adding on, the use of an internal wallet will also reduce costs paid to other payment processors, since most transactions are conducted internally. Lastly, Shopee has been quick to onboard key payment providers on its platform unique to each country – Gcash and Coins.ph in Philippines, Maybank2u in Malaysia, etc. By creating a suite of services adjusted to consumers’ preference and convenience, traction and volume on SEA Group’s platforms will intuitively increase with time. (3) Improving operating structure and stock-based compensation as a % of revenue SEA Group has managed to control its operating structure from blowing out of proportion, and as such we are able to see improving margins over the past few FYs (Fig 22). Should management be able to control their expenditures effectively, there is huge promise that the company is on the right track to read profitability by FY26/27 as projected by the financial model (will be discussed further into the report). (4) Shopee taking over as a market leader in SEA As a Singaporean, Lazada was the go-to marketplace platform over the past few years when I wanted to make a purchase on various item categories. Shopee on the other hand was a very haphazard C2C platform which I wasn’t comfortable using, as the next substitute that will instantly strike out to consumers was switching to Carousell instead. However, Shopee was able to overcome various doubts and has become a flagship product of SEA Group. Catalysts stand aplenty here, such as excessive cult-like marketing with catchy songs/dances, which ironically ingrained its brand into us consumers, access to MSME type of products which can’t be purchased elsewhere, a myriad of group buy options, and to a certain extent, the ability to purchase knock-off products to fulfil our needs for “consumerism”. Ultimately, Shopee’s marketing fully takes the cake here, helping the company propel its status as the leading e-commerce provider in SEA (Evident as Shopee took over Lazada as a market leader in e-commerce at end 2019). Lowlights (1) Relatively messy UI and unpleasant UX (Shopee) Albeit a subjective opinion, I personally am not a fan of Shopee’s UI as it feels like an information dump on the consumer. First, Shopee has added a form of advertising when browsing through products, which can typically come off as abrasive for a consumer like myself, who wants to do a “get-in-get-out” kind of transaction ASAP (since I already know what I’m intending to purchase). Second, the product information segments are well segmented by Lazada as you scroll down the product (Fig 23), whereas Shopee lacks this feature and thus the information presentation feels very unstructured. Typically for those reasons, when I’m purchasing an expensive product (which I will want to acquire more information specifics prior to making a purchase), I’m always more compelled to visit Lazada first. Shopee on the other hand, feels more of a platform to make one-time rash purchases that are often low in price. Fig 21: Building an Eco-system - 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 2016A 2017A 2018A 2019A 2020A 2021E Sales and Marketing General and Administrative Research and Development Share based compensation Fig 22: OPEX as % of Revenue (%) Source: Grab

- 9. (2) Potential D2C Competition (Shopee) With the rise in venture funding to build e-commerce infrastructure, payment mechanisms, underpriced social medial platforms for advertising, and gradual attitudes toward brand loyalty – D2C provides an alternate avenue for consumers to purchase their products, with the possibility to even experience cost savings since the sales process skips the middleman (marketplace platform connecting buyer to seller). Various VCs have been covering the concerns of D2C being a possible competitor to e-commerce marketplaces (PlugandPlay APAC, Insignia Ventures – you can check out their white papers by googling them), so this is a threat that should not be overlooked. (3) Uptake of “action” MOBAs (Garena) With Timi Studio’s recent release of Pokemon Unite, Garena may have trouble competing with gaming bigwigs as each company seeks to provide the best gaming experience for consumers. Supercell is also intending to roll out a line of games (Clash Quest, Clash Mini, and Clash Heroes) that can draw back gamers into the Supercell array of games. (4) High EV/Revenue valuation premium Compared with other companies operating e-commerce services, SEA Group is currently placed at a high 30.4x EV/LTM Revenue premium, almost 4 times larger than the mean (7.9x) (Fig 24). The valuation difference is even more stark when we peer into the competitor’s operating statistics – JD.com and Pinduoduo for example have been reporting way higher revenue growth for their current valuation – thus from a valuation perspective, SEA Group may not look like an attractive investment on a grander scheme of things. (5) Difficulty in penetrating into LATAM (primarily Shopee) Albeit of a rational and strategic move to continue expansion into LATAM, SEA Group may be vastly underestimating the concerns on penetrating into the LATAM market, such as: (a) Limited payment methods Fedex reported in its 2020 report that 80% of households use cash as the primary form for monetary transactions, although the figure of alternate payment methods have been increasing. However, adoption rates will continue to stay low for a prolonged period and eventual uptake will require a significant amount of vested time. (b) Lack of proper logistics infrastructure Unreliable customs clearance, last mile, and reverse logistics remain a huge obstacle to the eventual growth of LATAM’s e-commerce industry. Slapped with high insurance premiums on safe delivery of products, most local consumers would rather not use e-commerce and instead maintain their purchases with local retailers (c) Inefficient custom clearance In a private study conducted by Americas Market Intelligence in 2016, trial packages shipped across various Latin American countries often resulted in lost or damaged packages. Further, another study conducted by the World Bank also revealed that a parcel requires 110 hours on average to comply with customs documentation and border compliance – this is hardly a supportive factor for cross border e-commerce (Fig 25). More cross border challenges need to be addressed via improvements in infrastructure or consolidations in cross-border trade regulations, but the current climate presents these factors as hindrances to the potential of e- commerce in LATAM. Fig 23: Lazada’s Information Layout Company Name EV/LTM REV EV/NTM REV Sea Limited 30.4x 9.9x Amazon 4.6x 3.4x Alibaba Group Holding Limited 2.9x 1.9x JD.com 0.9x 0.6x Pinduoduo 6.0x 3.2x Jumia Technologies AG 5.2x 4.4x Coupang 3.7x 2.0x Chewy 3.6x 2.7x MercadoLibre 13.8x 6.2x Mean 7.9x 3.8x Median 4.6x 3.2x Fig 24: Comparable Companies Country Trading Rank Custom Clearance (Hours) Import Compliance Costs USA 36 9 275 $ Germany 40 1 - $ Canada 50 3 335 $ Panama 57 30 540 $ Dominican Republic 63 38 619 $ China 65 72 448 $ Mexico 66 62 550 $ Chile 71 90 340 $ Costa Rica 73 86 495 $ Guatemala 83 104 442 $ Brazil 106 54 482 $ Ecuador 109 144 325 $ Peru 110 144 780 $ Argentina 125 252 1,320 $ Colombia 133 186 595 $ Fig 25: Trade Indicators Source: Market Intelligence

- 10. Due to the current unprofitability of the company, past valuation metrics such as ROA, ROE, ROIC are not applicable to analyze the company We’ll look to project the overall revenue growth and operating structure to determine if the company is able to find the “trigger” – flipping the business model to profitability. Historical revenue grew at a 14.9% CAGR of up to US$4.4B in FY20 and will grow at a 10.7% CAGR of up to US$150B in FY27 (Fig 26). Revenue is primarily segmented into (a) Digital Entertainment, (b) E-commerce and other services, and (c) outright sales of goods where Shopee holds inventory and marks up an array of products for sale. To reiterate from the business overview segment (Fig 27), (a) Digital entertainment revenue is generated from the total amount of monthly paying users of Garena’s suite of games, who are set a percentage profitability on consuming in-game items. (b) E-commerce revenue is generated from a blended percentage take rate off the total Gross Merchandise Value (GMV) generated across all products/services on Shopee. (c) Sales of goods is a mark up of the inventory cost of various products that Shopee chooses to sell. It is to note that Shopee’s e-commerce revenue segment will comprise of >50% of SEA Group’s total revenue by FY27, presenting the sole catalyst that will drive up the stock’s price and valuation. I estimate GMV to grow at around 11-15% y-o-y (hitting US$1.2T in GMV by FY27) and blended take rate to be at a range of 6-7% (inclusive of SeaMoney transactions). Garena on the other hand will be SEA Group’s cash cow and a source of funding to aggressively expand Shopee into other countries and continents. The company is projected to be EBITDA positive by FY26 and will look to hit stability in margins by FY30. Additionally, the company’s operating structure (both COGS and OPEX) are projected as a % of revenue for each line item (Fig 28 & 29). These projections will be in line with the operating structures of other e-commerce platforms. In USD (US$ Millions) Actuals Estimates FY Ending Dec 31 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E Financial Analysis Profitability Gross Margin 2.2% 27.8% 31.0% 36.9% 36.4% 35.4% 35.2% 35.7% 36.6% 37.9% EBITDA Margin (110.2%) (35.9%) (26.6%) (15.4%) (9.6%) (7.3%) (4.2%) (0.4%) 3.8% 8.4% Profit Margin (116.4%) (67.5%) (38.0%) (19.8%) (10.4%) (8.6%) (5.7%) (2.3%) 1.5% 5.6% Liquidity Current Ratio 1.9 1.9 1.2 1.0 0.9 0.9 0.9 1.0 1.1 Quick Ratio 1.5 1.5 0.8 0.6 0.5 0.5 0.5 0.6 0.7 Debt/Equity Ratio 3.5 2.1 4.4 10.6 68.4 (115.3) 49.6 14.9 6.6 Returns Earnings per Share (2.84) (3.38) (3.47) (3.66) (3.09) (4.17) (4.41) (2.82) 2.71 15.18 Financial Analysis Fig 26: Financials (US$M) (40,000) - 40,000 80,000 120,000 160,000 Revenue EBITDA Net Profit/(Loss) - 40,000 80,000 120,000 160,000 Sales of goods E-commerce and other services Digital entertainment Fig 27: Revenue Segments (US$M) - 30.0% 60.0% 90.0% 120.0% 150.0% 180.0% 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E Digital entertainment COGS E-commerce COGS COGS (Outright Sales) Fig 28: COGS Projections (% of revenue)

- 11. The company has been improving its margins and operating structure despite the aggressive expansion employed on Shopee and I posit that improvements on these line items will continue moving forward, thus reflecting them on the company’s projections. A DCF methodology will be applied to SEA Group since the company is generating free cash flow despite unprofitability and deducting out share- based compensation – this is evidenced by a long turnover in its current liabilities section (specifically accrued revenue and accrued expenses) and a controlled share-based compensation structure. The robustness of the DCF will be cross-checked with sensitivity analysis given how a high-growth company usually falls under a wide valuation spectrum. Weighted Average Cost of Capital (WACC) WACC (Fig 30) is estimated at 10.5% for SEA Group. Cost of debt is calculated by taking the blended average of the convertible debt held by the company and adding the 10-year risk-free rate. Cost of equity is calculated with the CAPM formula, reflecting USA’s equity risk premium, risk-free rate, and SEA Group’s 5-year Beta. Fair Value/Share Using the exit multiple and perpetuity growth method for exit valuation, we arrive at a fair value/share of $372.86 and $409 .58 for each respective method. EV/EBITDA is pegged to JD.com EV/NTM EBITDA multiple since the two companies are comparable in grabbing market share at an accelerated pace in their target markets and facing similar growth trajectories. The perpetuity growth is capped at 5% since e-commerce and fintech services are currently in its growth stages and revenue growth will not cap out anytime soon. As a result, the share prices seem to be priced a discount currently and SEA Group looks like an attractive investment for a high-growth company in a rapidly growing industry (Fig 31) Option Value Conversion It is imperative to account for RSUs and value of options so that we can attain the true fair value/share of the company. The inputs are consolidated, and the Black-Scholes option pricing model is used (Fig 32) to determine the value of the outstanding options that will dilute the initial equity value of the company. Further, the new equity value will be divided across the unaccounted RSUs, representing the “true” fair value per share of the company (Fig 7). (20.0%) - 20.0% 40.0% 60.0% 80.0% 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E Other Operating Expenses/income Sales and Marketing General and Administrative Research and Development Share based compensation Valuation Fig 29: OPEX Projections (% of revenue) Input Rate Source Risk free rate 1.4% US 10-year Treasury Beta 1.30 Capital IQ Equity Risk Premium 7.6% USA Cost of Equity 11.3% CAPM Cost of Debt 2.0% Blended corporate rate+risk free rate Tax Rate 17.0% US Corporate Tax Rate WACC 10.5% Fig 30: WACC Calculation Discounted Cash Flow Total Valuation EBITDA Perpetuity Total of present value of cash flows 23,403 23,403 Present value of terminal value 187,056 207,421 Total Enterprise Value 210,458 230,824 Net Debt, Non-controlling interest 3,661 3,661 Equity Value 206,798 227,163 Share Count (Millions) 555 555 Share Price 372.86 $ 409.58 $ Implied Upside 43.4% 57.5% Fig 31: Fair value/Share Calculation Fig 32: Option Value Calculation Input Value Source Stock Price $ 280.00 Market Data Strike Price of Option $ 13.73 20-F Expiration of Options 7.0 20-F (Weighted Avg) Volatility (Std Dev) 47.97% Damodaran Database Annualised Div Yield - No issuance Treasury Bond Rate 1.4% US 10-year Treasury No. options outstanding 25,298,468 20-F No. shares outstanding 554,625,132 Market Data Value per option $ 267.14 Value of outs. Options 6,758,186,126 $

- 12. With the dilution effect accounted for (representing over US$6.7B in dilution across 10M RSUs), SEA Group’s true fair value per share will be priced at US$354.6 via EBITDA multiple method and US$390.8 via terminal growth method. This represents a further downside from both current share price and the initial fair value per share of the company. Sensitivity Analysis A sensitivity analysis is applied to SEA Group to weigh out different possibilities on where the share priced will be headed towards, depending on the scenario and the type of valuation methodology employed. A football field visualization (Fig 34) shows us that SEA Group is following more on the “market valuation” than the potential growth moving forward. Thus, the company has seen a depression in its share price from an all-time high of US$370 to a recent low of US$253. Should SEA Group start to regain confidence from investors in show that they are able to hit the growth rates that management has posited – a rebound back to its recent highs can be achieved. SEA Group’s share price has plummeted over the past 1-2 weeks over a retracement in growth stocks, a gradual recovery in interest rates, and an increase in market volatility (fear and volatility indices have been trending upwards). Due to a favorable position on how SEA Group can potentially push to US$100 billion in revenue and turn EBITDA positive within 5-6 years (assuming a conservative operating structure and healthy market conditions), an investment in the company can pose potential upside. The only concern lies on its relative pricey valuation, given how other e-commerce competitors are reporting similar growth percentages but have lower valuation multiples (EV/Revenue). However, most comparable companies are China technology firms that have faced further depression in their stock prices due to the China Communist Party clamping down on rules and regulations. Upon factoring other variables as mentioned, SEA Group looks to be a decent investment upon comparison – China e- commerce/gaming companies are facing huge scrutiny, relatively mature companies such as Amazon have a large market capitalization (US$1.8T as per early Dec 21) and most of its alpha is priced in. The next best investment covering e-commerce, gaming and financial services across strong developing economies is SEA Group – hence if an investor is comfortable with entering at a high valuation multiple, this investment decision is rather sound in the US$190-US230 for a first initial entry and dollar cost averaging upon lower prices. Disclaimer The information set forth herein has been obtained or derived from sources generally available to the public and believed by the author(s) to be reliable, but the author(s) does not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decision by a person or entity. This information does not constitute investment advice, nor is it an offer or a solicitation of an offer to buy or sell any security. Personal Take Fig 33: True Fair Value/Share Discounted Cash Flow Total Valuation (Incl Stock Comp) EBITDA Perpetuity Total of present value of cash flows 23,403 23,403 Present value of terminal value 187,056 207,421 Total Enterprise Value 210,458 230,824 Net Debt, Non-controlling interests,preferred securities 3,661 3,661 Value of Equity Options 6,765 6,765 Equity Value 200,033 220,399 Share Count (Millions) 564 564 Share Price 354.69 $ 390.80 $ Implied Upside 36.4% 50.3% $150 $300 $450 $600 EV/EBITDA Multiple EV/EBITDA Multiple (Dilution) DCF Growth (5%) DCF Growth (5%, Dilution) 52 week trading Avg High Target Price Current Price Fig 34: Football Field Valuation

- 13. Annex A: Management Team

- 14. In USD (US$ Millions) Actuals Estimates Period Ending Dec 31 2016A 2017A 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E Income Statement Revenue Service revenue Digital entertainment 328 365 462 1,136 2,016 4,125 5,678 7,731 10,427 13,942 18,445 24,122 E-commerce and other services 18 47 270 823 1,777 5,100 8,691 15,247 25,808 42,142 66,361 100,747 Sales of goods 0 2 94 217 582 1,051 2,173 3,812 6,452 10,536 16,590 25,187 Total Revenue 346 414 827 2,175 4,376 10,276 16,542 26,789 42,688 66,620 101,397 150,056 19.8% 99.7% 163.1% 101.1% 134.8% 61.0% 61.9% 59.3% 56.1% 52.2% 48.0% Cost of revenue Cost of service revenue Digital entertainment 185 218 267 436 702 1,204 1,533 2,010 2,607 3,346 4,242 5,307 E-commerce and other services 47 107 443 907 1,736 4,284 6,953 11,740 19,098 29,921 45,126 65,486 Cost of goods sold - 2 99 227 581 993 2,042 3,545 5,936 9,587 14,931 22,416 Total Cost of Revenue 233 327 809 1,570 3,019 6,481 10,528 17,295 27,641 42,854 64,299 93,209 Gross Profit 113 87 18 606 1,356 3,795 6,013 9,494 15,047 23,765 37,097 56,847 Gross Margin (%) 32.7% 21.1% 2.2% 27.8% 31.0% 36.9% 36.4% 35.4% 35.2% 35.7% 36.6% 37.9% Operating Expenses/(Income) Other operating income (2) (3) (10) (16) (190) (288) (496) (804) (1,281) (1,999) (3,042) (4,502) Sales and marketing 187 426 623 847 1,643 3,621 5,293 8,037 11,953 17,321 24,335 33,012 General and administrative 112 138 238 382 642 755 1,158 1,741 2,561 3,664 5,070 6,753 Research and development 21 29 20 58 133 793 959 1,420 2,049 2,865 3,853 4,952 Stock based compensation - - 58 116 290 500 695 1,045 1,537 2,198 3,042 4,052 Depreication and Amortisation - - 79 122 181 248 487 833 1,162 1,630 2,199 2,974 Total Operating Expenses 318 590 1,008 1,508 2,699 5,631 8,096 12,271 17,981 25,680 35,457 47,240 Operating income/(loss) (205) (502) (990) (903) (1,343) (1,835) (2,083) (2,777) (2,934) (1,914) 1,640 9,607 EBITDA (911) (781) (1,162) (1,587) (1,596) (1,945) (1,772) (284) 3,839 12,581 EBITDA Margin (%) (110.2%) (35.9%) (26.6%) (15.4%) (9.6%) (7.3%) (4.2%) (0.4%) 3.8% 8.4% Non-Operating Expenses (Income) Interest income (1) (3) (12) (34) (25) (75) (76) (70) (95) (173) (349) (793) Interest expense 0 27 31 48 148 39 59 77 106 144 180 254 Investment loss (gain), net (9) (34) (9) (12) 18 9 - - - - - - Changes in fair value of convertible notes - 52 (41) 473 0 - - - - - - - Forex loss (gain) 2 4 (5) 2 39 (6) - - - - - - Total Non-operating Expenses (Income) (8) 46 (35) 477 180 (32) (18) 7 11 (29) (169) (539) Profit/(Loss) Before Tax (197) (549) (955) (1,380) (1,523) (1,803) (2,065) (2,784) (2,945) (1,886) 1,809 10,146 Taxes 9 11 4 86 142 227 (351) (473) (501) (321) 308 1,725 Tax Rate (%) (4.3%) (2.0%) (0.4%) (6.2%) (9.3%) (12.6%) 17.0% 17.0% 17.0% 17.0% 17.0% 17.0% Shares of results of equity investees 20 2 3 3 (1) - - - - - - - Net Profit/(Loss) (225) (561) (962) (1,469) (1,663) (2,030) (1,714) (2,311) (2,445) (1,565) 1,501 8,421 Net Margin (%) (65.1%) (135.5%) (116.4%) (67.5%) (38.0%) (19.8%) (10.4%) (8.6%) (5.7%) (2.3%) 1.5% 5.6% Net profit (loss) attributable to non-controlling interests (2) (1) 0 5 (6) Net loss attributable to Sea Ltd's ordinary shareholders (223) (560) (963) (1,474) (1,657) Loss per share Basic and diluted (1.30) (2.72) (2.84) (3.38) (3.47) Weighted average of shares used in loss per share computation Basic and diluted 171,127,788 205,727,195 338,472,987 436,601,801 477,264,888 Balance Sheet Assets Cash and Cash Equivalents 3,119 6,167 7,260 8,685 11,542 16,806 26,540 45,040 77,193 Restricted cash 435 859 859 859 859 859 859 859 859 Accounts receivables 187 363 845 1,351 2,172 3,438 5,330 8,056 11,840 Prepaid expenses and other assets 535 1,054 2,131 3,461 5,686 9,087 14,089 21,140 30,644 Loans receivable - 286 286 286 286 286 286 286 286 Inventories, net 27 64 141 227 367 585 913 1,389 2,056 Short-term investments 102 126 237 369 550 794 1,108 1,487 1,902 Amount due from related parties 5 19 28 45 73 117 183 278 411 Total current assets 4,410 8,939 11,786 15,283 21,536 31,973 49,307 78,535 125,191 Property and equipment, net 319 386 823 1,195 1,620 2,247 3,070 4,074 5,518 Operating lease right of use assets, net 183 235 481 710 1,076 1,597 2,308 3,235 4,374 Intangible assets, net 15 40 74 125 180 269 381 524 683 Long term investments 114 190 356 554 825 1,191 1,662 2,230 2,853 Prepaid expenses and other assets 66 205 205 205 205 205 205 205 205 Loans receivable - 117 117 117 117 117 117 117 117 Restricted cash 17 27 27 27 27 27 27 27 27 Deferred tax assets 70 100 327 678 1,152 1,652 1,973 1,665 (59) Goodwill 31 216 216 216 216 216 216 216 216 Total assets 5,224 10,456 14,414 19,110 26,953 39,494 59,266 90,828 139,125 Liabilities Accounts payable 69 122 408 653 1,050 1,661 2,574 3,889 5,714 Accrued expenses and other payables 981 2,033 4,084 6,346 9,950 15,146 22,308 32,590 45,966 Advances from customers 65 161 366 589 954 1,520 2,373 3,611 5,344 Amounts due to related parties 35 43 107 173 284 454 704 1,057 1,532 Short-term borrowings 1 - - - - - - - - Operating lease liabilities 56 75 75 75 75 75 75 75 75 Deferred revenue 1,098 2,150 4,786 7,478 11,743 18,128 27,378 40,281 57,556 Convertible notes 29 - - - - - - - - Income tax paayable 27 52 52 52 52 52 52 52 52 Total current liabilities 2,362 4,636 9,877 15,365 24,108 37,036 55,463 81,555 116,240 Accrued expenses and other payables 26 36 36 36 36 36 36 36 36 Long-term borrowings 0 - - - - - - - - Operating lease liabilities 144 178 425 653 1,019 1,540 2,252 3,178 4,317 Deferred revenue 161 343 343 343 343 343 343 343 343 Convertible notes 1,356 1,840 1,059 1,059 1,057 883 - - - Deferred tax liabilities 1 2 2 2 2 2 2 2 2 Unrecognised tax benefits 1 0 0 0 0 0 0 0 0 Total long term liabilities 1,689 2,399 1,865 2,093 2,457 2,804 2,633 3,559 4,699 Total liabilities 4,052 7,035 11,742 17,458 26,565 39,839 58,096 85,114 120,938 Equity Class A shares 0 0 0 0 0 0 0 0 0 Class B shares 0 0 0 0 0 0 0 0 0 Additional paid in capital 4,687 8,527 9,808 10,503 11,550 13,261 16,342 19,384 23,436 Accumulated Other Comprehensive Income (Loss) 5 5 5 5 5 5 5 5 5 Statutory reserves 0 2 2 2 2 2 2 2 2 Retained earnings / (loss) (3,531) (5,151) (7,181) (8,896) (11,207) (13,651) (15,217) (13,715) (5,294) Non-controlling interests 10 37 37 37 37 37 37 37 37 Total equity 1,173 3,420 2,672 1,652 388 (345) 1,170 5,714 18,187 Total liabilities and equity 5,224 10,456 14,414 19,110 26,953 39,494 59,266 90,828 139,125 Balance? (Y/N) Y Y Y Y Y Y Y Y Y Annex B: Financial Model

- 15. Cash Flow Statement Cash flow from operations: Net income/(loss) (962) (1,469) (1,663) (2,030) (1,714) (2,311) (2,445) (1,565) 1,501 8,421 Adjustments in cash flow operations: Allowance for credit losses 2 4 58 - - - - - - - Amortization of discount on convertible notes 14 33 88 - - - - - - - Amortisation of intangible assets 24 5 12 17 32 51 82 121 161 216 Changes in fair value of convertible notes (41) 473 0 - - - - - - - Deferred income tax (20) (4) (27) (227) (351) (473) (501) (321) 308 1,725 Depreciation of property and equipment 55 117 169 231 455 781 1,080 1,509 2,038 2,757 Gain on disposal of subsidiaries - - (62) - - - - - - - Gain on disposal of investments (8) (0) - - - - - - - - Gain on re-measurement of equity interest - (5) (3) - - - - - - - Impairment loss on intangible assets 5 - 6 - - - - - - - Impairment loss on investments 3 1 61 - - - - - - - Loss on debt extinguishment - - 24 - - - - - - - Net foreign exchange differences (10) (0) 11 - - - - - - - Prepaid licensing fees written off 5 - - - - - - - - - Share based compsensation 58 117 290 500 695 1,045 1,537 2,198 3,042 4,052 Share of results of equity investees 3 3 (1) - - - - - - - Unrealized Loss from Marketable Securities - - 24 - - - - - - - Others 3 2 4 - - - - - - - Changes in operating working capital: Inventories (28) 12 (39) (77) (86) (140) (218) (328) (476) (667) Accounts receivables (39) (87) (175) (482) (506) (822) (1,266) (1,891) (2,727) (3,784) Prepaid expenses and other assets (159) (215) (527) (1,076) (1,331) (2,225) (3,402) (5,002) (7,050) (9,504) Amounts due from related parties (3) 1 (11) (9) (17) (28) (44) (66) (95) (133) Operating lease right of use assets - (62) (45) - - - - - - - Accounts payable 30 31 51 287 244 397 611 913 1,316 1,825 Accrued expenses and other payables 355 354 944 2,050 2,262 3,605 5,195 7,162 10,282 13,376 Advances from customers 3 34 93 205 223 365 566 852 1,239 1,733 Operating lease liabilities - 71 46 - - - - - - - Deferred revenue 204 637 1,162 2,636 2,692 4,265 6,385 9,250 12,903 17,275 Income tax payable (0) 17 26 - - - - - - - Amounts due to related parties 11 (12) 1 64 67 111 170 250 353 475 Net change in operating working capital 373 782 1,526 3,598 3,548 5,528 7,999 11,141 15,743 20,596 Net cash provided by (used in) operating activities (497) 59 517 2,089 2,665 4,621 7,752 13,084 22,793 37,768 Cash flow from investment activities: Purchase of property and equipment (177) (240) (336) (668) (827) (1,206) (1,708) (2,332) (3,042) (4,202) Purchase of intangible assets (1) (7) (21) (51) (83) (107) (171) (233) (304) (375) Purchase of investments (70) (118) (220) (473) (695) (1,018) (1,451) (1,999) (2,636) (3,301) Proceeds from disposal of property and equipment 1 1 2 - - - - - - - Proceeds from disposal of intangible assets 0 - - - - - - - - - Proceeds from sale and maturity of investments 23 1 20 196 365 567 842 1,213 1,690 2,263 Distributions from investments - 0 1 - - - - - - - Acquisition of businesses,net of cash acquired - - (92) - - - - - - - Disposal of subsidiaries, net of cash disposed - - 15 - - - - - - - Change in loans receivables - - (256) - - - - - - - Net cash provided by (used in) investing activities (225) (363) (887) (996) (1,239) (1,764) (2,488) (3,351) (4,293) (5,615) Cash flow from financing activities: Proceeds from issuance of convertible notes, net 565 1,139 1,141 - - - - - - - Purchase of capped call - (97) (136) - - - - - - - Proceeds from borrowings 2 1 1 - - - - - - - Repayment of borrowings (3) (3) (32) - - - - - - - Proceeds from issuance of ordinary shares, net 5 1,539 2,970 - - - - - - - Transaction with non-controlling interests (26) - (21) - - - - - - - Proceeds from issuance of ordinary shares, net 4 - - - - - - - - - Contribution buy non-controlling interest - 1 5 - - - - - - - Payments for exchange and conversion of convertible notes - - (50) - - - - - - - Change in accrued expenses and other payables - - (146) - - - - - - - Net cash provided by (used in) financing activities 547 2,580 3,733 - - - - - - - Forex effect on cash (13) 25 80.7 - - - - - - - Change in cash and cash equivalents (187) 2,300 3,443 1,093 1,425 2,857 5,265 9,733 18,501 32,152

- 16. Reconciliation Share options (US$ 000s) Cost of revenue 3,333 734 7,382 Sales and marketing 2,746 3,922 15,631 General and admin 47,354 98,861 220,511 Research and dev 4,687 12,009 46,722 Share options (US$ Millions) Cost of revenue 3 1 7 Sales and marketing 3 4 16 General and administrative 47 99 221 Research and development 5 12 47 Depreication and Amortisation 79 122 181 Cost of revenue Cost of service revenue Digital entertainment 185 218 267 436 702 E-commerce and other services 47 107 446 908 1,744 Cost of goods sold - 2 99 227 581 Operating Expenses/(Income) Other operating income (2) (3) (10) (16) (190) Sales and marketing 187 426 705 970 1,831 <<Deduct D&A from sales and marketing General and administrative 112 138 241 386 657 Research and development 21 29 68 157 354 Reconciliated statements Other operating income (2) (3) (10) (16) (190) Sales and marketing 187 426 623 847 1,643 General and administrative 112 138 238 382 642 Research and development 21 29 20 58 133 Stock based compensation 58 116 290 Depreication and Amortisation 79 122 181 Cost of service revenue Digital entertainment 267 436 702 E-commerce and other services 443 907 1,736 Cost of goods sold 99 227 581 5.7% 0.6% 2.5% 3.0% 4.7% 3.4% 5.4% 4.5% 81.5% 85.6% 76.0% 81.0% 8.1% 10.4% 16.1% 11.5% Deferred Taxes Schedule 12.6% For 2021 Tax Rate 17.0% Beginning Net Operating Loss (NOL) Balance: (4,603) << Accumulation of previous years' NOL since we don’t know whats the actual accumulated loss over the years PBT (1,803) (2,065) (2,784) (2,945) (1,886) 1,809 10,146 Less: Income Taxes 227 351 473 501 321 (308) (1,725) Beginning NOL Balance: 4,603 6,406 8,472 11,256 14,201 16,087 14,278 Add: NOLs created 1,803 2,065 2,784 2,945 1,886 - - Less: NOLs used - - - - - (1,809) (10,146) Ending NOL Balance 6,406 8,472 11,256 14,201 16,087 14,278 4,132 NOL adjusted pre-tax income (1,803) (2,065) (2,784) (2,945) (1,886) - - Cash taxes payable - - - - - - - Increase/(Decrease) in DTA 227 351 473 501 321 (308) (1,725) DTA 100 327 678 1,152 1,652 1,973 1,665 (59) Deferred income taxes (227) 351 473 501 321 (308) (1,725) In USD (US$ Millions) Actuals Estimates Period Ending Dec 31 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E Working Capital Schedule Revenue 827 2,175 4,376 10,276 16,542 26,789 42,688 66,620 101,397 150,056 COGS 809 1,570 3,019 6,481 10,528 17,295 27,641 42,854 64,299 93,209 Current Assets Accounts receivables 187 363 845 1,351 2,172 3,438 5,330 8,056 11,840 Days receivable 31.4 30.3 30.0 29.8 29.6 29.4 29.2 29.0 28.8 Prepaid expenses and other assets 535 1,054 2,131 3,461 5,686 9,087 14,089 21,140 30,644 Days receivable 124.4 127.4 120.0 120.0 120.0 120.0 120.0 120.0 120.0 Inventories 27 64 141 227 367 585 913 1,389 2,056 Days receivable 4.5 5.4 5.0 5.0 5.0 5.0 5.0 5.0 5.0 Amount due from related parties 5 19 28 45 73 117 183 278 411 Days receivable 0.8 1.6 1.0 1.0 1.0 1.0 1.0 1.0 1.0 Total Current Assets 754 1,501 3,144 5,084 8,299 13,228 20,514 30,862 44,951 Current Liabiliites Accounts payable 69 122 408 653 1,050 1,661 2,574 3,889 5,714 Days payable 16.1 14.7 14.5 14.4 14.3 14.2 14.1 14.0 13.9 Accrued expenses and other payables 981 2,033 4,084 6,346 9,950 15,146 22,308 32,590 45,966 Days payable 228.1 245.8 230.0 220.0 210.0 200.0 190.0 185.0 180.0 Deferred revenue 1,098 2,150 4,786 7,478 11,743 18,128 27,378 40,281 57,556 Days payable 184.2 179.4 170.0 165.0 160.0 155.0 150.0 145.0 140.0 Advances from customers 65 161 366 589 954 1,520 2,373 3,611 5,344 Days payable 10.9 13.5 13.0 13.0 13.0 13.0 13.0 13.0 13.0 Amount due to related parties 35.0 42.6 107 173 284 454 704 1,057 1,532 Days payable 8.1 5.2 6.0 6.0 6.0 6.0 6.0 6.0 6.0 Total Current Liabiliites 2,248 4,509 9,750 15,238 23,981 36,909 55,336 81,428 116,113 Total Operating Working Capital (1,494) (3,008) (6,606) (10,155) (15,683) (23,681) (34,823) (50,566) (71,162) Change in total operating working capital (1,514) (3,598) (3,548) (5,528) (7,999) (11,141) (15,743) (20,596)

- 17. In USD (US$ Millions) Actuals Estimates Period Ending Dec 31 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E Depreciation and Amortisation Schedule CAPEX 177 240 336 668 827 1,206 1,708 2,332 3,042 4,202 CAPEX as % of Revenue 21.4% 11.0% 7.7% 6.5% 5.0% 4.5% 4.0% 3.5% 3.0% 2.8% Accumulated Depreciation 319 386 618 1,072 1,854 2,934 4,443 6,481 9,238 PPE (Gross) Computers 339 522 984 1,556 2,390 3,570 5,183 7,286 10,192 Office equipment, furniture and fittings 25 32 60 94 145 216 314 441 617 Leasehold improvements 129 162 305 483 742 1,108 1,608 2,261 3,163 Motor vehicles 15 6 12 18 28 42 61 86 121 Warehouse equipment 3 7 14 22 33 50 72 102 142 Land 21 23 43 68 104 155 225 317 443 Building 1 2 4 6 10 14 21 29 41 Construction in progress - 1 2 3 4 7 10 14 19 Total PPE 533 755 1,423 2,250 3,456 5,163 7,495 10,537 14,738 Acquisition/CAPEX Computers 462 572 834 1,181 1,612 2,104 2,906 Office equipment, furniture and fittings 28 35 50 71 98 127 176 Leasehold improvements 143 177 259 366 500 653 902 Motor vehicles 5 7 10 14 19 25 34 Warehouse equipment 6 8 12 17 23 29 41 Land 20 25 36 51 70 91 126 Building 2 2 3 5 6 8 12 Construction in progress 1 1 2 2 3 4 5 Existing PPE 755 Total CAPEX 668 827 1,206 1,708 2,332 3,042 4,202 % of CAPEX Average CAPEX into respective PPE Computers 44.9% 69.2% 69.2% Office equipment, furniture and fittings 3.3% 4.2% 4.2% Leasehold improvements 17.1% 21.5% 21.5% Motor vehicles 1.9% 0.8% 0.8% Warehouse equipment 0.5% 1.0% 1.0% Land 2.7% 3.0% 3.0% Building 0.1% 0.3% 0.3% Construction in progress - 0.1% 0.1% Count Useful Lifespan Computers 3 years 33.3% 33.3% 33.3% - - - - Office equipment, furniture and fittings 3 years 33.3% 33.3% 33.3% - - - - Leasehold improvements 10 years 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% Motor vehicles 8 years 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% 12.5% Warehouse equipment 7 years 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% 14.3% Land 14 years 7.1% 7.1% 7.1% 7.1% 7.1% 7.1% 7.1% Building 18 years 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% 5.6% Construction in progress 50 years 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% Existing PPE 15 years 6.7% 6.7% 6.7% 6.7% 6.7% 6.7% 6.7% Computers 154 345 622 862 1,209 1,632 2,207 Office equipment, furniture and fittings 9 21 38 52 73 99 134 Leasehold improvements 14 32 58 95 145 210 300 Motor vehicles 1 2 3 5 7 10 14 Warehouse equipment 1 2 4 6 9 14 19 Land 1 3 6 9 14 21 30 Building 0 0 0 1 1 2 2 Construction in progress 0 0 0 0 0 0 0 Existing PPE 50 50 50 50 50 50 50 Total Depreciation 231 455 781 1,080 1,509 2,038 2,757 Intangible assets purchase 1 7 21 51 83 107 171 233 304 375 Purchase of intangible assets as % of Revenue 0.1% 0.3% 0.5% 0.5% 0.5% 0.4% 0.4% 0.4% 0.3% 0.3% Accumulated Amortisation Intangible assets Licensing fee 4 9 17 28 45 68 98 135 IP Rights 9 21 40 65 104 157 227 314 Trademarks 7 16 30 49 79 120 173 238 Technology 13 30 56 91 146 222 320 442 Others 7 16 30 49 78 118 171 236 Total intangible assets 40 91 174 281 452 685 989 1,364 Intangible assets purchase Licensing fee 5 8 11 17 23 30 37 IP Rights 12 19 25 39 54 70 86 Trademarks 9 14 19 30 41 53 65 Technology 17 27 35 55 75 98 121 Others 9 14 18 29 40 53 65 Existing intangible assets 40 Total intangible assets purchase 51 83 107 171 233 304 375 % of intangible asset purchase Average CAPEX into respective PPE Licensing fee 9.9% 9.9% IP Rights 23.0% 23.0% Trademarks 17.5% 17.5% Technology 32.4% 32.4% Others 17.3% 17.3% Count Useful Lifespan Licensing fee 6 years 16.7% 16.7% 16.7% 16.7% 16.7% 16.7% 0.0% IP Rights 4 years 25.0% 25.0% 25.0% 25.0% - - - Trademarks 10 years 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% Technology 6 years 16.7% 16.7% 16.7% 16.7% 16.7% 16.7% 0.0% Others 5 years 20.0% 20.0% 20.0% 20.0% 20.0% - - Existing intangible assets 5 years 20.0% 20.0% 20.0% 20.0% 20.0% - - Licensing fee 1 2 4 7 11 16 21 IP Rights 3 8 14 24 34 47 62 Trademarks 1 2 4 7 11 17 23 Technology 3 7 13 22 35 51 69 Others 2 5 8 14 22 31 41 Existing PPE 8 8 8 8 8 - - Total Amortisation 17 32 51 82 121 161 216

- 18. In USD (US$ Millions) Actuals Estimates Period Ending Dec 31 2018A 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2026E 2027E Debt Schedule Cash available to pay down debt Cash at beginning of year 6,167 7,260 8,685 11,542 16,806 26,540 45,040 Cash flow before debt paydown Months of operating expense 1,093 1,093 1,425 2,857 5,265 9,733 18,501 Manimum cash cushion 6 (2,815) (4,048) (6,136) (8,991) (12,840) (17,729) (23,620) Total cash available to pay down debt 4,444 4,304 3,974 5,409 9,231 18,545 39,921 Convertible notes Interest Rate Maturity yearMaturity month Share price Principal Remaining 2023 convertible note 2.25% 2023 7 19.80 $ 41.3 6.00% 0.06 0.06 0.03 - - - - 2024 convertible note 2.25% 2024 12 50.13 $ 916.6 19.00% 3.92 3.92 3.92 3.92 - - - 2025 convertible note 2.38% 2025 12 90.46 $ 882.6 100.00% 20.96 20.96 20.96 20.96 20.96 - - Total payment 1,840 25 25 25 25 21 - - Convertible notes Convertible notes (beginning of year) 1,840 1,059 1,059 1,057 883 - - Mandatory issurances/(retirements) (781) - (2) (174) (883) - - Convertible notes (end of year) 1,059 1,059 1,057 883 - - - Convertible notes interest expense 25 25 25 25 21 - - Convertible notes interest rate 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% 2.3% Other liabilities (Long term lease liabilities) Long term lease liabiliities (beginning of year) 178 425 653 1,019 1,540 2,252 3,178 Mandatory issurances/(retirements) - - - - - - - Long term lease liabilities (end of year) 178 425 653 1,019 1,540 2,252 3,178 Long term lease liabilities interest expense 14 34 52 82 123 180 254 Long term lease liabilities interest rate 8.0% 8.0% 8.0% 8.0% 8.0% 8.0% 8.0% Total issuances/ (retirements) Total interest expense 39 59 77 106 144 180 254 Cash at end of year 4,405 4,245 3,897 5,302 9,087 18,364 39,667 Interest income 75 76 70 95 173 349 793 Interest rate 1.7% 1.8% 1.8% 1.8% 1.9% 1.9% 2.0% Convertible note reconciliation Convertible changes in balance sheet Issuances/(retirements) (781) - (2) (174) (883) - - Shares issued 125,040 3,473,896 9,756,611 In USD (US$ Millions) Estimates Period Ending Dec 31 2021E 2022E 2023E 2024E 2025E 2026E 2027E Cost of Capital Risk Free Rate 1.4% Debt 11,742 Tax rate 17.0% Market Risk Premium 7.6% Stock Price 260.0 Beta 1.3 Shares Outstanding 554,625,132 Cost of Equity 11.3% Equity Value 144,203 Cost of Debt 2.0% Net Debt 3,624 << Debt - cash and cash equivalents WACC 10.548% Enterprise Value 147,826 Unlevered Free Cash Flow EBIT (1,835) (2,083) (2,777) (2,934) (1,914) 1,640 9,607 Less: Taxes (312) (354) (472) (499) (325) 279 1,633 NOPAT (1,523) (1,729) (2,305) (2,436) (1,589) 1,361 7,974 Add: D&A 248 487 833 1,162 1,630 2,199 2,974 Less: Changes in Net Working Capital (1,514) (3,598) (3,548) (5,528) (7,999) (11,141) (15,743) Less: Capital Expenditures 719 910 1,313 1,878 2,565 3,346 4,577 Unlevered FCF (480) 1,446 763 2,377 5,475 11,356 22,114 Net Present Value Calculation Period 1 2 3 4 5 6 7 Discounted Cash Flow (434) 1,184 565 1,591 3,316 6,222 10,960 Sum of Cash Flows 23,403

- 19. EBITDA Method Exit Year EBITDA 12,581 Multiple 30.0x Terminal Value 377,425 Net Present Value 187,056 Perpetuity Method Unlevered Free Cash Flow 22,114 Growth Rate 5.0% Terminal Value 418,518 Net Present Value 207,421 Discounted Cash Flow Total Valuation EBITDA Perpetuity Total of present value of cash flows 23,403 23,403 Present value of terminal value 187,056 207,421 Total Enterprise Value 210,458 230,824 Net Debt, Non-controlling interests,preferred securities 3,661 3,661 Equity Value 206,798 227,163 Share Count (Millions) 555 555 Share Price 372.86 $ 409.58 $ Implied Upside 43.4% 57.5% Discounted Cash Flow Total Valuation (Incl Stock Comp) EBITDA Perpetuity Total of present value of cash flows 23,403 23,403 Present value of terminal value 187,056 207,421 Total Enterprise Value 210,458 230,824 Net Debt, Non-controlling interests,preferred securities 3,661 3,661 Value of Equity Options 6,758 6,758 Equity Value 200,039 220,405 Share Count (Millions) 564 564 Share Price 354.70 $ 390.81 $ Implied Upside 36.4% 50.3%

- 20. Without Stock Compensation EV/EBITDA 372.9 15.0x 20.0x 25.0x 30.0x 35.0x 40.0x 45.0x 9.9% 212.8 271.4 330.0 388.6 447.1 505.7 564.3 10.1% 210.1 268.0 325.8 383.6 441.5 499.3 557.1 10.3% 207.5 264.6 321.7 378.8 435.9 493.0 550.1 WACC 10.5% 204.2 260.4 316.7 372.9 429.1 485.3 541.5 10.7% 202.3 257.9 313.6 369.3 425.0 480.6 536.3 10.9% 199.7 254.7 309.7 364.6 419.6 474.6 529.6 11.1% 197.2 251.5 305.8 360.1 414.3 468.6 522.9 Growth Rate 409.6 4.0% 4.3% 4.6% 5.0% 5.3% 5.6% 6.0% 9.9% 400.1 420.6 443.5 478.4 508.5 542.8 596.8 10.1% 383.3 402.2 423.3 455.2 482.7 513.7 562.3 10.3% 367.6 385.1 404.6 433.9 458.9 487.2 531.0 WACC 10.5% 349.5 365.5 383.1 409.6 432.1 457.3 496.2 10.7% 339.1 354.2 370.9 395.8 416.9 440.5 476.7 10.9% 326.1 340.2 355.7 378.7 398.2 419.9 452.9 11.1% 313.9 327.1 341.5 362.9 380.8 400.8 431.0 Including Stock Compensation EV/EBITDA 354.7 15.0x 20.0x 25.0x 30.0x 35.0x 40.0x 45.0x 9.9% 197.3 254.9 312.5 370.1 427.7 485.3 542.9 10.1% 194.7 251.5 308.4 365.3 422.2 479.0 535.9 10.3% 192.1 248.2 304.4 360.5 416.7 472.8 529.0 WACC 10.5% 188.9 244.1 299.4 354.7 410.0 465.3 520.5 10.7% 186.9 241.7 296.4 351.2 405.9 460.7 515.4 10.9% 184.4 238.5 292.6 346.6 400.7 454.7 508.8 11.1% 182.0 235.3 288.7 342.1 395.5 448.9 502.3 Growth Rate 390.8 4.0% 4.3% 4.6% 5.0% 5.3% 5.6% 6.0% 9.9% 381.5 401.7 424.2 458.5 488.1 521.8 574.9 10.1% 364.9 383.6 404.3 435.7 462.7 493.2 541.0 10.3% 349.5 366.8 385.9 414.7 439.4 467.2 510.2 WACC 10.5% 331.7 347.4 364.8 390.8 413.0 437.8 476.0 10.7% 321.5 336.4 352.7 377.2 398.0 421.2 456.8 10.9% 308.7 322.6 337.8 360.5 379.6 400.9 433.4 11.1% 296.7 309.7 323.8 344.9 362.5 382.1 411.9 Company Stock Price Revenue EBITDA Enterprise Value Gross Margin EBITDA Margin EV/LTM REV EV/NTM REV EV/LTM EBITDA EV/NTM EBITDA FY2019 FY2020 FY2021 FY2019 FY2020 FY2021 FY2020 FY2020 E-commerce SEA Group 253.44 2,175 4,376 9,390 (770) (1,117) (574) 132,873 30.8% (25.5%) 30.4x 9.9x NM NM Amazon.com 3389.79 280,522 386,064 470,386 36,193 48,150 69,382 1,776,374 39.6% 12.5% 4.6x 3.4x 32.6x 23.1x Alibaba 111.96 70,214 98,675 133,213 20,290 23,602 26,549 281,643 43.2% 23.9% 2.9x 1.9x 11.2x 9.8x JD.com 77.95 82,852 114,236 149,364 1,571 2,567 2,632 102,626 8.1% 2.2% 0.9x 0.6x 23.9x 30.3x Pinduoduo 54.44 4,329 9,112 15,476 (1,135) (1,337) 652 54,968 67.6% (14.7%) 6.0x 3.2x NM 38.9x Jumia 10.75 180 171 176 (252) (178) (192) 884 66.5% (104.3%) 5.2x 4.4x NM NM Coupang 26.55 6,273 11,967 18,599 (573) (400) (1,078) 44,659 16.6% (3.3%) 3.7x 2.0x NM NM Chewy 62.69 4,847 7,146 8,948 (231) (62) 196 25,859 25.5% (0.9%) 3.6x 2.7x - 109.6x MercadoLibre 1052.95 2,296 3,973 6,991 (80) 233 641 54,967 51.2% 5.9% 13.8x 6.2x 199.7x 66.0x Gaming Tencent 59.4 48,432 61,882 72,978 17,762 21,988 26,084 645,833 46.0% 35.5% 7.6x 23.2x 23.1x 18.5x Baidu 137.39 15,426 16,401 19,444 3,716 5,098 4,485 36,358 49.6% 31.1% 2.2x 1.7x 6.9x 7.7x Blizzard 57 6,489 8,086 8,748 2,072 3,025 3,739 38,284 72.1% 37.4% 4.7x 4.4x 12.3x 10.0x Mean 7.1x 5.3x 38.7x 34.9x Median 4.7x 3.4x 23.1x 26.7x