Keller acct 551 midterm exam set 2 new

•Download as DOC, PDF•

0 likes•10 views

acct 551,keller acct 551,keller acct 551 entire course,keller acct 551 week 1,keller acct 551 week 2,keller acct 551 week 3,keller acct 551 week 4,keller acct 551 week 5,acct 551 course project new,acct 551 final exam set 1 new,acct 551 final exam set 2 new,acct 551 midterm exam set 1 new,acct 551 midterm exam set 2 new,keller acct 551 tutorials,acct 551 assignments,acct 551 help

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (14)

Strayer university acc 304 final exam part 1 (3 sets) new

Strayer university acc 304 final exam part 1 (3 sets) new

FIN 515 NERD Introduction Education--fin515nerd.com

FIN 515 NERD Introduction Education--fin515nerd.com

ACC 423 MART Education for Service--acc423mart.com

ACC 423 MART Education for Service--acc423mart.com

Similar to Keller acct 551 midterm exam set 2 new

Similar to Keller acct 551 midterm exam set 2 new (20)

ACCT 551 RANK Education on Your Terms/acct551rank.com

ACCT 551 RANK Education on Your Terms/acct551rank.com

Acct 221 Principles of Accounting IIThere are 27 questions in thi.docx

Acct 221 Principles of Accounting IIThere are 27 questions in thi.docx

Omit all general journal entry explanations.Be sure to include cor.docx

Omit all general journal entry explanations.Be sure to include cor.docx

Problem 1 (10 Points)Jackson Browne Corporation is authorized to.docx

Problem 1 (10 Points)Jackson Browne Corporation is authorized to.docx

Omit all general journal entry explanations.Be sure to include c.docx

Omit all general journal entry explanations.Be sure to include c.docx

Intermediate Accounting I Final Exam Booklet Replacement.docx

Intermediate Accounting I Final Exam Booklet Replacement.docx

Question 1 30 pointsOn December 31, 2014, Frick Incorpora.docx

Question 1 30 pointsOn December 31, 2014, Frick Incorpora.docx

More from Isabeedd

More from Isabeedd (20)

Strayer cis 513 week 10 term paper wireless deployment plan new

Strayer cis 513 week 10 term paper wireless deployment plan new

Ash edu-695-week-6-assignment-final-paper-and-e portfolio-new

Ash edu-695-week-6-assignment-final-paper-and-e portfolio-new

Ash edu-695-week-5-dq-2-professional-learning-communities-new

Ash edu-695-week-5-dq-2-professional-learning-communities-new

Ash edu-695-week-5-dq-1-working-together-to-achieve-a-common-goal-new

Ash edu-695-week-5-dq-1-working-together-to-achieve-a-common-goal-new

Ash edu-695-week-5-assignment-leadership-in-the-21st-century-support-systems-new

Ash edu-695-week-5-assignment-leadership-in-the-21st-century-support-systems-new

Ash edu-695-week-4-dq-1-share-your-action-research-study-new-1

Ash edu-695-week-4-dq-1-share-your-action-research-study-new-1

Ash edu-695-week-4-dq-1-share-your-action-research-study-new

Ash edu-695-week-4-dq-1-share-your-action-research-study-new

Ash edu-695-week-4-assignment-research-and-educational-change-new

Ash edu-695-week-4-assignment-research-and-educational-change-new

Ash edu-695-week-3-dq-2-creativity-and-innovation-new

Ash edu-695-week-3-dq-2-creativity-and-innovation-new

Ash edu-695-week-3-dq-1-critical-thinking-and-problem-solving-new

Ash edu-695-week-3-dq-1-critical-thinking-and-problem-solving-new

Ash edu-695-week-3-assignment-learning-and-innovation-skills-and-student-asse...

Ash edu-695-week-3-assignment-learning-and-innovation-skills-and-student-asse...

Ash edu-695-week-2-dq-2-common-core-presentation-new

Ash edu-695-week-2-dq-2-common-core-presentation-new

Ash edu-695-week-2-dq-1-common-core-state-standards-new

Ash edu-695-week-2-dq-1-common-core-state-standards-new

Ash edu-695-week-2-assignment-21st-century-skills-and-standards-new

Ash edu-695-week-2-assignment-21st-century-skills-and-standards-new

Ash edu-695-week-1-dq-1-diversity-through-21st-century-teaching-and-learning-new

Ash edu-695-week-1-dq-1-diversity-through-21st-century-teaching-and-learning-new

Recently uploaded

Recently uploaded (20)

Z Score,T Score, Percential Rank and Box Plot Graph

Z Score,T Score, Percential Rank and Box Plot Graph

Seal of Good Local Governance (SGLG) 2024Final.pptx

Seal of Good Local Governance (SGLG) 2024Final.pptx

Basic Civil Engineering first year Notes- Chapter 4 Building.pptx

Basic Civil Engineering first year Notes- Chapter 4 Building.pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Unit-V; Pricing (Pharma Marketing Management).pptx

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Russian Escort Service in Delhi 11k Hotel Foreigner Russian Call Girls in Delhi

Russian Escort Service in Delhi 11k Hotel Foreigner Russian Call Girls in Delhi

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Beyond the EU: DORA and NIS 2 Directive's Global Impact

Keller acct 551 midterm exam set 2 new

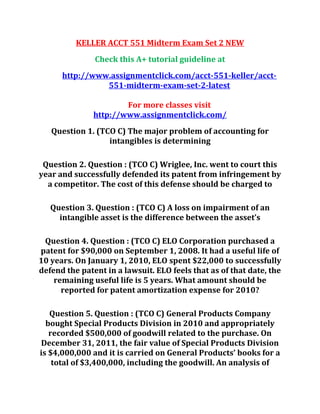

- 1. KELLER ACCT 551 Midterm Exam Set 2 NEW Check this A+ tutorial guideline at http://www.assignmentclick.com/acct-551-keller/acct- 551-midterm-exam-set-2-latest For more classes visit http://www.assignmentclick.com/ Question 1. (TCO C) The major problem of accounting for intangibles is determining Question 2. Question : (TCO C) Wriglee, Inc. went to court this year and successfully defended its patent from infringement by a competitor. The cost of this defense should be charged to Question 3. Question : (TCO C) A loss on impairment of an intangible asset is the difference between the asset’s Question 4. Question : (TCO C) ELO Corporation purchased a patent for $90,000 on September 1, 2008. It had a useful life of 10 years. On January 1, 2010, ELO spent $22,000 to successfully defend the patent in a lawsuit. ELO feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense for 2010? Question 5. Question : (TCO C) General Products Company bought Special Products Division in 2010 and appropriately recorded $500,000 of goodwill related to the purchase. On December 31, 2011, the fair value of Special Products Division is $4,000,000 and it is carried on General Products’ books for a total of $3,400,000, including the goodwill. An analysis of

- 2. Special Products Division’s assets indicates that goodwill of $400,000 exists on December 31, 2011. What goodwill impairment should be recognized by General Products in 2011? Question 6. Question : (TCO D) Which of these is not included in an employer's payroll tax expense? Question 7. Question : (TCO D) Which of the following taxes does not represent a payroll deduction a company may incur? Question 8. Question : (TCO D) Which of the following is not acceptable treatment for the presentation of current liabilities? Question 9. Question : (TCO D) On December 31, 2010, Irey Co. has $2,000,000 of short-term notes payable due on February 14, 2011. On January 10, 2011, Irey arranged a line of credit with County Bank that allows Irey to borrow up to $1,500,000 at 1% above the prime rate for 3 years. On February 2, 2011, Irey borrowed $1,200,000 from County Bank and used $500,000 additional cash to liquidate $1,700,000 of the short- term notes payable. The amount of the short-term notes payable that should be reported as current liabilities on the December 31, 2010 balance sheet issued on March 5, 2011 is Question 10. Question : (TCO D) Vargas Company has 35 employees who work 8-hour days and are paid hourly. On January 1, 2009, the company began a program of granting its employees 10 days of paid vacation each year. Vacation days earned in 2009 may first be taken on January 1, 2010. Information relative to these employees is as follows: Vargas has chosen to accrue the liability for compensated

- 3. absences at the current rates of pay in effect when the compensated time is earned. What is the amount of the accrued liability for compensated absences that should be reported at December 31, 2011? Question 11. Question : (TCO D) Reich, Inc. issued bonds with a maturity amount of $200,000 and a maturity 10 years from date of issue. If the bonds were issued at a premium, this indicates that Question 12. Question : (TCO D) If bonds are issued between interest dates, the entry on the books of the issuing corporation could include a Question 13. Question : (TCO D) On January 1, 2010, Ellison Co. issued 8-year bonds with a face value of $1,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds were sold to yield 8%. Table values are as follows: Present value of 1 for eight periods at 6% .627 Present value of 1 for eight periods at 8% .540 Present value of 1 for 16 periods at 3% .623 Present value of 1 for 16 periods at 4% .534 Present value of annuity for eight periods at 6% 6.210 Present value of annuity for eight periods at 8% 5.747 Present value of annuity for 16 periods at 3% 12.561 Present value of annuity for 16 periods at 4% 11.652 The issue price of the bonds is Question 14. Question : (TCO D) A company issues $20,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2010. Interest is paid on June 30 and December 31. The proceeds from the bonds are $19,604,145. What is the interest expense for 2011, using straight-line amortization?

- 4. Question 15. Question : (TCO D) On October 1, 2010, Bartley Corporation issued 5%, 10-year bonds with a face value of $500,000 at 104. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis. The entry to record the issuance of the bonds would include a (TCO C) Intangible assets may be internally generated or purchased from another party. In either case, the cost that should be included in the initial valuation of the asset is an issue. Instructions: - Identify the typical costs included in the cash purchase of an intangible asset. - Discuss how to determine the cost of an intangible asset acquired in a noncash transaction. - Describe how to determine the cost of several intangible assets acquired in a basket purchase. Provide a numerical example involving intangibles being acquired for a total price of $120,000. Question 2. Question : (TCO C) Recently, a group of university students decided to incorporate for the purposes of selling a process to recycle the waste product from manufacturing cheese. Some of the initial costs involved were legal fees and office expenses incurred in starting the business, state incorporation fees, and stamp taxes. One student wishes to

- 5. charge these costs against revenue in the current period. Another student wishes to defer these costs and amortize them in the future. Which student is correct and why? Question 3. Question : (TCO D) Edwards Co. includes one coupon in each bag of dog food it sells. In return for four coupons, customers receive a dog toy that the company purchases for $1.20 each. Edward’s experience indicates that 60% of the coupons will be redeemed. During 2010, 100,000 bags of dog food were sold, 12,000 toys were purchased, and 40,000 coupons were redeemed. During 2011, 120,000 bags of dog food were sold, 16,000 toys were purchased, and 60,000 coupons were redeemed. Instructions: Determine the premium expense to be reported in the income statement and the estimated liability for premiums on the balance sheet for 2010 and 2011. Question 4. Question : (TCO D) On January 1, 2011, Piper Co. issued 10-year bonds with a face value of $1,000,000 and a stated interest rate of 10%, payable semiannually on June 30 and December 31. The bonds were sold to yield 12%. Table values are: 11.470 Instructions:

- 6. - Calculate the issue price of the bonds. - Without prejudice to your solution in Part (a), assume that the issue price was $884,000. Prepare the amortization table for 2011, assuming that amortization is recorded on interest payment dates. Question 5. Question : (TCO D) Hurst, Inc. sold its 8% bonds with a maturity value of $3,000,000 on August 1, 2009 for $2,946,000. At the time of the sale, the bonds had 5 years until they reached maturity. Interest on the bonds is payable semiannually on August 1 and February 1. The bonds are callable at 104 at any time after August 1, 2011. By October 1, 2011, the market rate of interest has declined and the market price of Hurst’s bonds has risen to a price of 101. The firm decides to refund the bonds by selling a new 6% bond issue to mature in 5 years. Hurst begins to reacquire its 8% bonds in the market and is able to purchase $500,000 worth at 101. The remainder of the outstanding bonds is reacquired by exercising the bonds’ call feature. In the final analysis, how much was the gain or loss experienced by Hurst in reacquiring its 8% bonds? (Assume the firm used straight-line amortization.) Show calculations.

- 7. - Calculate the issue price of the bonds. - Without prejudice to your solution in Part (a), assume that the issue price was $884,000. Prepare the amortization table for 2011, assuming that amortization is recorded on interest payment dates. Question 5. Question : (TCO D) Hurst, Inc. sold its 8% bonds with a maturity value of $3,000,000 on August 1, 2009 for $2,946,000. At the time of the sale, the bonds had 5 years until they reached maturity. Interest on the bonds is payable semiannually on August 1 and February 1. The bonds are callable at 104 at any time after August 1, 2011. By October 1, 2011, the market rate of interest has declined and the market price of Hurst’s bonds has risen to a price of 101. The firm decides to refund the bonds by selling a new 6% bond issue to mature in 5 years. Hurst begins to reacquire its 8% bonds in the market and is able to purchase $500,000 worth at 101. The remainder of the outstanding bonds is reacquired by exercising the bonds’ call feature. In the final analysis, how much was the gain or loss experienced by Hurst in reacquiring its 8% bonds? (Assume the firm used straight-line amortization.) Show calculations.