Recommended

Introducing & naming products & brand extensions chapter 12 by Leroy J. Ebert

Content Extracted from “Strategic Brand Management” 3rd Edition

Authors: Kevin Lane Keller

M.G. Parameswaran

Issac Jacob

Presentation developed from SLIM Diploma In Brand Management Students

Presentation developed by Leroy J. Ebert (15th May 2014)

Introducing & naming products & brand extensions chapter 12 by Leroy J. Ebert

Introducing & naming products & brand extensions chapter 12 by Leroy J. EbertLeRoy J. Ebert MCIM Chartered Marketer (UK), MBA (AUS)

Recommended

Introducing & naming products & brand extensions chapter 12 by Leroy J. Ebert

Content Extracted from “Strategic Brand Management” 3rd Edition

Authors: Kevin Lane Keller

M.G. Parameswaran

Issac Jacob

Presentation developed from SLIM Diploma In Brand Management Students

Presentation developed by Leroy J. Ebert (15th May 2014)

Introducing & naming products & brand extensions chapter 12 by Leroy J. Ebert

Introducing & naming products & brand extensions chapter 12 by Leroy J. EbertLeRoy J. Ebert MCIM Chartered Marketer (UK), MBA (AUS)

More Related Content

Similar to Class 6

Similar to Class 6 (20)

Mathematical Reasoning (unit-5) UGC NET Paper-1 Study Notes (E-books) Down...

Mathematical Reasoning (unit-5) UGC NET Paper-1 Study Notes (E-books) Down...

Security Is Like An Onion, That's Why It Makes You Cry

Security Is Like An Onion, That's Why It Makes You Cry

Cognitve Behavioural Therapy: A basic overview (written document)

Cognitve Behavioural Therapy: A basic overview (written document)

1 Running head THE ETHICS OF ELEPHANTS IN CIRCUSES .docx

1 Running head THE ETHICS OF ELEPHANTS IN CIRCUSES .docx

10Consciousness© 2019 Cengage. All rights reserved.

10Consciousness© 2019 Cengage. All rights reserved.

More from Alexandre Linhares

More from Alexandre Linhares (20)

(Slideshare Version) 3. The Nature Of Understanding

(Slideshare Version) 3. The Nature Of Understanding

(Slideshare Version) 2. Emergence, Priming, And Understanding

(Slideshare Version) 2. Emergence, Priming, And Understanding

Recently uploaded

Recently uploaded (20)

Ensure the security of your HCL environment by applying the Zero Trust princi...

Ensure the security of your HCL environment by applying the Zero Trust princi...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

0183760ssssssssssssssssssssssssssss00101011 (27).pdf

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

Russian Call Girls In Gurgaon ❤️8448577510 ⊹Best Escorts Service In 24/7 Delh...

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

Call Girls Kengeri Satellite Town Just Call 👗 7737669865 👗 Top Class Call Gir...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

Call Girls From Pari Chowk Greater Noida ❤️8448577510 ⊹Best Escorts Service I...

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

B.COM Unit – 4 ( CORPORATE SOCIAL RESPONSIBILITY ( CSR ).pptx

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377877756

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Class 6

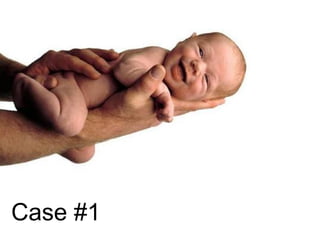

- 1. Case #1

- 7. The doctor releases the air, and the baby’s life is saved. Now…

- 9. The mystery #1 How did the nurse know immediately that it was a heart problem? What theory could explain it? Be the mind!

- 15. The mystery #2 How did the commander know immediately how to act? What theory could explain it? Be the mind!

- 32. Recognition-Primed Decision Model no yes Perceived as typical [Prototype or analog] Expectancies Relevant Cues Plausible Goals Recognition has four byproducts Action 1...n Modify yes,but Evaluate Course of Action Will it Work? Implement Course of Action Evaluate Action (n) [Mental Simulation] Experience the Situation in a Changing Context

- 33. Key Features of RPD Model 1. First option is usually workable Not random generation and selective retention 2. Serial generation/evaluation of options Not comparative evaluation 3. Satisficing Not optimizing 4. Evaluation through mental simulation Not MAUA or Decision Analysis 5. Focus on elaborating and improving options Not choosing between options 6. Focus on situation awareness Not CoAs 7. DM primed to act Not waiting to complete the analysis

- 46. www. getty .edu/art/ getty guide/artObjectDetails?artobj=12908 Around US$ 8.000.000,00

- 52. Recognition-Primed Decision Model: BOX AND ARROW PSYCHOLOGY? no yes Perceived as typical [Prototype or analog] Expectancies Relevant Cues Plausible Goals Recognition has four byproducts Action 1...n Modify yes,but Evaluate Course of Action Will it Work? Implement Course of Action Evaluate Action (n) [Mental Simulation] Experience the Situation in a Changing Context

- 55. The legal reasoning against world domination by women!

- 56. Since world domination started when they took our babies, this is where we should place our efforts!

- 60. ?