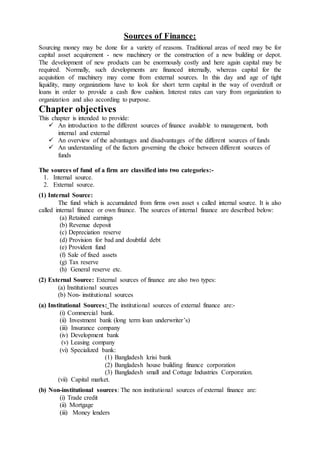

Sources of finance

- 1. Sources of Finance: Sourcing money may be done for a variety of reasons. Traditional areas of need may be for capital asset acquirement - new machinery or the construction of a new building or depot. The development of new products can be enormously costly and here again capital may be required. Normally, such developments are financed internally, whereas capital for the acquisition of machinery may come from external sources. In this day and age of tight liquidity, many organizations have to look for short term capital in the way of overdraft or loans in order to provide a cash flow cushion. Interest rates can vary from organization to organization and also according to purpose. Chapter objectives This chapter is intended to provide: An introduction to the different sources of finance available to management, both internal and external An overview of the advantages and disadvantages of the different sources of funds An understanding of the factors governing the choice between different sources of funds The sources of fund of a firm are classified into two categories:- 1. Internal source. 2. External source. (1) Internal Source: The fund which is accumulated from firms own asset s called internal source. It is also called internal finance or own finance. The sources of internal finance are described below: (a) Retained earnings (b) Revenue deposit (c) Depreciation reserve (d) Provision for bad and doubtful debt (e) Provident fund (f) Sale of fixed assets (g) Tax reserve (h) General reserve etc. (2) External Source: External sources of finance are also two types: (a) Institutional sources (b) Non- institutional sources (a) Institutional Sources: The institutional sources of external finance are:- (i) Commercial bank. (ii) Investment bank (long term loan underwriter’s) (iii) Insurance company (iv) Development bank (v) Leasing company (vi) Specialized bank: (1) Bangladesh krisi bank (2) Bangladesh house building finance corporation (3) Bangladesh small and Cottage Industries Corporation. (vii) Capital market. (b) Non-institutional sources: The non institutional sources of external finance are: (i) Trade credit (ii) Mortgage (iii) Money lenders

- 2. (iv) Friends and relatives (v) Bond and debentures Differences between Internal sources and External sources of finance: Internal Source External Source 1. Fund which is accumulated from firm’s own asset is called internal finance. 2. Retained earnings, depreciation, reserve, general reserve etc are sources of internal finance. 3. This type of fund used for short period of time. 4. There is no scope of insolvency in case of internal financing. 5. There is no need of security against the internal financing. 6. Interest is not paid on internal finance. 7. There is no need of formalities in case of internal financing. 1. Fund which is collected from outside like individual or any other firm is called external sources of finance. 2. Commercial bank, Financial institution, debenture etc are sources of external finance. 3. But, this type of fund used for long period of time. For example- owner’s capital. 4. The firm may insolvent if failure to repay the loan in due time. 5. Security is necessary against the external financing. 6. Interest must be paid on external sources of fund. 7. All kinds of formalities must be followed incase of external financing. Modes of Finance: There are three modes of financing: (i) Short- term financing (ii) Intermediate- term financing (iii) Long- term financing. (i) Short- term financing: Funds available for a period of one year or less is called short term financing. The sources of short- term financing are used mainly for the purchase of current assets such as purchase raw materials for production, rent, wages, paying bills etc. It can be collected from friends and family, financial institutions, lenders etc. (ii) Intermediate- term financing: Intermediate- term financing generally is thought to include maturities of one to five years or more than one year to ten years (iii) Long- term financing: A fund which is accumulated for more than 10 years is called long- term finance. Trade- credit: Trade Credit refers to the credit that a customer gets from supplier of goods in the normal course of business. In practice, the buying firms have not to pay cash immediately for the purchase made. This deferral of payment is a short term financing called trade credit. Trade-credit: In one word, trade credit is a credit which is provided by sellers or suppliers in the normal course of business. That means, credit given by all company to another is known as trade credit.

- 3. Components of Trade- Credit: Open account: For purchasing goods no contract is sign by the purchasers. The seller confidence is entering this kind of arrangement usually comes from checking the credit worthiness of the buyers and the history of previous business transactions with the buyer (No contract will be there). Note payable/ Promissory note: When the buyer sign’s promissory note to obtain trade credit it shows up on the buyer’s balance sheet as a trade note payable. The note will have a specified future payment date. It is typically used when the sellers has less confidence upon the buyer. Trade Acceptance: In this case, buyer’s must acknowledge the debt written against purchasing goods in credit formally. In this system seller makes a draft before sending goods to buyer which has been singed by buyer. It is a trade acceptance. Credit –Term: The repayment provisions that are part of a credit arrangement. The expression “credit term” refers to the conditions under which credit is granted. The three major items of credit -due date, cash discount and discount date are usually stated as follows y x , net z. Where, x is the cash discount y is the cash discount Period. z is the Credit period. For example: Credit term 10 2 , net 30. Interpretation: 2% cash discount is allowed if the bills are paid by the 10th day. If the discount is not taken, the full amount of bill is paid by the 30th day. Advantages of Trade Credit: 1. Easy Availability: Unlike other sources of finance, trade credit is relatively easy to obtain. Except in the case of financially vary unsound firm, it is almost automatic and does not require any negotiations. The easy availability is particularly important to small firms which generally face difficulty in raising funds from the capital markets. 2. Informality: Trade credit is an informal, spontaneous source of finance. It does not require any negotiations and formal agreement. It does not have the restrictions which are usually parts of negotiated sources of finance. 3. no need for collateral securities 4. Financing Volume: It depends on the quantity of purchase and period of payment. 5. Flexibility: Here debtor and creditor can easily increase or decrease their amount of debt. 6. possibility of more profit by increasing sales 7. less risk of bad debt. Disadvantages: 1. Shorter repayment period 2. High cost of foregoing cash discount benefit. 3. No exemption of tax.

- 4. Problem: Find out the nominal annual cost and effective annual rate for the following- i) 1/10 net 30 ii) 2/10 net 20 iii) 2/10 net 30 iv) 3/5 net 45 v) 4/5 net 60 Md. Azizur Rahman BBA(Major in Finance & Banking) MBA (Major in Finance)