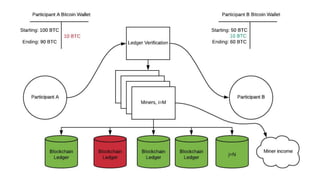

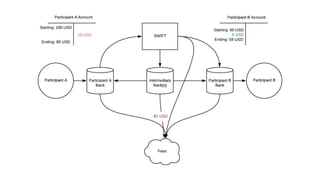

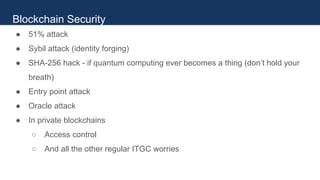

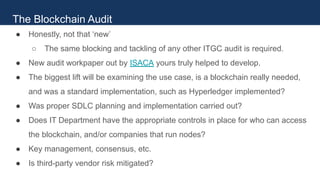

The document discusses the role of blockchain technology in auditing, highlighting its definition, types (public vs private), and useful applications such as traceability and international money transfers. It emphasizes the importance of evaluating whether blockchain is necessary for specific use cases, as it can often complicate processes rather than simplify them. Security considerations and the potential risks associated with blockchain implementations are also discussed, along with the author's credentials and experience in the field.