Report

Share

Download to read offline

Recommended

The Effects of Economic Recession and Family Stress on the Adjustment of 3-Ye...

The Effects of Economic Recession and Family Stress on the Adjustment of 3-Ye...Economic and Social Research Institute

More Related Content

What's hot

The Effects of Economic Recession and Family Stress on the Adjustment of 3-Ye...

The Effects of Economic Recession and Family Stress on the Adjustment of 3-Ye...Economic and Social Research Institute

What's hot (20)

Innovating for Ageing - Legal & General Home Finance

Innovating for Ageing - Legal & General Home Finance

The Effects of Economic Recession and Family Stress on the Adjustment of 3-Ye...

The Effects of Economic Recession and Family Stress on the Adjustment of 3-Ye...

Viewers also liked

Viewers also liked (8)

Similar to Lesson 6 Feb 25 2010

Similar to Lesson 6 Feb 25 2010 (20)

Key Factors of Affordability in Bangladesh_MaHi.pptx

Key Factors of Affordability in Bangladesh_MaHi.pptx

Residential Housing Market Outlook - NAR's Chief Economist Lawrence Yun

Residential Housing Market Outlook - NAR's Chief Economist Lawrence Yun

Cash Flow Planning Bonus ProjectPlan AheadWe are told, in

Cash Flow Planning Bonus ProjectPlan AheadWe are told, in

More from ingroy

More from ingroy (20)

Recently uploaded

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...Nguyen Thanh Tu Collection

Recently uploaded (20)

Mixin Classes in Odoo 17 How to Extend Models Using Mixin Classes

Mixin Classes in Odoo 17 How to Extend Models Using Mixin Classes

Role Of Transgenic Animal In Target Validation-1.pptx

Role Of Transgenic Animal In Target Validation-1.pptx

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Presentation by Andreas Schleicher Tackling the School Absenteeism Crisis 30 ...

Python Notes for mca i year students osmania university.docx

Python Notes for mca i year students osmania university.docx

Russian Escort Service in Delhi 11k Hotel Foreigner Russian Call Girls in Delhi

Russian Escort Service in Delhi 11k Hotel Foreigner Russian Call Girls in Delhi

Energy Resources. ( B. Pharmacy, 1st Year, Sem-II) Natural Resources

Energy Resources. ( B. Pharmacy, 1st Year, Sem-II) Natural Resources

Asian American Pacific Islander Month DDSD 2024.pptx

Asian American Pacific Islander Month DDSD 2024.pptx

ICT Role in 21st Century Education & its Challenges.pptx

ICT Role in 21st Century Education & its Challenges.pptx

Z Score,T Score, Percential Rank and Box Plot Graph

Z Score,T Score, Percential Rank and Box Plot Graph

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

TỔNG ÔN TẬP THI VÀO LỚP 10 MÔN TIẾNG ANH NĂM HỌC 2023 - 2024 CÓ ĐÁP ÁN (NGỮ Â...

Unit-IV; Professional Sales Representative (PSR).pptx

Unit-IV; Professional Sales Representative (PSR).pptx

Lesson 6 Feb 25 2010

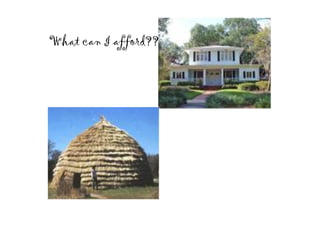

- 1. What can I afford??

- 2. What are the most significant monthly expenses related to owning a home? 1. Mortgage 2. Property Taxes 3. Heating costs

- 4. monthly mortgage payment + monthly property taxes + heating x 100 Gross monthly income

- 5. Jeyson and Rochel have a gross monthly income of $5680. Calculate their total affordable household expenses. $1817.60

- 7. If the best mortgage rate Jeyson and Rochel can http://www.edu.gov.mb.ca/k12/assess/archives/cm_wt_rp_08.pdf get is 6.5%, for 25 years what is the largest mortgage they can afford? Use the chart in your resource book.