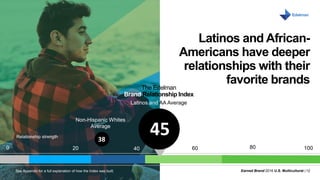

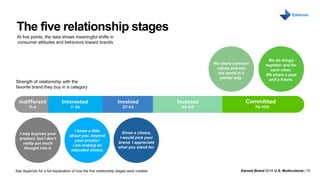

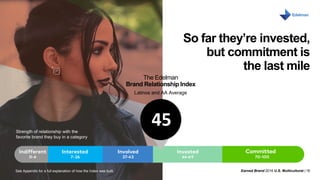

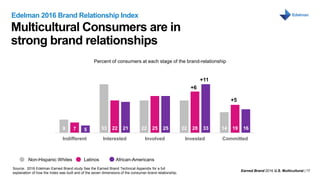

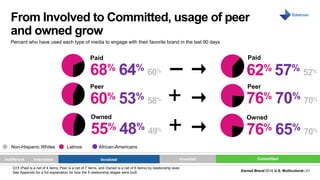

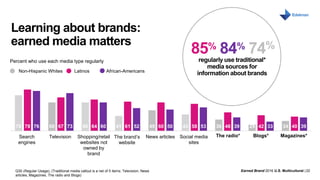

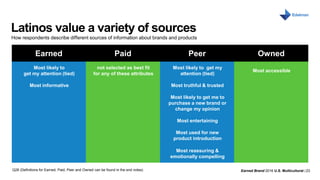

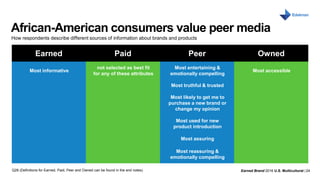

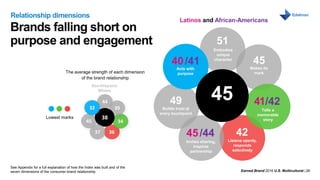

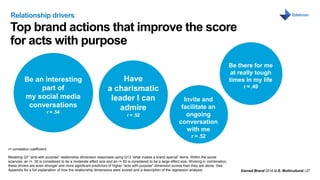

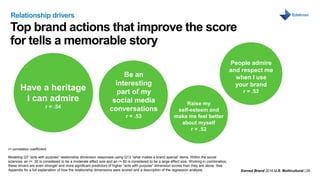

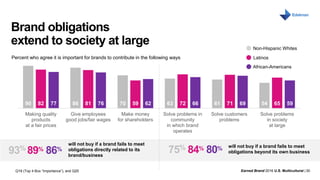

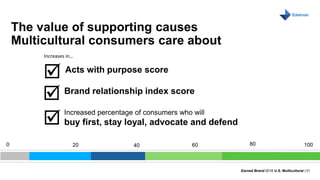

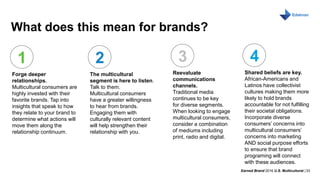

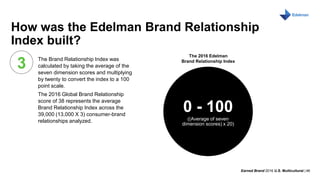

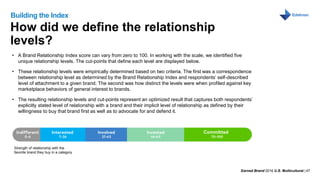

The 2016 U.S. Multicultural Earned Brand report illustrates the importance of brands demonstrating their values to connect with diverse consumers. It reveals that multicultural segments, particularly Latinos and African-Americans, have a deeper emotional investment in their favorite brands compared to non-Hispanic whites, and emphasizes the necessity for brands to engage meaningfully in societal issues. The study highlights that strong consumer-brand relationships drive loyalty and advocacy, underscoring the need for brands to communicate authentically and inclusively.