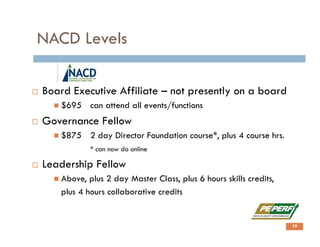

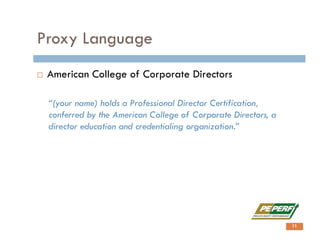

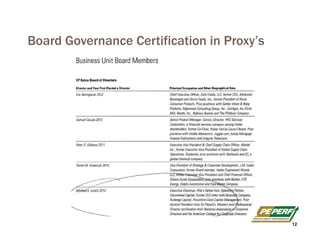

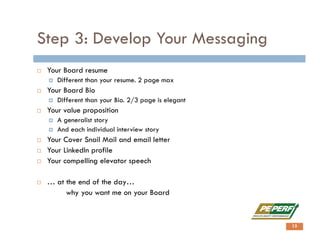

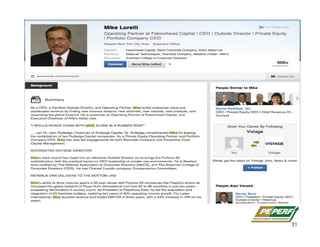

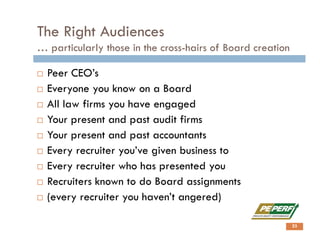

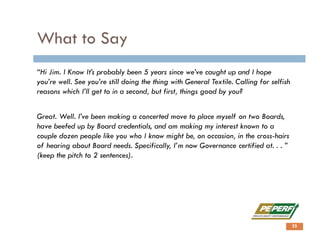

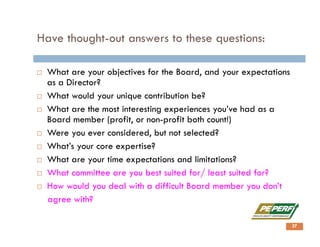

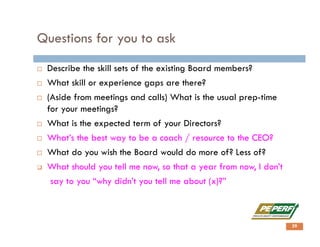

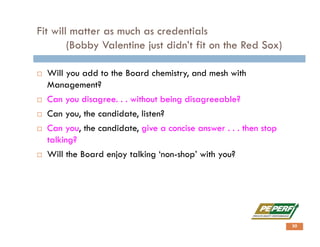

This document provides guidance on securing board seats. It discusses developing credentials through organizations like NACD and ACCD. Having governance certification and experience listed in proxy statements can strengthen applications. Cover letters, bios, resumes, and LinkedIn profiles should emphasize one's value proposition and fit for a board. Networking widely and getting quality referrals increases odds of opportunities. Thorough preparation and having answers to common interview questions also helps one stand out. Ultimately, fit is as important as credentials for landing a board seat.