Corporate Brand Valuation: Residual Contribution Method

- 3. What is Corporate Brand……...from a Valuation Standpoint? Universe of Attempts to Value Brand – Traps & Shortcomings Moving Beyond Current Threshold: Residual Contribution Method Tapping into the Wealth of Financial Reporting Valuation Concepts Setting Boundaries for Asset Group Values Value Drivers: Examination of Accounting vs. Non‐Accounting Intangibles Purification of Goodwill – Application of Filters Key Step toward Valuing Brand: Exclude it First! Path to Brand Royalty Rate – Without the Reliance on Generic Market Data Isolating, Extracting, and Unifying Residuals – The Essence of Brand Value Practical Overview of Analytical Flow and Synthesis Appendix: About the Presenter Copyright © 2015 Beacon Valuation Group LLC 3

- 4. Corporate brand, as opposed to product brands, is a single umbrella image that groups together the experiences, values, and images of a corporation’s panoply of activities. Can be depicted as a network of knowledge about a company stored in the mind of the target communities such as: Customers, employees, shareholders, investors, journalists, analysts, business partners, and competitors Although a corporate brand is defined partly by identifiable intangible assets, such as a company trade name, trademark, or logo, all of which can be legally protected, the greatest value of a corporate brand is even more intangible than these assets. Unlike product brands, or other intangible assets held by a company, corporate brands cannot be separated from the rest of the assets, without substantially diminishing the value of the majority of the company’s intangible assets or the overall business enterprise housing them. Brand equity is a phrase used in the marketing industry which describes the value of having a well‐known brand name, based on the idea that the owner of a well‐known brand name can generate more money from products with that brand name than from products with a less well known name. Copyright © 2015 Beacon Valuation Group LLC 4

- 5. The term Goodwill is defined by different bodies in ways that differ significantly. IRS Glossary to Publication 551 ‐ defines goodwill as “the value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor.” [NOTE THE SIMILARITY TO DEFINITION OF “BRAND”] The International Glossary of Business Valuation Terms defines goodwill as “that intangible asset arising as a result of name, reputation, customer loyalty, location, products, and similar factors not separately identified.” [NOTE THE SIMILARITY TO DEFINITION OF “BRAND”] Goodwill derived from financial reporting (accounting) guidance as “the premium that a buyer would be willing to pay for an entity over the net of the amounts assigned to assets and liabilities of the business. This “premium” amount recognized as goodwill includes acquired intangible assets that do not meet the economic criterion for recognition as assets apart from goodwill.” Copyright © 2015 Beacon Valuation Group LLC 5

- 7. Does not consider brand earnings potential Fails to distinguish strategic/financial component of brand value from legal aspects of ownership Overreliance on incomparable market data Quantitative relation between a specific brand element and a financial metric has not been established Qualitative relation (awareness impacts loyalty) is more common sense than science, and provides only little practical use for the valuation community Point systems, although providing valuable marketing data to brand managers, are highly dependent on the relevance of their surveys and target audiences to the key valuation drivers of a corporate brand More applicable to single product brands – not corporate Inappropriate inclusion/exclusion of brand value drivers Does not examine influence on/from intangibles other than brand Does not remove/reduce subjectivity – only moves it Does not incorporate the full spectrum of risk inherent in the different asset groups employed by the business enterprise Copyright © 2015 Beacon Valuation Group LLC 7

- 9. FMV of Long Term Interest Bearing Debt + FMV of Equity FMV of Intangible Assets FMV of Tangible Assets + Net Working Capital + FMV Value of Invested Capital = = Investing Approach Operating Approach Copyright © 2015 Beacon Valuation Group LLC 9

- 10. BEV = MA + TA + IA, where: BEV = Business Enterprise Value MA = Monetary (financial) Asset Value (Net Working Capital) TA = Tangible (fixed) Asset Value IA = Intangible Asset Value (including Accounting Goodwill) By default, the BEV represents the upper limit of value for any one or all of the asset (categories) housed by the entity Of the three approaches to value the enterprise (cost, market, and income), the multi‐period discounted cash flow (“DCF”) method within the income approach is most reliable when setting the basis (upper limit) for the valuation of a corporate brand, since it directly captures the expected risk‐adjusted economic benefit stream (and its relevant components) generated by the entire portfolio of assets associated with this key intangible. Copyright © 2015 Beacon Valuation Group LLC 10

- 11. Company XYZ Business Enterprise Value Model Multiple Period Discounting Method - Discounted Cash Flow Analysis Terminal ($000's) 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 12/31/2021 Value Revenues $1,360,000 $1,468,800 $1,571,616 $1,665,913 $1,749,209 $1,819,177 $1,873,752 % Growth 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% EBIT $108,800 $132,192 $157,162 $166,591 $174,921 $181,918 $187,375 % of Revenue 8.0% 9.0% 10.0% 10.0% 10.0% 10.0% 10.0% Provision for Income Taxes 40.0% $43,520 $52,877 $62,865 $66,637 $69,968 $72,767 $74,950 Net Income $65,280 $79,315 $94,297 $99,955 $104,953 $109,151 $112,425 Plus: Depreciation & Amortization $13,600 $29,376 $31,432 $33,318 $34,984 $36,384 $37,475 Less: Increase in Working Capital @ 10.0% $4,080 $10,880 $10,282 $9,430 $8,330 $6,997 $5,458 Less: Capital Expenditures $13,600 $29,376 $31,432 $33,318 $34,984 $36,384 $38,599 Net Free Cash Flow $61,200 $68,435 $84,015 $90,525 $96,623 $102,154 $105,843 $109,019 Partial Period Adjustment 0.583 1.000 1.000 1.000 1.000 1.000 1.000 1.000 Net Free Cash Flow (adjusted) $35,700 $68,435 $84,015 $90,525 $96,623 $102,154 $105,843 $109,019 Discount Rate 12.0% Long-term Growth Rate 3.0% Valuation Date 5/31/2015 Years to Discount 0.583 1.583 2.583 3.583 4.583 5.583 6.583 6.583 Mid-Year Adjustment 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 Adjusted Years to Discount 0.292 1.083 2.083 3.083 4.083 5.083 6.083 6.083 Terminal Value $1,211,318 Sum of the PV Interim Cash Flows $396,612 $34,539 $60,529 $66,347 $63,829 $60,829 $57,420 $53,120 PV of the Terminal Value $607,925 Present Value of Total Invested Capital $1,004,538 Less: Interest-Bearing Debt $0 Unadjusted Estimated Value of Equity $1,004,538 Fair Value of Equity (rounded) $1,000,000 Copyright © 2015 Beacon Valuation Group LLC 11

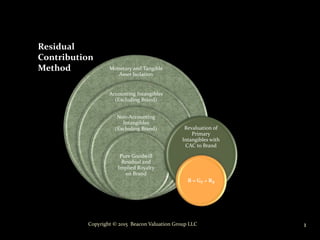

- 12. IA (Including Goodwill) = BEV – (MA + TA) Subtracting monetary and tangible asset values from the BEV establishes the maximum value allocable to Corporate Brand The next step in applying the Residual Contribution method is to “filter out” all elements included within the Intangible Asset Group value that are not a component of, or driven by, the entity’s Corporate Brand Copyright © 2015 Beacon Valuation Group LLC 12

- 13. Intangible Assets (IA) IAA IAA(Xb) TM(b) GA IAXA(Xb) Rx = [ RMA + RTA + RIA(XB) + RB(i) ] GP IA = Intangible Asset Value GP = Pure Goodwill Value IAA = Discretely Identifiable Accounting Intangible Assets RX = Returns on Assets Not Allocated to Any Specific Asset Group IAA(Xb) = IAA, excluding Brand Value Elements RMA = Return on Monetary Contributory Assets TM(b) = Trademark Value as Measured for Financial Reporting (Accounting) Purposes RTA = Return on Tangible Contributory Assets GA = Accounting Goodwill Value RIA = Return on Intangible Contributory Assets IAXA = Intangible Assets Not Measured for Financial Reporting (Accounting) Purposes RIA(Xb) = Return on Intangible Contributory Assets Other than Corporate Brand IAXA(Xb) = IAXA, excluding Brand Value Elements RB(i) = Return on Corporate Brand's Intrinsic Component Location of Corporate Brand Value Elements Copyright © 2015 Beacon Valuation Group LLC 13

- 14. For a discrete intangible asset to exist from a valuation or economic perspective, typically it should possess certain attributes. The more common attributes include that the asset may: Be subject to specific identification and recognizable description. Be subject to legal existence and protection. Be subject to the right of private ownership, and this private ownership may be legally transferable. Include some tangible evidence or manifestation of the existence of the intangible asset (for example, a contract, a license, or a set of financial statements). Have been created or have come into existence as an identifiable item or as the result of an identifiable event. Copyright © 2015 Beacon Valuation Group LLC 14

- 15. For a discrete intangible asset to have a quantifiable value in terms of an economic analysis or appraisal, it should possess certain additional attributes. Some of the additional attributes include the following: It should generate some measurable amount of economic benefit to its owner; this economic benefit could be in the form of an income increment or of a cost decrement; this economic benefit is sometimes measured by comparison to the amount of income otherwise available to the intangible asset owner (for example, the business) if the subject intangible asset did not exist. It should be able to enhance the value of the other assets with which it is associated; the other assets may encompass all other business assets including tangible personal property, tangible real estate, or other intangible assets. Copyright © 2015 Beacon Valuation Group LLC 15

- 16. Marketing‐related Typically assets used in the marketing or promotion of products or services Trademarks, domain names, newspaper mastheads, ….. Customer‐related Relating to existing customer relationships Customer lists, order backlogs, ….. Artistic‐related Arising from legal rights such as those provided by copyright Plays, operas, literary works, musical works, ….. Contract‐based Arising from contractual agreements Value‐added reseller channels, OEM agreements, favorable supply agreements, ….. Technology‐based Relate to innovations or technological advances Patented or non‐patented technology, IPR&D, databases, trade secrets, ….. Copyright © 2015 Beacon Valuation Group LLC 16

- 17. $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 95.0% 80.0% 67.9% 58.3% 50.4% 44.1% 38.9% 35.0% 31.5% 28.4% 25.5% 23.0% 20.7% 18.6% 16.7% 15.1% 13.6% 12.2% 11.0% 9.9% 5.0% 20.0% 32.1% 41.7% 49.6% 55.9% 61.1% 65.0% 68.5% 71.6% 74.5% 77.0% 79.3% 81.4% 83.3% 84.9% 86.4% 87.8% 89.0% 90.1% Existing Customers Future Customers Discretely Identifiable Intangible Component of Accounting Goodwill Copyright © 2015 Beacon Valuation Group LLC 17

- 19. The key is to focus on the corporate brand value components embedded within (manifested through) the entity’s primary income generating asset – this could also be the Company’s technology‐based intangibles (existing and future technology) as opposed to customer‐related intangibles. The example we will use assumes that customer relationships (existing and future) are the entity’s primary income generating asset, representing 100% of the Company’s future revenue/income stream. To capture the entire future economic benefit stream associated with a Corporate Brand, we must value both existing customer relationships (limited economic life ‐ IAA) and future customer relationships (indefinite economic life assuming a going concern business ‐ IAXA) Copyright © 2015 Beacon Valuation Group LLC 19

- 20. Represents a variation of the discounted cash flow model. The excess earnings method was first used in the 1920's to estimate the value of intangibles lost when liquor manufacturers were shut down by Prohibition. Earnings‐based valuation model attributes: Projection of earnings typically spans over a finite life (economic life of technology). A return on contributory assets is subtracted from net income (unlike in traditional DCF‐based models). The amount in excess of net income is the basis of the asset value. The earnings stream can therefore be broken down into two components: 1) Normal return on tangible and intangible assets; and 2) an “excess” amount. By separating the valuation problem into two parts, EEM focuses attention on the factors that create value for a firm. Most appropriate for primary income generating or enabling intangible assets (such as customer relationships). Copyright © 2015 Beacon Valuation Group LLC 20

- 21. Company XYZ Valuation of Existing Customer Relationships - IAA Multi-Period Excess Earnings Method ($000's) 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2034 year 1 2 3 4 20 Total Customer Revenue (Existing & Future) $1,360,000 $1,468,800 $1,571,616 $1,665,913 $2,751,668 Revenue Growth 8.0% 7.0% 6.0% 3.0% Existing Customer Relationship Revenue $1,292,000 $1,174,428 $1,067,555 $970,408 $272,071 EBIT Margin 8.0% 9.0% 10.0% 10.0% 10.0% Add: Sales & Marketing Expense on New Accounts 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% Adjusted EBIT Margin 9.0% 10.0% 11.0% 11.0% 11.0% EBIT $116,280 $117,443 $117,431 $106,745 $29,928 Less: Return on Trade Names @ 0.00% $0 $0 $0 $0 $0 Pretax Income $116,280 $117,443 $117,431 $106,745 $29,928 Provision for Income Taxes 40.0% $46,512 $46,977 $46,972 $42,698 $11,971 Net Income $69,768 $70,466 $70,459 $64,047 $17,957 Less: Return on Working Capital $6,460 $5,872 $5,338 $4,852 $1,360 Less: Return on Fixed Assets $5,362 $4,874 $4,430 $4,027 $1,129 Less: Return on Assembled Workforce $6,202 $5,637 $5,124 $4,658 $1,306 Total Return on Contributory Assets $18,023 $16,383 $14,892 $13,537 $3,795 CAC as a % of Existing Customer Revenue 1.40% 1.40% 1.40% 1.40% 1.40% Cash Flow Attributable to the Customer Relationships $51,745 $54,082 $55,566 $50,510 $14,161 Partial Period Adjustment 0.583 1.000 1.000 1.000 1.000 Cash Flow Attributable to Customer Relationships $30,184 $54,082 $55,566 $50,510 $14,161 Discount Rate 15.0% Valuation Date 5/31/2015 Years to Discount 0.583 1.583 2.583 3.583 19.583 Mid-Year Adjustment 0.5 0.5 0.5 0.5 0.5 Adjusted Years to Discount 0.292 1.083 2.083 3.083 19.083 Present Value of Cash Flows $28,979 $46,484 $41,530 $32,827 $984 Sum of PV Cash Flows $275,789 FMV of Existing Customer Relationships (rounded) $280,000 Copyright © 2015 Beacon Valuation Group LLC 21

- 22. Intangibles and Intangible Elements Included in Accounting Goodwill: Assembled Workforce Future Customers Future Technology‐based Intangibles Future Patents Next Generation Technology Know‐how Internal Technology Future Strategic Contractual Intangibles or Non‐Contractual Relationships Other Future Intangibles Marketing‐based that are Unrelated to the Company’s Corporate Brand Future Non‐compete Agreements Artistic and Other Less Likely Intangible Assets Copyright © 2015 Beacon Valuation Group LLC 22

- 23. Other Intangible Elements Included in Accounting Goodwill: Returns on Assets Not Allocated to Any Specific Asset Group (RX) Returns on Monetary Contributory Assets (RMA) Returns on Tangible Contributory Assets (RTA) Returns on Intangible Contributory Assets (RIA) Returns on Intangible Contributory Assets Other than Corporate Brand (RIA(Xb)) Returns on Corporate Brand's Intrinsic Component (RB(i)) Portion of Company’s Going Concern Value Outside of the Economic Life of Intangibles Separately Valued If a combination of the mutually exclusive cash flows of the primary income generating assets of the business enterprise already fully captures the entire economic benefit stream to be generated by the entity into perpetuity, then it can be assumed that all of the going concern value of the business is already captured within the value of those primary assets. Valuing both existing customer relationships (assuming a finite life) and future customers (assuming indefinite/infinite life), representing the residual from the overall business after deduction for existing customers, fully allocates the going concern value of the business enterprise to these two assets. (This of course assumes that 100% of the business is driven by the Company’s customers.) Copyright © 2015 Beacon Valuation Group LLC 23

- 24. Company XYZ Valuation of Future Customer Relationships - IAXA Multi-Period Excess Earnings Method ($000's) 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2034 year 1 2 3 4 20 Total Customer Revenue (Existing & Future) $1,360,000 $1,468,800 $1,571,616 $1,665,913 $2,751,668 Revenue Growth 8.0% 7.0% 6.0% 3.0% Existing Customer Relationships Revenue $1,292,000 $1,174,428 $1,067,555 $970,408 $272,071 Percent of Total 95.0% 80.0% 67.9% 58.3% 9.9% Future Customer Relationships Revenue $68,000 $294,372 $504,061 $695,505 $2,479,597 Percent of Total 5.0% 20.0% 32.1% 41.7% 90.1% EBIT Margin [3] 8.0% 9.0% 10.0% 10.0% 10.0% Add: Sales & Marketing Expense on Existing Accounts 0.50% 0.5% 0.5% 0.5% 0.5% 0.5% Adjusted EBIT Margin 8.5% 9.5% 10.5% 10.5% 10.5% EBIT $5,780 $27,965 $52,926 $73,028 $260,358 Less: Return on Trade Names @ 0.00% $0 $0 $0 $0 $0 Pretax Income $5,780 $27,965 $52,926 $73,028 $260,358 Provision for Income Taxes 40.0% $2,312 $11,186 $21,171 $29,211 $104,143 Net Income $3,468 $16,779 $31,756 $43,817 $156,215 Less: Return on Working Capital $340 $1,472 $2,520 $3,478 $12,398 Less: Return on Fixed Assets $282 $1,222 $2,092 $2,886 $10,290 Less: Return on Assembled Workforce $326 $1,413 $2,419 $3,338 $11,902 Total Return on Contributory Assets $949 $4,106 $7,032 $9,702 $34,590 CAC as a % of Future Customer Revenue 1.40% 1.40% 1.40% 1.40% 1.40% Cash Flow Attributable to the Customer Relationships $2,519 $12,673 $24,724 $34,115 $121,624 Partial Period Adjustment 0.583 1.000 1.000 1.000 1.000 Cash Flow Attributable to Customer Relationships $1,470 $12,673 $24,724 $34,115 $121,624 Discount Rate [6] 17.0% Valuation Date 5/31/2015 Years to Discount 0.583 1.583 2.583 3.583 19.583 Mid-Year Adjustment 0.5 0.5 0.5 0.5 0.5 Adjusted Years to Discount 0.292 1.083 2.083 3.083 19.083 Present Value of Cash Flows $1,404 $10,691 $17,827 $21,023 $6,079 Sum of PV Cash Flows $278,033 FMV of Future Customer Relationships (rounded) $280,000 Copyright © 2015 Beacon Valuation Group LLC 24

- 25. Goodwill is the favor or prestige that a business has acquired beyond the mere value of what it sells. Goodwill amount represents the premium that a hypothetical buyer would be willing to pay for a company, in excess of the total value of its underlying monetary, intangible, and identifiable intangible assets. The fact that a hypothetical buyer would be willing to pay this premium suggests that the company has developed an identifiable corporate brand, and hence, goodwill with its stakeholders. In essence, Pure Goodwill ‐ pure in a sense of not including any other accounting or non‐accounting intangible asset value ‐ is a fundamental component of Corporate Brand. Copyright © 2015 Beacon Valuation Group LLC 25

- 26. Fair Value % of BEV BEV $1,000,000 100.0% Less: Working Capital $70,000 7.0% Less: Return on NWC (Existing Customers) $30,493 3.0% Less: Return on NWC (Future Customers) $28,675 2.9% Less: Fixed Assets $30,000 3.0% Less: Return on NFA (Existing Customers) $25,309 2.5% Less: Return on NFA (Future Customers) $23,801 2.4% Less: Existing Customer Relationships $280,000 28.0% Less: Future Customer Relationships $280,000 28.0% Less: Trade Names - RFR Method (Excluded) $0 0.0% Less: Assembled Workforce ("AWF") $55,000 5.5% Less: Return on AWF (Existing Customers) $29,273 2.9% Less: Return on AWF (Future Customers) $27,528 2.8% Less: Return on Brand (Existing Customers) $0 0.0% Less: Return on Brand (Future Customers) $0 0.0% Equals: GP (Intrinsic Component of Corporate Brand) $119,921 12.0% Pure Goodwill = BEV - All Intangibles (IAA + IAXA) - Unallocated Returns on Assets Copyright © 2015 Beacon Valuation Group LLC 26

- 27. Copyright © 2015 Beacon Valuation Group LLC 27 Company XYZ Trademark / Trade Name Portfolio Valuation Calculation of Implied Royalty Rate for Intrinsic Component of Corporate Brand Relief from Royalty Method ($000's) Forecasted period Terminal 2015 2016 2017 2018 2019 2020 2021 Year Calculation of Royalty Savings: Total Revenues $1,360,000 $1,468,800 $1,571,616 $1,665,913 $1,749,209 $1,819,177 $1,873,752 Iterate Royalty Rate 1.10% 1.10% 1.10% 1.10% 1.10% 1.10% 1.10% Royalty Savings $14,960 $16,157 $17,288 $18,325 $19,241 $20,011 $20,611 Provision for Income Taxes $5,984 $6,463 $6,915 $7,330 $7,696 $8,004 $8,244 Net Royalty Savings $8,976 $9,694 $10,373 $10,995 $11,545 $12,007 $12,367 $12,614 Partial Period Adjustment 0.583 1.000 1.000 1.000 1.000 1.000 1.000 1.000 Net Royalty Savings (adjusted) $5,236 $9,694 $10,373 $10,995 $11,545 $12,007 $12,367 $12,614 Capitalized Value for Residual Year (CVRY) $140,155 Discount Rate 12.0% Valuation Date 05/31/15 Years to Discount 0.583 1.583 2.583 3.583 4.583 5.583 6.583 6.583 Mid-Year Adjustment 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 Adjusted Years to Discount 0.292 1.083 2.083 3.083 4.083 5.083 6.083 6.083 Present Value of Net Royalty Savings $5,066 $8,574 $8,191 $7,752 $7,268 $6,749 $6,206 $70,340 Present Value of Net Royalty Savings $49,807 Present Value of CVRY $70,340 After Tax Value $120,147 Solve for: Value of Brand Component (rounded) $120,000 119,921

- 28. Copyright © 2015 Beacon Valuation Group LLC 28 Company XYZ Valuation of Existing Customer Relationships - IAA Multi-Period Excess Earnings Method ($000's) 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2034 year 1 2 3 4 20 Total Customer Revenue (Existing & Future) $1,360,000 $1,468,800 $1,571,616 $1,665,913 $2,751,668 Revenue Growth 8.0% 7.0% 6.0% 3.0% Existing Customer Relationship Revenue $1,292,000 $1,174,428 $1,067,555 $970,408 $272,071 EBIT Margin 8.0% 9.0% 10.0% 10.0% 10.0% Add: Sales & Marketing Expense on New Accounts 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% Adjusted EBIT Margin 9.0% 10.0% 11.0% 11.0% 11.0% EBIT $116,280 $117,443 $117,431 $106,745 $29,928 Less: Return on Brand Component @ 1.10% $14,212 $12,919 $11,743 $10,674 $2,993 Pretax Income $102,068 $104,524 $105,688 $96,070 $26,935 Provision for Income Taxes 40.0% $40,827 $41,810 $42,275 $38,428 $10,774 Net Income $61,241 $62,714 $63,413 $57,642 $16,161 Less: Return on Working Capital $6,460 $5,872 $5,338 $4,852 $1,360 Less: Return on Fixed Assets $5,362 $4,874 $4,430 $4,027 $1,129 Less: Return on Assembled Workforce $6,202 $5,637 $5,124 $4,658 $1,306 Total Return on Contributory Assets $18,023 $16,383 $14,892 $13,537 $3,795 CAC as a % of Existing Customer Revenue 1.40% 1.40% 1.40% 1.40% 1.40% Cash Flow Attributable to the Customer Relationships $43,217 $46,331 $48,520 $44,105 $12,366 Partial Period Adjustment 0.583 1.000 1.000 1.000 1.000 Cash Flow Attributable to Customer Relationships $25,210 $46,331 $48,520 $44,105 $12,366 Discount Rate 15.0% Valuation Date 5/31/2015 Years to Discount 0.583 1.583 2.583 3.583 19.583 Mid-Year Adjustment 0.5 0.5 0.5 0.5 0.5 Adjusted Years to Discount 0.292 1.083 2.083 3.083 19.083 Present Value of Cash Flows $24,203 $39,822 $36,264 $28,664 $859 Sum of PV Cash Flows $238,950 FMV of Existing Customer Relationships (rounded) $240,000

- 29. Copyright © 2015 Beacon Valuation Group LLC 29 Company XYZ Valuation of Future Customer Relationships - IAXA Multi-Period Excess Earnings Method ($000's) 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2034 year 1 2 3 4 20 Total Customer Revenue (Existing & Future) $1,360,000 $1,468,800 $1,571,616 $1,665,913 $2,751,668 Revenue Growth 8.0% 7.0% 6.0% 3.0% Existing Customer Relationships Revenue $1,292,000 $1,174,428 $1,067,555 $970,408 $272,071 Percent of Total 95.0% 80.0% 67.9% 58.3% 9.9% Future Customer Relationships Revenue $68,000 $294,372 $504,061 $695,505 $2,479,597 Percent of Total 5.0% 20.0% 32.1% 41.7% 90.1% EBIT Margin [3] 8.0% 9.0% 10.0% 10.0% 10.0% Add: Sales & Marketing Expense on Existing Accounts 0.50% 0.5% 0.5% 0.5% 0.5% 0.5% Adjusted EBIT Margin 8.5% 9.5% 10.5% 10.5% 10.5% EBIT $5,780 $27,965 $52,926 $73,028 $260,358 Less: Return on Brand Component @ 1.10% $748 $3,238 $5,545 $7,651 $27,276 Pretax Income $5,032 $24,727 $47,382 $65,378 $233,082 Provision for Income Taxes 40.0% $2,013 $9,891 $18,953 $26,151 $93,233 Net Income $3,019 $14,836 $28,429 $39,227 $139,849 Less: Return on Working Capital $340 $1,472 $2,520 $3,478 $12,398 Less: Return on Fixed Assets $282 $1,222 $2,092 $2,886 $10,290 Less: Return on Assembled Workforce $326 $1,413 $2,419 $3,338 $11,902 Total Return on Contributory Assets $949 $4,106 $7,032 $9,702 $34,590 CAC as a % of Future Customer Revenue 1.40% 1.40% 1.40% 1.40% 1.40% Cash Flow Attributable to the Customer Relationships $2,071 $10,730 $21,397 $29,524 $105,259 Partial Period Adjustment 0.583 1.000 1.000 1.000 1.000 Cash Flow Attributable to Customer Relationships $1,208 $10,730 $21,397 $29,524 $105,259 Discount Rate [6] 17.0% Valuation Date 5/31/2015 Years to Discount 0.583 1.583 2.583 3.583 19.583 Mid-Year Adjustment 0.5 0.5 0.5 0.5 0.5 Adjusted Years to Discount 0.292 1.083 2.083 3.083 19.083 Present Value of Cash Flows $1,154 $9,052 $15,428 $18,195 $5,261 Sum of PV Cash Flows $240,360 FMV of Future Customer Relationships (rounded) $240,000

- 30. Fair Value % of BEV BEV $1,000,000 100.0% Less: Working Capital $70,000 7.0% Less: Return on NWC (Existing Customers) $30,493 3.0% Less: Return on NWC (Future Customers) $28,675 2.9% Less: Fixed Assets $30,000 3.0% Less: Return on NFA (Existing Customers) $25,309 2.5% Less: Return on NFA (Future Customers) $23,801 2.4% Less: Existing Customer Relationships $240,000 24.0% Less: Future Customer Relationships $240,000 24.0% Less: Trade Names - RFR Method (Excluded) $0 0.0% Less: Assembled Workforce ("AWF") $55,000 5.5% Less: Return on AWF (Existing Customers) $29,273 2.9% Less: Return on AWF (Future Customers) $27,528 2.8% Less: Return on Brand (Existing Customers) $67,084 6.7% Less: Return on Brand (Future Customers) $63,086 6.3% Equals: GP (Intrinsic Component of Corporate Brand) $69,751 7.0% Pure Goodwill = BEV - All Intangibles (IAA + IAXA) - Unallocated Returns on Assets Copyright © 2015 Beacon Valuation Group LLC 30

- 31. Intangible Assets (IA) IAA IAA(Xb) TM(b) GA IAXA(Xb) Rx = [ RMA + RTA + RIA(XB) + RB(i) ] GP IA = Intangible Asset Value GP = Pure Goodwill Value IAA = Discretely Identifiable Accounting Intangible Assets RX = Returns on Assets Not Allocated to Any Specific Asset Group IAA(Xb) = IAA, excluding Brand Value Elements RMA = Return on Monetary Contributory Assets TM(b) = Trademark Value as Measured for Financial Reporting (Accounting) Purposes RTA = Return on Tangible Contributory Assets GA = Accounting Goodwill Value RIA = Return on Intangible Contributory Assets IAXA = Intangible Assets Not Measured for Financial Reporting (Accounting) Purposes RIA(Xb) = Return on Intangible Contributory Assets Other than Corporate Brand IAXA(Xb) = IAXA, excluding Brand Value Elements RB(i) = Return on Corporate Brand's Intrinsic Component Location of Corporate Brand Value Elements TM(b) Copyright © 2015 Beacon Valuation Group LLC 31

- 32. B = GP + RB ($000's) Intrinsic Component of Corporate Brand (GP) $69,751 Add: Returns on Corporate Brand from Primary Intangibles (RB) Existing Customers $67,084 Future Customers $63,086 Other Intangibles $0 $199,921 Equals: Corporate Brand Value $200,000 Copyright © 2015 Beacon Valuation Group LLC 32

- 34. René Hlousek, ASA-BV/IA, MRICS President and Managing Director Beacon Valuation Group LLC E-mail: rh@beaconval.com Asia-Pacific (Guam) Office Phone: +1 671-653-5757 Fax: 671-653-5758 P.O. Box 7930 Tamuning, GU 96931-7930 San Francisco (U.S.) Office Phone: +1 415-357-1227 Fax: 415-357-1701 350 Bay Street, Suite 100-366 San Francisco, CA 94133 Copyright © 2015 Beacon Valuation Group LLC 34