Mad about Money Jan2017

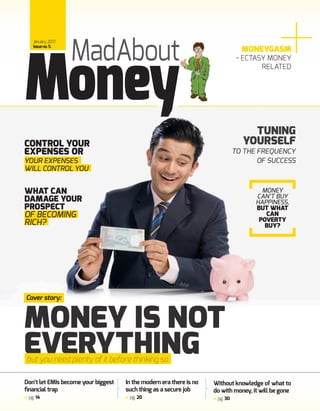

- 1. TUNING YOURSELF TO THE FREQUENCY OF SUCCESS MONEYGASM - ECTASY MONEY RELATED Without knowledge of what to do with money, it will be gone pg. 30 In the modern era there is no such thing as a secure job pg. 20 Don’t let EMIs become your biggest financial trap pg. 14 MONEY IS NOT EVERYTHING MadAbout January,2017, Issueno.5. Cover story: Money but you need plenty of it before thinking so MONEY CAN’T BUY HAPPINESS, BUT WHAT CAN POVERTY BUY? CONTROL YOUR EXPENSES OR YOUR EXPENSES WILL CONTROL YOU WHAT CAN DAMAGE YOUR PROSPECT OF BECOMING RICH?

- 2. Money MadAbout 2 Content 12_Wealth comes those who believe in themselves 14_ Don’t let EMIs become your biggest financial trap 16_ Money can’t buy happiness, but what can poverty buy? 18_Moneygasm - ectasy money related 20_ In the modern era there is no such thing as a secure job 22_Tuning yourself to the frequency of success 24_ Control your expenses or your expenses will control you 26_ Looking Rich Vs. Being Rich 28_ Banks should be paying you, not the other way around 30_ Without knowledge of what to do with money, it will be gone Money MadAbout Issue no.4 Neither this publication nor any part of it may be reproduced, stored in a retrieval system, or transmitted in any form of by any means electronic, mechanical, photocopying, recording or otherwise, without the permission of MadAboutMoney magazine. All information in MadAboutMoney magazine is checked and verified to the best of the publisher’s ability, however the publisher cannot be held responsible for any mistake or omission enclosed in the publication. 0410 06 “Money is not everything, but you need plenty of it before thinking so” Never rely on a single income to make you a millionaire A comfortable life will never make you a millionaire Cover story: 08What can damage your prospect of becoming rich?

- 3. 3 Money MadAbout Money MadAbout Editor’s NoteIf there’s one common thread, that runs through each and every one of us connecting us and binding us to each other is this – we are all mad about money in our respective lives! Be it a multimillionaire businessman or the local neighborhood vegetable vendor, our madness about money is a crucial part of our existence – the madness to have it, the madness to attain it, the madness to save it and protect it and of course, the madness to have excess of it and be rich! To put this in the current perspective, 8th November 2016 might have come that morning like any other day but it definitely left with a bang! Almost two months now, towards a new and constantly changing cashless economy, the only statement that can perhaps hold true about each and every citizen of India is everyone is currently Mad About Money, specifically cash! So right from the government down to the average young student, everyone is mad about one single thing right now– and that’s money! In this issue too we deal Money MadAbout with money itself as a core asset, what it means and stands for. More importantly, it will be about each and every facet that drives us crazy…how to earn it easily, how to have it more, how to save it better, how to invest it to grow, but more importantly, and here lies the difference, how to change our mindsets so that all this happens by default and much easily! Our lead story this edition is quite an interesting read where we talk about looking rich vs being rich. Since we all want to become rich, have we ever questioned ourselves whether we want to look rich because we want people to think we are rich, or whether we want to be rich so that we can look rich. Which do we want more? Which is more important to us? Which is more important to people who are already rich and successful? The Tata’s and the Zuckerbergs of the world? What do they do? How do they spend their time? In being rich or looking rich? More importantly, does one necessarily define the existence of the other? Interesting elements to assess from a mindset perspective isn’t it? Our lead story in our inaugural edition is all about this and much more. To conclude, Mad About Money is here to talk about everything to do with money that draws your attention and passion, but in a different way, with a slightly different touch…so that unique magic wand that just makes all this slightly more attainable in practical terms. So keep reading and keep getting rich! Sachin Mittal

- 4. Money MadAbout 4 The Mad Gang who makes it possible every month Vijendra Singh, Manager Money Craft Giving a tight twist to money Swadesh Mishra, Officer Out-standing The world in his pocket Shravan Giri, Creative Technologist Tech at his fingertips Anubha Rathore, Arts & Crafts Designer Designer craft creator Rajiv Ranjan, Joint Creative Technologist Joining forces in troubleshooting Dheeraj Kumar, Chief Money Scientist Sees the glass half full

- 5. 5 Money MadAbout Akanksha Mishra, Associate Money Scientist Hopefully optimistic Abhijit Banerjee, Idea Ambassador An idea for a song… Johny Chopra, Buzz Ambassador Spreading the good word Ahmed Ansari, Lord of the Ledgers Tight fisted…always Soma Ghosh, Chief Buzz Creator Creating the big buzz Dillip Rout, Account-ability Officer Wire | Digital Creative AgencyMagazine designed by:

- 6. Money MadAbout 6 “Money is not everything, but you need plenty of it BEFORE THINKING SO” You do know who said these words, right? The richest man on earth – Bill Gates! This coming from the richest person on the planet - it must mean something.

- 7. 7 Money MadAbout F or some, money is a translation for being able to afford the few harmless indulgen- ces of life and being able to enjoy the little luxu- ries. For others, it’s the way to make ends meet. Something to just get by and not really indulge in decadence! And so, while you may not need more of it and while it definitely cannot offer a replace- ment for everything in life, money definitely is a big necessity. This type of attitude creates negativity about being rich or having money The world is full of clichés. And, being rich or having adequate money is ano- ther cliché that is asso- ciated with dishonesty or being immoral for living an extravagant lifestyle. Every time we hear statements like these - that disapprove money/wealth – it hits us on a subconscious level. Unknowingly it moulds our mind into creating a negative attitude towards wealth. That’s precisely why it’s not uncommon for many peo- ple to feel guilty for being able to afford certain things financially – and for their fi- nancial success - that most people don’t have. This type of negativity towards money/finances is bound to affect you in some way or the other and discourage you from putting your best efforts to achieve financial stability. Our minds may be free, but we are bound by the matter Sure, money is not somet- hing that you need for fee- ling ‘joyful’. You know - the kind of joy you feel when you see you kid getting good grades, or the kind of joy you get by helping someone. Our emotions including fear or happi- ness don’t accept credit cards. But, we are bound by our physical needs. Our mind may be free to think whatever it wants to as it doesn’t really understands the monetary terms, our bodies do rely on the po- wer that comes with being financially sound and having enough money; for it needs safety and secu- rity. We do need a home, good food to survive, and clothes on our body. It gives us an excuse to be lazy Statements like these are basically a way for us to feel good about ourselves – about our inadequacies – and our flaws. It basically gives us approval that it’s okay to be lazy and not really do much about ac- hieving financial success. This is in no way to say that financially secure people are competent and others are not. But, achieving financial success does require us to go out of the way and get out of our comfort zone. THERE’S NO DENYING THAT MONEY IS NOT EVERYTHING. BUT, IT’S DEFINITELY SOMETHING. YOU CANNOT DENY THE FACT THAT YOU NEED IT FOR SURVIVING. It forces us into finding out who we are and what our true ca- lling is. And, all that requires efforts. But, because we want to stay comfortable and lazy, we give ourse- lves excuses with sta- tements like – money is not everything and we don’t need it, when clearly you do need it even if just to get by. So, next time you find yourself thinking that you don’t need money; make sure you have earned enough of it.

- 8. Money MadAbout 8 Your dream – a bungalow or a mansion, top luxury cars in your garage, multi-million dollars in your bank account, a private plane that you can take to anywhere in the world. This is your dream but the rich are already living it. In fact, they are so accustomed to it that it is a normal lifestyle to them. This is where you, a daily wager, needs to reach. You will know it when being rich becomes a habit rather than choosing to be wealthy. A comfortable life will never make you A MILLIONAIRE

- 9. Money MadAbout 9 I t’s all about the mi- ndset - the way you think, the way you see life, the way you see opportunities and the actions you take. “I am responsible for my circum- stances” This statement is an insight derived by Dave Ramsey, author of the article “20 Things the Rich Do Every Day” from analysis of feedbacks received from around the world on this article. This statement is impor- tant because being rich is a mind game. This school of thought advocates the fact that every individual has the ability to change his/her circumstances. Again, if you are strong willed, and you know what it takes to reach the sky, you can change it. If you are not scared of hard work, readily engage in self-improve- ment techniques, make the right choices and embrace good habits, you will know that you are on the right path. If an average person conti- nuously seeks to improve themselves by all means at their disposal, circum- stances will automatically turnaround, creating an abundance of wealth and prosperity. Hence it proves, that those who cry over spilled milk are responsible for it. They should stop victimizing themselves in the name of destiny and luck. The good vs the evil An average person usually thinks of the rich as the exploiting dictators who suck the money out of the poor people to gain for themselves. Apparently, they also believe that the God’s favor the fortunate ones and shower them with more and take away from the needy. It is a very unjustified and unreasona- ble thinking. The rich are the way they are because of their habits, and the poor remain poor because they refuse to change and to improve. The avera- ge person needs to rise above this ‘I am the victim’ mindset. They need to stop being a target of the almighty and accept all challenges with an open and positive mind. There is no Good or Evil person. There are only positive and negative thoughts. And it can only change if you move away from ne- gativity and remain within the positive mindset. Excuse yourself from excuses There should be no if’s or but’s when you want to achieve a goal in life. Once you start with it, that’s when you start slipping. Face your pro- blems chin up and avoid quitting just because you hit a roadblock.. Avoid giving into silly ex- cuses like procrastination, too many long working hours, luck not on my side, finances slipping away, etc. You need to exit your comfort zone and usual habits because a comfor- table life will never make you a millionaire. The gist of the matter is, reason the reason that stops you from doing what should be done to achieve your dreams. The moment that feeling pops up – ‘I can’t do it’ – do it. Charm yourself up, polish up and have the rich for your company, learn, and get rich.

- 10. Money MadAbout 10 There would definitely a question that always strikes the mind of entrepreneurs: why am I not becoming rich? As much as the question is important, the answer to it holds a higher precedence. WHAT CAN DAMAGE YOUR PROSPECT OF BECOMING RICH?

- 11. 11 Money MadAbout L ottery winners. They win a huge sum of money just like that, and lose it just the same way. Now think about other entrepreneurs, the inve- stors, the people who play a calculative yet adrenaline laden game. These people get rich, and then they lose money, but they earn it all again. These people make others wonder if getting rich is a matter of destiny and luck. This is the question that must be answered. We know it’s not possible to answer this question perfectly, but we are here with the best that we can. After all, that’s all that matters. It’s not about being absolutely right, it’s about knowing where we can fail and how to over- come it, not avoid it. You can’t avoid risks, you learn to take risks and turn them into your favor. The mindset of rich people Books such as Secrets of the Millionaire Mind by T. Harv Eke tell a lot about the mindset of rich people. What they think about money, how they perceive it in compari- son to poor or not so rich people. Learning how rich people think can be a very useful stepping stone as you can then figure put if your thought process mat- ches theirs. In case your thoughts don’t match, this can be considered as a hurdle, and this is what you might want to change about yourself. The mind- set is the key. Learn from the habits of the rich Your habits should take you towards wealth, success and healthy mind. Success is not a onetime event, it’s a habit, so if you want to be wealthy, make your habits that match your vision. Start with inculca- ting a habit of saving. The best idea is to spending money after saving a certain amount, rather than spending money before- hand and then saving the rest, chances are, there wouldn’t be any money left to save at the end of the month.Learn from the habits of rich people, and adapt them. You can either work for weekends, or work for a car, or a house. YourWorst Enemy: Procrastinating We understand that it’s hard to sit back and relax with so much going in today’s fast life. And this is what makes time even more valuable than it used to be earlier. Time is an asset that you never get back. Give your goals the highest priority. If you are a procrastinator, you can use this trait in your benefit too. Just delay the unnecessary expenditures and events that need your time but aren’t important. As they say, Lamborghini doesn’t advertise because the people who can afford it are not watching television, they are making money. Anger drives wealth away Fear is an emotion that stops people from taking a step, from taking an action, from making a decision. Fear leads to inaction, whi- ch will take you nowhere in best case, and bring you down in worst case. Fear doesn’t let you move forward. Anger, on the other hand, drives wealth, prosperity and mental health away. It also takes a toll on your immunity and overall well-being. You can’t be rich or successful if you are spending money and time to get your health fixed. Shame is a pain- ful emotion, as you feel inferior about yourself. How do you expect to excel when you don’t think you are capable or deserving of succeeding. The lesser you feel about yourself, the more you spend on your- self. That doesn’t sound like success at all. CHANGING YOURMONEY MINDSET Rule 1 Stay Away From Debts Debts are the worst thing one can have as it prevents your fi- nancial plans to grow. Hence rather than going for mindless expenditures through credit cards, make sure you use your de- bit cards more. Even with a pay raise, debts do affect a family in- come in many ways. Rule 2 Simplify And Make Realistic Monetary Goals Do not make mate- rial gains and posse- ssions as your long term goal. A prospe- rous stress free pre- sent and a social and financial security for you and your family’s future should be the goal for life. Owning houses, cars are part of this goal.

- 12. Money MadAbout 12 What did he do to become a millionaire? This is a common feeling that most of us experience in our life at one point or the other. We see many of our contemporaries moving forward faster than us when it comes to finance. Even people who have regular savings habit do a self-introspection every now and then to understand why they feel like stagnating in a single point for a long time. Never rely on a single income to make you A MILLIONAIRE

- 13. 13 Money MadAbout W e keep worrying why we feel left behind financially despite all our genuine efforts to build wealth. The answer to all the above ambigu- ities is simple. Building wealth is not purely about the genuinity of the efforts alone but also the dire- ction of the same. Let us simplify it further WHYINCOMEFROM MULTIPLESTREAMS ISAMUST Before we venture into the importance of multiple streams of income, it beco- mes inevitable to under- stand why it is so. We live in a society in which no job is as secured enough as it was in the yester years. Almost 80% of the popu- lation relies on the income that is generated from their job to run a livelihood. When the job is lost, life comes to a standstill which is a high risk situation. Health care and Educa- tion are two aspects that are highly important in everyone’s life. These two aspects are the costliest ones too. Most of us lead a life in which we are not able to pay cash for our purchases, particularly the high end ones like furni- ture, car or house. Buying things using cash remains a dream most of the times. We accumulate debts and repaying them swallows most of our income from a single stream namely employment. BUILDING MULTIPLE INCOME STREAMS IS THE BEST SOLUTION While our income rises in pennies, the financial commitments grow in pounds. To tackle our requirements, it is highly prudent to build multiple income streams which will take us to the shore safely. Diversify your savings and investments in various streams whose dependency differs in a huge manner Invest a portion of your income in real estate. Let your first investment on real estate be on a property rather than a land since property is capable of generating income earlier than plots. Earmark a portion of your income on savings. Let these savings be diversified into market dependant and non- market dependant investments. Fixed and Recurring Deposits are less market dependant, fetching you assured allied income. Investing in Monthly SIP and Mutual Funds can be highly market dependant. Bifurcate separate amounts for each type of savings based on your risk taking capability If you have enough income to balance your savings versus leading a comfortable life, invest possible amounts in small businesses assessing the profit earning capabilities of the same. Ensure this business doesn’t steal much of your time which you need to spend on your regular job. Let this venture fetch you income that is an add- on to your regular one If your office works only five days a week and your weekends are at your disposal, think of ways that will de-stress you and at the same time fetch you some extra income. If you are good at singing and music relaxes you, start taking music class for children in your vicinity during weekends. This will earn you the much sought for name, fame and money. If you can coach children on games, utilize the weekends which will become highly productive and relaxing We would insist you to think – When there are multiple streams available for spending why not cre- ate the same for earning? MAKING MONEYWORK FOR YOU Protect and safeguard your Money The first step towards becoming a rich man is to monitor your expenses, and not worry about it. Most of the times you spend more than what you've planned. It is the prime reason why you fall short of cash for every important assignment, which you waited for long. Budgeting will help you spend money wisely and within limits, and also make you learn to respect it. In other words, you can control your money well if you plan to spend it intelligently rather than money controlling your life. Thus, every single expense needs to be budgeted well enough to avail maximum monetary reaps in future. Burden off your Money Get rid of all the debts and let your money breathe. If you want your money to work for you, this is a crucial step. Debts could emerge due to various reasons like people investing their money without researching well in stock markets, buying and selling real estate or having loans on credit cards, etc. Not only are these factors strenuous, but extremely hard to overcome. So, your budgeting should also include clearing all kinds of dues at the earliest to have some breathing space regarding the cash inflow.

- 14. Money MadAbout 14 WEALTH COMES THOSE WHO BELIEVE IN THEMSELVES

- 15. 15 Money MadAbout A sk any of the wealthy people living an abundant lavish life, and they will raise their hands. They just know the game too well. They just let their money do the bit whi- le they focus on other luxuries of life. You can be one of them too. The constant urge of ruling the world like a king is what that will earn you the entire kingdom. But, is it so simple? Yes, it may be if you behave like one. “If you can Dream it, you can do it.” – Walt Disney Just follow these simple rules and you’ll be on your way to your goal: PROTECTAND SAFEGUARDYOUR MONEY The first step towards becoming a rich man is to monitor your expen- ses, and not worry about it. Most of the times you spend more than what you’ve planned. It is the prime reason why you fall short of cash for every important assignment, which you waited for long. Budgeting will help you spend money wisely and within limits, and also make you learn to respect it. In other words, you can control your money well if you plan to spend it intelligently rat- her than money contro- lling your life. Thus, every single expense needs to be budgeted well eno- ugh to avail maximum monetary reaps in future. LETYOUR MONEY BREATHE Get rid of all the debts and let your money breathe. If you want your money to work for you, this is a crucial step. Debts could emerge due to various reasons like people investing their money without researching well in stock markets, buying and selling real estate or having loans on credit cards, etc. Not only are these factors strenuo- us, but extremely hard to overcome. So, your budgeting should also include clearing all kinds of dues at the earliest to have some breathing space regarding the cash inflow. PUTYOUR MONEY WHERE IT GIVES YOU MONEY Stack up your cash in a high-yielding savings account. Your money will generate more value as it sits there. A high-yield saving account offers attractive interest rates that make your money grow. There you go, your money just doubled itself without you having to intervene. Though risky, stock markets are a great place to invest and to do- ubling your money. Invest your money in profitable and growth accustomed companies and organiza- tions as these business entities are valued higher. PAMPER YOUR MONEY By pampering, we mean to love it, respect it and save it. It is important because it will make your money grow exponentia- lly. Manage your wealth in a way that it prepares you for the unexpected situations and circum- stances. After paying off all your debts, tuck away rest of the money into savings. Let it rest, and let it grow. There will be a point when the money you saved would have doubled or tripled over time through interests. Remember to keep fueling your savings now and then. THERE IS A FAMOUS SAYING - “WEALTH COMES THOSE WHO BELIEVE IN THEMSELVES AND ARE DETERMINED TO MAKE IT HAPPEN.” ANYONE CAN EARN MONEY AND MULTIPLY IT TWO- FOLD. BUT HOW MANY PEOPLE DO YOU KNOW, WHO KNOW HOW TO MAKE THEIR MONEY WORK FOR THEM AND SELF-MULTIPLY! “Average people live beyond their means. Rich People live below theirs.” –Steven Siebold

- 16. Money MadAbout 16 Home loan EMI – check, Car loan EMI - check, Personal Loan EMI - check…the list is endless! The reality of today’s households is centered around everyone trying to keep their heads over the host of EMIs that they need to pay out every month! become your biggest FINANCIAL TRAP Don’t let EMIs

- 17. 17 Money MadAbout N eedless to say, for many…the amount spent on monthly EMIs has gradually beco- me greater than their mon- thly income! The result? Resorting to the plastic in the wallet for making purchases, and worse, for withdrawing cash. In short, unchecked debt increase and thereafter fatter and fatter credit card bills do nothing other than dig deeper pits for you and your family. And dangerously this is too common a story today! What one needs is a well thought out route towards being debt free. Don’t let EMIs become your big- gest financial trap! WHY IS STAYING DEBT FREE IMPORTANT? Staying debt free and having a clean borrowing history is crucial in cu- rrent times since various credit information organi- zations such as CIBIL and the like track and pass on the credit history of individuals to banks and other financial instituti- ons. In the calculation of your credit score, almost 35% weightage exists on your repayment history. Hence, if you have a poor credit history, you will find it very difficult to get loans from banks in the future. Your credit card limit will also get affected and in some cases credit cards even get blocked for people with a poor credit score. THE ROUTE TO BEING DEBT FREE: STEP 1 Knowyour status: Your first step is to know whether you have already fallen into the EMI trap or not and if you have then how deep in it you are. Experts say that if an in- dividual is paying EMIs to the tune of 45% of his/her income, then it is already a matter of concern. STEP 2 Assessyourdebts: Take a good look at the kind of debts you are paying EMI for. Are these good debts? That is, are these EMIs for assets or investment towards your- self that will give returns in the future? Max to max 25% of your income should go into EMIs that are non-mortgage loans or fall under discretionary spending. However, this does not mean that EMIs for good debts in huge proportions every month is financially healthy! There are umpteen no of examples where car loans or personal loans get rejected for people with good debts such as home loans, but with monthly EMI amounts that are more than two/ third of their net income. STEP 3 Possible debt repayments: Make a list of all your debts and analyze which ones are the costliest and which ones the cheapest. Credit card roll overs, for example are the most expensive with almost 40% interest rates so they should top your repayment list. Second priority is your personal loans. Take into consideration the tenure of these since there’s an element of penalty involved. If you see that the loan would get over in a couple of months then there is no point. Repay loans which still have 6-12 EMIs to go at least. One should also look at the tax aspects of the loan since some provide exemption bene- fits and might be better to keep in comparison to the others. For example, educational loans. STEP 4 Uniqueways to be Debt Free You can think of consoli- dating your debt in order to go debt free. Taking a loan to repay other loans might sound like a bizarre idea but it can actually work since the new interest rate would at least be lower than the interest rates of personal loans and credit card roll overs. Loan against property also works towards liquidity. Howe- ver, if you lack discipline than such measures mi- ght not work since taking another loan might just be adding to your pro- blems. In case you take a loan against property and then go for a holiday with that money, you would basically be digging a deeper financial burden pit for yourself. As a conclusion, it can be said that, being debt free and not having to think about the constantly growing EMI amounts leads to a lot of positives… both on your credit score front as well as your personal financial planning front. So now that you know how to go about being debt free, what are you waiting for? Get out of those big financial traps called EMI’s!

- 18. Money MadAbout 18 MONEY CAN’T BUY HAPPINESS, BUT WHAT CAN POVERTY BUY?

- 19. 19 Money MadAbout W ait, if you are starting to think that I am the mean minded miser who only counts money and doesn’t care about anyt- hing else, that’s far from the fact. I am very much the balanced person who values both the little ha- ppy and romantic nuances of life, values hard work as well as believes in living comfortably. Infact, I’m probably a little too balanced or practical than many and thus have a problem with that above statement. I mean why this misplaced negativity about money? The state- ment is all too common and if I may dare to say so, an all too common a justification for the lazy who would not want to use their potential in doi- ng something worthwhile (assuming they have it). SO WHY THIS NEGATIVITY? ‘Money can’t buy happi- ness’’ essentially means that something else can… and that something has to be something that’s not money or may be the opposite of money… so in our little human minds, we summarize that having no money is then okay. BUT IS IT? If we were to rephrase this statement and say it out loud what the sentence secretly tries to say…and that is…poverty can buy happiness. So I ask you friends…is that true? The only thing poverty can (perhaps) save you from is the added worry about how much to save, where to invest and the tax implications. Other than that…what does poverty save you from? I dare ask. WHEN YOUR LITTLE HOUSE NEEDS REPAIR You might argue that a little house beside the river with your loved ones is a happier and more peaceful existence than a glass facade high-rise on a congested cosmo- politan city with people with plastic smiles all around. Okay, but what about when your little house needs repair and you can’t afford it and the roof eventually caves in? What about the times when your loved ones fall sick and you can’t pay to save them? What about the times your kids want better education or to pursue their passion and you can’t support. Money might not buy happiness all the time, but let’s face it…neither does poverty and in far lesser instan- ces than the former! Isn’t it always better to be rich than poor or let say better to be working and aspiring towards a com- fortable life style rather than justifying being poor and helpless? WHAT YOU SHOULD BE DOING INSTEAD… Trash that proverb! Yes I mean it! Such negativi- ty is not needed in life, really. Be practical. You need money in life to be comfortable and to be happy. It might not be your main focus in life but you need it and it does give you happiness. The first paycheck gives you happi- ness, the first gifts you buy for your parents give you happiness, your first house, first car, that occasional vacation with your loved one from your hard earned savings…everything gives you happiness. MONEY CAN’T BUY YOU HAPPINESS. YEAH, AGREED…IT’S TRUE. BUT CAN POVERTY BUY YOU HAPPINESS THEN? CAN IT? THE ANSWER IS MOST DEFINITELY A RESOUNDING NO! AND WHY JUST HAPPINESS? POVERTY CAN’T BUY YOU ANYTHING…NOT FOOD, NOT SHELTER, NOT CLOTHING… HENCE DEFINITELY NOT HAPPINESS EITHER! HENCE, I HAVE A PROBLEM WITH THIS PROVERB IN THE FIRST PLACE. So let’s just get real here…our focus needs to shift from justifying being lazy and not thinking about money, to ac- cepting that money does make a diffe- rence and is needed and focus on your work and more im- portantly your savin- gs and investments that you make from it, for real happiness and peace in future!

- 20. Money MadAbout 20 THE BEST MONEYGASM SITUATION IS DEFINITELY BEING COMPLETELY DEBT FREE! YES, NOTHING RELATED TO MONEY CAN GIVE YOU THAT ECSTASY THAN WAKING UP ON THE 1STMORNING OF THE MONTH AND REALISING THAT YOU HAVE NO EMIS TO PAY! YES, JUST THINK ABOUT IT…NO EMIS TO PAY! DOESN’T IT FEEL LIKE A DREAM? IT DOES…AND THE COOLEST THING IS…THIS MONEYGASM SITUATION, ANYONE CAN ATTAIN IT IRRESPECTIVE OF THEIR INCOME OR NET WORTH! If you want to make most of your finances, being debt free is not even an option, it’s a dire necessity! You can argue that there are good debts and bad debts like the home loan EMI vs credit card for shopping debate, but keeping aside that for the time being, it’s a fact that any kind of debt ultimately negatively affects your income and drags it down. My top 5 Moneygasmic reasons for going debt-free include: 1. Being in complete control of your income in its entirety – an incredible feeling! 2. Having more money to save, invest and hence, to spend! 3. Removing the big ‘BUT’ from your finance related statements. Eg “I earn Rs. X per month ‘BUT’ Rs. Y has to go towards….” Will become a thing of the past! 4. Making it easier to quit your boring job whenever you want to! (Moneygasmic, isn’t it?) 5. Freeing your mind of the stress and anxiety that’s part and parcel of debts. So what are you waiting for, in life...go debt-free n be stress-free! COMPLETE DEBT-FREE SITUATION

- 21. 21 Money MadAbout When we think about emergency funds, we tend to think about it as a short term goal. Strictly speaking that might be true but its implications and benefits are for much lon- ger term and that’s exactly why it features in our top moneygasmic situation list. Our Top 5 reasons for having a well-stocked emergency fund include: 1. Takes away most of the money related stress, worries and anxiety and provides a sense of security of having a reserve if you ever get into an tight spot 2. Softens the big blows of unexpected and sudden life events such as job loss or medical emergencies 3. Features as one of the crucial finance management tools since if one can be dis- ciplined enough to save for an emergency fund, he/she would be able to save up for any financial goal that the person might have. 4. Acts as an intermediate source of finance between your income and your inves- tments…that is, the half way mark where you can safely stand and use the money without disrupting any long term investments that you have 5. Makes the wild stock market swings more tolerable and emotionally less dama- ging since you always know that your survival would never be at stake – a true moneygasm situation indeed! A TRULY MONEYGASMIC SITUATION WOULD BE TO HAVE A WELL-STOCKED UP EMERGENCY FUND! WELL, I DO REALIZE THAT YOU MIGHT NOT HAVE BEEN EXACTLY THINKING ABOUT THIS, AS IT DIRECTLY DOES NOT RESULT IN ANY ECSTASY FOR YOU PER SE…HOWEVER, IT INDIRECTLY WORKS TOWARDS KEEPING YOUR MONEY RELATED ECSTASY INTACT AND OVER LONG TERM! AND IF YOU ASK ME, THAT’S EXTREMELY CRUCIAL! WELL STOCKED UP EMERGENCY FUND SITUATION

- 22. Money MadAbout 22 In the modern era THERE IS NO SUCH THING AS ASECUREJOB

- 23. 23 Money MadAbout E ven jobs that fell out of this category were considered safe if people worked in the same place for many number of years. People performed these jobs in a monotonous manner which in turn made them feel highly safe and steady. This scenario per- sisted for many decades emphasizing the relativity between the duration and job security. JOB SCENARIO TODAY The world has become highly competitive. We live in a professional era that is absolutely different from the yester years. Every moment matters for succeeding in career. Anyone who slacks in thinking for a few seconds faces the danger of losing out in the organization. These performance standards mostly depend on the business expectations from the concerned mar- ket and the performance of the Competitors. KEY DIFFERENCES IN APPROACHES Organizations today work based on the perfor- mance of employee. This calls for constant up-gra- dation of one’s skill sets to suit market standards from time to time. Unlike the olden days, people no more stick to jobs in organizations beyond a point of time. Being with organizations depends on the growth prospects that it is able to provi- de to every employee. People quit organizations very frequently for higher money and positions. Today, Employees’ expe- ctations from a job are typically the money they earn and experience they gain out of being on rolls. No emotional or psyc- hological bonding gets created between em- ployees and organizati- ons relieving them of any commitments towards each other. Once an em- ployee feels he is ready for the next level, he jumps job without setting any expectations on the job security aspect. CONCLUSION There is no single factor that helps organizations retain work force for lon- the race. The vast expo- sure world wide web and technological advance- ments have thrown on people has complicated life more than value ad- ding to the same. People have started dragging themselves towards the competitive edge in such a fast paced manner that there is no such thing as a secure job today. COMPETITION IS COMPLICATING THINGS The speed in which the world is moving today has inculcated a thought process that is totally opposed to the earlier day thinking. Today, the longevity of service is no more related to security of the job being done. Performance parame- ters have become highly stringent for every role in organizations. Peo- ple’s performance levels are being assessed in a periodical manner irres- pective of the duration of their association with Organizations todaywork based on the performance of employee.This calls for constant up-gradation of one’s skillsets to suit market standards from time to time. ger duration of time. As long as one performs and business requirements are being met, he is on the job. The moment when these factors go for a toss, the job is out of hand. This approach of the organizations as well as the individuals has created a scenario today where there is no such thing as a secure job.

- 24. Money MadAbout 24 TUNING YOURSELF TO THE FREQUENCY OF SUCCESS MAKE THE LAW OF ATTRACTION WORK IN YOUR FAVOR. YOU KNOW WHAT THEY SAY - ‘YOU ATTRACT NOT WHAT YOU WANT, BUT WHAT YOU ARE!’

- 25. 25 Money MadAbout T his famous quote by one of the most successful people on earth gives away a lot than meets the eye about finding and achie- ving success. These are pearls of wisdom which if applied rightly can set into motion a series of actions that will definitely lead you upto success. If you want to tune into a particular channel on the radio, what do you do? Of course you adjust the radio button accordingly, don’t you? You do that to set the radio to a cer- tain frequency; the one that matches with the frequency of the channel. As soon as you can do that, you start downloa- ding the information from that channel. Well, guess what! Human mind is quite like that radio you use to tune into various channels. Now it’s up to you to de- cide which frequency you set your mind to. A mise- rable person sees misery in every situation. A happy person sees happiness in every situation. The same way, a person with the mi- ndset of success sees it in all situations around him. Think like a successful person ‘Fake it till you make it’. It’s not just some quote. It’s the truth. Keep saying something to yourself and you will actually start be- lieving it and it will start ha- ppening. Tell yourself you are already successful and it will happen. It is bound to happen. Read the stories of successful people who made it big. Keep yourself engrossed with success stories and try to surround yourself with success- ful people. You will start observing that good things have started gravitating towards you. Make the law of attraction work There’s nothing you can’t achieve if you really set your mind to it. But, of course you have to be sure about what you want and the fact that you really want it. Just wishing for something is not enough. You have to believe in it. Believe that success will come to you, and it will. Make the law of attraction work in your favor. You know what they say - ‘You attract not what you want, but what you are!’ if you are successful in your mind, you will start attra- cting it in everything else as well; whether you mean entrepreneurial success, success in relationship, or success materialistically. Set yourself to the frequency of success To do that, you will have to define success in real quantifiable measure. Don’t think of it as an abstract concept. Set clear and precise goals and know what success means to you. Don’t think of it as some distant identity that is impossible to achieve. If even one person can do what you wish to achieve, then it means it’s achie- vable. That’s the first step to setting yourself to the frequency of success.If you can do even this much, you are on the path to success and achievement. But, it is important to take that first step and the path will keep getting created on its own. You will keep figuring things out and the all the pieces of the puzzle will slowly start falling into places. HOWTO GROWUP& GETRICH STEP 1 Gain Knowledge About Money The understanding and utilization of money have gone a revolutionary change over the decades. Hence from an early life do not let your fi- nances be handled by advisors or your bank. Rather read yourself and try to gain the knowledge about the dynamics of money and its investments. STEP 2 Have Clear Expectations It is important to have a definite and clear understanding about what you want out of your life. The expecta- tions also need to be realistic and should be in sync to your own skills and capacities. “When you make a decision, you flip your brain onto a different frequency. You begin to attract whatever is on that frequency”. ~ Bob Proctor

- 26. Money MadAbout 26 Control your expenses or your expenses will control you

- 27. 27 Money MadAbout F inance is the cum- bersome happiness which can turn our life in to a pain filled hell. The main reason for this is that our income comes through a single path while expenses continue happening vide many side roads. If expenses do not get controlled at the right time every time, we will inevitably come under its control sooner or later. Control your ex- penses or your expenses will start controlling you WHO CONTROLS WHAT MATTERS Three things that a human being must not become a slave of are people, past and money. Among these three things, dealing with money which is prevalent everywhere is one of the toughest things. I provide here some tips for having money under your control so you do not fall under its control UNDERSTANDING THE NATURE OF MONEY Money is an omnipotent force in the world next only to God. However, it is the most eluding factor too. While earning suffi- cient money is the most difficult thing in the world, spending happens auto- matically. Money never stays in a place but keeps flowing from one space to another constantly in an effortless manner FIRST STEP TO CONTROLLING MONEY The very first step to controlling your money is to track in a meticulous manner the areas in to which it flows. Every little expense needs to be tracked if you want to have complete control over the moneyyou have. Create a tracker that will help your track your expenses on a day to day basis. This will automatically help you track your weekly and monthly expense status. Regularly tracking expenses will make you understand the major areas where your money is getting wasted. This will automatically help you contain spending your mo- ney in the concerned area. INVESTING PRUDENTLY IS THE SECOND LOGICAL STEP As soon as you recognize the area where your money is getting wasted, plugging the loopholes needs to be done immediately. Divert the money that was going for a toss towards prudent investments and savings. This will help you control your money’s movement in the direction you want it to move. MAKE YOUR MONEY SEEK YOUR PERMISSION When you streamline your expenses, every movement of your money happens with your permis- sion. Money starts seeking your permission to enter in to a space and exist out of many. Anyone who cannot control his own emotions can certainly not control his money. Controlling one’s emotions is the key to controlling your money. Lack of control over your emotions creates financial loss. Be conscious about the interaction between your emotions and money so that you never ever get under its control. Lack of money is the state in which money takes control over you. Ascertaining the wastage areas at the appropriate time and buil- ding money in the form you wish to build will help you to have complete control over your money. HOLD ONTO YOUR CASH Plan 1 Plan a long-term strategy foryour cash You seemed a lot ha- ppier when the prices of stocks were high and expected it go higher. Now, that they are behaving in just an opposite manner doesn’t mean all is gone. The rich won’t stress over markets downturn, although it would make them take charge to moni- tor their savings and investments and see they don’t lose it.. Plan 2 Monitoring Wealth is Important Stash your wealth whichever way, you think is suitable, but keep your eyes on it at all times. Keep track of all the investments so that you are aware of the slightest fluctuations in the market. It will also help you in ma- intaining budgets for future expenses and investments.. ‘Money comes to those who have faith in themse- lves.’ So, restructure your financial port- folio, harmonize with the market’s ups and downs and never give up on your dreams to achieve your financial goals. Rise, awake and stop not until the goal is reached. SOME THINGS NEVER CHANGE IN LIFE. THEY REMAIN SO CONSTANT THAT WE KEEP STRUGGLING TO HANDLE THEM IN A PROPER MANNER. ONE SUCH THING THAT CAUSES ISSUES OF DIFFERENT TYPES IS OUR FINANCE.

- 28. Money MadAbout 28 THEY SAY ‘’SEEING IS BELIEVING!’’ BUT, WE NEED TO ASK OURSELVES, IS IT REALLY TRUE? ARE THINGS ALWAYS THE WAY THEY LOOK? WELL, MORE THAN HALF THE TIMES, THEY’RE NOT. Looking Rich Vs. Being Rich

- 29. 29 Money MadAbout B ut, look closer. Look at the biggest millionaires. Look at Bill Gates. The guy is the definition of geek. Look at Mark Zuckerberg. It’s hard to think of a nerdier looking person than him, and yet he’s the youngest billionaire in the history. The guy virtually controls everyone’s life around the globe. Something to think about, isn’t it? BUT, CAN YOU REALLY TELL THAT BY THE WAY THESE PEOPLE LOOK? Imagine someone coming from an alternate dimen- sion, who knows nothing about the people on the earth. Do you think they could describe a person’s personality – who they are – purely based on their looks? Chances are slim to none! WE’RE THE CREATURE OF THE EYES We rely on our eyes to judge/analyze things. But, when we scratch the surface, things often turn out to be completely di- fferently and not how they looked initially. That’s the power of deception. The entire advertising industry has been long exploiting the power of deception to lure the customers in. You pass by a bakery shop and all the items are pre- sented in an alluring way to catch the customer attention. But, we all know that most of the stuff that looks good on the sur- face, doesn’t necessarily taste that good. The same way, just because so- meone appears to be rich looking outwardly, may actually be buried under a mountain of debt. THE ‘MARK ZUCKERBERG’ STORY Just the other day, Disco- very was broadcasting a show about Mark. It talked about how his employees thought that Mark wears the same jacket again and again. It was not until later that the employees at Facebook found out that he actually has several jac- kets that look exactly the same. An average person will be thrown in for a loop hearing this. But, there’s a reason why he wears simi- lar looking jackets every day. It saves him the time and the energy that is ot- herwise wasted browsing through the wardrobe trying to figure out what to wear. Zucker knows that he only has one item to pick and so he can save more time and use it to actually become rich instead of looking rich. FACEBOOK AND INSTAGRAM – the game of deception based on looks It’s hard to imagine any other platform that could better describe the game of deception involving looks than these leading social media channels. Do you really think people actually look the way they try to portray themselves on Instagram and Face- book? We all know how sometimes people that we meet on everyday ba- sis sometimes look like an entirely different person on Instagram – all thanks to the countless filters and effects available. Just because a person is relaxing near a swimming pool or near a beach do- esn’t mean that, that per- son is having the time of his life. People only show what they want to show, and not the truth.What we see on Instagram are only the highlights of people’s lives. Try to catch them off guard someday relaxing in their PJs and you’ll see what they actually look like. The same concept applies to looking rich and actually being rich. It’s not to say that the two are mutually exclusive. Meaning if you are rich then you would look ugly or that all broke people look good. It’s just that the two don’t necessarily define each other. RICH PEOPLE DON’T HAVE TIME TO LOOK RICH because they are busy making money. By all means, go ahead and look great! Just don’t always think that good looks are the definition of wealth and richness. Most rich people are busy making money and couldn’t care less about what they look like, because they don’t have anything to prove and hence don’t feel the need to overcompensate for things by their looks. If you were given a choice between looking rich and being rich, what would be your pick? Different people will have their own pick.

- 30. Money MadAbout 30 Sounds radical, right? But no, this is not a radical thought; rather this is how it should be. If you want to maintain healthy finances, this is the only possible way. BANKS SHOULD BE PAYING YOU, NOT THE OTHER WAY AROUND

- 31. 31 Money MadAbout S ee, the basic idea is that if you are spen- ding more money than you earn, you are losing money. If you plan to do something big with your career, or your life, you need to make decisions that can, and will curb your basic desires. What’s more important for you, the car you want to buy, the house you need to purchase, the investment you need to make to start your own bu- siness, or that pair of funky shoes? Is your weekend party more important than the dream vacation you always wanted but co- uldn’t materialize because of budget restraints? Those who keep saving money on everything We come across many people who keep saving money on everything, but don’t think twice before buying a phone on credit card. Most of us have done so, but when you come to think about it, it’s just a phone, it can wait. Why buy it if you can’t afford it? Save money for it, and may be when you actually get to buy it, the rates already drop to suit your pocket.. Consumeri- sm has always been be- neficial for companies and banks. You buy expensive phones with money you don’t have, and end up paying a good amount of money to the phone company, and even a larger amount to the bank as an interest. End up worrying about the payments And it’s not just the money that we are talking about here. No. You also end up worrying about the pay- ments, about the last da- tes, about the load you’ve got on your head. The more such unnecessary expenditure you incur, the more worrisome it gets. It is draining, exhausting. The tension you go through every day, every moment feeds on y our energy, your life and your time. You know the most important asset we all have? It’s time! Time is an asset that once spent can never come back. Make sure you spend your time on good things, with good people. Things that matter, people that make you become a better version of you. Plan your life according to your aim Sounds like a lecture, ri- ght, no, this is a life lesson. This is a lesson that many people learn the hard way. You need to plan your life according to your aim, according to your ultimate objective. Phones, expen- sive clothes won’t leave a lasting mark. Every phone becomes a thing of past, every expensive cloth gets out of fashion. Stop paying banks money that you don’t have to impress people that don’t even matter, especially at the cost of your goals. Read a quite somewhere couple of days ago: Lamborghini doesn’t advertise because people who can afford it don’t waste time watching television. Yes, that television can wait. If you can afford to buy either a Smart TV or go to a vacation with your loved ones, we don’t need to tell you which one you should choose. Make memories. Smart business owners know this; it’s high time you should also join the league. TIPSFOR FINANCIAL FREEDOM Tip 1 Team Work Matters If you are aiming for financial freedom and has a family, your spouse also needs to think likewise. As a team, you need to work out on your financial gains and expenses to reach towards financial freedom. Tip 2 Budgeting Is Important To curtain expenses and pay off your loans, a budget is the most essential key to financial freedom. It gives you a clear picture about the money which you need to spend and the moneyyou can actually end up saving. Tip 3 Start Early Financial freedom should be a goal that should be cultivated early in life and hence an attitude to save money and make proper investments at an early stage and at regular intervals is crucial.

- 32. Money MadAbout 32 Without knowledge of what to do with money, it will be gone It’s one thing to earn money, to earn plenty of it. We know it’s not an easy task to do so, but that’s not the end of your journey. On the contrary, this is where your journey reaches its most crucial checkpoint.

- 33. 33 Money MadAbout L et’s take a look at these rules, otherwi- se you will never know what to do with your money, and you’ll keep losing it. NEVER SPEND MORETHANYOU EARN: It is plain common sense, and we would like to explain with an example. Suppose you earn Rs. 30,000 per month, and have a monthly expense of Rs. 38,000. This would mean that each month, you will have a debt of 8 thousand rupees, resul- ting in a total debt of Rs. 96,000 at the end of the year. This amount would be hard to clear up. On the other hand, if you spend exactly what you earn, you won’t have even a single penny to save for an emergency. If your ex- penses are less than your income, you will always have money to save. So, make sure your expenses are always less than your income, and the lesser the expense, the more you can save. PLAN FORTHE FUTURE: And we are not talking about retirement here. Remember all those car ads where they ask you to make a down payment now and start giving in- stallments from next year onward, you’ve got to be sure that you will be able to make those payments. If you are not sure, let go of the deal. On the other hand, if you invest in an accidental cover plan for your car, you will have your expenses covered in case of such unwelco- ming emergency. MAKE MORE MONEYWITH YOUR MONEY: People always wonder how rich keep making money even while they sleep. The thing is they have saved plenty of it before setting foot towar- ds this goal. Once you have saved a good amount of money, invest some part of it in high interest investment account. But never ever empty all the money from your low interest standard savings acco- unt. Always save enough amount of money so that you have somet- hing with you in case an investment doesn’t work out. See, the first thing that you must know, and we are sure you do, is that the trends of money making have changed a great deal. But the basics haven’t changed a bit. Yes, there are higher paying jobs; there are more growth opportuni- ties, in current times. But keeping your expenses lower than your income, investing part of your sa- ved money will always be a good advice. And never blow up your paycheck the moment you get it, think about our future and plan accordingly. THE WAY YOU SPEND, MANAGE AND INVEST YOUR MONEY LEAVES A PROMINENT IMPACT ON YOUR LIFE, AND EVEN THEN, MAJORITY OF SCHOOLS DON’T TEACH YOU THESE SKILLS. ALTHOUGH THE MARKET IS FULL OF EVER CHANGING CONCEPTS, BUT THERE ARE SOME RULES THAT JUST NEVER CHANGE. THEY ARE CALLED THE BASICS, AND THEY FORM THE FOUNDATION OF ALL OTHER RULES. We all have heard that good old quote, “Money begets money”, right? As much as it sounds like honey to the ears, it takes effort and wisdom to make it a reality.

- 34. Money MadAbout 34 We live in a society which has two types of people in it. While one set of people is highly cost conscious, the other is highly quality conscious. There have been opinion clashes between these two classes of people all throughout history. People who are highly quality conscious feel threatened to go in for cheaper priced things. This is due to the inherent fear that low cost things will not be of good quality. JUST BECAUSE SOMETHING IS CHEAP DOESN’T MEAN IT’S WORTH THE COST

- 35. 35 Money MadAbout Cheap cost & good quality Thebasiclogicaboutthingsbeingavailableforcheapisthat they are made up of ‘not-so-good’ components or raw ma- terials. Everyone, after all, is in business. People in business target to earn profit and do not run a charityshow.This being the case, they invest in producing superior quality products that would enhance the name of their brand. Their focus is to safeguard their bottom line and top line. Any prudent bu- sinessman would not do anything that would damage the image and brand name of their products. For this reason, they use quality material and produce quality products. This is the justification why one set of people do not go in for cheap cost products since they know what the quality of the same would be Quality and cost go hand in hand Some people swarm in to buy products that are cheap in cost just for the happiness the possession of the product provides. Certain others buy cheap cost products knowing that they can enjoy those things for very short periods of time. Another psychology behind buying cheap cost pro- ducts is to show off the possession of products in front of the green eyed monsters around them. One more aspect that makes people buy cheap cost products without bot- hering themselves with the quality is to experience variety from time to time. The other thinking pattern of people is that the price of the products are purely based on the brand name it is associated with most of the time. All these theories act as the logic behind ways of thinking that make people compromise on the quality of products. If the low cost means bad quality Before taking the decision to buy a cheap cost product, just think if the low cost means bad quality or superior value. Va- lueandqualityarealwaysproportionatetoeachother.Wedo not get anything in this world without sacrificing some other thing. We cannot get anything we want in this world, without letting go off something else. This is applicable for cost and qualityof the products too. Ifyouwant to go in for a good qu- ality product probably you may have to compromise of the cost. This will certainly be worth the buy. However, if you are cost conscious and want to stick to a budget, then you are automatically compromising on the quality many a times. While the final decision whether to compromise on cost or qualityis purelyyours, remember, just because something is cheap doesn’t mean it’s worth the cost.

- 36. 36 you know the difference between GOOD AND BAD ADVICE FINANCIAL EDUCATION TELLS YOU HOW YOU CAN USE THE TAXATION POLICIES IN YOUR FAVOR AND HOW TO AVOID THE BAD DEBT AND USE GOOD DEBT TO YOUR FINANCIAL ADVANTAGE. Money MadAbout Financial education helps

- 37. 37 W e have to make so many decisions thro- ughout the life regarding finances and so being literate in this particular ni- che is the only weapon in your arsenal to make sure you end-up taking sound decision. Not just that, it’s the only way to discern whether or not someone is giving sound advice or simply trying to scam you. Take a look at the benefits of being financial literacy education You know the difference between asset and liability You may think you already know the difference, but believe it, most people don’t. For example, it’s common to think that your house is an asset when in fact it’s not. Here’s why – it’s not helping you earn any money. If anything, it’s only draining you off of it. Taxes, mortgages, what not! You have to pay these things. A rental property on the other hand is putting money in pocket. So, there you have a true asset. Financial knowled- ge and literacy helps you understand such differen- ce. With that knowledge, you know whether you’re being offered sound finan- cial advice and whether or not you actually stand to make anything out of it. You know the difference between good debt vs. bad debt Not all debt is bad. Most financial advisors are seen advising people to avoid the debt. But, they won’t tell you to avoid the bad one. And, it’s easy to start to blindly follow any advi- ce if you don’t understand such nitty-gritties. Examples of bad debt wo- uld be going on vacations or buying luxury items using credit cards. But, using bank’s money to buy a rental property is actu- ally the good kind of debt. You are not using your money to invest in the property and the rent you will receive each month will easily make up for the debt. The same goes with taxation. Smart investors who are well-educated financially know that go- vernment offers relaxation on various investments. For example, anything related to oil explorati- on, affordable housing, etc. are the areas where government cuts back on taxation. Financial education tells you how you can use the taxation policies in your favor and how to avoid the bad debt and use good debt to your financial advantage. It enables you to make your own financial decisions There’s no such thing as a tough or easy questi- on. Either you know the answer or you don’t. When you know the answer, question seems easy and if you don’t, it’s challen- ging. The same goes for making financial decisions. If you know what hand you’re being dealt with, you make good decision. Otherwise, you rely on outside help for making financial decision. And as long as you rely on some- body else, you can never be fully sure of whether you’re being offered good advice or bad. Therefore, do make it a point to stay abreast with the latest goings on of the financial market and keep reading finance rela- ted stuff to increase your knowledgebase. WHETHER WE WOULD LIKE TO ADMIT IT OR NOT, BUTA HUGE CHUNK OF OUR LIFE REVOLVES AROUND EARNING AND MANAGING FINANCES. SO, IT GOES WITHOUT SAYING THAT FINANCIAL LITERACY IS SOMETHING THAT WE SHOULD NOT TAKE LIGHTLY. Money MadAbout

- 38. 38 Money MadAbout PAYING OFF DEBT IS ABOUT MOMENTUM, NOT MATH!

- 39. T he thing about getting out of financially challen- ging situations is that you hear all kinds of advice. So much so, that after a point you begin to lose the sense of what’s right and what’s not. You rely on professional help. You listen to what experts have to say. You sudden- ly decide to become a mathematician crunching numbers and calculating interest rates trying to make your way out of it. But, Dave Ramsey - the famous American busine- ssperson and motivatio- nal speaker who helped countless people come out of debt successfully says that - you don’t have to be a math expert or a financial guru to have a plan to get out of debt. According to him, people should pay off their debts from smallest to largest. It’s not really so much about mathematics, as it’s about building the momentum. Let’s understand what he actually means by that, shall we? THE HUMAN PSYCHOLOGY According to Dave, the ability to pay off debt successfully has many psychological implicati- ons. One of these impli- cations is experiencing those ‘yes, I was able to do it’ moments. You enjoy that moment when you are able to successfully check an item off the list. For example, say you owe money to ten people and make a list of it. Ac- cordingly to this rule, you begin by paying off the person you owe the least amount of money. Just the act of knowing that you have one less person to deal with is enough to make you feel as if a huge baggage has been lifted off your shoulder. THE BENEFIT OF BUILDING MOMENTUM SLOWLY If you start off by the big- gest item on your list, the- re’s a high likelihood that soon you will start feeling discouraged and may gi- ve-up midway. We human want instant results. And not being able to pay off a huge loan for long could easily make you frustra- ted. Before you know, you succumb to debt fatigue. But, when you start by the easiest item on the list, you start building the mo- mentum slowly but surely. The step by step success makes you feel more con- fident that you are headed the right direction, and that what you’re trying to achieve is not impossible. You feel confident that will get there. 39 Money MadAbout ACTIVATES THEIR MIND’S REWARD MECHANISM What Dave meant when he said that it’s not about math, but about momen- tum - was that the art of paying off debt is less about the math being in favor of helping you pay off the highest interest rates first. People just want to feel like they have been able to pay off a loan and have only few more to go. For them, the psychologi- cal implications associa- ted with list getting shorter and shorter activates their mind’s reward mechanism by releasing dopamine. Starting off with the smallest loans and gradually moving towards bigger items reduces the likelihood of debt fatigue happe- ning. So, that should pretty much explains how you can exploit human psychology in the favor of bidding your loans goodbye. SO, YOU HAVE SPENT MORE THAN YOU EARNED AND NOWYOU’RE FINDING YOURSELF BURIED UNDER A MOUNTAIN OF DEBT. THAT’S OKAY! WE’VE ALL MADE MISTAKES. NO JUDGMENT! HAVING A LOT OF DEBT IS THE PROBLEM. NOW LET’S TALK ABOUT THE SOLUTION.

- 40. MadAbout Money