Survey of Realtor Perspectives on the Housing Market Nationally

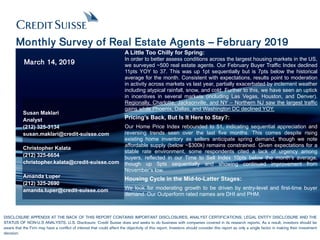

- 1. March 14, 2019 Susan Maklari Analyst (212) 325-3134 susan.maklari@credit-suisse.com Christopher Kalata (212) 325-6654 christopher.kalata@credit-suisse.com Amanda Luper (212) 325-2690 amanda.luper@credit-suisse.com Monthly Survey of Real Estate Agents – February 2019 DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-U.S ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. A Little Too Chilly for Spring: In order to better assess conditions across the largest housing markets in the US, we surveyed ~500 real estate agents. Our February Buyer Traffic Index declined 11pts YOY to 37. This was up 1pt sequentially but is 7pts below the historical average for the month. Consistent with expectations, results point to moderation in activity across markets vs last year, partially exacerbated by inclement weather including atypical rainfall, snow, and cold. Further to this, we have seen an uptick in incentives in several markets (including Las Vegas, Houston, and Denver). Regionally, Charlotte, Jacksonville, and NY – Northern NJ saw the largest traffic gains while Phoenix, Dallas, and Washington DC declined YOY. Pricing’s Back, But Is It Here to Stay?: Our Home Price Index rebounded to 51, indicating sequential appreciation and reversing trends seen over the last five months. This comes despite rising existing home inventory as sellers anticipate spring demand, though we note affordable supply (below ~$300k) remains constrained. Given expectations for a stable rate environment, some respondents cited a lack of urgency among buyers, reflected in our Time to Sell Index 10pts below the month’s average, though up 5pts sequentially and showing continued improvement from November’s low. Housing Cycle in the Mid-to-Latter Stages: We look for moderating growth to be driven by entry-level and first-time buyer demand. Our Outperform rated names are DHI and PHM.

- 2. Executive Summary: Winter Chill Lingering Into Spring February Buyer Traffic Index Down 11pts YOY to 37: This month’s reading rose 1pt sequentially but was 7pts below the long- term historical average for February. Consistent with expectations, results point to broader moderation in activity across markets vs the robust levels seen last year. This was compounded by inclement weather including atypical rain, snow, and cold delaying the start of the spring selling season in some geographies. That said, agents reported demand strength at entry-level price points (below ~$300k) with in-migration and corporate relocations supporting sales in areas of relative affordability (i.e. Charlotte, Raleigh, San Antonio). Overall, our surveyed realtors held two views of prospective buyers: 1) those encouraged by additional supply coming online and hunting for deals ahead of the March rush and 2) those adopting a wait and see approach in hopes of moderating prices and given accommodative rates. Traffic levels at or above agents’ expectations in 7 out of the top 20* markets (vs 10 last year and 3 last month): – The Index was up 10+ points YOY in 3 MSAs (Charlotte, Jacksonville, and New York – Northern NJ); – Was up 10 to down 5 points YOY in 6 (Atlanta, Denver, Austin, Tampa, San Antonio, and Miami); and – Was down 5+ points YOY in the remaining 10 (Nashville, Seattle, Orlando, Los Angeles, Raleigh, Houston, Las Vegas, Phoenix, Dallas, and Washington DC). Home Price Index Down 23pts YOY to 51: For the first time since August, the majority of our agents saw a sequential increase in home prices. This comes despite increased existing home inventory as sellers prepare for spring demand, though we note affordable supply remains constrained. Prices rose year over year in three of our surveyed MSAs (vs one last month). Days on market elongated with our Time to Sell Index at 32, down 26pts year over year (though +5pts sequentially) and 10pts below the long-term historical average for the month. Realtors Provide On-the-Ground Read on Conditions: We survey local agents on a monthly basis in order to better gauge changes in supply and demand. Results are used to calculate a diffusion index, with a reading of 50+ indicating an improvement. (*) Note: Inland Empire was excluded from our top 20 market summary this month due to lack of respondents Please see appendix for a detailed description of our survey and index calculation methodology 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Source: Credit Suisse

- 3. February Top Market Summary Note: Inland Empire excluded from this month’s survey due to lack of respondents; Markets ranked according to YOY change in Buyer Traffic Index Rank Top MSAs Prior Month Rank Buyer Traffic Index Home Price Index Home Listings Index Sell Time Index Builder Incentives Index Agent Highlights 1 Charlotte, NC 12(+11) 50 (+21) 56 (-27) 36 (-36) 31 (-19) 44 (-6) Traffic levels met agents' expectations as rising employment opportunities encourge in-migration. That said, closings are constrained by the lack of inventory at more affordable price points. 2 Jacksonville, FL 10(+8) 57 (+20) 79 (-9) 57 (-18) 43 (-32) 36 (-2) Moderating rates and snowbirds coming down from Northern states drove demand above realtors' expectations. In turn, the persistent inventory shortage has buyers out and looking at any available property. 3 New York-Northern NJ 2(-1) 39 (+11) 42 (-32) 52 (-15) 42 (-20) 55 (-2) Demand is concentrated at the more affordable price points, including first-time and multi-family properties. Given the potential for further home price moderation, buyers seem willing to wait longer before purchasing. 4 Atlanta, GA 5(+1) 52 (+5) 59 (-25) 35 (-15) 41 (-25) 27 (-7) Agents cited an early start to the spring market with buyers motivated by year over year price declines and improving inventory levels. Days on market remain low with multiple offers on quality inventory, though we note 52% of our respondents saw greater than anticipated incentives. 5 Denver, CO 7(+2) 40 (+3) 30 (-49) 10 (-69) 40 (-10) 20 (-26) In-line with broader trends, realtors noted healthy demand at affordable price points vs sluggishness at the higher-end ($500k+). Easing rates and down payment assistance programs are also supporting entry-level traffic. 6 Austin, TX 11(+5) 50 (0) 50 (-40) 20 (-35) 30 (-25) 40 (-5) Demand held steady sequentially and vs 2018 as buyers look to purchase before an increase in prices or rates. Although more inventory is coming online, supply remains tight. 7 Tampa, FL 3(-4) 39 (-3) 72 (-9) 17 (-64) 33 (-36) 39 (-15) Against a healthy local economic backdrop, realtors reported an increased number of both sellers and buyers in the market vs the prior two months. In turn, home prices were up sequentally as inventory increases at the higher-end vs a shortage at the entry-level (<$250k). 8 San Antonio, TX 17(+9) 63 (-4) 75 (-25) 63 (+46) 50 (-17) 25 (-8) Activity held above expectations supported by corporate and military relocations. Despite continued price appreciation, 75% of our respondents saw an uptick in incentives offered. 9 Miami, FL 9(+0) 21 (-5) 13 (-42) 17 (-31) 13 (-23) 27 (-9) Agents reported move-up buyers looking for deals within a softer luxury market while others are opting to stay on the sidelines in anticipation of further price reductions. As such, 75% saw elongated days on market. 10 Nashville, TN 4(-6) 50 (-6) 63 (0) 38 (-25) 38 (-5) 50 (+31) Demand met realtors' expectations for the month with prospective buyers still scheduling tours despite inclement weather, including record rainfall. Respondents saw prices flat year over year and up sequentially. 11 Seattle, WA 8(-3) 44 (-6) 65 (-23) 32 (-45) 33 (-35) 32 (-20) Easing rates and additional supply have kept buyers out and looking despite several snowstorms and colder than usual weather. Prices have risen steadily since autumn, though remain lower year over year. 12 Orlando, FL 6(-6) 22 (-9) 44 (+1) 36 (-8) 17 (-21) 39 (-30) Although some additional supply has come online, the inventory shortage persists. As such, the length of time needed to sell has increased as buyers search for affordable properties (<$300k) in good locations. 13 Los Angeles, CA 15(+2) 21 (-10) 50 (-1) 35 (-24) 7 (-45) 23 (-30) Against a backdrop of elevated prices and lingering macro uncertainty, buyers are adopting a wait and see approach. Agents cited affordability constraints and a mismatch in expectations between buyers and sellers. 14 Raleigh, NC 1(-13) 65 (-18) 50 (-42) 38 (-4) 50 (-25) 31 (-19) Traffic rose above agents' expectations as significant job growth and in-migration (esp. from the Northeast) supplement the seasonal increase. We note buyers encouraged by additional listings and stable prices. 15 Houston, TX 16(+1) 33 (-22) 25 (-25) 33 (-27) 17 (-53) 17 (-33) Agents highlighted uncertainty prevailing in the MSA, with some buyers hunting for bargains as prices moderate. We note 67% reported longer days on market despite heightened incentives. 16 Las Vegas, NV 19(+3) 30 (-24) 70 (-22) 0 (-62) 20 (-47) 10 (-40) Home prices rebounded this month, with our Index at 70 (vs 92 in February 2018). This comes despite all respondents reporting an increase in inventory levels. 17 Phoenix, AZ 14(-3) 24 (-26) 50 (-24) 44 (-32) 32 (-32) 44 (-3) Although sales are down compared to the robust activity seen in 2017 and 2018, realtors are still seeing healthy traffic. That said, some buyers are fatigued by the persistant price appreciation and lack of supply. 18 Dallas, TX 13(-5) 17 (-40) 38 (-20) 11 (-39) 22 (+1) 25 (-4) Commentary centered on buyers taking a wait and see approach, given lingering concerns over the economy's trajectory and the potential for further decelerating prices. We note the majority saw an increase in the number of listings. 19 Washington, DC 18(-1) 22 (-40) 61 (+2) 61 (-7) 17 (-48) 44 (-6) Realtors cited poor weather conditions delaying the start of the spring selling season. Reflecting this, 71% reported less than expected open house traffic.

- 4. Table of Contents Key Housing Markets: Key Housing Markets Continued: 5 Atlanta, Georgia 27 Philadelphia-Southern New Jersey 6 Austin, Texas 28 Phoenix, Arizona 7 Baltimore, Maryland 29 Portland, Oregon 8 Boston, Massachusetts 30 Raleigh, North Carolina 9 Charlotte, North Carolina 31 Sacramento, California 10 Chicago, Illinois 32 San Antonio, Texas 11 Cincinnatti, OH 33 San Diego, California 12 Columbus, OH 34 San Francisco, California 13 Dallas, Texas 35 Sarasota, Florida 14 Denver, Colorado 36 Seattle, Washington 15 Detroit, Michigan 37 Tampa, Florida 16 Fort Myers, Florida 38 Tucson, Arizona 17 Houston, Texas 39 Virginia Beach, VA 18 Jacksonville, Florida 40 Washington, D.C. 19 Kansas City, Missouri 20 Las Vegas, Nevada 41 Appendix: 21 Los Angeles, California 42 Historical Trends by Market 22 Miami, Florida 47 Agent Recommendations 23 Minneapolis, Minnesota 49 Survey Methodology 24 Nashville, Tennessee 50 Disclosures 25 New York-Northern New Jersey 26 Orlando, Florida

- 5. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 5 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” “Buyers competing for a limited supply of good inventory.” “Interest rates lower than expected, spring market starting early.” “Multiple offers with buyers scrambling for quality inventory.” “Listing prices are not as over inflated as they were in 2018.” “Inclement weather with lots of rain and wind.” “Inventory is improving slightly and demand is still strong.” “Buyers willing to wait for the right property.” “Days on market are still low.” 3rd largest market in the country 2018 single family permits: 26,097 The Buyer Traffic Index increased to 52 from 46 in 2018. The Home Price Index declined to 59 from 85 last year: Moderating prices and rates drove traffic above expectations with some agents’ citing multiple offers on listings. Atlanta, GA 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Atlanta as a % of Total Closings 1 D.R. Horton 3,450 17.8% 7.3% 2 Century Communities 1,316 6.8% 36.2% 3 PulteGroup 1,039 5.3% 4.9% 4 Lennar Corp. 909 4.7% 2.1% 5 Smith Douglas Communities 692 3.6% 6 Taylor Morrison 628 3.2% 7.8% 7 Rocklyn Homes 529 2.7% 8 Ashton Woods Homes 479 2.5% 9 Green Brick Partners 441 2.3% 44.5% Top 9 Totals 9,483 48.9% 31% 52% 38% 52% 13% 56% 26% 44% 42% 50% 13% 23% 19% 6% 37% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 6. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 6 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Austin, TX “Mortgage rates are still reasonable.” “Buyers looking to purchase before rates and prices rise.” “Strong open house traffic due to limited inventory.” “Prices remain elevated, outpacing wage growth.” 5th largest market in the country 2018 single family permits: 16,904 The Buyer Traffic Index was unchanged at 50 YOY: Demand held steady MoM and YOY as buyers look to purchase before an increase in prices or rates. The Home Price Index decreased to 50 from 90 in February 2018.0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Austin as a % of Total Closings 1 D.R. Horton 2,374 15.8% 5.0% 2 Lennar Corp. 1,523 10.2% 3.5% 3 KB Home 1,017 6.8% 9.3% 4 PulteGroup 878 5.8% 4.2% 5 Milestone Community Builders 797 5.3% 6 Meritage Homes 585 3.9% 7.6% 7 Pacesetter Homes 505 3.4% 8 Gehan Homes 490 3.3% 9 Taylor Morrison 466 3.1% 5.8% Top 9 Totals 8,635 57.6% 40% 60% 60% 20% 20%20% 40% 20% 80% 20% 40% 0% 20% 0% 60% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 7. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 7 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Baltimore, MD “More inventory and lower interest rates.” “Traffic has been good.” “Rates and buyer confidence.” “Poor weather conditions.” “Slight drop in mortgage rates, early spring shoppers.” 32nd largest market in the country 2018 single family permits: 5,347 The Buyer Traffic Index declined to 50 from 83 in 2018: Although down YOY, demand met realtors’ expectations as more inventory provides buyers with additional options. The Home Price Index lowered to 60 from 83 in Feb ’18. 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Note: Baltimore was excluded from March survey results due to lack of respondents Rank Top Builders Closings 2017 Market Share Baltimore as a % of Total Closings 1 NVR 1,419 36.5% 8.9% 2 Lennar Corp. 682 17.5% 1.6% 3 Beazer Homes USA 437 11.3% 4 Hovnanian Enterprises 158 4.1% 3.0% 5 Richmond American Homes 150 3.9% 6 Toll Brothers 123 3.2% 1.7% 7 PulteGroup 102 2.6% 0.5% 8 Brookfield Homes 4 2.4% 9 Bob Ward Companies 75 1.9% Top 9 Totals 3,150 83.4% 40% 60% 40% 0% 20% 40% 0% 40% 100% 40% 20% 40% 20% 0% 40% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 8. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 8 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Boston, MA “Low inventory.” “Lack of available listings.” The Buyer Traffic Index fell to 25 from 40 last year. The Home Price Index decreased to 50 from 90 in February 2018: Prices held flat sequentially for the second consecutive month. 2018 single family permits: 4,846 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month 20% 50% 33% 17% 0% 60% 33% 67% 50% 67% 20% 17% 0% 33% 33% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 9. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 9 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Charlotte, NC “Not enough homes in the lower or more affordable price ranges; buyers waiting to find the right property.” “Mortgages are easier to obtain, jobs are plentiful and wages are rising.” “Low inventory levels.” “Expecting traffic to further increase in March.” 8th largest market in the country 2018 single family permits: 15,282 The Buyer Traffic Index rose to 50 from 29 last year: Buyers are returning to the market despite the lack of inventory at the affordable price points. The Home Price Index fell to 56 from 83 in Feb ‘18. 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Charlotte as a % of Total Closings 1 Lennar Corp. 1,842 17.3% 4.2% 2 D.R. Horton 1,243 11.7% 2.6% 3 True Homes 871 8.2% 4 PulteGroup 773 7.3% 3.7% 5 NVR 694 6.5% 4.3% 6 AV Homes 524 4.9% 21.0% 7 M/I Homes 478 4.5% 9.4% 8 Eastwood Homes 457 4.3% 9 LGI Homes 357 3.4% 6.1% Top 9 Totals 7,239 68.1% 25% 43% 50% 13% 0% 63% 43% 38% 88% 67% 13% 14% 13% 0% 33% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 10. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 10 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Chicago, IL “Buyer traffic has been a bit slower but inventory has not increased as much as usual post-Super Bowl.” “Brutal cold weather and low inventory.” “Homes in $500-$750k range seeing slower traffic with buyers more cautious and searching for deals.” “Weather has not helped the market.” “Property tax uncertainty.” The Buyer Traffic Index declined to 18 from 29 in 2018: Severe cold weather and the persistent inventory shortage kept traffic below agents’ expectations this month. The Home Price Index fell to 45 from 67 last February. 21st largest market in the country 2018 single family permits: 8,476 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Chicago as a % of Total Closings 1 Lennar Corp. 742 11.5% 1.7% 2 D.R. Horton 600 9.3% 1.3% 3 PulteGroup 452 7.0% 2.1% 4 M/I Homes 420 6.5% 8.3% 5 Olthof Homes 412 6.4% 6 Hovnanian Enterprises 237 3.7% 4.4% 7 Providence Real Estate Development 200 3.1% 8 Taylor Morrison 123 1.9% 1.5% 8 NVR 123 1.9% 0.8% 10 Lexington Homes 107 1.7% Top 10 Totals 3,416 53.0% 21% 58% 58% 32% 0% 47% 32% 26% 63% 53% 32% 11% 16% 5% 47% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 11. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 11 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Cincinnati, OH “Fewer homes on the market.” “Limited number of listings.” The Buyer Traffic Index decreased to 0 from 40 in February 2018. The Home Price Index decreased to 50 from 90 last year: Prices were flat sequentially as all agents reported fewer than anticipated listings. 43rd largest market in the country 2018 single family permits: 4,273 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Cincinnati as a % of Total Closings 1 The Fischer Group 723 24.3% 2 NVR 590 19.8% 3.7% 3 The Drees Co. 497 16.7% 4 M/I Homes 335 11.3% 6.6% 5 Maronda Homes 84 2.8% 6 Arlinghaus Builders 82 2.8% 7 Hills Communities 78 2.6% 8 Cristo Homes 65 2.2% 9 Ashford Homes 62 2.1% 10 Meridian Mark 52 1.7% Top 10 Totals 2,568 86.3% 0% 0% 0% 33% 0% 100% 0% 100% 67% 33% 0% 100% 0% 0% 67% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected Note: October 2017 results were excluded due to lack of respondents

- 12. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 12 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Columbus, OH “Continued low inventory and multiple offers on homes below $400k.” “Slight pick-up in traffic, though demand mitigated by the extreme cold weather.” “Some buyers waiting for the sellers market to end.” “Lack of available inventory has kept traffic below expectations.” “Interest rate reductions and pent-up demand.” The Buyer Traffic Index was 42 this month: Agents continue to see pent-up demand and multiple offers at the affordable price points (<$400k). The Home Price Index came in at 67 in February. 39th largest market in the country 2018 single family permits: 4,237 Note: This market had been excluded from our survey from Nov 17 – April 18 Rank Top Builders Closings 2017 Market Share Columbus as a % of Total Closings 1 PulteGroup 685 21.6% 3.3% 2 M/I Homes 474 15.0% 9.3% 3 The Fischer Group 303 9.6% 4 Westport Homes 271 8.6% 5 Epcon Communities Franchising 229 7.2% 6 Rockford Homes 217 6.8% 7 NVR 214 6.8% 1.3% 8 Maronda Homes 142 4.5% 9 Village Communities 114 3.6% 10 Homewood Homes 98 3.1% Top 10 Totals 2,747 86.8% 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month 42% 17% 50% 27% 27% 50% 83% 33% 64% 55% 8% 0% 17% 9% 18% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 13. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 13 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Dallas, TX The Buyer Traffic Index declined to 17 from 57 last year: Commentary centered on buyers taking a wait and see approach, hoping for additional price reductions. The Home Price Index lowered to 38 from 57 in the prior year. Largest market in the country 2018 single family permits: 36,196 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Dallas as a % of Total Closings 1 D.R. Horton 4,877 15.7% 10.3% 2 Lennar Corp. 2,318 7.5% 5.3% 3 Highland Homes 1,646 5.3% 4 PulteGroup 1,302 4.2% 6.2% 5 Bloomfield Homes 1,260 4.0% 6 First Texas Homes 1128 3.6% 7 HistoryMaker Homes 915 2.9% 8 LGI Homes 835 2.7% 14.3% 9 Megatel Homes 794 2.6% Top 9 Totals 15,075 48.5% “Buyers are in no hurry as they await a shift in the market. Sellers still looking for top dollar and multiple offers. Mismatch in expectations.” “Lower interest rates and higher inventory.” “Most are on the sidelines waiting for a buyers market.” “Concerns over the economy’s trajectory.” “Increased number of sellers.” 0% 78% 67% 50% 25% 75% 22% 22% 50% 38% 25% 0% 11% 0% 38% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 14. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 14 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Denver, CO “Low end market is okay, but above $500k is slow.” “Traffic is picking up.” “Seeing more flexible guidelines form lenders.” “Down payment assistance programs and more affordable interest rates.” The Buyer Traffic Index rose to 40 from 38 last year: In-line with broader trends, agents noted healthy demand at the entry- level vs sluggishness at the higher-end ($500k+). The Home Price Index declined to 30 from 79 in February 2018. 14th largest market in the country 2018 single family permits: 11,801 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Denver as a % of Total Closings 1 Lennar Corp. 1,285 14.6% 2.9% 2 M.D.C. Holdings 1,181 13.4% 21.3% 3 Century Communities 699 8.0% 19.2% 4 KB Home 617 7.0% 5.7% 5 Oakwood Homes 578 6.6% 6 Meritage Homes 443 5.0% 5.7% 7 D.R. Horton 437 5.0% 0.9% 8 Shea Homes 333 3.8% 9 Taylor Morrison 248 2.8% 3.1% Top 9 Totals 5,821 66.2% 0% 80% 40% 60% 0% 60% 20% 40% 40% 60% 40% 0% 20% 0% 40% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 15. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 15 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Detroit, MI “Rates are leveling out and prices have actually come down over the past 4-5 months, which has helped buyer traffic.” “Severe winter weather keeping buyers inside and sellers not interested in showing their homes.” “Quality of buyer traffic has improved even though the gross traffic numbers aren’t necessarily higher.” “Very cold weather has put some property searches on hold.” The Buyer Traffic Index increased to 25 from 17 last year: Although traffic remains below expectations, agents cited more serious buyers in the market. The Home Price Index declined to 33 from 67 in February 2018. 41st largest market in the country 2018 single family permits: 6,169 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Detroit as a % of Total Closings 1 PulteGroup 628 20.0% 3.0% 2 Lombardo Homes 312 9.9% 3 Pinnacle Homes 217 6.9% 4 MJC Cos. 195 6.2% 5 Infinity Homes 166 5.3% 6 Toll Brothers 153 4.9% 2.1% 7 Robertson Brothers Corp. 152 4.8% 8 Clearview Homes 99 3.2% 9 Hunter Pasteur Homes 56 1.8% 10 Allen Edwin Homes 46 1.5% Top 10 Totals 2,024 64.5% 0% 17% 83% 33% 0% 67% 33% 17% 67% 50% 33% 50% 0% 0% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 16. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 16 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Fort Myers, FL “February traffic relatively consistent with January.” “High prices, low inventory, algae in the news.” “Decent amount of lookers but few offers.” “Green and red tide algae has led to consumer wariness of the Gulf Coast environment.” The Buyer Traffic Index decreased to 19 from 67 in February 2018: Demand stayed below agents’ expectations as 75% reported elongated days on market. The Home Price Index lowered to 19 from 67 in the prior year. 35th largest market in the country 2018 single family permits: 5,817 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Ft. Myers as a % of Total Closings 1 Lennar Corp. 994 27.8% 2.3% 2 D.R. Horton 796 22.3% 1.7% 3 PulteGroup 424 11.9% 2.0% 4 LGI Homes 232 6.5% 4.0% 5 Neal Communities of Southwest Florida 223 6.2% 6 Wade Jurney Homes 192 5.4% 7 GL Homes 132 3.7% 8 Adams Homes 124 3.5% 9 Stock Development 71 2.0% 10 Taylor Morrison 66 1.8% 0.8% Top 10 Totals 3,254 91.1% 0% 50% 75% 50% 0% 38% 38% 25% 38% 50% 63% 13% 0% 13% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 17. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 17 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Houston, TX “Improving crude oil prices.” “Buyers looking for a good deal.” “Poor housing sentiment beginning to wear off.” “Market seems to be in limbo.” “Still uncertainty in the market place.” The Buyer Traffic Index lowered to 33 from 55 in February 2018. The Home Price Index decreased to 25 from 50 in the prior year: Agents highlighted uncertainty prevailing in the market, with some buyers bargain hunting as prices moderate. 2nd largest market in the country 2018 single family permits: 40,083 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Houston as a % of Total Closings 1 D.R. Horton 2,582 10.2% 5.5% 2 Lennar Corp. 2,221 8.8% 5.1% 3 Perry Homes 1,459 5.8% 4 Hovnanian Enterprises 1,204 4.8% 22.6% 5 Long Lake Limited 1,096 4.3% 6 Taylor Morrison 1079 4.3% 13.4% 7 KB Home 1073 4.2% 9.8% 8 PulteGroup 938 3.7% 4.5% 9 Meritage Homes 901 3.6% 11.7% 9 LGI Homes 901 3.6% 15.4% Top 10 Totals 13,454 53.3% 0% 33% 67% 67% 0% 50% 67% 33% 33% 67% 50% 0% 0% 0% 33% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 18. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 18 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Jacksonville, FL “Seasonal purchasers as the temperature begins to rise.” “Low inventory has buyers ready to pounce when a new listing is available.” “Mortgage rates and down payment assistance programs have spiked the activity.” “Colder weather up North.” “Lack of available supply.” The Buyer Traffic Index rose to 57 from 38 last year. The Home Price Index decreased to 79 from 88 in the prior year: The majority saw home prices rise sequentially driven by the lack of available inventory. 20th largest market in the country 2018 single family permits: 10,756 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Jacksonville as a % of Total Closings 1 D.R. Horton 1,805 24.4% 3.8% 2 Lennar Corp. 940 12.6% 2.1% 3 Dream Finders Homes 806 10.9% 4 Mattamy Homes 492 6.6% 5 KB Home 468 6.3% 4.3% 6 PulteGroup 366 4.9% 1.7% 7 David Weekley Homes 251 3.4% 8 M.D.C. Holdings 248 3.3% 4.5% 9 ICI Homes 201 2.7% Top 9 Totals 5,577 75.1% 71% 29% 29% 43% 14%14% 29% 57% 43% 43% 14% 43% 14% 14% 43% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 19. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 19 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Kansas City, MO “Buyers trying to take advantage while rates are still low.” “Seeing younger buyers actively looking to purchase.” “Poor weather during the month.” “Inventory levels remain low.” “Homes selling quickly with multiple offers.” “Some buyers fatigue.” The Buyer Traffic Index fell to 31 from 70 in the prior year: Agents cited activity at the first-time and entry-level price points. The Home Price Index lowered to 50 from 80 in Feb ’18. 33rd largest market in the country 2018 single family permits: 5,608 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Kansas City as a % of Total Closings 1 Summit Custom Homes 273 7.1% 2 Prieb Homes 270 7.0% 3 James Engle Custom Homes 116 3.0% 4 Johnnie Adams Homes 103 2.7% 5 Don Julian Builders 100 2.6% 6 Rodrock Homes 96 2.5% 7 Robertson Construction 88 2.3% 8 SAB Construction 78 2.0% 9 Hearthside Homes of Kansas City 63 1.6% 10 Integrity Homebuilders 62 1.6% Top 10 Totals 1,249 32.4% 25% 25% 50% 43% 13% 50% 13% 38% 57% 38% 25% 63% 13% 0% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 20. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 20 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Las Vegas, NV “Buyers lack urgency as more properties come on the market.” “Better rates and sustainable inventory levels.” “Many purchasers are using companies like Open Door and other online sites.” The Buyer Traffic Index declined to 30 from 54 last year: The majority noted lower than anticipated open house traffic with buyers adopting a “wait and see” approach as more inventory comes online. The Home Price Index fell to 70 from 92 in Feb ’18. 15th largest market in the country 2018 single family permits: 9,589 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Las Vegas as a % of Total Closings 1 Lennar Corp. 1,598 18.3% 3.6% 2 D.R. Horton 1,221 13.9% 2.6% 3 KB Home 1,013 11.6% 9.3% 4 M.D.C. Holdings 870 9.9% 15.7% 5 American West Homebuilding Group 630 7.2% 6 PulteGroup 602 6.9% 2.9% 7 Century Communities 519 5.9% 14.3% 8 TRI Pointe Group 479 5.5% 10.2% 9 Woodside Homes 384 4.4% Top 9 Totals 7,316 83.6% 40% 100% 60% 80% 0% 60% 0% 40% 20% 20% 0% 0% 0% 0% 80% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 21. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 21 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Los Angeles, CA “Buyers waiting to see if rates move lower and how the new tax rules impact the bottom line.” “Clients taking a wait and see approach.” “Dip in interest rates and a concurrent increase in inventory.” “High prices constraining affordability.” “Still demand for housing but sellers have yet to fully comprehend they are no longer in the driver’s seat.” The Buyer Traffic Index fell to 21 from 31 in Feb ’18: Demand remains muted against a backdrop of elevated prices and tax uncertainty. The Home Price Index declined to 50 from 77 last year. 17th largest market in the country 2018 single family permits: 10,029 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Los Angeles as a % of Total Closings 1 The Irvine Co. 855 9.9% 2 Lennar Corp. 797 9.2% 1.8% 3 KB Home 672 7.7% 6.2% 4 Toll Brothers 459 5.3% 6.2% 5 Shea Homes 440 5.1% 6 TRI Pointe Group 438 5.0% 9.3% 7 California Pacific Homes 371 4.3% 8 William Lyon Homes 354 4.1% 10.9% 9 Brookfield Homes 310 3.6% Top 9 Totals 4,696 54.2% 21% 54% 86% 55% 10% 57% 23% 14% 45% 40% 21% 23% 0% 0% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 22. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 22 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Miami, FL “Move-up buyers are bargain hunting in a softer luxury market.” “Relocation to the area.” “Buyers waiting for luxury prices to fall further.” “Buyers waiting for an expected price reduction.” “Low consumer confidence.” The Buyer Traffic Index declined to 21 from 26 last Feb. The Home Price Index lowered to 13 from 54 last year: Buyers are opting to stay on the sidelines in anticipation of further price reductions. 11th largest market in the country 2018 single family permits: 7,044 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Miami - Ft. Lauderdale as a % of Total Closings 1 Lennar Corp. 2,651 27.9% 6.0% 2 The Related Group 1,350 14.2% 3 D.R. Horton 753 7.9% 1.6% 4 GL Homes 518 5.5% 5 Eastview Development 390 4.1% 6 Key International 380 4.0% 7 Century Homebuilders 343 3.6% 8 Hovnanian Enterprises 224 2.4% 4.2% 9 Plaza Equity Partners 207 2.2% Top 9 Totals 6,816 71.8% 0% 67% 75% 55% 17% 25% 33% 25% 36% 33% 75% 0% 0% 9% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 23. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 23 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Minneapolis, MN “Bad weather and not enough quality listings coming on.” “Extreme cold weather and record monthly snow.” “Buyers looking to get a jump on the selling season and avoid multiple offer situations.” “Shortage of properties and lower interest rates.” “Crippling cold alternating with deep snows and ice.” “Weather and higher prices.” The Buyer Traffic Index lowered to 27 from 64 in the prior year: Severe cold weather and record snowfall likely discouraged activity this month. The Home Price Index lowered to 58 from 88 in Feb ‘18. 22nd largest market in the country 2018 single family permits: 8,873 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 120 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Minneapolis as a % of Total Closings 1 Lennar Corp. 1,197 21.6% 2.7% 2 PulteGroup 462 8.3% 2.2% 3 D.R. Horton 427 7.7% 0.9% 4 M/I Homes 251 4.5% 4.9% 5 Mattamy Homes 210 3.8% 6 Capstone Homes 207 3.7% 7 Robert Thomas Homes 191 3.4% 8 R Home 144 2.6% 9 Hanson Builders 141 2.5% Top 9 Totals 3,230 58.1% 38% 25% 15% 36% 20% 38% 42% 69% 64% 30% 23% 33% 15% 0% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 24. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 24 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Nashville, TN “Record rain fall in the area.” “Weather has been an issue, however buyers are still scheduling tours and signing offers.” The Buyer Traffic Index decreased to 50 from 56 last year: Demand met expectations despite inclement weather and rising prices. The Home Price Index was unchanged at 63 YOY. 13th largest market in the country 2018 single family permits: 12,343 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top 10 Builders Closings 2017 Market Share Nashville as a % of Total Closings 1 Ole South Properties 811 9.2% 2 NVR 658 7.4% 4.1% 3 Goodall Homes 504 5.7% 4 Regent Homes 354 4.0% 5 Beazer Homes 290 3.3% 5.2% 6 PulteGroup 271 3.1% 1.3% 7 Lennar Corp. 212 2.4% 0.5% 8 Signature Homes 203 2.3% 9 The Jones Company of Tennessee 199 2.3% 10 The Drees Co. 189 2.1% Top 10 Totals 3,691 41.8% 25% 50% 50% 25% 50% 75% 25% 25% 50% 0%0% 25% 25% 25% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 25. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 25 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” New York – Northern NJ “Buyers are out in force, but seem reluctant to purchase as prices creep higher.” “Multi-family properties are red hot.” “Majority of home buyers are in first-time price ranges.” “Some concern about taxes and the possibility of declining home prices in the future.” “Buyers willing to wait longer to find a well-priced property.” The Buyer Traffic Index rose to 39 from 28 in the prior year: Agents cited heightened demand at the more affordable price points (including multi-family and first-time properties). The Home Price Index fell to 42 from 74 in Feb 2018. 10th largest market in the country 2018 single family permits: 10,633 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share NY - Northern NJ - Long Island as a % of Total Closings 1 Toll Brothers 744 7.2% 10.1% 2 ONEX 463 4.5% 3 Hovnanian Enterprises 384 3.7% 7.2% 4 PulteGroup 343 3.3% 1.6% 5 Lennar Corp. 237 2.3% 0.5% 6 Magnum Real Estate Group 179 1.7% 7 Greenland USA 176 1.7% 8 NVR 173 1.7% 1.1% 9 Flushing Commons Property Owner, LLC 140 1.4% 10 Elad Group and Silverstein Properties 137 1.3% Top 10 Totals 2,976 28.8% 18% 33% 39% 18% 19% 48% 30% 36% 54% 56% 33% 36% 24% 29% 25% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 26. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 26 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Orlando, FL “Cold weather up North has brought buyers to Florida.” “More inventory on the market. Buyers looking for homes under $300k in good locations.” “Prices are rising.” “Still a shortage of inventory.” The Buyer Traffic Index declined to 22 from 31 in Feb 2018: Activity is concentrated at the entry-level price points below ~$300k. The Home Price Index was unchanged at 44 YOY. 6th largest market in the country 2018 single family permits: 16,238 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Orlando as a % of Total Closings 1 Lennar Corp. 2,629 20.7% 6.0% 2 D.R. Horton 1,049 8.3% 2.2% 3 The Villages of Lake Sumter 982 7.7% 4 PulteGroup 770 6.1% 3.7% 5 Meritage Homes 649 5.1% 8.4% 6 AV Homes 636 5.0% 25.5% 7 Mattamy Homes 568 4.5% 8 Taylor Morrison 536 4.2% 6.7% 9 KB Home 489 3.9% 4.5% Top 9 Totals 8,308 65.5% 33% 43% 78% 33% 0% 22% 43% 11% 56% 33% 44% 14% 11% 11% 67% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 27. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 27 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Philadelphia – Southern NJ “Buyers trying to get a jump on the spring market due to the limited amount of inventory.” “Rising prices.” “Buyers looking for amenities with their homes.” The Buyer Traffic Index was higher at 70 vs 46 in 2018: Agents cited motivated buyers looking to get a head start on the spring market given the lack of supply. The Home Price Index came in lower at 50 vs 75 last February. 27th largest market in the country 2018 single family permits: 7,001 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Philadelphia as a % of Total Closings 1 NVR 1,223 23.7% 7.7% 2 Toll Brothers 682 13.2% 9.2% 3 Lennar Corp. 546 10.6% 1.2% 4 D.R. Horton 171 3.3% 0.4% 5 PulteGroup 147 2.9% 0.7% 6 W.B. Homes 100 1.9% 7 T.H. Properties 98 1.9% 8 Hovnanian Enterprises 89 1.7% 1.7% 9 V2 Properties 80 1.6% Top 9 Totals 3,136 60.8% 20% 20% 0% 0% 0% 60% 60% 60% 67% 33% 20% 20% 40% 33% 67% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 28. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 28 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Phoenix, AZ “Buyers feel home properties are priced too high. Investors are low balling properties that have been sitting on the market longer than 60 days.” “Transactional volume down from two banner years; still a good market but 2017/18 spoiled agents and sellers.” “Buyers waiting for tax returns.” “Inventory levels are low; serious buyers in the market.” The Buyer Traffic Index fell to 24 from 50 last year: Although serious buyers remain in the market, others are discouraged by the elevated home prices. The Home Price Index lowered to 50 from 74 in Feb ’18. 4th largest market in the country 2018 single family permits: 23,553 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Phoenix as a % of Total Closings 1 Lennar Corp. 2,000 11.5% 4.6% 2 D. R. Horton 1,937 11.2% 3 Meritage Homes 1,295 7.5% 16.8% 4 Taylor Morrison 1,183 6.8% 14.7% 5 PulteGroup 1,138 6.6% 5.4% 6 Fulton Homes 794 4.6% 7 Shea Homes 788 4.5% 8 KB Home 590 3.4% 5.4% 9 Richmond American Homes 569 3.3% Top 9 Totals 10,294 59.4% 18% 41% 47% 24% 0% 65% 29% 41% 65% 50% 18% 29% 12% 12% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 29. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 29 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Portland, OR “Seeing the most activity in the more affordable range of homes (under $500k).” “Attractive mortgage rates and softened prices.” “Low inventory levels, lower interest rates and moderation of home price increases.” “Activity from mid-January through February has been quite busy – sellers taking offers and rates are lower.” The Buyer Traffic Index ticked up to 50 from 46 in 2018: As rates and prices moderate, demand remains healthy – especially below $500k. The Home Price Index lowered to 43 from 77 in the prior year. 28th largest market in the country 2018 single family permits: 6,849 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Portland as a % of Total Closings 1 D.R. Horton 842 16.7% 1.8% 2 William Lyon Homes 747 14.8% 23.1% 3 Lennar Corp. 382 7.6% 0.9% 4 New Tradition Homes 169 3.3% 5 Pahlisch Homes 121 2.4% 6 Pacific Lifestyle Homes 119 2.4% 7 Stone Bridge Homes NW 116 2.3% 8 Urban NW Homes 98 1.9% 9 Everett Custom Homes 90 1.8% 10 Manor Homes 86 1.7% 10 Renaissance Custom Homes 86 1.7% Top 11 Totals 2,856 56.6% 27% 38% 63% 40% 18% 33% 25% 25% 60% 73% 40% 38% 13% 0% 9% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 30. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 30 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Raleigh, NC “Dip in interest rates, corporate hiring with relocations from the Northeast and California.” “Low inventory of resale homes.” “More listings coming on the market has increased traffic.” “Significant job growth in the area and in-migration.” “Seasonal increase combined with continued tight resale inventory and retreat of interest rates from November highs.” “Strong last two months in the market.” The Buyer Traffic Index declined to 65 from 83 in Feb 2018: Increased listings are exciting buyers with demand strength supported by corporate relocations and in-migration. The Home Price Index lowered to 50 from 92 last year. 18th largest market in the country 2018 single family permits: 11,163 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Raleigh as a % of Total Closings 1 Lennar Corp. 982 12.2% 2.2% 2 Dan Ryan Builders 524 6.5% 3 PulteGroup 482 6.0% 2.3% 4 M/I Homes 399 5.0% 7.8% 5 Royal Oaks Building Group 331 4.1% 6 D.R. Horton 330 4.1% 0.7% 7 Terramor Homes 277 3.4% 8 Taylor Morrison 220 2.7% 2.7% 8 Mungo Homes 220 2.7% Top 9 Totals 3,765 46.7% 23% 50% 31% 46% 50%54% 25% 38% 46% 17% 23% 25% 31% 8% 33% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 31. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 31 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Sacramento, CA “More available homes on the market.” “Steady prices and rates are making purchasing palatable.” “Coldest and wettest February in recent history.” “Low inventory levels.” “Buyers looking for competitive loan rates.” The Buyer Traffic Index decreased slightly to 57 from 58 in the prior February. The Home Price Index fell to 64 from 75 last year: Prices moderated YOY, but increased sequentially alongside inventory levels. 23rd largest market in the country 2018 single family permits: 6,420 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Sacramento as a % of Total Closings 1 Lennar Corp. 1,212 21.9% 2.8% 2 Taylor Morrison 409 7.4% 5.1% 3 KB Home 391 7.1% 3.6% 4 Woodside Homes 368 6.6% 5 Hovnanian Enterprises 293 5.3% 5.5% 6 Elliott Homes 288 5.2% 7 JMC Homes 287 5.2% 8 D.R. Horton 267 4.8% 0.6% 9 Beazer Homes 243 4.4% 4.3% Top 9 Totals 3,758 67.9% 43% 43% 57% 43% 43%43% 43% 43% 57% 43% 14% 14% 0% 0% 14% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 32. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 32 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” San Antonio, TX “Continued military moves; in-migration for employment and family.” “It’s becoming a buyers’ market.” “Rain and cold weather, but buyers emerge when the sun comes out.” The Buyer Traffic Index declined to 63 from 67 in February 2018: Activity held above expectations supported by corporate and military relocations. The Home Price Index decreased to 75 from 100 last year. 9th largest market in the country 2018 single family permits: 8,028 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 120 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share San Antonio as a % of Total Closings 1 D.R. Horton 1,833 17.7% 3.9% 2 KB Home 1,115 10.7% 10.2% 3 PulteGroup 821 7.9% 3.9% 4 Lennar Corp. 742 7.1% 1.7% 5 Meritage Homes 495 4.8% 6.4% 6 LGI Homes 480 4.6% 8.2% 7 Chesmar Homes 337 3.2% 8 M/I Homes 325 3.1% 6.4% 9 Armadillo Homes 320 3.1% 10 Legend Homes 316 3.0% Top 10 Totals 6,784 65.2% 50% 0% 25% 75% 0% 50% 75% 50% 0% 50% 0% 25% 25% 25% 50% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 33. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 33 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” San Diego, CA “High prices and general uneasiness in California.” “Interest rates still good, inventory picking up.” “Interest rates and home prices have settled down, increasing buyers’ interest.” “Favorable rates brought some buyers back to the market.” The Buyer Traffic Index declined to 32 from 44 last year. The Home Price Index decreased to 36 from 69 in Feb 2018: The majority of agents continue to report home price moderation as the number of listings increase. 49th largest market in the country 2018 single family permits: 3,510 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share San Diego as a % of Total Closings 1 Lennar Corp. 607 24.0% 1.4% 2 TRI Pointe Group 351 13.9% 7.5% 3 Shea Homes 260 10.3% 4 KB Home 225 8.9% 2.1% 5 Toll Brothers 146 5.8% 2.0% 6 Taylor Morrison 121 4.8% 1.5% 7 Baldwin & Sons 98 3.9% 8 Cornerstone Communities 88 3.5% 9 Meritage Homes 62 2.5% 0.8% Top 9 Totals 1,958 77.6% 9% 70% 50% 22% 0% 55% 30% 50% 67% 60% 36% 0% 0% 11% 40% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 34. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 34 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” San Francisco, CA “Stable interest rates and more inventory on the market.” “Attractive rates have encouraged buyers.” “Prices remain elevated.” “Buyers still waiting for additional inventory in the spring.” The Buyer Traffic Index lowered to 55 from 70 in the prior year: Easing rates and additional supply have encouraged buyers to return to the market. The Home Price Index fell to 45 from 73 last year. 25th largest market in the country 2018 single family permits: 4,051 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share San Francisco as a % of Total Closings 1 KB Home 530 10.1% 4.9% 2 Lennar Corp. 357 6.8% 0.8% 3 D.R. Horton 354 6.7% 0.8% 4 Toll Brothers 343 6.5% 4.6% 5 TRI Pointe Group 315 6.0% 6.7% 6 Shea Homes 312 5.9% 7 William Lyon Homes 306 5.8% 9.4% 8 A.D. Seeno Construction Co. 287 5.5% 9 PulteGroup 260 4.9% 1.2% 10 Trumark Cos. 233 4.4% Top 10 Totals 3,297 62.6% 18% 55% 55% 30% 36% 55% 27% 36% 70% 45% 27% 18% 9% 0% 18% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected

- 35. Note: Adjusting for the merger, Lennar Corp. data has been revised to include CalAtlantic Source: Credit Suisse; Census Bureau, Builder Magazine, Metrostudy, Company Data Slide 35 Key Takeaways: Comments from Real Estate Agents Market Overview and Builder Exposure Note: Indexes above 50 indicate “exceeds expectations” or “higher” Sarasota, FL “Lingering red tide algae concerns.” “Buyers taking more time.” “People are wary of the uncertain economic conditions.” “Winter temperatures encouraged travel to the south.” “Strong interest in second/retirement homes has rebounded.” The Buyer Traffic index decreased to 28 from 40 last year: Notably, demand held below expectations despite the majority (78%) reporting heightened incentives. The Home Price Index lowered to 22 from 50 in February 2018. 26th largest market in the country 2018 single family permits: 6,324 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 BuyerTrafficIndex <50 - Below Expectations; =50 - Meets Expectations; >50 - Exceeds Expectations 0 20 40 60 80 100 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 HomePriceIndex <50 - Lower than Prior Month; =50 - Flat vs Prior Month; >50 - Higher than Prior Month Rank Top Builders Closings 2017 Market Share Sarasota - North Port as a % of Total Closings 1 Lennar Corp. 1,225 23.4% 2.8% 2 Neal Communities of Southwest Florida 861 16.4% 3 D.R. Horton 767 14.6% 1.6% 4 PulteGroup 699 13.3% 3.3% 5 Taylor Morrison 468 8.9% 5.8% 6 Mattamy Homes 240 4.6% 7 The Kolter Group 114 2.2% 8 Maronda Homes 90 1.7% 9 Medallion Homes 89 1.7% Top 9 Totals 4,553 86.8% 11% 67% 89% 78% 11% 22% 22% 11% 22% 33% 67% 11% 0% 0% 56% 0% 20% 40% 60% 80% 100% Home Prices Number of Listings Time to Sell Incentives Open House Traffic How Do the Recent 30 Days Compare to the Prior 30 Days... More than expected Meets expectations Less than expected