Apex Bank Project Report

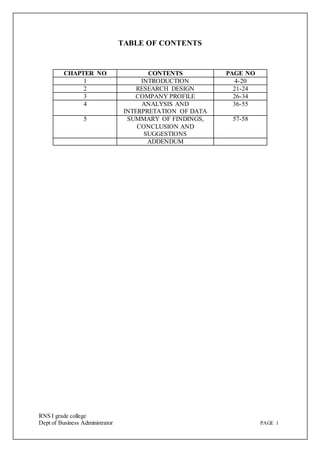

- 1. RNS I grade college Dept of Business Administrator PAGE 1 TABLE OF CONTENTS CHAPTER NO CONTENTS PAGE NO 1 INTRODUCTION 4-20 2 RESEARCH DESIGN 21-24 3 COMPANY PROFILE 26-34 4 ANALYSIS AND INTERPRETATION OF DATA 36-55 5 SUMMARY OF FINDINGS, CONCLUSION AND SUGGESTIONS 57-58 ADDENDUM

- 2. RNS I grade college Dept of Business Administrator PAGE 2 INTRODUCTION

- 3. RNS I grade college Dept of Business Administrator PAGE 3 HISTORY OF INDIAN BANKING: Ancient Indian writings tell us that banking was practiced by the Vaishyas, the merchants and landowners who were ranked third among the four castes. Later even the top-ranked cast like the Brahmins was involved in banking. Commercial banking has been the oldest business in India. The establishment of General Bank in India in the year 1786 marked the development of structured banking system in India. . Later the Bank of Hindustan and the Bengal bank came into existence. The East India Company established three banks which were amalgamated in the year 1920 to form the Imperial Bank of India; this bank was nationalized and renamed as the State Bank of India. The Swadeshi Movement witnessed the birth of several indigenous banks, such as Punjab National Bank, Bank of Baroda and Canara Bank. The government of India in order to increase their control over the banking sector nationalized 14 major private sector banks with deposits exceeding Rs.500 million in 1969. The present banking system can be classified into the following categories: A. Scheduled Banks i) Public sector banks ii) Foreign Banks iii) Regional Rural Banks iv) Other Commercial Banks. B. Scheduled Co-operative Banks Primary Credit Societies at the base, Central Co-operative Banks at the district level in the middle, and Provincial or State Co-operative Banks (also called as apex banks) at the top DEFINITION OF BANKS In India, the definition of the business of banking has been given in the Banking Regulation Act, (BR Act), 1949. According to Section 5(c) of the BR Act, 'a banking company is a company which transacts the business of banking in India.' Further, Section 5(b) of the BR Act defines banking as, ' accepting, for the purpose of lending or investment, of deposits of money

- 4. RNS I grade college Dept of Business Administrator PAGE 4 from the public, repayable on demand or otherwise, and withdraw able, by cheque, draft and order or otherwise. This definition points to the three primary activities of a commercial bank which distinguishes it from the other financial institutions. These are: (i) maintaining deposit accounts including current accounts, (ii) issue and pay cheques, and (iii) collect cheques for the bank's customers. CO-OPERATIVE BANKING IN INDIA ORIGIN: India is an agricultural country and agriculture is termed as the backbone of Indian Economy. Generally, in India, agriculture plays an important role. It is an important sector as75% of the country's population depends on agriculture or agro-industries or agro-business. In India, agriculture is mainly carried on by the small and marginal farmers on a small scale. It is immensely exposed to the risks of nature. Indian commercial banks, which are mainly governed by the principles of safety, liquidity and profitability meticulously kept themselves away from agriculturists in villages. The interest rates charged by the village money lenders were very high. This led to chronic poverty, heavy indebtedness to money lenders and stagnation of the rural masses attracted the attention of the government and made the government to take steps for the creation of an institutional credit agency for the provision of the cheap and adequate credit to the agriculturists in rural areas. This resulted in the emergence of co-operative banks which plays an important role in India's financial and economic development. The history of co-operative movement in India is about a century old. The movement was commenced in India with a view to encourage and promote economic management of money and They are based on the principles of co-operation, self help and mutual help for the development of persons of small means such as agriculturists, craftsmen, artisans and other sections of the society. It was mainly focused on the efforts of releasing the exploited classes out of the control of the money lenders. This was the

- 5. RNS I grade college Dept of Business Administrator PAGE 5 main objective for the formation of co-operative units under Co-operative Societies Act of 1904. Under the co-operative Societies Act (1904), primary credit societies were entitled to register and federal and non-credit organizations of primary co-operative credit societies were repressed. This gap was bridged by the Co-operative Societies Act, 1912. This Act laid the first stone for the organization of central co-operative banks throughout the country. But the provisions of 1912 Act were inadequate to meet the requirements of those states where co- operative movement had made considerable progress. Mumbai, the pioneers in this regard passed a new Act, namely the Mumbai Co-operative Societies Act, 1925 for serving the many developments of the state. Later on, Madras (1932), Bihar (1935) and Bengal (1940) passed their own Acts respectively. The co-operative banks are monitored by the RBI. They are governed by the Banking Regulations Act 1949 and Banking Laws (Co-operative Societies Act) of 1965. MEANING: A co-operative bank is a financial entity which belongs to its members or associates, who are at the same time the owners and the customers of the bank. Cooperative banks are most often created by people belonging to the same local or professional community or sharing a common interest. Co-operative banks mostly provide their members with a wide range of banking and financial services (loans, deposits, banking accounts etc). Co-operative banks are different from stockholder banks by their organization, operations, goals, values and governance. DEFINITION: In the words of Henry wolf," co-operative banking is agency which is in the position to deal with small on his own terms accepting the own security he has and without drawing on the protection of rich."

- 6. RNS I grade college Dept of Business Administrator PAGE 6 Henry C Devine defines a co-operative bank as "a formed, composed, governed for working people themselves for encouraging regular savings and small loans on easy terms and repayment. CO-OPERATIVE MOVEMENT IN KARNATAKA: Karnataka has a special stature in the Indian co-operative sector, as it is one of the first state to start co-operative movement in India. The first agricultural credit cooperative society in Karnataka was started in the year 1905. In the same year consumer co-operative society was also started in Bangalore. Prior to unification of states, present Karnataka was divided into various provinces such as Mumbai, Hyderabad, Madras, Mysore etc. All provinces had their own Law relating to co- operative Societies. After unification of states in 1956, The Mysore Co-operative Societies Act, 1959 was implemented, which applied to whole Mysore State. It was put into effect from June 1, 1950. The name of Mysore State was changed to Karnataka in-1973 and the Act was. also renamed as Karnataka State Co-operative Societies Act, 1959. The state has over 4,000 Primary Agricultural societies (PACS) and over 10.12 lacs farmers are benefited from these co-operatives. In Karnataka 100% villages are covered by co-operative Societies. Karnataka is progressive in Co-operative movement. It is leader in bringing parallel cooperative law. CHARACTERISTICS FEATURES OF CO-OPERATIVE BANKS: Like commercial banks, co-operative banks also have to perform the banking functions of accepting the deposit and lending of funds. Co-operative banks function on "no profit, no loss" basis. Co-operative banks, as a principle, do not follow the goal of profit maximization. Co-operative bank performs all the main banking functions of deposit mobilization, provision of remittance facilities and supply of credit. Co-operative Banks provide minimum banking products and are functionally specialists in agriculture and allied products. However, co-operative banks are also offering housing loans to their members.

- 7. RNS I grade college Dept of Business Administrator PAGE 7 The operations of co-operative banks are generally restricted to a specified area such as a village, district or a state. Co-operative Banks belong to the capital market as well as to the money market. Primary agricultural credit societies (PACS) provide short term and medium term loans. Co-operative banks are organized and managed on the principal of co-operation, mutual help, and self-help. They function with the rule of "one member, one vote". Thrifts and savings is the main essence on which co-operative works. Generally, the cost of co-operative banking is relatively low because of low cost of management. Co-operative bank mainly perpetuate banking business in the agriculture and rural sector. The rate of interest charged by co-operative banks is low. In fact, to enable the co- operative banks to provide credits at low interest rates the Central co-operative banks provide financial assistance to co-operative banks at concessional rates. OBJECTIVES OF CO-OPERATIVE BANKS: To raise funds by way of deposits, grants, loans, subscriptions donations and subsidies etc. For financing the members by way of cash credits, loans, overdrafts and advances. To engage in the schematic lending and to provide loans for which refinance facility is available with term lending institutions. To buy and sell securities for the legal investment of surplus funds and act as agents for buyers and sellers of securities of Central/State. To carryon general business of Banking and other banking activities to the members and customers. To take measures or steps to help Co-operative Education. To purchase, raise or acquire otherwise obtain moveable or immoveable property for the own use of the Bank and also to dispose them of when not required. To endorse and undertake Co-operative Research and Co-operative

- 8. RNS I grade college Dept of Business Administrator PAGE 8 Development. To manage, release or sell any property which may come into the possession of the bank in satisfaction of or part satisfaction of any of its claims. To promote economic interest of the associates of the Bank in accordance with the principles of Co-operation. TYPES OF CO-OPERATIVE BANKS: Co-operative banks are classified into two types: Agricultural co-operative banks Non-Agricultural co-operative banks Agricultural co-operative banks: Agricultural co-operative banks cover all co-operative agencies, which meet the short term, medium-term and long-term financial requirement of agriculture and allied activities. Agriculture co-operative banks are sub divided into: Short-term and medium-term agricultural credit institution which meets the requirement of agriculturists. Long-term agricultural credit institutions. Non-Agricultural co-operative banks: Non-Agricultural co-operative banks are the credit institutions, which offer finance for activities other than agriculture in commercial and industrial towns and trade centers. They offer finance to salaried employees, artisans and craftsmen, small traders, cottage and small scale industries. Co-operative urban banks, employees' co-operative credit societies and industrial banks fall under the category of Non-Agricultural co-operative banks. Urban co- operative banks are formed to provide cheaper credit facilities to a large number of urban people with small means and limited resources like salaried employees and artisans

- 9. RNS I grade college Dept of Business Administrator PAGE 9 MERITS OF CO-OPERATIVE BANKS: Co-operative banks have several merits. Some of them are: 1. The co-operative banks have a rural touch. 2. They are familiar with rural problems. 3. They are having attitudinal identification with rural economy. 4. They have local feel. 5. Their methods, procedures and orientation are best adapted to rural economy. 6. Their relationship with members and non-members are not only confidential but also humane. The cost of operating a co-operative bank is very low. Because of the low cost of operation, the co-operative banks are able to provide credit to weaker sections of the rural areas at less rates of interest. Co-operative banks strengthened the character of the agricultural borrowers. Co-operative banks also provide information with regard to repay the loans at the right time and also to retrench the savings so that they may not borrow frequently. With the expansion of co-operative banks in rural areas, the hold of village money lenders over rural masses has been considerably. Co-operative banks are widely accepted as the only mean of eradicating poverty and raising the standard of living of rural masses. LIMITATION OF CO-OPERATIVE BANKS: Co-operative banks are not able to mobilize adequate resources from members as well as non-members for one reason or the other. Therefore, they have to depend upon the central bank for re-finance facilities to a large extent. On account of limited funds at their disposal, co-operative banks are not able to great adequate credit to their members. Most of the co-operative banks at the bottom level, Le., the agricultural primary credit societies, are in the hands of influential people of the villages. This has led to indiscrimination among the borrowers without looking into the character and

- 10. RNS I grade college Dept of Business Administrator PAGE 10 repaying capacity of the borrowers and the purposes of credit. The limited managerial talent available with the co-operative banks and the ineffective post-credit supervision leads to poor recoveries of advances or funds. Many people in the rural areas have the misconception that co-operative banks are charitable government institutions for dispensing credit. Due to lack of honesty and integrity of the persons in charge of the day to day administration, cases of defalcation and embezzlement of funds are quite common in the case of many co-operative credit societies. Co-operative banks i.e., primary credit societies in rural areas, suffers from stiff competition from village money lenders. This has also contributed to the unsuccessful working of many village co-operative credit societies. STRUCTURE OF CO-OPERATIVE BANKING SYSTEM IN INDIA: Co-operative banking in India functions in three sections. At the top there is the state co- operative bank, which is the apex bank at the state level. The co-operative banks and societies perform very useful and important role in meeting the requirements of people in the rural areas. Co-operative banks are distinct entities by themselves with separate jurisdiction and independent board of directors. The co-operative banks are organized on a co-operative basis and governed by their members according to the control of the respective stated government. Certain provisions of the Banking Regulation Act also apply to co-operative societies and on top; there are state co-operative banks. The structure of co-operative institutions is shown under:

- 11. RNS I grade college Dept of Business Administrator PAGE 11 CO-OPERATIVE BANKING SYSTEM IN INDIA STATE CO-OPERATIVE BANKS (APEX) CENTRAL CO-OPERATIVE BANKS (DISTRICT) (DISTRICT) AGRICULTURAL CREDIT SOCIETIES PRIMARY AGRICULTURAL CO-OPERATIVE SOCIETIES (PACS) GRAIN BANKS FARMERS’ SERVICE SOCIETIES NON- AGRICULTURAL CREDIT SOCIETIES URBAN CO-OPERATIVE BANKS EMPLOYEES CO-OPERATIVE SOCIETIES

- 12. RNS I grade college Dept of Business Administrator PAGE 12 STATE CO-OPERATIVE BANKS (SCBs): The state co-operative banks, also known as apex banks obtain their funds mainly from general public by way of deposits, loans and advances from the reserve bank and their own share capital and reserves. Anywhere between 50-90% of the working capital of the SCBs, are contributed by the Reserve Bank of India. FUNCTIONS: The following are the major functions of the SCBs 1. They act as a 'balancing Centre' by balancing excesses and deficiencies in the resources of central co-operative banks. 2. They have no power to supervise or control the activities of the affiliated CCBs 3. A SCB serves as a lender of co-operative movement in a state. WEAKNESS: SCBs also have the same weaknesses of the CCBs. The following are the major weaknesses of SCBs: 1. They are mixing commercial banking activities with co-operative banking. 2. They have insufficient share capital. 3. They utilize their reserve funds as working capital. DISTRICT CENTRAL CO-OPERATIVE BANKS (DCCBs): The central co-operative banks are federation of primary credit societies operating in a specified area, normally, extending to the whole district. Generally, they are located in the district headquarters or some prominent towns of the district. They are organized on the basis of limited liability. Central co-operative banks is confined to only primary credit societies the central co-operative banks are called 'pure central co-operative banks or co-operative banking unions.

- 13. RNS I grade college Dept of Business Administrator PAGE 13 FUNCTIONS: The major functions of the CCBs are: 1. They accept deposits from the public. 2. They grant credit to their customers on the security of first class giltedged securities, gold etc. 3. They provide remittance facilities. WEAKNESS: The following are the major weakness: 1. They violate the principle of co-operation by working on the line of commercial banks. 2. They do not appoint experts to examine the creditworthiness of the primary societies. Hence, there have been problems of recovery and over dues. 3. Many of these banks are financially and organizationally weak. PRIMARY AGRICULTURAL CREDIT SOCIETIES (PACS): Primary credit societies is an association of ten or more persons, residing in a particular locality, knowing one another intimately and showing interest in the welfare of one another. FUNCTIONS: The main functions of primary agricultural credit societies are: 1. Granting short-term and medium term loans and advances to members for procedure purpose. 2. Encouraging saving habit among the rural society and mobilizing rural savings. 3. Supplying farm inputs like seeds, chemical fertilizers, pesticides etc. WEAKNESS: Though the PACS have made remarkable progress in the area of rural finance, their weaknesses may be listed as under: 1. They have failed to meet the growing needs of the people. 2. A large number of members lacked potential viability.

- 14. RNS I grade college Dept of Business Administrator PAGE 14 3. The Bank commission (1972) observes that PACS neither provided credit for all productive activities of the farmers nor fulfilled their credit needs adequately. SERVICE CO-OPERATIVE SOCIETIES: After the independence, the Government of India undertook several measures to develop rural economy through co-operative movement. One major direction was the setting up All India Rural Credit Survey Committee to study entire gamut of agricultural credit. This committee developed rural credit co-operative structure. The Banking Commission in 1972 recommended programs of revitalizing the rural credit structure. MERITS: If a farmer becomes the member of service society, he can derive multiple services from such society. Services are loans purchase seeds, fertilizers and pesticides and also they provide marketing guarding and storing. DEMERITS: There has been a shortage of trained personnel to organize and administer three or four societies in the village. It is impossible to raise loans in those societies and offer securities to those societies. URBAN CO-OPERATIVE BANKS: Urban Co-operative Banks are also referring as Primary Co-operative banks by the Reserve Bank of India among the non-agricultural credit societies, urban co-operative banks occupy an important place. The RBI defines Urban Co-operatives Banks as "small sized Co-operatively organized banking units which operate in metropolitan, urban and semi-urban centers to cater mainly to the needs of small borrowers, viz., owners of small scale industrial units, retail traders, professional and salaried classes". Urban Co-operative banks mobilize savings from the middle and lower income groups and purvey credit to small borrowers, including weaker sections of the society. These banks organize on a limited liability basis; generally extend their area of operation over a town.

- 15. RNS I grade college Dept of Business Administrator PAGE 15 FUNCTIONS: 1. To promote thrift by attracting deposits from members and non-members and to advance loans to the members. 2. These banks grants sizeable loans and advances under priority sector for lending to small business enterprises, retail trade, road and water transport operators and professional and self-employed persons. 3. Urban Co-operative banks are mostly located in towns and cities and cater to the credit requirement of the urban clients. OBJECTIVES OF CO-OPERATIVE BANKS: The Objectives and Functions of the Urban Co-Operative Banks: 1. Primarily, to rise funds for lending money to its members 2. To attract deposits from members as we as non-members 3. To encourage thrift, self-help ad mutual aid among members. 4. To draw, make, accept, discount,. by sell, collect and deal hl bills of exchange, draft certificates and other securities. 5. To provide safe deposits vaults. 6. To issue letters of credit and traveler's Cheques. 7. To arrange for the safe custody of valuables. 8. It acts as an agent of its customers. 9. To borrow funds and utilize them for giving loans to needy persons.

- 16. RNS I grade college Dept of Business Administrator PAGE 16 DIFFERENCE BETWEEN COMMERCIAL BANKING AND CO- OPERATIVE BANKING Sl No. COMMERCIAL BANKING CO-OPERATIVE BANKING 1 Commercial banks are joint-stock banks. Co-operatives banks, on the other hand, are co-operative organizations. 2 Commercial banks are governed by the Banking Regulation Act. Co-operatives banks are governed by the Co-operative Societies Act of 1904. 3 Commercial banks are subject to the control of the Reserve Bank of India directly Co-operative banks are subject to the rules laid down by the Registrar of Co- operative Societies. 4 Commercial banks offer a variety of banking services. Co-operative banks have lesser scope in offering a variety of banking services 5 Commercial banks in India are on a larger scale. They have adopted the system of branch banking, so they have countrywide operations. Co-operative banks are relatively on a much smaller scale. Many co-operative banks follow only unit-bank system, though there are cooperative banks with a number of branches but their coverage is not countrywide. 6 Commercial banks in India are of two types: (i) public sector banks and (ii) private sector banks. Co-operative banks are private sector banks. 7 Commercial banks mostly provide short-term finance to industry, trade and commerce, including priority sectors like exports, etc. Co-operative banks usually cater to the credit needs of agriculturists. 8 Commercial banks offer less rate of interest to their depositors. Co-operative banks offer a slightly higher interest to their depositors. 9 Borrowers of commercial banks are only account- holders and have no voting power as such, so they cannot have any influence on the lending policy of these banks. In co-operative banks, borrowers are member share holders, so they have some influence on the lending policy of the banks, on account of their voting power. 10 Commercial banks, on the other hand, are free from such rigidities Co-operative banks have not much scope of flexibility on account of the rigidities of the bye-laws of the Co-operative Societies.

- 17. RNS I grade college Dept of Business Administrator PAGE 17 FINANCIAL FUNCTIONSCARRIED ON BY CO-OPERATIVE BANKS: RETAIL ASSETS: INTRODUCTION: The most prominent issue in the context of banking these days are the implications arising out of the sub-prime crisis and Basel I Basel " accord. Basel Committee on Banking Supervision (BCBS) announced the adoption of risk-based capital standards by banks in 1999. The Basel accord " proposes three alternative regimes: the "standardized", the "foundation IRB" (for internal ratings based) and the "advanced IRB." Banks that choose the advanced regime have to provide internal estimates of expected losses and use the Basel formula for capital calculation Retail assets in banks have grown at a much faster pace as compared to commercial assets over the past few years. The commercial exposures that are managed individually, on an exposure-by-exposure basis, retail assets, whose singular exposures at default are typically much smaller, need to be analyzed in fewer pools to be more manageable and meet regulatory guidelines. The banking industry has typically concentrated on large losses in corporate loan portfolios and viewed retail portfolios as a relatively (homogeneous) set of small value transactions, with highly predictable loss characteristics. The importance of a robust, consistent and easily deployable solution that can help a bank create pools of retail exposures and also conduct various analyses to manage them effectively cannot be underestimated. MEANING Assets that are retail able i.e., the estimated amount for giving loans to fruitful projects. In every year's budget preparation, a certain portion of amount is kept for certain development and certain help that supports the nation and the bank's interests. Such amount is known as retail assets. Bank's retail assets include all personal and small business relationships, such as mortgages, auto loans, personal loans, and small business loans. This also includes revolving retail assets like credit cards, ready cash and overdrafts, home equity loans where the borrower can rotate the balance after

- 18. RNS I grade college Dept of Business Administrator PAGE 18 paying a minimum due amount. Retail portfolios are quite different from their commercial counterparts, in terms of the number, ticket size and expected loss measures. The volume of retail assets can add up to millions on the banks' books. RELATON OFCO-OPERATIVE BANKS WITH THE GOVERNMENT: In India, "Co-operation" is a State subject whereas "Banking" is with federal Government. Laws governing the management and operations of the cooperative financial institutions are therefore not uniform. There are several restrictive provisions in these laws hindering the operations and management functions. Government control over institutions is excessive and interference is unwarranted. Very often, elected Boards/Managements are superseded not for reasons of mismanagement or violation of law but on political consideration. Apex level financial institutions invariably are managed at the top level not by professionals but by deputed Government officers. Central Government's support or control is not always direct. It is through the Central Bank by way of banking regulations or as a part of monetary policy and through public sector financial institutions on which the cooperative banks depend for funding/ refinance. Cooperatives over the last few years have been demanding amendments in the cooperative laws for their autonomy. The issue has evoked a national debate and pressures are mounting on the Governments for amendments in the laws. Economic liberalization and reforms have no meaning without functional autonomy. PRESENT POSITION OF CO-OPERATIVE BANKS IN INDIA The co-operative banks constitute the second segment of Indian banking system, comprising of about 14% of the total banking sector asset (March 2008). Most of the co-operative banks operate in the rural regions with rural co-operative banks accounting for 67% of the total asset and 67% of the total branches of all co-operative banks and the rest 33% are urban co-operative banks. Share of rural co-operatives in total institutional credit was 62% in 1992-93, 34% in 2002-03 and 53% in 2006-07. Co-operative banks have an impressive network of outlets for institutional credit in India, particularly in rural India (1 PACS per 7 villages). In March 2007, there were 97,224 PACS in rural India against 30,393 branches of commercial banks (more than 3 times of outlet of co-operative banks). In March 2007, there were 102 savings AlC and 113

- 19. RNS I grade college Dept of Business Administrator PAGE 19 co-operative bank members per 1000 rural in India. Co-operative banks (both rural and urban) cater to small and marginal clients. Financial health of the co-operative credit institutions, particularly the rural co-operatives, has been found to be poor by several Committees. As of March 2008, special audit was completed in 59,294 PACS in the country. As of Sept 2008, governments of 8 States have passed bills to amend their co- operative societies Acts. Common Accounting System (CAS) and Management Information System (MIS) have been introduced along with human resources development initiatives in the States willing to participate. The figures of PACs in rural areas in 2009 were 97,224 while commercial banks were having 30,393 branches in India.

- 20. RNS I grade college Dept of Business Administrator PAGE 20 COMPANY PROFILE KARNATAKA STATE CO- OPERATIVE APEX BANK LTD., BANGALORE

- 21. RNS I grade college Dept of Business Administrator PAGE 21 Co-operative sector has a long history of more than a century. In the co- operative movement, agriculture sector has acquired a special importance in order to avoid the exploitation of poor farmers from the middlemen and money lenders and to provide suitable assistance to the eligible farmers. As our nation is basically an agricultural country, agriculture, credit system plays an important role in the development of this sector. - The credit sector is extending helping hand to the farmers in its own way to boost the agricultural production in the state in particular and in the country at large. The Karnataka state co-operative apex bank over the 94 years, since its inception has always come forward to extend its assuring hand to the farmers of the state through district central co-operative banks , primary agriculture co-operative societies working under three tier agriculture co-operative credit system. The bank is also providing the needed financial assistance for development of human resources, training; computerization, and all other encouragement from time to time to the DCC banks and PACS. The Apex Bank is a pioneer in agricultural finance and allied activities in Karnataka. The Bank, thanks to its broad spectrum of activities and a proven track record, is ranked as one of the premier State Cooperative Banks in the country. The Banks' main objectives are to serve the farmers in the State by providing short and medium term agricultural loans, carryon general Banking business and function as a leader of Co-operative Banks in the State. The Karnataka State Co-operative Apex Bank in its past 94 years is growing from strength to strength each year and working as a model institution to all other Co-operative institutions. Besides, Apex Bank has always come forward to extend its assuring hand to District Central Co-operative banks, Primary Agricultural Co-operative Societies working under three tiered Agricultural Co-operative Credit System and also provide the needed financial assistance, helping in development of Human Resources, extending financial

- 22. RNS I grade college Dept of Business Administrator PAGE 22 assistance to improve the Development of Technology in Banking Sector and all other encouragement from time to time to the above said institutions. The State Government has accepted the Prof.Vaidyanathan’s Committee recommendations which intend to revive the Rural Area Credit Institutions and Apex Bank is also playing its successful role in this regard. Further, Apex Bank is determined to serve in protecting the interest of State and farmers by taking all the necessary measures. PREAMBLE: The Karnataka State Co-operative Apex Bank Ltd, established in the year 1915 with deposits of Rs.1.26 lakh, owned funds of Rs.0.54 lakh and working capital of Rs.1.80 lakh is extending its continued service for the past 94 years to its members and customers. The Bank which had a humble beginning, in the year 1951 grew over the years and achieved a significant development in the Co-operative Banking sector and became a pioneer State Co-operative Bank, among the State Co- operative Banks in the nation. Apex Bank rendering its service in the State Co-operative Sector, very particularly in the Agricultural Credit Sector is rather very great and invaluable and the Banks is known for its commitment for the development of State farmers and Credit Co-operative institutions. The primary objective of the Bank is to provide Short term and Medium term loans and loans to SHG through various Co-operative institutions, to the farmers so as to help them in managing their agricultural activities, provides loans to the farmers for their allied activities and also to extend loans to sugar sector, marketing and schematic activities, which are linked with agriculture. Besides, Apex Banks as a Scheduled Bank under Banking Regulation Act is carrying out all other banking activities successfully as on other Banks. Apex Bank has 42 branches in the city of Bangalore carrying out the Banking business such as Deposit mobilization, providing credit facilities, Money transfer. Collection of Bills, Issue of Demand Drafts and Banking activities through its Bank Branches.

- 23. RNS I grade college Dept of Business Administrator PAGE 23 OBJECTIVES OF THE BANK: The main aims and objectives of the Bank are defined in the Bank Bye Law No.III are given below: To serve as a State co-operative Bank and as an balancing center in the State of Karnataka for registered co-operative societies. To raise funds by way of deposits, loans, grants, donations, subscriptions, subsidies etc for financing the members by way of loans, cash credits, overdrafts and advances. To develop, assist and co-ordinate the member DCCBs and other Co-operative Societies and secure financial assistance for them. To arrange hold periodical Co-operative Conferences of the DCCBs and other members of the bank and to take action. HISTORY The Bank was registered on 10th November 1915 under the name and style of “The Mysore Provincial Co-operative Bank Limited,” under the Mysore Co- operative Societies Act of 1905. Then, the Bank was not an Apex Institution, as it was not exclusively meant for financing the Co-operatives in the then state of Mysore. Another Bank called the Bangalore Central Co-operative Bank Limited, Bangalore (which was later converted into an Urban Bank), which was registered in 1905, was also financing the co-operatives. The bank owes its origin to Sri.M. A.Narayan Iyengar, B.A., BL., who was the registrar of Co-operative Societies at that time. The Bank was founded with the objective financing, inspecting and supervising the co-operative societies in the Mysore State. Subsequently, several district co- operative central banks within the jurisdiction of a district were registered. Five such district central banks were started. But their working was not satisfactory and they became defunct. As such, the provincial bank started financing the societies directly. Besides, granting of loans, the bank served as an outlet for investment of the surplus

- 24. RNS I grade college Dept of Business Administrator PAGE 24 funds of the co-operative societies in the State. The Bank thus acts as the balancing Centre of the Co-operative Movement in the State, safeguarding its interests. REORGANIZATION OF PROVINCIAL CO-OPERATIVE INTO AN APEX BANK: At the time of inception of the Mysore Provincial Co-operative Bank, there was also another co-operative organization. The Bangalore Central Co-operative Bank, which was working on similar lines. This was an anomaly, which led to mutual competition unnecessarily in the matter of financing of co-operative societies. In order to remove this peculiarity and to have only one institution as an Apex institution exclusively for financing the co-operatives in the State, the Government appointed an Enquiry Committee know as the Mysore Co-operative Enquiry Committee, 1920-22 presided over by Mr.Lallubhai Samaldas and the Committee after reviewing the position of these banks, made the following three alternative recommendations to the Government: To amalgamate the Mysore Provincial Co-operative Bank and the Bangalore Central Co- operative Bank. To create a new Apex Bank. To convert the Central Co-operative Bank into an urban bank dealing only with the individuals and to reorganize the Provincial Co-operative Bank into an new Apex Bank. The Bangalore Central Co-operative bank opposed the amalgamation with the Provincial Co-operative BANK. Thus, the creation of a new Apex Bank was out of question. The Government therefore accepted the third suggestion made by the Committee. Accordingly, the Government passed orders on 14 and 15 September 1925 permitting the Mysore Provisional Bank to get it converted into Apex Bank Ltd., With the jurisdiction extending over the entire State for financing the Co-operative Societies exclusively and the Bank thereafter was name as Mysore Provincial Co-operative Apex Bank Ltd., popularly

- 25. RNS I grade college Dept of Business Administrator PAGE 25 its known as "Apex Bank". In the beginning, the Bank was advancing long-term loans through agricultural credit co- operatives for land improvements and redemption of prior debts. Large amounts were given for the above purposes. After the organization of Central Co- operative Land Mortgage Bank in the year 1929 and Primary Land Mortgage Ranks at the taluk level, the Bank had to give up this model of business. On account of depression between the years 1925-30, the value of land sand the prices of agricultural produce fell very steeply and the Bank had to face a lot of difficulties in the recovery of long term loans advanced. However, during Second World War, there was rise in the land value and agricultural prices and the Bank could therefore recover a major portion of ifs dues. In order to meet the loss of business on account of stoppage of long-term loan for land improvement and redemption of prior debts consequent on the organization of Central Land Mortgage Bank, the Bank started financing of long term loans for construction of houses through House Building and House Construction Societies. Besides, on account of Second World War, there was great stimulus for consumer stores activities for distribution of essential commodities through co-operatives. The Bank undertook the finance of these consumer societies in the form of cash credit loan. The financing of House Building Societies continued up to the year 1950 when a separate Apex Institution c,alled Mysore State Co-operative House Building Corporation was registered. The Government directed the Bank not to issue loans to the House Building Societies. This was period of crisis in the history of Bank. The bank had to satisfy itself by financing a few marketing societies by way of crop and produce loans and few stores societies. Fortunately for the bank, consequent to the amendment of Reserve Bank of India Act 1953-54, the RBI suggested that the State Government should step into and strengthen the capital structure by contributing Rs. 5 lakhs towards share capital of Apex Bank. Accepting the proposal, the State

- 26. RNS I grade college Dept of Business Administrator PAGE 26 Government contributed the amount proposed towards share capital and rehabilitation grant of Rs. 4 lakhs to meet anticipated bad debts. VISION OF THE BANK: The bank's vision is to be the leading Apex co-operative bank of the country. The Apex bank shall he a dominant financial institution in the state, leading the state to economic prosperity. The bank shall be a role model of an effective, protective, dynamic and financial sound organization, respectively to state goals and aspirations. The bank shall contribute to building a progressive standard Of co-operative societies in the service of farmers and rural men. MISSION OF THE BANK: The banks' mission is to provide finance to all the farmers in the state by ensuring the best quality of life and success of their farmer, agricultural co- operative societies, district central co-operative banks, client and employees who are the reasons for their being. PRINCIPLES FUNCTIONS OF THE BANK Financing short term agricultural loans for crop production and marketing of crops and medium term loans for development of allied activities. During the 2009-2010, apex bank has disbursed total loans of Rs 2950.39 crores of which Rs 2252.38 crores for agricultural purposes. Advancing medium term loans for the development of agricultural infrastructure such as irrigation, dairy, poultry, plantations, gobar gas etc., under schematic lending. Extending cash credit and working capital loans to processing, marketing and consumer co-operative as well as sugar factories in the Karnataka state.

- 27. RNS I grade college Dept of Business Administrator PAGE 27 The bank is advancing term loans to new co-operative sugar factories under consortium arrangement in Karnataka Retail banking transactions like remittance of funds by demand drafts, mail transfer, collection of cheques and drafts, issue of Consumer loans, vehicle loans, housing loans salary earners loans and gold loans. To Finance the non-reform sector for development of cottage industries, small scale industries and rural artisans and wavers. Monitoring the inland mutual arrangements scheme under which money remittances and off bills and cheques are facilitated between member banks. HIGHLIGHTS AND MILESTONES: The co-operatives were first" started in Europe to serve the credit starved. people of Europe as a self-reliant, self-managed people's movement with no role for the government. British ruled India replaced the Raiffeisen-type co-operative movement in India to mitigate the miseries of the poor farmers, particularly harassment by money lenders. The first credit co-operative society was formed in banking in the year 1903 with the support of the government of Bengal. It was registered under the friendly societies act of the British government. Co-operative credit societies act of India was enacted on 25th March1904. Co-operation became a state subject in 1919. In 1951, 501 central Co- operative unions were renamed as central co-operative banks. Land mortgage co-operative banks were established in 1938 to provide loans initially for debt relief and land improvement. Co-operatives have played an important role in the liberation and

- 28. RNS I grade college Dept of Business Administrator PAGE 28 development of our country. The Reserve Bank of India started refinancing co-operatives for seasonal agriculture operations from 1939. From 1948, the Reserve Bank of India started refinancing state co-operative banks for meetings the credit needs of central co-operative banks and through them the primary agriculture co-operative societies. Only 3% of rural .families availed farm credit in 1951. In 1954, the all India rural credit survey committee recommended strengthening of DCC banks and PACS with state partnership and patronage to solve the farmers' woes. Registrar of co-operative societies became custodian of' co-operative societies from 1962 with the enactment of respective state acts. Reserve Bank introduced seasonality and scale of financing of crop loans provided for conversion, replacement and re-scheduling over crop loss due to calamities. The primary agriculture co-operative societies became multipurpose. Reorganization the PACS into viable units, FSCS, LAMPS started under action programme of the RBI in 1964. The establishment of regional rural banks from 1975 has not reduced the problems of rural credit as they reached only to 6% of the farmers. The finding of the all India rural credit review survey committee that coverage of co-operatives is limited to hardly 30% of farmers. Co-operatives have contributed their part in the implementation of 20 point programme and integrated rural development programme. Though the cooperatives were lagging behind in rural credit till 1991, they regained their prime place with 629-i share in rural crop loans between 1991 and 2001.

- 29. RNS I grade college Dept of Business Administrator PAGE 29 BOARD OF DIRECTORS: According to the Karnataka state co-operative societies act and by-laws of the bank, functions of the bank are regulated by the board of directors of the bank consisting of one elected nominee of each district central co-operative banks and government nominees. The board is headed by the president followed by the vice-president, the managing director, the chief general manager, National Bank for agriculture, Rural development Bank and Registrar of co-operative societies are also among the board of directors, and are government nominees. The board meeting is convened once in a month. The executive committee meeting is convened once in a month. In addition, the bank also has sub committees consisting of board of directors in each committee to monitor the functions of the bank and district central co-operative bank.

- 30. RNS I grade college Dept of Business Administrator PAGE 30 ANALYSIS AND INTERPRETATION OF DATA

- 31. RNS I grade college Dept of Business Administrator PAGE 31 TABLE: 1 SHOWING THE % CHANGE IN THE GROWTH RATE OF INSTALLMENT LOANS (RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 31.02 - 2010 43.08 38.86 2011 65.57 20.65 2012 79.11 20.65 2013 84.77 7.15 ANALYSIS: From the above table it is indicated that the bank has increased its Installment Loans disbursement amount. In the year 2009 it stood up to 31.02 crores and in the year 2013 it has increased to 84.77 crores.

- 32. RNS I grade college Dept of Business Administrator PAGE 32 GRAPH: 1 GRAPH SHOWING % CHANGE IN THE GROWTH OF INSTALLMENT LOANS(%) INTERPRETATION: The above graph indicates the growth rate of Installment Loan in the year 2010 was 38.88%, it increased to 52.21% in the year 2011, it dropped to 20.65% in the year 2012, and again decreased to 7.15% in the year 2013 respectively.

- 33. RNS I grade college Dept of Business Administrator PAGE 33 TABLE: 2 SHOWING THE % CHANGE IN THE GROWTH RATE OF VEHICLE LOANS(RS. IN CRORES) YEARS VEHICLE LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 11.59 - 2010 15.17 30.88 2011 18.38 21.18 2012 22.83 24.17 2013 22.65 -0.79 ANALYSIS: From the above table it is indicated that the bank has increased its Vehicle Loans disbursement amount. In the year 2009 it stood up to 11.59 crores and in the year 2013 it has increased to 22.65 crores.

- 34. RNS I grade college Dept of Business Administrator PAGE 34 GRAPH: 2 GRAPH SHOWING % CHANGE IN THE GROWTH OF vehicle LOANS(%) INTERPRETATION: The above graph indicates the growth rate of Vehicle Loan in the year 2010 was 30.89%, in the year 2011 it decreased to 21.16%, in the year 2012 it gradually increased to 24.21%, and there was drastic drop to -0.79% in the year 2013 respectively.

- 35. RNS I grade college Dept of Business Administrator PAGE 35 TABLE: 3 SHOWING THE % CHANGE IN THE GROWTH RATE OF JEWELLERY LOANS(RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 49.49 - 2010 74.21 49.94 2011 102.17 37.67 2012 185.10 81.17 2013 344.46 86.09 ANALYSIS: From the above table it is indicated that the bank has increased its Jewellery Loans disbursement amount. In the year 2009 it stood up to 49.49 crores and in the year 2013 it has increased to 344.46 crores.

- 36. RNS I grade college Dept of Business Administrator PAGE 36 GRAPH: 3 GRAPH SHOWING % CHANGE IN THE GROWTH OF JEWELLERY LOANS(%) INTERPRETATION: The above graph indicates the growth rate of Jewellery Loan in the year 2010 was 49.95%, in the year 2011 it decreased to 37.58%, in the year 2012 it again increased to 81.17%, in the year 2013 it gradually increased to 86.09% respectively.

- 37. RNS I grade college Dept of Business Administrator PAGE 37 TABLE: 4 SHOWING THE % CHANGE IN THE GROWTH RATE OF AGRICULTURAL LOANS(RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 181.24 - 2010 189.13 4.35 2011 195.64 3.44 2012 317.13 62.10 2013 587.76 85.34 ANALYSIS: From the above table it is indicated that the bank has increased its Agricultural Loans disbursement amount. In the year 2009 it stood up to 181.24 crores and in the year 2013 it has increased to 587.76 crores.

- 38. RNS I grade college Dept of Business Administrator PAGE 38 GRAPH: 4 GRAPH SHOWING % CHANGE IN THE GROWTH OF AGRICULTURAL LOANS(%) INTERPRETATION: The above graph indicates the growth rate of Agricultural Loan in the year 2010 was 4.35%, and there was a little drop in the growth in the year 2011 to 3.44%, in the year 2012 it drastically increased to 62.10%,and to 85.34% in the year 2013 respectively.

- 39. RNS I grade college Dept of Business Administrator PAGE 39 TABLE: 5 SHOWING THE % CHANGE IN THE GROWTH RATE OF NON- AGRICULTURAL LOANS(RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 88.53 - 2010 81.55 -7.88 2011 198.36 143.22 2012 209.21 5.47 2013 168.30 -19.55 ANALYSIS: From the above table it is indicated that the bank has increased its Non-Agricultural Loans disbursement amount. In the year 2009 it stood up to 88.53 crores and in the year 2013 it has increased to 168.30 crores.

- 40. RNS I grade college Dept of Business Administrator PAGE 40 GRAPH: 5 GRAPH SHOWING % CHANGE IN THE GROWTH OF NON-AGRICULTURAL LOANS(%) INTERPRETATION: The above graph indicates the growth rate of Non-Agricultural Loan in the year 2010 it was - 7.88%, in the year 2011 there was a huge increase in the growth to 143.24%, in the year 2012 it was 5.64%,and again there was a drop in the year 2013 to 19.68% respectively.

- 41. RNS I grade college Dept of Business Administrator PAGE 41 TABLE: 6 SHOWING THE % CHANGE IN THE GROWTH RATE OF HOUSING LOANS – STAFF (RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 6.77 - 2010 5.95 -12.09 2011 6.12 2.8 2012 7.06 15.36 2013 8.50 20.44 ANALYSIS: From the above table it is indicated that the bank has increased its Housing Loans (staff) disbursement amount. In the year 2009 it stood up to 6.77 crores and in the year 2013 it has increased to 8.50 crores.

- 42. RNS I grade college Dept of Business Administrator PAGE 42 GRAPH: 6 GRAPH SHOWING % CHANGE IN THE GROWTH RATE OF HOUSING LOANS – STAFF (%) INTERPRETATION: The above graph interprets that the growth rate of Housing Loan (Staff) for the year 2010 it was -12.11%, in the year 2011 it increased to 2.86% and again it increased to 15.36% and 20.40% in the year 2012 and 2013respectively.

- 43. RNS I grade college Dept of Business Administrator PAGE 43 TABLE: 7 SHOWING THE % CHANGE IN THE GROWTH RATE OF HOUSING LOANS– PUBLIC (RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 144.01 - 2010 110.47 -23.29 2011 113.26 2.52 2012 124.78 10.17 2013 127.72 2.36 ANALYSIS: From the above table it is indicated that the bank has decreased its Housing Loans (Public) disbursement amount. In the year 2009 it stood up to 144.01 crores and in the year 2013 it has increased to 127.72 crores.

- 44. RNS I grade college Dept of Business Administrator PAGE 44 GRAPH: 7 GRAPH SHOWING % CHANGE IN THE GROWTH OF HOUSING LOANS- PUBLIC (%) INTERPRETATION: The above graph indicates the growth rate of Housing Loans (public) in the year 2010 it was -23.29%, it gradually increased to 2.53% in the year 2011and increased to 10.17%, in the year 2012 and again there is a dip in the year 2013 it has come down to 2.36%.

- 45. RNS I grade college Dept of Business Administrator PAGE 45 TABLE: 8 SHOWING THE % CHANGE IN THE GROWTH RATE OF PROJECT LOANS (RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 22.52 - 2010 19.03 -15.09 2011 17.80 -6.49 2012 12.16 -31.69 2013 142.26 1069.85 ANALYSIS: From the above table it is indicated that the bank has increased its Project Loans disbursement amount. In the year 2009 it stood up to 22.41 crores and in the year 2013 it has increased to 142.26 crores.

- 46. RNS I grade college Dept of Business Administrator PAGE 46 GRAPH: 8 GRAPH SHOWING % CHANGE IN THE GROWTH OF PROJECT LOANS (%) INTERPRETATION: The above graph indicates the growth rate of Project Loans in the year 2010 was -15.50%, in the year 2011 again it dipped to -31.69% , in the year 2012 again it dipped to -31.69%, but in the year 2013 there was a drastic increase to 1069.90% as more Project loans were sanctioned in that particular year.

- 47. RNS I grade college Dept of Business Administrator PAGE 47 TABLE: 9 SHOWING THE % CHANGE IN THE GROWTH RATE OF HOUSE/MORTGAGE LOANS (RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 60.61 - 2010 158.56 161.59 2011 222.71 40.46 2012 207.87 -6.66 2013 192.44 -7.43 ANALYSIS: From the above table it is indicated that the bank has decreased its House/Mortgage Loans disbursement amount. In the year 2009 it stood up to 60.61 crores and in the year 2013 it has increased to 192.44 crores.

- 48. RNS I grade college Dept of Business Administrator PAGE 48 GRAPH: 9 GRAPH SHOWING % CHANGE IN THE GROWTH OF HOUSING LOANS- PUBLIC (%) INTERPRETATION: The above graph indicates the growth rate of House/Mortgage Loans in the year 2010 it was - 161.59%, it drastically decreased to 40.46%, in the year 2011 and it decreased to -6.66%, in the year and again it decreased to -7.43 in the year 2013.

- 49. RNS I grade college Dept of Business Administrator PAGE 49 TABLE: 10 SHOWING THE % CHANGE IN THE GROWTH RATE OF EDUCATION LOANS (RS. IN CRORES) YEAR INSTALMENT LOANS (CRORES) GROWTH RATE AS PER PREVIOUS YEAR(%) 2009 - - 2010 14.6 2011 25.9 77.40 2012 47.4 83.01 2013 116.5 145.78 ANALYSIS: From the above table it is indicated that the bank has increased its Education Loans disbursement amount. In the year 2009 there was no education loans offered but it has increased to 116.5 lakhs in the year 2013.

- 50. RNS I grade college Dept of Business Administrator PAGE 50 GRAPH: 10 GRAPH SHOWING % CHANGE IN THE GROWTH OF EDUCATION LOANS- PUBLIC (%) INTERPRETATION: The above graph indicates the growth rate of Education Loans in the year 2010 it was nil and gradually increased to 77.40% in the year 2011, in the year 2012 it has gone up to 83.01%, it was 20.65% and in the year 2013 it has achieved all time high of 145.78%.