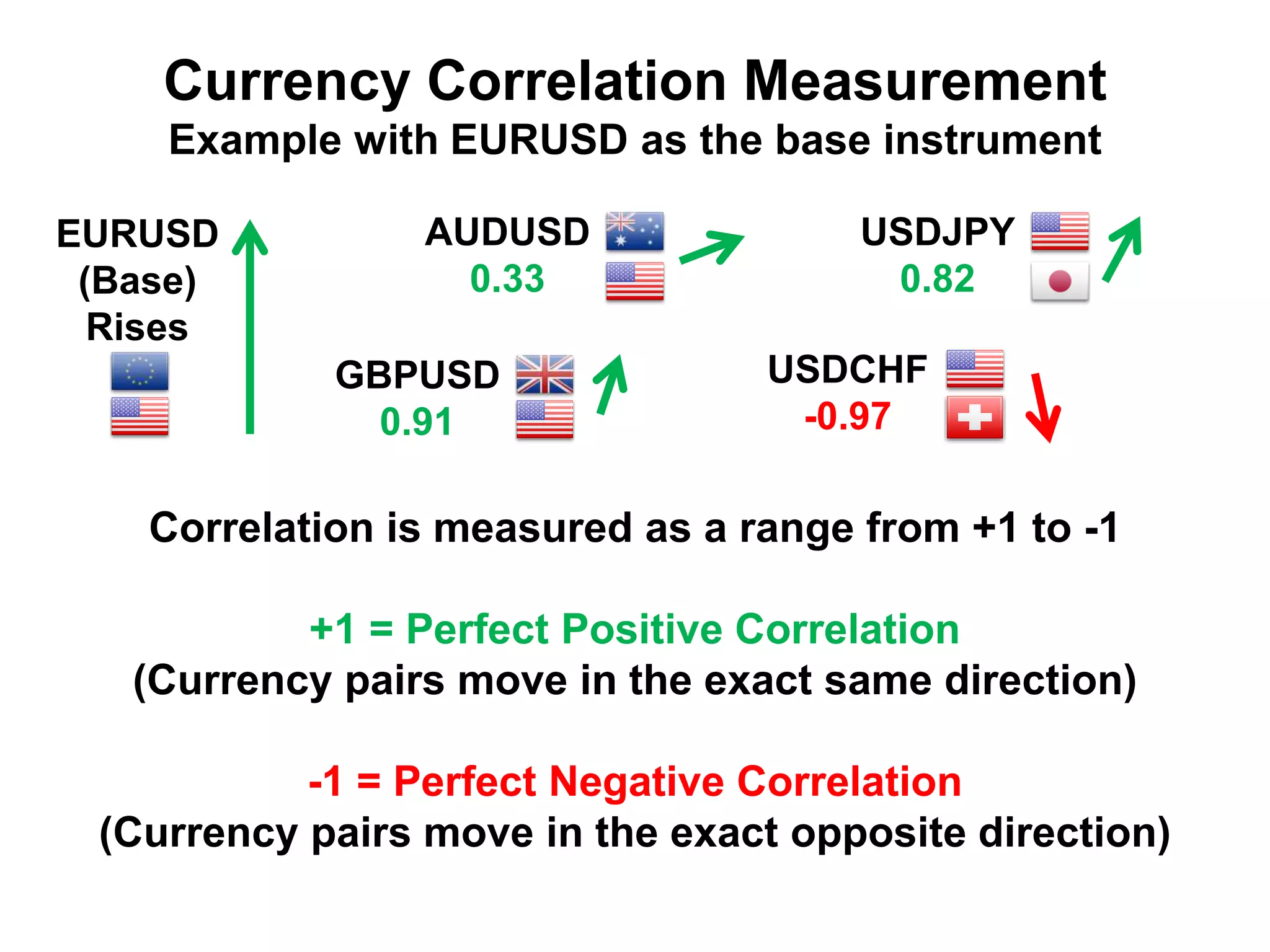

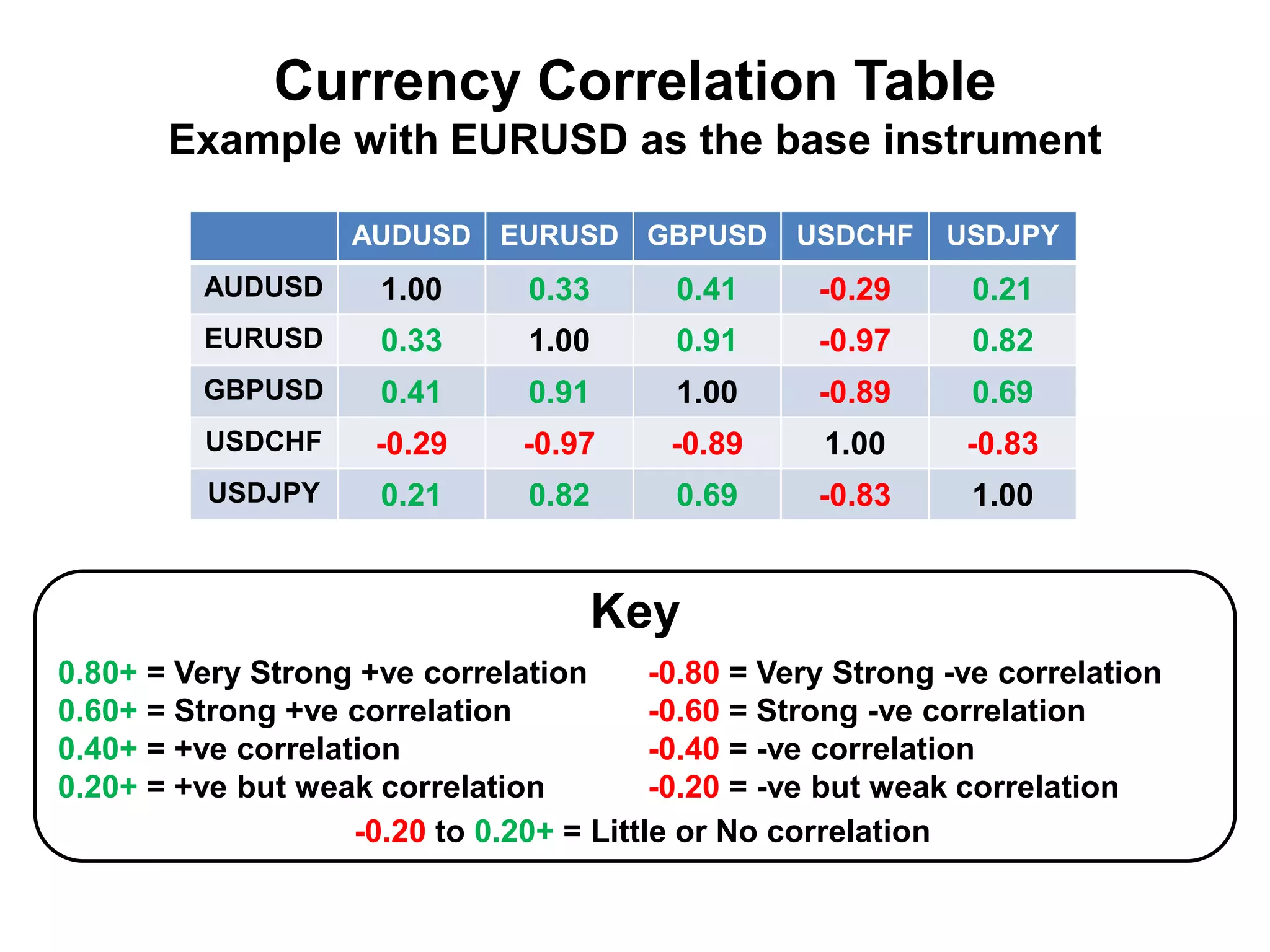

Currency correlation defines the relationship between forex pairs and how they move in relation to one another. The document provides an example correlation table showing the correlation between EURUSD and other major currency pairs, with EURUSD as the base currency. It explains that EURUSD and USDCHF have a very strong negative correlation near -1, meaning they typically move in opposite directions, while EURUSD and GBPUSD have a very strong positive correlation near +1, meaning they typically move in the same direction. Understanding correlation is important for correctly managing risk when trading multiple currency pairs.