Inside Retail Asia Magazine April 2020 Issue

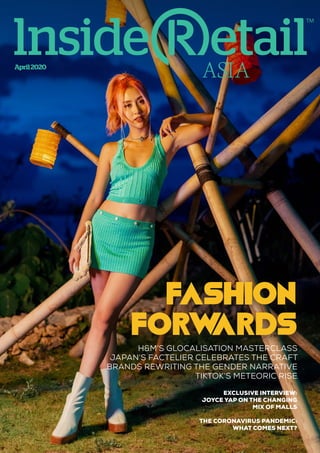

- 1. ASIA Fashion forwardsH&M’S GLOCALISATION MASTERCLASS JAPAN’S FACTELIER CELEBRATES THE CRAFT BRANDS REWRITING THE GENDER NARRATIVE TIKTOK’S METEORIC RISE EXCLUSIVE INTERVIEW: JOYCE YAP ON THE CHANGING MIX OF MALLS THE CORONAVIRUS PANDEMIC: WHAT COMES NEXT? April2020

- 3. C oronavirus has affected all of us in ways we had never imagined: we are all suddenly trapped in a lifestyle only experienced by current generations through the lens of apocalyptic-movie directors. At the time of writing in early April – and things have changed week by week since February – the physical retail sector has been decimated through most of Asia. Supermarkets excepted, malls and stores, restaurants and bars have been shuttered completely across Thailand, Vietnam, Malaysia, Indonesia and India. There are varying restrictions in place in Hong Kong and Singapore. But in China, where the virus now officially known as Covid-19 first caused fatalities sometime last December, trading restrictions are now progressively being lifted. Shopping centres in large cities like Shanghai are reopening and consumers are cautiously returning to browse, shop and eat. Strict government bans on movement are being relaxed in the worst- hit territories, factories have resumed production and logistics networks are returning to normal. So while retailers such as Apple have closed every store outside China, on the mainland staff are back in stores and people are buying again, albeit not at quite the same volumes just yet. Should the slightly shaky recovery of China be seen as hope for the rest of us, or is it a false dawn? That China is starting to return to normal should be an encouragement for the rest of the planet, but any optimism must be tempered by the reality that even the most experienced medical minds of the West, people who have devoted their lives to understanding pandemics and viral outbreaks, say it is still too soon to celebrate. Firstly, the infection curves in almost every geographic location outside Mainland China and South Korea have yet to peak. Secondly, there are genuine but muted concerns among some medical professionals that Covid-19 could evolve, or that if some forms of social distancing are not enforced, infection rates could spike again in places where the original infection rate was milder. The one truth for now is that uncertainty is set to prevail for another three to six months or even longer. There is no cure for Covid-19, there is no vaccine – and either could take a year or more to emerge in safe and effective forms. The so-called Spanish Flu of 1918 took two years to pass, and that was in an era where only a fraction of people travelled from country to country compared with today. For now, retailers across Asia are caught in a seemingly endless holding pattern. Those that have an online presence can at least mitigate a portion of the sales they previously conducted through stores by moving online – especially those selling food and groceries, medical and health supplies and any form of indoor home entertainment. Around the world, book sellers and stationers have reported increased sales due to homeschooling and a small but apparent shift from digital books to printed ones. Streaming services and online training courses are thriving (has anyone else noticed the sudden return of the Masterclass digital ads?). Puzzles, kitchenware (people are cooking again), and digital devices like tablets, game systems and wifi boosters are back in demand. Restaurants which have previously resisted deliveries are signing up to delivery apps as a means of interim survival. Some smart retailers are pivoting into new categories to keep momentum going or assist with the vast challenges faced by governments, health providers and consumers dealing with lockdowns and trying to protect themselves from transmission: Burberry, Gucci, Louis Vuitton are among a raft of fashion brands creating masks and other protective gear. McDonald’s in Australia, its dine-in restaurants closed for now, has started selling grocery items like milk through its drive-thrus. These times are unlike any our generation has faced before. They are debilitating, unpredictable and often very frightening. But they will pass. Humanity will endure. And so will retailing. Inside Retail Asia is published by Inside Retail Asia Ltd. 1204 Dominion Centre, 43-59 Queen’s Road East, Wanchai, Hong Kong Tel: +852 9019 6060 Subscriptions For subscription information in digital or print format to your country, email: subs@insideretail.asia ASSOCIATE EDITOR Michael Arnold michael.a@insideretail.asia WRITERS Dean Blake, Nick Bradstreet, Emily Cheng, Norelle Goldring, Phung Yi Jun, Pascal Martin, Kate Maszluch, Emma Sharley, Katie Smith, Robert Stockdill, Tong Van, Veronica Wong GRAPHIC DESIGNER Sofia Costales sofia.c@insideretail.asia GENERAL MANAGER Jasper Chung jasper@insideretail.asia T: +852 9019 6060 GROUP GENERAL MANAGER Amie Larter facebook.com/InsideRetailAsia linkedin.com/company/inside-retail-asia twitter.com/insideretailasia www.insideretail.asia Inside Retail Asia Limited is a subsidiary of Octomedia Pty Ltd, Australia The entire content of this magazine is subject to copyright. No reproduction is permitted by printed or electronic means without the express written permission of the publisher, Inside Retail Asia. Robert Stockdill Director of Content Inside Retail Asia robert@insideretail.asia ASIA Fashion forwardsH&M’S GLOCALISATION MASTERCLASS JAPAN’S FACTELIER CELEBRATES THE CRAFT BRANDS REWRITING THE GENDER NARRATIVE TIKTOK’S METEORIC RISE EXCLUSIVE INTERVIEW: JOYCE YAP ON THE CHANGING MIX OF MALLS THE CORONAVIRUS PANDEMIC: WHAT COMES NEXT? April2020 Robert Fresh hope or false dawn? Our cover: Vietnamese model Quynh Anh Shyn of Vietnam who joined four other Asians to give a ‘glocal’ feel to H&M’s premium Studio SS2020 range. Read more on page 24. 3April 2020 – insideretail.asia

- 4. 4 insideretail.asia – April 2020 Inside Gender-bending Katie Smith looks at how younger consumers are rewriting the narrative on gender and PhungYi Jun looks deeper into the origins of the genre and which brands are taking the lead. Pascal Martin, Veronica Wang and Nick Bradstreet on what Hong Kong retail will be like when the pandemic is over. After the virus 7 Tales and trends from Asia’s apparel sector. Fashion forwards 11 Celebrating the craft Robert Stockdill meets a Japanese entrepreneur who is building a direct- to-consumer fashion label that celebrates the skills and identity of clothing factories usually hidden behind luxury brands. 19 TikTok: new on the block Kate Maszluch and Dean Blake look at the latest social-media trend and ask if it is worth brands’while signing up. 22 Going glocal Robert Stockdill looks at how Swedish fast-fashion label H&M is celebrating Asian creativity. 24 Six fashion labels to watch Sustainable, Instaworthy and size-inclusive: Emma Sharley picks emerging retailers set to hit their stride. 28 Q&A with Pavilion Kuala Lumpur CEO Joyce Yap about the changing trends in shopping centres. The maturing mall mix 30 Norrelle Goldring explains how artisan bakeries are exciting the taste buds of consumers all over the world. Rising to the occasion 34 PLUS: Our most-read stories online New retail stores in Asia Pop up of the quarter 5 38 40 22 24 34 11

- 5. 5April 2020 – insideretail.asia Around the region Chinese chain Luckin Coffee has admitted senior executives exaggerated sales to boost the company’s worth and reputation. In a stunning admission, the company advised investors not to rely on financial statements for the nine months to September last year. Transactions totalling about 2.2 billion yuan (US$310 million), have been cited. The true extent of the false sales data remains unclear while a panel reviews financial records. However, in November, the company claimed sales were running at six times the rate of the previous year. China Singapore-based bookstore chain Popular has fallen victim to the coronavirus pandemic and shuttered all 16 stores in Hong Kong. However, Popular’s other non-retail businesses in publishing and distribution will continue to operate there. The company was recently taken to court by Palliser Investments over allegedly unpaid rent, totalling around HK$520,000 (US$67,000). The group will now redirect its resources and focus on education publishing, e-learning and educational services instead of retailing. Hong Kong Local food-delivery app Zomato acquired UberEats in India for US$350 million. The purchase was made via an all-stock transaction, which results in Uber holding a 9.99-per-cent stake in Zomato. “India remains an exceptionally important market to Uber and we will continue to invest in growing our local Uber Rides business, which is already the clear category leader,”said Uber CEO Dara Khosrowshahi. UberEats in India has discontinued operations and directed restaurants, delivery partners, and users of its app to the Zomato platform. India Uniqlo will open its largest store yet at the recently refurbished Mitsui Outlet Park in Japan this month. The space will host both Uniqlo and sister brand GU in the same location with Uniqlo’s sales area comprising 2182sqm and GU’s 1818sqm. Despite turbulent times amidst the coronavirus pandemic, the retailer will proceed with plans to open three large stores in Tokyo’s metropolitan area in April-May, originally aiming to strengthen its presence for the Tokyo Olympics 2020, although these have now been postponed until next year. Japan

- 6. 6 insideretail.asia – April 2020 The Jason Food Hall at Kuala Lumpur’s Bangsar mall closed after 20 years. A spokesperson for the store’s parent, Dairy Farm International’s Malaysian joint-venture subsidiary Giant, said it had failed to renegotiate a lease on satisfactory terms and was closing the store with regret. A new concept to be operated by the country’s fast-growing independent grocery group The Food Purveyor, which operates the B.I.G banner, will open in The Food Hall’s place. Malaysia The Singapore Retailers Association called for“unprecedented rental relief measures” from landlords to help retailers overcome the coronavirus crisis. The association has urged landlords to implement a rental-payment structure for six months capped at no more than 15 per cent of gross turnover or a 50-per-cent base rent reduction, whichever is lower. It also asked landlords to allow retail businesses who cannot sustain their operations to exit before their lease expiration without losing security deposits or risking punitive legal action. Singapore The Philippines’first Mos Burger store opened on the second floor of Robinsons Galleria at the Ortigas Center. Mos Food Services chairman Atsushi Sakurada said the store is just one of many branches planned for Metro Manila this year. Philippines UK-headquartered Tesco accepted a US$10.6 billion bid for its Asian businesses from a consortium of companies controlled by Thai billionaire Dhanin Chearavanont. The price represents a multiple of 12.5 times in earnings and marks a significant premium on analysts’ estimates of the business being worth about $9 billion. In winning the Tesco business, CP Group beat rival local bidders Central Group and TCC Group. The decision was reached quickly by the Tesco board given that final binding bids closed on February 29. However, the deal remains subject to regulatory approval by Thai and Malaysian authorities, so it won’t be settled until the second half of this year. Thailand Lotte Shopping plans to shut down as many as 200 department stores and large-format supermarkets in South Korea, marking one of the biggest retail network culls in the nation’s history. Lotte reported a near US$1 billion net loss for the fourth quarter. Kang Hee-tae, who heads Lotte Shopping, cited an increase in the minimum wage and falling Chinese tourist arrivals as contributors to the poor result. But analysts in Seoul say Lotte Shopping’s problems are in part caused by a shift to online shopping, where consumers can often pay less for goods. South Korea Vietnam’s largest company VinGroup sold its retail unit in a merger with FMCG giant Masan Consumer Holdings, aiming to form Vietnam’s largest grocery retailer. Masan subsequently confirmed the closure of up to 300 unprofitable VinMart-bannered convenience stores, but promised to open up to 30 new supermarkets. Meanwhile, VinGroup closed its network of VinPro appliance stores, and its smartphone retail chain trading as the Vien Thong A brand. Vietnam

- 7. 7April 2020 – insideretail.asia A fter nearly a year of double- digit year-on-year retail sales declines in Hong Kong, just as we thought things were starting to improve, the Covid-19 (coronavirus) outbreak escalated globally. This long crisis is already profoundly shifting how people live, work and shop. In response to the crisis, brands, retailers and mall operators are busy trying to contain costs, renegotiate leases, re-evaluate staff requirements, fix supply plans and shift their focus to online channels, as much as they can. But what will happen when the crisis is over and how will this affect their long-term outlook? There is an optimistic view that“Hong Kong always recovers”… as it did from the 1997 Asia Financial crisis, the SARS epidemic, the 2008 global financial What will Hong Kong retail be like when things return to normal? PERSPECTIVESPERSPECTIVES After the virus... By Pascal Martin andVeronicaWang meltdown, the 2014 umbrella movement, and so it will again from the current crisis. However, our view at OC&C is that there are structural factors that will make a full recovery and“return to normal”very difficult this time. The signs of these trends were already visible before the crisis: Narrowingpriceadvantage Under pressure from the transparency created by the online environment, and consumers’propensity to research online before shopping (as more than 60 per cent of Chinese shoppers do), international brands have adjusted their global pricing structures to limit pricing differences across markets. Hong Kong’s price advantage over Mainland China, which used to be in the range of 30 to 40 per cent, has shrunk to less than 15 per cent. Consequently, bargain hunters no longer see Hong Kong as a shopping paradise, particularly those traveling from remote mainland locations. ShiftsinMainlandChinesetourists Easier visa rules for Chinese nationals, in most countries, have expanded travel and shopping options. Chinese people – particularly those from higher income and higher tier cities – are increasingly travelling beyond Hong Kong to a variety of“exotic”destinations in Asia, Europe and Americas instead. Meanwhile, there has been an increase in the share of first-time visitors to Hong Kong from lower income and/or lower tier Chinese cities, with less spending power. There are also more day-trippers to Hong Kong from nearby locations, who find it worth the trip to benefit from the 10-15-per-cent price advantage they can find in Hong-Kong. CompetitionfromtheGreater BayArea Continuous investment in commercial properties in the Greater Bay Area, especially Shenzhen and Guangzhou, has heightened retail competition with Hong Kong. These properties often boast innovative retail formats and models, making the Hong Kong retail scene less distinctive and attractive than it used to be. The longer the crisis, the more ingrained new behaviours will be in

- 8. 8 insideretail.asia – April 2020 consumers’lifestyle and shopping habits. Once consumers have experienced the convenience of online shopping, it may be less compelling for them to go back to physical stores, even after the crisis. This will likely affect basic shopping categories such as grocery, electronics and pet food the most, for which the shopping experience is not particularly exciting in itself. The luxury sector may be less affected by this trend, as the shop visit is a key part of the overall brand experience. Adviceforbrands The disruptions that we are experiencing have simply accelerated the pace of structural trends that were already in motion before the COVID-19 outbreak. To cope with these changes, brands and retailers in Hong Kong must do four things: 1Become closer to local customers, by understanding them better and figuring out how to serve them with more relevant products and services, which may have been overlooked in the past. This will require: • Knowing how different consumers are from each other, depending on their income level, their purchasing habits, preferences are from each other, depending on their income level, their purchasing habits, preferences and service expectations. For many retailers, it will mean conducting some consumer research and segmentation to“re-discover”neglected local consumers. • Developing membership and loyalty programs that are meaningful to them, balancing financial incentives (eg. coupons, discounts) with functional benefits (parking, delivery) and emotional benefits (eg. lounge, concierge service, special events, gifts). 2Engage with Customers through Digital Media, as DFS is doing through a WeChat mini-program that pushes“monthly top discounts”to their registered customers, or as IFC is doing through a mini-program that pushes lifestyle and trend updates and mall events on a regular basis. 3Improve Online-To-Offline shopping convenience across the board, from payment methods (Alipay and WeChat Pay are a must) to different click-and-collect options, from product information to product returns. 4Adjust store footprints in line with more modest business ambitions in the market. This is probably the rationale behind Chow Tai Fook’s dramatic decision to shut down a fifth of its store network in Hong Kong. LV’s recent announcement to close a store in Times Square, even if it might just be a tactic to force an inflexible landlord to cut rent, can be seen as another example of this trend. In fact, many international brands have more stores in Hong Kong than in any other major cities around the world. But with the reduced flow of Chinese tourists and an increase in online sales, it is time to re-evaluate how many stores are really needed and where are the best locations for them. As a result, the next rounds of store renewals over the next two to three years will be very interesting to watch, with brands choosing to close certain stores, or obtaining significant reductions in rent conditions in others. In this context, landlords and mall operators must also adapt along three major areas: Find ways to boost their customer attractiveness by introducing more trend-setting brands (e.g. recent openings of Sephora and Brandy Melville in IFC), as well as F&B and entertainment options that may appeal more to local residents, even in these tenants cannot afford the rent levels paid by retailers. Diversifying store formats is another way to enhance attractiveness, and we have seen more Mainland Chinese developers introduce pop-up store formats. This might be a win-win trial for both brands and landlords, giving brands a low-cost platform to test the market while allowing landlords to maintain a sense of novelty for consumers. Shift focus from big box tenants to smaller tenants to create newness and excitement: The recent split of the Zara store in IFC into three smaller outlets including Sephora and a smaller Zara is a good illustration of this trend. In doing so, landlords are not only improving mall attractiveness, they are also maximising average rent yield because smaller units typically pay higher rent per square foot than larger ones. But this strategy has its limits – once big brand anchor tenants are shrunk or gone and all units are down to a minimum size – it will become harder to fight against an irresistible trend toward rent erosion. Prepare to become more aggressive in competing with other malls on marketing, promotions and events, not only within the Hong Kong marketplace but within the Greater Bay Area. This will require landlords to explore deeper collaboration and exchanges with their tenants, develop more distinctive value propositions toward their target customers, either local or foreign visitors, and engage with customers more proactively through smarter membership programs. On this topic, unfortunately, as summarised by one of the Hong Kong landlords we recently interviewed, many landlords are still lagging behind in customer data and analytics, and will need significant investment in technological capabilities to catch up. Pascal Martin and Veronica Wang are partners at OC&C Strategy Consultants.

- 9. 9April 2020 – insideretail.asia H ong Kong’s turbulent retail sector has posted its 13th consecutive month of downturn. Combined retail sales for January and February fell by 31.8 per cent year on year, battered by a steep drop in Mainland tourists attributable to months of political unrest followed by the COVID-19 epidemic which emerged just before the Lunar NewYear. Tourist arrivals have plummeted at their fastest rate since 2003 and in February, average daily traffic plunged to just 3000 people after the closure of border crossings and travel bans. Compare this with 2018, when 40 million mainland visitors chose Hong Kong as their number one destination to purchase luxury goods. Despite the sharp pullback in retail sales, we have not yet seen a corresponding fall in rents. Many shopping centre landlords have offered short-term rental relief but there needs to be a long-term rental adjustment to match the new“sales norm”which most luxury retailers currently feel is around 50 to 60 per cent from peak 2014 levels. Shopping centre landlords’reluctance to adjust rents significantly will present considerable challenges to mall-based retailers. Large adjustments are unlikely to happen until the general situation becomes clearer and as a result, retailers will need to either“bite the bullet”or vacate. Many retailers will take the latter ► PERSPECTIVESPERSPECTIVES Vacancies and rent pressure loom as Hong Kong’s retail sector tries to recover from the steep decline in mainlanders visiting. The next revolution By Nick Bradstreet

- 10. 10 insideretail.asia – April 2020 course and therefore vacancies are expected to rise across most centres. Over the years, spending from Chinese tourists has cemented Hong Kong’s position as Asia’s most important luxury hub, hailed as the“Great Mall of China”. Chinese tourists have typically accounted for 40 per cent of luxury demand and are more focused on hard luxury (watches and jewellery) rather than soft luxury (handbags and accessories). Thanks to its mainland tourists, Hong Kong contributes approximately 5 to 8 per cent of the world’s luxury sales. Since February last year, Hong Kong retail sales have seen negative growth against a backdrop of a weak RMB, as well as China’s economic slowdown and the ongoing trade war. Chinese consumers are shifting luxury purchases back home to China where consumption taxes have been lowered, undermining the need to travel overseas for discounts. Retailers are now more focused on first-tier cities in China with the highest retail sales including Shanghai, Beijing, Guangzhou, Chongqing and Chengdu. Butallhopeisnotlost Hong Kong remains one of the wealthiest cities in Greater China with plenty of attractions for visitors. Upcoming infrastructure will see eight major new transport projects providing much better connectivity including the airport’s third runway, estimated to handle more than 30 million passengers annually. For shopping mall landlords, it is an opportunity to rethink and refresh the traditional trade mix. Vacant shops are likely to be turned into pop ups or let on short-term leases costing a fraction of a long-term lease. Shops will become smaller to maintain affordability and malls will include more F&B to help surrounding retailers by attracting more foot fall. For retailers new to Hong Kong, now is a good time to test the market; to be in shopping malls or street locations which they would never have been able to afford previously. This year’s tough retail climate underlines the importance for retailers and landlords to adapt to changing consumer preferences and spending patterns in order to maintain competitive. And for some, the focus will return back home to Hong Kong – to its local consumption. Nick Bradstreet is MD and head of leasing at Savills.

- 11. 11April 2020 – insideretail.asia FASHION FORWARDSFASHION FORWARDS B eyonce’s January drop of her latest Ivy Park collection included a subtle shift: it’s positioned as gender neutral. Whether you want to call it“gender neutrality”,“androgyny”or“unisex”, gender expression is being reworked by younger consumers. They’re abandoning the notion of binary definitions of“male”and“female”. Of course, the blurring of gender lines is nothing new in fashion. Icons include Yves Saint Laurent’s 1966 Le Smoking tuxedo for women and Jean Paul Gaultier’s 1985 skirt for men. What is new is the broader, consumer-driven cultural conversation around gender and sexuality. Digital platforms have enabled marginalised people to form community online, amplifying understanding of diverse viewpoints. Gender is now operating on a moving scale – consumers can use the scale as an expression on any given day. Data suggests this is an enduring shift in values rather than a passing fad. According to research by GLAAD, an organisation that champions LGBTQ rights, 12 per cent of American millennials identify as transgender or gender non-conforming. That’s double the amount of the preceding generation. The report also found that 27 per cent of millennials know someone who is transgender, versus just 9 per cent of Americans over the age of 45. And in a survey of 4500 Gen Z consumers, Wunderman Thompson Intelligence’s Generation Z Asia report found eight out of 10 respondents say gender doesn’t define a person as much as it used to. Whoworeitbest? A look at Gen Z’s current role models highlights the broad range of gender non- conforming personas. Harry Styles stands out, with his 26 million Instagram audience fanatical for his pastel nails, pearl necklace, brocade fabric suits and pussy bow shirts. In a December interview with the Guardian on the subject of his style, he stated,“[I don’t do it] because it makes me look gay, or it makes me look straight, or it makes me look bisexual, but because I think it looks cool. And more than that, I dunno, I just think sexuality’s something that’s fun.” It was perhaps 2019’s Met Gala theme, “Camp: Notes on Fashion”, hosted by Styles in a sheer blouse and single pearl earring, that launched Timothee Chalamet onto the global fashion scene. He won the top male spot in Lyst’s Most Influential in Fashion 2019 report, which takes into account search volume, social media, sales and designer ranking. Chalamet is often seen in fluid tailoring and feminine blouses on the red carpet. But his style isn’t limited to subversive or camp gender- mixing. He also dresses androgynously, including the cerulean blue Haider Ackermann colour-block look he wore for the Sydney premiere of The King, his latest film. At the Academy Awards last year, actor Billy Porter appeared on the red carpet in a jaw-dropping tuxedo gown designed by Christian Siriano, arguably propelling him into fashion icon status. ► Say goodbye to old stereotypes: younger consumers are rewriting the narrative on gender. GENDER-BENDING By Katie Smith

- 12. 12 insideretail.asia – April 2020 Singer Harry Styles

- 13. 13April 2020 – insideretail.asia “My goal is to be a walking piece of political art every time I show up. To challenge expectations. What is masculinity? What does that mean? Women show up every day in pants, but the minute a man wears a dress, the seas part,”Porter wrote in Vogue about his outfit choice that night. “People are going to be really uncomfortable with my black ass in a ball gown – but it’s not anybody’s business but mine.” The hugely influential K-pop stars in Southeast Asia have driven consumers locally. Its stars, like Kang Daniel of Wanna One and the Gucci-drenched BTS band members, are pros at mixing jewellery, accessories, atypically feminine garments and makeup. According to Amelia Teh, head of business intelligence at Omnilytics,“Korean fashion is known to defy the boundaries of stereotypical gender-labelled clothing and diverging towards a more gender-neutral approach. The rise of streetwear further blurred the lines of gender specification. Åland, Seoul’s leading streetwear retailer which operates a flagship store in Brooklyn, New York, has over 60 per cent contribution of unisex assortment.” Teh attributes the shift to“exponential economic success”of the region, with more “affluent families sending their children for education overseas, their new influences break down the traditional conservatism of the older generations”. Acropofnewbrands Not only are existing brands, like Acne Studios, Adidas Originals, H&M and Tommy Hilfiger responding to the gender-neutral shift with crossover merchandise, but there is also a wave of new entrants to the market. Tomboyx, a new brand from the US, produces ungendered underwear. A range of lengths ensures fit“no matter your size or equipment”! In retail, The Phluid Project is an ungendered retail store that opened in Brooklyn in late 2018. The store also acts as a platform for community, hosting events and discussions. Australia has its own gender-inclusive brands too, including Melbourne-based Best Jumpers, Ten Pieces and A.BCH, which was founded in 2017 by Courtney Holm. Though the brand’s website is separated into men’s and women’s, most items are styled on either gender. The brand’s aesthetic, muted tones, natural fibres and boxy shapes perfectly appeal to all. It’s almost by chance that things turned out like this. ►

- 14. 14 insideretail.asia – April 2020 “When we did our first round of style research and development, we’d designed specific pieces for men and women but we also encouraged people to try on anything they wanted and purposely didn’t display the pieces in categories,”Holm shared. “What we noticed was that men tried on traditional women’s pieces and vice versa. They didn’t even realise at the time.” Subsequently the brand is“always looking for ways to make our clothes more inclusive and wearable for all”, with its linen shirts, trousers, boxy shorts and sweatshirts selling best across genders. Wheretostart? According to JWT Intelligence research, only 37 per cent of Gen Z and 36 per cent of millennials shop the accessories category by gender. Accessories only currently account for 9.6 per cent of Australia’s gender neutral assortment. It’s an easy way in, without constraints of fit. A good place to start is with the styling and casting of models in campaign imagery – make it inclusive and give the stylist free rein over both men’s and womenswear. As Holm pointed out,“It’s up to us as the brand to portray through our digital communications and imagery just how great garments can look on men, women, non-binary, short, tall, slim, curvy, mature, youthful and everyone in between.” It’s crucial to talk to your customers to find out what they want and need. Open the conversation and find ways for store staff to share anecdotal insight on which products have non-binary appeal. From here, shift the way your customer profiles are built, making them less prescriptive and encapsulating the new values. The real challenge lies not in fit, but in the way retail businesses are structured and stores are laid out. Designers and buyers at most retailers are separated into men’s and women’s teams, with reporting and budgets specific to each. As we move into the future of fashion, we’ll need to take a more agile approach to team function. Whether you see a future with product defined by occasion or fit and not gender, or whether it’s styling the occasional men’s piece on women, our consumers are changing and so must the industry. Defying that change will only alienate Gen Z consumers. Katie Smith is a retail and trends strategist, with a deep love of data-led insights and technology. Her research is used by brands and retailers on four continents to build out effective product offerings and connect with their consumers. Contact: hi@katiesmith.me

- 15. 15April 2020 – insideretail.asia FASHION FORWARDSFASHION FORWARDS Androgynous Fashion: Behind the movement to redefine gender through clothing By PhungYi Jun

- 16. 16 T he genderless movement in fashion has come a long way. Alok Vaid-Menon, performance artist, designer and a champion of LGBTQ rights, was once dismissed early from a photoshoot for a major fashion publication. They overheard the photographer ask the editor:“do you want the best photo, or do you want the politically correct photo?” Vaid-Menon later found out they were cut from the magazine cover. “My beauty is so tremendous it had to be edited out of magazines, whitewashed from history… just to prove it does not exist,”they declared in BoF Voices 2019. This isn’t a singular case. For years, fashion has been homogenous. Most runway shows are gendered. Brands strictly separated their clothing into two genders, subscribing to the narrow identity of what makes a man and a woman. Unisex items are often confined to just plain t-shirts, jackets and uninspired drabs. While there have been instances of blurred gender lines in fashion (Jean Paul Gaultier’s 1985 skirts for men come to mind), the notion wasn’t prevalent across the industry. That is, until recently. Changingtimes The younger generation is increasingly rejecting binary labels, and instead, reclaiming their personal identities.‘They’, a pronoun preferred by non-binary individuals such as Sam Smith, Alok Vaid-Menon and Vittorio Franco, saw a 313-per-cent increase in searches on Merriam-Webster – signifying increasing awareness of the non-binary movement. A study by the Pew Research Center showed that 59 per cent of Gen Zs believe forms should not include traditional gender pronouns – and 35 per cent know someone that identifies as gender non- conforming. Transgender and gender non-binary influencers played a large role in changing the narrative. Jamie Windust, editor-in-chief of Fruitcake Magazine and a non-binary model, uses their strong platform of 39,000 followers to continuously fight for LGBTQIA+ rights and representation. Windust set a strong example themselves, as they quit the set of Fantastic Beasts 2 due to“misogynistic, homophobic and transphobic”members of the cast. Chella Man, a trans activist who was recently cast in DC’s Titans, fights for the same cause too. “There is an extreme lack of representation for young, deaf, queer, Jewish, Asian, transgender artists… so, I decided to be my own representation,”Chella Man told Teen Vogue. Meanwhile, in Asia, Geena Rocero broke barriers as the first Asian Pacific transgender Playboy playmate. Born and raised in the Philippines, she’s sending a clear message to everyone – no matter their sexuality, gender or beliefs – their dreams are valid. Andrea Razali, recently crowned as Miss International 16 insideretail.asia – April 2020

- 17. Queen of Singapore, is vocal about her experiences with gender dysmorphia – and actively contributes to the transgender community. Celebrities, too, are breaking the boundaries of fashion across red carpets, photoshoots and on the streets. Harry Styles, Billy Porter and K-pop stars like 2AM’s Jo Kwon and f(x)’s Amber Liu are just some of the names challenging the norm. There’s a cultural embrace of gender fluidity – and the industry is finally listening. Fashionisfluid Telfar, a brand founded by designer Telfar Clemens, saw a strong 82-per-cent sell out in the past six months, and according to Omnilytics, 43 per cent sold out at full-price. One of its most popular items, the Telfar bag, became the industry’s‘it’ accessory, helmed for its affordability and practicality. But it isn’t as simple as that. The bag stood on the shoulders of Clemens, a black, queer designer that didn’t design for a specific niche. Telfar creates genderless products that are“not for you”, they are“for everyone”– an inclusive messaging that many fashion brands lack. Androgynous brands often stem from the gap that fast fashion left: creating timeless, exclusive pieces for everyone, including the marginalised. And in today’s world where brand values are more important than ever, it explains why androgynous brands are on the rise. Toogood, a unisex brand from London, is making waves in the industry. Data from Omnilytics showed that even though Toogood had a median price almost four times higher than the average (above US$1000), it still achieved a 90-per- cent sell-out at full price. Other gender-neutral brands with a premium price point, such as Eckhaus Latta and Ader Error, had decent sell-out rates at 76 per cent and 82 per cent respectively – further proof that customers are more than willing to pay for products that strike a chord. Global brands are tapping into the opportunity too. In 2018, Asos announced it would focus on expanding its genderless clothing. Three years later, the company has quadrupled its unisex offer and is now ranging colourful tops, overalls and accessories. H&M launched a similar strategy with its Denim United collection. Puma collaborated with South Korean label Ader Error and birthed a streetwear-inspired collection, each piece representing a different subculture with bright colours, progressive silhouettes and evergreen styles. The collection was successful with 76-per-cent sell- out, but this comes as no surprise – streetwear was the pioneer in blurring gender lines. The one to keep an eye out for is the collaboration between Telfar and Gap, expected to drop next September. Clemens, who has long used his artistic style to promote clothing that encompasses gender, is positive the collaboration would help spread his message further. We are not a trend. We are not a moment. We are a movement. 17April 2020 – insideretail.asia

- 18. 18 insideretail.asia – April 2020 It’samovement,notatrend While strides were taken to empower the gender-neutral movement, it’s to be made clear: genderless fashion is not a trend. For many trans and non-binary individuals, stepping out in clothing they feel comfortable in is a life-or-death situation. In the US alone, violence against trans has increased since 2016 – a statistic that proves more needs to be done. “The gender-neutral movement isn’t to be commercialised for sales,”says Katie Smith, a retail and trends strategist.“For retailers that want to expand into this market, it needs to come from a place of authenticity, not aesthetics.” To start, retailers need to widen the conversation. Amelia Teh, the head of business intelligence of Omnilytics, recommends going directly to the source: the customers.“Seek to understand how you can best support the LGBTQI+ community,”says Teh.“Look into your brand positioning, how your retail store or website is set up – the little details matter.” Once that’s established, Teh suggests to start with a small capsule collection in extended sizing, to be shared during a key event that speaks to the community, such as Pride Month.“Monitor the performance closely and listen to what your customers are saying.”If it proves to be successful, the next product expansion strategy can be a collaborative capsule, engaging a non- binary influencer for marketing or designs. “More importantly,”Teh says,“the genuine heart to help the community needs to be present.” In the words of Alok Vaid-Menon:“We are not a trend. We are not a moment. We are a movement.” Phung Yi Jun is the lead content editor at Omnilytics, a data platform powering business decision making with deep and actionable insights. Jun built her career as an independent fashion writer and covering news and trends in retail before transitioning to her current position at Omnilytics. AlokVaid-Menon with Sam Smith at the premiere of Judy at the Samuel GoldwynTheater in Beverly Hills last September.Geena Rocero

- 19. 19April 2020 – insideretail.asia T oshio Yamada is a young Japanese entrepreneur who wants to preserve the craftsmanship of his country’s apparel industry. Yamada has created his own uniquely Japanese brand Factelier, which designs and sources clothing and accessories for men, women and babies from experienced, typically family-owned, clothing factories spread all over the nation. They are sold online and shipped to 100 countries, through a small network of boutiques in Japan and Taiwan, and in selected department stores. Yamada’s vision is to preserve the rich heritage of apparel manufacturing and let the suppliers he works with emerge from the unavoidable anonymity that comes with supplying global brands. Thirty years ago, Japan, one of the world’s largest apparel markets, used to produce 50.1 per cent of its domestic sales. Today, thanks to the rise of fast fashion and the outsourcing of manufacturing to countries like China, Bangladesh and Vietnam, that share has slumped to just 3 per cent. More than three quarters of the companies manufacturing clothing in Japan in 1990 are no longer trading today. Yamada was born into a family which ran a women’s clothing store for 100 years in Kumamoto, on the island of Kyushu. Living upstairs, he helped out on the shop floor from early childhood, surrounded by quality locally made clothes in an era when ‘made in Japan’was a familiar label. Later, as a student, Yamada interned with luxury brand Gucci in Paris. There the realisation dawned on him that labels like Gucci, Hermes and Louis Vuitton were all born in factories.“So they respect craftsmanship. Now I’m hoping to revive the local craftsmanship in Japan. “Our dream is to create world-class brands made in Japan, and build a sustainable and profitable link between these local artisans and consumers around the world, by selling clothes from Japanese factories directly to consumers, cutting out the middleman.” Factelier was created via an astonishing commitment to researching the industry. Yamada personally visited some 600 factories the length and breadth of ► A Japanese entrepreneur has built a direct-to-consumer fashion label that celebrates the skills and identity of clothing factories usually hidden behind luxury brands. FASHION FORWARDSFASHION FORWARDS Celebrating the craft By Robert Stockdill

- 20. 20 insideretail.asia – April 2020 Japan before selecting 55 of them as suppliers, all of them with experience in supplying top international brands. “A lot of these companies did not have a homepage, right, and Google did not know about them. So I would take a train and get off at a station and go to a telephone box and use the telephone book to find them.”He would then phone the factories he found listed and ask if he could stop by. Somewhat surprised, they invariably welcomed him.“It was a very old style approach,”he recalls in an interview with Inside Retail Asia on the side of the Asian E-tailing Summit in Hong Kong. Having built the network, he not only maintains constant personal contact with his suppliers, but their company names appear beneath Factelier on the clothing labels. The connection between craftsmanship and consumer runs even deeper: Yamada’s company runs regular factory tours for customers so they can see the art and commitment that goes into the clothing they buy. “We know the stories behind the factories, how they make the products, and it’s very interesting – when our customers go to the factories and they see the craftwork behind the clothes they become loyal customers.” It took Yamada three years to build the base of the business, living off a part- time job as he travelled from factory to factory and developed designs and products. Eight years since his mission began, Factelier has grown to a 50-strong team with four stores and a warehouse in Japan, two stores in Taipei – and even a cafe. Sales are currently doubling twice a year with 80 per cent of orders from Japan. The largest overseas markets are the US, Mainland China, Taiwan and Hong Kong. “Fashion manufacturing used to be a declining industry in Japan, but I think if we have the passion and the vision, I think we can revive it. And more importantly, [our customers] will spend more for better products.” Factelier’s garments are of similar quality (but not design) to those being supplied to the likes of Gucci or Hermes – but sell for about half the price. It helps, of course, that Factelier is not paying for massive international advertising budgets and other overheads associated with luxury brands. Typically the factory gets a higher price for the clothing it produces

- 21. 21April 2020 – insideretail.asia for Factelier because the two parties jointly decide on the retail price, rather than the label dictating pricing and how much the factory gets for making it. “It’s a very, very different business model from traditional brands,”says Yamada. That said, the factories could not survive on Factelier alone – the Japanese label typically only accounts for between 5 and 10 per cent of a partner factory’s production. But they are getting a better deal and Yamada says many are finding themselves able to employ more graduates to expand their business. The closer relationship between brand, manufacturer and customer has produced an unexpected spinoff: consumers are starting to influence the range and style of clothing being produced, especially in the field of functional clothing. “One day a customer asked us to manufacture clothes that would repel mosquitos. That’s a very, very difficult request.”Diligently working with factories and textile suppliers, Yamada’s team succeeded by incorporating a herb in the fabric that sends the mozzies packing. During the interview, Yamada wore a stylish blue wrinkle-free jacket.“If I pack it in a trunk, it does not crease.”Another product uses baseball-uniform techniques to create 3D pattern effects. Factelier also sells stain-proof white jeans. Spill soy sauce, wine, coffee or ketchup over the denim and it comes off immediately without leaving a stain. This was another product designed to fulfil a customer’s request. Besides his interest in functional clothing, Yamada is committed to sustainability. The company uses natural fibres and biodegradable fabrics and it recently planted an organic cotton farm near Mount Fuji. Japan imports 99 per cent of its cotton and he wants to change that reliance on other countries. Yamada is optimistic there is a strong future for direct-to-consumer brands.“The size of the B2C market in Japan expanded to US$180 billion in 2018. It grew by $160 million, or 9 per cent, in that year. “Yes, craftsmanship is very big. I want to spread the idea of craftsmanship all over the world.”

- 22. 22 insideretail.asia – April 2020 T he last year has seen a number of social-media giants take the leap and enter the e-commerce market in a bid to expand their offering. The latest example of this is TikTok, which has roughly 625 million active users. According to Tryzens’latest consumer-insight survey, 63 per cent of consumers have bought an item that they first saw on social media, so this is a channel that we think retailers should be considering as a means of building brand and product awareness. Since its merger with Musica.ly in 2018, TikTok has exploded for the 16-24 market and shows no signs of slowing. It has learned from the commerce evolution undergone by Instagram, and within the space of three months, added features such as paid advertising, curated feeds and links to shop products off the platform. As an example, Beats by Dre has recently started to advertise on the platform with pop icon Billie Eilish flaunting a set of headphones that users can click on a link to‘buy now’. While we predict a global rollout of in-app shopping to be a little while away, we would recommend that retailers and brand owners start to experiment with the platform and begin to find their unique voice on the platform. There are a number of high-profile brands, such as Burberry, Showpo, NFL and Ralph Lauren that are jumping to become an early adopter of TikTok and are using it to build an audience. We are also seeing the emergence of TikTok influencers as we did on Instagram. Like most new innovative platforms, TikTok has certainly had its fair share of ‘teething problems’. Unfortunately, the popularity and potential of the video sharing app has been overshadowed by claims that harmful content has been exposed to its users, damaging the likelihood of brands considering advertising on the app. However, it is rumoured TikTok may launch a curated feed where retailers can advertise separately from content creators, ensuring their content won’t appear alongside inappropriate videos. While the use of TikTok may be a daunting prospect for retailers and brands at present, if it can work to address the current issues it is facing, it may well By Kate Maszluch FASHION FORWARDSFASHION FORWARDS TikTok: time for another social media channel? [Photo by Oliver Sjöström on Unsplash]

- 23. 23April 2020 – insideretail.asia become a very attractive platform for retailers in the future. So, with a high chance TikTok could be the next new way consumers shop, it is imperative retailers start preparing now and begin creating unique social-commerce strategies for the array of social media apps, including TikTok. Although it may be possible to sell the same product on TikTok and Instagram, they are two completely different social-media apps that require very different ways of connecting with their audiences. Retailers and brands need to be sure to take into account the nuances of each platform. This will enable them to understand the way in which they need to develop their different types of content to ensure it accurately portrays their brand. As a starting point, it is critical retailers and brands keep on top of what is trending and who TikTok’s main influencers are, as well as understanding its current offering, like paid advertisements and sponsored hashtags. Retailers that can find their voice and produce content that appeals to TikTok’s users will flourish on the platform. What this means for actual conversions is heavily dependent on their offering and audience. Kate Maszluch is VP of marketing at Tryzens, based in London, UK. One size does not always fit at all By Dean Blake I s it worth investing in TikTok, yet another social media channel? TikTok can be“a great place to find new customers”if that is where your ideal customers are spending time, the author of Sell Like Crazy and founder of digital agency King Kong Sabri Suby told Inside Retail in Australia. “But the principle of good marketing remains the same, whatever the channel. If you can fully understand a potential customer’s psyche and drill down into what drives them, it’s possible to create incredible returns on investment.” While TikTok is still largely untapped in terms of the retail market, much like other‘new’social media platforms, its consumer base is smart and tight-knit. Simply generating the same content used for a seperate audience is likely to backfire. “As feeds reach saturation point, average content will no longer fly. People know their value as a customer, so unless you are providing them at least that same value in return, they will simply scroll on past,”Suby said. “The same is true of TikTok. Unless marketers can learn how to create content that’s as good as, if not better than, regular users, then they don’t stand a chance.” A report by Hootsuite seems to support that view. If a brand isn’t suited, Hootsuite concluded, then it is better off investing its time and energy elsewhere. But for retailers with a funny and playful tone, TikTok could be worth keeping an eye on. According to the report,“if TikTok evolves beyond formulaic, meme-based content and attracts a broader user base, you may want to get in on the action”. “For now, monitor trends that bubble up on TikTok and adapt the ideas that make sense for your brand into other social content.” The report also recommends brands try out other short-form video formats that might be better aligned with its messaging – Instagram, Facebook and Snapchat, to name a few. However, smaller platforms can punch above their weight, according to Gartner research, which found that retailers with large shares of social traffic to their sites tend to see as much inbound traffic from smaller platforms than large ones. Dean Blake writes for Inside Retail in Australia. This is an abridged version of an article published in Inside Retail Weekly, our digital subscriber-only publication. More details insideretail.com.au/shop

- 24. By Robert Stockdill FASHION FORWARDSFASHION FORWARDS Grasping glocal ‘G localisation’is a trend retail chains have been embracing for more than a decade. It’s the art of fostering a local appeal to a globalised retail offer, empowering regional decision making in the hope of creating a bond with people in communities of consumers a world away from the company’s head office, but continuing to enjoy the advantages of critical mass in production, logistics and other back-of-house operations. But the fashion industry, trapped in the pressure cooker of seasonality-driven product design and release, has been slow to respond on a global scale. While luxury brands have always found an insatiable audience of consumers in markets like China, where wearing a brand is a sign of status and success, some mainstream global fashion brands have foundered abroad. Gap failed in Australia, Victoria’s Secret had mixed success after discovering its styles, fits and sizes weren’t really a As fast-fashion label H&M expands its focus both online and offline in Asia, the Swedish company is tapping Asian models and creative partners to give it more of a local appeal. 24 insideretail.asia – April 2020

- 25. 25April 2020 – insideretail.asia natural match for typically petite Asian physiques. River Island and Banana Republic never took off in Singapore, Marks & Spencer quit Mainland China – and labels like Forever 21 and Macy’s struggled to make any headway on the mainland. And that’s before you consider some of the public relations disasters in recent years by brands large and small who were tone deaf to cultural differences and regional geopolitical tinder points (think Versace, Coach and Givenchy, who learned the hard way not to project Hong Kong, Macau and Taiwan as territories separate from China…) Given that context, H&M has begun to stand out from its peers by steadily building affinities with local personalities, influencers and designers – and most recently models. Not just in China, but regionally, this is one of the few continents where the company is aggressively expanding its store networks as growth wanes in Europe and North America. The move has been subtle and undertaken without fanfare (H&M declined to comment for this feature) but it gained momentum last year when the company appointed musician and artist Lay Zhang Yixing as its spokesperson for its menswear collection in Greater China. Most recently, the company assembled a group of models from around Asia for a photoshoot for its upscale H&M Studio Spring Summer 2020 collection, choosing women well known in their home markets. While H&M has long embraced diversity in the talent modelling its new lines, this was something quite unique for the label. FromGotlandtoSumba While top international models posed in the new collections on beaches and sand dunes in America, far away on the island of Sumba in Indonesia, five Asian models created a very different look for the range. The five were Quynh Anh Shyn of Vietnam, who has her own fashion line; Iman Fandi Ahmad of Singapore; and three Malaysians: designer Kittie Yiyi, blogger Rachel Wong and fashion and beauty entrepreneur Bella Kuan. The move drove widespread exposure for the brand and the range across Southeast Asia as the models-cum- influencers shared their experiences during the photo shoot, which one Vietnamese fashion magazine described as an“island boot camp”. “Free, colourful and bravery – adjectives to describe H&M Studio Spring Summer 2020 – are also adjectives easy to relate to Quynh Anh Shyn’s fashion style during the past year,”it wrote. That’s grassroots glocal praise for a fashion brand bedded in Sweden and a

- 26. 26 insideretail.asia – April 2020

- 27. 27April 2020 – insideretail.asia range inspired by a research trip to the Swedish island of Gotland, according to H&M creative advisor Ann-Sofie Johansson. “The SS20 collection muse is a forward- looking free spirit – someone who surfs, climbs, explores and who wants to experience new things,”she explained at the US launch.“The collection is both raw and refined: natural fabrics with raw edges are mixed with refined elements, such as shiny metallics and futuristic accessories. There’s a freedom in the way the collection can be worn, too: we want our customers to feel that anything goes.” Some of the new Studio pieces went on sale in February this year and the balance will be launched in late May. Chinafocus Unsurprisingly, perhaps, a core focus of H&M’s‘glocalisation’in Asia is Mainland China. Lay’s appointment was a first for the brand’s menswear collection. The 28-year- old Chinese singer was a member of the South Korean-Chinese boy band EXO and has starred in films including The Island and Golden Eyes. Lay has also served as an ambassador for other global fashion brands, including Converse, Mac Cosmetics, Chaumet Paris and Ray-Ban. Last year he also signed on as Calvin Klein’s first Chinese global spokesperson and publicly terminated a similar contract with Samsung after the company violated the One China policy. When he was signed with H&M, the company said in a statement that the move was aimed at continuing to enhance its market competitiveness and brand influence. “The brand is taking a bigger step developing further its business in Greater China based on its menswear products with design and quality.” “I hope everyone can see the versatility of H&M men’s wear through Lay’s interpretation,”added Magnus Olsson, GM of H&M Greater China, at the time. In late September, H&M released its first collaboration with Chinese designer Angel Chen, which it says was inspired by the theme of“Kung Fu”. “The collection portrays a surprising, unique East-meet-West street style via a groundbreaking combination of vivid colour and embroidery,”Chen’s publicity explained. Educated in London but now Shanghai- based Chen has her own successful label, which is now sold through 70 retailers around the world, including department stores Bergdorf Goodman in the US, Lane Crawford in Hong Kong, Galeries Lafayette in France and Selfridges in the UK. She has tailored garments for influential celebrities including Bella Hadid, Chris Lee and Fan Bingbing, all influential pop culture figures in Mainland China. Lunar NewYear provides an opportunity for many international brands to plug in to a core feature of China’s culture and H&M is no different. This year, the brand released what was probably its most extensive range yet, spanning women, men and children. Celebrating theYear of the Rat, items featured motifs, bold red colour swatches and comfortable silhouettes, spanning more than 100 SKUs. The accompanying campaign and photography focused on families sharing time together, a core aspect of the festive season across Asia. H&M has a long way to go in its Asian journey. While it has an established presence in Southeast Asia, there was – before the coronavirus pandemic – a plan to open stores in smaller cities. India is H&M’s fastest-growing market globally, with 47 stores in tier-one cities (compared to Zara’s 22) and an online presence achieving 49-per-cent year-on- year growth last year. It is now targeting smaller cities and has announced a collaboration with local designer Sabyasachi Mukherjee to launch a new collection this year. With their rapidly rising middle class, parts of Asia represent a huge opportunity for global fashion brands. Using local models, influencers and celebrities is a sure- fire way to engage with consumers, adding local context to a global brand name.

- 28. 28 insideretail.asia – April 2020 Sustainable, Insta-worthy and size-inclusive, here are a few emerging retailers set to hit their stride. By Emma Sharley I n a year in which results are predicted to be mixed, retailers are exploring new ways to align with the changing needs and expectations of customers, and inventive ways to reconcile online and in-store experiences. Established global brands are likely to continue increasing in value, and will be closely managed in 2020. It’s often those on the cusp that are the most provocative and interesting to watch, so let’s take a look at the fashion forward-thinkers that are showing early promise across sales, customer growth, scalability, community and diversity. Fabricant thefabricant.com Why it’s one to watch: Pioneers in the digital-only clothing sector. Origin: Amsterdam, Netherlands Last year, The Fabricant, in collaboration with Dapper Labs and artist Johanna Jaskowska, sold the world’s first piece of bespoke digital couture,‘Iridescence’, for $9500 as a blockchain digital asset. The dress wasn’t made of silk or wool. Instead, it was a computer-generated image, made of pixels and superimposed on a photograph of its wearer. ‘Iridescence’generated global hype but, more importantly, it legitimised the concept of virtual fashion and digital houses. By designing clothes that exist solely online, digital fashion offers newness and diversity for social media feeds without the need to create physical garments – providing a powerful and more sustainable alternative to fast fashion. Summersalt summersalt.com Why it’s one to watch: Data-backed, size- inclusive travel-wear. Origin: St. Louis, Missouri With sales reportedly exploding by 610 per cent over the last two years and US $17.3 million under its belt following Series B funding, this direct-to-consumer, eco-friendly brand is making waves in the lucrative, rising travel wear market. Created for a mindset, not a demographic, Summersalt appeals to curious women who love to explore with fashion that’s designed for both culture and convenience. The best part? It’s all available at an affordable price point from $25 to $125. Summersalt’s strategic expansion into travel-focused apparel comes at a prime moment. In recent years, the travel trend has skyrocketed among high-end consumers, with annual spend on travel increasing by 6 per cent. The rise of travel wear is also fuelled in part by Instagram: 97 per cent of millennial travellers post on social networks when holidaying, according to research from Chase Bank. A crucial part of Summersalt’s success lies in its eco-friendly design ethos. Ninety per cent of the collection is made with recycled materials and its packaging is entirely compostable. On top of this, the retailer has a rapid development cycle, quick-response supply chain, design library of over 10,000 shapes, and a patent for recommending garments based on body shape and customer preferences. Summersalt also brings data to fashion: the brand took over 1.5 million body measurements from women around the world to design the perfect swimsuit. A smash hit, the swimsuit sold out 25 times in one year and catapulted Summersalt into the global fashion arena. ForDays fordays.com Why it’s one to watch: An innovative circular T-shirt company. Origin: Los Angeles, California At first glance, For Days looks like a simple subscription-based T-shirt company. But every single purchase goes towards addressing the waste problem created by fast fashion. According to the Environmental Protection Agency, more than 15 million tons of textile waste is generated annually FASHION FORWARDSFASHION FORWARDS 6 OVERSEAS BRANDS TO WATCH

- 29. 29April 2020 – insideretail.asia forward-thinking mindset. All of Ninety Percent’s materials are responsibly sourced and built to last. But what makes this company different is its dedication to supporting causes they believe in. Reflecting its namesake, 90 per cent of the brand’s profits are donated to charity. Once a customer orders a piece of clothing, they can choose an organisation to donate to from a list of charities that tackle various social and environmental causes. Jacquemus Why it’s one to watch: Filter-free fashion that’s instagrammable beyond doubt. Origin: Paris, France If anyone knows how to sell clothes in a 1080-pixel square, it’s fashion’s favourite Instagram brand, Jacquemus. Last year, brand creator Simon Porte Jacquemus shared a photo of actress Emily Ratajkowski wearing little more than a straw sunhat with the circumference of a 44-gallon drum — and had so much demand that his hat manufacturer ran out of straw. As one of the newest brands making headlines around the world, Jacquemus is living proof that self-made fashion brands can survive and thrive. The brand reportedly expects to double revenue in 2020 and shows no signs of slowing down anytime soon. As more disruptive brands enter the fashion industry, the list of visionary fashion retailers will only pick up in the future. Some other more well-known fashion brands to watch in 2020 include Aday, Fenty, Rimowa, Mejuri, Ganni, Outdoor Voices, M.Gemi and Veja. Unsurprisingly, these brands has integrated culture and/or convenience into its approach and brand philosophy, exemplifying how customer aspirations and retail business models are shifting. These brands also demonstrate the importance and constant pace of innovation and cause existing and new brands to make the right bets on what will drive future demand. Emma Sharley is the director of Sharley Consulting, co-founder of personalised shopping app Shop You, a startup adviser and a board member of Independent Fashion Advisory Board. in the US, with Americans throwing away about 36kg of used clothing per person each year. For Days aims to answer this problem by making permanent changes in the customer’s consumption pattern. Founder Kristy Caylor has developed a unique closed-loop system that’s empowering customers to be more responsible with purchasing. Instead of throwing away a T-shirt once it’s worn out, it’s taken back to For Days where it’s broken down into pulp and upcycled into another T-shirt – zero-waste genius. In addition, For Days gamifies sustainability with a rewards system, where customers are encouraged to buy and swap as much as they want. For Days tracks the water, energy, and landfill waste savings from every purchase and then converts them into“impact points”which can be used on future purchases. Norrøna norrona.com Why it’s one to watch: Championing the “loaded minimalism”movement. Origin: Lysaker, Norway One of the most innovative makers of outdoor gear in the world, Norrøna has recently expanded to the US. This family- owned brand pushes the boundaries of functional apparel with a collection of eco-friendly products, designed to meet the diverse needs of outdoor sports enthusiasts and beginners alike. Norrøna stands out in today’s fashion world for its unique approach to manufacturing. Every product is sold with a 100 per cent guarantee, and Norrøna retail stores double down as repair centres for customers to bring their damaged apparel. The brand also advocates for transparency and sustainability: the materials and hardware for every product are openly available online, along with the factories they were manufactured in. Ninetypercent ninetypercent.com Why it’s one to watch: A sustainable, contemporary agent of change. Origin: London, UK Another key player in the sustainable fashion space, Ninety Percent is dedicated to giving back to the environment and society. This luxury brand is a driver in the #DressBetter movement, encouraging their customers and other companies in the fashion industry to embrace a sustainable,

- 30. 30 insideretail.asia – April 2020 Pavilion Kuala Lumpur CEO Joyce Yap talks about how the centre has evolved in the 12 years it has been open, the role of flagships and the rise of O2O. PROPERTYPROPERTY The maturing mall mix I n May next year, Kuala Lumpur’s next supermall will open in the suburb best known for hosting the 1998 Commonwealth Games. Pavilion Bukit Jalil shopping centre is being developed by the same team behind the downtown Kuala Lumpur Pavilion. Once completed, the 1.8 million sqft development will have a catchment of 1.9 million people, 85 per cent of them locals, the balance tourists. The centre will feature a 300,000sqft multi-storey Parkson department store, and smaller anchors Dadi Cinema, China’s second- largest cinema group; Harvey Norman; Food Republic and a grocery concept called The Food Merchant. Dato JoyceYap, CEO of Kuala Lumpur Pavilion, is the retail planner of Pavilion Bukit Jalil. Inside Retail Asia sat down and talked to her about how retail in Malaysia has evolved in the 15 years since Pavilion Kuala Lumpur was conceived and how the next venture will differ. PavilionKualaLumpurhasbeen tradingfor12yearsnow.Whathaveyou learntinthattimethatwillinfluencethe newproject? Theory is theory. How you actually execute it – and execute it in the right timing – is very important. Fifteen years ago, when we started planning for Pavilion Kuala Lumpur, everybody told us there should be only one luxury mall in Malaysia. We went against that thought, by working together with researchers who understand the retail market. I learnt that no matter how much By Robert Stockdill The Pavilion Kuala Lumpur has now been trading for 12 years, but it has changed a lot in that time.

- 31. 31April 2020 – insideretail.asia research you do, you have to look at the real situation in terms of not only human character, but the business trends also – the wants versus the needs. For the past 12 years, we have been learning, learning, learning. But now not so much. Now I can sit together with retailers to come up with a formula to mitigate the risk for all stakeholders. I think that is very important ... to base the relationship on trust. To me, everything has to be correct. Firstly, at the conceptualisation stage: You have got to know how to plan the project, you have got to understand the demographic, you have got to understand the current market and how you foresee for the next three years – not too far ahead. Then, after conceptualisation, you need to run focus groups with the people that you think should anchor your tenant mix. Then, because of our relationship with our tenants, I usually get a very frank opinion. Never ever ask a retailer how much rent they will pay you, because nobody’s going to pay you more, okay? But they will more or less tell you what sales they forecast. How do they see this market? What do they need in terms of technical requirement or assistance from the landlord? Then after you get this, you have to identify who are your category killers and anchors because when the leader comes, the followers will follow. Once open, you have to look at your marketing. You must have a very aggressive team which understands that the success of a marketing strategy is not based on just traffic. It has to be based on how traffic translates into sales. Sometimes you do not look at the sales or at the traffic, but you look at the value creation, or the social-media profile or the community. Yousaidyoupolledtheretailers,your prospectivetenants.Whatdidthey tellyouthatmighthavesurprisedyou orchangedyourvisionforthecentre? Number one is the trend of food & beverage. Previously we felt that F&B should not be more than a certain percentage of the total space, but with today’s trends, it needs more space. Some of them will need delivery access for GrabFood-style services. So, their business model has to change. They may not need a very big kitchen or they may not need a very big outlet, but they will ask you in return for space for them to pack the delivery orders. Secondly, the services. For example, in Australia, some Westfield Centres have valet parking and a very good valet car- park lounge. Next, you look at the entertainment element. In the past we would always say if there is an area nobody wants, you can turn it into a gaming or entertainment centre or whatever. Now it is a component you must put in, especially if you are going to entice families. Isthere anythingspecificthat15 yearson,you’retakingacompletely differentapproachto? Over the last 12 years, the Pavilion tenant mix and model has changed tremendously. For example, we used to have a lot of large format, so-called mini anchors and department stores, which we have converted into other purposes. For instance, Tokyo Street. It used to be a designer furniture corner. At the time we opened there were a lot of high-end condominiums around us and we thought a high-end furniture zone would cater very well to them. Unfortunately, it did not turn out right because these high-end people ask the retailers to go and see them – they ► Kuala Lumpur’s next Pavilion centre is scheduled to open in May next year at Bukit Jalil.

- 32. 32 insideretail.asia – April 2020 don’t come here [to a showroom] to talk. Secondly, if I want to buy very expensive furniture, their showroom in the mall is not big enough for me to see the whole range. So in the end, our traffic was low and it was very difficult for us. Through our exit surveys, we found that our Japanese restaurant was continuously doing well – and Asians and Malaysians love Japanese concepts. So we changed the whole precinct – 36,000sqft – and invited a Japanese architect and an operator and marketing manager to create Tokyo Street, which has won us a lot of awards. The traffic to that space has gone up three times and my return has doubled. But the challenge now is sustainability. Can we keep on getting authentic Japanese food? That will be our challenge. The other precinct we have changed is where we used to have a Tangs department store. We had strong demand from specialty stores wanting to come into the centre, so we reconfigured that area and invited 36 brands there. Didyoutakealookatanycentres overseaswhenyouwereplanning PavilionBukitJalil?Wheredidyouget theideasforthedesign? Usually we go to Japan for inspiration. I go to Thailand to really understand the flagship store, the services and things like that, and the supermarket food offering is so interesting. Then we usually go to Australia to learn concepts about cafes and food, and also centre management. In the UK we like to look at department stores like Selfridges and Harrods, which are continuously so successful. And also, you know Harrods’ owner is a strong partner in Pavilion. And nowadays I love to go to Dubai, because it is a very interesting country where all the brands converge. When I was young we used to go to Hong Kong. But it has lost the magic now, and so has Singapore. Inthenewcomplexthere’snoluxury componentasthereisinPavilionKL? No. I’m looking at the highest as affordable luxury, brands like Coach, Michel Kors or Kate Spade. The rest of it I want in trend with the performance store concept. The performance category is the‘in thing’. So I need to have a good JD Sport store, a good Adidas, a good Nike, and a good Lululemon. And that part of the city is traditionally a sports hub. Soyou’regoingtohaveasportshubin recognitionofthesportsheritageof thearea? Yes, because we also have 80 acres of parkland connected to this property. So we intend to tell our retailers that okay, besides running your zumba dance classes or your gyms in our piazza, if you want, you can adopt a small area in the park for a badminton court, or a jogging track, a One of the mini anchors at Pavilion Bukit Jalil will be a new grocery conceptThe Food Merchant. A bird’s eye view of the Pavilion Bukit Jalil currently under construction. Entertainment elements are an essential part of today’s retail malls, says JoyceYap.

- 33. 33April 2020 – insideretail.asia bicycle trail, things like this. It has to be something different. Howdoflagshipsfitintothemodern malldesign?Istheeraofflagship storesover? No, no, no. I think the definition of a flagship should not be confined to size. It should actually include examples of your merchandise. For example, can this store feature limited-edition products? Secondly, for personal services, such as a private room. Number three is does this flagship store give me something more compared to your other stores? So besides size, these are the things I’m looking at. The exception may be Hermes or Cartier, for example, that can have only one or two stores in the city, not 10. You cannot tell them you can only have a flagship store. But you can tell them that if you want it in my centre, I demand something more. But SinceTokyo Street replaced a high-end furniture precinct at Pavilion KL, foot fall in the zone has trebled. for, like, The Body Shop, we can say: You may have 140 shops but why would people come to the Pavilion for The Body Shop when the traffic is so bad in town? So I tell them that you need to give me something more. Manypeoplehavebeensayingthat KualaLumpurhastoomanyshopping malls.What’syourviewonthat? Government statistics define shopping centres to even include arcades. That is not a very good definition. We should be talking about quality. During the past 20 years … less than 10 quality centres have not only survived, they have survived very well. The difference between them and the rest is the occupancy rate and per- square-foot sales compared to all those older ones. Today, retailers are selective. That’s why I say that unless you do not want to be in this business anymore, you need to be in the good shopping centres. How many good shopping centres are out there? I mean, you can count them. Only this week, a shopping centre only 40 years old is being demolished because the model was not right. It was strata titled. Today if you’re in a strata title ... I won’t say you will die, but it is hard to compete. So I say that if you believe you can build a quality shopping centre, you should do it. But you should build it as an integrated project, don’t build a stand-alone mall. They will need a lot of effort to promote and build up. Next, you need to look at the content. Even if you build the largest, it may not be the best, but the largest promises to give you flexibility of area to cater for more concepts, more brands and make it more of a community centre so you can command more market share. But you must know how to plan and manage it. Whatareyoudoinginthenewcentre torespondtotheO2Otrend?Areyou talkingtoallyourtenantsandasking themtobringsomethingdifferentto thetable? You cannot ignore O2O. It will definitely come. For the retailers now, the statistics show that 10 per cent of the people are using online to gain knowledge and information. Ninety per cent of the purchasing is still done in physical stores and they find that people who have done the online research and come to the physical stores will buy more than what they would usually order online. Next, online for them is not about cost saving. The logistics cost is very high. When Alibaba talks about how many billion dollars worth of goods they sell during 11.11, they never tell us how much of that was returned. But you cannot ignore this and a lot of high-end brands are using O2O as well. JoyceYap, CEO of Pavilion Kuala Lumpur and retail plan- ner for Pavilion Bukit Jalil.