Financial Analysis of Hero Motocorp Ltd

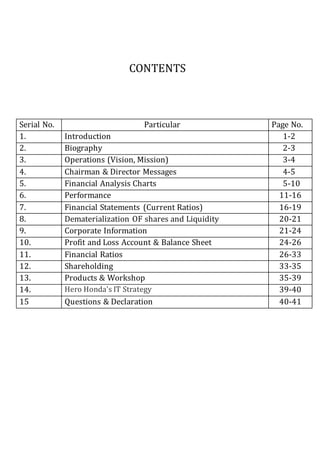

- 1. CONTENTS Serial No. Particular Page No. 1. Introduction 1-2 2. Biography 2-3 3. Operations (Vision, Mission) 3-4 4. Chairman & Director Messages 4-5 5. Financial Analysis Charts 5-10 6. Performance 11-16 7. Financial Statements (Current Ratios) 16-19 8. Dematerialization OF shares and Liquidity 20-21 9. Corporate Information 21-24 10. Profit and Loss Account & Balance Sheet 24-26 11. Financial Ratios 26-33 12. Shareholding 33-35 13. Products & Workshop 35-39 14. Hero Honda's IT Strategy 39-40 15 Questions & Declaration 40-41

- 2. ACKNOWLEDGEMENT I am using this opportunity to express my gratitude to everyone who supported me throughout the course of this MBA project. I am thankful for their aspiring guidance, invaluably constructive criticism and friend advice during the project work. I am sincerely grateful to them for sharing their truthful and illuminating views on a number of issues related to the project. I express my warm thanks to Mr. Sanjay Samtani for their support and guidance at “Financial Accounting of Hero Motocorp” I would also like to thank my project external guide Mr. Pradeep Joshi and all the people who provided me with the facilities being required and conductive conditions for my MBA project. Thank you, Hitesh Patidar

- 3. Introduction Hero Motocorp Ltd., formerly Hero Honda, is an Indian motorcycle and scooter manufacturer based in New Delhi, India. The company is the largest two wheeler manufacturer in the world. In India, it has a market share of about 46% share in 2-wheeler category. The 2006 Forbes 200 Most Respected companies list has Hero Honda Motors ranked at #108. On 31 March 2013, the market capitalization of the company was INR 308 billion (USD 5.66 billion). Hero Honda started in 1984 as a joint venture between Hero Cycle of India and Honda of Japan. In 2010, when Honda decided to move out of the joint venture, Hero Group bought the shares held by Honda. Subsequently, in August 2011 the company was renamed Hero MotoCorp with a new corporate identity. In June 2012, Hero motocorp approved a proposal to merge the investment arm of its parent Hero Investment Pvt. Ltd. into the automaker. The decision comes after 18 months of its split from Honda Motors. Most companies today face rising/growing expectations about their environmental performance from a variety of stakeholders. A growing number of companies realize that to achieve their environmental goals and satisfy stake-holders expectations, they need to look beyond their own facilities and to involve their suppliers/vendors in environmental initiatives. Leading companies also understand that customers do not always differentiate between a company and its suppliers and hold companies accountable for supplier’s environmental and labor practices. In addition many companies are working to streamline their supply base and develop more cooperative, long-term relationships with key suppliers, a practice that has fostered greater opportunities to work together on environmental issues. The concept of the green supply/vendor chain management is to consistently meet specifies environmental performance criteria among the participants of the supply chain and also approach more consistent corporate environmental behavior among all players in the chain of products and services. Additional objective is to help the suppliers recognize the importance of environmental issues and support them in their own programs for improvements. About:- “Hero” is the brand name used by the Munjal brothers for their flagship company, Hero Cycles Ltd. A joint venture between the Hero Group and Honda Motor Company was established in 1984 as the Hero Honda Motors Limited at Dharuhera, India. Munjal family and Honda group both owned 26% stake in the Company. During the 1980s, the company introduced motorcycles that were popular in India for their fuel economy and low cost. A popular advertising campaign based on the slogan 'Fill it – Shut it – Forget it' that emphasized the motorcycle's fuel efficiency helped the company grow at a double-digit pace since inception. In 2001, the company became the largest two-wheeler manufacturing company in India and globally.[2] It

- 4. maintains global industry leadership till date.[2] The technology in the bikes of Hero Motocorp (earlier Hero Honda) for almost 26 years (1984–2010) has come from the Japanese counterpart Honda. History:- 1956—Formation of Hero Cycles in Ludhiana(majestic auto limited) 1975—Hero Cycles becomes largest bicycle manufacturer in India. 1983—Joint Collaboration Agreement with Honda Motor Co. Ltd. Japan signed Shareholders Agreement signed 1984—Hero Honda Motors Ltd. incorporated 1985—Hero Honda motorcycle CD 100 launched. 1989—Hero Honda motorcycle Sleek launched. 1991—Hero Honda motorcycle CD 100 SS launched. 1994 – Hero Honda motorcycle Splendor launched. 1997—Hero Honda motorcycle Street launched. 1999 – Hero Honda motorcycle CBZ launched. 2001 – Hero Honda motorcycle Passion and Hero Honda Joy launched. 2002—Hero Honda motorcycle Dawn and Hero Honda motorcycle Ambition launched. 2003—Hero Honda motorcycle CD Dawn, Hero Honda motorcycle Splendor plus, Hero Honda motorcycle Passion Plus and Hero Honda motorcycle Karizma launched. 2004—Hero Honda motorcycle Ambition 135 and Hero Honda motorcycle CBZ Star launched. 2005—Hero Motocorp SuperSplendor, Hero Honda motorcycle CD Deluxe, Hero Honda motorcycle Glamour, Hero Honda motorcycle Achiever and Hero Honda Scooter Pleasure. 2007—New Models of Hero Honda motorcycle Splendor NXG, New Models of Hero Honda motorcycle CD Deluxe, New Models of Hero Honda motorcycle Passion Plus and Hero Honda motorcycle Hunk launched. 2008—New Models of Hero Honda motorcycles Pleasure, CBZ Xtreme, Glamour, Glamour If and Hero Honda motorcycle Passion Pro launched. 2009—New Models of Hero Honda motorcycle Karizma: Karizma – ZMR and limited edition of Hero Honda motorcycle Hunk launched 2010—New Models of Hero Honda motorcycle Splendor Pro and New Hero Honda motorcycle Hunk and New Hero Honda Motorcycle Super Splendor launched. 2011—New Models of Hero Honda motorcycles Glamour, Glamour FI, CBZ Xtreme, Karizma launched. New licensing arrangement signed between Hero and Honda. In August Hero and Honda parted company, thus forming Hero MotoCorp and Honda moving out of the Hero Honda joint venture. In November, Hero launched its first ever Off Road Bike Named Hero "Impulse". 2012-New Models of Hero Motocorp Maestro the Musculine scooter and Ignitor the young generation bike are launched. 2013-Hero MotoCorp unveiled line-up of 15 updated products including Karizma R, ZMR, Xtreme, Pleasure, Splendor Pro, Splendor iSmart, HF Deluxe ECO, Hero Motocorp SuperSplendor, Passion Pro and Xpro, Glamour and Glamour FI etc. It also introduced three new technologies- Engine Immobilizer in new Xtreme, Integrated Braking System (IBS) in new Pleasure and i3S (Idle Stop and Start System) in new Splendor iSmart . Operations Hero MotoCorp has three manufacturing facilities based at Dharuhera and Gurgaon in Haryana and at Haridwar in Uttarakhand. These plants together have a production capacity of 6.9 million 2-wheelers per year.[2][24] Hero MotoCorp has a sales and service network with over 3,000 dealerships and service points across India. It has a customer loyalty program since 2000, called the Hero Honda Passport Program. [25]

- 5. It is reported that Hero MotoCorp has five joint ventures or associate companies, Munjal Showa, AG Industries, Sunbeam Auto, Rockman Industries and Satyam Auto Components, that supply a majority of its components.[26] The company has a stated aim of achieving revenues of $10 billion and volumes of 10 million two-wheelers by 2016–17. This in conjunction with new countries where they can now market their two-wheelers following the disengagement from Honda. Hero MotoCorp hopes to achieve 10 per cent of their revenues from international markets, and they expected to launch sales in Nigeria by end-2011 or early-2012. In addition, to cope with the new demand over the coming half decade, the company is coming up with their fourth factory in Neemrana in Rajasthan while their fifth factory is planned to be set up at Halol in Gujarat. MISSION Hero MotoCorp’s mission is to become a global enterprise fulfilling its customers’ needs and aspirations for mobility, solidity and sturdiness. We aim to set benchmarks in technology, style and quality to convert its customers into brand advocates. The Company provides an engaging environment for its people to perform to their true potential. it aims to continue its focus on value creation and enduring relationships with its partners. VISION The story of Hero Honda began with a simple vision – that of a mobile and empowered India, powered by its bikes. The Company’s new identity – Hero MotoCorp ltd. – reflects its commitment towards providing sturdy and solid world-class mobility solutions with a renewed focus on steadily moving ahead and expanding the footprint in the global arena. FOCUSED STEATAGY Key strategies focus on building a steady and robust product portfolio across categories and explore growth opportunities globally. We also seek to continuously improve upon operational efficiency, aggressively expand our customer reach, invest in brand-building activities and ensure customer and shareholder delight. Chairman's Message: - BRIJ MOHAN LAL MUNJAL In a country where millions live in poverty, where the population continues to grow and where the earth’s resources are being over exploited, we cannot continue to afford to let things take their course. People and organizations with influence need to step up to the challenge. Corporate need to make their contribution in meeting this challenge.

- 6. Sustainable Development is a core element of Hero MotoCorp’s strategy. We believe that we can best achieve sustainable enterprise by creating the right balance between business growth, environmental protection and social stability. My vision for sustainable development is that it becomes fully integrated into everything we do, it becomes instinctive. In this process I invite you all to partner with us on our journey towards sustainability. Managing Director's Message: - PAVAN MUNJAL Today, there is a need for businesses to take action on balancing their economic and environmental imperatives by embracing technological innovations, engaging and informing stakeholders to an extent and managing inherent risks of business. Hero MotoCorp Limited, the largest motorcycle manufacturer in the world, identifies its Vendors and Dealers as the key stakeholders and partners to work towards the goal of sustainable development. We believe in implementing business strategies not based on consumption but on operations, products and services that support the quality of life for all, today and for the next generation. Through our Green Supply Chain Initiative, we shall jointly work with our vendors and dealers as responsible corporate citizens, adopting sustainable and environmental practices to achieve economic growth that contributes to the sustainable development of the nation. Product Basket Offer one of the widest ranges of two- wheelers with over 19 different products across the 100 cc, 125 cc, 150 cc, 225 cc and scooter categories. Operating locations Two of our manufacturing plants are based at Gurgaon and Dharuhera in Haryana (India) and one manufacturing plant is located at Haridwar, Uttarakhand (India). The combined annual installed capacity is approx. 6.90 million units. Enhancing Reach We have one of the most extensive customer reaches with 5,800+ pan-India touch points with deepening presence across 1,00,000+ villages. We are consistently expanding our footprint across Asia, Central & Latin America and Africa. Company performance The company has sold over 47 million 2-wheelers since its inception in 1984 till March 2013. It sold 6.07 million 2-wheelers in 2012, out of which 5.5 million were motorcycles. Hero Motocorp sells more two wheelers than the second, third and fourth placed two-wheeler companies put together. Its most popular bike Hero Honda Splendor sells more than one million units per year. In 2013, Hero MotoCorp registered best ever calendar year performance of more than 6.1 million unit sales. By selling 6.25 lakh units in the month of October, it became the first-ever manufacturer to cross landmark 6 lakh unit sales in a month. In the last quarter of the year or say in the festive season, the company sold more than 1.6 million units, while in non festive time in April–May 2013, it managed to sell out quite good numbers of units- 1.1 million.

- 7. Best-In-Class Practices our benchmarked processes and operations are ISO 9001 (Quality Management Systems), ISO 14001 (Environmental Management Systems) and OHSAS 18001 (Occupational Health and Safety Management Systems) certified. For Shareholders Our shares are listed on the BSE Limited and National Stock Exchange of India Limited. Our market capitalization as on March 31, 2013 was ` 30,792 cores. Moreover, we Recommended a dividend of 3000% in 2012-13, i.e. ` 60 per equity share of the face value of ` 2 per share. Human Capital We have highly motivated and experienced team of over 5,800 people. Expansion agenda We are creating capacities to ensure sustainable long-term growth by: Setting up a fourth plant at Neemrana in Rajasthan with an annual installed capacity of 750,000 units. Setting up a fifth plant at Halol in Gujarat, with an annual installed capacity of 1.2 million in the initial phase, which will grow to 1.8 million in the next phase. Setting up a new state-of-the-art integrated R&D centre at Kukas, Rajasthan. Consistent expansion across all three existing plants. The Combined Annual Installed Capacity of Plants is 6.90 Million units. Setting up a Global Parts Centre (GPC) at Neemrana, Rajasthan

- 8. 7000000 6000000 5000000 4000000 3000000 2000000 1000000 Products Sales No of Units Total Net Income Chart Rs. In crores EARNING PER SHARE CHART 30000 25000 20000 15000 10000 Rs 0 2012-2013 2011-2012 2010-2011 2009-2010 2008-2009 Series 1 5000 0 2012-2013 2011-2012 2010-2011 2009-2010 2008-2009 140 120 100 80 60 40 20 0 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013

- 9. PROFIT BEFORE TAX Material OPERATIONS & OTHER EXPENSES TAXES AND DUTIES EMPLOYEES INTEREST DEPRECIATION SHAREHOLDERS AND RESERVES & SURPLUS Rs. In crores 46% Market Share in the Domestic Two-Wheeler Market 53.2% Market Share in the Domestic Motorcycle Market 47.77 Million Two Wheeler Sold at the End of the year of 2014 0 1000 Particulars Rs. Crores (%) MATERIALS 17,397.66 66.76 OPERATIONS & OTHER EXPENSES 2,265.05 8.69 TAXES AND DUTIES 2,302.84 8.84 EMPLOYEES 820.92 3.15 INTEREST 11.91 0.05 DEPRECIATION 1,141.75 4.38 SHAREHOLDERS AND RESERVES & SURPLUS 2,118.16 8.13 Total 26058.29 100

- 10. Distribution of Revenue of 2012-13 Distribution of Revenue of 2011-12 Particulars Rs. Crores (%) MATERIALS 17,281.57 67.51 OPERATIONS & OTHER EXPENSES 1,943.16 7.59 TAXES AND DUTIES 2,142.57 8.37 EMPLOYEES 735.52 2.87 INTEREST 21.30 0.08 DEPRECIATION 1,097.34 4.29 SHAREHOLDERS AND RESERVES & SURPLUS 2,378.13 9.29 Total 25,599.59 100 2011-12 MATERIALS OPERATIONS & OTHER EXPENSES TAXES AND DUTIES EMPLOYEES INTEREST DEPRECIATION

- 11. 90 80 70 60 50 40 30 20 10 0 Return on Average Capital Employed 2012-13 2011-12 2010-11 2009-10 2008-09 Return on Average Capital Employed 2500 2000 1500 1000 500 0 Profit After Tax 2012-13 2011-12 2010-11 2009-10 2008-09 Profit After Tax 2000 1800 1600 1400 1200 1000 800 600 400 200 0 Economic Value Added 2012-13 2011-12 2010-11 2009-10 2008-09 Economic Value Added

- 12. 120 100 80 60 40 20 0 Stable Dividend Per Share 2012-13 2011-12 2010-11 2009-10 2008-09 Fundamentals steer Future strategies Amid the shifting dynamics of global markets, customers count on Hero as a reliable manufacturer of products, services and solutions to meet their evolving aspirations. This hard earned trust represents the foundation of our business sustainability and future growth. Growths in Sales, Income, PAT Stable Dividend Per Share 80 70 60 50 40 30 20 10 0 -10 -20 Growth in Sales Growth in Income Growth in Profit After Tax

- 13. Annual trends In GDP at factor cost (%) Particular 2008-09 2009-10 2010-11 2011-12 2012-13 Agriculture and allude 0.1 0.8 7.9 3.6 1.9 activities Industry 4.4 9.2 9.2 3.5 2.1 Services 10 10.5 9.8 8.2 7.1 Two-wheeler Market in 2012-13 18000000 16000000 14000000 12000000 10000000 8000000 6000000 4000000 2000000 0 Two-Wheelers Motercycle Scooter Moped Momentum of a Frontrunner Headquartered in India, Hero MotoCorp is the world’s largest manufacturer of two-wheelers. In 2001, the Company achieved the coveted position of being the largest two-wheeler manufacturing company in India and globally. It maintains global industry leadership till date. Operational Performance In 2012-13, Hero MotoCorp sold 6.07 million units compared to 6.23 million units in the previous year. This was on account of poor rains, firm interest rates, high fuel prices and heightened caution on the part of customers across the two-wheeler industry. In the dominant motorcycle segment, Hero MotoCorp with sales of 5.5 million units, continued to lead the domestic market with 46% market share. This, however, was marginally lower than the 48.4% market share in 2011-12. Sales in the domestic motorcycle market remained flat at 10.08 million units, compared to 10.07 million units in the previous year. In the Indian market, Hero MotoCorp captured 53.2% market share, with sales of 5.3 million units. Despite the

- 14. slowdown, the Company sold more than the second, third and fourth placed motorcycle manufacturers in India taken together during the year. Exports Hero MotoCorp, with sales of over 1,36,000 units, accounted for 7.3% of motorcycle exports from India. Hero Motocorp’s International Focus During 2012-13, the Company exported 1, 61,043 units as compared to 1, 65,925 units the previous year resulting in a decline of 2.94%. Moreover, the Company exported spare parts worth ` 38.38 crores depicting a growth of 16% over the previous year. The growth came as a result of distributor realignments in existing markets, launches across Sri Lanka and Nepal, increased promotional activities in Bangladesh and a stronger focus on the Columbian market. In 2012-13, the Company prepared the template for an ambitious international foray covering the countries of Africa, Latin America and Central America. At the time of writing the Report, Hero MotoCorp’s first consignments to new international markets across these geographies had been well received. Analyzing Numbers (%) KEY PROFITABILITY METRICS 2012-13 2011-12 Return on Average Capital Employed 47.8 58.9 Return on Average Equity 45.6 65.6 Profit after Tax 8.9 10.1 Profit Before Tax 10.6 12.1 Profit Before Interest and Tax 10.7 12.2 Operating Profit Before Tax 9.0 10.7 Operating Profit before Depreciation, Interest and Tax 13.8 15.3 RATIOS 2012-13 2011-12 Inventory Period ( in days) 11.2 10.5 Inventory and Receivable Conversion period (in days) 17.8 13.4 Cash Cycle -25.4 -32.2 Current Ratio 0.73 0.45 Acid Test Ratio 0.50 0.25 3000% Dividend For 2012-13, The Board Has Recommended a Dividend of 3000% Compared to 2250% Declared in the previous year and has maintained a Payout Ratio of 66.2% VIS-À-VIS 43.9% in the previous year. SALES The Company registered total sales of 6.07 million units during 2012-13, recording a 2.6% decline. In value terms total sales (net of excise duty) increased by 0.9% to Rs. 23,583 crores from Rs. 23,368 crores recorded in the previous fiscal year.

- 15. PROFIABILITY The Company’s earnings before interest, depreciation and taxes (EBITDA) margins decreased from 15.35% in 2011-12 to 13.82% in 2012-13. Operating margins fell from 10.69% to 9.02% on account of higher input costs and amortization. Operating profit (PBT before other income) decreased from Rs. 2,521 crores in 2011-12 to Rs.2,143 crores in 2012-13. Decline in sales caused the margins to fall. OTHER INCOME (INCLUDING OTHER OPERATING REVENUE) Other income increased by 1.42% from Rs.576 crores in 2011-12 to Rs.584 crores in 2012-13. CASH FLOWS During the year, the free cash flow from operations stood at Rs. 1,890 crores (previous year Rs . 2,360 crores). These cash flows were deployed in capital assets, investments and also paid out as dividend during the year. RAW MATERIAL COSTS During the year, metal prices were volatile, particularly for steel, copper, aluminum and nickel. However, raw material costs as a proportion of sales declined from 73.95% to 73.77%. CURRENT ASSETS TURNOVER The Company’s current asset turnover, indicating sales as a proportion of average current assets (excluding investments), decreased from 18.3% to 13.5%. This was primarily due to higher average inventory, trade receivables and loans & advances. DEBT STRUCTURE Hero MotoCorp is debt-free for the past 12 years and incurs no borrowing costs. Finance cost includes interest on account of advances from dealers and other transactional costs. DIVIDEND POLICY Over the years, the Company has consistently followed a policy of paying high dividends, keeping in mind the cash-generating capacities, the expected capital needs of business and strategic considerations. For 2012-13, the Board recommended a dividend of 3000% compared to 2250% declared in previous year and has maintained a payout ratio of 66.2% vis-a-vis 43.9% in the previous year. WORKING CAPITAL MANAGEMENT The Company has always sought to efficiently use the various components of working capital cycle. It has also effectively controlled the receivables and inventories, enabling it to operate on a negative working capital. Evolving a risk-focused Strategy

- 16. At Hero MotoCorp, a risk focused strategy is the result of identifying, assessing and evaluating risks and taking proactive measures to address those risks. CURRENCY DEPRECIATION A flight of safety to the US dollar and India’s ballooning current account deficit resulted in the Indian rupee depreciating significantly of its value in a year. If the rupee further continues its downfall, costs of imported spares, technology royalties, raw materials and capital goods can significantly shoot up, impacting the Company’s bottom line. INFLATION Inflation is finally moderating after a two- year hiatus, but the plunging Indian rupee and uncertainty in crude oil prices have the capability to dampen sentiments. An uptick in inflation during 2013-14 can stall or pause the process of monetary easing, thereby impacting consumer sentiment. INTEREST RATES The Company has not been significantly affected by the higher interest rate scenario owing to a strong balance sheet and healthy cash flows. However, in the event of significant expansions being planned by the Company, rising interest rates can increase the cost of capital and also impact the operations of crucial vendors. To counter this challenge, the Company is pursuing an aggressive policy of multiple sourcing. GLOBAL UNCERTAINTY With the Company having firm plans to increase its footprint in Latin America and Africa, it will become more susceptible to country-specific as well as region-specific geo-political events. Considering this, the Company is chalking out an overseas entry strategy, post careful consideration of local dynami cs. COMPETITION The Company has completed its first full year of operations, post its new brand identity. However, the level and intensity of competition from Hero MotoCorp’s erstwhile partner is expected to shoot up by many notches. Product launches pitted against Hero MotoCorp’s strongest brands can exert some pressure on market share, but the Company is adequately prepared to defend and consolidate its strong turf. R&D To enable the Company to succeed in an altered landscape, the R&D function is being s et up afresh with a strong focus on technology sourcing and new product development. New alliances and technology tie-ups were finalized during the year under review, but it will take a while before the Company is ready with a solid portfolio of its own products.

- 17. PHILOSOPHY ON ‘CODE OF CORPORATE GOVERNANCE’ The Company’s philosophy of Corporate Governance stems from a belief that the Company’s business strategy and plans should be consistent with the welfare of all its stakeholders, including shareholders. Good Corporate Governance practices enable a Company to attract financial and human capital. In turn, these resources are leveraged to maximize long-term shareholder value, while preserving the interests of multiple stakeholders, including the society at large. Corporate Governance rests upon the four pillars of: transparency, full disclosure, independent monitoring and fairness to all, especially to minority shareholders. The Company has always strived to promote Good Governance practices, which ensure that: A competent management team is at the helm of affairs; The Board is strong with an optimum combination of Executive and Non-Executive (including Independent) Directors, who represent the interest of all stakeholders; The Board is effective in monitoring and controlling the Company’s affairs; The Board is concerned about the Company’s shareholders; and The Management and Employees have a stable environment. We believe that the essence of Corporate Governance lies in the phrase “Your Company”. It is “Your” Company because it belongs to “you” – the shareholders. The Chairman and Directors are “Your” fiduciaries and trustees. Their objective is to take the business forward to maximize “Your” long -term value. The Securities and Exchange Board of India (SEBI) has specified certain mandatory governance practices, which are incorporated in Clause 49 of the Listing Agreement of Stock Exchange. The Company is committed to benchmark itself with the best standards of Corporate Governance, not only in form but also in spirit. This section, along with the section on ‘Management Discussion & Analysis’ and ‘General Shareholders’ Information’ constitute the Company’s compliance with Clause 49 of the Listing Agreement, entered into by the Company with the Stock Exchanges. Minutes of the Audit Committee, Shareholders’ Grievance Committee, Remuneration and Compensation Committee and Committee of Directors; Information on recruitment of senior management just below the Board level including appointment or removal of the Chief Financial Officer and the Company Secretary; Any material defaults in financial obligations to and by the Company or substantial non-payments for goods sold by the Company; Fatal or serious accidents, dangerous occurrences, any material effluent or pollution problems; Transactions that involve substantial payment towards goodwill, brand equity or intellectual property;

- 18. Materially important show cause, demand, prosecution and penalty notices; Details of quarterly foreign exchange exposures and steps taken by the management to limit the risks of adverse exchange rate movement; Sale of material nature, of investments and assets, which are not in the normal course of business; Details of joint ventures and agreements or variations thereof; Quarterly statutory compliance report; Non-compliance of any regulatory, statutory nature or listing requirements and shareholder’s service such as non- payment of dividend, delay in share transfer etc.; Investments strategy/plan; Any issue which involves possible public or product liability claims of substantial nature, including any judgment or order which may have passed strictures on the conduct of the Company or taken an adverse view regarding another enterprise that can have negative implications on the Company; and Significant labor problems and their proposed solutions. Also, any significant development in Human Resources/ Industrial Relations front like signing of wage agreement, implementation of voluntary retirement schemes etc. STOCK CODES Scrip Code Reuters Code Bloomberg NSE 500182 HROM.BO HNCN:IN BSE HEROMOTOCO HROM.NS HMCL:IN STOCK MARKET DATA The Company’s market capitalization is included in the computation of the BSE Sensex, BSE -100, BSE- 200, BSE- 500, BSE Sect oral Indices, BSE TASIS Shariah 50, S&P CNX Nifty, S&P CNX 500 and CNX 100. Monthly high and low quotations as well as the volume of shares traded at the NSE and BSE are given in Table 8. SHARE CAPITAL (Liabilities) Particulars MAR 2014 MAR 2013 MAR 2012 MAR 2011 MAR 2010 Share Capital 399.4 399.4 399.4 399.4 399.4 Total Reserves 55599.30 49663.00 42498.90 29161.20 34250.80 Shareholder’s Funds 55998.70 50062.40 42898.30 29560.60 34650.20 Total Current Liabilities 55271.30 96416.50 98889.20 107262.60 85152.10 Total Non Current -315.50 4647.30 12576.50 17534.90 2187.80

- 19. Liabilities 20000 18000 16000 14000 12000 10000 8000 6000 4000 2000 0 -2000 Total Non-Current Liabilities 2014 2013 2012 2011 2010 70000 60000 50000 40000 30000 20000 10000 0 Total Current Liabilities 2014 2013 2012 2011 2010 Share Price of Hero Motocorp Total Non-Current Liabilities Total Current Liabilities Year 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Nov. 2014 price 550 873 758 701 808 1739 1943 1899 1886 2067 2960

- 20. 3500 3000 2500 2000 1500 1000 500 0 Share Price 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Nov-14 Growth Rate in the share Price Share Price Year 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Aug- 2014 % 41.01 58.72 -10.08 -7.52 15.26 115.22 11.73 2.26 0.68 9.60 21.48

- 21. 140 120 100 80 60 40 20 0 Share Holding Pattern (%) Particular % INDIAN PROMOTER GROUP 52.21 MUTUAL FUNDS / UTI 0.82 FINANCIAL INSTITUTIONS / BANKS 1.69 INSURANCE COMPANIES 5.94 -20 Growth Rate in Share Price Growth Rate in Share Price Share Holding Indian Promoter Group Mutual Funds / UTI Financial Institution / Banks Insurance Companies Foreign Institution Investors Bodies Corporate Indian Pubilc Trusts Clearing Members Non Resident Indians

- 22. FOREIGN INSTITUTIONAL INVESTORS 30.57 BODIES CORPORATE 1.44 INDIAN PUBLIC 6.69 TRUSTS 0.44 CLEARING MEMBERS 0.08 NON RESIDENT INDIANS 0.12 Category of Shareholding as on March 31, 2013 Category No. of Holders % to Total holders Total Shares Physical 7,381 9.75 3,754,214 NSDL 49,329 65.20 193,895,563 CDSL 18,951 25.05 2,037,723 TOTAL 75,661 100.00 199,687,500 % of Holding Dematerialization OF shares and Liquidity PHYSICAL NSDL CDSL The shares of the Company are traded in compulsory demit segment. As on March 31, 2013, 98.12% of the total share capital is held in dematerialized form with National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). During the year under review, share certificates involving 989,558 shares of ` 2 each were dematerialized by the shareholders, however share certificates

- 23. involving 2 shares of ` 2 each, were rematerialized. During the year under review the net dematerialization represents 98.12% of the total share capital of the Company. Outstanding GDR’S/ADR’S/Warrants Or any Convertible Instruments’ Conversion Date and Likely Impact ON equity Not applicable. Details OF Public FUNDING Obtained IN the Last Three Years The Company has not obtained any public funding in the last three years. CERTIFICATE Auditors’ Certificate ON the Compliance OF CONDITIONs OF Corporate Governance under Clause 49 OF the Listing agreement We have examined the compliance of conditions of Corporate Governance by Hero MotoCorp Ltd. for the year ended March 31, 2013, as stipulated in Clause 49 of the Listing Agreement of the said Company with stock exchanges. The compliances of conditions of Corporate Governance is the responsibility of the management. Our examination was limited to procedures and implementation thereof, adopted by the Company for ensuring the compliances of the conditions of Corporate Governance. It is neither an audit nor an expression of opinion on the financial statements of the Company. In our opinion and to the best of our information and according to the explanations given to us, we certify that the Company has complied with the conditions of Corporate Governance as stipulated in the above mentioned Listing Agreement. We further state that such compliance is neither an assurance as to the future viability of the Company nor the efficiency or effectiveness with which the management has conducted the affairs of the Company. Certification by Chief executive Officer and Chief Financial Officer OF The Company We, Pawan Munjal, Managing Director & Chief Executive Officer (CEO) and Ravi Sud, Sr. Vice President & Chief Financial Officer (CFO) of Hero MotoCorp Ltd., to the best of our knowledge and belief certify that: 1. We have reviewed the Balance Sheet and Profit and Loss Account of the Company for the year ended March 31, 2013 and all its schedule and notes on accounts, as well as the Cash Flow Statement. 2. To the best of our knowledge and information: a. these statements do not contain any materially untrue statement or omit to state a material fact or figures or contains statement that might be misleading;

- 24. b. these statements together present a true and fair view of the Company’s affairs and are in compliance with existing accounting standards, applicable laws and regulations. 3. We also certify, that based on our knowledge and the information provided to us, there are no transactions entered into by the Company, which are fraudulent, illegal or violate the Company’s code of conduct. 4. We are responsible for establishing and maintaining internal controls and procedures for the Company, and we have evaluated the effectiveness of the Company’s internal controls and procedures. 5. We have disclosed, based on our most recent evaluation, wherever applicable, to the Company’s auditors and through them to the audit committee of the Company’s Board of Directors: a. Significant changes in internal control during the year; b. Any fraud, which we have become aware of and that involves Management or other employees who have a significant role in the Company’s internal control systems; c. Significant changes in accounting policies during the year. 6. We further declare that all board members and senior management have affirmed compliance with the code of conduct for the year 2013-14. Corporate information Hero MotoCorp Limited (the Company) is a public company domiciled in India and incorporated under the provisions of the Companies Act, 1956 on January 19, 1984. The name of the Company has been changed from Hero Honda Motors Limited to Hero MotoCorp Limited on July 29, 2011. The shares of the Company are listed on two stock exchanges in India i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). The Company is engaged in the manufacturing and selling of motorised two-wheelers, spare parts and related services. The Company is a leading two wheeler manufacturer and has a dominant presence in domestic market. Significant accounting policies i) Accounting convention The financial statements of the Company have been prepared in accordance with the Generally Accepted Accounting Principles in India (Indian GAAP) to comply with the Accounting Standards notified under the Companies (Accounting Standards) Rules, 2006 (as amended) and the relevant provisions of the Companies Act, 1956. The financial statements have been prepared on accrual basis under the historical cost convention. ii) Use of estimates The preparation of the financial statements in conformity with Indian GAAP requires the Management to make estimates and assumptions considered in the reported amounts of

- 25. assets and liabilities (including contingent liabilities) and the reported income and expenses during the year. The Management believes that the estimates used in preparation of the financial statements are prudent and reasonable. Future results could differ due to these estimates and the differences between the actual results and the estimates are recognized in the periods in which the results are known / materialize. iii) operating Cycle Based on the nature of products / activities of the Company and the normal time between acquisition of assets and their realization in cash or cash equivalents, the Company has determined its operating cycle as 12 months for the purpose of classification of its assets and liabilities as current and non-current. iv) Fixed / intangible assets and depreciation / amortization Fixed assets are stated at cost less accumulated depreciation. Cost of acquisition is inclusive of freight, duties, taxes and other incidental expenses. Exchange differences arising on restatement / settlement of long-term foreign currency borrowings relating to acquisition of depreciable fixed assets are adjusted to the cost of the respective assets and depreciated over the remaining useful life of such assets. Depreciation is charged on a pro-rata basis at the straight line method rates prescribed in schedule XIV to the Companies Act, 1956. Assets covered under employee benefit schemes are amortized over a period of five years. Assets costing up to ` 5000 each are fully depreciated in the year of purchase. Intangible assets, comprising of expenditure on model fee etc, incurred are amortized on a straight line method over a period of five years. Licenses for Technical know-how / export licenses have been amortized on a straight line basis up to June 30, 2014 i.e. forty two months (refer note 11). The carrying values of assets / cash generating units at each Balance Sheet date are reviewed for impairment. Leasehold land has been amortized over the period of lease. v) Investments Current investments are stated at lower of cost and fair value computed category wise. Long term investments are stated at cost less provision for permanent diminution, if any. Premium paid on purchase of debt securities is amortized over the period of maturity. vi) Inventories Stores and spares and loose tools are stated at cost or under. Raw materials and components, finished goods and work in progress are valued at cost or net realizable value, whichever is lower. The basis of determining cost for various categories of inventories is as follows:- Stores and spares, loose tools, raw materials and components - Weighted average cost Materials in transit - Actual cost Work in progress and finished goods - Material cost plus appropriate share of labor, manufacturing overheads and excise duty vii) Employee benefits a) Defined contribution plan Provident fund, Superannuation fund and Employee’ State Insurance Corporation (ESIC) are the defined contribution schemes offered by the Company. The contributions to these schemes are

- 26. charged to the profit and loss account of the year in which contribution to such schemes becomes due. b) Defined benefit plan and Long term Employee benefits Gratuity liability and long term employee benefits, are provided on the basis of an actuarial valuation made at the end of each financial year as per projected unit credit method. Actuarial gains or loss arising from such valuation are charged to revenue in the year in which they arise. viii) Foreign currency transactions Exchange differences are dealt with as follows:- Transactions in foreign currency are recorded at the exchange rate prevailing at the time of the transaction. All loss or gain on translation is charged to revenue in the year in which it is incurred. Monetary assets and liabilities denominated in foreign currency are restated at the rate prevailing at the year end and resultant gain or loss is recognized. The exchange differences arising on restatement / settlement of long-term foreign currency monetary items are capitalized as part of the depreciable fixed assets to which the monetary item relates and depreciated over the remaining useful life of such assets or amortized on settlement / over the maturity period of such items in line with Notification No. GSR 378(E) dated May 11, 2011 issued by The Ministry of Corporate Affairs, Government of India. In respect of forward contracts, the forward premium or discount is recognized as income or expense over the life of contract in the profit and loss account and the exchange difference between the exchange rate prevailing at the year end and the date of the inception of the forward exchange contract is recognized as income or expense in the profit and loss account. ix) Sales Sale of goods is recognized at the point of dispatch of finished goods to the customers. Gross sales are inclusive of applicable excise duty and freight but are exclusive of sales tax. Services income is recognized when the services are rendered. - Scrap is accounted for on sale basis. x) Warranty claims The estimated liability for product warranties is recorded when products are sold. These estimates are established using historical information on the nature, frequency and average cost of warranty claims and management estimates regarding possible future incidence based on corrective actions on product failures. The timing of outflows will vary as and when warranty claim will arise - being typically two to three years. The Company accounts for the post-contract support / provision for warranty on the basis of the information available with the Management duly taking into account the current and past technical estimates. xi) Leases Lease arrangements where the risks and rewards incidental to ownership of an asset substantially vest with the lesser are recognized as operating leases. Lease rentals under operating leases are recognized in the Statement of Profit and Loss. xii) Research and development expenses Research and development expenditure of a revenue nature is expensed out under the respective heads of account in the year in which it is incurred. Fixed assets utilized for

- 27. research and development are capitalized and depreciated in accordance with the policies stated for Tangible Fixed Assets and Intangible Assets. xiii) Earnings per share Earnings per share are computed by dividing the profit / (loss) after tax by the weighted average number of equity shares outstanding during the year. xiv) Taxation The provision for taxation is ascertained on the basis of assessable profits computed in accordance with the provisions of the Income-tax Act, 1961. Minimum Alternate Tax (MAT) paid in accordance with the tax laws, which gives future economic benefits in the form of adjustment to future income tax liability, is considered as an asset if there is convincing evidence that the Company will pay normal income tax. Accordingly, MAT is recognized as an asset in the Balance Sheet when it is probable that future economic benefit associated with it will flow to the Company. Deferred tax is recognized, subject to the consideration of prudence, on timing differences, being the difference between taxable incomes and accounting income that originate in one period and are capable of reversal in one or more subsequent periods. xv) provisions and contingent liabilities A provision is recognized when the Company has a present obligation as a result of past events and it is probable that an outflow of resources will be required to settle the obligation in respect of which a reliable estimate can be made. Provis ions are not discounted to their present value and are determined based on the best estimate required to settle the obligation at the Balance Sheet date. These are reviewed at each Balance Sheet date and adjusted to reflect the current best estimates. Contingent liabilities are disclosed in the Notes. xvi) Derivatives Foreign currency derivatives are used to hedge risk associated with foreign currency transactions. All open positions as at the close of the year are valued by marking them to the market and provision is made for losses, if any. Profit & Loss account of Hero Motocorp ------------------- in Rs. Cr. ------------------- Mar '14 Mar '13 Mar '12 Mar '11 Mar '10 12 mths 12 mths 12 mths 12 mths 12 mths Income Sales Turnover 25,275.47 23,768.11 25,252.98 20,787.27 16,856.43 Excise Duty 0.00 0.00 1,666.18 1,420.30 1,016.85 Net Sales 25,275.47 23,768.11 23,586.80 19,366.97 15,839.58 Other Income 446.38 398.38 347.46 238.27 290.69 Stock Adjustments -8.36 0.00 94.03 27.00 -11.54 Total Income 25,713.49 24,166.49 24,028.29 19,632.24 16,118.73 Expenditure

- 28. Raw Materials 18,320.46 17,470.73 17,485.65 14,236.45 10,822.99 Power & Fuel Cost 137.46 129.18 112.66 100.47 81.05 Employee Cost 930.04 820.92 735.52 618.95 560.32 Other Manufacturing Expenses 0.00 0.00 51.62 409.89 454.36 Selling and Admin Expenses 0.00 0.00 1,257.84 1,090.72 885.03 Miscellaneous Expenses 2,339.09 2,025.33 389.52 340.42 280.64 Preoperative Exp Capitalised 0.00 0.00 0.00 0.00 0.00 Total Expenses 21,727.05 20,446.16 20,032.81 16,796.90 13,084.39 Mar '14 Mar '13 Mar '12 Mar '11 Mar '10 12 mths 12 mths 12 mths 12 mths 12 mths Operating Profit 3,540.06 3,321.95 3,648.02 2,597.07 2,743.65 PBDIT 3,986.44 3,720.33 3,995.48 2,835.34 3,034.34 Interest 11.82 11.91 33.43 28.20 11.14 PBDT 3,974.62 3,708.42 3,962.05 2,807.14 3,023.20 Depreciation 1,107.37 1,141.75 1,097.34 402.38 191.47 Other Written Off 0.00 0.00 0.00 0.00 0.00 Profit Before Tax 2,867.25 2,566.67 2,864.71 2,404.76 2,831.73 Extra-ordinary items 0.00 0.00 0.00 0.00 0.00 PBT (Post Extra-ord Items) 2,867.25 2,566.67 2,864.71 2,404.76 2,831.73 Tax 758.17 411.04 486.58 476.86 599.90 Reported Net Profit 2,109.08 2,118.18 2,378.13 1,927.90 2,231.83 Total Value Addition 3,406.59 2,975.43 2,547.16 2,560.45 2,261.40 Preference Dividend 0.00 0.00 0.00 0.00 0.00 Equity Dividend 1,299.13 1,198.13 898.59 2,096.72 2,196.56 Corporate Dividend Tax 220.79 203.62 145.77 340.14 371.00 Per share data (annualised) Shares in issue (lakhs) 1,996.88 1,996.88 1,996.88 1,996.88 1,996.88 Earning Per Share (Rs) 105.62 106.07 119.09 96.55 111.77 Equity Dividend (%) 3,252.70 3,000.00 2,250.00 5,250.00 5,500.00 Book Value (Rs) 280.43 250.70 214.83 148.03 173.52 Hero Motocorp Standalone Balance Sheet ------------------- in Rs. Cr. ------------------- Mar '14 Mar '13 Mar '12 Mar '11 Mar '10 12 mths 12 mths 12 mths 12 mths 12 mths Sources Of Funds Total Share Capital 39.94 39.94 39.94 39.94 39.94 Equity Share Capital 39.94 39.94 39.94 39.94 39.94 Share Application Money 0.00 0.00 0.00 0.00 0.00 Preference Share Capital 0.00 0.00 0.00 0.00 0.00 Reserves 5,559.93 4,966.30 4,249.89 2,916.12 3,425.08

- 29. Revaluation Reserves 0.00 0.00 0.00 0.00 0.00 Networth 5,599.87 5,006.24 4,289.83 2,956.06 3,465.02 Secured Loans 0.00 302.16 994.85 1,458.45 0.00 Unsecured Loans 0.00 0.00 0.00 32.71 66.03 Total Debt 0.00 302.16 994.85 1,491.16 66.03 Total Liabilities 5,599.87 5,308.40 5,284.68 4,447.22 3,531.05 Mar '14 Mar '13 Mar '12 Mar '11 Mar '10 12 mths 12 mths 12 mths 12 mths 12 mths Application Of Funds Gross Block 3,761.52 4,427.29 6,308.26 5,538.46 2,750.98 Less: Accum. Depreciation 1,518.27 1,356.31 2,522.75 1,458.18 1,092.20 Net Block 2,243.25 3,070.98 3,785.51 4,080.28 1,658.78 Hero Motocorp Capital Structure Period Instrument --- CAPITAL (Rs. cr) --- - P A I D U P - From To Authorised Issued Shares (nos) Face Value Capital 2012 2013 Equity Share 50 39.94 199687500 2 39.94 2011 2012 Equity Share 50 39.94 199687500 2 39.94 2010 2011 Equity Share 50 39.94 199687500 2 39.94 2009 2010 Equity Share 50 39.94 199687500 2 39.94 2008 2009 Equity Share 50 39.94 199687500 2 39.94 2007 2008 Equity Share 50 39.94 199687500 2 39.94 2006 2007 Equity Share 50 39.94 199687500 2 39.94 2005 2006 Equity Share 50 39.94 199687500 2 39.94 2004 2005 Equity Share 50 39.94 199687500 2 39.94 2003 2004 Equity Share 50 39.94 199687500 2 39.94 2002 2003 Equity Share 50 39.94 199687500 2 39.94 2001 2002 Equity Share 50 39.94 199687500 2 39.94 2000 2001 Equity Share 50 39.94 199687500 2 39.94 1998 2000 Equity Share 50 39.94 39937500 10 39.94 1994 1998 Equity Share 25 19.97 19968750 10 19.97 1992 1994 Equity Share 22 15.98 15975000 10 15.98 1991 1992 Equity Share 20 15.98 15975000 10 15.98 1990 1991 Equity Share 20 15.98 15975000 10 15.98

- 30. 1989 1990 Equity Share 20 15.97 15974150 10 15.97 1987 1988 Equity Share 20 15.98 15975000 10 15.98 1986 1987 Equity Share 20 15.6 15600000 10 15.6 1984 1985 Equity Share 20 12 12000000 10 12 Hero Motocorp Previous Years » Key Financial Ratios Mar '14 Mar '13 Mar '12 Mar '11 Mar '10 Investment Valuation Ratios Face Value 2.00 2.00 2.00 2.00 2.00 Dividend Per Share 65.05 60.00 45.00 105.00 110.00 Operating Profit Per Share (Rs) 177.28 166.36 182.69 130.06 137.40 Net Operating Profit Per Share (Rs) 1,265.75 1,190.27 1,181.19 969.86 793.22 Free Reserves Per Share (Rs) -- -- 212.83 146.03 171.52 Bonus in Equity Capital 59.98 59.98 59.98 59.98 59.98 Profitability Ratios Operating Profit Margin(%) 14.00 13.97 15.46 13.40 17.32 Profit Before Interest And Tax Margin(%) 9.45 9.02 10.77 11.26 16.01 Gross Profit Margin(%) 9.62 9.17 10.81 11.33 16.11 Cash Profit Margin(%) 12.50 13.64 13.56 11.36 14.00 Adjusted Cash Margin(%) 12.50 13.64 13.56 11.36 14.00 Net Profit Margin(%) 8.19 8.76 10.04 9.89 14.00 Adjusted Net Profit Margin(%) 8.19 8.76 10.04 9.89 14.00 Return On Capital Employed(%) 51.41 48.57 49.83 52.13 75.07 Return On Net Worth(%) 37.66 42.31 55.43 65.21 64.41 Adjusted Return on Net Worth(%) 37.66 43.05 49.27 61.34 58.87 Return on Assets Excluding Revaluations 280.43 250.70 214.83 148.03 173.52 Return on Assets Including Revaluations 280.43 250.70 214.83 148.03 173.52 Return on Long Term Funds(%) 51.41 48.57 49.83 52.13 75.07 Liquidity And Solvency Ratios Current Ratio 0.65 0.67 0.42 0.24 0.58 Quick Ratio 0.47 0.52 0.28 0.15 0.49 Debt Equity Ratio -- 0.06 0.23 0.50 0.02 Long Term Debt Equity Ratio -- 0.06 0.23 0.50 0.02

- 31. Debt Coverage Ratios Interest Cover 243.58 216.51 123.65 146.73 1,262.36 Total Debt to Owners Fund -- 0.06 0.23 0.50 0.02 Financial Charges Coverage Ratio 337.26 312.37 111.61 96.48 255.15 Financial Charges Coverage Ratio Post Tax 273.12 274.71 104.96 83.63 218.53 Management Efficiency Ratios Inventory Turnover Ratio 37.75 37.33 40.84 43.88 42.80 Debtors Turnover Ratio 31.88 50.72 117.09 162.08 122.63 Investments Turnover Ratio 37.75 37.33 40.84 43.88 42.80 Fixed Assets Turnover Ratio 7.40 7.32 4.05 3.70 6.29 Total Assets Turnover Ratio 4.81 5.76 4.91 4.68 4.80 Asset Turnover Ratio 4.63 4.49 4.85 4.85 4.28 Average Raw Material Holding -- -- 8.81 9.53 10.78 Average Finished Goods Held -- -- 2.84 1.52 1.22 Number of Days In Working Capital -25.44 -21.24 -40.58 -90.84 -47.76 Profit & Loss Account Ratios Material Cost Composition 72.48 73.50 74.13 73.50 68.32 Imported Composition of Raw Materials Consumed 55.76 5.79 3.92 4.22 1.66 Selling Distribution Cost Composition -- -- 4.08 4.47 4.80 Expenses as Composition of Total Sales 1.85 2.62 2.54 2.29 2.13 Cash Flow Indicator Ratios Dividend Payout Ratio Net Profit 61.59 66.17 43.91 126.39 115.04 Dividend Payout Ratio Cash Profit 40.39 42.99 30.04 104.57 105.95 Earning Retention Ratio 38.41 34.98 50.59 -34.38 -25.86 Cash Earning Retention Ratio 59.61 57.49 67.48 -9.98 -15.06 AdjustedCash Flow Times -- 0.09 0.31 0.67 0.03 Mar '14 Mar '13 Mar '12 Mar '11 Mar '10 Earnings Per Share 105.62 106.07 119.09 96.55 111.77 Book Value 280.43 250.70 214.83 148.03 173.52

- 32. 140 120 100 80 60 40 20 0 Earning Per Share 2014 2013 2012 2011 2010 Cash Flow Indicator Ratios 140 120 100 80 60 40 20 0 -20 -40 Profit & Loss Account Ratios Earning Per Share -60 2014 2013 2012 2011 2010 Dividend Payout Ratio Net Profit Earning Rerention Ratio

- 33. 80 70 60 50 40 30 20 10 0 2014 2013 2012 2011 2010 Material Cost Composition Imported Composition of Raw Materials Consumed Selling Distribution Cost Composition Inventory Turnover Ratio & Debtors Turnover Ratio 180 160 140 120 100 80 60 40 20 0 2014 2013 2012 2011 2010 Inventory Turnover Ratio Debtors Turnover Ratio Fixed Assets Turnover Ratio, Total Assets Turnover Ratio & Asset Turnover Ratio 8 6 4 0 Asset Turnover Ratio Fixed Assets Turnover… 2 Fixed Assets Turnover Ratio Total Assets Turnover Ratio Asset Turnover Ratio

- 34. Debt Coverage Ratios 2000 1800 1600 1400 1200 1000 800 600 400 200 0 2014 2013 2012 2011 2010 Liquidity and Solvency Ratios Financial Charges Coverage Ratio After TAX Financial Charges Coverage Ratio Total Debt to Owners Fund Interest Cover 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2014 2013 2012 2011 2010 Long Term Debt Equity Ratio Debt Equity Ratio Quick Ratio Current Ratio

- 35. Return on Long Term Funds 80 70 60 50 40 30 20 10 0 Return on Long-term Funds 2014 2013 2012 2011 2010 Return on Assets Return on Long-term Funds 300 250 200 150 100 50 0 Return on Assets 2014 2013 2012 2011 2010 Return on Assets

- 36. Return on Capital 80 70 60 50 40 30 20 10 0 Return on Capital 2014 2013 2012 2011 2010 Net Operating Profit per Share Return on Capital 1400 1200 1000 800 600 400 200 0 Net Operating Profit Per Share 2014 2013 2012 2011 2010 Net Operating Profit Per Share

- 37. Dividend per Share 120 100 80 60 40 20 0 Dividend Per Share 2014 2013 2012 2011 2010 Series 1 (A) Shareholding of Promoter and Promoter Group (1) Indian Individuals / Hindu Undivided Family 17 62,404,852 62,404,852 31.25 31.25 - - Bodies Corporate 3 17,307,630 17,307,630 8.67 8.67 - - Sub Total 20 79,712,482 79,712,482 39.92 39.92 - - (2) Foreign Total shareholding of Promoter and Promoter Group (A) 20 79,712,482 79,712,482 39.92 39.92 - - (B) Public Shareholding (1) Institutions Mutual Funds / UTI 191 4,753,066 4,689,596 2.38 2.38 - - Financial Institutions / Banks 48 639,089 620,384 0.32 0.32 - - Insurance Companies 31 9,885,881 9,885,881 4.95 4.95 - - Foreign 602 68,504,616 68,466,416 34.31 34.31 - -

- 38. Institutional Investors Sub Total 872 83,782,652 83,662,277 41.96 41.96 - - (2) Non- Institutions Bodies Corporate 1,199 2,933,493 2,906,652 1.47 1.47 - - Individuals - - - - - - Individual shareholders holding nominal share capital up to Rs. 1 lakh 57,659 11,847,723 8,747,577 5.93 5.93 - - Individual shareholders holding nominal share capital in excess of Rs. 1 lakh 6 1,059,179 803,139 0.53 0.53 - - Any Others (Specify) 1,465 20,351,971 20,351,900 10.19 10.19 - - Non Resident Indians 1,294 229,316 229,245 0.11 0.11 - - Clearing Members 127 143,229 143,229 0.07 0.07 - - Trusts 42 1,050,437 1,050,437 0.53 0.53 - - Foreign Corporate Bodies 2 18,928,989 18,928,989 9.48 9.48 - - Sub Total 60,329 36,192,366 32,809,268 18.12 18.12 - - Total Public shareholding (B) 61,201 119,975,018 116,471,545 60.08 60.08 - - Total (A)+(B) 61,221 199,687,500 196,184,027 100.00 100.00 Motorcycles See also: Category: Hero Motocrop motorcycles It has 17 models of motorcycles across the 100 cc, 125 cc, 150 cc, 225 cc categories.

- 39. Sleek Street Achiever Ambition 133, Ambition 135 CBZ, CBZ Star, CBZ Xtreme, Hero New Xtreme 2014 CD 100, CD 100 SS, Hero Honda Joy, CD Dawn, CD Deluxe, CD Deluxe (Self Start) New HF Dawn,New HF Deluxe, HF DELUXE ECO Glamour, Glamour F.I. Hunk Karizma, Karizma R, Karizma ZMR FI Passion, Passion Plus, Passion Pro, Passion XPro , New Passion Pro TR Splendor, Splendor+, Splendor+ (Limited Edition), SuperSplendor, Splendor NXG, Splendor PRO, Splendor [iSmart] Hero Impulse launched in 2011 after the separation of Hero and Honda. Its India's first off -road and on road Bike. Hero Ignitor launched in 2012 Hero MotoCorp picks up 49.2% stake in US-based Erik Buell racing for $25 million NEW DELHI: Cometh the hour, cometh the man! The Pawan Munjal that the media in the Capital got to meet on Monday morning was a different man - not the usually reticent, suit-attired, guarded personality. This time, the chief of the world's largest two-wheeler manufacturer, by volume was oozing confidence with his shirt sleeves rolled-up, and aggressive body language, which easily conveyed that he was ready to take on the competition. While announcing Hero MotoCorp's first-ever equity purchase in an overseas company - a 49.2% stake for US$25 million in its US-based technology partner Erik Buell Racing (EBR) - Munjal also outlined a slew of aggressive plans that he has already initiated - the imminent foray into Africa with assembly lines, spreading operations in more countries in Latin America, multiple product launches leading up to the festive season, and a big splash in the coming Auto Expo in Delhi in February 2014. The big news of the day was the equity purchase by Hero in EBR. ET on February 27, 2012 was the first to report the likelihood of Hero picking up stake in American bike company.The company on Monday announced that the first tranche of $15 million has already been invested by HMCL, while the second tranche of $10 million will be invested within the next nine months. The investment in EBR is being done through Hero MotoCorp's newly-incorporated wholly-owned American subsidiary - HMCL (NA). Hero MotoCorp will now have representations on the EBR board with two directors and one observer. However, there will be no organizational changes at EBR, and Erik Buell will continue to be its Chairman and CEO. This time, Pawan was candid enough to say that he is definitely looking at both organic as well as inorganic options for growth. In an exclusive interview to ET immediately after making the announcement, he said "Yes, definitely, I am always looking out (for further overseas acquisitions)...I am constantly travelling around the globe, keeping my mind open. If a good opportunity comes our way, I will certainly look at it."

- 40. "In terms of expanding our global footprint, we are going to commence our operations in Africa - with launches in Kenya, Ivory Coast and Burkina Faso - very soon. We will also shortly be launching in Peru and Ecuador in Latin America. This will be in addition to Colombia where we already have our presence," he said. Hero is looking at setting up assembly in Africa and Latin America. "The assembly in Colombia would possibly come up sometime by the middle of next year," Munjal said. On new launches, he said that the first of the new launches - variants and refreshes on existing platforms - will be launched around the festive season this year, although 'the completely new model will come up in calendar year 2014'. "Wait till Auto Expo next year in Delhi, you will see a lot of new stuff from us," said Munjal. "The equity partnership with EBR is reflective of our long-term vision of transforming Hero MotoCorp to a truly global two-wheeler major with footprints spread across continents, offering a wide range of technologically-advanced two-wheelers. As we go on spreading our footprint in new international markets, we will look at having extended centers of our own R&D at multiple locations around the world, developing two-wheelers for our global customers. Our fully-owned new overseas subsidiaries such as the one in the US and in Netherlands will play important roles in our future overseas acquisitions and investments," he added. Hero Honda Motors, Ltd. In this interview, Brijmohan Lall, chairman of motorcycle manufacturer Hero Honda Motors, Ltd., and his son, Pawan Munjal, the company's managing director and CEO, speak about the part innovation has played in the company's rise to the top. Innovation Helps Hero Honda Ride to No. 1 Spot A question for motorcycle fans around the world: Where is largest manufacturer of motorcycles located? Japan? Germany? Italy? The answer is India, where Hero Honda Motors became the largest single-entity manufacturer of two-wheelers in 2001, shipping 1.4 million motorcycles -- seizing a dominant 48-percent share of the domestic market in the process. In 2002 it plans to increase shipments further to 1.8 million. The New Delhi-based company is a joint venture between India's Hero Group and Japan's giant Honda Motor Company. Established in 1984, it came about when Honda chose Hero Cycles as its partner to set up a motorcycle operation in India after the Indian government relaxed foreign investment and import regulations on two-wheel motorized technology up to 100 cc. Hero Cycles was then, and still is, the world's largest maker of bicycles, selling over 5 million cycles annually. Another Hero company, Hero Majestic, had also established a moped manufacturing business. This combination of mass-production know-how and a large distribution network proved crucial to Honda's decision to join Hero, despite being ardently courted by a number of other Indian manufacturers. "Honda saw that we had similar business philosophies," says Brijmohan Lall, chairman and founder of the Hero Group of companies. "We were careful with capital investment, and made efficient use of equipment and manpower. Honda also saw how we had created a strong

- 41. relationship with the entire stakeholder community, whether it was with our employees, our dealers or our customers. So it all clicked." From the beginning, Brijmohan Lall made the bold decision to bet on four-stroke motorcycle technology, when two-stroke scooters were by far the most popular form of transport in India at the time. After talking with potential customers around the country, Hero engineers worked with Honda to come up with a design for an extremely fuel-efficient two-wheeler adapted for the Indian environment. In 1985 Hero launched its first motorcycle, the CD100, which gave 80 km to the liter. "The four-stroke engine is more fuel efficient and cleaner," says Brijmohan Lall. "There was nothing like the CD100 being built in India. Scooters were not getting more than 40 km to the liter. So this was a breakthrough product, and we rode on its success in the early years." Hero has since fine-tuned its process for finding out just what a diversified customer base across the length and breadth of India wants. It does this by regularly conducting vast market surveys that question up to 70,000 people at a time. What comes back are specific customer requirements and preferences. These are then translated by Hero's marketing and R&D teams into basic specifications, which are sent on to Honda's R&D group in Japan. Honda comes up with a prototype design, and Hero takes this back into the market to sound out customers for possible further refinement, until a winning design is eventually arrived at for Hero to build. Reaching Out With Mobile Workshops Given the country's one billion population and large area, it is impractical for Hero to establish sales and maintenance outlets in every town. So it's come up with the fresh idea of mobile service workshops: a complete workshop incorporated into trucks that travel predetermined routes, visiting small towns and villages where existing Hero customers reside. "Customers are informed a workshop will be coming, so that they don't have to travel hundreds of kilometers to an authorized workshop for servicing or repairs," explains Pawan Munjal, who, as managing director and CEO of Hero Honda, has taken over the daily running of the company from his father. These mobile workshops also double as sales outlets and spare-part distributors. The concept has been so successful that some of Hero's largest distributors have adopted the idea and send out their own workshops to supplement Hero's efforts. At the same time Hero has brought innovation into its authorized dealerships. To reduce the amount of manual labor involved in repairs and maintenance, it has introduced pneumatic tools to replace hand tools, while hydraulic ramps now position bikes for easy inspection. It has also installed automatic ventilation systems in repair shops to remove engine exhaust fumes. It doesn't stop there. Customers can wait in air-conditioned waiting rooms where TVs and water coolers have been installed, while in a few key dealerships, they can enjoy a cup of tea and surf the Internet in Hero cyber cafes. What's more, in certain larger dealerships, customers can actually watch ongoing repairs through glass-fronted workshops. "This gives customers more confidence in our service and support," says Pawan Munjal. "Normally, workshops are dirty areas and companies don't want their customers to see them. We've installed glass walls so customers

- 42. can see the cleanliness and the type of work that's going on." Passport to Customer Loyalty Last April Hero launched the Hero Honda Passport, a program designed to increase customer loyalty. Customers who sign up are issued "passports," and they receive points when purchasing parts or referring new customers. "This helps us in getting to know our customers better," says Pawan Munjal. "We have 600,000 members in the program, and we also organize events where they can meet sports stars and film stars. This creates loyalty in our customers." But to create loyal customers, a company must first have loyal employees. "Fortunately, Honda has a good name, Hero has a good name, so we attract very good people," says Brijmohan Lall, who at 79, still continues to put in a full day's work as chairman. "With our long experience we have created a friendly atmosphere. My door is never closed, so anyone can walk in at any time." As a reward for becoming the world's largest motorcycle manufacturer, the Munjals took the managers (along with their wives) who had contributed most to this success on a vacation to Switzerland last year. "We conducted a seminar on top of a Swiss mountain to symbolize our success," says Brijmohan Lall. "We also invited a professor from Harvard University to come and give us a talk on how we must now compete and sustain ourselves at this new level." Hero Honda's IT Strategy With the Indian motorcycle market opening up to overseas competitors and more fierce domestic competition, Hero Honda decided it needed to overhaul its various computer systems and create a single integrated IT system. Rather than continue to use computers merely for data processing, it sought to use IT to integrate business operations such as product planning, materials resource planning, financials and sales and distribution. It was also looking to automate its internal supply chain, reduce overall costs, and create a transparent information system that would help managers make decisions more quickly. To do all this it teamed up with SAP in June 2000 to implement the system, and went live in February 2001. "Now we can look at the same information, when earlier we had three or four different versions, which didn't always match," says Pawan Munjal. "Now we (the managers) can all look at the same costs, for example, because all the information is up there on the screen. Nothing is hidden, everything is transparent. So there are no arguments over figures now, which used to waste time and hold up decision-making." There are improvements on the factory floor too, now that manufacturing has been brought into the new IT system. In the past there was no accurate way of checking the consumption of raw materials and inventory in general. So excess stocks in some areas became inevitability. "Now we know what should be there and what is there," says Pawan Munjal. At the same time, defective parts and materials are no longer accepted, forcing suppliers to upgrade their quality. "The next step is to get dealers and suppliers online, so that orders can be taken directly by the suppliers," says Pawan Munjal. This will eliminate any wastage that is still left in our supply chain."

- 43. In upcoming issues of the SAP 30th Anniversary Leadership Interview series, we learn how experience, innovation and vision are driving other major Asian corporations to be leaders in their fields. Hero goes global; to unveil new brand identity in London New Delhi: Hero Honda Motors Ltd will reveal its new brand identity on 9 August—on the eve of third cricket test match between India and England—in London, according to two persons familiar with the development who requested anonymity.“It is a global launch and a first such step taken by the company to become global,” one of them said. “If you are following the ongoing India-England test series, they have already started giving teasers to what is going to come,” said the second person. The company’s promotions on hoardings at Lord’s stadium in London read: A new Hero will rise. London-based branding firm Wolff Olins has created Hero Honda’s new identity after India’s largest motorcycle maker split from its Japanese partner Honda Motor Co. Ltd in December. It will be renamed HeroMoto Corp. Ltd shortly. The Hero group, which sells the Splendor, Passion and Karizma bikes, has said it will evolve its own brand after the split with Honda and enter markets such as Latin America, Africa and West Asia with a new logo. The company will unveil its new branding strategy by the end of July or early August, Mint reported in March.Hero can use the Honda brand till 2014, according to an agreement between the two erstwhile partners, but the Indian group wants to a new identity soon to maintain pole position. The new identity will not only help Hero group venture overseas but will also allow it to source components from alternative vendors, say analysts. “As long as the name of Honda exists on the product, component sourcing can be done from the approved vendor list. Once the re-branding under Hero name happens, Hero honda will be free to scout for alternative vendors, if there is need,” Chirag Shah, a sector analyst with Mumbai-based brokerage Emkay Research, wrote in an 8 April report on Hero Honda. Questions 1. When Company are Founded? 2. What is the strategy of the Company? 3. Why Investors are like to invest? 4. What is the Vision & Mission of the company?

- 44. 5. How company perform batter then competitors? 6. How many Human Capital? 7. How much products sell by the company? 8. How much Net Profit Generate? 9. How much material use by the company? 10. How much Tax pay by the company? 11. Return on Average Capital Employed? 12. Return on Assets? 13. Debt to Equity Ratios? 14. Return on Equity? (ROE) 15. Net profit to Sales Ratios? 16. How much Research & Development? R&D 17. What is the total Current Liabilities? 18. What are the Current Assets? 19. Average Growth Rate? 20. What is earning per Share (EPS)? 21. What is the Return on Long-term Funds? 22. What is the Cash Flow Indicator Ratios? 23. What is the Inventory Turnover Ratio & Debtors Turnover Ratio? 24. What are the Fixed Assets Turnover Ratio, Total Assets Turnover Ratio & Asset Turnover Ratio? 25. What is the Debt Coverage Ratios? Declaration I solemnly declare that the bellow information is true and correct to the best of my knowledge.