Representative Transactions of David L. Pratt (updated_ 7_20_16) (2)

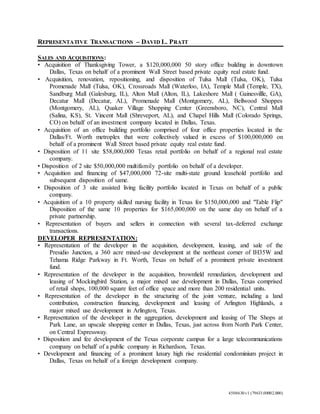

- 1. 4508630v1 (79633.00002.000) REPRESENTATIVE TRANSACTIONS – DAVID L. PRATT SALES AND ACQUISITIONS: • Acquisition of Thanksgiving Tower, a $120,000,000 50 story office building in downtown Dallas, Texas on behalf of a prominent Wall Street based private equity real estate fund. • Acquisition, renovation, repositioning, and disposition of Tulsa Mall (Tulsa, OK), Tulsa Promenade Mall (Tulsa, OK), Crossroads Mall (Waterloo, IA), Temple Mall (Temple, TX), Sandburg Mall (Galesburg, IL), Alton Mall (Alton, IL), Lakeshore Mall ( Gainesvillle, GA), Decatur Mall (Decatur, AL), Promenade Mall (Montgomery, AL), Bellwood Shoppes (Montgomery, AL), Quaker Village Shopping Center (Greensboro, NC), Central Mall (Salina, KS), St. Vincent Mall (Shreveport, AL), and Chapel Hills Mall (Colorado Springs, CO) on behalf of an investment company located in Dallas, Texas. • Acquisition of an office building portfolio comprised of four office properties located in the Dallas/Ft. Worth metroplex that were collectively valued in excess of $100,000,000 on behalf of a prominent Wall Street based private equity real estate fund. • Disposition of 11 site $58,000,000 Texas retail portfolio on behalf of a regional real estate company. • Disposition of 2 site $50,000,000 multifamily portfolio on behalf of a developer. • Acquisition and financing of $47,000,000 72-site multi-state ground leasehold portfolio and subsequent disposition of same. • Disposition of 3 site assisted living facility portfolio located in Texas on behalf of a public company. • Acquisition of a 10 property skilled nursing facility in Texas for $150,000,000 and "Table Flip" Disposition of the same 10 properties for $165,000,000 on the same day on behalf of a private partnership. • Representation of buyers and sellers in connection with several tax-deferred exchange transactions. DEVELOPER REPRESENTATION: • Representation of the developer in the acquisition, development, leasing, and sale of the Presidio Junction, a 360 acre mixed-use development at the northeast corner of IH35W and Tehama Ridge Parkway in Ft. Worth, Texas on behalf of a prominent private investment fund. • Representation of the developer in the acquisition, brownfield remediation, development and leasing of Mockingbird Station, a major mixed use development in Dallas, Texas comprised of retail shops, 100,000 square feet of office space and more than 200 residential units. • Representation of the developer in the structuring of the joint venture, including a land contribution, construction financing, development and leasing of Arlington Highlands, a major mixed use development in Arlington, Texas. • Representation of the developer in the aggregation, development and leasing of The Shops at Park Lane, an upscale shopping center in Dallas, Texas, just across from North Park Center, on Central Expressway. • Disposition and fee development of the Texas corporate campus for a large telecommunications company on behalf of a public company in Richardson, Texas. • Development and financing of a prominent luxury high rise residential condominium project in Dallas, Texas on behalf of a foreign development company.

- 2. 4508630v1 (79633.00002.000) • Acquisition, zoning, platting, permitting, development and financing of various multifamily projects in Dallas and Austin, Texas area on behalf of a development company ranging from $18,000,000 to $47,000,000 in value. • Representation of a developer in connection with the acquisition, and redevelopment of a 15 acre retail property into a mixed use property at Alpha Rd. and Inwood Rd, west of the Tollway, near the Galleria Mall, in Dallas, Texas, which involved rezoning, replatting, an election to allow for alcohol sales, the purchase of an easement from a railroad, the assumption of a conduit loan, the refinancing of the debt, a land contribution to a joint venture partnership, and the construction of a 400 unit multifamily property, a hotel and retail complex. • Representation of a REIT in the development of industrial properties in Texas. • Representation of a publicly trade railroad in the aggregation of 360-acres of land for the development of a Dallas Intermodal Terminal. LENDER REPRESENTATION: • Closed over 200 loans on behalf of over 10 different lenders ranging from $1,000,000 to $35,000,000 in principal amount (includes permanent, conduit, construction, mezzanine and leasehold financing secured by retail, office, multifamily residential, industrial and hotel projects located in 12 states). • Local Texas counsel issuing enforceability opinions and reviewing local documents in connection with over 25 multi-state mortgage loan transactions on behalf of institutional lenders. • Lender's counsel on fifty six separate securitized loan transactions involving more than $150,000,000 in aggregate loan value, on behalf of two conduit lenders secured by office, retail and apartment properties in Florida, Georgia, Maryland, Michigan, Texas, and the District of Columbia. • Pro bono representation of a national bank's community development division in an acquisition and renovation loan made to a non-profit group secured by a former convent, the transaction involved low income housing tax credits, county grants, historic building tax credits, city grants, and interim debt financing for use as a mixed use retail and multifamily property and artists colony known as Art Space in Ft. Worth, Texas. LEASING TRANSACTIONS: • National leasing representation on behalf of an international restaurant development company in build to suits, ground leases in line leasing transactions. • National leasing representation on behalf of a national salon located in regional malls. • Representation of a tenant in connection with the office lease of over 60,000 square feet on two floors in downtown Dallas, Texas. • Representation of the owner of Republic Center in the leasing of over 1,000,000 square feet of office space in downtown Dallas, Texas. • Representation of an investment company in a $206,000,000 credit-tenant sale-leaseback and financing transaction involving seventy-six CVS drug stores located in eighteen states (Alabama, Connecticut, Georgia, Illinois, Indiana, Kentucky, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Tennessee, and Virginia) and the District of Columbia.

- 3. 4508630v1 (79633.00002.000) •Representation of an investment company in the $59,650,000 credit tenant sale-leaseback and financing transaction involving thirty 7-11 convenience stores located in eleven states (Arizona, California, Colorado, Florida, Illinois, Maryland, Michigan, Missouri, New York, Texas, and Virginia). •Representation of an investment company in the $283,000,000 credit-tenant sale-leaseback and financing involving a total of ninety-six CVS drug stores located in fifteen states (Alabama, Connecticut, Georgia, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Tennessee, and Virginia) and the District of Columbia. WORKOUT AND RESTRUCTURING EXPERIENCE: • Workout and restructuring of a $190,000,000 credit facility secured by office buildings located in 4 different states on behalf of a syndicate of institutional lenders and international investors. • Restructuring of $67,000,000 state pension fund real estate portfolio with insurance company lender on behalf of a major pension fund advisor. • Assisted with the real estate aspects of the restructure and bankruptcy reorganization of a large Texas based insurance company and the related asset dispositions. • Workout of $75,000,000 loan secured by premiere office building in downtown Dallas, Texas. • Restructuring of a $48,000,000 loan secured by a Texas retail portfolio on behalf of a regional real estate company. • Foreclosure counsel for regional and local financial institutions in the foreclosure of real estate and personal property collateral in counties throughout the State of Texas. MERGERS AND ACQUISITIONS EXPERIENCE: • Representation of buyers and sellers in various strategic relationships involving the purchase, sale or combination of businesses, ranging from the sale of stock or assets, merger agreements, joint venture arrangements, leveraged buyouts, recapitalizations and reorganizations. • Representation of free standing emergency center operator in the sale of stock, membership interests, real and personal property assets located throughout Texas.