Rental Drivers & The Power of the Penny

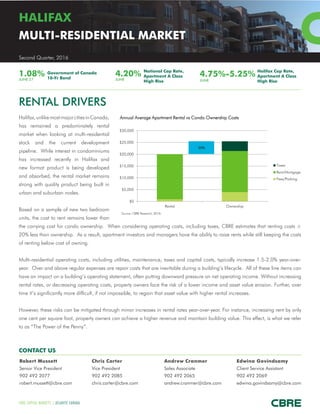

- 1. HALIFAX MULTI-RESIDENTIAL MARKET Robert Mussett Senior Vice President 902 492 2077 robert.mussett@cbre.com Chris Carter Vice President 902 492 2085 chris.carter@cbre.com Andrew Cranmer Sales Associate 902 492 2065 andrew.cranmer@cbre.com Edwina Govindsamy Client Service Assistant 902 492 2069 edwina.govindsamy@cbre.com RENTAL DRIVERS Halifax,unlikemostmajorcitiesinCanada, has remained a predominately rental market when looking at multi-residential stock and the current development pipeline. While interest in condominiums has increased recently in Halifax and new format product is being developed and absorbed, the rental market remains strong with quality product being built in urban and suburban nodes. Based on a sample of new two bedroom units, the cost to rent remains lower than the carrying cost for condo ownership. When considering operating costs, including taxes, CBRE estimates that renting costs ± 20% less than ownership. As a result, apartment investors and managers have the ability to raise rents while still keeping the costs of renting below cost of owning. Multi-residential operating costs, including utilities, maintenance, taxes and capital costs, typically increase 1.5-2.0% year-over- year. Over and above regular expenses are repair costs that are inevitable during a building’s lifecycle. All of these line items can have an impact on a building’s operating statement, often putting downward pressure on net operating income. Without increasing rental rates, or decreasing operating costs, property owners face the risk of a lower income and asset value erosion. Further, over time it’s significantly more difficult, if not impossible, to regain that asset value with higher rental increases. However, these risks can be mitigated through minor increases in rental rates year-over-year. For instance, increasing rent by only one cent per square foot, property owners can achieve a higher revenue and maintain building value. This effect, is what we refer to as “The Power of the Penny”. Second Quarter, 2016 CBRE CAPITAL MARKETS | ATLANTIC CANADA $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 Rental Ownership Source: CBRE Research, 2016. Annual Average Apartment Rental vs Condo Ownership Costs Taxes Rent/Mortgage Fees/Parking 20% CONTACT US Government of Canada 10-Yr Bond National Cap Rate, Apartment A Class High Rise Halifax Cap Rate, Apartment A Class High Rise 1.08% JUNE 27 4.20% JUNE 4.75%-5.25% JUNE

- 2. THE POWER OF THE PENNY - 5 YEAR CYCLE © 2016 CBRE, Inc. This information has been obtained from sources believed reliable. We have not verified it and make no guarantee, warranty or representation about it. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the property. You and your advisors should conduct a careful, independent investigation of the property to determine to your satisfaction the suitability of the property for your needs. Photos herein are the property of their respective owners and use of these images without the express written consent of the owner is prohibited. CBRE and the CBRE logo are service marks of CBRE, Inc. and/or its affiliated or related companies in the United States and other countries. All other marks displayed on this document are the property of their respective owners. As outlined below, increasing rental rates year-over-year by one penny has a significant impact on asset value. The model below shows how a penny per year increase can ensure Building B maintains value and how by not doing so, results in significant value loss as seen in Building A. Raising monthly rental rates only one cent per square foot will see: • Increases in revenue, effective rent, NOI and market value; • Expenses as a percentage of revenue increase at slower rate; and • Over a 5 year cycle, Building B has maintained an upward trajectory of market value. PROFESSIONAL PROFILE Year 1 Year 5 Year 1 Year 5 Avgerage Rent Per Square Foot 1.02$ 1.02$ 1.02$ 1.06$ Average Rent Per Suite 1,450 SF) 1,479$ 1,479$ 1,479$ 1,537$ Total Rental Revenue 1,171,368$ 1,171,368$ 1,171,368$ 1,217,304$ Effective Rent (less vacancy and bad debt 2.0%) 1,147,941$ 1,147,941$ 1,147,941$ 1,192,958$ Total Expenses (1.75% increase per year) 382,800$ 410,322$ 382,800$ 410,322$ Expenses/Revenue 33.3% 35.7% 33.3% 34.4% NET OPERATING INCOME 765,141$ 737,619$ 765,141$ 782,636$ Estimated Cap Rate Value Per Door 220,820$ 212,877$ 220,820$ 225,869$ Market Value 14,574,107$ 14,049,879$ 14,574,107$ 14,907,351$ Assumptions 1. Based on 66 unit building 2. 1.75% increase in expense YoY 3. Flat cap rate at 5.25% 4. 1,450 SF/2 Bedroom Building A | Year 1-5 Building B | Year 1-5 5.25% 5.25% No change in rental rate One cent increase over 5 years Assumptions 1. Based on 66 unit building 2. 1.75% increase in expenses YoY 3. Unchanged cap rate at 5.25% 4. 1,450 SF/2 Bedroom Building A | Year 1-5 No change in YoY rental rate Building B | Year 1-5 One cent increase YoY CBRE Capital Markets, National Investment Team & National Apartment Group CHRIS CARTER Vice President www.cbre.ca/chris.carter • No change in Effective Rent • $27,522 decrease in NOI • $524,228 loss in Market Value • $45,017 increase in Effective Rent • $17,495 increase in NOI • $333,244 increase in Market Value AVERAGE INVESTMENT CAP RATE Apartment Q2 2015 Q2 2016 High Rise A 5.00-5.50% 4.75-5.25% High Rise B 5.00-6.00% 5.00-5.75% Low Rise A 5.00-5.50% 5.00-5.50% Low Rise B 5.75-6.25% 5.50-6.00% Source: CBRE Research, 2016. CAP RATE SURVEY HALIFAX MULTI-RESIDENTIAL MARKET Second Quarter, 2016