Private Money411 - Featuring B2R Finance

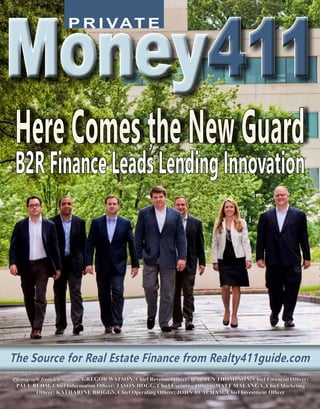

- 1. P R I VAT E Money411Money411 The Source for Real Estate Finance from Realty411guide.comThe Source for Real Estate Finance from Realty411guide.com Photograph from left to right: GREGOR WATSON, Chief Revenue Officer; DARREN THOMPSON, Chief Financial Officer; PAUL BEHM, Chief Information Officer; JASON HOGG, Chief Executive Officer; MATT MALANGA, Chief Marketing Officer; KATHARINE BRIGGS, Chief Operating Officer; JOHN BEACHAM, Chief Investment Officer HereComestheNewGuard B2RFinanceLeadsLendingInnovation FALL ISSUE 2015

- 3. P R I VAT E Money411 Join Us for a Finance Expo in Los Angeles, see pg. 8 4 Celebrate Private Money411 Live 6 Fuquan Bilal on Raising Capital 8 Here Comes the New Guard: B2R Finance Leads Lending Innovation 11 The New Rules of the Fundraising Game 12 Meet Your Creative Finance Experts 14 Disclosing Risk in Funding 17 Meet the Money Minds 28 Benefits of Private Funding 28 Colony American Finance Wants to Jumpstart Portfolios CONTACT US: 805.693.1497 or info@realty411guide.com Be social, look for Realty411 updates on Facebook, Twitter, LinkedIn, Pinterest, Google+ Important Disclosures for Our Readers: The information and presentations provided herein do not constitute an offer or solicita- tion to buy or sell securities or real estate. Please be aware that real estate investing can be risky. Realty411, the publisher of Private Money411, is not responsible for any information provided and/or statistical data presented, and does not reflect the opinions, advice or research by us. Readers are 100% responsible for their due diligence, for all investment information and for all decisions with respect to any potential investment or transaction. 411 recommends readers seek the advice of a trusted attorney, broker, CPA and/or financial adviser before investing. PRIVATE MONEY411 Cover: Photograph from Left to Right: Gregor Watson, Chief Revenue Officer; Darren Thompson, Chief Financial Officer; Paul Behm, Chief Information Officer; Jason Hogg, Chief Executive Officer; Matt Malanga, Chief Marketing Officer; Katharine Briggs, Chief Operating Officer; John Beacham, Chief Investment Officer Below: Mingle with hundreds of active inves- tors in Los Angeles on September 19, 2015. Join us to celebrate our new issue. Private Money411 will be hosting industry gatherings with a focus on technology and finance. For more information, see pages 4 and 5. Photo left: Rebecca Rice with Rebecca Rice & Associates, pg. 12 CONTENTS

- 4. Celebrate Our Financial Supplement and Learn from the Top Leaders of Finance in CA & NY. Private Money411 will be hosting two important events in 2015. Whether you are based in the West or East Coast, you will have the opportunity to network, learn, and mingle with extraordinary finance leaders and speakers. Industry Leaders are Welcomed as Our Complimentary Guests. Reserve Your Participation @ 805.693.1497 or RSVP by email: info@realty411guide.com

- 5. WEST - LOS ANGELES - CA Real Estate Finance & Technology Expo Network with the VIPs of Finance Saturday, Sept. 19th - 9 am EAST - MANHATTAN - NEW YORK Real Estate Finance Expo with REIA NYC Join Us in Manhattan - Visit New York City Saturday, November 7th - 9 am Private Money411 Finance Conference Private Money411 Finance Conference For information, visit REALTY411guide.com/events • 805.693.1497 • info@realty411guide.com CaliforniaandNewYork

- 6. Realty411Guide.com PAGE 6 • 2015 Private Money411 1.888.604.3353 1135 Clifton Avenue, Suite 204 Clifton, New Jersey 07013 www.NationalNoteGroup.com Now that we have your attention, isn’t it time you partnered with National Note Group and invested in this alternative asset class, earning double-digit returns, while providing stabilization and diversification to your investment portfolio in the fast growing Mortgage Note Market. NNG DE LLC 1 is a private fund, which was launched by National Note Group in March 2013 with the sole purpose to focus on investments in second lien mortgage notes. The Fund is registered as a private placement under Sec 506 Reg D., and is incorporated in Delaware. The fund was created to provide accredited investors with the opportunity to purchase shares that represent a proportionate undivided interest in a portfolio of re-performing and non-performing second lien mortgages. Call today to get started. 66% FIRST YEAR WORKOUT RATE National Note Group 2013 Record of Success $ 0pRINcIpAl WRITE-OFF 40% INVESTMENT YIElD Generate High Yield Passive Income and Build Long-Term Wealth NNG DE LLC 1 50 Loans closed in 2013 Successful Workouts Short Sale & Deed in Lieu Foreclosures 22% 12% NNG DE LLC 1 Successful Workouts Short Sale & Deed in Lieu Foreclosures Different Ways to Raise Capital and Buy Notes. BY FUQUAN BILAL P eople often think that raising money is the most challenging aspect of the note business when in actuality, once the fundamentals are established, finding money is the easiest part. Raising capital whether you know or not is heavily influenced by cred- ibility, reputation, and strong marketing. If you want to keep generating cash flow, never stop raising money, and never stop marketing. Getting involved and networking are little things that make a big difference. There are many ways to raise capital, from investors to partnerships, and to make note purchases. When working with investors, strive to go out of your way because the way you treat them directly affects your capital. Your reputation will precede you. If you pay on time, keep your word, and display re- sponsibility you are showing strong qualities that will make positive impressions on people and especially investors. Investors want to invest with the people they feel they can depend on, trust, and are comfortable with. Therefore, building strong relationships is critical and fundamental in the note business. How you market yourself to other target audiences is also critically im- portant. Sell more than just interest rates and show that your company, or even you, is exclusive and different. Asset building isn’t just accomplished through sin- gle purchases. One can also build collateral by creating partnerships and forming an LLC. In forming an LLC with partners, each person can put x amount of dollars in and then go out and buy notes with the money. Since note buying is a capital intensive business, most note buyers start off on a smaller scale before RAISING CAPITAL andPrivateMoney Continued on pg. 38

- 7. Faster, easier ways to save. Welcome to the modern world. Call 1-800-712-6050 to see how much you could save on car insurance. Not available in all states. Savings may vary.

- 8. THE LEADERS OF FINANCE With offices nationwide, B2R Finance is a financial tech- nology company founded to address the unique needs and financial goals of single-family rental property investors. The company offers a full suite of lending solutions designed for investors at all stages of port- folio growth. Current products include fix and flip financing, bridge to term loans, portfolio rental loans for refinancing, the Entrepreneurial Lending Program and the Institutional Lending Program.

- 9. the New Guard B2R Finance Leads Lending Innovation What The B2R Finance Lending Lab Is Developing Now… W hat is the world’s most innovative real estate financing laboratory cooking up next? B2R Finance CEO Jason Hogg has been shaking things up at one of the most exciting lenders we’ve seen emerge in the new real estate landscape. This is the innovative mortgage lender that brought us new residential buy to rent financ- ing, the industry’s first multiborrower securitization and was established by funds managed by Black- stone Tactical Opportunities. Jason shares what new loan products and tools are being rolled out, and how investors can stay ahead of the curve. THE WAYNE GRETZKY OF MORTGAGE LENDING “A good hockey player plays where the puck is. A great hockey player plays where the puck is going to be.” – Wayne Gretzky Gretzky developed a formidable reputation on the ice, by staying ahead of the game. B2R Finance appears to not only wield the physique of a legend- ary hockey player, but is driving the game with its speed skates on, and hitting the puck into the fu- ture. The firm has already been disrupting the me- chanics of the industry, and paving the way with entrepreneurial lending products. But most don’t re- alize how much new technology and creative prob- lem solving is set to reshape real estate investment. We got a peek inside the brain of the finance giant, and the 411 on what’s next in an exclusive interview with CEO Jason Hogg… DWELL FINANCE: THE NEW DEAL FOR INVESTORS B2R Finance just acquired Dwell Finance. The big move helps B2R dig deeper with an expanding local market presence and adds new investment loan products. Jason Hogg says the Dwell Finance acquisition is significant on three fronts: 1. New Loan Products for Investors Jason says it “augments the suite of products for customers with fix and flip, and bridge to term lend- ing programs.” This includes a single credit line that facilitates rehabbing and reselling houses, acquiring multiple vacant properties for conversion to rentals, and portfolio refinance loans for buy and hold inves- tors. 2. Integrating the Industry Not only does the Dwell move help connect the industry, but few realize that it adds to an expand- ing national footprint with physical regional offices to optimize service for borrowers. This facilitates “business relationships,” including face-to-face time, which Hogg says is “paramount” to the organization and developing new products. 3. New Technology Platform Dwell provides a simplified front end portal online. This delivers on what the CEO describes as “fast- er, low friction lending.” It’s not just about beauty in web design either. Behind the curtain is a unified COVER Realty411Guide.com PAGE 9 • 2015 Private Money411 BY TIM HOUGHTEN

- 10. platform which enhances the lender– investor relationship. It even acts as a mobile dashboard for investors to interact and upload documents on the go, as well as monitoring their portfo- lio performance from anywhere in the world. This helps further build the rela- tionship by tapping big and small data to provide users better solutions. This isn’t your creepy Facebook stalking- style relationship. It is about getting to know where you want to go, where your portfolio is in relation to that, the DNA of your local market, and how to connect the dots with great financing. THE BIG IDEA While some newer real estate in- vestors were griping about access to inventory as we turned the corner into 2015, B2R Finance’s Dwell acquisition and investments in product develop- ment suggest bullishness on the US market’s future. We’ve already seen a significant spike in foreclosure ac- tivity and distressed properties being leaked onto the market in early 2015. Jason Hogg told Realty411 that the firm sees a “huge growth opportunity, worth billions of dollars.” In fact, Hogg says the firm has seen demand for in- vestment property loans nearly double as of May 2015. B2R Finance’s CEO describes the opportunity as being “ideal for profes- sionals like doctors, lawyers, dentists, and professors looking to achieve higher yields.” He points out the com- bination of yield and income from an appreciating asset as a far better option for these intelligent individual investors, in addition to professional investors and investment firms. He goes on to highlight how the newly upgraded B2R-Dwell tool chest auto- mates management to make investing “radically easier.” THE LENDING LAB So where does B2R come up with these innovative products, and what’s next? A peek inside the mortgage lend- er’s offices reveals that this company is nothing like the stuffy, dark bankers’ corner offices of the past. This is more like Airbnb and Uber meets mortgage lending. In addition to the Dwell Fi- nance acquisition, Jason has headed up a three-pronged approach to driving entrepreneurship in mortgage lending in-house. This includes: 1. Active listening 2. The Idea Incubator 3. The Lending Lab There are few, if any other firms where you’ll catch executives, including the CEO, active in the trenches alongside their frontline team members. Hogg says he loves listening in to the origi- nation team in action in the Charlotte office, as well as sitting next to the due diligence staff clearing loans for fund- ing. It is this connection to the daily me- chanical challenges and client that will certainly help B2R retain an edge. The Idea Incubator is where team members get to pose their own sug- gestions for improving operations and delivering better solutions. The Lend- ing Lab is where Hogg has assem- bled a team of experts from a variety of other industries to pioneer new loan programs for investors. It is here that dynamic “agile development” happens and new pilot programs are launched for live testing with clients. The CEO says that one of the new game changing product tools coming out of this lab is harnessing the power of predicative analytics, and algorith- mic approvals. By summer 2015, this is expected to be revealed in the form of ‘Instant Pre-Qualification’ using just seven fields of information. The result is to be an even more effi- A peek inside the mortgage lender’s offices reveals that this company is nothing like the stuffy, dark bankers’ corner offices of the past. This is more like Airbnb and Uber meets mortgage lending. Continued on pg. 38 Here Comes the New Guard, pg. 9 Realty411Guide.com PAGE 10 • 2015 Private Money411

- 11. T he real estate busi- ness is buzzing with talk about fundrais- ing and the SEC’s new Regulation A+. But what is it really? Is it right for you? Can you test drive it before taking an acciden- tal detour, and how do you stay out of jail? If anyone knows the answers to these important questions it is Gene Trowbridge, Esq., CCIM. Trowbridge’s California law firm Trowbridge, Taylor & Sidoti was responsible for almost 50% of Reg- ulation A real estate offerings filed between 2008 and 2013. In fact, Gene Trowbridge has been helping launch real estate syndications for 21 years. The media and real estate circles have be swirling with news of the SEC’s recent ruling on Regulation A+. Reg. A+ is a part of the JOBS Act. However, Gene warns inves- tors and sponsors not to overlook the ongoing benefits of 506c and Regulation A fundraising. It’s really all about finding the right fit for you, and your investors. Unfortunately, the recent storm of press has often made it sound as if everyone has the green light to just go out and raise money from the crowd for whatever they like from burritos to mortgage notes and apartment buildings. But this California attorney suggests you get some counsel, and do some real planning and budgeting, at least if you want to “stay out of jail.” BEFORE YOU RAISE A DOLLAR… It should go without saying, but talk to an expert. As in the real estate industry, many legal firms are rapidly trying to position themselves as ‘pros’ in this arena. If you’ve ever done a real estate or note deal, or launched a business, you already know there is a giant gap to bridge between theory and effective execution. When re- searching and interviewing law firms Gene recommends looking for “flat fee pricing, and checking references.” An attorney that is upfront in telling you even the advice and facts you don’t want to hear, rather than just trying to win you as another client can be a good sign too. If you sit down for a consultation on creating a syndication or fundrais- ing with Gene he says he’ll walk you through which is the best legal entity to use (i.e. an LLC), which regulatory laws are easiest for you to navigate (Reg. D, A, or A+), and can assist in strategizing the deal structure on both the front and back end. STAYING SAFE WHEN RAISING FUNDS FROM THE STAGE Many, many fundraisers have gotten themselves in trouble when publi- cizing their offerings and investment opportunities. More often than not this can be because they simply don’t know better, and didn’t seek comprehensive legal counsel in advance. Of course, that isn’t an excuse that is going to fly with any judge. Nor is the fact that “everyone else is doing it.” Trowbridge reminds us that “breaking securities laws is a serious criminal offense.” Many just don’t realize that when they The NEW RULES of the Fundraising Game An exclusive interview with Gene Trowbridge Esq., CCIM on the New Real Estate Crowdfunding Landscape CAPITAL Realty411Guide.com PAGE 11 • 2015 Private Money411 Continued on pg. 38 By Tim Houghten

- 12. By Sandy Fox O ur 5th Annual Los Angeles Real Estate In- vestors’ Expo will feature some remarkable experts. On that day, we will spotlight Rebec- ca Rice and Jim Beam, industry leaders in a little-known financial area. They’ve perfected a way to turn a unique and specific kind of life insurance policy into a reservoir of money you can use to simplify your real estate investing. More than that, the strategy actually compounds and increases the ROI on your investments. A Financial Vehicle That Compounds Your Investments When you hear from Rice and Beam you’ll find a finan- cial vehicle beyond what most investors use. Typically investors turn to cash, mortgages, private lending or a combination of the above. Each has its own costs and limitations. Beam, who started as a real estate investor in Florida said, “We worked awfully hard to make our money. And it seemed like someone was always standing there at the end of the day with their hand out to take our money. Clos- ing costs, fees, taxes, interest rates.” He felt there had to be a better way. His search led him to Rice and her specially constructed policies. He learned a way that he could: • Keep his money safe and private • Borrow money at low cost or net-zero cost • Avoid credit checks and bank approval for loans • Gain tax-free retirement income • Loan his business money and save on taxes • Pay off debt faster • Create an emergency fund that earned interest four times higher than most banks pay He now helps other real estate investors learn how to take advantage of this system. This type of insurance poli- Meet Your Creative Financing Experts: Learn more with Rebecca Rice’s book, “Multi- ply Your Wealth: Essential Secrets for Financial Freedom.” Contact her directly at (501) 868-3434 or www.rebeccarice.net - You can connect with Jim Beam at (239) 591-3781 or email: jbeam@lifewayadvisors.com Rebecca Rice & Jim Beam Continued on pg. 22 Realty411Guide.com PAGE 12 • 2015 Private Money411

- 13. LOS ANGELES - CA$HFLOW Expo West Coast Network with investors from around the nation! September 19th - 9 am, Complimentary Book REALTY411 EVENTSREALTY411 EVENTS LAS VEGAS, NV - 2nd Viva Las Vegas Expo Event hosted with Real Estate Insider’s Club October 24th - 9 am, Play & Learn in Vegas SEATTLE, WA - Network in the Northwest With Real Estate Association of Puget Sound August 15th - 9 am in Bellevue, Washington NAPA VALLEY, CA - CRUSH It Expo 2015 Hosted by BAWB, Bay Area Wealth Builders October 3rd - 8 am, It’s Harvest Time NEW YORK CITY, NY - CA$HFLOW Expo East Hosted with REIA NYC - Meet Us in Manhattan November 7th - 9 am, Focus on Finance DALLAS, TX - Giving Thanks / Giving Back Lone Star State Expo with Dennis Henson, AREA November 21st - 9 am to 5 pm, Charity Expo! Our expos recently received exposure here:

- 14. AttractingPrivateMoneyBook.com Learn how to find your own private lenders! Get your copy of our new book by going to Pacific Private Money Inc. • CA Dept Real Estate Broker #1897444 PacificPrivateMoney.com | 415-883-2150 We’re the Northern California leader for loans to real estate investors. We’re fast, we’re reliable, and we never change pricing on you mid-stream. WE MAKE BORROWING EASY! Loans@PacificPrivateMoney.com

- 15. Attracting Private Money DISCLOSING RISK Attracting Private Money DISCLOSING RISK risk-factor disclosures in their presentations because they are afraid that they will scare away their prospective private lend- ers. They worry that if their potential lender understood the risks, then that person would decide not to invest with them. However, just sitting back and hoping that everything goes perfectly is not a strong strategy for success. The truth is that many real estate entrepreneurs have ended up in lawsuits because they failed to provide even the most basic disclosure of potential risks. You should strongly consider engaging a real estate attorney to advise you if you plan to raise capital from private individuals. I am not an attorney, and this does not constitute legal advice. That being said, I have attended numerous real estate conferences and seminars on the topic of private capital, and I have seen many examples of risk disclosures ranging from simple ones to explanations that were long and compli- cated. As an example, for my mortgage pool fund, I provide prospective investors with a memorandum that includes over twenty pages of risk-factor disclosures. The fact is that there are basic risks that you should be dis- closing to your investors. Those disclosures should be includ- ed in any write-up you create for the purpose of raising capital from private individuals. You don’t disclose these risks to your potential investor to scare them away. You disclose them so that the investor can make an informed decision. Risk factors you might discuss Realty411Guide.com PAGE 15 • 2015 Private Money411 An excerpt from “The Insider’s Guide to Attracting Private Money: Five Secrets to Fast, Unlimited Capital So You Can Save Money, Buy More Real Estate, & Build Wealth,” by Mark Hanf, President of Pacific Private Money. W hen you seek to attract capital from private investors, you need to disclose the risk in- volved in your proposed project. The reasons you need to do so are several, but one of them is that you are asking people to lend you a portion of their life savings, and they are entitled to know what hap- pens to that money in the event that you exit the picture. The fifth question we answer in The Five Steps to Mon- ey Method™, “What happens if you disappear?” is asking much more than just “What happens if you get hit by a bus?” Disclosing risk is a very important yet often over- looked or ignored piece of the private lending equation. That is, risk disclosure is often overlooked or ignored by borrowers. Your prospective private lender, on the other hand, is absolutely thinking about the risks of investing with you whether you bring them up or not. And what that prospective lender wants to hear from you is, “What are the risks, and what are your plans if things go wrong?” You can answer this question by showing your lender how you are structuring your company and what measures you are taking to protect that individual’s investment. For example, who on your team is positioned to take over in the event that something happens to you? If you can address this question and others like it, you will show your potential lender that you have thought this through, and that you take the protection of his or her capital investment very seriously. The level of detail that you go into when disclosing risk is up to you (with sound advice from your real estate attorney). But the most basic risk disclosure essentially boils down to this message: YOUR INVESTOR COULD LOSE SOME OR ALL OF HIS OR HER MONEY. That is why disclosing risk is such an important factor when you create your investment opportunity presentation. Addressing and disclosing risks in your presentation will make you look professional and thorough, just as the other important components that we have discussed so far in this book have done. Many real estate investors don’t want to include Continued on pg. 26

- 16. Direct Your Future™ Instant Access To Your IRA Funds Real estate transactions just got easier TheEntrustGroup.com Cards are issued by Citibank, N.A. pursuant to a license from Visa U.S.A. Inc. and managed by Citi Prepaid Services. This card can be used everywhere Visa debit cards are accepted. Full disclosures, terms and conditions apply. The Entrust Group is an administrator for self-directed retirement plans. We specialize in providing administrative services to help investors diversify their retirement portfolios with alternative investments of their choice. © 2014. The Entrust Group, Inc. All Rights Reserved. The Entrust Group myDirection Visa® Prepaid Card Make faster real estate investments, pay property costs, and maintain your assets, all with the swipe of a card. Affordable, convenient, and easy to use, The Entrust Group myDirection Visa® Prepaid Card gives you the freedom to invest in what you want, when you want. Direct Your Future™ Instant Access To Your IRA Funds Real estate transactions just got easier TheEntrustGroup.com Cards are issued by Citibank, N.A. pursuant to a license from Visa U.S.A. Inc. and managed by Citi Prepaid Services. This card can be used everywhere Visa debit cards are accepted. Full disclosures, terms and conditions apply. The Entrust Group is an administrator for self-directed retirement plans. We specialize in providing administrative services to help investors diversify their retirement portfolios with alternative investments of their choice. © 2014. The Entrust Group, Inc. All Rights Reserved. The Entrust Group myDirection Visa® Prepaid Card Make faster real estate investments, pay property costs, and maintain your assets, all with the swipe of a card. Affordable, convenient, and easy to use, The Entrust Group myDirection Visa® Prepaid Card gives you the freedom to invest in what you want, when you want. Direct Your Future™ Instant Access To Your IRA Funds Real estate transactions just got easier TheEntrustGroup.com Cards are issued by Citibank, N.A. pursuant to a license from Visa U.S.A. Inc. and managed by Citi Prepaid Services. This card can be used everywhere Visa debit cards are accepted. Full disclosures, terms and conditions apply. The Entrust Group is an administrator for self-directed retirement plans. We specialize in providing administrative services to help investors diversify their retirement portfolios with alternative investments of their choice. © 2014. The Entrust Group, Inc. All Rights Reserved. The Entrust Group myDirection Visa® Prepaid Card Make faster real estate investments, pay property costs, and maintain your assets, all with the swipe of a card. Affordable, convenient, and easy to use, The Entrust Group myDirection Visa® Prepaid Card gives you the freedom to invest in what you want, when you want.

- 17. Two of the Best Tactical Minds in Investment Property Financing Team Up The new Bighaus-Chapman mortgage alliance offers a new capital partner for real estate investors navigating financial purgatory. The new merger brings together two of the best tactical and stra- tegic minds in the mortgage busi- ness, with the backing of one of the largest and fastest-growing mortgage lenders in the U.S. And intelligent investors are finding an interesting match in leveraging the business partnership that packs a ton of value. YOUR GUIDES THROUGH FINANCIAL PURGATORY Steve Bighaus, Security National Mortgage Company Branch Man- ager, says that the new underwrit- ing inquisition is here to stay. And it could get worse! Whether it is new appraisal sys- tems that have been created to generate additional revenues for other providers, or demanding a written, verified, and quality con- trolled ‘confession’ of your life’s deeds, there is a new status quo in underwriting. While in some ways it has become easier to qualify for a loan on the surface, getting from loan application to closing may take an army of 300 Spartans guid- ing you home with sharp spears and oversized shields. So while CoreLogic reports there are still some almost 15 million underwater and ‘under-equi- tied’ homes in America, in addition to a fresh batch of foreclosures in 2015, real estate investors still need a fearless and wise guide to un- lock the potential out there, and optimize financial leverage. Continued on pg. 19 Realty411Guide.com PAGE 17 • 2015 Private Money411 STEVE BIGHAUS (IN WHITE) AND AARON CHAPMAN (IN BLACK) EXPLAIN THEIR VIEWS ON FINANCE. By Tim Houghten

- 18. Steve Bighaus has over 24 years experience in the mortgage industry. He maintains a focus on servicing the real-estate investor by offering aggressive financing options and resources for buyers interested in purchasing or refinancing their investment property. By concentrating on investment properties and the financing that comes with them, Steve is recognized nationally as an industry expert. The knowledge that he has enables him to find financing for people even when they have had difficulty elsewhere. This is not a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant. Security National Mortgage Co. is an Equal Opportunity Lender. NMLS#: 112825 Contact Steve Bighaus Senior Loan Officer 206.930.1801 steve.bighaus@snmc.com Attention Investors: Pre-Qualify Today! It’s about time we show you A REAL HERO Close your loan in as little as 30 days! NMLS# 3116

- 19. THIS IS WHERE STEVE BIGHAUS AND AARON CHAPMAN COME IN... Merging two SNMC branches together these mort- gage masters offer a stark contrast, that stand out on the investment property financing landscape. They are instantly recognizable, have a very unique style, and yet perhaps most notable is the fact that they have been in the mortgage business for longer than anyone else you’ll probably ever meet. They have both been in the financial industry since well before 2000, which gives them a veritably unrivalled edge in experience in an industry where it is hard to meet anyone that started before 2008. But it is often their mental agility, and refreshing commitment as long-term business partners to their investor clients that make them highly-prized assets. THE MINDS BEHIND THE MONEY To not just survive this long in the mortgage indus- try, but thrive and grow, and have investor clients coming back for dozens of transactions as they grow their income property portfolios, requires a mind that plays on a whole other level than the thousands that have fallen into the abyss. In fact; there is no question that more real estate investors would have survived and thrived in the last couple of decades if they had paid more attention to how those they chose to do business with kept themselves sharp. Steve Bighaus, who runs opera- tions in Washington state, says he is religious about hitting the gym, as well expanding his love of mu- sic from the drums to learning the vibraphone, and experimenting with jazz improvisation. Aaron Chap- man who heads up the Mesa, Ariz., office survived a crushing motorcycle accident in 2008, yet continues to volunteer with the local Sherriff’s Office Volunteer rescue unit. His specialties include technical-high angle, off-road rescue & extrication, as well as be- ing a member of their elite six-man helicopter rappel team. These are battle-hardened warrior financiers and tacticians that know how to help investors strategize to stay ahead of the game, assess and successfully navigate calculated risks, and win the long race. THE VALUE OF THESE CAPITAL PARTNERS The Bighaus-Chapman mortgage team offers intel- ligent property investors a specialized team to aid in optimizing and growing their portfolios, to hit their individual goals, no matter whether that is having un- limited money to make it rain, or fulfilling philanthropic aspirations. Aaron explains: “The business is evolving to need spe- cialists. If one hits their head and has complications as a result, they don’t have the family general practitioner perform brain surgery in his office. Their situation re- quires a specialist. Not just any specialist, but they want the best. Investment lending is no different. Why go to a general lender who offers any kind of program available when there are specialists in what they need?” Steve Bighaus describes the mortgage company coa- lition as a holistic service that aids investors in getting from where they are, to where they want to go, and incorporating all of their real estate financing from residences to second homes, to rental properties, and even commercial properties. Specifically this financial duo act almost as business partners or your CFO, only without having to take on the burden of a giant salary or having to give up a share of your investment portfolio. They provide assistance in financial tactics, the heavy lifting and manpower to get it done, and the capital. Investors just pay the inter- est and borrowing costs. Discover more about this dynamic team and the in- vestment property loans offered, visit online at http:// BighausChapman.com. Two of the Best Tactical Minds, pg. 17 Realty411Guide.com PAGE 19 • 2015 Private Money411

- 20. BAWB & Realty411 Invite You to the: NAPA VALLEY REAL ESTATE EXPO Embassy Suites Napa Valley 1075 California Boulevard Napa, CA 94559 @ 8 am!! Visit During the Harvest Season CRUSH IT in Real Estate, Business + Life! TOP Companies - Learn NEW Niches Celebrate Our New Issues with Us! REAL ESTATE - FINANCE - TECH www.Realty411Guide.com/EVENTS QUESTIONS?805.693.1497 CRUSH IT! NAPA REAL ESTATE EXPO - OCT. 3 REALTY411guide.com/EVENTS Scott Myers Sensei Gilliland Michael Morringelio Mindy & Anthony PatrickAidel Gorel Mary Morrongiello BAWB & Realty411 Invite You to a REAL ESTATE INVESTOR EXPO in Napa Valley Embassy Suites Napa Valley 1075 California Boulevard Napa, CA 94559 @ 8am!! Visit During the Harvest Season CRUSH IT in Real Estate, Business + Life! TOP Companies - Learn NEW Niches Celebrate Our New Issues with Us! REAL ESTATE • FINANCE • TECH www.Realty411Guide.com/EVENTS

- 21. www.ISurvivedRealEstate.com or 951-780-5856 Hosted By THE SPONSORSTHE SPONSORS THE CHARITY REAL ESTATEI SURVIVED 2015 REAL ESTATEI SURVIVED 2015 On October 16, 2015, join The Norris Group and our panel of industry experts at the Nixon Library in Yorba Linda, California for another award-winning evening. Get the inside scoop on top real estate trends from the leaders shaping our industry. Dress up, enjoy a spectacular meal in the Presidential East Room, network with successful real estate professionals from all over California, and help raise funds for kids with life threatening medical conditions. A Powerhouse Lineup of Industry Experts Converge for The Biggest Night in Real Estate Bruce Norris President The Norris Group Eileen Reynolds Chair California Building Industry Assoc. Bill Emerson 2015/16 Chair Mortgage Bankers Association Leslie Appleton-Young Chief Economist California Association of Realtors Doug Duncan Chief Economist Fannie Mae Sean O’Toole President PropertyRadar.com Sean O’Toole Benefit Make-A-Wish and St. Jude Children’s Research Hospital. We’ve raised over $520,000 for charity since 2008. THE CHARITYTHE CHARITY Benefit Make-A-Wish and St. Jude Children’s Research Hospital. We’ve raised over $520,000 THE CHARITYTHE CHARITY Benefit Make-A-Wish and St. Jude Children’s THE CHARITYTHE CHARITY Benefit Make-A-Wish and St. Jude Children’s Adrenaline Atheltics Coachella Valley Real Estate Investors Association Coldwell Banker Town and Country Elite Auctions In A Day Development Inland Valley Association of Realtors IRA Services Trust Company Jennifer Buys Houses Keystone CPA Las Brisas Escrow LA South REIA Leivas Tax Wealth Management New Western Acquisition North San Diego Real Estate Investors Pilot Limousine Northern California Real Estate Investors Association Real Wealth Network Realty 411 Magazine Rick and LeAnne Rossiter San Jose Real Estate Investors Association Spinnaker Loans Tri-Counties Association of Realtors uDirect IRA Services Wilson Investment Properties, Inc. MVT PRODUCTIONS THE PANEL Realty411-8.5x10.5.indd 1 7/13/2015 10:09:06 AM

- 22. cy is not new. It’s has been around for centuries and is tried and tested. Currently banks, businesses, and high net worth individuals use it to preserve and grow their money. But Rice and Beam offer a unique struc- ture that makes it a powerful tool for even the small real estate investor. SHE BROKE THE GLASS CEILING Rice discovered Nelson Nash’s book, “Becoming Your Own Banker,” over 25 years ago. She recognized the revolutionary technique and became a protégé of Nash, building on his philosophy with concrete action plans. It became her passion to help as many people as possible. “I help people see how money really works in the economy. It’s often not the way you think it does,” Rice says. “I love to show my clients how to reduce their debt in an extremely short period of time — faster than they ever thought possible.” Through the years she’s structured Living Bene- fit policies for people from 21 to 93 years old. “Each is unique,” Rice says. “I’ve helped people profit who could only start with $100 a month. And I’ve worked with people who wanted to contribute a million dollars a year. Whatever your income or investment goals, you can use this to take control of your money and grow it faster and safer.” Rice’s passion and dedication to her clients made her extremely successful. She became the first woman to be the top-performing agent at Mutual Trust. Then she went on to break the glass ceiling at Massachu- setts Mutual as the first woman in its 170-year history to become the top life producer. She is also one of only three policy agents endorsed by the Palm Beach Letter, a financial newsletter. Because she has written thousands of policies— and uses many of them herself — she knows every nuance of how to structure it to benefit you. YOU NEED AN EXPERT On the owner’s side, a policy looks deceptive- ly simple and is easy to use. But the creative side takes an act of genius to give you all the benefits and advantages necessary to use it effectively in your business and investing. Rice always learns what her client’s goals are. Then she tailors a Living Benefits policy specifically to meet those goals. Some want a pool of money to run their business. Others need free access to money for real estate investing or hard money lending. And some have their top goal to safeguard their wealth and transfer it to the next generation. “It’s possible to accomplish all those goals with- out invading lifestyle money,” Rice says. Lifestyle money is what you live on after paying your bills and Uncle Sam. Rice’s brilliance is that she frees up mon- ey for you to invest from other sources. Often it’s from the debt payments you are already making. PUTTING YOUR POLICY TO WORK FOR YOU “The simplest way to use your Living Benefits pol- icy is with hard money lending,” Beam says. “There are hundreds and hundreds of folks out there who are in need of hard money lending.” Beam works through organizations that send out leads for people who want to borrow the amount of money you have to in- vest — whether that’s $10,000 or $150,000 or more. And the Living Benefits policy creates a vehicle to amplify the investment. “You borrow against your policy at 5% and you put it out on the street to go to work at 10% or 12% plus points,” Beam says. “But you’re still earning 5% on those same dollars within in your policy! Wow, what a platform to work from!” Beam’s strength is that he can guide real estate investors in the best ways to take advantage of this platform for their specific goals. There are a number of ways to take advantage of the policy. One of their clients buys HUD houses to rehab and rent. Although her Living Benefits policy is only a few years old, she’s been able to use money from her policy to cut costs and increase returns. • Used for a down payment for a conventional loan Continued on pg. 36 Realty411Guide.com PAGE 22 • 2015 Private Money411 Meet Your Creative Financing Experts, pg. 12

- 24. Wanna be a big boy? Now is the time to put your big boy (or big girl) shoes on and grow your business model up. www.pitbullconference.com 858-736-7788 October 13, 2015 Caesars Atlantic City New Jersey Pitbull’s 38th National Hard Money Conference Now is the time to put your big boy (or big girl) shoes on and grow your business model up. Do you, like many brokers, spend most of your time looking for a lending source? Are you chasing bad deals because you don’t know they‘re bad? Don't settle for being good at what you do, be the best by attending Pitbull’s next National Hard Money Conference, October 13th in Atlantic City. Presentations by seasoned lenders, brokers and service provid- ers will give you the invaluable insight needed to cut your learning curve in half. And if you already know a thing or two about hard money, there are still plenty of reasons to attend. Participate in our “Bring Your Deal” segment, where attendees are allowed to present a deal to the entire house. Deals happen. Network with investors, lenders, and vendors. Discover the advantages of becoming the bank, which allows you to dictate points and spreads yourself. Sound daunting? It’s not. Sound liberating? It is. So, be a big boy or girl and grow your business model up. See you in Florida!

- 25. FINANCING SOLUTIONS FOR RESIDENTIAL REAL ESTATE INVESTORS We’ve purchased, rented and financed thousands of investment properties so we know your business. Experienced Efficient Our streamlined closing process allows you to focus on your business, not our paperwork. Certain Investor Loans on Residential Assets Loans from $500K to $50M 1 - 4 Family, Town Home, Condo & Small Multi-Family Properties 5 & 10 Year Term Loan Options 12 & 18 Month Credit Line Options We Finance Up To 80% of Cost NATIONWIDE Acquisition Lines • Long-Term Debt for Portfolios • Non-Recourse Loans Contact Us Today! 844.CAF.CAF1 Visit us online at ColonyAmericanFinance.com INVESTORS: We Provide You with Financing Options You Can Count On. We Provide You with Financing Options You Can Count On. We Provide You with Financing Options You Can Count On. We provide funds when you need them most.

- 26. AttractingPrivateMoneyBook.com Learn how to find your own private lenders! Get your copy of our new book by going to We’re the Northern California leader for loans to real estate investors. We’re fast, we’re reliable, and we never change pricing on you mid-stream. Attracting Private Money, Disclosing Risk, pg. 15 PAGE 26 • 2015 Private Money411 could include things such as: • changes in the real estate market • cash flow problems • conflicts of interest • an unproven real estate investing company (if you’ve never done a deal before) CHANGES IN THE REAL ESTATE MARKET Your opportunity presentation is based on a set of assumptions. Those assumptions include things like mar- ket demand, potential market appreci- ation, and an estimate of the increase in value as a result of your planned improvements. However, the real estate market is subject to cycles that can affect the marketability, pricing, and days-on- market estimate of your project. Real estate can and does decline in value as a result of certain market forces. Ris- ing interest rates, job growth, jobless- ness, new inventory, and other factors can contribute to a drop in demand and prices for real estate in a given market. Your prediction of how well your proposed project will do should be based on a careful review of local market conditions, but you cannot guarantee that the results you predict will be realized. CASH FLOW PROBLEMS You have proposed a budget and a spreadsheet to your lender that shows your sources and uses of funds. But what if you come across significant and unexpected cost increases? Do you have the ability to cover them? Typically, your money partner will not be under any obligation to fund addi- tional costs beyond the agreed-upon budget unless you bring this up in your written agreement beforehand. If the project stops as a result of running out of cash, you could be faced with mounting costs and declining profits as time goes on. CONFLICTS OF INTEREST Are you planning to dedicate 100 per- cent of your time to this one project with your prospective money partner? Or do you have other projects or work obligations that might be construed as “conflicts of interest”? You can make a statement in your presentation that gives your lender notice that, while you are dedicated to the success of this endeavor, you are nonetheless free to pursue other business ventures or obligations, as well. UNPROVEN REAL ESTATE INVESTING COMPANY If you are new to real estate investing or if you have formed a new compa- ny to pursue real estate investments, you may not have a track record of success. In that case, your business model is unproven. Changes in the market, cash flow problems, conflicts of interest, and an unproven real estate company are just a few examples of the risks that you may want to disclose to your lender. There are many others that you can identify and include in your propos- al to give your investor a complete picture of what the project will entail. A qualified real estate attorney is an integral component to your team and should be consulted to assist you in drafting an appropriate disclosure statement. I have been telling you to always put the best interests of your private lender first, but the fact of the matter is that a primary purpose of your dis- closure statement is to protect you in case your lender chooses to sue you. If you can demonstrate that you dis- closed material risks to your private lender before that individual invested with you, should things not work out as planned, you will be much better protected in a court of law. Excerpted from the book “The In- sider’s Guide to Attracting Private Money” by Mark Hanf, available at www.AttractingPrivateMoneyBook. com. Mark is president of Pacific Pri- vate Money Inc., a California-based hard money lender who has raised over $200 million in private capital since 2009.

- 28. G etting started as a new Real Estate Investor or to bring your existing business to the next level of success will generally require investment capital. More and more investors are taking advantage of using private lenders to achieve their business goals. The advantages of using a Private Lender over conventional lenders or Hard Money lenders can be summarized as follows: • You may be able to agree to terms more suitable to you • You may be able to finance 100% of the project plus expenses (many tra- ditional banks and lenders will require you to have some “skin in the game”) • Less underwriting scrutiny of you and the particular project • Quicker response • Avoid the oversight that many lenders are now putting in place during the life cycle of the project • Private lenders may not require you to have any documented experi- ence Finding Your Private Lenders Once you have decided that using a private lender is the right and perhaps the only possible direction for you to take, it is now time to ex- plore your oppor- tunities of locating people who may be interested in funding your projects. Generally, a great place to start looking is among your personal and business circle of influence. This may include the following: • Family • Friends • Co-workers • Acquaintances • Local real estate groups I do get some push-back from people when I suggest that they approach family and friends for investment capi- tal because some feel uneasy asking them for money and the possible implications if things don’t work out exactly to plan. Just keep this in mind, you are asking them to participate in a business opportunity, not a hand out. Furthermore, many of these people are already taking some form of investment risk; so why not in you? Keep it Legal and Get it Down on Paper Just because using a private lender may be a simpler and less formal pro- cess than what you would typically experience with either a Hard Money lender or conventional lender, this does not mean you will forgo all of the required docu- ments and due diligence that will protect both you and your private lenders. Make sure to discuss the terms and conditions of the private loan with your attorney and have them prepare all of the necessary documents. It is always advisable to encourage your lender to also have their attorney review the documents. Positioning Yourself as a Solid Borrower Even if you personally know the people who will be providing the capital to fund your project, this does not take you off the hook from properly prepar- ing yourself as a reputable borrower. There are some characteristics that your lenders will be expecting from you and include the following: Knowledge of the Business Even as a new investor, it will be critical for you to have the basic skill set in order to effectively analyze opportu- nities that may come your way. In the excitement of the hunt for your project, you will need to know when it is time to move forward or pass on an opportuni- ty. In fact, as part of your discussions with your lender, you should illus- trate why the project is a solid deal by sharing the assumptions and results you The Benefits of Using a Private Lender By Carl Schiovone Realty411Guide.com PAGE 28 • 2015 Private Money411

- 29. a program designed just for real estate investors! Program Highlights: • No Primary Residence • No Pre-Payment Penalties! • Loan Amounts up to $400,000* • Short Term Bridge Financing* • Rates: 12.5 – 14% • LTV: 65% to 80%1 of purchase price • Points vary. Please see website for pricing information 1 Up to 85% of acquisition, LTV with minimum of 5 or more profitable transactions with ZINC in the last 12 months. *Please go to www.zincfinancial.net for complete details Hard Money Wholesale Lender Funding at High Speed! This information is for use by mortgage professionals only and should not be distributed to the general public. All loans are made in compliance with Federal, State and Local Laws. This is not a commitment to lend. Loans made or arranged pursuant to a California Lender’s License. Loans We lend on distressed Real Estate Investments! F I N A N C I A L , L L C PROGRAM HIGHLIGHTS: • No Primary Residence • No Pre-Payment Penalties! • Loan mounts up to $800,000 • Short Term Bridge Financing* • Rates starting out at 10.0% • Up to 85% of Purchase • Points vary. Please see website for pricing information Equity Based Lending Wholesale Division • California • Arizona Telephone 559.326.2509 Fax 866.602.8892 zincfinancial.net made or arranged in Arizona must be represented and originated by a mortgage broker qualified to do business in that state.

- 30. pletely achieved, you should elaborate on the root cause. Evaluating lessons learned can be a great way to mitigating future errors on the next project. Have an Exit Strategy As part of your overall project or business plan, you may need to consid- er your exit strategy from the private lender in advance of moving forward with them. There are generally a few options to consider when exiting private money that include: • Selling the property upon completion of a ren- ovation, the lender will be paid from the proceeds (this is common with a Rehab and Flip project) • Refinance the property with a cash out conventional mortgage (this is very common on a Hold to Rent property) • Repaying the loan from the sale of other assets or investment sources In conclusion, building a solid base of reliable private lenders will help set the stage for you to respond very quick- ly to the opportunities presented, This can clearly be the path for you to scale the business as large as you want! Once the people in your network actually see that you have the bandwidth to move forward they will bring you even more opportunities. Carl Schiovone is a Performance Coach with over 33 years of experience and is President of Carl Schiovone & Associ- ates Real Estate Coaching Inc. In addi- tion Carl is the President of East Coast Real Estate Investors Association. For information, visit http://EastCoastREIA. net or http://CarlSchiovone.com have made. In addition, you should pro-actively identify the barriers and risks you may face and how you plan on mitigating them. Remember, by identifying this upfront you will go a long way. Keep in mind that most lenders (or their at- torney) will inquire about risks anyway, and it looks much better coming from you without being asked. As part of your Business Plan, you should have identified all skill set shortfalls you may have and include a specific action plan on over- coming the deficien- cy. If you are a new investor with no or limited experience, it is advisable to have someone who can shadow your decisions and path and guide you along the way. As a Performance Coach, all too often I see new investors jumping into their first project without the proper skill foundation and many experience some challenges that could have been prevented. Transparency If there is one thing that can ruin any business relationship is holding back in- formation that is critical to your lender. With real estate investing, things may not always go to plan. However, what is important here is how and when you communicate when there are challenges. Always share information that affects your lenders as soon as possible and during that discussion, communicate possible ways to get back on track and avoid a future re-occurrence. Credibility In order for your business to grow and continue to have your lenders coming back for more opportunities, it will be critical to leverage off of the success of prior projects. Once they see what you can do and have performed as planned, you will find that the people around you will be literally throwing more money your way. In addition, they will be ask ing if they can bring their family and friends along as well. Talk about free marketing, it doesn’t get any better than that! I can’t tell you how many times I have seen this play out with my Students. Properly documenting your past performance in your Credibility Report will go a long way in securing new lenders. As a great way to demon- strate your performance is to invite your lenders and potential new lenders to your projects both before you get started with the project and after it is completed. During this time you can share with them both the initial expectations and how the final results compared. Just think how powerful this can be. During this exchange, if the specific perfor- mance you were planning was not com- I can’t tell you how many times I have seen this play out with my students. Properly documenting your past performance in your Credibility Report will go a long way in securing new lenders. “ “ Realty411Guide.com PAGE 30 • 2015 Private Money411

- 31. Colony American Finance Wants to Jumpstart Your SFR Portfolio Do you think that you might have missed the boat to invest in single-family rental homes? The answer is a resounding NO! We all remember 2005-2007 when it seemed that investors couldn’t make a mistake in the residential fix and flip market. Investors with little experience were able to outbid the competition, slap some minor paint and carpet improvements and then sell their properties for incredible returns. But then the bubble burst and many investors were left with homes that couldn’t be sold or in some cases, even given away. They had two choices: Give up the properties through foreclosure or become a landlord. RENTAL DEMAND OUTPACES EXPECTATIONS Statistics show that nearly 35% of Americans now rent instead of own. Drill further into the statistics and you’ll find that 35% of renters choose single-family homes and 19% choose duplexes, triplexes or fourplex- es. With these two categories encompassing 54% of all rental choices, it makes perfect sense that investors are looking to 1-4 unit properties instead of owning larger multi-family apartment-style buildings; 1-4 unit properties have a lower price point, the ownership risk is spread out among multiple structures and the overall expense ratio is lower. Renters in single family housing tend to pay their own utilities, maintain the landscaping themselves and have access to municipal water/sew- er/garbage at a much lower rate than through private service. Rental demand is projected to change significantly over the next ten years, primarily driven by the changing nature of the household. Baby boomers are moving in with their children or into senior housing and millennials are favoring renting over owning because of its flexibil- ity and lower commitment level. Being well versed in the changing market is the key to having a profitable portfolio. Also noteworthy is that there are an estimated 14 million rental homes owned by non-institutional inves- tors in the United States – most of which are owned free and clear. Quick math: Using 14 million rental homes at an average value of $100,000 each, that’s potential- ly $1.4 trillion in new loans that can be originated and re-invested into the market. Colony American Finance has multiple financing op- FINANCE tions available so you can access your portfolio’s equity and quickly put it to work to buy additional properties, invest in your children’s education, or simply replenish your cash position. KNOWLEDGE IS POWER The savviest investor will do three things: research, research and more research. Mortgage brokers and real estate brokers have invaluable information such as market trends and vacancy rates as well as access to properties that might not be listed for sale. But it’s significantly more critical for investors to have access to capital: Both liquid cash and innovative financing. No longer is the SFR rental market monopolized by private money loans with steep interest rates and fees or the more traditional Fannie/Freddie product that caps out at 5-10 properties. Colony American Finance pro- vides non-recourse term loans for stabilized portfolios and fix and flip lines of credit for acquisition funding. FIX/FLIP LINES OF CREDIT If you want to grow your portfolio or perhaps don’t yet own a rental portfolio, a line of credit is definitely the right choice. Colony American Finance offers two differ- ent line of credit options depending on investor experi- ence and short-term/long-term goals. Our Entrepreneurial Line of Credit is a non-revolving, declining line designed for the investor who does less Realty411Guide.com PAGE 31 • 2015 Private Money411 Continued on pg. 34 By Jennifer Goralski, Senior Vice President Originations

- 32. Changing the Way Americans Plan for the Future Is Market Volatility Bringing You Down? Synergy Financial Partners gives individuals, families and business owners the extra edge to thrive in today’s challenging economic climate. Contact Pilar Tobias today to schedule your complimentary consultation. 209-874-6762 We specialize in: Safe Money Strategies Tax Free Retirement Solutions Asset Protection Wealth Building Strategies Creating Guaranteed Lifetime Income Streams PTobias@SynergyFinancialPartners.com

- 33. • Residential • Raw Land • Auctions • Leveraged • Commercial • Agriculture • Options • Short Sales • Fix and Flip • Fix and Hold • Trust Deeds • Mineral Rights Put your Real Estate Expertise to work for your IRA www.NewDirectionIRA.com • 1-877-742-1270 • info@ndira.com • 1070W Century Dr, Ste 101 Louisville, CO 80027 Traditional, Roth, SEP, SIMPLE, HSA, Individual 401(k) Open an Account Online Schedule a Free Consultation View Educational IRA Videos Download our Real Estate IRA Info Packet Free Online Bill Pay Personalized Customer Service Online account access with myDirection®

- 34. are dealing in mortgage notes, and pools of properties in different jurisdictions, that they can unknowingly be trading ‘securities’. If you think it’s a joke go ask Bernie Madoff who is serving a 150 year prison sentence. And the truth is that this life sentence is nothing compared to the other consequences he is dealing with. If you are working under a Reg. A filing you need a permit. Under a Reg. D Rule 506c filing you need to stick to raising money from accredited investors. And even under Reg. A+ you need to get approval before taking in money from investors. And Gene says that you’d be surprised at how many SEC investigators are patrolling investor groups, workshops, the internet, and magazines to look for those violating advertising and fundraising laws. HERE’S THE HACK… While it is important to stay on the right side of the law, invest in legal counsel, allow sufficient budgeting for marketing and promoting, and to be very careful about staying within the guidelines, there is no question that Regulation A+ does appear to be a huge win for inves- tors, fund operators, and the public. In fact; Trowbridge sees the broker-dealer community embracing Reg. A+ in a big way due to the ability to raise up to $50M a year in ‘mini-IPOs’, and favorable auditing rules. The impact is likely to include more cash in the economy, more competitive offerings for investors, and attractive returns. For those that are concerned about the paperwork, than 20 fix/flip projects per year and only within the 1-4 unit residential arena. Line amounts start at $500,000 and go upwards of $5,000,000. Borrowers have 12 months to utilize the proceeds and 12 months to pay back each draw. This loan has no prepayment penal- ties. For the more active investor, our Institutional Line of Credit offers additional flexibility as it allows for both residential 1-4 unit properties and commercial prop- erties up to 20 units. The Institutional Line of Credit is also a revolving line, meaning you can access the funds multiple times. Line amounts start at $3,000,000 and can go as high as $50,000,000. Borrowers have 12 months to access the proceeds and typically 9 months to repay each draw. This is a non-recourse loan and has no prepayment penalties. Also important to note is that you can utilize either the Entrepreneurial or Institutional Line of Credit to build your own personal rental portfolio. Once you have completed the renovations on your fix/flip proper- ties, you can look to refinance your holdings into one of Colony American Finance’s term loans. NON-RECOURSE TERM LOAN OPTIONS If your SFR rental portfolio has five or more prop- erties, Colony American Finance is your option for attractive financing options. Our loans are underwritten like a commercial loan, which means no more debt-to- income ratios hurting you when qualifying. Rather, your portfolio is underwritten on the assets and the cash flow generated from those assets. Plus, because we lend across the U.S., a single term loan can be made on portfolios with holdings in multiple states. Our rates are competitive with traditional FNMA loans, are amortized over 30 years and can be fixed for five or ten years. Our loan amounts start at $500,000 and can go up to $100 million – and almost all term loans are available on a non-recourse basis. Important too, is that borrowers can have multiple tranches of loans to facilitate estate planning or property manage- ment issues. REGIONAL STRATEGIES Auction.com recently released data that showed investors are favoring buy-and-hold strategies over fix/ flip on a nationwide basis, but that investor intent varies between online/offline investors, regions, and property prices. Midwesterners and Southerners are more likely to buy and hold whereas those in the Northeast are more likely to fix/flip. Investors in the western states are evenly split between fix/flip and buy/hold strategies. Jumpstart Your SFR Portfolio, pg. 31 The NEW RULES of the Fundraising Game, pg. 11 Realty411Guide.com PAGE 34 • 2015 Private Money411 Continued on pg. 36 GENE’S QUICK TIPS FOR INVESTORS TO STAY SAFE These presentations can be extremely attractive for end inves- tors. So far the majority of crowdfunding projects that have been funded seem to be working out. But not all will. So how can you stay safe when investing in these opportunities? • Be thorough in due diligence upfront. • Understand what pools of properties or notes include. • Look at the track record of promoters. • Check them out online, and watch out for SEC ‘Cease and Desist’ orders. • Pick up the phone and talk to sponsors if you get nervous. Continued on pg. 38

- 35. NETWORK, LEARN, GROW Thank you for your interest in the Lone Star Real Estate Investors’ Expo. Since 2006, the Realty411 publishers have owned multifamily rentals in Texas, their mission with this Complimentary Real Estate Investors’ Expo is to provide those who are interested in learning about real estate the opportunity to increase their knowledge and contacts in person. Our VIP tickets featuring reserved seating are available for only $49. Plus, in the spirit of Thanksgiving, net ticket proceeds will be donated to the local Salvation Army. Top industry speakers joining us from throughout the country include: Dennis Henson, John Jackson, Dolf de Roos Brad Sumrok, Arnie Abramson, Tom Wilson, Tim Herriage, Merrill Chandler, Randy Hughes, Anthony Patrick, Reggie Brooks, Pat James, Geoge Antone, plus many more soon to be announced. LONE STAR Real Estate Expo Arlington - Nov. 21 Give Thanks, Give Back Successful Investors from Around the Country Unite for ONE DAY in Texas! The Lone Star Real Estate Expo Raises Awareness and Donations for the Salvation Army. To Register or Learn More Visit http://Realty411guide.com/events I don’t recommend being a real estate investor…un- less you have a well-de- fined strategy, quantitative goals and are dedicated to go by the numbers and not by unsup- ported advice or emotions. My engineering training and 30 years of experience manag- ing high tech profit centers in Silicon Valley taught me how to analyze for the best return on investment in any mar- ket. Today, the principles of analysis remain the same. Anyone can do it, however, one needs to be very disciplined and educated about the submarkets and products, or ride the coattails of someone who is. The primary parameters for selecting the best investment markets are: •Rent to purchase price ratio •Population growth and inward migration •Employment growth and business climate •Housing affordability •Location •Cost of living •Rental market •Current and projected market conditions Now that speculative investing for fast profit has gone the way of the last super- model, the wise investor is focused on cash Are there markets that have weathered the down- turn well, are superior in many of the parameters above, and have had rela- tively calmer waters dur- ing these past few tumulus years? Indeed, my experience in more than 1800 unit transactions over 35 years has revealed that Dallas / Fort Worth is one of the best real estate investment markets in the United States; that is why I chose it for most of my personal portfolio long term holdings. The strengths of Dallas / Ft. Worth are: •Business and financial capital of the South. •The highest rent per invested dollar for a major economic center in the United States, and therefore, the highest cash flow •One of the lowest risk and safest harbors in the United States for real estate •Lowest decline housing price from peak; the only US single digit depreciation met- ro •Fourth largest and one of the fastest grow- ing MSAs (Metropolitan Statistical Area) in the United States. Projected to double population to 12 million by 2030 •Broad-based economy that has had double Why Dallas / Ft. Worth of the Best Metros in t by Tom Wilson Tom Wilson Hosted & Produced by AREA, Arlington Real Estate AssociationFREE TICKETS: 805.693.1497 Your Host: Dennis HensonDolf de Roos John Jackson Tom Wilson Tim Herriage Brad Sumrok Arnie Abramson

- 36. Tim Rood to Deliver Keynote at Private Lending Conference T he American Association of Private Lenders (AAPL) announced that Tim Rood will de- liver the keynote address at the 2015 Amer- ican Association of Private Lenders Annual Conference. The Conference will be held November 8-10, in Las Vegas, Nevada and features over 25 presentations, panels and work- shops addressing a broad spectrum of personal real estate finance topics. Rood is Chairman of The Collingwood Group, which he co-founded in 2009. Rood was co-founder and managing director of the firm’s predecessor compa- ny, Capital Financial Solutions. Earlier he was Vice President of First American, where he successfully led the company’s professional services group tasked with creating business solutions for the top ten lenders in the country. Rood served as Director and Principal of Fan- nie Mae’s eBusiness Division. He has more than two decades of mortgage industry experience which has made him a highly sought after speaker and contributor to a variety of national media outlets, including; CNBC, Bloomberg Tele- vision, FOX Business News, Washington Post, New York Times, Wall Street Journal, and the American Banker. AAPL’s Annual Conference is expected to attract a large contingent of real estate professionals including; private lenders, residential and commercial investors, investment firms, note buyer and brokers, CPAs, IRA Servicing Companies, as well as other service advisors. Registration for the Conference is open. Visit online at: http://aaplonline.com to register today. Meet Your Creative Financing Experts, pg. 22 and saved the cost of mortgage insurance • Used for repair costs on the house and avoided the expense and effort of a construction loan • Kept an “emergency fund” that earns 5% or so on that money instead of a bank’s pitiful near zero rate • Used a regional bank for a 5 year balloon loan with much lower loan origination costs and interest rates. She can do that because this system pays off the bank loan in just a few years—well before the balloon kicks in and interest rates rise The client says, “The best part is that I end up with a house AND all the money that would have gone to mortgage payments!” Can This Work For You? You can learn more about investing in real es- tate using a Living Benefits policy when you attend national Realty411 events where Rice and Beam will be featured speakers. Plus, look for future issues with articles explaining in more depth how to increase your real estate returns using a Living Benefit policy. Whatever your investment style, we have the capital for either strategy. It’s an exciting time to be an inves- tor; trends indicate that the rental market will continue to improve over the next decade. Colony American Fi- nance is ready to provide meaningful and cost effective financing options for your portfolio. Colony American Finance (www.colonyamericanfinance. com) is the leading provider of low cost, non-recourse revolving bridge & permanent mortgage financing for owners of single family rental portfolios. Our affiliate, Colony American Homes, owns more than 22,000 homes across the United States, so we approach lend- ing from the perspective of the landlord-investor. Both companies are owned and controlled by Colony Cap- ital LLC, a real estate investment firm with $54 billion invested, including a publicly-traded mortgage REIT. When you work with Colony American Finance, you are talking to a professional, experienced lender who offers competitive rates, knows how to underwrite and get your deals funded. Please call 1844.CAF-CAF1 and visit us at http://www.colonyamericanfinance.com to refinance your rental portfolio or leverage your buying power with a credit line. We have the capital for either strategy. Jumpstart Your SFR Portfolio, pg. 34 Realty411Guide.com PAGE 36 • 2015 Private Money411

- 37. Join Us for Our CashFlow Expo Network Your Way to Success! REAL ESTATE - FINANCE - TAXES - INSURANCE -BUSINESS - CREDIT RSVP: Realty411guide.com/EVENTS or Reserve Your Tickets: 310.499.9545 400 Registered! FREE EXPO for Investors, Agents & RE Professionals OUR GOLD SPONSOR IS: SATURDAY, SEPTEMBER 19 - 9 AM Embassy Suites LAX North 9801 Airport Boulevard, LA, CA FREE BOOK TO FIRST 100 GUESTS - NEW MAGAZINES! KATHY FETTKEREBECCA RICE LINDA PLIAGASTONY WATSON JIM BEAM PAT JAMES Network with Awesome Companies!

- 38. Here Comes the New Guard: B2R Finance Leads Lending Innovation, pg. 10 cient lending platform which provides low rates and speed in funding, re- quiring the least amount of data, while retaining sound credit decisions. Be- yond the sunnier math of using single credit lines to flip or rehab and man- age multiple properties, this creates a more turnkey financing solution so that investors can redirect their time to growing their portfolios versus man- aging them. SCALING YOUR PORTFOLIO WITH LESS FRICTION Both passive investors and real estate entrepreneurs will find loan solutions like these provide the framework need- ed to scale their portfolios while the market is ripest. Looking forward, it is finance relationships and the opera- tional edge which will divide those with the best net returns and most time to enjoy their gains from the rest. Whomever investors have been using for leverage until now, it is worth keeping an eye on what’s coming out of the B2R Finance Lending Lab. For more insight into the minds and intelligence being in- jected into this mortgage maverick’s DNA, check out B2RFinance.com and DwellFinance.com. going into pools. The benefits to loan level buying include the ability to cherry pick and purchase equity deals. Loans with equity are usually priced at a premium but are consid- ered to be “safer.” In due time and with experience you’ll find more loans and more discounts and will be able to buy pools, of which you can choose high or low equity for exam- ple. Time and experience are barri- ers to entry on large trades mainly because banks want to unload pools to reputable servicers that can show their history in the business. The NEW Rules of Fundraising, pg. 34 Realty411Guide.com PAGE 38 • 2015 Private Money411 time, and financial burden of filing to raise funds like this Trowbridge gives us a smart legal ‘hack.’ That is, using the ability to ‘test the waters.’ With the help of a good at- torney you can run tests, and solicit letters of interest, and encourage investors to provide their information to receive an invitation. And you can do it online or live on stage at real estate industry events. GET THE 411+ Find out more about safe and effective capital raising at Syndi- cationLawyers.com, and check out the great articles on So You Want to Be a Hard Money Lender for the 25 questions you should be able to answer first, and Powerful Tools to Raise Big Money for the technical details of Reg. D, Rule 506c, Reg. A, and crowdfunding. NEW ISSUE! Realty411guide.com/ CashFlow-Express Raising Capital and Private Money pg. 6 For two years, REI Wealth Monthly has been delivering vital industry news, tips and insider secrets to success. REIWealthmag.com Co-owned by Realty411 Advertise in Our New Issue!

- 39. TRIPLE YOUR EARNINGS Sponsor | Exhibit | Register High-impact exposure. High-quality results. The American Association of Private Lenders Annual Conference is supported by aggressive marketing and an extensive exhibitor program to ensure that your conference investment is as successful as it can be. Contact us today to learn how we can triple your exposure to the AAPL audience. 2015 AAPL ANNUAL CONFERENCE & EXPO NOVEMBER 8-10, 2015 | CAESARS PALACE | LAS VEGAS, NEVADA AAPLCONFERENCE.COM | 913-888-1250 |#AAPLANNUAL

- 40. Nationwide Financing Up to 75% LTV Recourse & Non-Recourse Aquisition Line Available Up to 30-Year Amoritization . . . . . . . . . . . . . . . . . . . . . . . . PROPERTY TYPES Single-Family Residences 2-4 Family Units • Condos Townhomes • Apartments Mixed-Use Residential real estate investors aren’t used to having easy options for financing, re-financing and unlocking equity from their rental properties. Until now. At B2R Finance, residential rental mortgages are all we do. That means we’re committed to finding faster, easier and smarter options for you. For example, we provide blanket loans allowing you to eliminate multiple mortgages and “package” several properties into a single loan. We also make asset-based loans that consider the cash flow of your rental property rather than your personal debt-to-income ratio. In short, we provide innovative solutions that are tailor- made for real estate investors. B2R Finance L.P., NMLS ID # 1133465, 1901 Roxborough Road, Suite 110, Charlotte, NC 28211. B2R Finance L.P. is not a residential mortgage lender. B2R Finance L.P. only makes loans with a commercial purpose and is not currently authorized to make such loans in all jurisdictions. Your specific facts and circumstances will determine whether B2R Finance L.P. has the authority to approve loans in your specific jurisdiction. B2R Finance L.P. operates out of several locations, but not all locations conduct business in all jurisdictions.Arizona Mortgage Banker License BK#0926974. Minnesota: This is not an offer to enter into an agreement.Any such offer may only be made in accordance with the requirements of Minn. Stat. §47.206(3), (4). Oregon Mortgage Lender #ML-5283. 855.710.0227 B2Rfinance.com We’ve been looking for a way to refinance our rental properties. B2R was the answer. Brian Evans Investor Plano, TX “B2R walked us through the process and made sure we were comfortable every step of the way.” - Brian Evans