Step 2 Training Materials - Market Maps

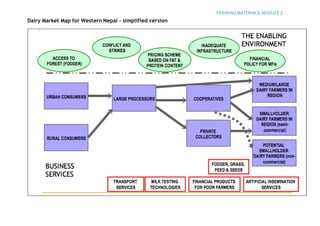

- 1. TRAINING MATERIALS: MODULE 2 Dairy Market Map for Western Nepal – simplified version

- 2. TRAINING MATERIALS: MODULE 2 Dairy Western Nepal market map

- 3. TRAINING MATERIALS: MODULE 2 Dairy Market Map for Western Nepal - Narrative KEY MARKET CHAIN ACTORS Percentages: indicate current share of volume Semi-commercial farmers (60,000-70,000): Average productivity very low i.e. approx 1 produced by farmers and channelled by litre/day per cow (2.3 litres/day for buffalos). Due to poor genetics (breed), low quality intermediaries feedstuffs and health problems the milk quality is low further eroding their prices. Arrows show flow of money from end markets to Non-commercial farmers (250,000-300,000): They have at least 1 or 2 milking cows/ producers buffalo but are either not producing adequate amount to sell or have not seen the incentives to be linked with the market channels to sell their milk. Bold arrow: Dominant market channel Cooperatives are the traditional point of milk collection. Dhading, Tanahu and Gorkha Normal arrow: existent market channels have relatively few; Chitwan has over 100 mostly formed by DDC to secure their supply. Most have chilling facilities and some have technologies (though old) for pasteurization Dotted arrow: potential market channels and minimal processing; however less than a third have any storage facilities. Large-scale processors: Dairy Development Corporation is government-owned and the largest and most influential actor since 1969. It dominates provision of chilling facilities, which has hampered private investment up to now. Private processors are now start ing to emerge and even overshadow it. SERVICES/INPUTS All the services and input included in the Map have various levels of challenges in terms of outreach, affordability, appropriateness and quality. Milk quality testing technologies: Services mostly embedded into cooperatives and/or large processors or dairies, but transparency and impartiality is dubious. Intermediate technologies like lactometers are hard to find and not used properly when available. Financial products: Current loans and insurance products are not suitable for small holder dairy farmers. Interest rates are relatively high and repayment options are not conducive for dairy farmers (does not take into account their production cycle). AI service: Weak or non-existent. Gorkha district has no AI service and semen is unavailable. Service providers are not well trained or equipped for rural and remote locations resulting in low success rate and at times death of cow from infection. Breeding stock and cattle purchase markets: Improved breeds of cattle come from India and there are stringent quarantine measures. Majority of small-scale farmers rely on poor supply and low quality of breeding stock. Fodder/ grass/ feed: Nutrition inputs are one of the key constraints to realising production potential. Lack of access to community forest is a problem and other options require more labour and time. Feed is not affordable as most is procured outside the district. Know ledge on improved grass cultivation is low and land to grow them scarce.

- 4. TRAINING MATERIALS: MODULE 2 Transport services: Labour for transporting milk to local market centres is scarce and/or expensive (partly due to migration). Large scale processors use small trucks with milk cans rather than chilled tankers – further eroding milk quality. Animal health advice and drugs (public and private): The key issues are: Lack of out-reach: lack of quality services; lack of resources for service providers to upgrade their skills and knowledge. Traditional healers are currently an important but low -quality channel of advice for marginalised farmers. Dairy equipment and maintenance: As large processors expand their supply catchment areas there will be a need to ensure that local service providers are available. Trained providers (electricians and metal-workers) are hard to find due to migration. Info & knowledge (public and private; mass media and targeted communication and training): Mass media, such as radio, targets few products at increasing the knowledge of small holder dairy farmers. From other sources, there is a lack of available knowled ge providers for agro-vets, AI providers and other essential providers. Embedded services: The majority of intermediary players are interested in improving bulking and chilling. Some processors have taken additional steps by hiring professional agro-vets who provide technical advice at collection point. However, the service is paid by all milk suppliers whether they ask for advice or not (cess deducted from every litre of milk). Processors are open to exploring new models as long as they make business sense. BUSINESS ENVIRONMENT Agriculture policies Such as agriculture subsidies, import duties and quarantine laws look good in theory but create an unfavourable environment for small holder dairy farmers in practice. Fat- and protein-based pricing scheme: Promoted by DDC and given its governmental nature and size this scheme acquired a “quasi-policy” status. However most farmers go down the route of low added value transactions where price is determined by volume. Conflict has hit small holder farmers the hardest as there has been very low out-reach of government extension services to rural and remote areas. Continued political unrest has resulted in frequent strikes and bandhs which force farmers to throw away their milk as they lack storage facilities. Weak governance has made this sector highly vulnerable to corruption, bribes and bureaucratic hassles e.g. on issues such as import of cattle and semen. Decreasing access to community and leasehold forest for small holder dairy farmers is a further issue. Milk holidays: During flush periods large dairy processors often stop buying milk for a set number of days. Farmers have learned to live with this practice but it has a negative impact on the efficiency of the whole system. Instead of evening-out seasonality peaks it discourages emerging farmers from taking part in this sector, hampers value addition to extra supply (e.g. powdered milk, sweets and ice creams) and reinforces national dependency on imports during dry seasons.

- 5. TRAINING MATERIALS: MODULE 2 Market system for maize, Bangladesh

- 6. TRAINING MATERIALS: MODULE 2 Maize Market Map Narrative Maize is one of the field crops most suitable for cultivation on char sandy-loam soils. Demand for maize is very strong in Bangladesh, due to the growth of its use as feed-stuff in poultry, cattle and fishery production. Although nationally production has grown rapidly from a very low base in the last ten years, it has still not reached anything like its full potential – with imports still making up 30 – 40 % of the country‟s needs. Due to the dependency on imports, maize prices within Bangladesh are generally driven by international market – where the current long-term trend along with other cereal crops is for sharply rising prices. On the chars, maize cultivation is already practiced by larger land-owners, and produces good returns on investment. There appear to be good opportunities for smaller farmers to benefit, provided critical constraints in the area of access to quality seeds, i nputs, processing and storage can be addressed. The market mapping study was conducted in Sadar and Fulchari upazilas, in Gaibandha district; an area that CLP [the NGO] has been working in since 2007. The most important issues identified by the study were: • Huge potential for improvements in germination rates and yield – from better quality seeds (e.g. hybrid) and inputs. Constraints are related to very weak seed supply chains. • Maize drying (processing) is poor – due to a combination of high humidity, limited awareness of issues, and lack of drying facilities (chatal / drying floors). This leads to problems with crop storage, risk of Aflatoxin contamination, wastage and ultimately lower prices. The underlying problem is lack of knowledge and engrained traditional crop practices. Farmers also lack awareness of price differentiation on the basis of quality by buyers. • Lack of short-term storage facilities. This is a problem both on farm, and within the market chain (at haat / wholesalers) – and leads to a temporary glut in the market around the rabi crop harvest in April. The problem is compounded by lack of finance to enable farmers / wholesalers to retain crop on their property for longer. • Crop insurance might protect farmers investments against extreme weather, flooding. But insurance providers do not have a „presence‟ on the char, and awareness of the concept of insurance is very low. There may be an opportunity to embed insurance with micro-finance agri-loans. • Bargaining power. Individual farmers are vulnerable to cartel-behaviour by buyers – especially where selling points / options are few. Farmer organisation, or farmer-organised markets on the chars may be a solution.

- 7. TRAINING MATERIALS: MODULE 2 Vision of sustainable outcomes We envisage that the maize market system could work better for CLP households – providing an important livelihood diversification option in future, if: • There were effective affordable agri-services provision based on the chars. Agricultural service providers could offer quality seeds and inputs, accurate information and advice (e.g. cultivation practices) to maize farmers for a small fee. The ASP would intermediate with the mainland input suppliers (taking an appropriate margin). • Farmers were organised informally on a small scale (10 – 20 households) – particularly for bulk purchasing and marketing of produce. This might include informally organised special markets. • Farmers had access to relevant financial services: seasonal loans, crop insurance which is provided by local micro -finance organisations. The ASP might play a role as an agent in this. Plausible intervention strategies The type of activities that CLP [the NGO] needs to engage in, to achieve this, are: • Technology innovation and improving farmer knowledge on cultivation techniques, proper use of inputs and post -harvest processing – through demonstration / marketing of simple solutions • Development (innovation) of the agri-services function – as a sustainable business (see agri-services market) or through „contract farming‟ to ensure availability of quality inputs (seeds, fertilizer, micro- nutrients) • Facilitation of small maize-producers‟ marketing groups to improve market linkages and get better prices. • Ensuring the availability of appropriate agricultural facilities like irrigation and shelling facilities. Recommendation: in 2008 Winrock International conducted a detailed study of the maize market system on the Kurigram-Gaibandha and Bogra-Shirajganj chars. CLP should consult closely with Katalyst rural sectors division, to learn the lessons from subsequent intervention strategies.

- 8. TRAINING MATERIALS: MODULE 2 Tanzania Palm Oil Market Map

- 9. TRAINING MATERIALS: MODULE 2 Tanzania Palm Oil Narrative BACKGROUND: FELISA Ltd is based in Kigoma town on the shores of Lake Tanganyika in western Tanzania. The company cultivates oil palm tree s (Elaeis guineensis) and processes fresh fruit bunches (FFB) to produce crude palm oil (CPO), an edible oil used for cooking, cosmetics and pharmaceuticals. FELISA is presently 100% self-financing, funded by equity contributions from 24 (majority Belgian) shareholders. FELISA has a 100 hectare oil palm plantation 75km from Kigoma town. They have recently obtained another 4,258 hectares of land 150km from Kigoma, where they plan to also plant oil palm. A first crop of seedlings was planted in December 2005, and a second in January 2007. Oil palm trees take four to five years to mature to fruition, and the production of CPO is planned to begin in 2009. FELISA also aims to purchase FFB from local small-scale farmers as part of a proposed outgrower scheme. They calculate that a total of 500 hectares under lo cal cultivation will meet demand once their own plantations bear fruit. An influx of refugees from conflicts in Burundi and the Democratic Republic of Congo has placed great pressure in the Kigoma area, but this trend is now reducing with repatriations. The refugee camps absorbed many natural resources regionally, as evidenced in mass deforestation for firewood and a large reduction of water. Investment in western Tanzania, especially Kigoma region, is low, and there is sparse allocation of funds in the agricultural sector. Many people in the region are subsistence farmers and, according to FELISA, do not notice economic shocks as profoundly as those with stronger ties to the wider economy. Crops are harvested and planted during the rainy seasons of October-January and March-June, and prices decline during these times of peak production. During off-peak periods farmers owning palm oil harvest the few ripe FFB and prune and weed. Between January – February farmers harvest maize and plant fast crops, such as beans and sunflower. The planting of palm oil trees takes place at the onset of the rainy season because the oil palm requires much water. Although malaria is present all year, infection rates increase during these wet periods. The company‟s initial strategic choice was to grow and process palm oil for biodiesel production for the domestic market, targeting the national utility TANESCO back-up generators and possible transport fuel blending markets. However with the world market price of CPO having risen sharply, from $0.25/litre in 2005 (when their first planting took place) to a high of US$1.35) in 2008, FELISA are considering additional non-energy market options. ENABLING ENVIRONMENT: With respect to the Enabling Environment, FELISA have sought to influence the Ministry of Energy‟s biofuel policy so that they and other domestic biodiesel producers can operate in a known environment when negotiating with foreign buyers. One call is for a polic y that stipulates the blending ratio between biodiesel and fossil diesel used in Tanzania. Ideally this policy would also ensure that a certain percentage of biodiesel is produced internally. Primary producers and processors have not made similar efforts to engage with the

- 10. TRAINING MATERIALS: MODULE 2 policymaking process. Contract enforcement issues have not affected any Kigoma-based actors, nor have bodies that monitor trade standards. There are reported cases of product adulteration, with incidents of waste water being added to CPO (apparently by middlemen who, in one case, paid farmers to bring waste water to be added to the oil). The effect has been that some buyers avoid Kigoma and now purchase instead in Mbeya. While FELISA has not experienced corruption, employees recognise that any process that involves go vernment officials can run the risk of delay due to institutional bureaucracy which may impact on the timely accessing of services. In registering their new land, for example, FELISA had to wait close to an entire year for the process to be completed. This is due to the fact th at only one person is authorised to make declarations about land and their services are in high demand. FELISA currently enjoys a five ye ar tax holiday, along with a capital goods import duty exemption. Local farmers, however, are frequently levied to pay various taxes, including a tax for goods going to market. Accessing loans or grants for agricultural and agri-related industries is difficult. Banks in particular perceive the sector to be high-risk, and rarely provide loans, especially for perennial crops. FELISA have recently applied to Private Agricultural Sector Support for assistance in obtaining a loan and, if successful, this should have positive knock-on effects for primary producers working with FELISA. SUPPORTING SERVICES Of the Supporting Services, inputs and finance are sourced by FELISA themselves. All linkages are created and maintained by FELISA‟s own efforts, although they have benefited from some outside influences, in particular training received from specialists from Cos ta Rica. Research relating to market information is self-initiated, and lessons are learnt within the company from their exposure to the domestic and international production markets. FELISA‟s proposed outgrower scheme, for example, bears some resemblance to the agreement be tween Prokon, a German private company in Rukwa that sources its Jatropha from local farmers in the region. The Ministry of Agriculture sends investors interested in palm oil production to FELISA, and one of the Directors is regularly invited to present at internati onal conferences. FELISA regard themselves as a learning institution.