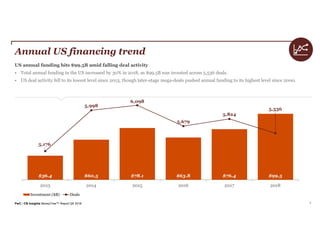

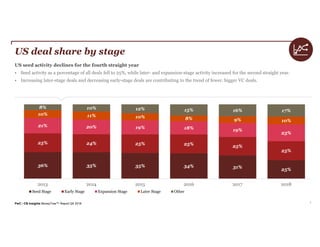

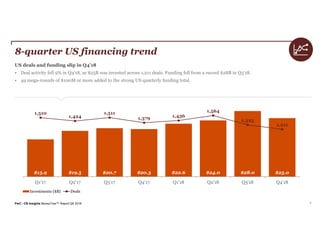

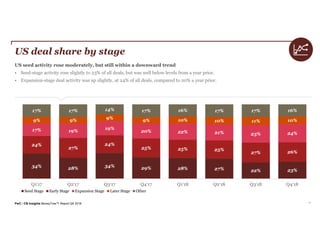

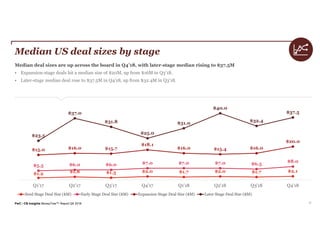

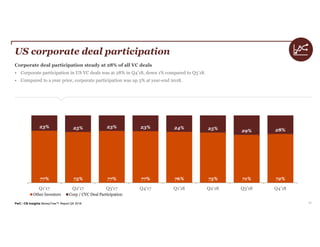

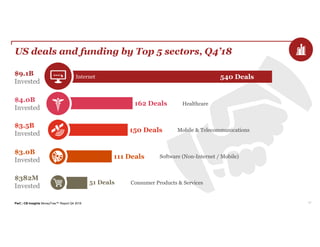

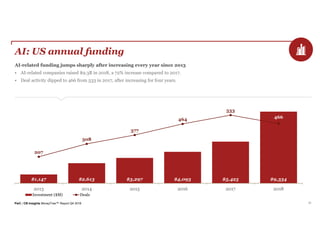

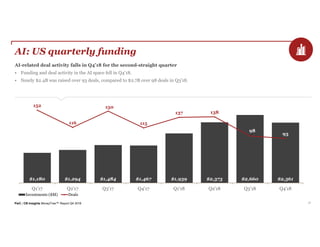

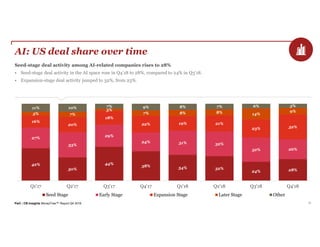

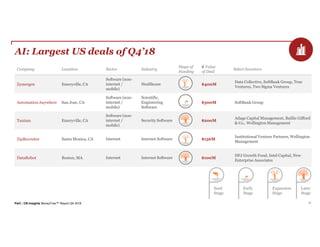

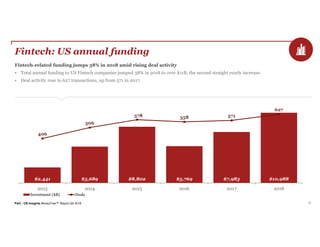

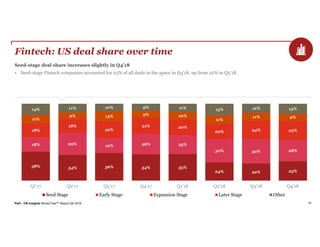

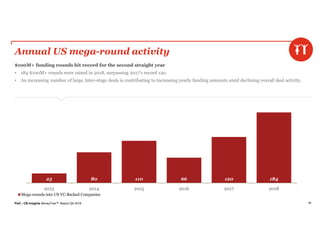

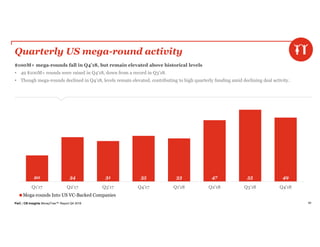

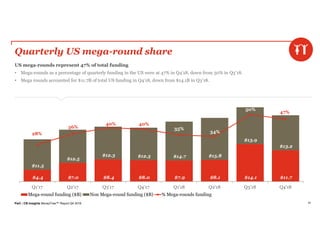

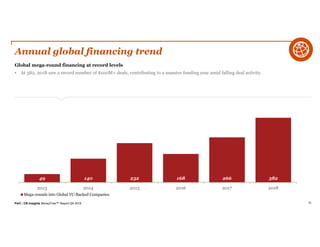

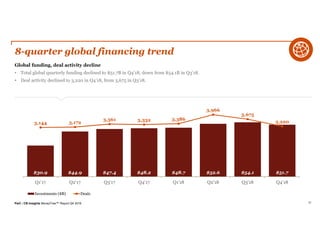

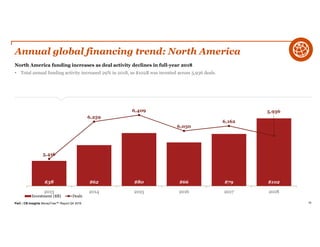

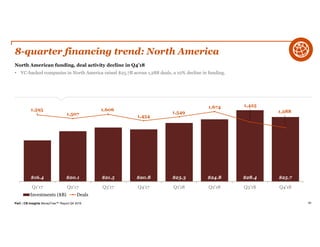

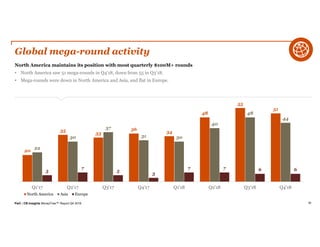

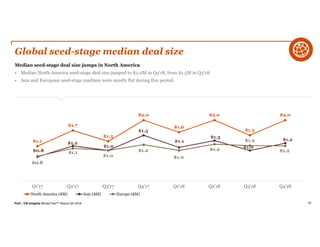

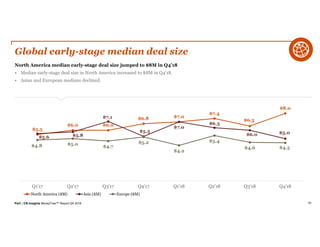

In Q4 2018, US venture capital funding totaled $25 billion across 1,211 deals. This represented a decline from the record $28 billion invested in Q3 2018. However, annual US funding reached $99.5 billion in 2018, the highest level since 2000, driven by a record number of "mega-rounds" of $100 million or more. Seed-stage deal activity rose slightly but remained within a downward trend over the past few years as larger, later-stage deals have become more prominent.