HOUSTON INDUSTRIAL MARKET

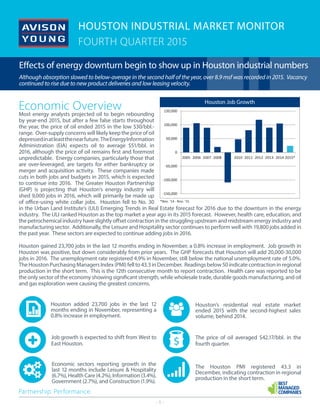

- 1. - 1 - HOUSTON INDUSTRIAL MARKET MONITOR FOURTH QUARTER 2015 Partnership. Performance. Economic Overview Most energy analysts projected oil to begin rebounding by year-end 2015, but after a few false starts throughout the year, the price of oil ended 2015 in the low $30/bbl.- range. Over-supply concerns will likely keep the price of oil depressedinatleastthenearfuture.TheEnergyInformation Administration (EIA) expects oil to average $51/bbl. in 2016, although the price of oil remains first and foremost unpredictable. Energy companies, particularly those that are over-leveraged, are targets for either bankruptcy or merger and acquisition activity. These companies made cuts in both jobs and budgets in 2015, which is expected to continue into 2016. The Greater Houston Partnership (GHP) is projecting that Houston’s energy industry will shed 9,000 jobs in 2016, which will primarily be made up of office-using white collar jobs. Houston fell to No. 30 in the Urban Land Institute’s (ULI) Emerging Trends in Real Estate forecast for 2016 due to the downturn in the energy industry. The ULI ranked Houston as the top market a year ago in its 2015 forecast. However, health care, education, and the petrochemical industry have slightly offset contraction in the struggling upstream and midstream energy industry and manufacturing sector. Additionally, the Leisure and Hospitality sector continues to perform well with 19,800 jobs added in the past year. These sectors are expected to continue adding jobs in 2016. Houston gained 23,700 jobs in the last 12 months ending in November, a 0.8% increase in employment. Job growth in Houston was positive, but down considerably from prior years. The GHP forecasts that Houston will add 20,000-30,000 jobs in 2016. The unemployment rate registered 4.9% in November, still below the national unemployment rate of 5.0%. TheHoustonPurchasingManagersIndex(PMI)fellto43.3inDecember. Readingsbelow50indicatecontractioninregional production in the short term. This is the 12th consecutive month to report contraction. Health care was reported to be the only sector of the economy showing significant strength, while wholesale trade, durable goods manufacturing, and oil and gas exploration were causing the greatest concerns. *Nov. '14 ‐ Nov. '15 Houston Job Growth ‐150,000 ‐100,000 ‐50,000 0 50,000 100,000 150,000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015* Houston added 23,700 jobs in the last 12 months ending in November, representing a 0.8% increase in employment. Job growth is expected to shift from West to East Houston. Economic sectors reporting growth in the last 12 months include Leisure & Hospitality (6.7%), Health Care (4.2%), Information (3.4%), Government (2.7%), and Construction (1.9%). Houston’s residential real estate market ended 2015 with the second-highest sales volume, behind 2014. The price of oil averaged $42.17/bbl. in the fourth quarter. The Houston PMI registered 43.3 in December, indicating contraction in regional production in the short term. Houston Job Growth Effects of energy downturn begin to show up in Houston industrial numbers Although absorption slowed to below-average in the second half of the year, over 8.9 msf was recorded in 2015. Vacancy continued to rise due to new product deliveries and low leasing velocity.

- 2. - 2 - 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% YE09 YE10 YE11 YE12 YE13 YE14 YE15 Vacancy Rates Houston Industrial Market Monitor Fourth Quarter 2015 NOTABLE FOURTH QUARTER ACTIVITY: • City Park East, located in the Northeast submarket, recorded significant renewals in the fourth quarter. Exel, a logistics and supply chain company, renewed its lease totaling 906,339 sf and Michelin Tire renewed its 663,821-sf lease. • Fedex announced plans to open a new 800,000-sf ground facility in the Northwest submarket, located off of the Grand Parkway expansion. It will be Fedex’s largest ground facility in Texas with an estimated completion date of August 2017. • Dunavant, a logistics and supply chain company, preleased two buildings totaling 565,760 at Bay Area Business Park Phase II. The company additionally leases 365,000 sf in Phase I of the park. • GE Oil and Gas renewed its 261,990-sf lease at Port North West in the Northwest submarket. • Jacobson Warehouse Co. renewed its 210,000-sf lease at Williamsport DC in the Southeast submarket. Industrial Market Overview The effects of the energy downturn began to show up in the Houston industrial numbers in the fourth quarter. Although positive, absorption slowed in the second half of 2015. The fourth quarter was the first time since 2011 when quarterly absorption registered less than one million square feet. However, over 8.9 msf was absorbed in 2015, the most to occur since 2008. Vacancy continued to slowly increase. However, the industrial market experienced years of supply struggling to meet demand, resulting in an incredibly tight market with sound fundamentals. Vacancy still ranks among some of the lowest in the U.S. Asking rates appreciated substantially through much of 2015, but asking rate growth stalled in the fourth quarter. Leasing activity is down by 38% from 2014. A large percentage of these leases are renewals, rather than expansion in the market. Leasing activity isn’t expected to pick up in the near future, which will affect absorption going forward. Houston’s industrial development pipeline has remained conservative and is well pre-leased, which will dampen the effect of new space hitting the market. ABSORPTION & DEMAND Absorption continued to slow in the fourth quarter, indicating that the industrial market is starting to feel the impact from falling oil prices. Over 28.0 msf was leased in 2014, one of the most active years on record (this includes renewals). The strong leasing activity in 2014 resulted in substantial space gains throughout the first half of 2015. For the first time since 2011, the Houston industrial market recorded less than one million square feet of quarterly net absorption. The market absorbed 869,200 sf in the fourth quarter, totaling over 8.9 msf at year-end 2015. This is the most yearly absorption to be recorded since 2008. 4Q15 marks the 20th consecutive quarter of positive net absorption, 17 quarters of which Houston absorbed over one million square feet. Submarkets that recorded negative net absorption in the fourth quarter include the Northwest (-335,689 sf), CBD Inner Loop (-152,704 sf), and the Northeast (-56,409 sf). The Southeast submarket led Houston in absorption in the fourth quarter with 630,844 sf. All submarkets recorded yearly positive absorption. 2015 leasing activity is down by 38% compared $‐ $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 YE09 YE10 YE11 YE12 YE13 YE14 YE15 Asking Rents 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 YE09 YE10 YE11 YE12 YE13 YE14 YE15 Net Absorption

- 3. - 3 - with 2014, which will impact absorption in 2016. VACANCY & AVAILABILITY New deliveries outpaced absorption in the fourth quarter, causing vacancy to increase by 40 basis points to 4.6%. This still ranks among some of the lowest vacancies in the U.S. Vacancy registered 4.3% at this point last year. With vacancy at historically-low levels, it will take time for the market as a whole to feel the impact of low leasing velocity. Vacancy is expected to slowly increase in 2016, particularly in the North and Northwest submarkets where a high concentration of manufacturing, warehouse, and distribution properties that serve Houston’s upstream, midstream, and service companies are located. Vacancy in the Northwest submarket increased by 50 basis points from the previous quarter to 5.0%. The North submarket has the highest vacancy in Houston, registering 7.2% in the fourth quarter. Vacancy in the Southeast is up by 50 basis points from the previous quarter but remains low at 3.3%. ASKING RATES Aftersignificantappreciationthroughout2015,askingrates began to level out in the fourth quarter. Asking rates are expected to remain relatively flat throughout 2016. Asking rates decreased by $0.03 per square foot (psf) from the previous quarter to $6.42 psf NNN. Year-over-year, asking rates have increased by 9.7%. The rental rate appreciation in 2015 was experienced across the different Houston geographic sectors to varying degrees. In the Southeast market, where industrial properties are benefitting from the downstream petrochemical boom, rental rate growth has been substantial with an increase of 5.2% from the previous quarter. Most notably, this is a submarket that has been plagued by years of high vacancy and negative rental rate growth. Asking rates fell in the Northwest and Southwest submarkets from the previous quarter by 1.8% and 3.4%, respectively. Even though asking rates fell in the Northwest, it continues to be the most expensive submarket in Houston with an asking rate of $7.64 psf. CONSTRUCTION Construction activity tapered off slightly in the fourth quarter with 9.1 msf underway. Daikin Industries, a major HVAC manufacturer, broke ground on its 4-msf campus in the Northwest in 2015. The new development accounts for nearly 45% of total industrial construction in Houston. The company is consolidating operations at the new location which is set to deliver in mid-2016. Although energy service companies and manufacturers (both heavily located in the Northwest) are dampening new development, supply and logistics companies are drawn to the area due to the Grand Parkway, Houston’s new third major highway loop. Fedex announced that it will open a new 800,000-sf facility in Cypress, located off of the Grand Parkway expansion. It will be Fedex’s largest ground facility in Texas and will employ 400 people. The new facility has an estimated completion date of August 2017. Construction activity in the Southeast submarket increased significantly in 2015. Over 2.2 msf delivered in 2015 with another 1.8 msf currently under construction. Bay Area Business Park Phase 2 broke ground in 2015, consisting of four buildings totaling 830,000 sf. When Phase 2 is complete, the park will total more than 2.0 msf, making it the largest park in the Southeast. The development is capitalizing on the surge in petrochemical activity with two of the buildings able to handle hazardous materials. The new phase broke ground on Houston Industrial Market Monitor Fourth Quarter 2015 Houston Industrial Development Timeline 0 2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000 14,000,000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD Delivered YE Under Construction

- 4. - 4 - Tenant Name Building Submarket Square Feet Exel City Park East Northeast 906,339 Michelin Tire City Park East Northeast 663,821 Dunavant Bay Area Business Park Southeast 565,760 Jeannie Tobin, Research Director 512.913.4438 jeannie.tobin@avisonyoung.com For more information: Largest Houston Transactions ©2016 Avison Young Texas, LLC. All rights reserved. avisonyoung.com THE INFORMATION CONTAINED HEREIN WAS OBTAINED FROM SOURCES BELIEVED RELIABLE; HOWEVER, AVISON YOUNG MAKES NO GUARANTEES, WARRANTIES OR REPRESENTATIONS AS TO THE COMPLETENESS OR ACCURACY THEREOF. THE PRESENTATION OF THIS PROPERTY IS SUBMITTED SUBJECT TO ERRORS, OMISSIONS, CHANGE OF PRICE, OR CONDITIONS, PRIOR TO SALE OR LEASE, OR WITHDRAWAL WITHOUT NOTICE. NOTABLE BUILDINGS UNDER CONSTRUCTION • Daikin Manufacturing & Distribution Center (4,000,000 sf). Northwest. • Bay Area Business Park Phase 2 (830,000 sf). Southeast. • Aldi Distribution Center (650,000 sf). Southwest. • Fallbrook 1 (500,400 sf). North. • Port 225 Building 4 (394,489 sf). Southeast. • 14151 E Hillcroft St Phase I (240,000 sf). Southwest. • FloWorks (225,000 sf). South. • Gateway Southwest Industrial Park Bldg. 2 (217,440 sf). Southwest. • Prologis Greens Parkway (213,218 sf). North. • Port 225 Building 6 (205,015 sf). Southeast. • Fallbrook 2 (193,000 sf). North. Houston Industrial Market Monitor Fourth Quarter 2015 Trends to Watch Employment: Houston added 23,700 jobs in the 12 months ending in November. Active Markets: Southeast, Northwest, North Market Drivers: Petrochemical Industry, Health Care, Retail a speculative basis but has leased quickly. Dunavant, a logistics and supply chain company, preleased 565,760 sf of Phase II. The company will occupy this space in addition to the 365,000 sf it leases in Phase I of the park. The Houston market delivered 10.6 msf of new space in 2015. 7.7msfwasdeliveredin2013and9.1msfwasdelivered in 2014. Despite the energy downturn, space in Houston’s industrial market remains very tight. The conservative development pipeline will add much needed space to alleviate the tight market and has yet to be overbuilt.