COMPLIANCE WITH ETHICAL REQUIREMENTS

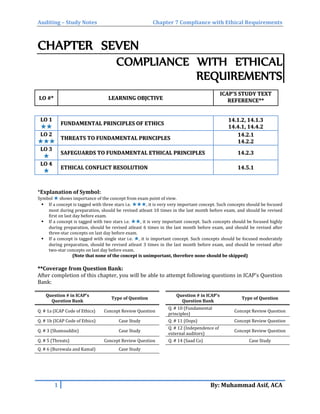

- 1. Auditing – Study Notes Chapter 7 Compliance with Ethical Requirements CHAPTER SEVEN COMPLIANCE WITH ETHICAL REQUIREMENTS LLOO ##** LLEEAARRNNIINNGG OOBBJJCCTTIIVVEE IICCAAPP''SS SSTTUUDDYY TTEEXXTT RREEFFEERREENNCCEE**** LLOO 11 ✯✯✯✯ FFUUNNDDAAMMEENNTTAALL PPRRIINNCCIIPPLLEESS OOFF EETTHHIICCSS 1144..11..22,, 1144..11..33 1144..44..11,, 1144..44..22 LLOO 22 ✯✯✯✯✯✯ TTHHRREEAATTSS TTOO FFUUNNDDAAMMEENNTTAALL PPRRIINNCCIIPPLLEESS 1144..22..11 1144..22..22 LLOO 33 ✯✯ SSAAFFEEGGUUAARRDDSS TTOO FFUUNNDDAAMMEENNTTAALL EETTHHIICCAALL PPRRIINNCCIIPPLLEESS 1144..22..33 LLOO 44 ✯✯ EETTHHIICCAALL CCOONNFFLLIICCTT RREESSOOLLUUTTIIOONN 1144..55..11 *Explanation of Symbol: Symbol ✯✯ shows importance of the concept from exam point of view. If a concept is tagged with three stars i.e. ✯✯✯✯✯✯, it is very very important concept. Such concepts should be focused most during preparation, should be revised atleast 10 times in the last month before exam, and should be revised first on last day before exam. If a concept is tagged with two stars i.e. ✯✯✯✯, it is very important concept. Such concepts should be focused highly during preparation, should be revised atleast 6 times in the last month before exam, and should be revised after three-star concepts on last day before exam. If a concept is tagged with single star i.e. ✯✯, it is important concept. Such concepts should be focused moderately during preparation, should be revised atleast 3 times in the last month before exam, and should be revised after two-star concepts on last day before exam. ((NNoottee tthhaatt nnoonnee ooff tthhee ccoonncceepptt iiss uunniimmppoorrttaanntt,, tthheerreeffoorree nnoonnee sshhoouulldd bbee sskkiippppeedd)) ****Coverage from Question Bank: After completion of this chapter, you will be able to attempt following questions in ICAP’s Question Bank: Question # in ICAP’s Question Bank Type of Question Question # in ICAP’s Question Bank Type of Question Q. # 1a (ICAP Code of Ethics) Concept Review Question Q. # 10 (Fundamental principles) Concept Review Question Q. # 1b (ICAP Code of Ethics) Case Study Q. # 11 (Oops) Concept Review Question Q. # 3 (Shamsuddin) Case Study Q. # 12 (Independence of external auditors) Concept Review Question Q. # 5 (Threats) Concept Review Question Q. # 14 (Saad Co) Case Study Q. # 6 (Burewala and Kamal) Case Study 1 By: Muhammad Asif, ACA

- 2. Auditing – Study Notes Chapter 7 Compliance with Ethical Requirements LLOO 11:: FFUUNNDDAAMMEENNTTAALL PPRRIINNCCIIPPLLEESS OOFF EETTHHIICCSS:: ✯✯✯✯✯✯ Integrity: A chartered accountant should be straight forward, honest, fair and truthful in his professional dealings and business relationships. A chartered accountant should not be associated with reports, returns or communications which (in his belief): are false. are furnished recklessly. Omit information where such omission would be misleading. Objectivity: A chartered accountant should not allow bias, undue influence or conflict of interest in his professional judgments. A way to achieve objectivity is to be Independent. Independence has two aspects: Actual Independence: (also called “Independence of Mind/Fact) Actual independence means auditor should make his professional judgment and opinions with freedom of mind, and without any bias or influence. Perceived Independence: (also called “Independence in Appearance”) The auditor must be seen to be independent, i.e. the auditor should avoid actions and circumstances due to which a third party may conclude that his independence has been compromised. Confidentiality: Confidentiality Principle: A chartered accountant, acquiring confidential information in the course of professional relationship: should not disclose such information to any third party except when permitted by client or required by law or where there is professional right or duty to disclose. should not use such information for personal advantage or for advantage of third parties. Confidentiality principle applies even within the firm, in social environment, and after termination of relationship. Exceptions of Confidentiality Principle: Confidential information may be disclosed in following circumstances: − If disclosure is permitted by client or − If disclosure is required by law or court e.g. o There is non-compliance of law (e.g. money laundering) which is required to be disclosed, or o Court orders chartered accountant to produce documents in a legal proceedings. − When there is professional duty or right to disclose: o To comply with Quality Control Review Program of the ICAP. o To respond to an inquiry/investigation by the ICAP/SECP. o To comply with requirements of international standards of auditing or ethics (e.g. when required to communicate with lawyer, professional or regulatory authorities) 2 By: Muhammad Asif, ACA

- 3. Auditing – Study Notes Chapter 7 Compliance with Ethical Requirements o To protect the professional interest of a chartered accountant in legal proceedings (e.g. in case of unpaid fee or defending case of negligence). Factors to Consider in deciding whether to disclose confidential information: Whether all the relevant information is known and substantiated. If any information is unsubstantiated, professional judgment should be applied to determine type of disclosure to be made. Whether the interest of any party (including third parties) could be harmed. Type of communication to be made and whom it is to be addressed. Professional competence and due care: Professional competence and due care means attaining and subsequently maintaining (through continuing professional development) professional knowledge and skill at the level required to ensure that clients receive a quality service, based on latest developments in profession, legislation and techniques. Consequences of not exercising professional competence and due care: Legal claims against the auditor in the law of contract or the law of tort. Disciplinary proceedings against the auditor by ICAP Firm may lose clients due to bad reputation Professional behavior: A chartered accountant should comply with relevant laws and regulations. He should always behave with courtesy in professional dealings and should avoid misconduct and actions that discredit profession. CONCEPT REVIEW QUESTION A professional accountant is required to comply with the five fundamental principles described in “Code of Ethics for Professional Accountants”. What are these principles? Explain. (10 marks) (ICMA Pakistan, Summer 2009) LLOO 22:: TTHHRREEAATTSS TTOO FFUUNNDDAAMMEENNTTAALL PPRRIINNCCIIPPLLEESS:: ✯✯✯✯✯✯ In many circumstances, there arises possibility that a Chartered Accountant may not comply with above fundamental principles. These circumstances are called Threat (given below). Self-interest threat: Definition: Threat that judgment or behavior of a team member will be inappropriately influenced because of a financial interest held by an assurance team member (or his relatives). Examples: 1. Holding of shares in assurance client by team member or his relatives 2. Loan or Guarantee from an assurance client by team member or his relatives. 3. Business relationship between firm (or assurance team member) and client (or management) 4. Contingent fee arrangements (also called incentive based fee). 5. Overdue fee. 3 By: Muhammad Asif, ACA

- 4. Auditing – Study Notes Chapter 7 Compliance with Ethical Requirements 6. Undue dependence on total fee from a client 7. An assurance member entering into employment negotiations with client. 8. An audit team member is evaluated or compensated on the basis of selling non-assurance services to assurance client. Familiarity threat: Definition: Threat that an assurance team member will be too sympathetic to the interest of client or too accepting work of client because of long or close relationship with client. Examples: 1. Immediate or close family member of an assurance team member is a director or officer of client, or an employee in a position to significantly influence financial statements. 2. Long association of a senior team member with assurance client. 3. Acceptance of significant gifts or preferential treatment. 4. An assurance team member has been a director officer, or employee of client in a position to significantly influence financial statements (and vice-versa). Self review threat: Definition: Threat that an assurance team member will not appropriately evaluate results of previous service performed by himself or by another individual of his firm. Examples: 1. Performing non-assurance services that directly affect subject matter of assurance services (e.g. preparation of accounting records or valuation of assets and liabilities). 2. A member of assurance team has been a director, officer or employee of client. 3. A member of the audit team has provided temporary staff services to client during engagement period. 4. A firm reviewing the operations of financial system after designing and implementation of the system. Intimidation threat: Definition: Threat that an assurance team member is deterred from acting objectively because of threats, undue influence or pressure. Examples: 1. Threat of dismissal of auditor from client. 2. Threat of dismissal of auditor (or his relative) by client from proposed engagement (e.g. in case of disagreement). 3. Threat of litigation by client 4. A pressure by client to inappropriately reduce the extent of work (to reduce fee). 5. An engagement partner threats team member not to promote unless he agrees with client’s inappropriate accounting treatment. Advocacy threat: Definition: Threat that an assurance team member will promote client’s position on a matter (to third parties) and compromises his own objectivity. 4 By: Muhammad Asif, ACA

- 5. Auditing – Study Notes Chapter 7 Compliance with Ethical Requirements Examples: 1. Firm promoting shares of an assurance client. 2. Acting as an advocate of assurance client in litigations or disputes (e.g. tax disputes) with third parties. CONCEPT REVIEW QUESTION State the FIVE threats contained within ACCA’s Code of Ethics and Conduct and for each threat list ONE example of a circumstance that may create the threat. (05 marks) (ACCA F8 – June 2010) LLOO 33:: SSAAFFEEGGUUAARRDDSS TTOO FFUUNNDDAAMMEENNTTAALL EETTHHIICCAALL PPRRIINNCCIIPPLLEESS:: ✯✯ Safeguards are actions or other measures that may eliminate threats or reduce them to an acceptable level. They fall into two broad categories: 1. Safeguards created by the profession, legislation or regulation; and 2. Safeguards in the work environment. Safeguards created by the profession, legislation or regulation: (i.e. by regulators) Education, training and experience requirements for entry into profession Continuing Professional Development (CPD)Requirements Professional standards e.g. Code of Ethics, Code of Corporate Governance External Quality Control Review Programs by professional/regulatory organizations. Disciplinary mechanism by professional and regulatory bodies. Safeguards in the work environment: (i.e. by firm) Internal Quality Control Review of engagements Use of separate teams to provide assurance and non-assurance services. Use of information barriers between teams providing services to clients having conflict of interest (e.g. competitors) Appointment of ethics partner. Rotation of senior team members. Terminating financial interest with clients. declaration of independence to be signed by all team members at start of audit. Policies and procedures to identify and communicate interests or relationships between engagement team and client identified during audit. A disciplinary mechanism by firm CONCEPT REVIEW QUESTION How do the audit firm's own systems and procedures provide safeguards against threats to its independence? (05 marks) (ICMA Pakistan, Winter 2006) 5 By: Muhammad Asif, ACA

- 6. Auditing – Study Notes Chapter 7 Compliance with Ethical Requirements LLOO 44:: ETHICAL CONFLICT RESOLUTION:: ✯✯ When faced with an ethical conflict, a chartered accountant should consider relevant facts of the situation and should: 1. Identify threat(s) involved in the situation. 2. Evaluate threat (i.e. whether significant or insignificant). 3. Apply relevant safeguards (or course of actions) to reduce threat to acceptable level. 4. All ethical issues and relevant considerations should be documented. If a significant ethical conflict/threat cannot be resolved, chartered accountant should consider withdrawal from engagement, if possible and practicable. 6 By: Muhammad Asif, ACA

- 7. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements FREQUENTALLY ASKED CASES IN EXAMS & THEIR SOLUTIONS Note: Cases starting from ✯✯ are comparatively more important than others. ✯✯ Case 1 Holding of financial interest (i.e. shares) in assurance client by team members or their relatives. Threat: Holding of shares in an audit client (or its associated entities) by assurance team members or by other partners practicing in the same office or by other partners providing non-assurance services to same client or by their relatives creates Self- Interest Threat. Possible Course of Action/Safeguards: Significance of threat should be evaluated. If threat is other than clearly insignificant, following safeguards should be considered to reduce it to acceptable level: 1. Firm’s quality control policies and procedures should require team members to immediately communicate to audit firm any financial interest in assurance client. 2. Team member (or his relative) should be convinced to dispose-off financial interest as soon as practicable. 3. If interest is not disposed, firm should remove concerned member from assurance team. 4. If any work is performed by concerned individual prior to disposal or removal, firm should involve an independent chartered accountant to review the work performed by team member. Situations Tested in Exam Questions Team manager inherited shares during audit. Son of engagement partner is a sales manager and receives shares as part of remuneration. A partner of the firm holds shares in subsidiary of audit client. Close relative of team manager holds shares in audit client. Brother of partner acquired shares in audit client. Father of trainee has financial interest in audit client. ✯✯ Case 2 Long Association with assurance client (e.g. more than 3 years). Threat: Using the same senior personnel on an assurance engagement over a long period of time creates Familiarity Threat and Self-Interest Threat. Possible Course of Action/Safeguards: Significance of threat should be evaluated. If threat is other than clearly insignificant, firm should remove the concerned team member from assurance engagement, and should involve independent chartered accountant to review the work performed by senior personnel (if any). If threat is insignificant, individual can stay as part of engagement team with following safeguards: 1. Firm should involve an independent chartered accountant to review the work performed by senior personnel. 2. Regular independent internal or external quality control reviews of engagement. In case of listed companies in Pakistan, engagement partner shall be rotated after 5 years, and shall not resume for next 2 years. Situations Tested in Exam Questions Engagement partner was rotated but manager was retained in team who were involved in audit for past 5 years. A past consultant of firm joins the firm and is deputed on audit of client. Because of time pressure, client requests to use same team member which has been auditing client for many years. Engagement partner has been partner of the engagement for 6 years. Engagement partner has been partner for 5 years, now rotated and proposed to be quality control reviewer. Firm has been the auditor of client for 10 years. Engagement partner served for 4 years and client is now becoming a listed company. 1 By Muhammad Asif, ACA

- 8. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements ✯✯ Case 3 If a director, officer or certain employee of client is Immediate family member, or Close family member, or Close relative of an assurance team member or a partner of firm. Threat: If a director, officer or certain employee of client is Immediate family member, or Close family member, or Close relative of an assurance team member or a partner of firm, it creates Familiarity Threat, Intimidation Threat, and Self-interest Threat. Possible Course of Action/Safeguards: In case of a listed company in Pakistan, parents/spouse/children of CEO, CFO, Internal auditor or a director shall not be involved in audit of company. In case of unlisted company, significance of threat should be evaluated. If threat is other than clearly insignificant, following safeguards should be considered to reduce it to acceptable level: 1. Firm’s quality control policies and procedures should require team members to immediately communicate to audit firm close relationships with employees of assurance client. 2. Firm should remove concerned member from assurance team or, if possible, firm should restructure responsibilities of team member so that the professional does not work on matters under the responsibility of the relative. Situations Tested in Exam Questions Engagement Partner’s brother-in-law joined audit client as CFO. Wife of the partner is Director Marketing in audit client. Engagement Partner’s son is a sales manager in audit client. Spouse of partner is a consultant and prepares tax return for client. Partner and Director Finance of audit client are friends and go on holidays. Engagement Partner’s daughter is Director Finance in audit client. Audit manager is married to the finance director of client. Audit client insists to appoint sister of finance controller as senior member of engagement team. Case 4 Loan or Guarantee from an audit client. Threat: Obtaining a material loan from an audit client by Firm, Team member or their immediately family members creates Self- Interest Threat. Safeguards: If loan is accepted from client: Loan from a client which is NOT a Bank or similar financial institution Loan from a client which is a Bank or similar financial institution Loan by an assurance team member or his immediate family member If a loan is accepted from a client which is NOT a bank or similar financial institution, Self-interest threat would be so significant that no safeguard could reduce the threat to acceptable level, unless loan is immaterial to both: a) Assurance client, and b) Firm or Team member or his immediate family members. If loan is NOT under normal lending procedures and terms and conditions, Self-interest threat would be so significant that no safeguard could reduce the threat to acceptable level. If loan is made under normal lending procedures and terms and conditions, it does not create threat to independence (e.g. Home Mortgage, Bank Overdraft, Car loans and Credit card balances). Loan by Firm If loan is not under normal lending procedures and terms and conditions, Self-interest threat would be so significant that no safeguard could reduce the threat to acceptable level. If loan is made under normal lending procedures and terms and conditions, but loan is material either to the audit client or firm receiving the loan, firm should apply safeguards to reduce the threat to acceptable level e.g. 2 By Muhammad Asif, ACA

- 9. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements firm should involve an independent chartered accountant to review the work done by firm. If loan is given to client: If firm or an assurance team member or his immediate family member gives loan to assurance client, Self-interest threat would be so significant that no safeguard could reduce the threat to acceptable level, unless loan is immaterial to both: a) Assurance client, and b) Firm or Team member or his immediate family members. If deposit is made with a client which is a Bank or similar financial institution: It does not create threat to independence if deposit is made under normal commercial terms. Situations Tested in Exam Questions Audit manager has obtained Lease Finance from audit client. A partner has obtained house loan from audit client. Two team members obtained significant loans from audit client. Finance director offers loan at reduced interest rate to a team member. ✯✯ Case 5 If a director, officer or certain employee of client leaves the client and joins firm as an assurance team member. Threat: If a director, officer or employee (in a position to significantly influence preparation of financial statements) of client leaves the client and joins firm as an assurance team member, it creates Self-Review Threat, Familiarity Threat and Self- Interest Threat. Course of Action/Safeguards to reduce significant threat to acceptable level: If the concerned assurance team member has served the client during the period covered by audit report, threat would be so significant that no safeguard can reduce it to acceptable level. Consequently, such individual shall not be assigned to assurance team. If the concerned assurance team member has served the client before the period covered by audit report, significance of threat should be evaluated and necessary safeguard should be applied e.g. review of the work performed by individual as a member of the audit team. Situations Tested in Exam Questions Assistant finance director of client has joined audit firm as a partner and is proposed to be a review partner on audit of client. Finance director of the client has joined audit firm as engagement partner of client. ✯✯ Case 6 If an assurance team member leaves the firm and joins client as a director, officer or certain employee. Threat: If an assurance team member or a partner of the firm leaves the firm and joins client as a director, officer or employee (in a position to significantly influence preparation of financial statements), it creates Familiarity Threat, and Intimidation Threat. Possible Course of Action/Safeguards: Ensure that there is no significant connection remaining between firm and individual i.e.: Individual is not entitled to any benefits or payments from firm unless these are made in accordance with fixed pre-determined arrangements; and any amount owed to individual is not material to firm, and Individual does not continue to participate in firm’s business or professional activities. If significant connection remains, threat would be so significant that no safeguard can reduce it to acceptable level. If no significant connection remains between firm and individual, significance of threat shall be evaluated and following safeguards may be applied to reduce threat to acceptable level: 1. Firm should modify the audit plan. 3 By Muhammad Asif, ACA

- 10. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements 2. Firm should assign staff to audit team who have sufficient experience in relation to individual who joined firm. 3. Having a chartered accountant review the work of the former member of the audit team. Situations Tested in Exam Questions An audit manager on previous audit, has recently joined audit client as GM Finance. An audit manager on last year’s audit of client, has jointed client as Manager Finance, prior to commencement of the current year’s audit. Former member of firm’s staff who had managed the audit of client for last 4 years, has replaced client’s finance director. Case 7 A partner, employee or assurance team member is simultaneously appointed director, officer or employee of client (i.e. simultaneous employment) Threat: If a partner or employee of the firm simultaneously serves as a director or officer of an audit client, it creates Self-Interest Threat and Self-Review Threat. Course of Action/Safeguards: This threat is so significant that no safeguards could reduce the threats to an acceptable level. Accordingly, no partner or employee shall serve as a director or officer of an audit client. However, a partner can attend board meetings of client to discuss audit related matters; but he should not participate in management decisions at meeting. Situations Tested in Exam Questions Client requested engagement partner to attend board meetings on monthly basis. Directors suggested that a partner in your firm should join the board as a non-executive director. ✯✯ Case 8 An assurance team member is willing to join client in future. Threat: If an engagement team member is willing to join client in future, it creates Self-Interest threat. Course of Action/Safeguards to reduce significant threat to acceptable level: Firm’s quality control policies and procedures should require team members to immediately notify audit firm when entering employment negotiations with client. (team member lacks integrity if he does not notify firm) On receiving such notification, firm should evaluate significance of threat and should apply safeguards to reduce threat to acceptable level e.g. 1. Firm should remove the individual from audit team, or 2. A review of any significant judgments made by that individual while on the team. Situations Tested in Exam Questions Two assurance team members have applied (or being interviewed) for vacancies in accounts department of audit client. Audit manager has been offered a job of CFO in audit client, to be joined after the completion of audit. CEO of an audit client sent an email to engagement partner that one of engagement team member has been short-listed for position as finance director. An audit manager notified firm that she is to join audit client as finance director after three months. ✯✯ Case 9 Purchase of Goods and Services from client. Threat: Purchase of goods or services from client by firm or assurance team member or his immediately family member generally does not create a threat 1. Magnitude of transaction is immaterial for client and firm, and 2. Transaction is within normal course of business of client, and 3. Transaction is on arm’s length basis. 4 By Muhammad Asif, ACA

- 11. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements However, if any of above conditions is not met, it creates Self-Interest Threat. Possible Course of Action/Safeguards: Significance of threat should be evaluated. If threat is other than clearly insignificant, following safeguards should be considered to reduce it to acceptable level: Eliminating or reducing the magnitude of transactions Removing the individual from assurance engagement. Situations Tested in Exam Questions Accepting discount vouchers from audit client. Partners stay in hotel managed by audit client. Audit client offers 10% discount on purchase of goods to staff. Same is offered to audit team. Audit team members received/provided investment advice to client or its management. Firm rents office space from audit client. Case 10 Threat of removal by client (e.g. on disagreement). Threat: Threat by client to remove the existing auditor over disagreement creates Intimidation Threat, and Self-Interest Threat. Course of Action/Safeguards to reduce significant threat to acceptable level: Discuss the issue with other partners (e.g. ethics partner), and also disclose to TCWG. Consider withdrawal from engagement (as threat by management indicates lack of trust and management integrity) Conduct engagement quality control review, if not withdrawn from engagement. Situations Tested in Exam Questions CEO threatened partner not to re-appoint for next year if partner did not agree on CEO’s accounting treatment and disclosure of certain items. Managing director capitalized research cost and indicated to remove firm if opinion is modified. ✯✯ Case 11 Gifts and Hospitality. Threat: Accepting gifts or hospitality from an assurance client creates Self-Interest threat and Familiarity threats, unless value is trivial and inconsequential. Possible Course of Action/Safeguards: Firm or member of assurance team shall not accept significant gifts or hospitality from client because threat would be so significant that no safeguard could reduce threat to acceptable level. Situations Tested in Exam Questions Finance director invited team to watch a football match followed by a luxury dinner. Client using yacht or balloon-flight to entertain audit team. Free subscription of a club for one year Client offering free stay for assurance team at a luxury resort. Case 12 Litigation between assurance team and assurance client. Threat: When litigation takes place or is likely to take place between firm (or assurance team) and audit client, it creates intimidation threat and self-interest threat. Course of Action/Safeguards to reduce significant threat to acceptable level: Firm should disclose nature and extent of litigation to TCWG (e.g. audit committee). If individual is involved in litigation, firm should remove individual from engagement. 5 By Muhammad Asif, ACA

- 12. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements If firm is involved in litigation, an independent chartered accountant should be engaged to review the work done. If threat is not reduced, firm should withdraw from engagement. Situations Tested in Exam Questions There is a litigation between client and a member of team about possession of a land. Case 13 Large proportion (i.e. 15%) of revenue of firm coming from a single client. Threat: If a firm (or an office or a partner) is generating large portion of its revenue (e.g. more than 15%) from a single assurance client, it creates Self-Interest Threat and Intimidation Threat. Course of Action/Safeguards to reduce significant threat to acceptable level: 1. Firm should take necessary steps to reduce this dependency e.g. increase client–base or withdraw from some of services. 2. Regular internal or external quality control reviews. 3. Consulting a third party (e.g. an independent chartered accountant or a professional regulatory body) on key audit judgments. Situations Tested in Exam Questions Total fee received from client last year equated to 16% of firm’s total income. This year, increase in fee from client is expected. Firm provides substantial non-assurance services to audit client. ✯✯ Case 14 Overdue Fee. Threat: If fee (or significant part of fee) due from an assurance client remains unpaid for a long period, it creates Self-Interest Threat. Possible Course of Action/Safeguards: Firm should discuss the matter with audit committee and TCWG and should require that: Predecessor auditor’s fee should be paid before acceptance of engagement (initial engagements). Fee of previous year’s professional services (assurance as well as non-assurance) should be paid before issuance of current year’s assurance report. (for recurring engagement). If previous year’s fee is not paid before issuance of audit report, significance of threat shall be evaluated and following safeguards may be applied: 1. Firm should involve an independent chartered accountant to review the work done or otherwise advice as necessary. 2. Firm should consider whether overdue fee may be equivalent to loan. 3. Firm should also consider whether it is appropriate to be reappointed or continue the engagement. Situations Tested in Exam Questions Previous year’s audit fee is still unpaid at completion of current audit. CFO committed to pay both years’ fee after signing of current year’s audit report. 20% of last year’s audit fee is still outstanding. Taxation fee for last year is still outstanding. ✯✯ Case 15 Contingent Fee. Definition: Contingent fees are fees calculated on the basis of outcome of a transaction or results of service performed by firm. However, a fee is not regarded as being contingent if established by a court or other public authority. Threat: Accepting a contingent fee from an assurance client (for assurance or non-assurance service) creates Self-Interest Threat. Course of Action/Safeguards to reduce significant threat to acceptable level: 6 By Muhammad Asif, ACA

- 13. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements Threat for contingent fee is so significant that no safeguard could reduce the threat to acceptable level. Consequently, a firm shall not enter into any such fee arrangement. Fee should be based on required time and experience to complete job. Situations Tested in Exam Questions Fee will be Rs. 200,000 if audit is completed in a month. If delayed, fee will be Rs. 150,000. Assisting client in issuance of securities and agreeing different fee level depending on amount of subscription. Fee for tax services will be 10% of tax relief allowed by tax authorities. Audit fee will be 10% of actual profit. Fee for assurance service will be paid only if bank approves loan. Fee based on type of opinion. ✯✯ Case 16 Accepting a fee lower than predecessor auditor or market rates Threat: Accepting a fee lower than that charged by predecessor auditor is regarded as undercutting. Similarly, Course of Action/Safeguards to reduce significant threat to acceptable level: An auditor should not quote fee lower than that charged by predecessor auditor unless the scope and quantum of work materially differs from the scope and quantum of work carried out by the previous auditor, and following safeguards are also applied: Appropriate time and qualified staff is assigned to engagement. Client should be made aware of scope of work and basis of fee. Note: a slightly different concept is Lowballing which means accepting a fee lower than market rates (in hope of getting lucrative non-assurance services in future). Above safeguards are also applied if a firm accepts a fee less than market rates. Situations Tested in Exam Questions Client suffered heavily because of financial crisis and asked auditor to appoint them if they could quote fee less than previous auditor. A limited assurance engagement has been accepted at a fee which is lower than predecessor auditor. Audit firm quoted a fee which is less than market rate with hope to get tax and advisory services in future. ✯✯ Case 17 Providing assurance services to two clients which have conflict of interest (e.g. competitors or clients having disputes). Threat: Providing audit (or other) services to two clients which are competitors or have dispute causes Conflict of Interest. A conflict of interest creates threat to: Objectivity (because auditor may not act in the best interest of both parties) and Threat to other fundamental ethical principles (e.g. Confidentiality as information from one client may be used for benefit/loss of other). Course of Action/Safeguards to reduce significant threat to acceptable level: ̶ Both clients should be notified about the fact and their consent should be obtained to act as auditor of other company. ̶ Separate teams and engagement partners should be engaged to perform audit. ̶ Chinese Walls (i.e. Information barriers) should be implemented between teams to prevent leakage of confidential information. These are implemented by: giving clear guidelines to members of the engagement team on issues of security and confidentiality of information. strict physical separation of such teams confidential and secure data filing. Use of confidentiality agreement, signed by team members. ̶ An independent senior should regularly review safeguards applied. If above safeguards cannot be applied, auditor should not act for one of the parties. Situations Tested in Exam Questions 7 By Muhammad Asif, ACA

- 14. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements Two assurance clients are in dispute with each other. Providing valuation/due diligence services to two different clients for same subject matter. Providing assurance services to two different clients which are competitors. Providing assurance services to two clients who trade with each other One assurance client intends to acquire other assurance client (not competitor), and asks advice of firm about proposed acquisition. Case 18 Advertisement and Publicity. Threat: Advertisement for solicitation and undue publicity by a chartered accountant in practice create Self-interest threat and Threat to Professional Behavior. Course of Action/Safeguards: A chartered accountant should not make advertisement/publicity of his services in the manner as is done by other normal businesses. However, a chartered accountant can use appropriate newspaper/magazine only to inform public (e.g. about establishment of new practice, changes in partnership or address etc) provided such announcements are limited to bare statement of fact. Any announcement, communication and notices by a chartered accountant should not: (a) Use means which bring the profession into disrepute. (b) Exaggerate work of himself (c) contain testimonials or endorsements; (d) make comparisons with other chartered accountants in practice or degrade work of other accountants. (e) create false expectations of favorable results Situations Tested in Exam Questions Owner of an advertising agency offered firm to provide significant discount for publicity of his new practice. Advertisement with following statements: “Contact us, if you are fed up of your accountants charging too much for poor quality services”. “We are the largest firm with team of most professional and leading experts”. “We guarantee to improve your business efficiency and save your tax”. “For new clients we offer a 25% discount when both audit and tax services are provided”. ✯✯ Case 19 Preparing Accounting Records or Financial Statements Threat: Preparing accounting records or financial statements for audit client creates Self-Review Threat when financial statements are subsequently audited by firm. Services that can be offered: In case of listed companies, a firm cannot provide bookkeeping or accounting services to listed audit clients. A firm can provide bookkeeping and accounting services to an unlisted audit client if services are of a routine or mechanical nature e.g.: Recording transactions approved by client. Posting transactions to general ledger and to trial balance. Preparing financial statements based on information in the trail balance. Providing payroll services based on client-originated data. Safeguards for assurance service: 1. Individual performing non-assurance engagement should not be part of audit engagement team. 2. Firm should involve an independent chartered accountant to review the work. Safeguards for non-assurance service: 3. Managerial functions/decisions should not be taken by firm/individuals (e.g. approval of transactions, preparing or changing source data for transactions, determining or changing journal entries). 4. Obtaining the client’s acknowledgement of responsibility for the results of the work performed by the firm/individual. 8 By Muhammad Asif, ACA

- 15. Auditing – Case Studies Chapter 7 Compliance with Ethical Requirements Situations Tested in Exam Questions CEO of audit client requested audit manager to carry out accounting work and prepare financial statements at a mutually agreed fee. Engagement team prepares financial statements from trial balance and proposes adjusting entries. A listed audit client requested firm to reconcile creditors’ ledger with the statements submitted by suppliers. Director requested firm to provide a team member to assist in preparation of its annual financial statements. ✯✯ Case 20 Temporary Staff Assignments. Permissibility: A firm cannot provide temporary staff assignments to listed audit clients. However, temporary staff services can be provided to unlisted audit clients for short period of time. Threat: The lending of staff by a firm to an assurance client will create Self-review threat. Course of Action/Safeguards to reduce significant threat to acceptable level: Safeguards for non-assurance engagement: Staff should not assume management responsibilities, and Audit client shall be responsible for directing and supervising the activities of the loaned staff. Safeguards for assurance engagement: Significance of threat shall be evaluated and following safeguards should be applied to reduce the threat to acceptable level: Firm should not include the loaned-staff in assurance team. If loaned-staff is included in assurance team, he should not be given responsibility for any function or activity that he performed during temporary staff assignment. Firm should involve an independent chartered accountant to review the work performed by loaned staff. Situations Tested in Exam Questions Client’s two accountants resigned and client requested auditor to send two staff members on secondment for three months. Client requested that an audit team member be seconded for two months as temporary director finance or credit manager. Person who provided temporary staff services, is proposed to be part of engagement team. Directors required that a team member in previous audit should be seconded to company to assist in preparation of financial statements. CEO of an unlisted audit client asked firm to send audit manager of secondment to assist new chief internal auditor. 9 By Muhammad Asif, ACA