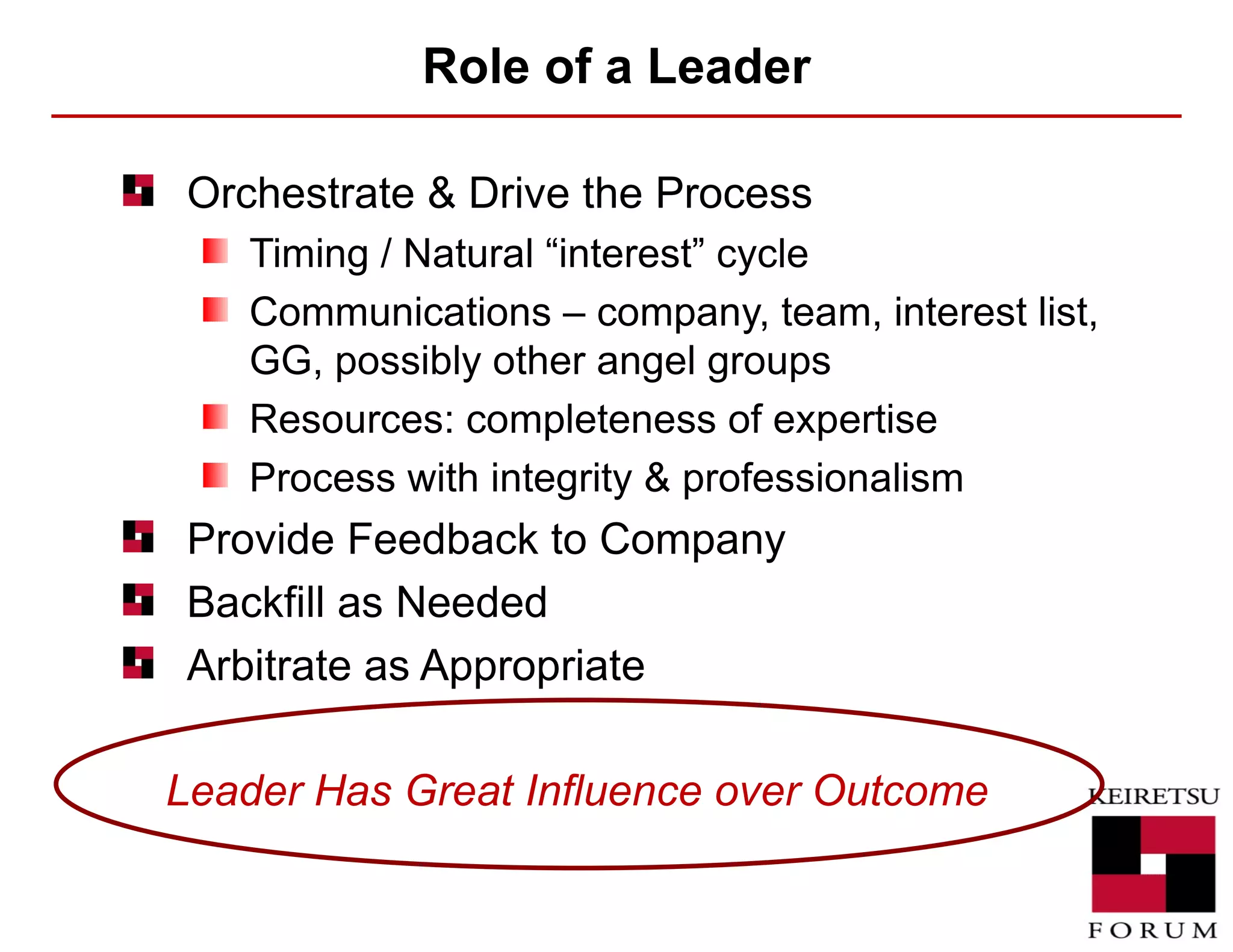

The document discusses the role and responsibilities of an effective leader for a due diligence process. The leader needs to orchestrate and drive the timing of the process, ensure open communication with stakeholders, and make sure the due diligence team has the right expertise. The leader must keep the overall objective in sight, identify the top deal-breakers, rely on external validation and facts, and run an open and professional process. They also need to properly assess management, find the natural rhythm of the process, and provide early feedback or decisively end the process if needed.