Outlook for Week of June 15, 2015

•Download as ODP, PDF•

0 likes•4,198 views

Free weekly newsletter with outlook and weekly comments for world stock markets. Weekly reversal levels for stocks, gold and currencies. This method was designed to keep you on the right side of the market most of the time, letting the winners run while avoiding big losses on investments. Weekly reversal levels for over 1500 stocks and ETF are posted on the website every weekend.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

More from LunaticTrader

More from LunaticTrader (20)

Recently uploaded

Recently uploaded (20)

Top 5 Asset Baked Tokens (ABT) to Invest in the Year 2024.pdf

Top 5 Asset Baked Tokens (ABT) to Invest in the Year 2024.pdf

Fintech Belgium General Assembly and Anniversary Event 2024

Fintech Belgium General Assembly and Anniversary Event 2024

Next Steps for Poonawalla Fincorp After Abhay Bhutada’s Shift to Non-Executiv...

Next Steps for Poonawalla Fincorp After Abhay Bhutada’s Shift to Non-Executiv...

Indirect tax .pptx Supply under GST, Charges of GST

Indirect tax .pptx Supply under GST, Charges of GST

Economics - Development 01 _ Handwritten Notes.pdf

Economics - Development 01 _ Handwritten Notes.pdf

Economic Risk Factor Update: May 2024 [SlideShare]![Economic Risk Factor Update: May 2024 [SlideShare]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Economic Risk Factor Update: May 2024 [SlideShare]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Economic Risk Factor Update: May 2024 [SlideShare]

Outlook for Week of June 15, 2015

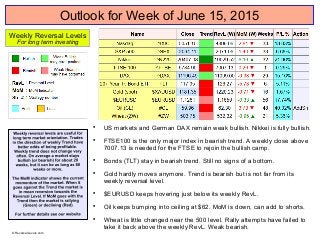

- 1. Outlook for Week of June 15, 2015 US markets and German DAX remain weak bullish. Nikkei is fully bullish. FTSE100 is the only major index in bearish trend. A weekly close above 7007.13 is needed for the FTSE to rejoin the bullish camp. Bonds (TLT) stay in bearish trend. Still no signs of a bottom. Gold hardly moves anymore. Trend is bearish but is not far from its weekly reversal level. $EURUSD keeps hovering just below its weekly RevL. Oil keeps bumping into ceiling at $62. MoM is down, can add to shorts. Wheat is little changed near the 500 level. Rally attempts have failed to take it back above the weekly RevL. Weak bearish. Weekly Reversal Levels For long term investing © ReversalLevels.com

- 2. The Nasdaq is back into bullish mode, with the S&P remaining weak bearish. There is a weak buy signal for Nikkei and the European indexes are weak bearish. Bonds are giving a speculative buy signal, as MoM is turning up after a significant decline. First target is the RevL, currently at 121.33 Gold is weak bearish. MoM is going up so there is potential for another rally to start. MoM is turning back down for $EURUSD, so this could be a failed rally. Must hold above 1.1082 to stay in bullish mode. Oil went into bullish mode 3 days ago, but will need urgent follow through to keep it up. Wheat appears to be in another failing rally. Daily Reversal Levels For shorter term trading © ReversalLevels.com

- 3. Sell signal for Canada. Comment: Most international markets have downward MoM and are pulling back or in bearish trend already. So, far it looks like a mild pullback, but that could change of course. China is the main exception, going from record to record with MoM at the maximum +10. As soon as MoM turns down for China it will be a sign to take partial profits. Weekly Reversal Levels for World markets For long term investing © ReversalLevels.com

- 4. Sell signal for MRK 16 stocks bullish, down from 17 last week. Below 20 = struggling bull market. See article: Keeping an eye on the Dow stocks Comment: Another seller this week, leaving us with only 16 bullish stocks in the Dow. If the number of bullish stocks drops below 15 it will indicate a possible bear market. This may pass without much of a decline, but then we should start seeing several stocks go into upward MoM. With only 6 stocks having upward MoM, the downside risks are significant and we stay cautious at this point. Weekly Reversal Levels for 30 Dow stocks For long term investing © ReversalLevels.com The weekly reversal levels for over 1500 stocks and ETF can be picked up for free on ReversalLevels.com every weekend The daily reversal levels for over 1500 stocks and ETF are available for a few $ on Scutify every day: click here

- 5. More details about the reversal levels and how to use them in your trading can be found at ReversalLevels.com Blog: http://LunaticTrader.Wordpress.com On Twitter: http://twitter.com/lunatictrader1 On Scutify: https://www.scutify.com/profiles/LunaticTrader On Stocktwits: http://stocktwits.com/LunaticTrader For daily reversal levels, regular market commentary or questions you are welcome to follow or contact us here: © ReversalLevels.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. ReversalLevels.com cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility. The weekly reversal levels for over 1500 stocks and ETF can be picked up for free on ReversalLevels.com every weekend The daily reversal levels for over 1500 stocks and ETF are available for a few $ on Scutify every day: click here

- 6. More details about the reversal levels and how to use them in your trading can be found at ReversalLevels.com Blog: http://LunaticTrader.Wordpress.com On Twitter: http://twitter.com/lunatictrader1 On Scutify: https://www.scutify.com/profiles/LunaticTrader On Stocktwits: http://stocktwits.com/LunaticTrader For daily reversal levels, regular market commentary or questions you are welcome to follow or contact us here: © ReversalLevels.com Disclaimer Investing in stocks, forex or commodities is risky. No guarantee can be given that the opinions or predictions given in this presentation will be correct. ReversalLevels.com cannot in any way be responsible for eventual losses you may incur if you trade based on the given information. Simulated trading programs in general are subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Trade at your own risk and responsibility. The weekly reversal levels for over 1500 stocks and ETF can be picked up for free on ReversalLevels.com every weekend The daily reversal levels for over 1500 stocks and ETF are available for a few $ on Scutify every day: click here