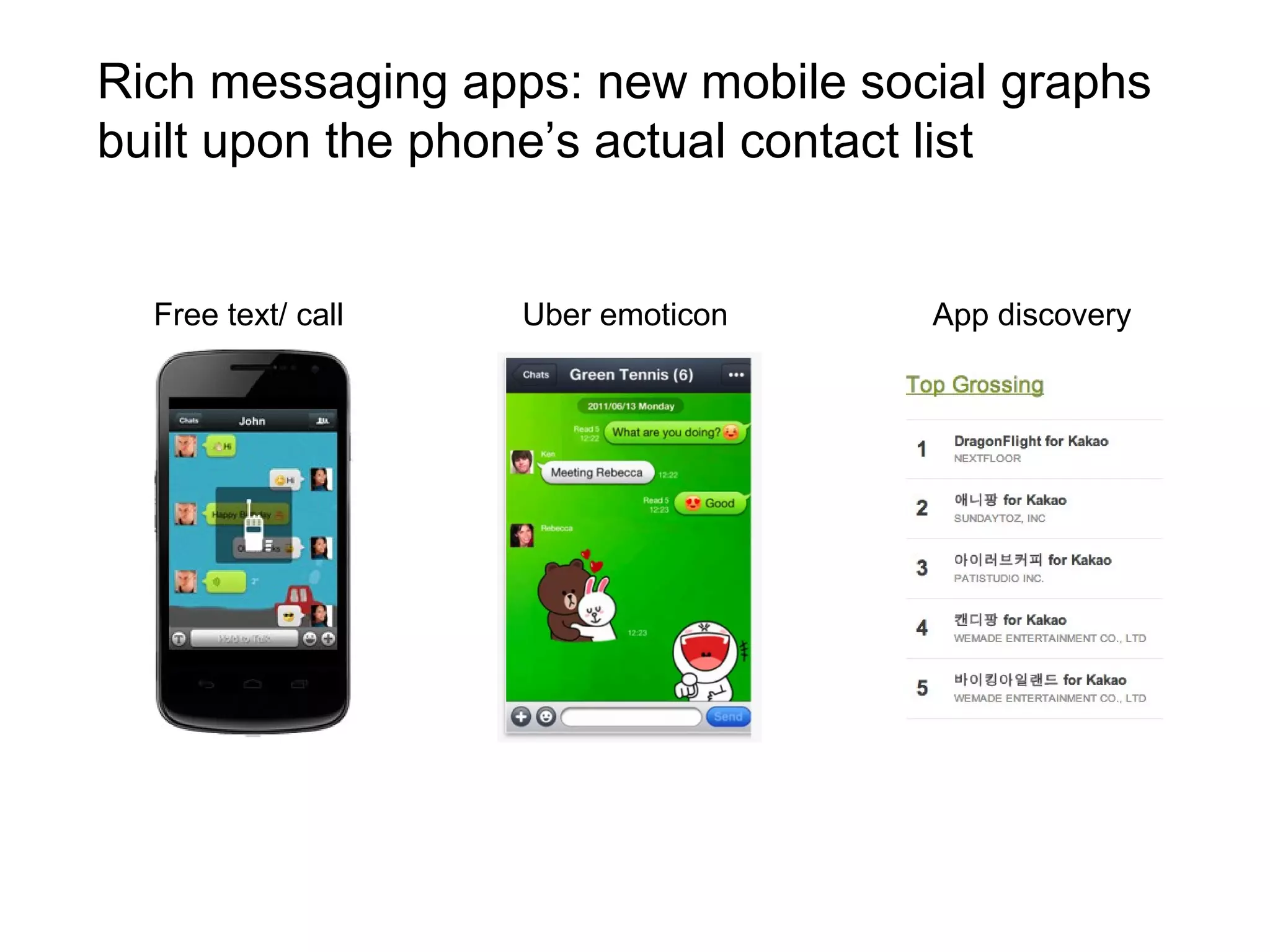

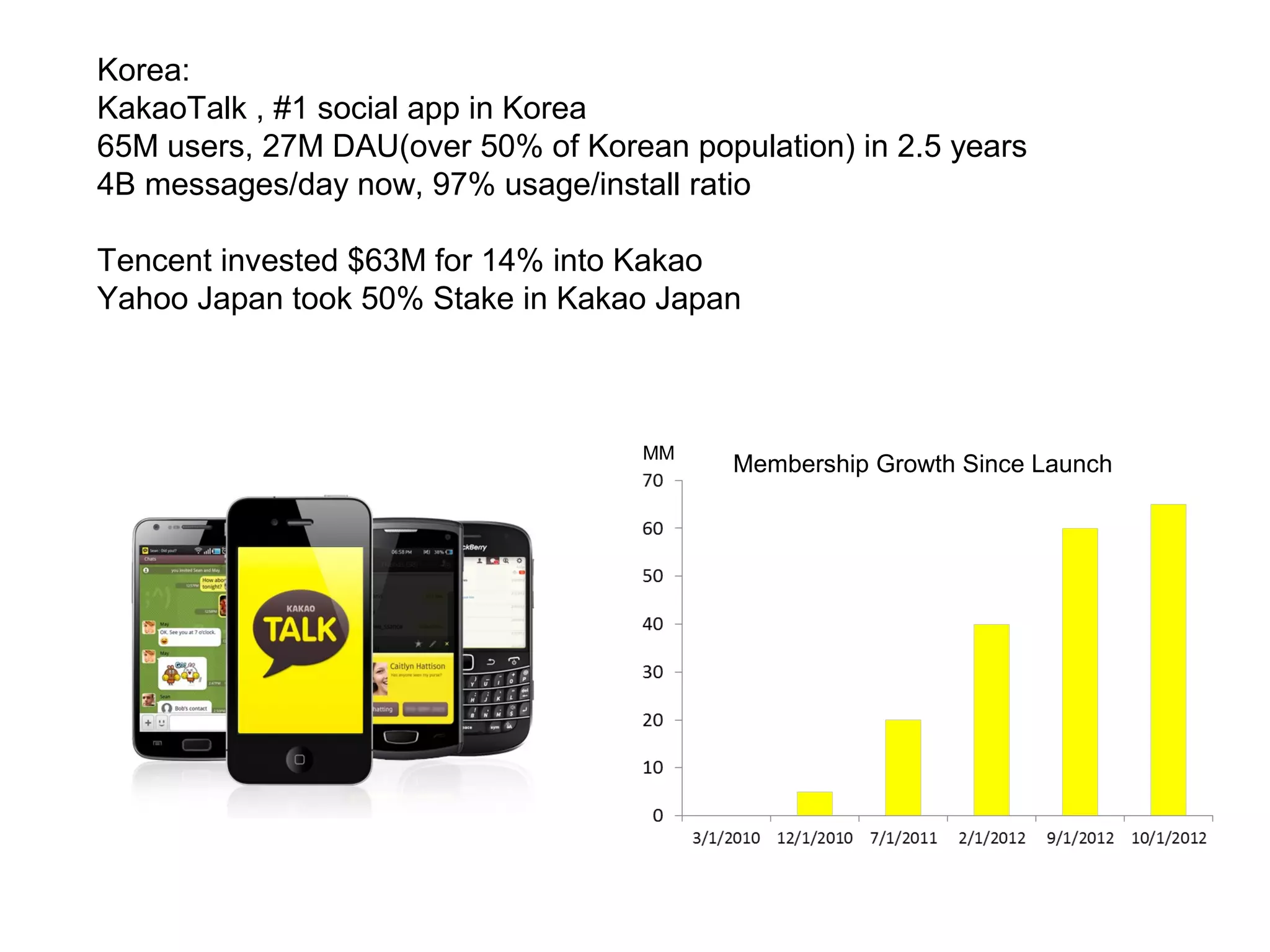

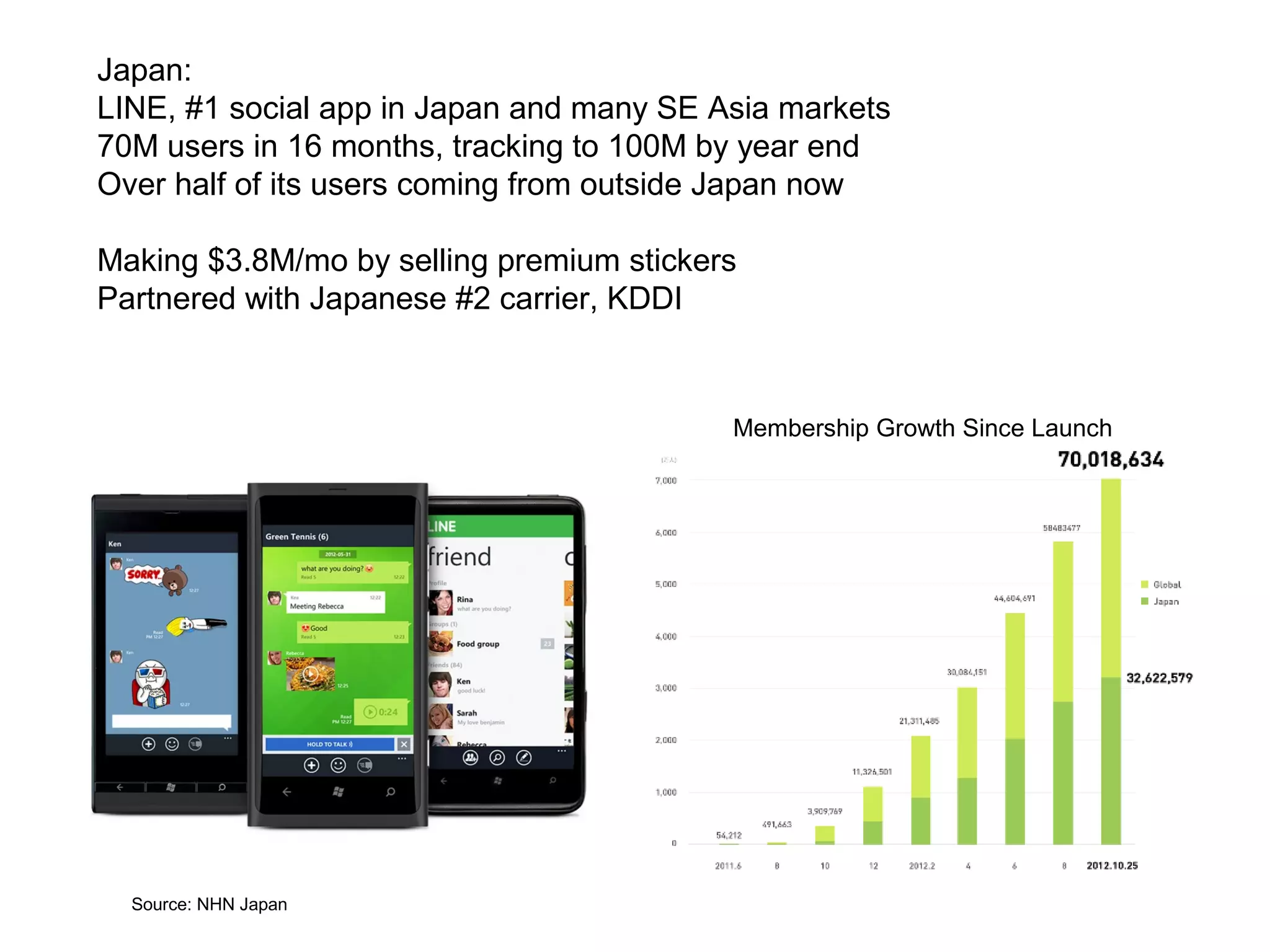

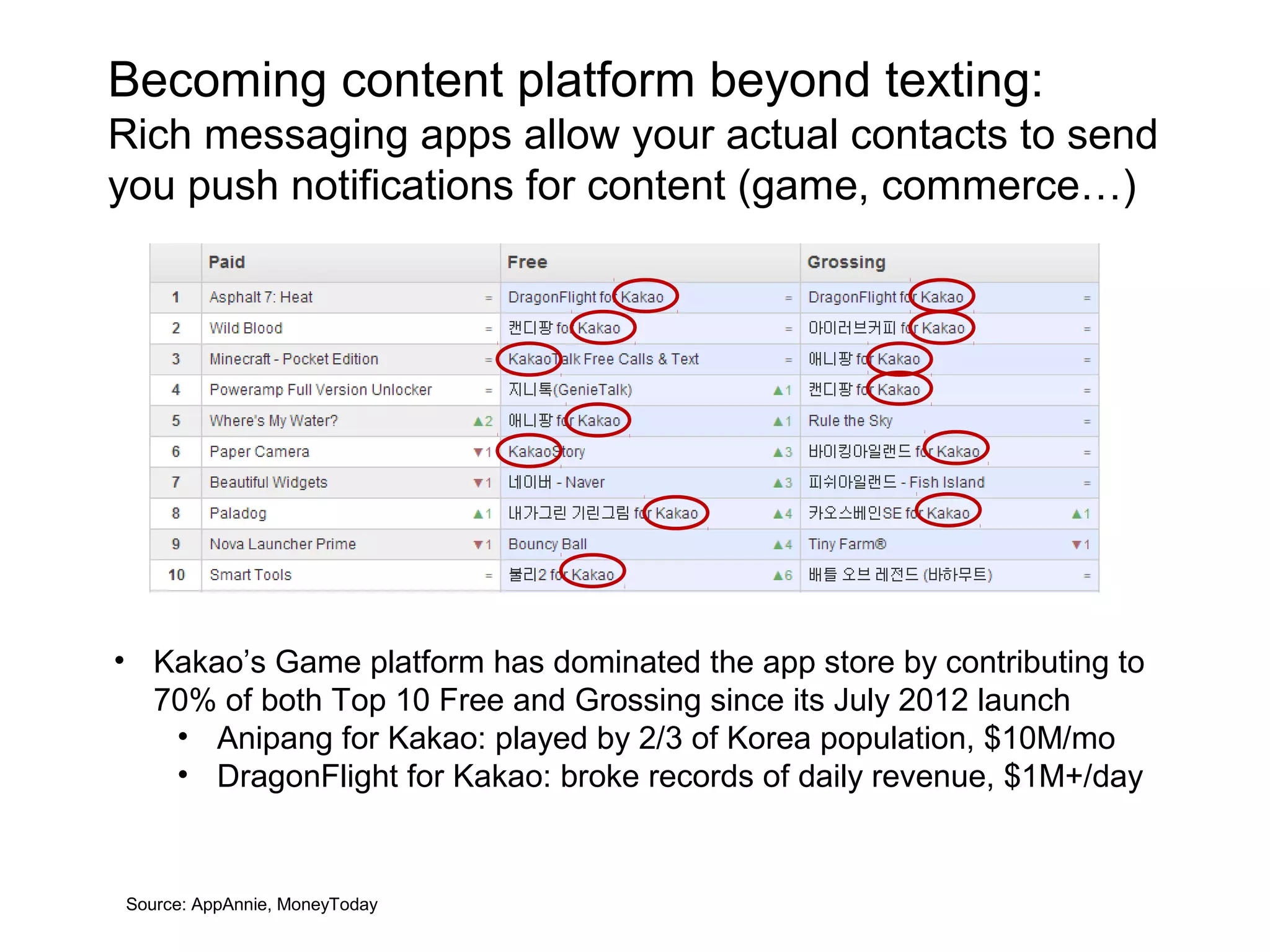

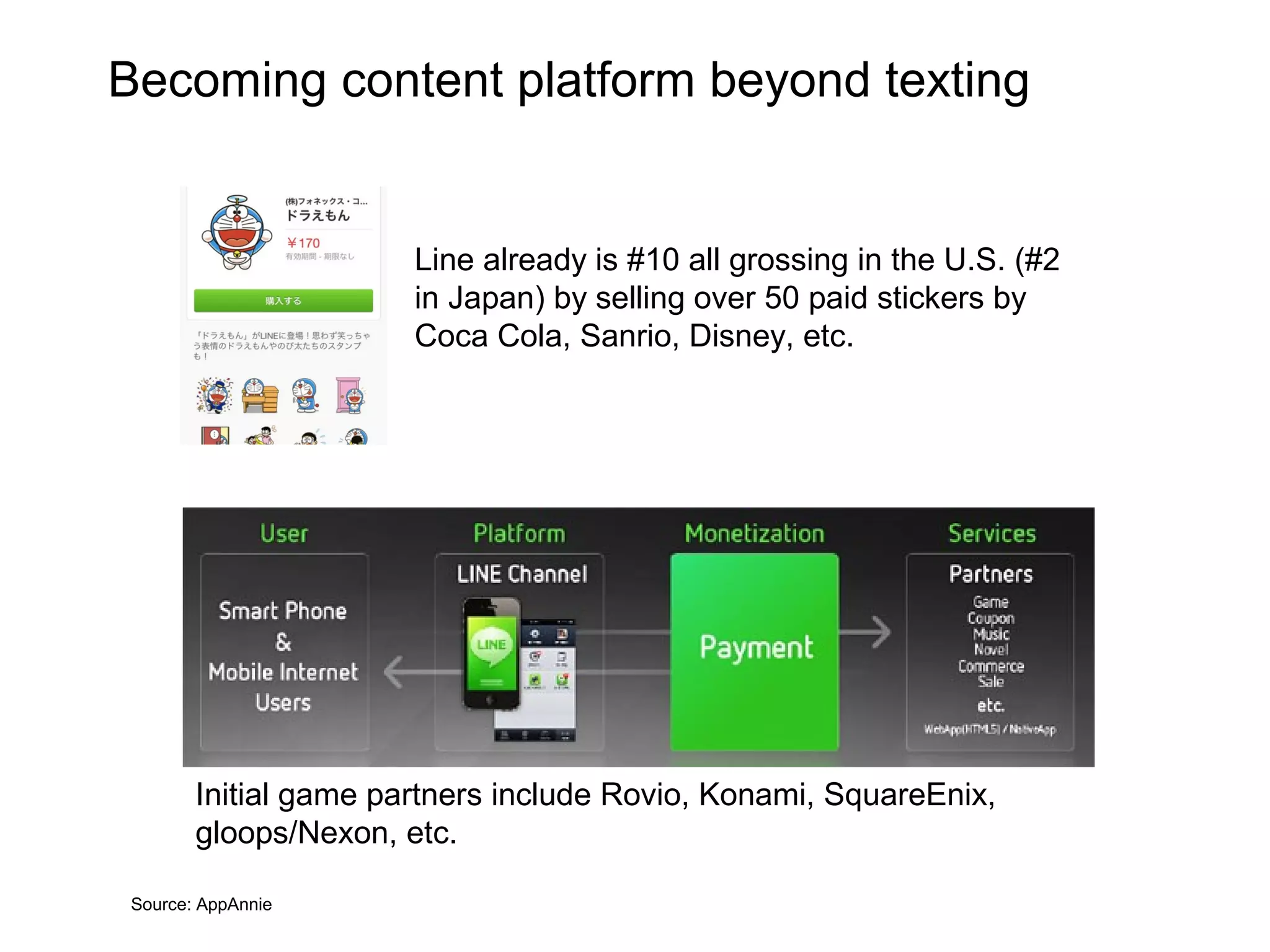

Rich messaging apps have become hugely popular social platforms in Asia, led by KakaoTalk in Korea and LINE in Japan/Southeast Asia. These apps allow users to text but also integrate other services like games, commerce, and content discovery through their contact networks. KakaoTalk has 65 million users in Korea sending 4 billion messages daily, while LINE has over 70 million users, more than half from outside Japan. Telecom and internet companies are responding by partnering with or developing their own rich messaging apps to engage users and drive revenue from new services.