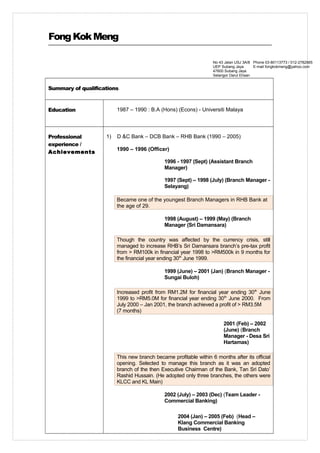

FongKokMeng Summary of Qualifications and Experience

- 1. FongKokMeng Summary of qualifications Education 1987 – 1990 : B.A (Hons) (Econs) - Universiti Malaya Professional experience / Achievements 1) D &C Bank – DCB Bank – RHB Bank (1990 – 2005) 1990 – 1996 (Officer) 1996 - 1997 (Sept) (Assistant Branch Manager) 1997 (Sept) – 1998 (July) (Branch Manager - Selayang) Became one of the youngest Branch Managers in RHB Bank at the age of 29. 1998 (August) – 1999 (May) (Branch Manager (Sri Damansara) Though the country was affected by the currency crisis, still managed to increase RHB’s Sri Damansara branch’s pre-tax profit from > RM100k in financial year 1998 to >RM500k in 9 months for the financial year ending 30th June 1999. 1999 (June) – 2001 (Jan) (Branch Manager - Sungai Buloh) Increased profit from RM1.2M for financial year ending 30th June 1999 to >RM5.0M for financial year ending 30th June 2000. From July 2000 – Jan 2001, the branch achieved a profit of > RM3.5M (7 months) 2001 (Feb) – 2002 (June) (Branch Manager - Desa Sri Hartamas) This new branch became profitable within 6 months after its official opening. Selected to manage this branch as it was an adopted branch of the then Executive Chairman of the Bank, Tan Sri Dato’ Rashid Hussain. (He adopted only three branches, the others were KLCC and KL Main) 2002 (July) – 2003 (Dec) (Team Leader - Commercial Banking) 2004 (Jan) – 2005 (Feb) (Head – Klang Commercial Banking Business Centre) No 43 Jalan USJ 3A/8 UEP Subang Jaya 47600 Subang Jaya Selangor Darul Ehsan Phone 03-80113773 / 012-2782565 E-mail fongkokmeng@yahoo.com

- 2. Klang Commercial Banking Business Centre (CBBC) was the No. 2 Business Centre (out of 42 Business Centres) in terms of Loan Growth in Malaysia. (as at 31st Dec 2004). 2) UNITED OVERSEAS BANK : 2005 - 2015 2005 (March) – 2006 (March) (Vice President / Branch Manager) (Shah Alam Branch) UOB Shah Alam branch became profitable after reporting a loss in 2004. The branch was touted as a “rising star” in early 2006 by the then Head of Personal Financial Services Division, Mr Khoo Chock Seang. 2006 (April) – 2015 (Sept) (Vice President) Risk Management (Operational Risk Management) In charge of the following: 1) Operational risk management framework/policies/procedures and guidelines 2) Conduct training on operational risk tools, policies and exercises (e.g. Business Impact Analysis (BIA), Key Risk Control Self-Assessment (KRCSA), Key Risk Indicators (KRI), etc. 3) Monitoring and Reporting of incidents. 4) Management of Bank’s Insurance Policies. 5) Product Program (i.e. development of new products) 6) Management of Business Continuity Management. 7) Management of Outsourcing arrangements 8) Monitoring and reporting Reputation Risk 10) Implementation of Operational Risk Management Toolkits. 2) AMBANK: 2015 (Sept) – 2016 (Oct) In charge of 12 staff and responsible for the following: 1) Operational risk management framework / policies / procedures and guidelines / Operational Risk Appetite. 2) Conduct training on operational risk tools and incident reporting. 3) Product Risk Assessment & Operational Readiness. 4) Incident Management Reporting (including to BNM ORION) 5) ICAAP (for operational risk) 6) Implement Operational Risk Management Tools (Risk & Control Self-Assessment, Key Risk Indicators, Key Control Testing, etc.) Present Occupation Head of Operational Risk, Bangkok Bank Berhad (2016 (Nov) – present) Areas of Expertise a) Branch Management b) Marketing for new borrowers / customers

- 3. c) Operational Risk Management APPENDIX 1 CURRENT ROLES & RESPONSIBILITIES 1) Operational Risk Management Framework / Policies / Procedures & Guidelines Develop, maintain and review bank’s operational management framework / policies / guidelines : a) Operational Risk Management Framework b) Operational Risk Management Policy c) Operational Risk Management Guide 2) Conduct Training Facilitate and provide support and guidance to business/support units in the development of their operational risk profiles, conduct of operational risk self- assessments, development of key operational risk indicators and incident management reporting. Promote greater awareness of operational risk management in the Bank. 3) Product Risk Assessment & Operational Readiness Review new product / product variation proposals from Business units, i.e. in terms of product risk assessment and operational readiness. 4) ICAAP Develop operational risk’s Stress Test Methodology. Prepare and submit operational risks’ ICAAP Stress Test results based on identified scenarios. 5) Operational Risk Management Tool a) Risk & Control Self-Assessment (RCSA) Facilitate and assist the Business / Support units with the RCSA process, including identifying and addressing the risks associated with their key processes. b) Key Risk Indicators (KRI) Facilitate and assist Business / Support units with their implementation of the KRI program. Review Business/Support units’ KRI submissions and action plans and report KORI exceptions and adverse KRI trends which have a significant negative impact on the Bank’s overall risk profile to the relevant committees on a monthly basis. c) Key Control Testing (KCT) Facilitate and assist Business / Support units with their implementation of the KCT program. Review Business/Support units’ KCT submissions and action plans. Report KCT exceptions to the relevant committees on a monthly basis. 6) Monitoring & Reporting

- 4. Timely reporting and escalation of risk events (including analysis of risk events) to Senior Management, relevant committees and Board of Directors. Identification of root causes and financial / non-financial impact of incidents. Provide advice and guidance to Business / Support Units on risk mitigating measures to minimize recurrence of risk loss events. Monitoring and reporting emerging operational risk issues to Senior Management, relevant committees and Board of Directors for their attention.