Plant the seeds of innovation before your IPO: How innovation imprinting helps companies remain innovative after they go public

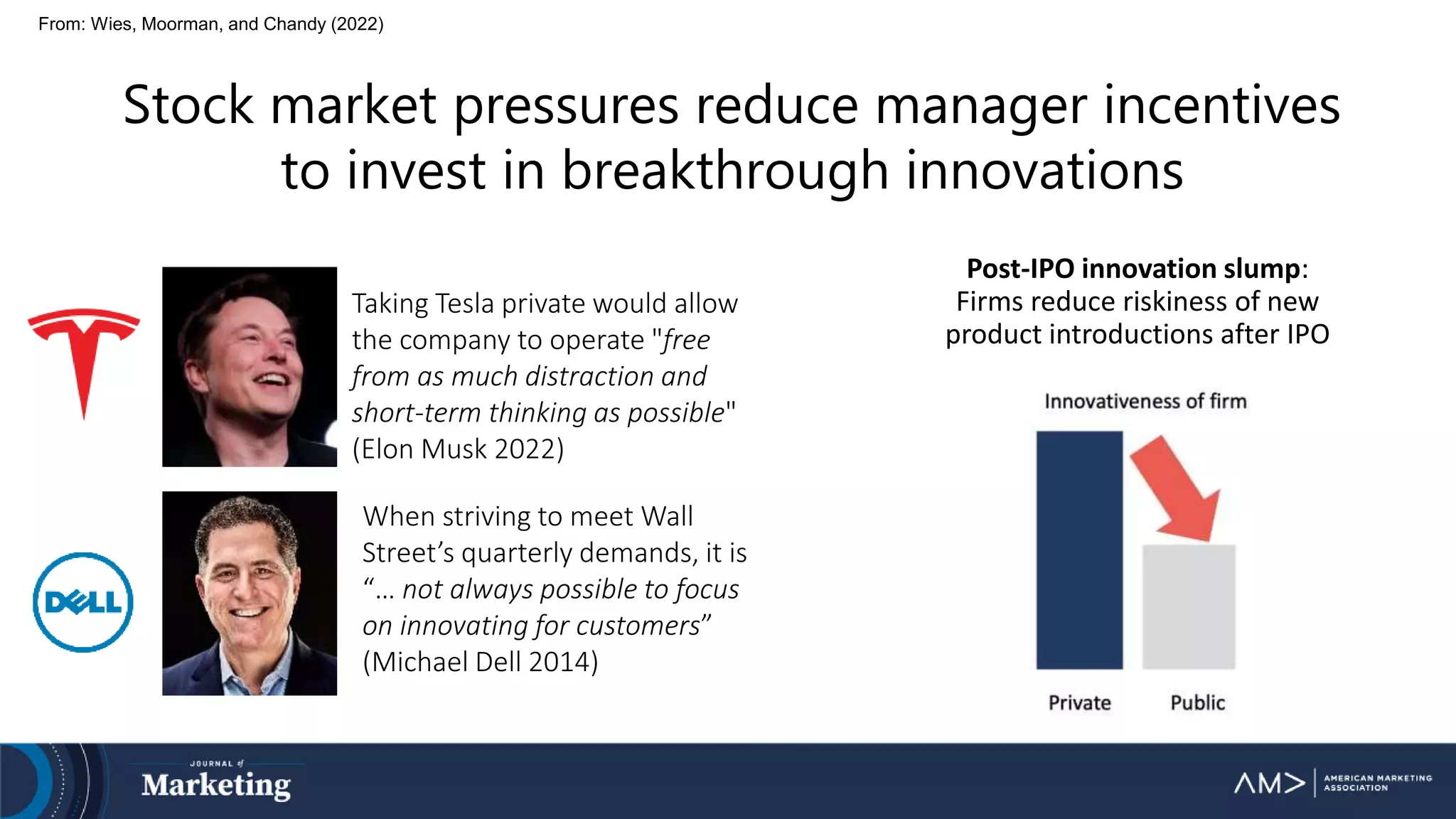

The document discusses how going public can reduce manager incentives to invest in breakthrough innovations due to stock market pressures, leading to a post-IPO innovation slump. It introduces the concept of "innovation imprinting," which involves establishing priorities and building capabilities for breakthrough innovations before an IPO. Innovation imprinting attracts investors who support risk and innovation, allowing companies to continue innovating after going public. The study observed 207 IPO firms over 30+ years and found that while most experienced a slump, companies that engaged in pre-IPO innovation imprinting were able to "beat the slump" and