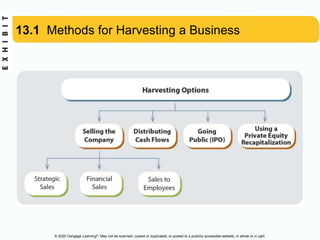

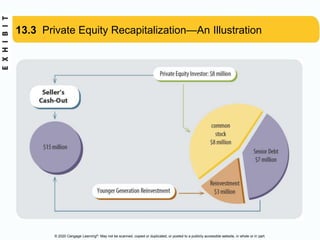

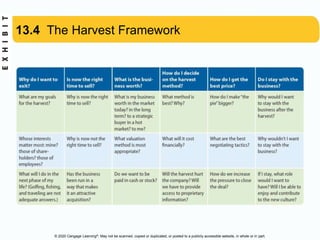

This document discusses planning for harvesting (exiting) a business. It covers the importance of having a harvest plan, methods for harvesting like selling the firm, distributing cash flows, initial public offerings, and private equity recapitalizations. When selling a firm, it's important to consider valuation and payment methods. An effective harvest plan should anticipate the harvest years in advance, expect emotional and cultural conflicts, get good advice, understand personal motivations, and consider plans after exiting.