Javed akthar m k subprime

- 2. PRESENTATION OUTLINE • WHAT IS SUBPRIME & PRIME? • WHAT IS CRISIS? • Causes of subprime crisis • How subprime crisis spread? • Housing bubble burst • SUBPRIME CRISES Impact on India • SOLUTIONS GIVEN BY US GOVERNMENT

- 3. PRIME LOANS AND SUBPRIME LOANS • PRIME- These are the loans that are offered to borrowers with good credit histories and carry lower interest and low rates as compared to subprime crises. • SUBPRIME- These are the loans that are offered to borrowers with bankruptcies, defaults, or late payment histories.

- 4. WHAT IS CRISIS……??? • An unstable and dangerous situation affecting an individual, group, community or whole society. • Negative changes in the security, economic, political, social or environmental affairs, especially when they occur abruptly, with little or no warning.

- 6. Large Loan given at low rate of interest FINANCIAL INSTITUTUION/ INVESTMENT BANK Small loans distributed at high rate of interest Money is Invested HIGH profits

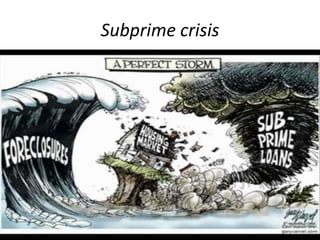

- 7. THE SUBPRIME MORTGAGE CRISIS EXPLAINED: • Up until 2006, the housing market in the United States was flourishing due to the fact that it was so easy to get a home loan. • Individuals were taking on subprime mortgages, with the expectations that the price of their home would continue to rise and that they would be able to refinance their home before the higher interest rates were to go into effect. 2005 was the peak of the subprime boom. At this time, 1 in 5 mortgages was subprime. • However, the housing bubble burst and housing prices had reached their peak. They were now on a decline.

- 8. Bankrupt FINANCIAL INSTITUTUION/ INVESTMENT BANK Subprime Defaulters Bankrupt Investor House

- 10. What Is a Bubble, Exactly? In the simplest terms, a bubble is an overheated market in which there are too many buyers who are too keen to buy. As a result, prices rise way too fast, and this situation becomes unsustainable. Eventually, some people realize this and start to sell out. The whole process goes into reverse equally rapidly, and the bubble bursts, with people selling in panic so that prices plunge. Particularly those who entered the market late in the process suffer substantial losses.

- 11. HOUSING BUBBLE Housing prices go up because demand goes up. Housing bubbles usually start with an increase in demand , in the face of limited supply which takes a relatively long period of time to replenish. Speculators enter the market, believing that profits can be made through short-term buying and selling. This further drives demand. It is impossible to predict and difficult to detect !

- 12. CAUSES HOME OWNERSHIP RESIDENTIAL REAL ESTATE AS A SAFE BUYING FOR SPECULATION Since, till 2006 Real Estate market was increasing.

- 14. WHY DID THE HOUSING BUBBLE BURST??? • Home prices reached their peak in the second quarter of 2006. They did not fall drastically at first. • Home prices fell by less than 2 percent from the 2nd quarter of 2006 to the 4th quarter of 2006. • The foreclosure start rates increased by 43 percent over these two quarters, and increased by 75 percent in 2007 compared to 2006. • This implies that mortgage default rates began to rise as soon as home prices began to fall. • Just as rising home prices reinforced the continuing rise in home prices, falling home prices reinforced the continuing fall in home prices.

- 15. Conti…… • The increase in foreclosures added to the inventory of homes available for sale. • This further decreased home prices, putting more homeowners into a negative equity position and leading to more foreclosures. • The increase in foreclosures also decreased the value of mortgage-backed securities. • This made it difficult for investment banks to issue new mortgage-backed securities, eliminating a major source of financing for new mortgage loans and contributing to the continuing decline in home prices.

- 16. • Most of the losses were not incurred by homeowners but by the financial system. • Large losses were incurred by the following groups: I. Mortgage lenders: One thirds of top 30 mortgage lenders have either been acquired or have filed for bankruptcy or have been liquidated. II. Investment banks: Since the housing bubble burst, the five largest U.S. investment banks have either filed for bankruptcy (Lehman Brothers), been acquired by other Firms or become commercial banks subject to greater Regulation. III. Foreign investors (mainly banks and governments) who had invested in mortgage backed securities. IV. Insurance companies: (e.g., AIG) who had sold credit default swaps. Credit default swaps are a type of contract that insures against the mortgage-backed securities.

- 17. NOTE……. • The bursting of any housing bubble would be expected to have a negative effect on the economy for two reasons: A. Home construction is an important economic activity, and the decline in home construction would reduce GDP. B. The decrease in home prices would also reduce household consumption due to the wealth effect. But the bursting of this housing bubble caused more severe and widespread harm than would be predicted from just these two reasons. As mentioned previously, most of the losses were suffered by the financial system, not by the homeowners. The bursting of the housing bubble sent a shock through the entire financial system.

- 18. IMPACT ON INDIA . • The foreign banks started unloading their holding in INDIAN EQUITIES resulting in fall in the stock price and weakening the domestic currency . • Hitting the IT enabled services since a majority firms derive 75% of revenue from US. • Manufacturing sectors has to ramp up scale economies and improve productivity & operational efficiency . • The near recession situation in the US has lead to the loss of demand for Indian exports and hence there is loss of export earnings in India.

- 19. • A recession in US has seen some job loss in India • The subprime crisis has led to a loss of confidence in the American stock market • Investment banks and other financial institutions are on a job slashing spree to cut costs • There will be several implications for the banking sector Indian banks have to follow stricter norms while disbursing loans

- 20. SOLUTIONS GIVEN BY US GOVERNMENT • To help lower-income people renegotiate their loans & stay in their homes. • They hope more money for lower-income families will be free & shift the balance of power between borrowers & lenders. • FHA insure slightly more expensive homes. • Deutsche Bank estimates that about $400 billion in subprime loans are scheduled for rate increase of 30% or more. • To provide the needy financial institutions with the liquidity that they need. • ECB is lending at the normal rate.