Lat-Am Week Two (30.10.2016)

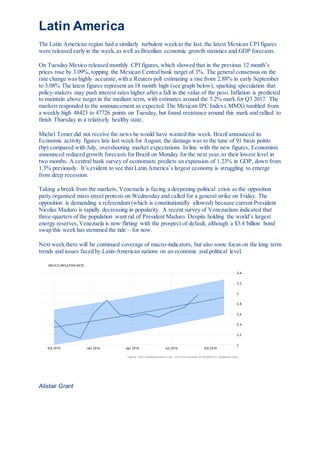

- 1. Latin America The Latin American region had a similarly turbulent week to the last. the latest Mexican CPI figures were released early in the week,as well as Brazilian economic growth statistics and GDP forecasts. On Tuesday Mexico released monthly CPI figures, which showed that in the previous 12 month’s prices rose by 3.09%, topping the Mexican Centralbank target of 3%. The general consensus on the rate change was highly accurate,with a Reuters poll estimating a rise from 2.88% in early September to 3.08% The latest figures represent an 18 month high (see graph below), sparking speculation that policy-makers may push interest rates higher after a fall in the value of the peso. Inflation is predicted to maintain above target in the medium term, with estimates around the 3.2% mark for Q3 2017. The markets responded to the announcement as expected. The Mexican IPC Index (.MMX) tumbled from a weekly high 48423 to 47726 points on Tuesday, but found resistance around this mark and rallied to finish Thursday in a relatively healthy state. Michel Temer did not receive the news he would have wanted this week. Brazil announced its Economic activity figures late last week for August, the damage was to the tune of 91 basis points (bp) compared with July, overshooting market expectations. In line with the new figures, Economists announced reduced growth forecasts for Brazil on Monday for the next year,to their lowest level in two months. A central bank survey of economists predicts an expansion of 1.23% in GDP, down from 1.3% previously. It’s evident to see that Latin America’s largest economy is struggling to emerge from deep recession. Taking a break from the markets, Venezuela is facing a deepening political crisis as the opposition party organised mass street protests on Wednesday and called for a general strike on Friday. The opposition is demanding a referendum (which is constitutionally allowed) because current President Nicolas Maduro is rapidly decreasing in popularity. A recent survey of Venezuelans indicated that three-quarters of the population want rid of President Maduro. Despite holding the world’s largest energy reserves,Venezuela is now flirting with the prospect of default, although a $3.4 billion bond swap this week has stemmed the tide – for now. Next week there will be continued coverage of macro-indicators, but also some focus on the long term trends and issues faced by Latin-American nations on an economic and political level. Alistair Grant