Bay Area Economic Profile Chapter 2

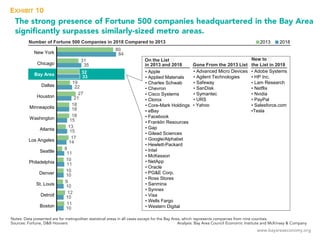

- 1. www.bayareaeconomy.org The strong presence of Fortune 500 companies headquartered in the Bay Area significantly surpasses similarly-sized metro areas. Number of Fortune 500 Companies in 2018 Compared to 2013 2013 2018 Detroit Los Angeles Boston Seattle Atlanta St. Louis Minneapolis Denver Washington Philadelphia Houston Dallas Bay Area Chicago New York 80 31 32 19 27 18 18 13 17 8 10 10 9 12 11 Gone From the 2013 List ▪ Advanced Micro Devices ▪ Agilent Technologies ▪ Safeway ▪ SanDisk ▪ Symantec ▪ URS ▪ Yahoo New to the List in 2018 ▪ Adobe Systems ▪ HP Inc. ▪ Lam Research ▪ Netflix ▪ Nvidia ▪ PayPal ▪ Salesforce.com ▪Tesla On the List in 2013 and 2018 ▪ Apple ▪ Applied Materials ▪ Charles Schwab ▪ Chevron ▪ Cisco Systems ▪ Clorox ▪ Core-Mark Holdings ▪ eBay ▪ Facebook ▪ Franklin Resources ▪ Gap ▪ Gilead Sciences ▪ Google/Alphabet ▪ Hewlett-Packard ▪ Intel ▪ McKesson ▪ NetApp ▪ Oracle ▪ PGE Corp. ▪ Ross Stores ▪ Sanmina ▪ Synnex ▪ Visa ▪ Wells Fargo ▪ Western Digital 84 35 33 22 21 18 15 15 14 11 11 10 10 10 10 EXHIBIT 10 Notes: Data presented are for metropolitan statistical areas in all cases except for the Bay Area, which represents companies from nine counties. Sources: Fortune, DB Hoovers Analysis: Bay Area Council Economic Institute and McKinsey Company

- 2. www.bayareaeconomy.org The Bay Area has strong industry diversification across its top-performing companies compared to other U.S. economic hubs. Houston New York Bay Area 2017 U.S. Fortune 500 Companies by Industry Energy Financials / Insurance Tech / Telecom / Media Others Consumer Products EXHIBIT 11 Notes: The Bay Area hub includes 17 cities: Cupertino, Dublin, Foster City, Fremont, Los Gatos, Menlo Park, Mountain View, Oakland, Palo Alto, Redwood City, San Jose, San Mateo, San Ramon, Santa Clara, San Francisco, South San Francisco, and Sunnyvale. Sources: Fortune, Capital IQ Analysis: Bay Area Council Economic Institute and McKinsey Company

- 3. www.bayareaeconomy.org The value of Bay Area Fortune 500 companies is concentrated in the tech sector. Four of the top ten global companies by market capitalization are headquartered in the Bay Area. Bay Area 890 769 543 309 269 209 201 195 97 95PayPal Gilead Wells Fargo Oracle Alphabet Intel Cisco Apple Visa Inc. Facebook Financials IT Healthcare Consumer Staples New York 96 162 101 IBM Phillip Morris Verizon Goldman Sachs Bristol-Myer 150 220 214 JP Morgan Pfizer 376 Chicago ORI TDS Jones Lang LaSalle Conagra Archer-Daniels Exelon Motorola UC Holdings LKQ Boeing Others Consumer Staples IT Telecom Consumer Discretionary FinancialsHealthcare Industrials Consumer Staples Consumer Disc. Telecom Real Estate Utilities IT Financials Market Capitalization Share by Industry / Top Ten Companies by Market Capitalization 100% = 2,983 USD billion 100% = 4,087 USD billion 100% = 205 USD billion Company Company Company 199 169 168 Citigroup Pepsico Mastercard USD billions USD billions USD billions 37 23 21 15 15 13 7 5 3 184 EXHIBIT 12 Sources: Capital IQ, 2017 PwC Global Top 100 Report Analysis: Bay Area Council Economic Institute and McKinsey Company

- 4. www.bayareaeconomy.org The Bay Area has seen rapid high-technology jobs growth since the Great Recession. EXHIBIT 13 Source: BLS Quarterly Census of Employment and Wages Analysis: Bay Area Council Economic Institute

- 5. www.bayareaeconomy.org The Bay Area’s San Jose Metropolitan Statistical Area has the highest concentration of high-technology jobs in the nation. Top Ten Concentrations of High-Technology Jobs by MSA, 2017 Location Quotient 0 0.5 1.0 1.5 2.0 2.5 AustinNew YorkLos AngelesAtlantaDenverHoustonBostonSan FranciscoSeattleSan Jose 1.59 1.49 1.11 1.09 1.02 0.97 0.87 0.83 2.40 1.77 EXHIBIT 14 Source: BLS Quarterly Census of Employment and Wages Analysis: Bay Area Council Economic Institute

- 6. www.bayareaeconomy.org The Bay Area’s three largest companies by market capitalization—Alphabet, Apple, and Facebook—have real estate footprints that span the region. EXHIBIT 15 Source: Tam Duoing, Jr. / San Francisco Chronicle / Polaris

- 7. www.bayareaeconomy.org Since 2011, the tech sector has represented more than 60% of sales from Fortune 500 companies in the Bay Area. EXHIBIT 16 Source: Fortune, Capital IQ Analysis: Bay Area Council Economic Institute and McKinsey Company

- 8. www.bayareaeconomy.org Ten disruptive Bay Area startups have valuations close to or greater than $4 billion, with 2017 or 2018 funding rounds closing at $425 million on average. EXHIBIT 17 Note: Valuation is based data accessed December 22, 2017. Source: Pitchbook Analysis: Bay Area Council Economic Institute and McKinsey Company Company Current Valuation USD Billion Latest Funding Round USD Million 1 2 3 4 5 6 7 8 10 9 4.4 3.8 11.5 5.1 4.0 9.2 10.0 31.0 12.3 68.0 400 500 500 600 100 250 150 350 150 448 ▪ ▪ 2017 or 2018 funding rounds across these 10 startups closed at $425 million on average. Privately-held companies like Uber and Airbnb are now valued higher than a significant number of companies on the Fortune 500 list.

- 9. www.bayareaeconomy.org The Bay Area attracts much of the nation’s venture capital investment, and deal size in the region is growing. EXHIBIT 18 Note: The Bay Area is defined as the San Francisco and Silicon Valley constituent MSAs. Sources: PwC MoneyTree Report Analysis: Bay Area Council Economic Institute and McKinsey Company

- 10. www.bayareaeconomy.org Since 2010, levels of venture capital investment in the Bay Area in six key sectors have greatly exceeded venture investment in the same sectors in other peer regions. 8,000 6,000 4,000 2,000 0 8,000 4,000 0 6,000 2,000 6,000 10,000 8,000 0 2,000 4,000 8,000 6,000 10,000 2,000 0 4,000 2013 20172010 20,000 0 30,000 10,000 10,000 20,000 15,000 0 25,000 5,000 Venture Capital Investment by Industry Vertical, 2010–2017 $ Millions FinTechBig Data Software as a Service AI and Machine Learning MobileLife Sciences 2013 20172010 2013 20172010 2013 20172010 2013 201720102013 20172010 Bay Area Boston Denver NYC Seattle EXHIBIT 19 Source: Pitchbook Analysis: Bay Area Council Economic Institute and McKinsey Company