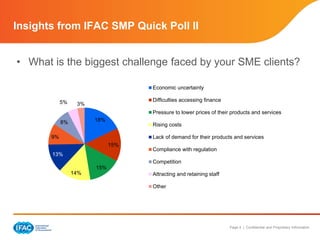

The document discusses global and regional trends affecting Small and Medium Practices (SMPs) and their role in supporting Small and Medium Enterprises (SMEs). It includes insights from an IFAC quick poll detailing challenges SMPs face, the importance of accountants as advisors, and the need for SMPs to adapt to technological advancements and changing market demands. The document highlights the necessity for SMP diversification to remain relevant amid evolving business landscapes and regulatory changes.