UNIT 5

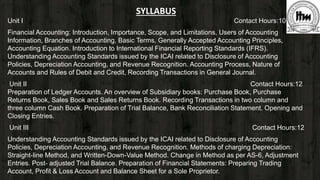

- 1. SYLLABUS Unit I Contact Hours:10 Financial Accounting: Introduction, Importance, Scope, and Limitations, Users of Accounting Information, Branches of Accounting, Basic Terms, Generally Accepted Accounting Principles, Accounting Equation. Introduction to International Financial Reporting Standards (IFRS). Understanding Accounting Standards issued by the ICAI related to Disclosure of Accounting Policies, Depreciation Accounting, and Revenue Recognition. Accounting Process, Nature of Accounts and Rules of Debit and Credit, Recording Transactions in General Journal. Unit II Contact Hours:12 Preparation of Ledger Accounts. An overview of Subsidiary books: Purchase Book, Purchase Returns Book, Sales Book and Sales Returns Book. Recording Transactions in two column and three column Cash Book. Preparation of Trial Balance, Bank Reconciliation Statement. Opening and Closing Entries. Unit III Contact Hours:12 Understanding Accounting Standards issued by the ICAI related to Disclosure of Accounting Policies, Depreciation Accounting, and Revenue Recognition. Methods of charging Depreciation: Straight-line Method, and Written-Down-Value Method. Change in Method as per AS-6, Adjustment Entries. Post- adjusted Trial Balance. Preparation of Financial Statements: Preparing Trading Account, Profit & Loss Account and Balance Sheet for a Sole Proprietor.

- 2. Unit IV Contact Hours:14 Understanding Contents of Financial Statements of a Joint Stock Company as per Companies Act 2013. Understanding the Contents of a Corporate Annual Report. Preparation of Cash Flow Statement as per AS-3 (Revised). Unit V Contact Hours:12 Analyzing Financial Statements: Objectives of Financial Statement Analysis, Sources of Information, Standards of Comparison, Techniques of Financial Statement Analysis: Horizontal Analysis, Vertical Analysis, and Ratio Analysis. Meaning and Usefulness of Financial Ratios, Analysis of Financial Ratios from the perspective of different Stakeholders like Investors, Lenders, and Short-term Creditors. Profitability Ratios, Solvency Ratios, Liquidity Ratios and Turnover Ratios, Limitations of Ratio Analysis.

- 3. 3

- 4. 4 ANALYSIS OF FINANCIAL STATEMENTS: Analysis of financial statements refers to the treatment of information contained in the financial statement in a way so as to afford a full diagnosis of the profitability and financial position of the firm concerned. The process of analyzing financial statements involves the rearranging, comparing and measuring the significance of financial and operating data. Interpretation, which follows analysis of financial statements, is an attempt to reach to logical conclusion regarding the position and progress of the business on the basis of analysis.

- 5. 5 OBJECTIVES OF FINANCIAL STATEMENT ANALYSIS: The analysis would enable the present and the future earning capacity and the profitability of the concern. The operational efficiency of the concern as a whole as well as department wise can be assessed. Hence the management can easily locate the areas of efficiency and inefficiency.

- 6. 6 The solvency of the firm, both short-term and long-term, can be determined with the help of financial statement analysis which is beneficial to trade creditors and debenture holders. The comparative study in regard to one firm with another firm or one department with another department is possible by the analysis of financial statements.

- 7. 7 SOURCES OF INFORMATION ON FINANCIAL STATEMENT ANALYSIS: The three main sources of information for financial analysis which we can easily access via the annual report of the Company are: Balance Sheet, Income Statement, And Cash Flow Statement.

- 8. 8 STANDARD FOR COMPARISON IN ANALYSIS: Standards for comparisons in analysis of Financial Statements include Intracompany—prior performance and relations between financial items for the company under analysis; Competitor—one or more direct competitors of the company; Industry—industry statistics; and Guidelines (rules of thumb)—general standards developed from past experiences and personal judgments.

- 9. 9 TECHNIQUES OF FINANCIAL STATEMENT ANALYSIS: The most common techniques of financial statement analysis are: Horizontal Analysis— comparing a company's financial condition and performance across time; Vertical Analysis—comparing a company's financial condition and performance to a base amount such as revenues or total assets; and Ratio Analysis—using and quantifying key relations among financial statement items.

- 10. 10 Horizontal Analysis: A horizontal analysis is a two-year comparison of analysis of the financial statements and its elements. It is also referred to as trend analysis, usually expressed in monetary terms and percentages. This comparison provides analysts with insight into the aspects that could contribute significantly to the financial position or profitability of the organization.

- 11. 11

- 12. 12 Vertical Analysis: Vertical analysis is a financial statement analysis technique in which every line items of the financial statements are listed as percentages, based on a figure within the financial statement. The line items on the income statement could be stated as percentages of the gross sales, while the line items on the balance sheet could be stated as percentages of the total assets or liabilities. And in case of cash flow, every inflow or outflow of cash could be stated as a percentage of total cash inflows.

- 13. 13

- 14. 14 Ratio Analysis: A ratio between two quantities is used for representing the relationships between different figures on the profit and loss account, balance sheet, cash flow statement or such other accounting records. It is a form of Financial Statement Analysis, used for obtaining a quick indication of the organization’s financial performance in various key areas.

- 15. 15 Users of Financial Ratios: Bankers and Lenders: Use profitability, liquidity and investment because they want to know the ability of the borrowing business in regular scheduled interest payments and repayments of principal loan amount. Investors: Use profitability and investment because they are more interested in profitability performance of business and safety & security of their investment and growth potential of their investment.

- 16. 16 Government: Use profitability because government may use profit as a basis for taxation, grants and subsidies. Employees: Use profitability, liquidity and activity because employees will be concerned with job security, bonus and continuance of business and wage bargaining.

- 17. 17 Customers: Use liquidity because customers will seek reassurance that the business can survive in the short term and continue to supply. Suppliers: Use liquidity because suppliers are more interested in knowing the ability of the business to settle its short-term obligations as and when they are due. Management: Use all ratios because management is interested in all aspects i.e., both financial performance and financial condition of the business.

- 18. 18 The importance and advantages of financial ratios are given below: Ratios help in analyzing the performance trends over a long period of time. They also help a business to compare the financial results to those of competitors. Ratios assist the management in decision making. They also point out problem and weak areas along with the strength areas. Ratios to help to develop relationships between different financial statement items. Ratios have the advantage of controlling for differences in size. For example, two businesses may be quite different in size but can be compared in terms of profitability, liquidity, etc., by the use of ratios.

- 20. 20

- 21. 21

- 22. 22

- 23. 23 Profitability Ratios: Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative to revenue, balance sheet assets, operating costs, and shareholders’ equity during a specific period of time. They show how well a company utilizes its assets to produce profit and value to shareholders. A higher ratio or value is commonly sought-after by most companies, as this usually means the business is performing well by generating revenues, profits, and cash flow.

- 24. 24

- 25. 25 Operating Profit = Net profit – Non operating Income + Non operating expenses Capital Employed = Shareholder’s fund + Non current Liabilities OR = Total Assets – Current liabilities

- 26. 26

- 27. 27

- 28. 28

- 29. 29 Working Capital = Current Assets – Current liabilities Total Assets = Non Current Assets + Current Assets Cost of Goods Sold= Opening Stock + Purchases + Direct expenses- Closing Stock OR = Sales – Gross Profit

- 30. 30