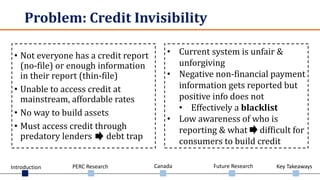

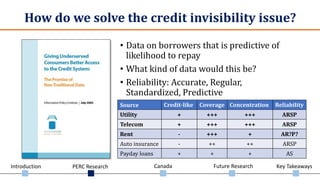

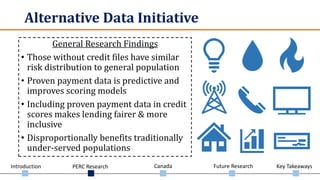

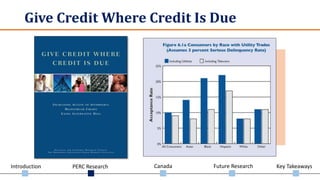

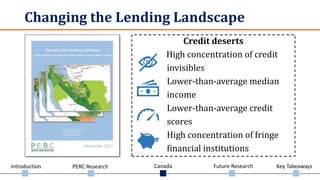

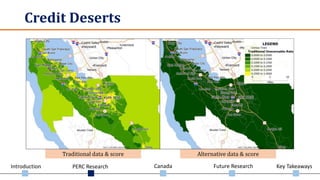

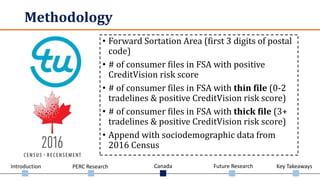

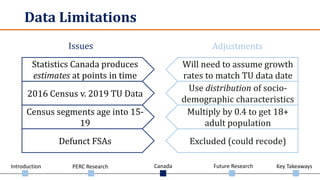

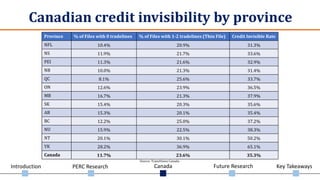

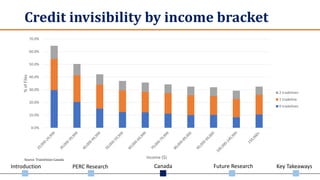

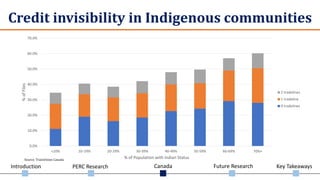

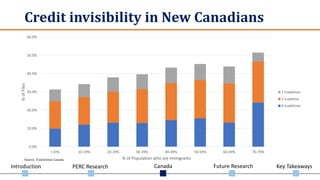

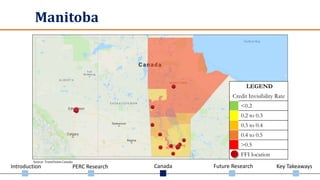

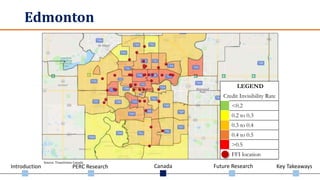

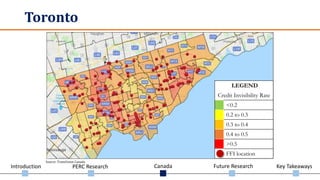

The document discusses the issue of credit invisibility in Canada, highlighting the challenges faced by individuals without credit files or sufficient information for credit access. It presents research findings that suggest using alternative data, such as proven payment data, could create a more inclusive lending landscape and benefit underserved populations. The document calls for policy changes to improve credit reporting practices and increase financial inclusion through better data sharing.