More Related Content

Similar to P75 axa

Similar to P75 axa (20)

Mod 3 Part 6 2-IN-ONE Savings and SPInv Plan as at Oct2014

Mod 3 Part 6 2-IN-ONE Savings and SPInv Plan as at Oct2014

More from Brian Boyd

More from Brian Boyd (20)

Metlife Guaranteed funds Assets since launch 18Oct15-4

Metlife Guaranteed funds Assets since launch 18Oct15-4

Income reward sales aid 1412 ukv5 income1_v10_final-2

Income reward sales aid 1412 ukv5 income1_v10_final-2

P75 axa

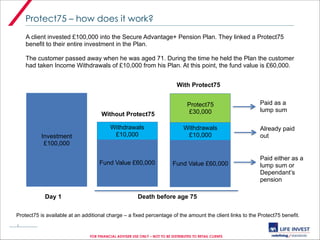

- 1. Protect75 – how does it work? !1 FOR FINANCIAL ADVISER USE ONLY – NOT TO BE DISTRIBUTED TO RETAIL CLIENTS A client invested £100,000 into the Secure Advantage+ Pension Plan. They linked a Protect75 benefit to their entire investment in the Plan. ! The customer passed away when he was aged 71. During the time he held the Plan the customer had taken Income Withdrawals of £10,000 from his Plan. At this point, the fund value is £60,000. Investment £100,000 Fund Value £60,000 Fund Value £60,000 Withdrawals £10,000 Withdrawals £10,000 Protect75 £30,000 Day 1 Death before age 75 Without Protect75 With Protect75 Paid as a lump sum Already paid out Paid either as a lump sum or Dependant’s pension Protect75 is available at an additional charge – a fixed percentage of the amount the client links to the Protect75 benefit.