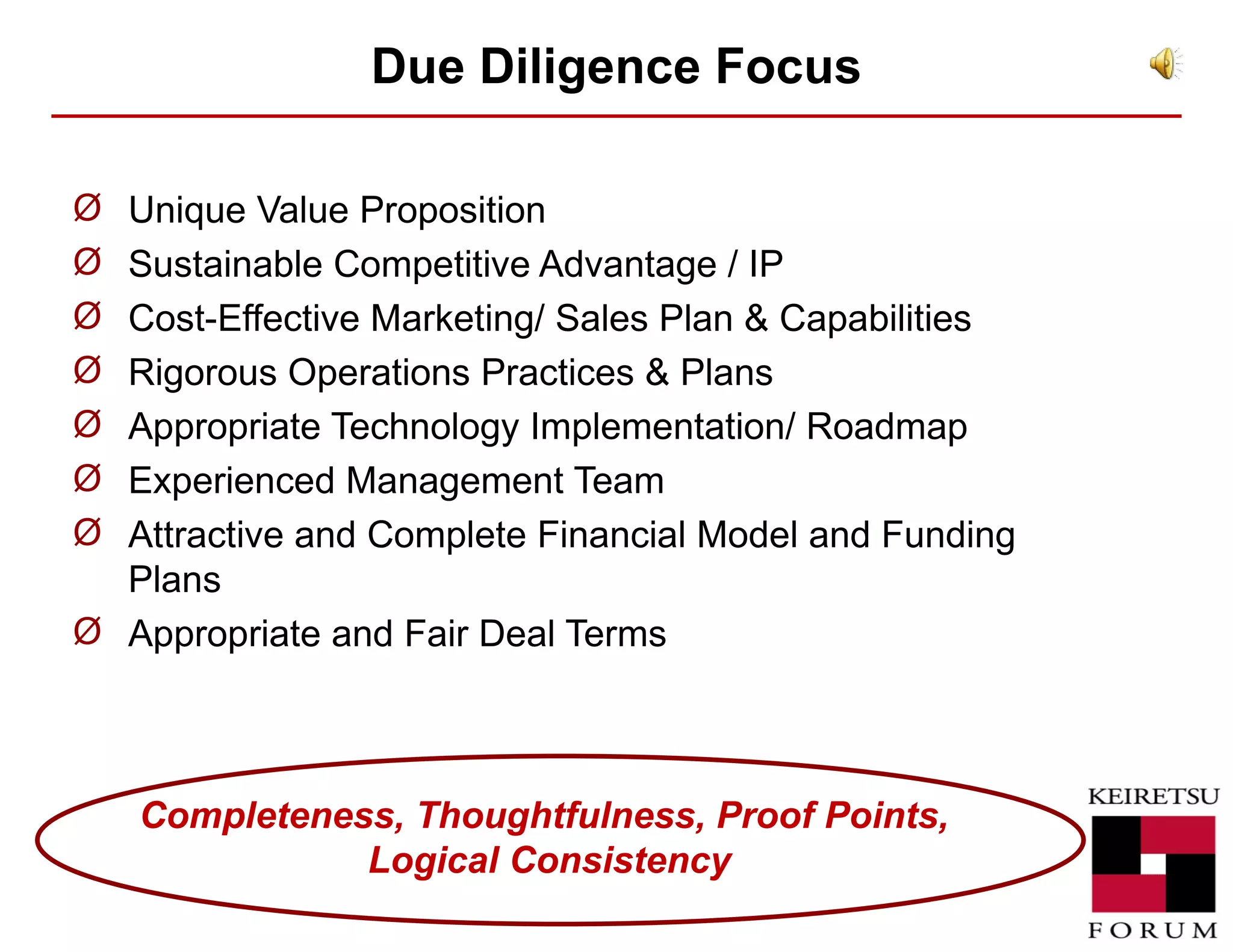

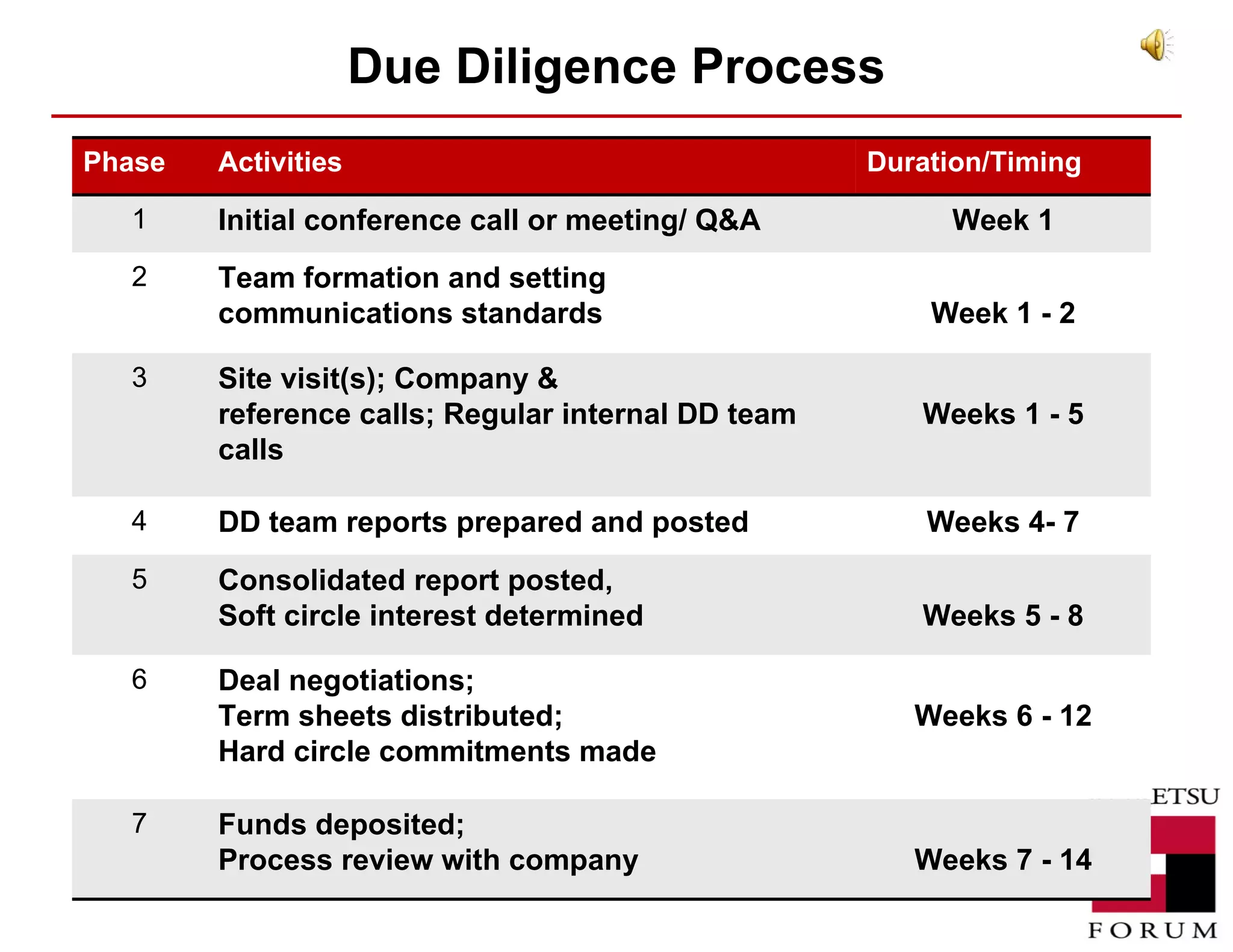

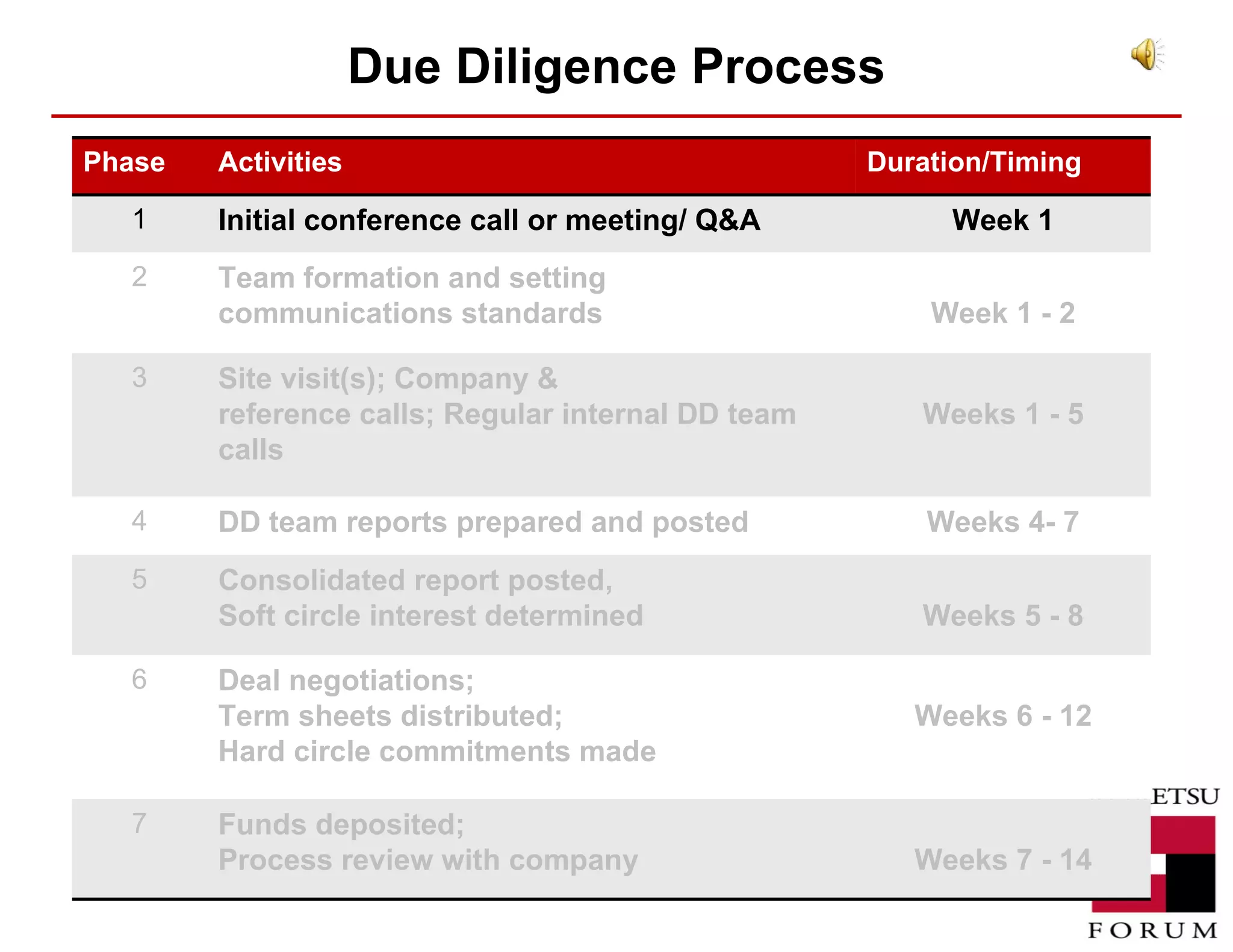

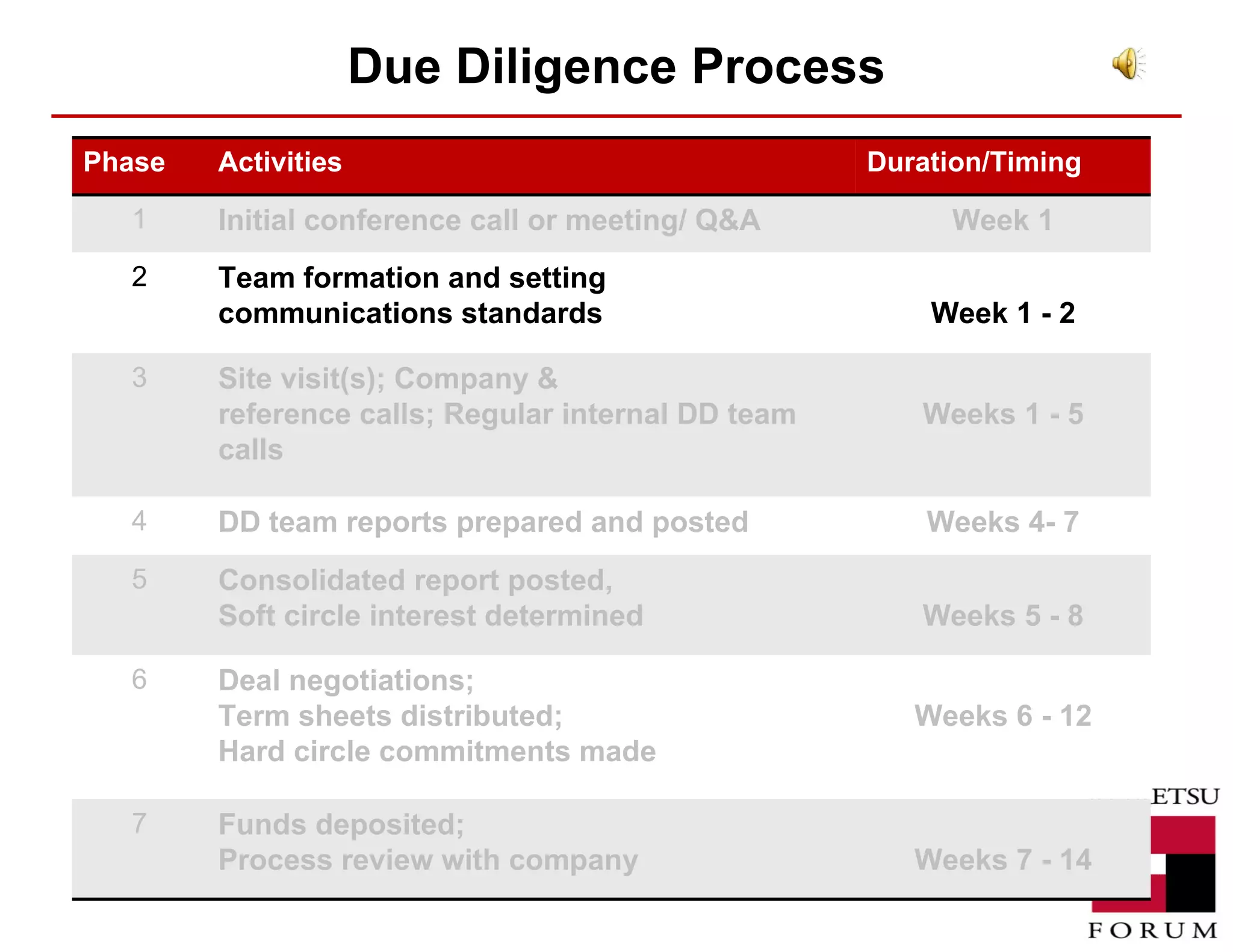

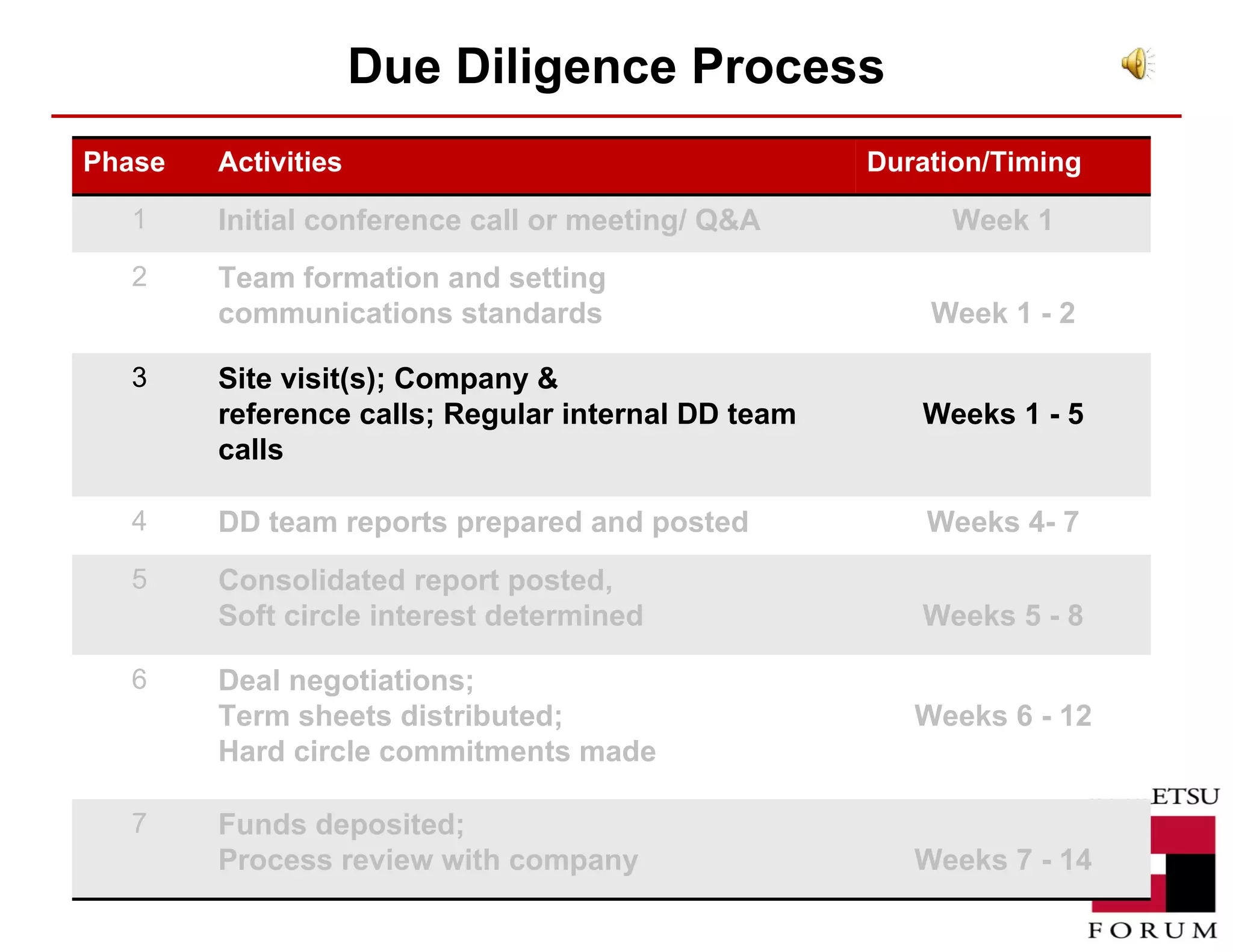

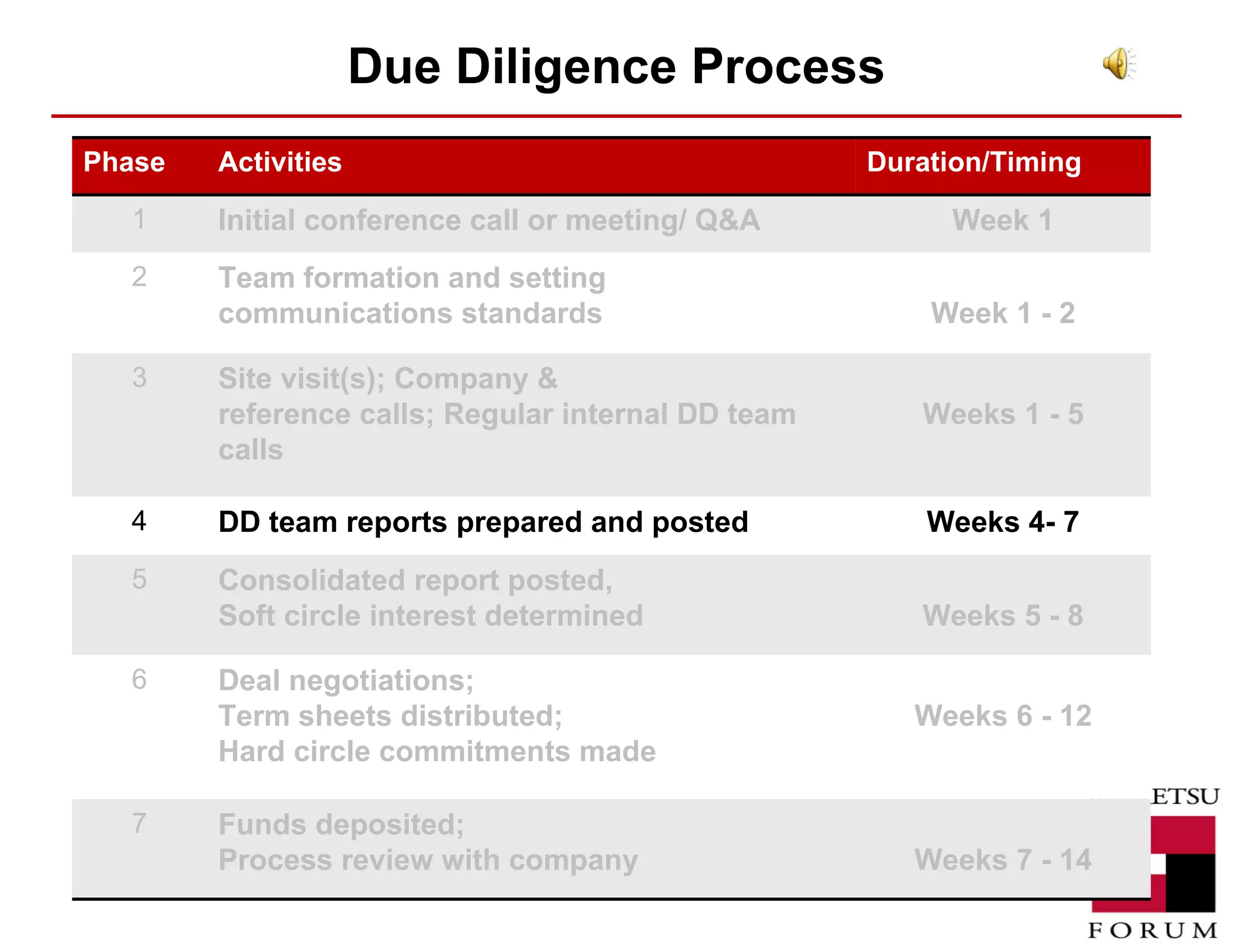

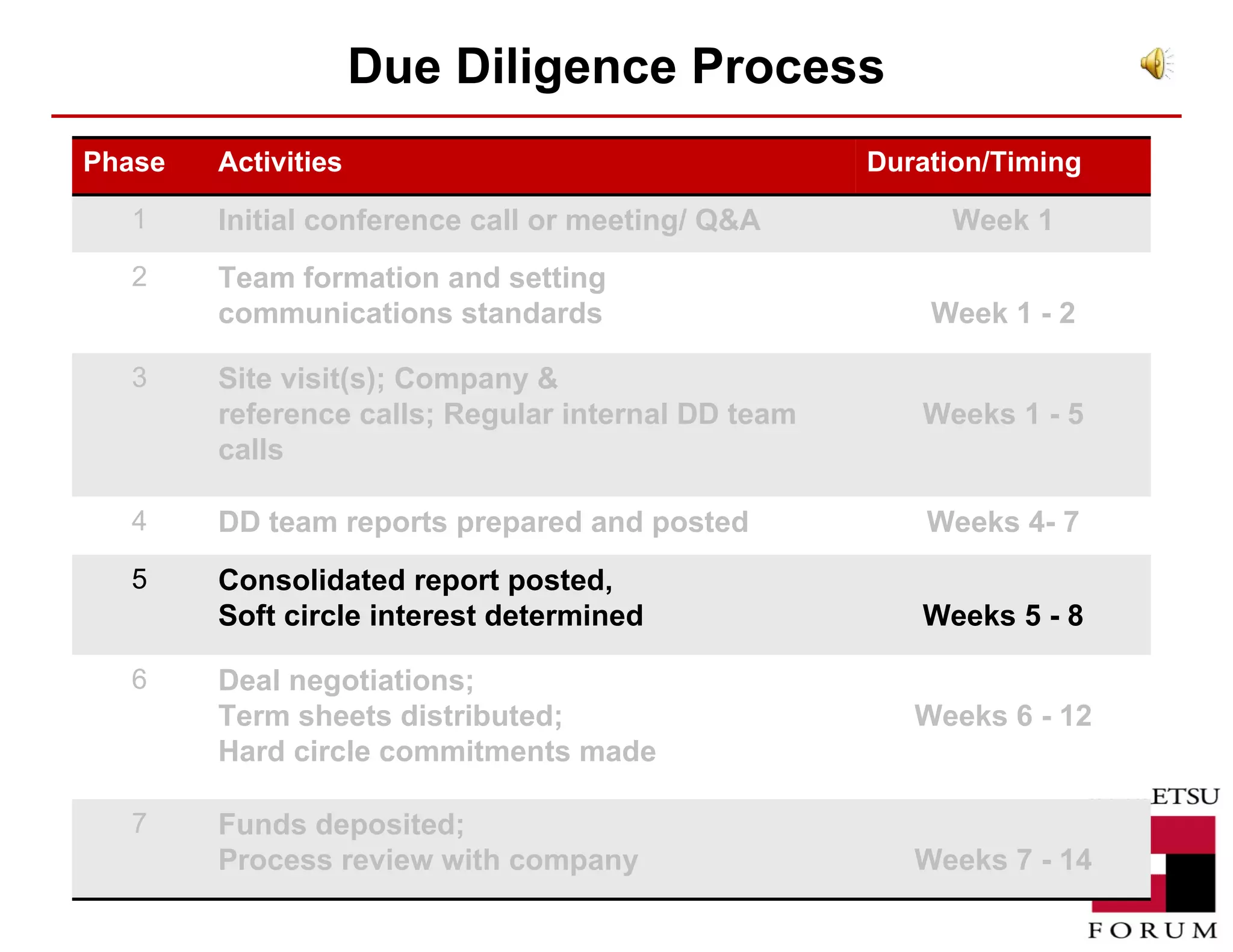

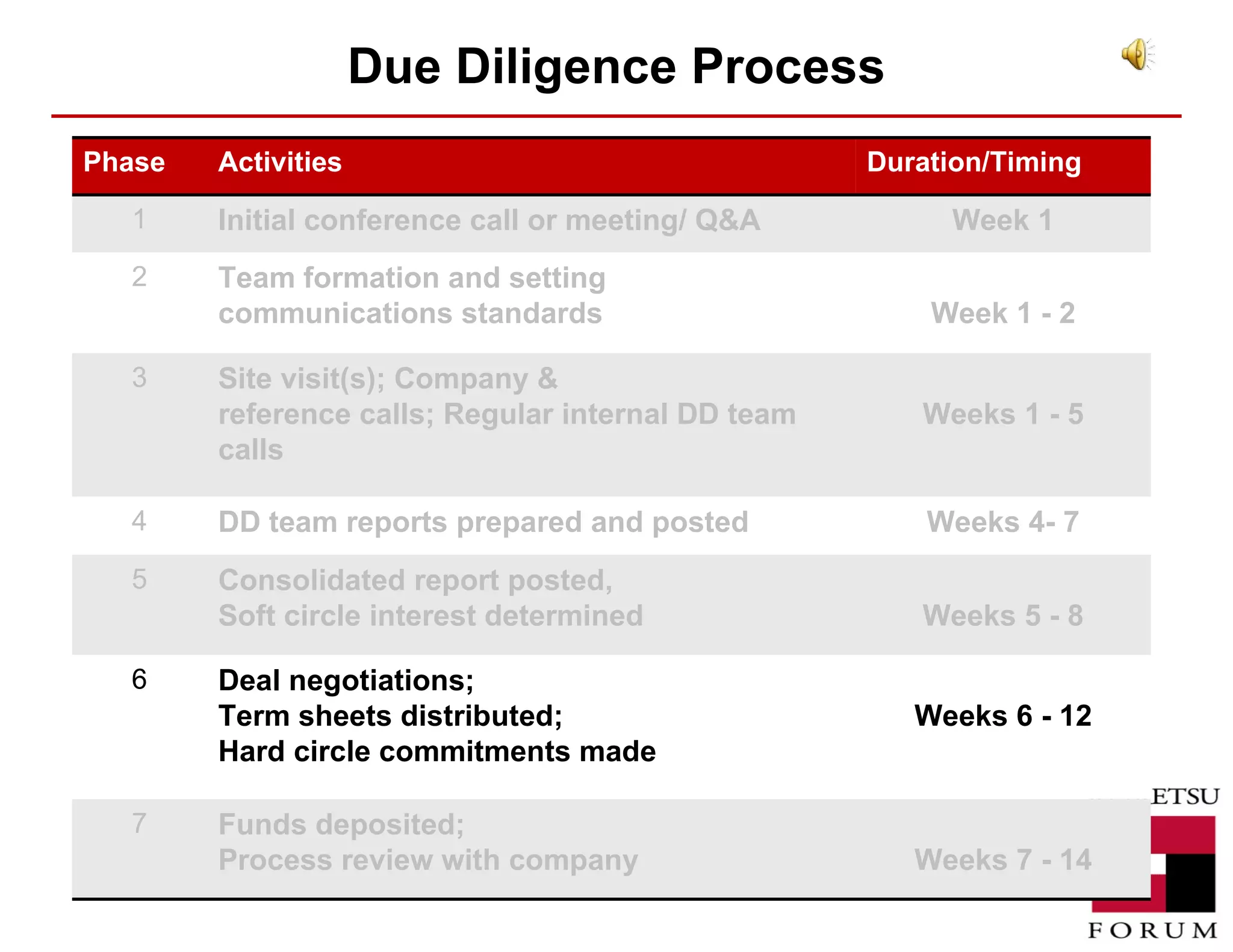

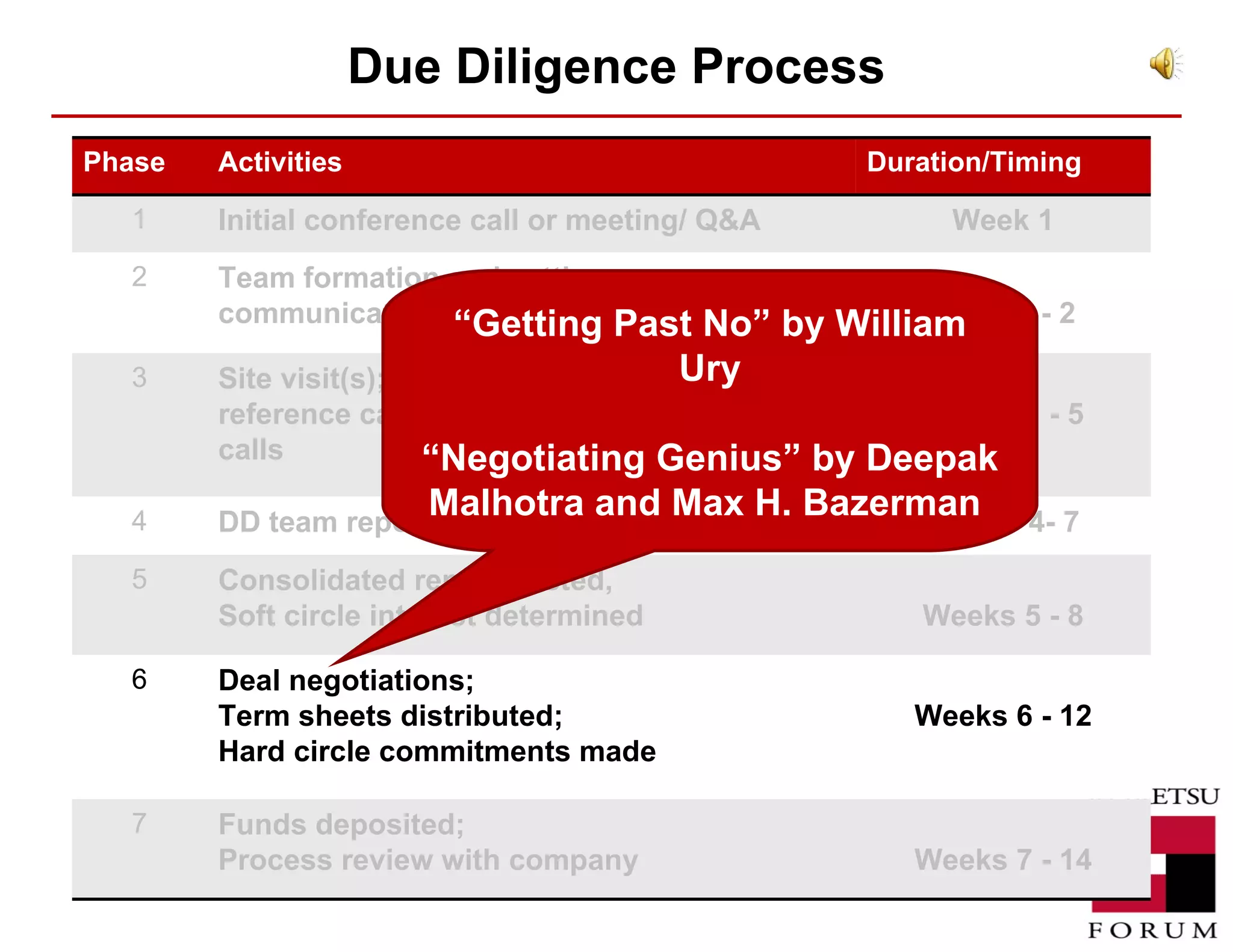

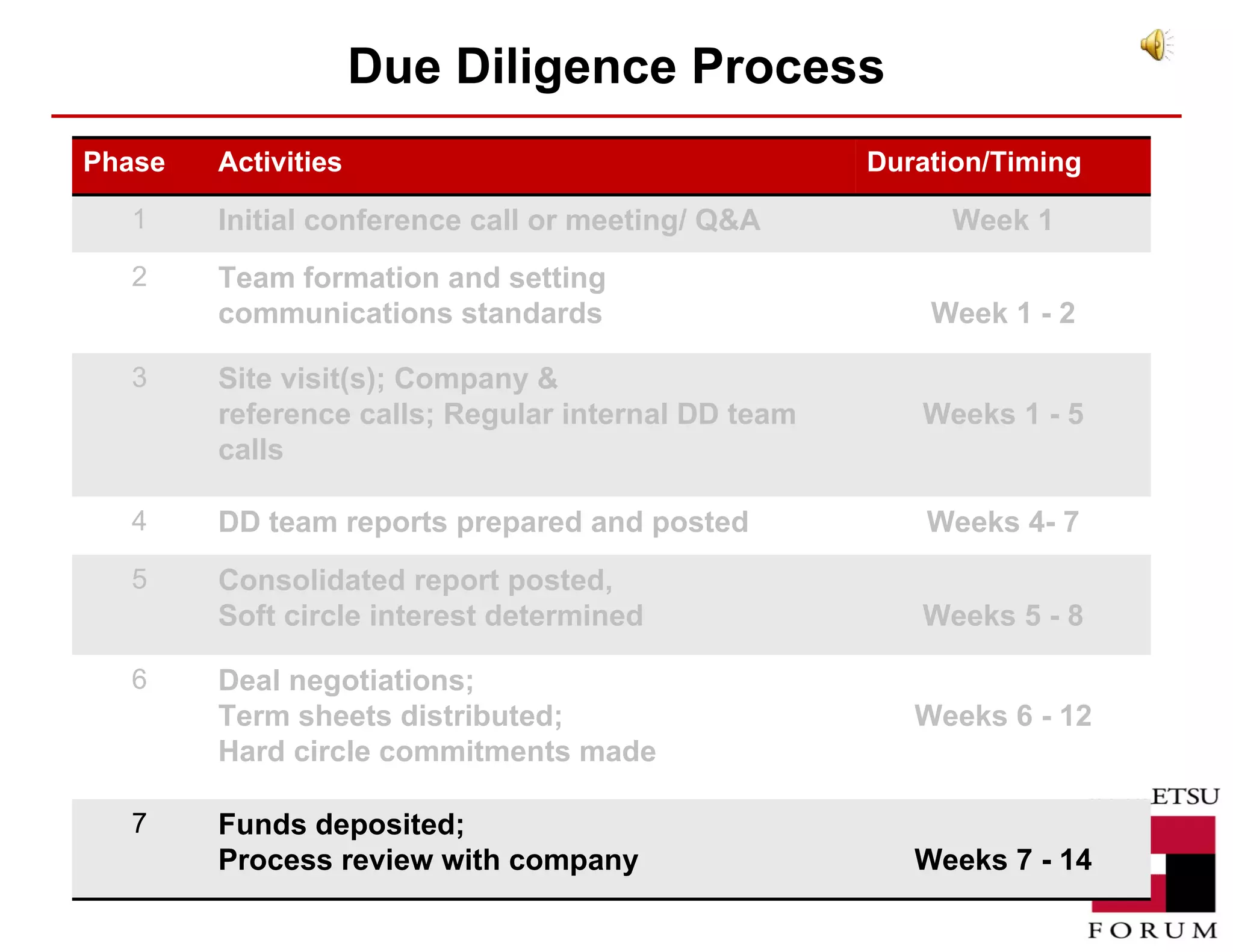

This document discusses the role of an effective due diligence leader. It introduces the due diligence process, which involves an initial meeting, forming an evaluation team, conducting site visits and reference calls over several weeks, preparing individual and consolidated reports, and negotiating deals. The leader ensures the team focuses on key factors like the company's value proposition and management team. Due diligence involves both objective assessment and subjective judgment, and a strong leader is needed to guide the process.