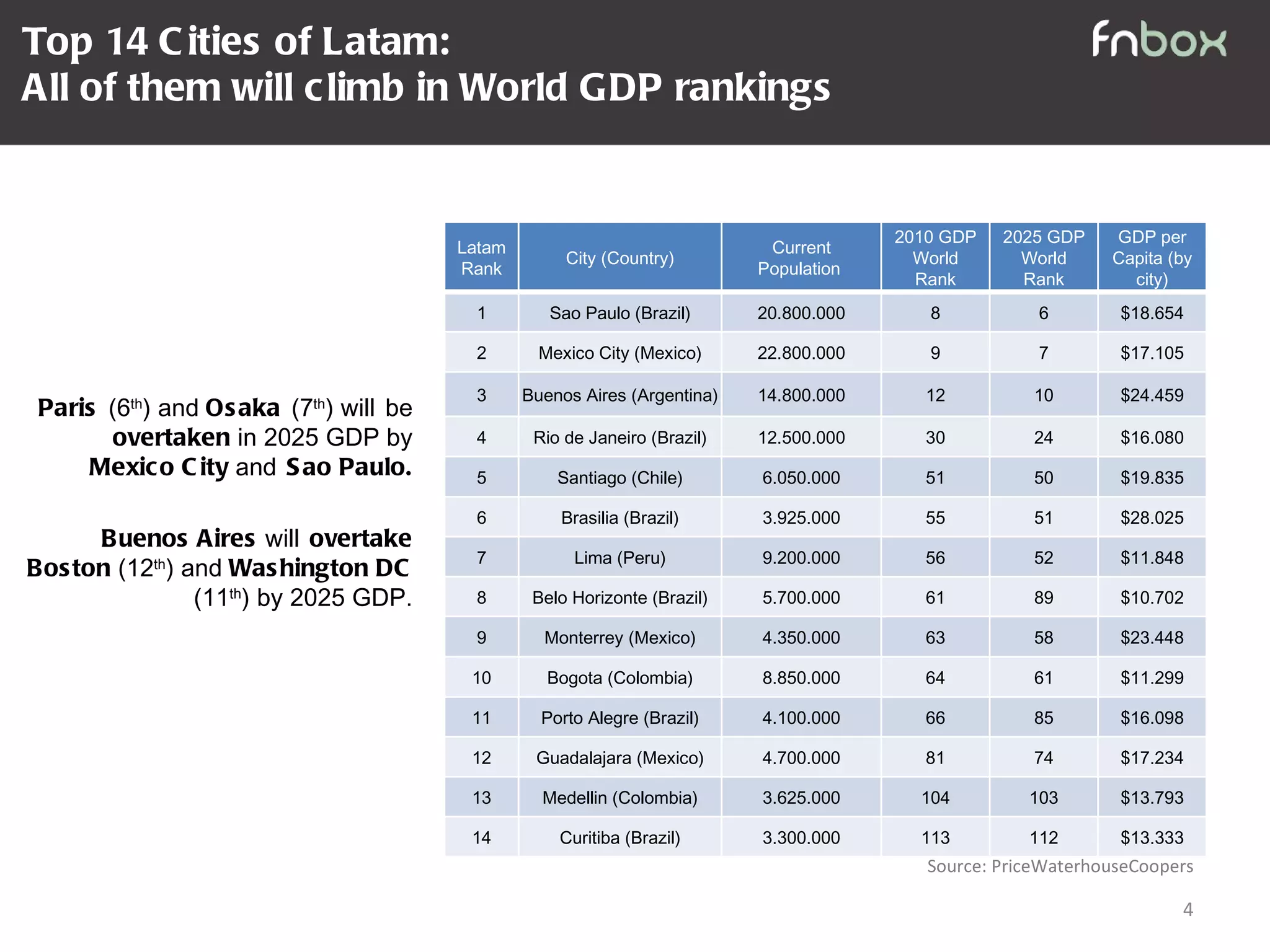

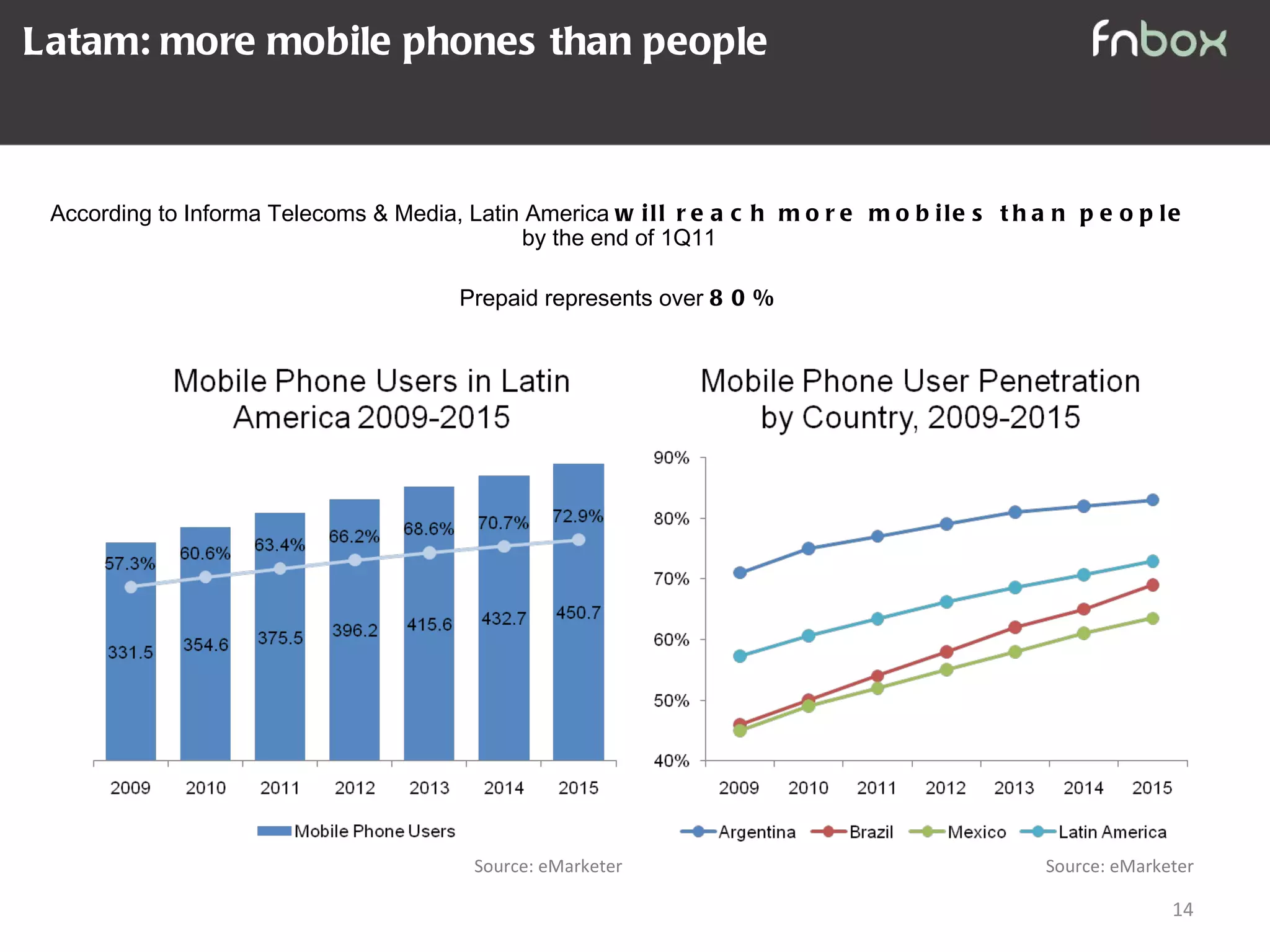

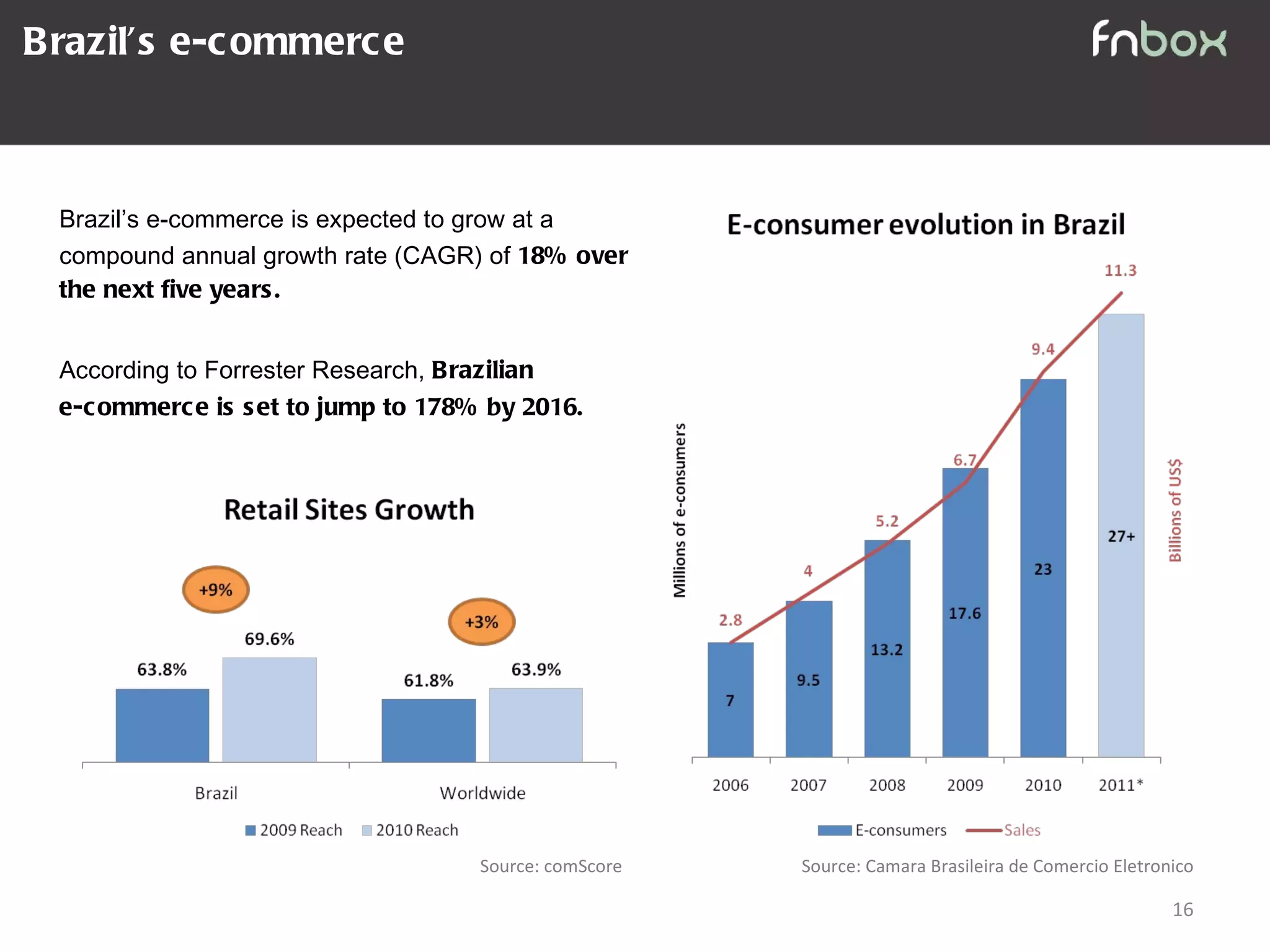

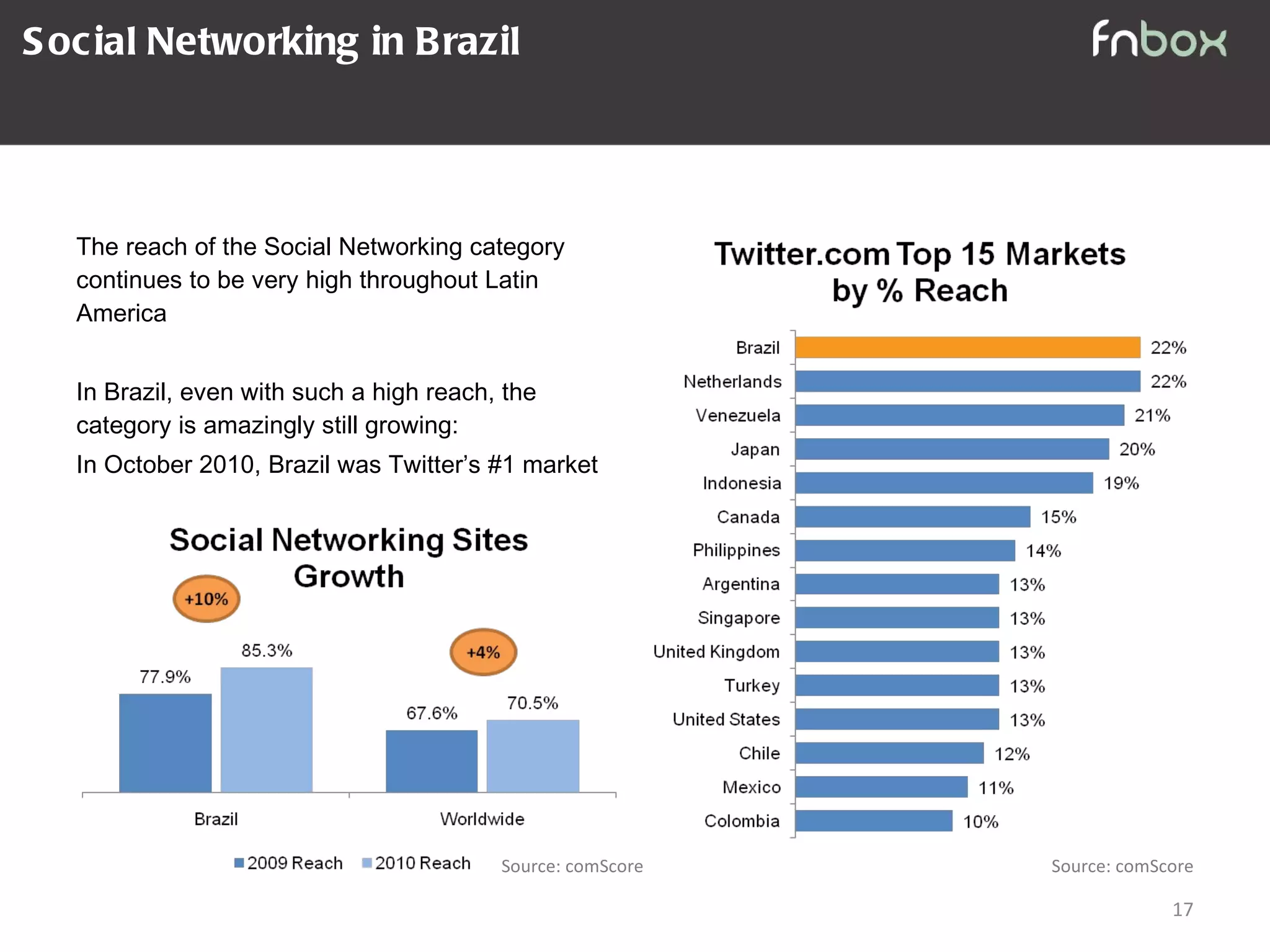

Latin America's internet market is growing rapidly, driven by a booming population and economy. The region's internet user base and online advertising spending are both expected to more than double by 2014. Mobile phone penetration has surpassed people, and e-commerce is also taking off, led by Brazil which has the largest online population and fastest growing social media engagement in the region. The large and growing Hispanic population in the US also represents a major opportunity for Latin American internet companies.

![Most major markets in Latam have grown significantly Eric Schmidt (Google ’s former CEO): “ ..internet usage has increased dramatically [in Latin America]. In the last years, Brazil and Argentina are having the fastest growth in the world. We are looking forward to make strong investments in both countries” (April 2011 Interview – Diario Perfil) Source: comScore](https://image.slidesharecdn.com/latam2010-2011-110419144015-phpapp01/75/Latam-Research-2010-2011-7-2048.jpg)

![For more information visit: http://www.fnbox.com Gustavo Victorica CFO [email_address] Federico Yu Finance Analyst [email_address]](https://image.slidesharecdn.com/latam2010-2011-110419144015-phpapp01/75/Latam-Research-2010-2011-29-2048.jpg)