Revised web presentation 4 21-16 - oea

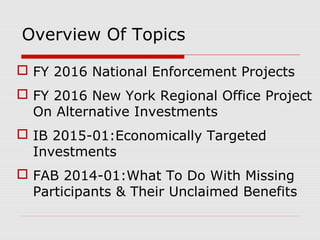

- 1. Overview Of Topics FY 2016 National Enforcement Projects FY 2016 New York Regional Office Project On Alternative Investments IB 2015-01:Economically Targeted Investments FAB 2014-01:What To Do With Missing Participants & Their Unclaimed Benefits

- 2. National Enforcement Projects (FY 2016) Contributory Plans Criminal Project (CPCP) Health Benefits Security Project (HBSP) Rapid ERISA Action Team (REACT) Employee Stock Ownership Plans (ESOPs) Plan Investment Conflicts Project (PIC) Pilot Projects • Prohibited Persons Pilot Project • Audit Deficiency Pilot Project (ADPP)

- 3. National Enforcement Projects (FY 2016) Contributory Plans Criminal Project: In more egregious situations, EBSA will call upon federal and state prosecutors to prosecute crimes against contributory plans (retirement and health plans).

- 4. National Enforcement Projects (FY 2016) Contributory Plans Criminal Project: • Employers may convert employee payroll contributions for their own personal use or to pay business expenses. • Unscrupulous service providers may target these plans for their own personal benefit and profit. • Employee accounts can be susceptible to theft by internal employees or third parties who may steal from these accounts by using identity theft and tampering with personal records.

- 5. National Enforcement Projects (FY 2016) Contributory Plans Criminal Project: • Misuse of employee contributions may result in unpaid health benefits or insurance premiums, leaving workers without medical coverage. • When employers or other parties keep employee payroll contributions intended for 401(k) plans, they deprive workers of their earned retirement savings. • Many of these investigations have led to successful prosecutions by the Department of Justice as well as state and local prosecutors.

- 6. National Enforcement Projects (FY 2016) Health Benefits Security Project: • Covers group health plans and their service providers. • EBSA hopes to obtain monetary recoveries and global corrections of problematic practices or plan terms that run afoul of ERISA. • Investigations are conducted at both the plan level and service provider level.

- 7. National Enforcement Projects (FY 2016) Health Benefits Security Project: • Plan-Level Investigations – Group health plans are reviewed for compliance with all applicable ERISA provisions unless extenuating circumstances prevent a full investigation. • These investigations will include medical benefit MEWAs and criminal cases involving health fraud.

- 8. National Enforcement Projects (FY 2016) Health Benefits Security Project: • Service Provider Investigations – these investigations are focused on specific investigative issues based on information gathered before the case is opened (i.e., specific information suggesting potential for systemic violations). • EBSA may pursue ERISA violations to the extent a service provider, acts as a plan fiduciary by exercising discretionary authority or control over plan administration, plan management, or plan assets. This includes a health insurance issuer that exercises discretion/control over benefit claim decisions.

- 9. National Enforcement Projects (FY 2016) Health Benefits Security Project: • Multiple Employer Welfare Arrangements (MEWAs)– MEWAs will be reviewed for compliance with all applicable ERISA provisions. • Regional offices are alert for opportunities to use the MEWA enforcement provisions in the Affordable Care Act. • Cease and desist orders • Seizure provisions

- 10. National Enforcement Projects (FY 2016) Health Benefits Security Project: • The goal is to complete substantive reviews. • Will frequently require on-site investigation, a review and/or audit of claims procedures, and interviews on the administration of health plans by service providers.

- 11. Case Examples A large self-insured group health plan had an annual limit on preventive care, which is not in compliance with PHSA 2711- Annual and Lifetime limit rules under the Affordable Care Act.

- 12. Case Examples Health Benefits Security Project: • A large group health plan offered fully-insured and self-insured benefit packages. • The plan was not following plan terms for reimbursement of out-of network providers, which could cause participants to be over-billed by million dollars. • Also, plan had multiple ERISA Part 7 violations, including an impermissible smoker surcharge that did not meet the wellness program criteria, which resulted in participants paying millions of dollars more than should have.

- 13. Case Examples Health Benefits Security Project: • A large self-insured group health plan administered benefit claims in-house and failed to properly administer and communicate the Plan’s exclusion of benefits for illnesses or injuries due to actions of a third party that may be liable for such expenses.

- 14. Case Examples Health Benefits Security Project: • The plan did not comply with the claims procedure regulations, resulting in disparate treatment among similarly situated participants, untimely claims adjudication, and inadequate notice of claims denials. • Also, several Part 7 violations, including a pre- existing condition exclusion, Mental Health Parity violations, and failure to cover required preventive services.

- 15. Case Examples Health Benefits Security Project: • EBSA received complaints from area hospitals and participants that emergency service claims were being denied arbitrarily by a third party administrator to a plan. Also, this third party administrator charged undisclosed fees to plans for laboratory services.

- 16. Case Examples Health Benefits Security Project: •Finally, a large Taft-Hartley plan had as much as 100 million dollars in outstanding claims. The findings demonstrated claims processing issues. Creditors are pursuing participants for unpaid claims and providers are starting to require up-front payments for services. This resulted in some participants delaying treatment due to financial hardship.

- 17. National Enforcement Projects (FY 2016) Health Benefits Security Project: • Transition from small plan-level cases to larger plans and service provider cases. • Look at claims administration by large self- insured plans and service providers to ensure health benefit claims are being properly paid.

- 18. National Enforcement Projects (FY 2016) Health Benefits Security Project: •This would include a review of claims data to determine: • Compliance with plan terms on cost sharing and reimbursement rates • Compliance in the timing of claims adjudication and appeals requirements. • Flaws in the claims processing system – systemic errors • Compliance with external review requirements

- 19. National Enforcement Projects (FY 2016) Health Benefits Security Project: •Part 7 compliance with special focus on loss of grandfather status. If grandfather status is lost, then review Affordable Care Act requirements that are applicable to non-grandfathered plans: • Coverage of all recommended preventive services without cost sharing. • Emergency department services • Choice of primary care physician • Enhanced claims and appeal requirements • External review

- 20. National Enforcement Projects (FY 2016) Health Benefits Security Project: •Review third party administrators (TPAs) that provide administrative services and claims administration services to large self-insured plans to determine whether there are: • Conflicts of interest – whether the TPA offers other services to the plan which incentivizes improper claims adjudication (e.g. stop loss coverage). • Hidden or undisclosed fees • Wellness Programs/Case Management Services provided by the TPA – is there any discrimination based on a health factor.

- 21. National Enforcement Projects (FY 2016) Rapid ERISA Action Team (REACT): • Due to the potential impact on employee benefit plans, there is a need for early intervention in companies that have severe financial hardships. • Evaluate the risks posed to a plan: • unnecessary delay of plan administration, • abandonment by responsible plan fiduciaries, • failure to locate missing participants, • misuse of plan assets for non-plan expenses.

- 22. National Enforcement Projects (FY 2016) Employee Stock Ownership Plans (ESOPs): • Increase focus on ESOP valuation cases. • Each ESOP investigation with a stock purchase or sale within the statute will be examined for valuation issues. • EBSA has contracted with a valuation expert for certain ESOP cases.

- 23. National Enforcement Projects (FY 2016) Employee Stock Ownership Plans (ESOPs): •Compliance project will continue to evaluate whether ESOP appraisals have improved as a result of EBSA’s recent ESOP enforcement actions. •EBSA will examine ESOPS for any complex issues like ESOP refinancing, indemnification and diversification.

- 24. National Enforcement Projects (FY 2016) Plan Investment Conflicts Project (PIC) • Succeeds Fiduciary Service Provider Compensation Project by expanding cases to include the investigation of plan asset vehicles. • Focus on inherent conflicts in plan asset vehicles • Allow EBSA to maintain a strong enforcement presence in the regulated financial community.

- 25. National Enforcement Projects (FY 2016) Plan Investment Conflicts Project (PIC)- • Continue with service provider and plan level cases, looking at 12(b)(1) fee offset failures or revenue sharing, non-compliance with plan guidelines and prohibited transactions. • Alert national office to Breakage Compensation cases to ensure corrective action is consistent with developing policies. • Investigate 408(b)(2) and 404(a)(5) disclosure violations and seek global correction when applicable. • Pursue service provider conflicts of interest that lead to fiduciary service providers setting their own compensation

- 26. National Enforcement Projects (FY 2016) Prohibited Persons Pilot Project (PPPP) - • Introduced in FY 2014 as a means of protecting plans from individuals disqualified to serve as plan fiduciaries pursuant to ERISA Section 411. • Section 411 bars individuals convicted of a range of state and federal crimes from serving in specified roles in relation to employee benefit plans for up to 13 years. • Transitioning from a pilot project to a monitoring program.

- 27. National Enforcement Projects (FY 2016) Prohibited Persons Pilot Project (PPPP) - • Regional office will conduct periodic reviews on people who are disqualified under Section 411 as a standard component of field enforcement work. • Will determine the feasibility of posting information about disqualified persons on EBSA’s public website.

- 28. National Enforcement Projects (FY 2016) Audit Deficiency Pilot Project - • It seeks to identify a nexus between deficient plan audits and fiduciary violations. • Geared to recommend and implement changes in procedures that increase EBSA identification of violations through reviews of Form 5500 and audits. • Will review due diligence in the hiring and monitoring of the plan auditor.

- 29. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project - • Twofold objective: • To determine whether plan level fiduciaries and service providers properly selected and monitored hard to value alternative investments in the portfolio. • To determine whether investment advisors & managers are properly valuing the plan’s hard to value assets and, as appropriate, expand the investigation to obtain global correction for all of a service provider’s ERISA clients.

- 30. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project - • Was the alternative investment permitted by plan documents; • Was it a prudent investment for the plan; • Did fiduciaries take into consideration the qualifications of the alternative investment manager.

- 31. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project - • Did fiduciaries take into consideration: • The liquidity needs of the plan; • The riskiness of the investment; and • The effect the investment would have on the diversity of the Plan’s assets.

- 32. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project - • Investigation will review whether fiduciaries determined the current value of the alternative investments and whether investments were overvalued, causing the plan to pay higher than necessary asset management, custody, or incentive fees.

- 33. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project - • Investigate fees paid to purchase and maintain ownership of the alternative investments, the expenses deducted from the asset value of the alternative investment, and whether the investment arrangements meet the disclosure requirements of ERISA section 408(b)(2).

- 34. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project – • Includes a review for the following: • Party in interest transactions, • Self-dealing, • Fiduciaries acting on behalf of parties with interests adverse to the plan, and • Kickbacks.

- 35. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project - • Ensure alternative investments are titled in the name of the plan. • In those instances where an investment manager or advisor is compensated by the assets under management (AUM) and internally values the hard to value investments, the DOL will determine whether the valuation procedures are prudent and free of impermissible conflicts of interest.

- 36. Regional Enforcement Project (FY 2016) Alternative Investments/Valuation Project – • Ensure valuation procedures are rigorous and free of undue influence from individuals or entities whose compensation is based on the amount of the AUM. • Asset managers maybe incentivized to overvalue assets and/or cause plans to pay higher than necessary fees.

- 37. Interpretive Bulletin 2015-1: Economically Targeted Investments Provides guidance on the investment duties of plan fiduciaries under ERISA when considering economically targeted investments (ETIs) and investment strategies that take into account environmental, social and governance (ESG) factors.

- 38. Interpretive Bulletin 2015-1: Economically Targeted Investments The DOL previously addressed issues related ETI’s in 1994 (IB 94-1) and in 2008 (IB 2008-1). In IB 94-1, the objective was to correct popular misconception that ETI’s were incompatible with ERISA’s fiduciary obligations.

- 39. Interpretive Bulletin 2015-1: Economically Targeted Investments The requirements of ERISA sections 403 and 404 do not prevent plan fiduciaries from investing plan assets in ETI’s if: The ETI has an expected rate of return that is commensurate to rates of return of alternative investments with similar risks characteristics that are available to the plan, and The ETI is otherwise an appropriate investment for the plan in terms of such factors as diversification and the investment policy of the plan (all things being equal).

- 40. Interpretive Bulletin 2015-1: Economically Targeted Investments The DOL has consistently stated that ERISA plan trustees or other investing fiduciaries may not use plan assets to promote social, environmental, or other public policy causes at the expense of the financial interests of plan participants and beneficiaries in receiving their promised benefits. A fiduciary may not accept lower expected returns or take on greater risks in order to secure collateral benefits.

- 41. Interpretive Bulletin 2015-1: Economically Targeted Investments In 2008, IB 2008-01 replaced IB 94-1. IB 2008-01 did not alter the basic legal principles set forth in IB 94-1. IB 2008-01 stated that its purpose was to clarify that fiduciary consideration of collateral, non- economic factors in selecting plan investments should be rare and, when considered, should be documented in a manner that demonstrates compliance with ERISA’s fiduciary standards.

- 42. Interpretive Bulletin 2015-1: Economically Targeted Investments Since its publication, IB 2008-01 may have unduly discouraged fiduciaries from considering ETI’s and environmental, social and governance factors. This is even where fiduciaries looked solely at the economic benefits of ETI’s to identify economically superior investments which were better than other types of investments.

- 43. Interpretive Bulletin 2015-1: Economically Targeted Investments In an effort to correct the misperceptions that followed the publication of IB 2008-01, the DOL withdrew IB 2008-01 and replaced it with IB 2015- 01, which reinstated the language of IB 94-01. IB 2015-01 does not supersede the “investment duties” in 29 CFR section 2550.404a-1, nor does it address any issues that may arise in connection with the prohibited transaction provisions of ERISA.

- 44. Interpretive Bulletin 2015-1: Economically Targeted Investments Fiduciaries may invest in ETI’s so long as the investment is appropriate for the plan and economically and financially equivalent to other potential investments with respect to the plan’s investment objectives, return, risk, and other financial attributes.

- 45. Interpretive Bulletin 2015-1: Economically Targeted Investments Acknowledges that ESG factors may have a direct relationship to the economic and financial value of the plans’ investment. In such instances, the ESG issues may be a component of the fiduciary’s primary analysis of the economic merits of competing investment choices. When a fiduciary prudently concludes that an investment is justified based solely on the economic merits of the investment, there is no need to evaluate the collateral goals as tie-breakers.

- 46. Interpretive Bulletin 2015-1: Economically Targeted Investments According to the Interpretive Bulletin, a fiduciary may address ETI’s or incorporate ESG factors in investment policy statements, or integrate ESG related tools, metrics and analysis to evaluate an investment’s risk or return or choose among otherwise equivalent investments. Fiduciaries may consider whether and how potential investment managers look at ETIs or use ESG criteria in their investment practices.

- 47. Interpretive Bulletin 2015-1: Economically Targeted Investments Nonetheless, fiduciaries must reasonably conclude that the investment manager’s practices in selecting investments are consistent with ERISA and the principles in IB 2015-01.

- 48. Interpretive Bulletin 2015-1: Economically Targeted Investments ETI’s are not inherently suspect or in need of special scrutiny merely because they take into consideration ESG factors. No special documentation is presumptively required for such investments. But, fiduciaries responsible for investing plan assets should maintain records sufficient to demonstrate compliance with ERISA’s fiduciary provisions.

- 49. FAB 2014-01: Fiduciary Duties & Missing Participants In Terminated Defined Contribution Plans Replaces Field Assistance Bulletin 2004-02 Describes how fiduciaries of terminated defined contribution plans can fulfill their obligations under ERISA in, Locating missing participants or unresponsive participants Distributing participant’s account balance

- 50. FAB 2014-01 Background Upon termination of a plan, a fiduciary must notify participants and distribute benefits. Usually first class mail or electronic notice compliant with 29 CFR section 2520.104b-1 will be adequate. If there is no response from the participant, the fiduciary must take steps to locate the participant or beneficiary.

- 51. FAB 2014-01 FAB 2014-01 was created to reflect the changes that have occurred since FAB 2004-02 (including both the IRS and SSA discontinuing their letter forwarding programs for locating missing participants). There are now free or low cost Internet search tools and services that can be used to locate missing participants and beneficiaries. FAB 2014-01 also helps fiduciaries properly discharge their obligations to these missing participants.

- 52. FAB 2014-01 Required Search Steps Plan fiduciaries should take all of the following steps (not in any order) before abandoning efforts to find a missing participant or beneficiary and obtain distribution instructions: Use Certified Mail Check Related Plan and Employer Records Check With Designated Plan Beneficiary Use Free Electronic Search Tools

- 53. FAB 2014-01 Required Search Steps Use Free Electronic Search Tools: Plan fiduciaries must make reasonable use of Internet search tools that do not charge a fee to search for a missing participant or beneficiary. Such online services include the following: Internet Search Engines Public Record Databases (licenses, mortgages, etc.) Obituaries Social Media

- 54. FAB 2014-01 Additional Search Steps If plan administrator follows required search steps but does not find missing participant or beneficiary, should consider if additional search steps are appropriate. A plan fiduciary should consider the size of a participant’s account balance and the cost of further search efforts in deciding if any additional search steps are appropriate. Specific additional search steps will depend on the facts and circumstances.

- 55. FAB 2014-01 Additional Search Steps Possible additional search steps include: Internet Search Tools Commercial Locator Services Credit Reporting Agencies Information Brokers Investigation Databases Similar Services That May Involve Charges

- 56. Locating Missing Participants Governed By ERISA Fiduciary Requirements Plan fiduciaries must be able to demonstrate compliance with ERISA’s fiduciary standards for all decisions made to locate missing participants and distribute benefits on their behalf.

- 57. Costs Associated With Locating Missing Participants A plan fiduciary may charge missing participants’ accounts reasonable expenses for efforts to find them. The method of allocating the expense must be consistent with the terms of the plan and the plan fiduciary’s duties under ERISA.

- 58. Vesting Upon Plan Termination IRC 411(d)(3) states that upon termination or complete discontinuance of contributions, benefits accrued become vested to the extent funded on such date.

- 59. Distributions After Plan Termination The plan administrator must distribute all plan assets as soon as administratively feasible after plan termination.

- 60. Distributing the Account After a plan fiduciary reasonably determines that a participant or beneficiary cannot be located, the fiduciary may distribute the missing participant’s or beneficiary’s benefits in the manner described in FAB 2014-01. A plan fiduciary’s choice of a distribution option for a missing participant’s account balance is also a fiduciary decision subject to the general fiduciary responsibility provisions of ERISA.

- 61. FAB 2014-01 Distribution Options If after due diligence a participant cannot be located, plan fiduciaries will have no choice but to select an appropriate distribution option to complete the plan’s termination.

- 62. FAB 2014-01 Distribution Options To An Individual Retirement Plan Preferred Distribution Option ERISA Section 404(a) requires plan fiduciaries to consider distributing missing participant benefits into individual retirement plans (i.e., an individual retirement account or annuity). An individual retirement plan is more likely to preserve funds for retirement than any other option.

- 63. FAB 2014-01 Eligible Rollover Distribution A distribution that qualifies as an eligible rollover distribution from a qualified plan, which is handled by a trustee to trustee transfer into an individual retirement plan, will avoid immediate taxation. Avoid 20% mandatory withholding. Avoid any 10% additional tax for early distributions that might otherwise apply based on the participant’s age and other related facts. Plan funds grow tax free and income taxes are paid only when funds are withdrawn.

- 64. FAB 2014-01 Fiduciary Decisions Selecting an individual retirement plan trustee, custodian or issuer to receive the distribution. Choice of an initial investment in the individual retirement plan.

- 65. FAB 2014-01 Distribution Safe Harbor, 29 C.F.R. §2550.404a-2 In general, the automatic rollover safe harbor applies to distributions of $5,000 or less for participants who leave an employer’s workforce without electing to receive either a taxable cash distribution or directly rollover assets into an individual retirement plan or another qualified plan.

- 66. FAB 2014-01 Expanded Distribution Safe Harbor In 2006, section 2550.404a-3 was added clarifying that the regulation covers distributions from terminated defined contribution plans on behalf of missing participants/beneficiaries into an individual retirement plan or inherited retirement plan.

- 67. FAB 2014-01 Distribution Options When a fiduciary complies with the conditions of the safe harbor, a fiduciary satisfies its ERISA 404(a) duties in: The distribution of benefits; The selection of an individual retirement plan provider; and The investment of the distributed funds including: Must choose appropriate investment products designed to preserve principal, where fees and expenses are not excessive when compared to other individual retirement plans offered by the provider.

- 68. FAB 2014-01 Alternative Distribution Options If an individual retirement plan is unavailable or imprudent based on the facts and circumstances, the fiduciary may consider two other options: Opening an interest-bearing federally insured bank account in the name of the missing participant or beneficiary, or Transferring the account balance to a state unclaimed property fund.

- 69. FAB 2014-01 Alternative Distribution Caveats Before making a decision, the fiduciary must prudently conclude that such a distribution is appropriate despite the potential considerable adverse tax consequences to the plan participant. Unlike tax-free rollovers into an IRA account, the funds transferred to a bank account or state unclaimed property fund generally are subject to income taxes, mandatory income tax withholding and a possible additional tax for premature distributions. Consequently, there would be less money for retirement.

- 70. FAB 2014-01 Alternative Distribution Caveats Any interest that accrues after the transfer is generally taxable upon accrual (unless, the interest is subject to special favorable taxation rules, such as rules for interest earned from investment in state bonds or U.S. savings bonds). In most cases, a fiduciary would violate its obligations of prudence and loyalty by causing such negative consequences (in the absence of compelling offsetting considerations) rather than making an individual retirement plan rollover distribution.

- 71. FAB 2014-01 Other Distribution Options Federally Insured Bank Accounts: Plan fiduciaries may consider establishing an interest bearing federally insured bank account in the name of the missing participant, as long as the participant would have an unconditional right to withdraw funds from the account. In selecting a bank and accepting an initial interest rate, with or without a guarantee period, a plan fiduciary must give appropriate consideration to all available information about the bank and interest rate, including any bank charges.

- 72. FAB 2014-01 Other Distribution Options State Unclaimed Property Funds: Plan fiduciaries may also consider transferring /escheating missing participants’ account balances to state unclaimed property funds in the state of each participant’s last known residence or work location. Usually these state unclaimed property funds pay minimal interest. However, often states provide searchable internet databases that list the names of property owners. Any transfers to state unclaimed property funds must comply with state law requirements.

- 73. FAB 2014-01 Other Distribution Options In deciding between distribution into a federally insured bank account and distribution into a state unclaimed property fund, the plan fiduciary should consider the features of each option. For a bank account, this includes reviewing any bank fees, such as charges for establishing and maintaining the account, along with any interest payable on the account’s funds. For a state unclaimed property fund, a fiduciary should look at the availability of a searchable database maintained by the state, which may help participants find their retirement funds, and any interest payable by the state.

- 74. FAB 2014-01 Unacceptable Distribution Option 100% Income Tax Withholding: This would be in effect transferring 100% of a missing participant’s benefit to the IRS. This option is not in the best interest of participants and beneficiaries and would violate ERISA’s fiduciary requirements. Does not necessarily result in crediting of the withheld amount against the missing participant’s income tax liabilities. Therefore, participants may not receive the benefit and this method should not be used.

- 75. FAB 2014-01 - Issues with the USA PATRIOT ACT and Establishment of Retirement or Bank Accounts Perceived conflicts with the customer identification and verification provisions (CIP) of the USA PATRIOT ACT; The CIP provisions establish standards for financial institutions to verify the identity of customers who open accounts. Federal regulators have issued helpful guidance for fiduciaries: “FAQS:Final CIP Rule” at www.fincen... and www.fdic...

- 76. FAB 2014-01 Issues With The USA PATRIOT ACT and CIP The Federal regulators have told the DOL that they interpret the Act’s CIP compliance requirements to apply only at the time a former participant or beneficiary first contacts the financial institution to claim ownership or exercise control over the account.

- 77. FAB 2014-01 Miscellaneous Issues Issues caused by the application of state laws, including those governing signature requirements and escheat are beyond DOL’s jurisdiction.

- 78. FAB 2014-01 In Summary The fiduciary responsibility provisions of ERISA govern actions taken by plan administrators to implement a plan sponsor’s decision to terminate a plan. These actions include the search for missing participants, and if search efforts fail, the selection of a distribution option for the benefits of missing participants. There are certain steps fiduciaries must take to locate missing participants. When required steps fail, the fiduciary should consider the size of the account balance and cost of further search efforts when determining how to proceed.

- 79. Result of Distribution Once a plan fiduciary properly distributes the entire benefit to which a missing participant is entitled, the distribution ends the individual’s status as a participant covered under the plan and the distributed assets are no longer plan assets under ERISA. If the distributed benefit is reduced due to a fiduciary breach, the individual will still have standing to file suit against the breaching fiduciary under section 502(a)(2) of ERISA.

- 80. Questions