DOL Fiduciary Rule Reallocation guide

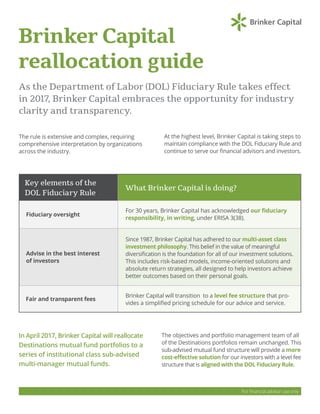

- 1. Brinker Capital reallocation guide As the Department of Labor (DOL) Fiduciary Rule takes effect in 2017, Brinker Capital embraces the opportunity for industry clarity and transparency. The rule is extensive and complex, requiring comprehensive interpretation by organizations across the industry. For financial advisor use only At the highest level, Brinker Capital is taking steps to maintain compliance with the DOL Fiduciary Rule and continue to serve our financial advisors and investors. In April 2017, Brinker Capital will reallocate Destinations mutual fund portfolios to a series of institutional class sub-advised multi-manager mutual funds. Fiduciary oversight Advise in the best interest of investors Fair and transparent fees For 30 years, Brinker Capital has acknowledged our fiduciary responsibility, in writing, under ERISA 3(38). Since 1987, Brinker Capital has adhered to our multi-asset class investment philosophy. This belief in the value of meaningful diversification is the foundation for all of our investment solutions. This includes risk-based models, income-oriented solutions and absolute return strategies, all designed to help investors achieve better outcomes based on their personal goals. Brinker Capital will transition to a level fee structure that pro- vides a simplified pricing schedule for our advice and service. What Brinker Capital is doing? Key elements of the DOL Fiduciary Rule The objectives and portfolio management team of all of the Destinations portfolios remain unchanged. This sub-advised mutual fund structure will provide a more cost-effective solution for our investors with a level fee structure that is aligned with the DOL Fiduciary Rule.

- 2. Destinations mutual funds A 22-year history in a more cost-efficient structure. Conservative Moderately Conservative Moderate Aggressive Moderately Aggressive Aggressive Equity RETURN RISK Defensive Destinations portfolios cover a range of risk tolerances and investment time horizons and the objectives and portfolio management team remain unchanged. The underlying investments will be reallocated to institutional Destinations Mutual Funds Investment objective Benchmark Target # of sub-advisors Large Cap Equity Fund Provides large cap US equity exposure across styles Russell 1000 Index 5-7 Small-Mid Cap Equity Fund Offers mid and small cap US equity exposure across styles Russell 2500 Index 3-5 International Equity Fund Provides all cap international equity exposure, including allocations to developed, emerging and frontier markets MSCI All Country World Index ex USA 4-6 Equity Income Fund Provides exposure to equity-oriented income generating strategies S&P 500 Index 2-4 Real Assets Fund Offers exposure to real asset strategies MSCI World Index 1-4 Core Fixed Income Fund Provides stability, income and low correlation to equity-oriented asset classes, multi-sector exposure, primarily investment grade and intermediate duration Bloomberg Barclays US Aggregate Index 2-3 Municipal Fixed Income Fund Provides stability, income and low correlation to equity-oriented asset classes, multi-sector exposure, primarily investment grade and intermediate duration BofA Merrill Lynch 1-10 Yr US Municipals Index 1-3 Low Duration Fixed Income Fund Provides stability, income and low correlation to equity-oriented asset classes, but with less interest rate risk than core fixed income BofA Merrill Lynch 1-3 Year Treasury Index 2-4 Global Fixed Income Opportunities Fund Complements a core fixed income allocation; includes allocations to extended fixed income sectors like high yield, EMD, int’l fixed income and preferreds Bloomberg Barclays Universal Index 3-6 Multi-Strategy Alternatives Fund Offers a differentiated source of return, includes allocations to mulitple absolute return and alternative strategies HFRX Global Hedge Fund Index 4-8 share class sub-advised mutual funds for increased cost efficiency. Destinations mutual funds will be utilized as the underlying components to construct the same Destinations portfolios that exist today. Domestic Equity International Equity Fixed Income Absolute Return Real Assets Destinations range of risk-based portfolios utilizing Destinations mutual funds Balanced Income As of December 31, 2016. For illustrative purposes only.

- 3. Destinations Moderate Consistent portfolio execution in mutual fund format. Target Domestic Equity 42.36% Destinations Large Cap Equity Fund 32.31% BlackRock S&P 500 Index 10.99% Columbia Focused Large Cap Growth 4.20% T. Rowe Price Growth Stock 4.85% Delaware Focused Large Cap Value 4.20% TCW Relative Value Dividend Appreciation 4.85% Fort Washington Large Cap Focused Equity 3.23% Destinations Small-Mid Cap Equity Fund 8.50% Ceredex Mid Cap Value 3.40% iShares Core S&P Mid Cap ETF 1.53% Driehaus Micro Cap Growth 1.36% LMCG Small Cap Value 1.36% iShares Core S&P Small Cap ETF 0.85% Destinations Equity Income Fund 1.55% Columbia Dividend Opportunity 0.59% Federated Strategic Value Dividend 0.59% iShares Core High Dividend ETF 0.37% International Equity 12.54% Destinations International Equity Fund 12.54% MFS International Value 2.51% T. Rowe Price International Growth 3.01% iShares Core MSCI EAFE ETF 2.13% Wasatch International Micro Cap 2.26% Baron Emerging Markets 1.50% iShares Core MSCI Emerging Markets ETF 1.13% Fixed Income 28.26% Destinations Core Fixed Income Fund 20.48% DoubleLine Total Return Tactical 12.29% BlackRock US Aggregate Index 8.19% Destinations Low Duration Fixed Income Fund 1.24% CrossingBridge Low Duration High Yield 0.56% DoubleLine Low Duration 0.37% iShares Core 1-5 Yr USD Bond ETF 0.31% Destinations Global Fixed Income Opp Fund 6.54% CrossingBridge Corporate Credit 3.27% DoubleLine Low Duration Emerging Markets 2.22% Nuveen Preferred Securities Opportunities 1.05% Real Assets 2.60% Destinations Real Assets Fund 2.60% SailingStone Global Natural Resources 1.82% iShares Core US REIT 0.78% Absolute Return 13.15% Destinations Multi Strategy Alternatives Fund 13.15% RiverNorth Opportunities 3.29% Driehaus Active Income 3.16% JPMorgan Strategic Income Opportunities 1.58% Driehaus Event Driven 1.84% Legg Mason BW Absolute Return Opportunities 0.66% Avenue Credit Strategies 2.63% Expected mutual fund portfolio holdings (0%-25%) Target Domestic Equity 42.36% Large Cap 32.31% Fidelity 500 Index Fund 4.73% Columbia Select Large Cap Growth 5.49% T. Rowe Price Growth Stock 6.20% Delaware Value 5.96% TCW Relative Value Dividend Appreciation 6.45% Touchstone Focused Equity 3.47% Small/Mid Cap 8.50% RidgeWorth Ceredex Mid Cap Value 4.49% Driehaus Micro Cap Growth 1.92% Touchstone Small Cap Value 2.09% Equity Income 1.55% Columbia Dividend Opportunity 1.55% International Equity 12.54% International Equity 12.54% MFS International Value 3.67% T. Rowe Price International Stock 3.23% Wasatch International Opportunities 2.97% Baron Emerging Markets 1.69% Wasatch Frontier Emerging Small Countries 0.99% Fixed Income 30.87% Core Fixed Income 20.48% DoubleLine Total Return 11.87% Dreyfus Bond Market Index 8.61% Low Duration Fixed Income 1.24% RiverPark Short Term High Yield 1.24% Credit Fixed Income 9.15% RiverPark Strategic Income 3.81% DoubleLine Low Duration Emerging Markets 2.72% Avenue Credit Strategies 2.61% Real Assets 2.60% Real Assets 2.60% Victory Global Natural Resources 2.60% Absolute Return 10.54% Multi Strategy Alternatives 10.54% RiverNorth Core Opportunity 3.33% Driehaus Active Income 2.71% JPMorgan Strategic Income Opportunities 1.76% Driehaus Event Driven 1.76% Legg Mason BW Absolute Return Opportunities 0.98% Current portfolio holdings (12/31/16) Cash allocation of 1.07% is not included in current portfolio holdings. Holdings are as of 12/31/16 and are subject to change at any time. The Destinations Moderate mutual fund portfolio will retain the same overview, objective and asset allocation, as well as many of the same underlying positions as the existing portfolio. Portfolio overview Long-term growth of capital with moderate volatility Strategic target of 60% growth and 40% stable assets 5+ year investment time horizon Blend of active and passive investment management

- 4. Destinations portfolio (Q) Current Expected Aggressive Equity 1.08% 0.96% Aggressive 1.10% 0.99% Moderately Aggressive 1.08% 0.99% Moderate 1.05% 0.99% Balanced Income 1.03% 0.98% Moderately Conservative 0.95% 0.97% Conservative 0.90% 0.97% Defensive 0.88% 0.95% Service and support The same exemplary service and support you’ve come to expect from us. Fees One pricing schedule for our advice and service. BrinkerCapital.com 1055 Westlakes Drive, Suite 250 Berwyn, PA 19312 800.333.4573 Connect With Us: Dedicated sales support and client service teams Assets Current New* (tiered) $10,000-$50,000 0.55% 0.25% $50,000-$100,000 0.35% 0.25% $100,000 to $1 million 0.25% 0.11% Next $1 million 0.25% 0.06% Next $1 million 0.25% 0.01% Over $3 million 0.25% 0.00% Sales and marketing materials Client reporting Sample Client Sample Client IRA Sample Client IRA - Unmanaged Assets 123456789 123456789 Quarterly commentary and market updates At Brinker Capital, we remain commited to serving the needs of financial advisors and investors. great ideas + strong discipline = better outcomesTM For financial advisor use only. Brinker Capital Inc., a Registered Investment Advisor. Brinker Capital feesDestinations internal expense ratios *New fee structure will be effective beginning April 1, 2017. Destinations mutual funds will have a 0.39% investment management fee paid to Brinker Capital. The new Brinker Capital fee listed above will be offset by this management fee at each breakpoint. This complies with the DOL Fiduciary Rule as this is an offset between account level advisory fee and fund level management fee. Minimum account size for the Destinations mutual funds has been lowered to $10,000 to provide multi-asset class, risk-based portfolios for smaller investor accounts. DSA_GUIDE 02/17