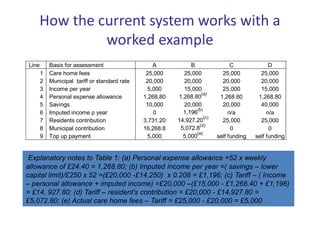

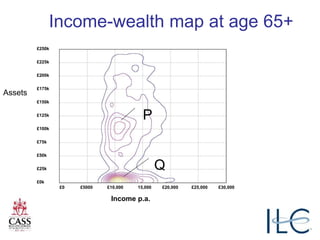

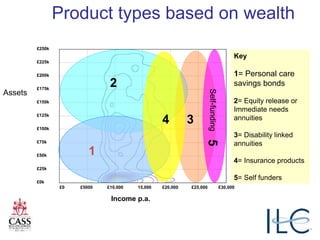

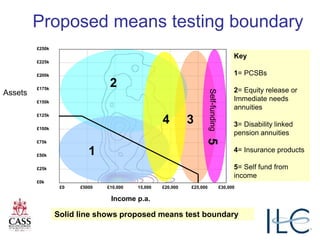

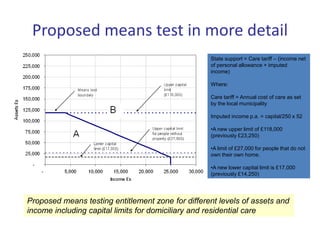

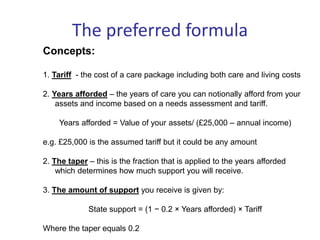

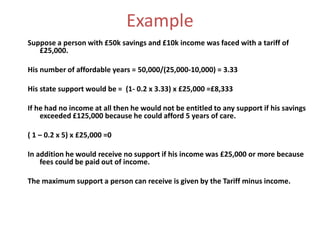

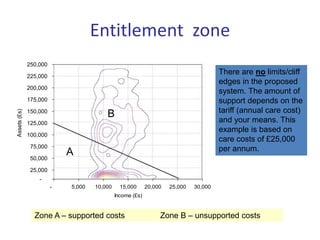

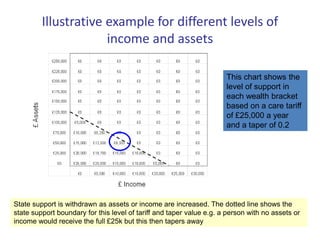

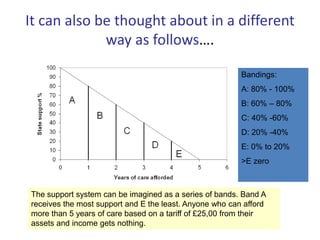

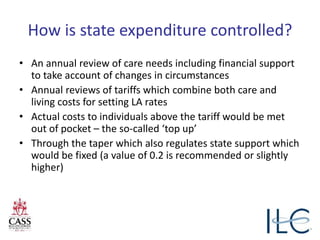

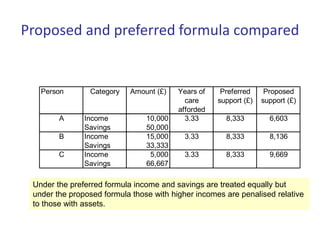

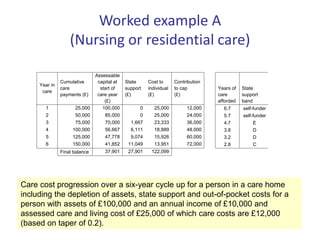

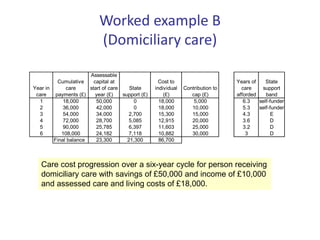

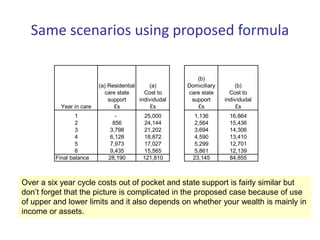

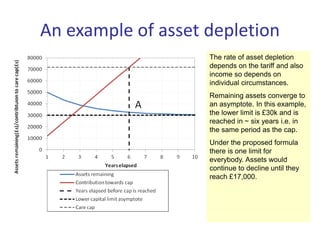

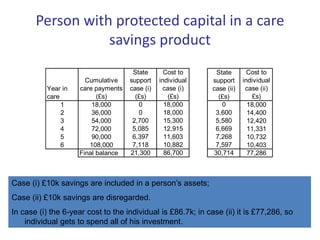

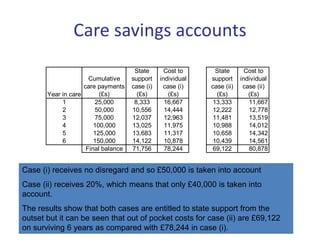

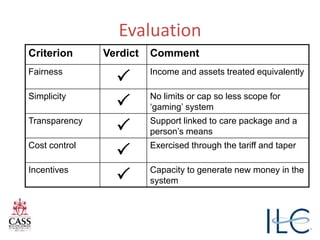

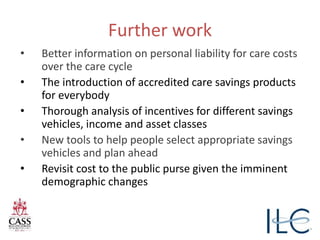

The document discusses the need for reform in the means-testing and funding of adult social care in England, highlighting the inadequacies and complexities of current systems. It proposes a simpler, fairer approach that treats income and savings equitably while aiming to attract new funding into the care system. Additionally, it critiques potential new means-testing boundaries and financial disincentives, ultimately suggesting mechanisms to reward savings for care.