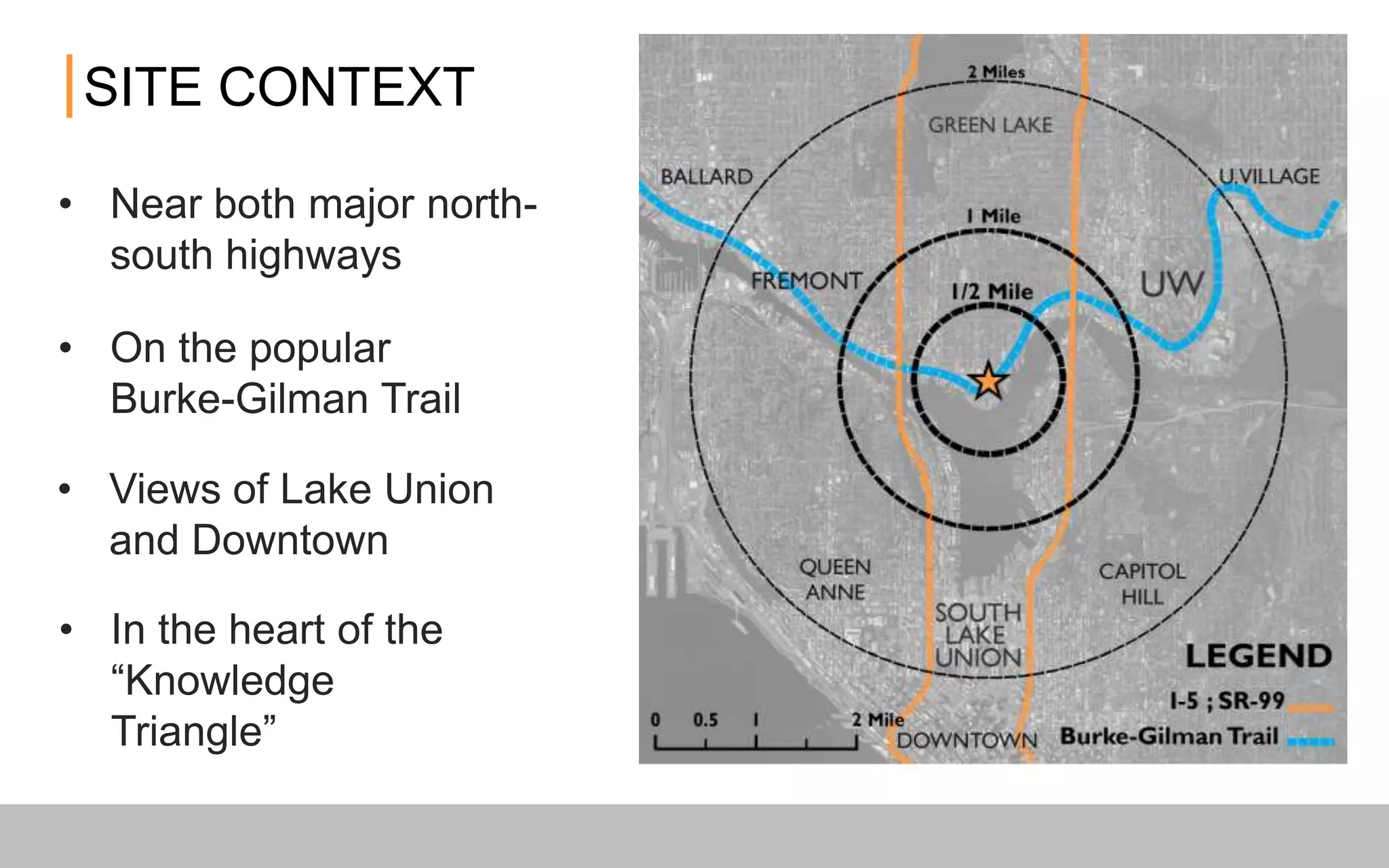

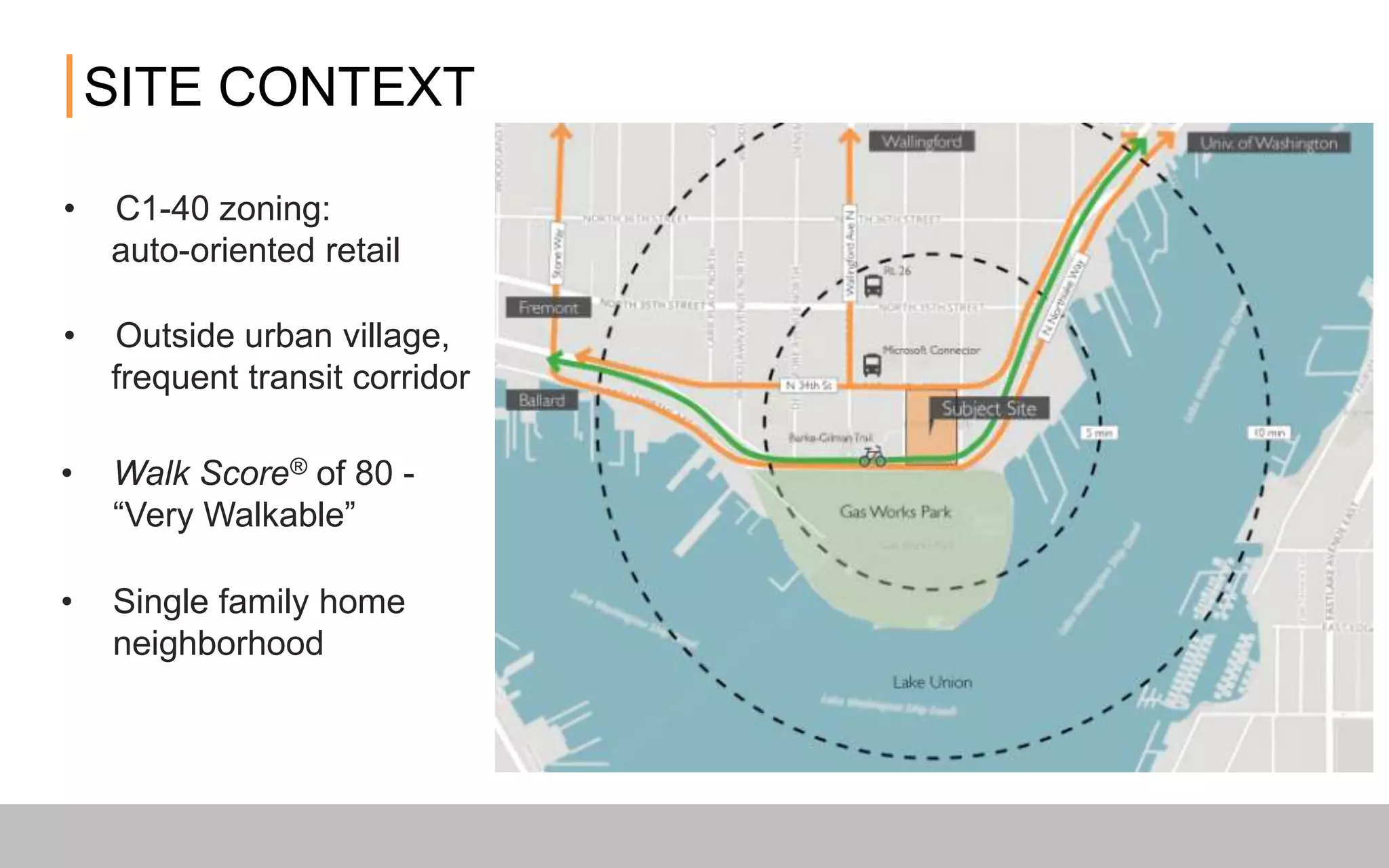

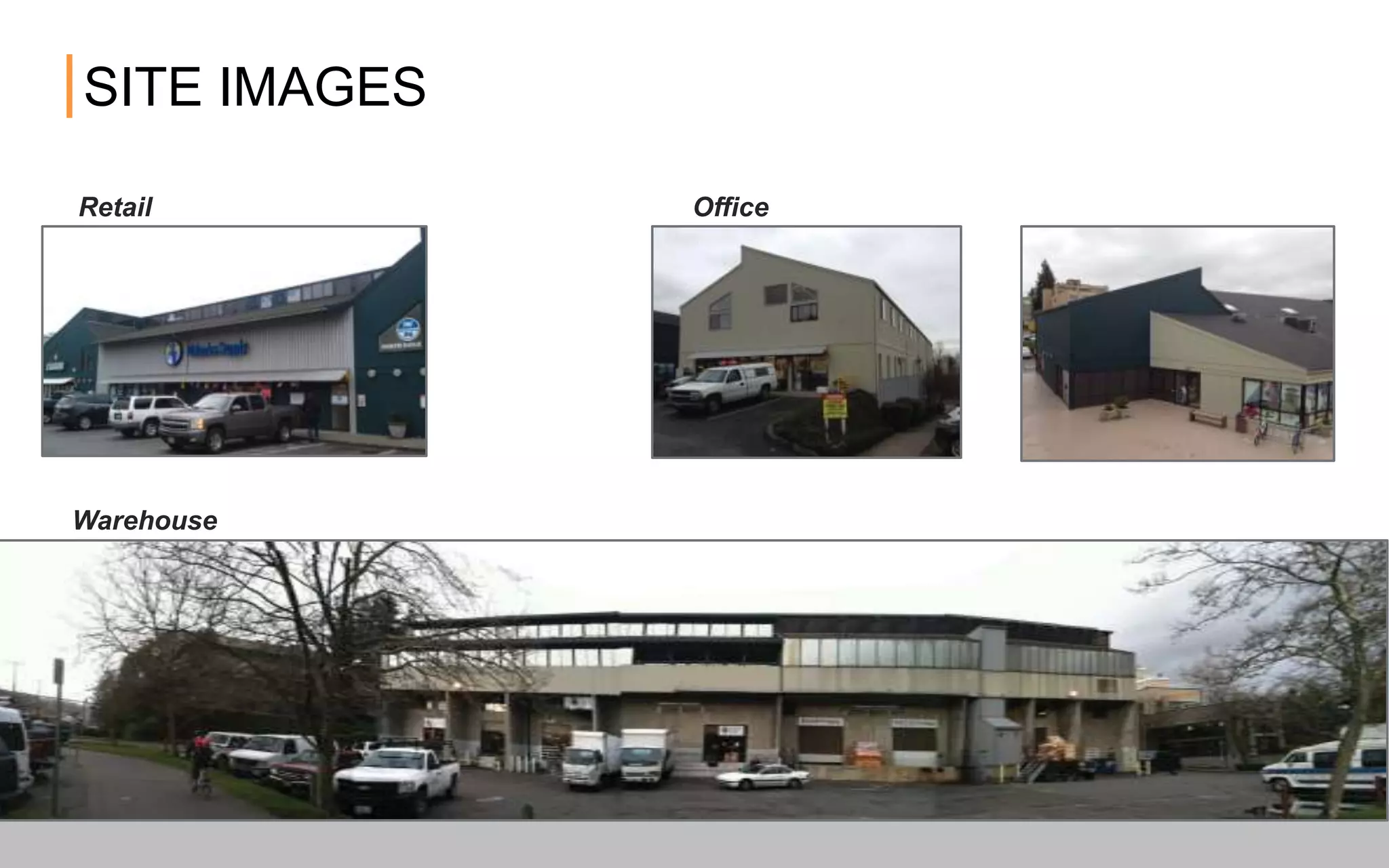

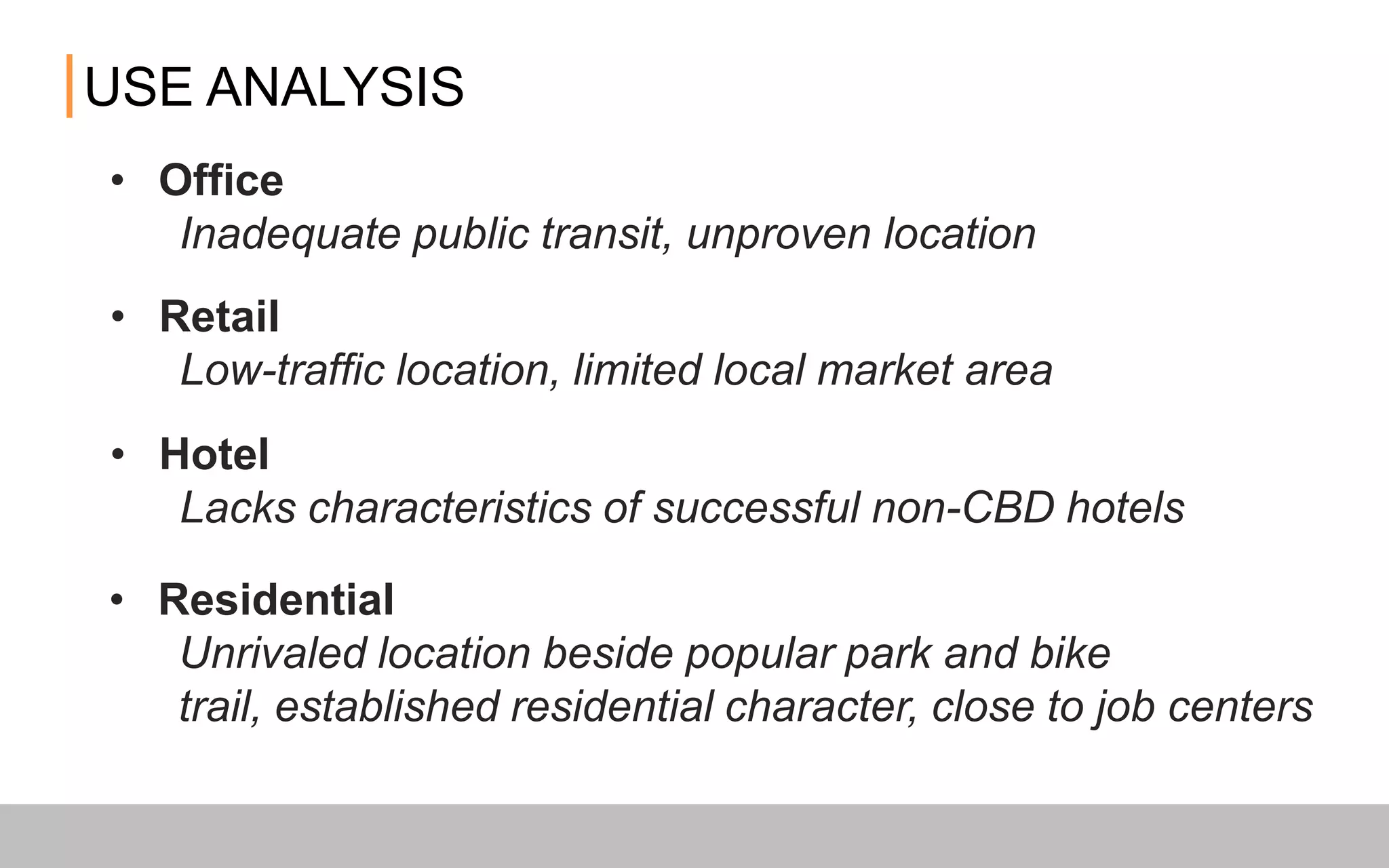

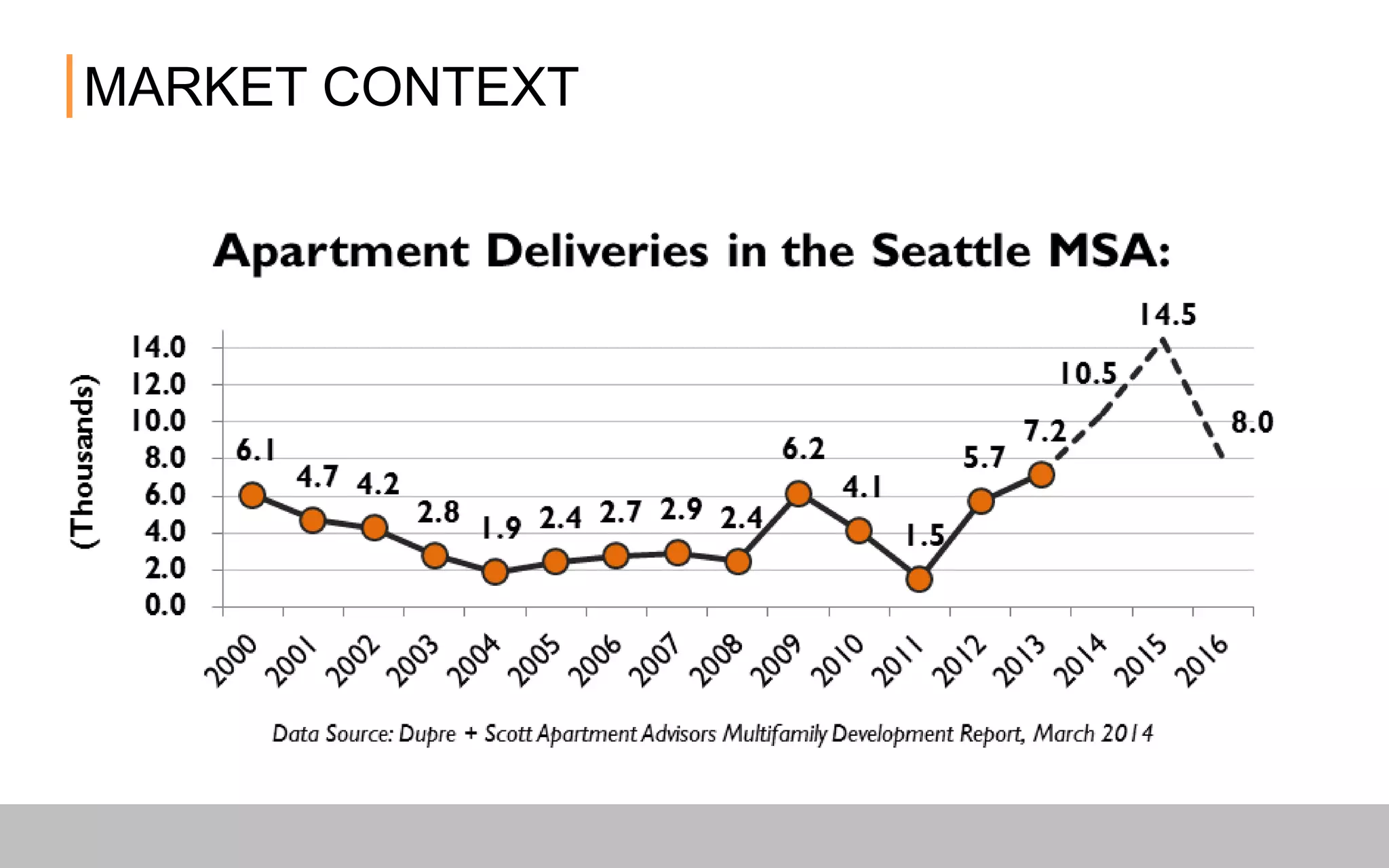

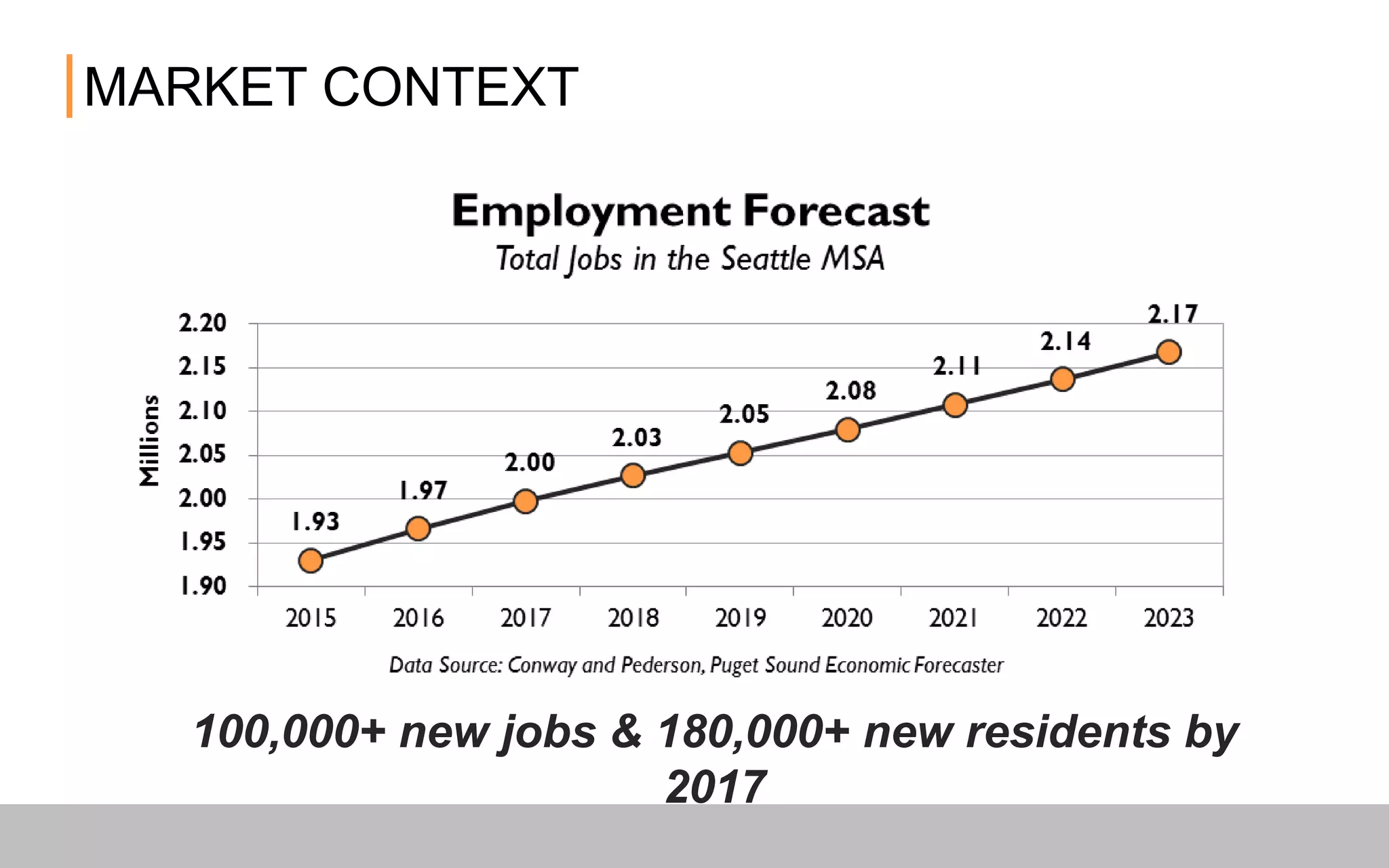

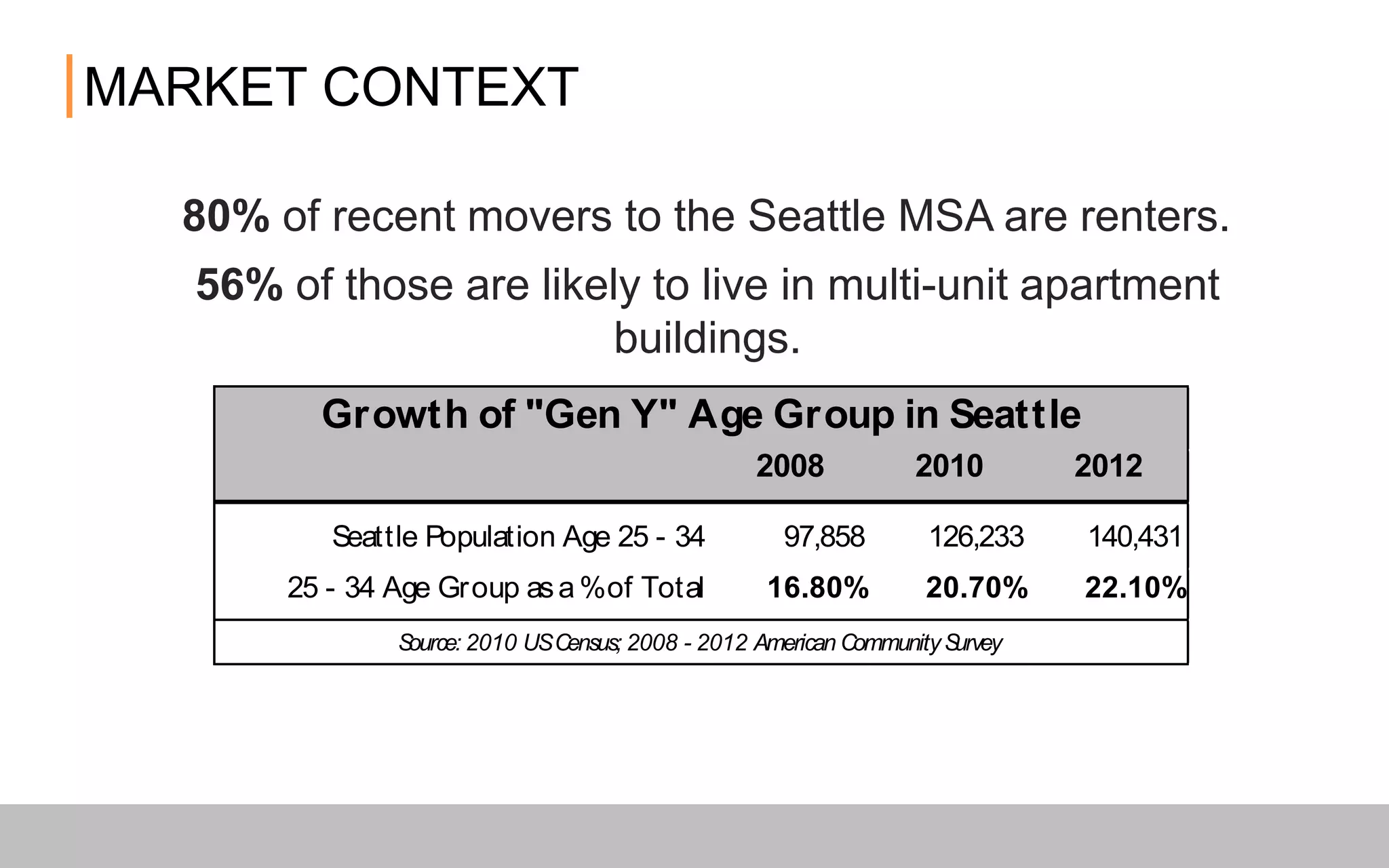

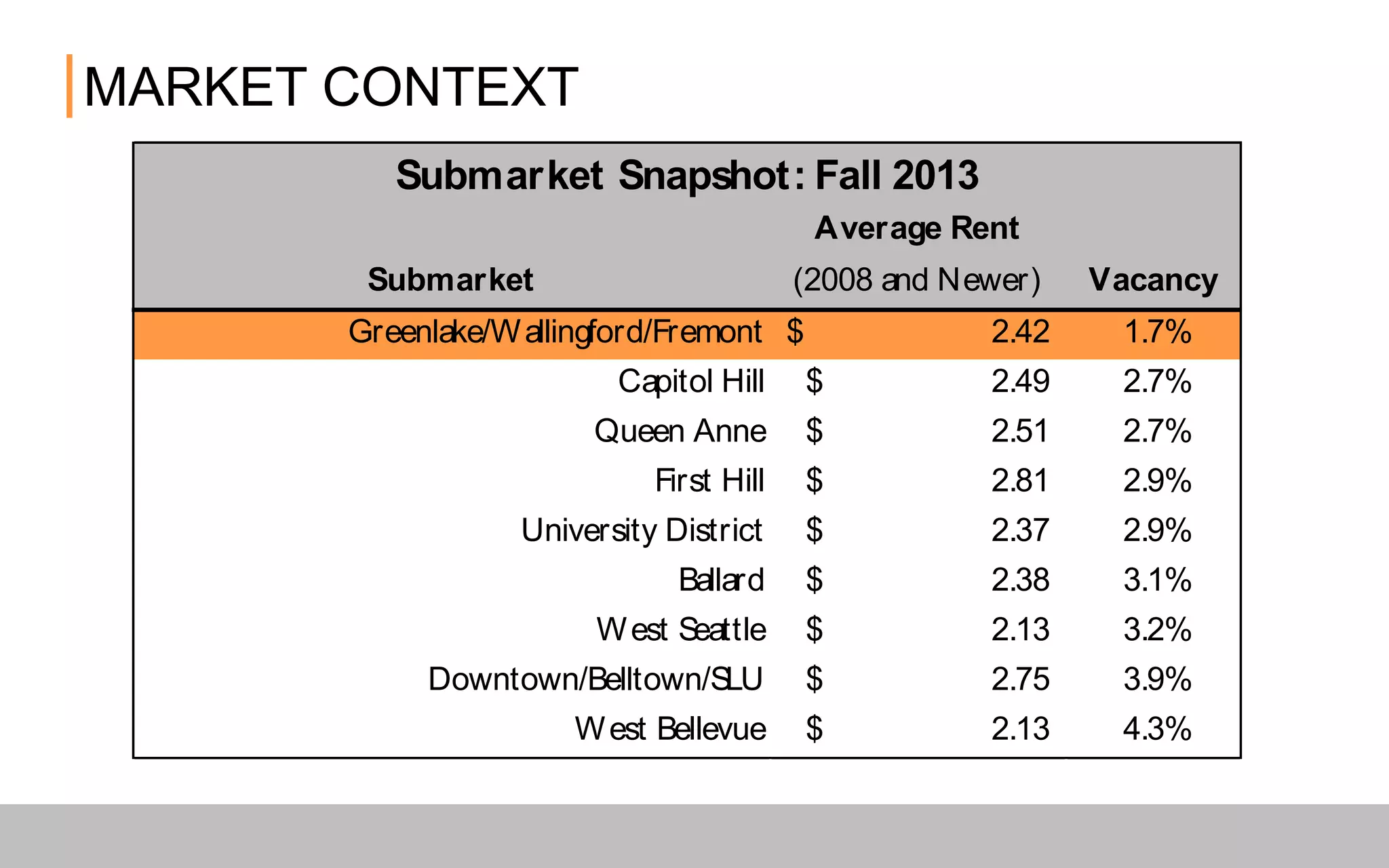

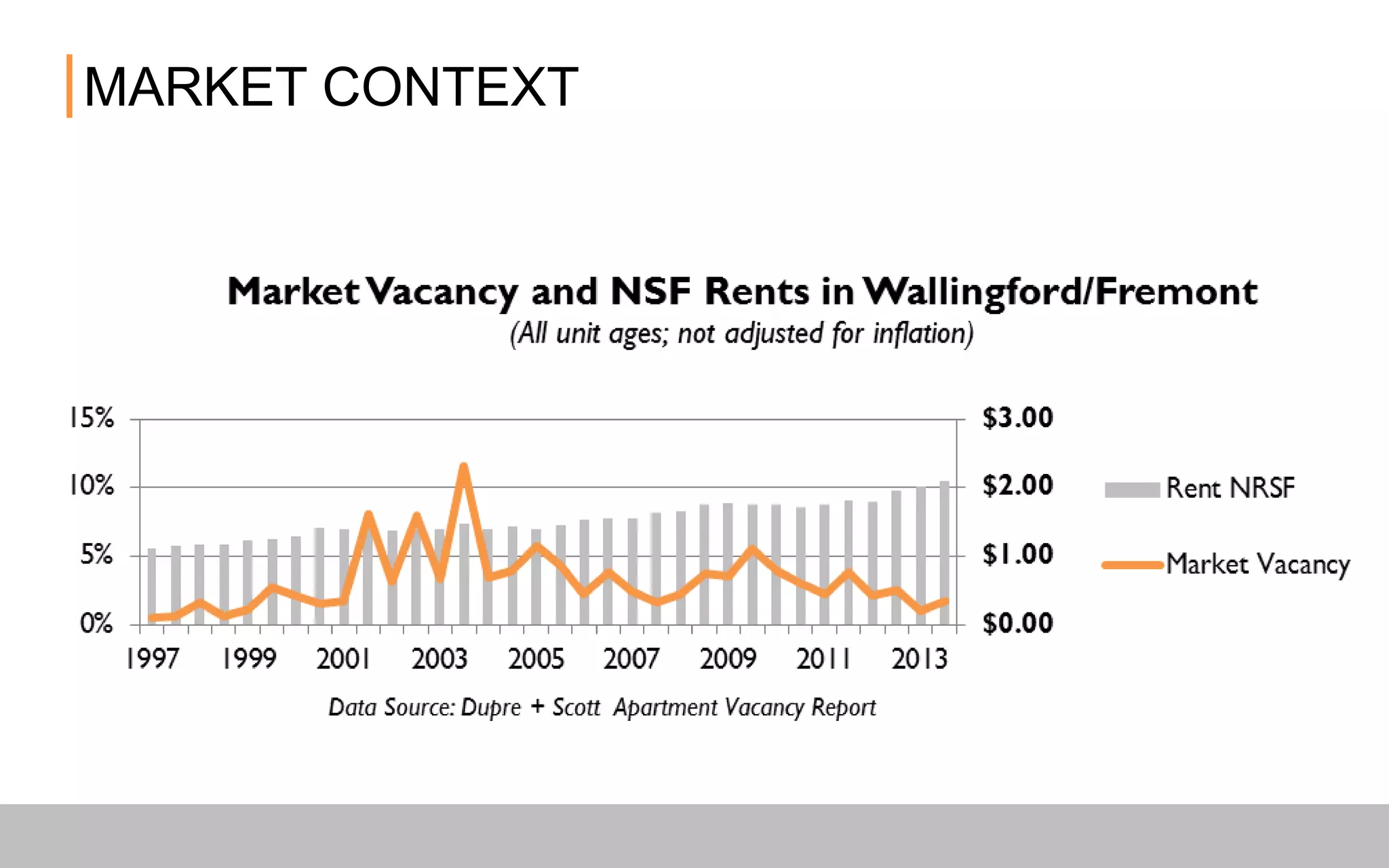

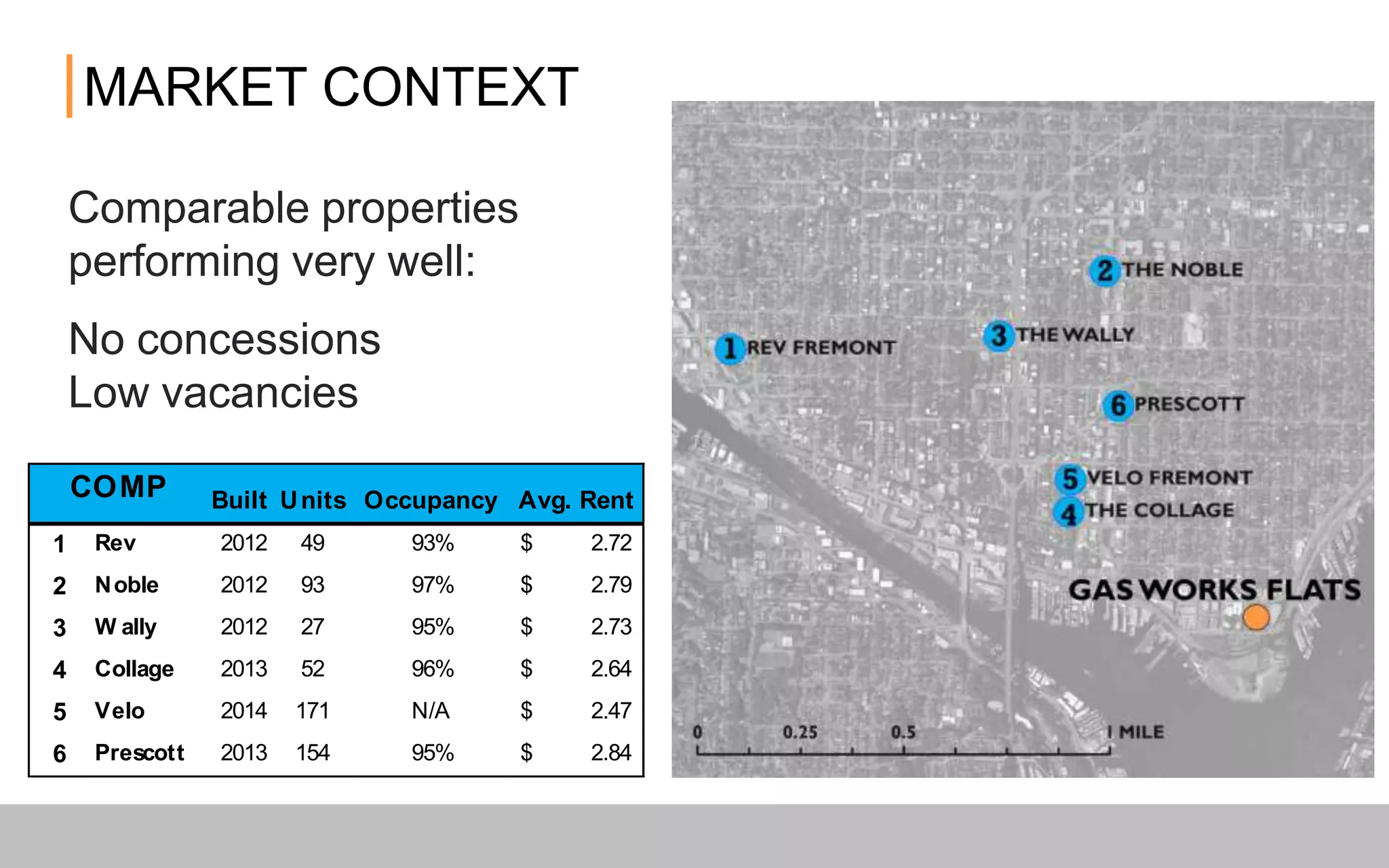

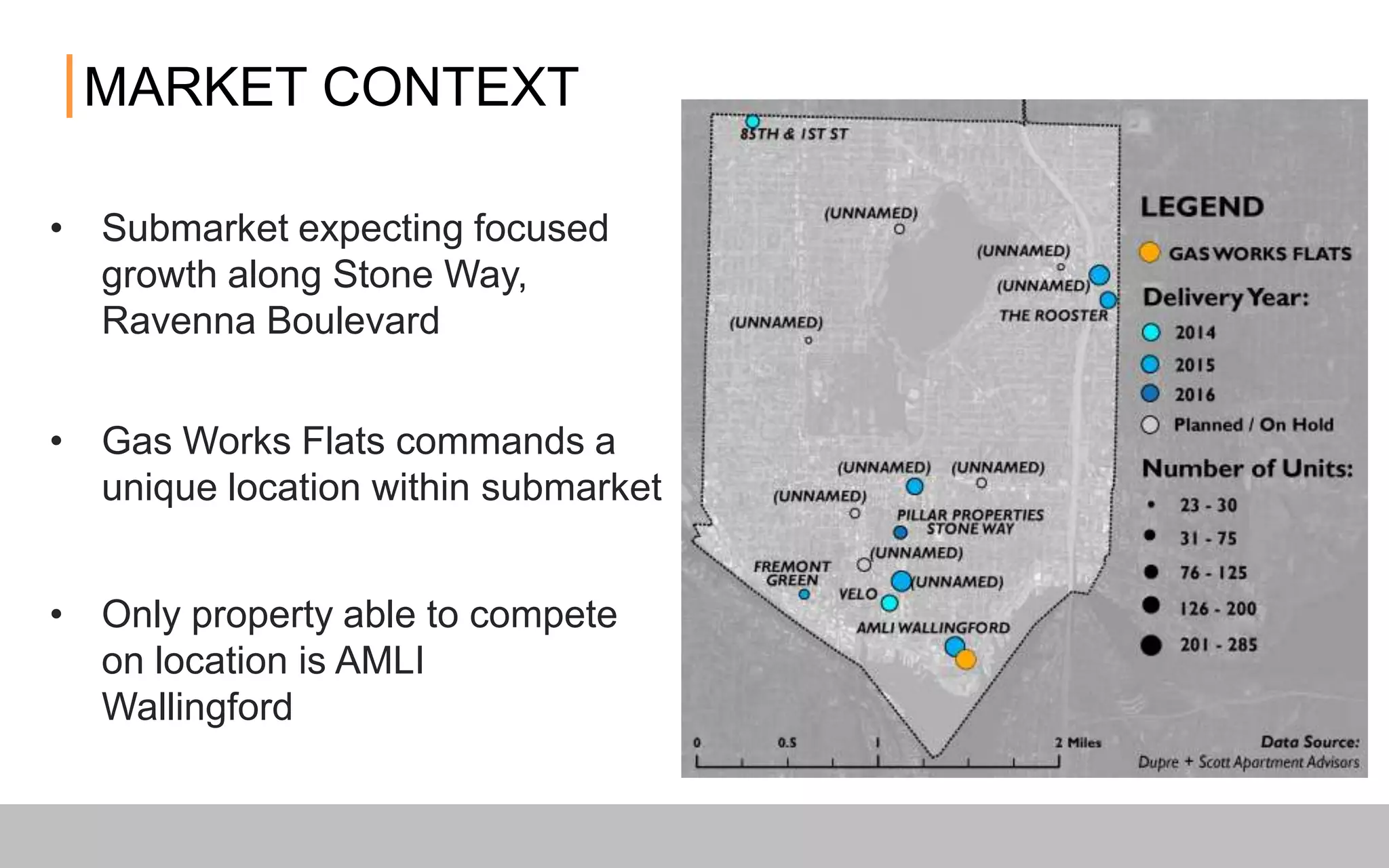

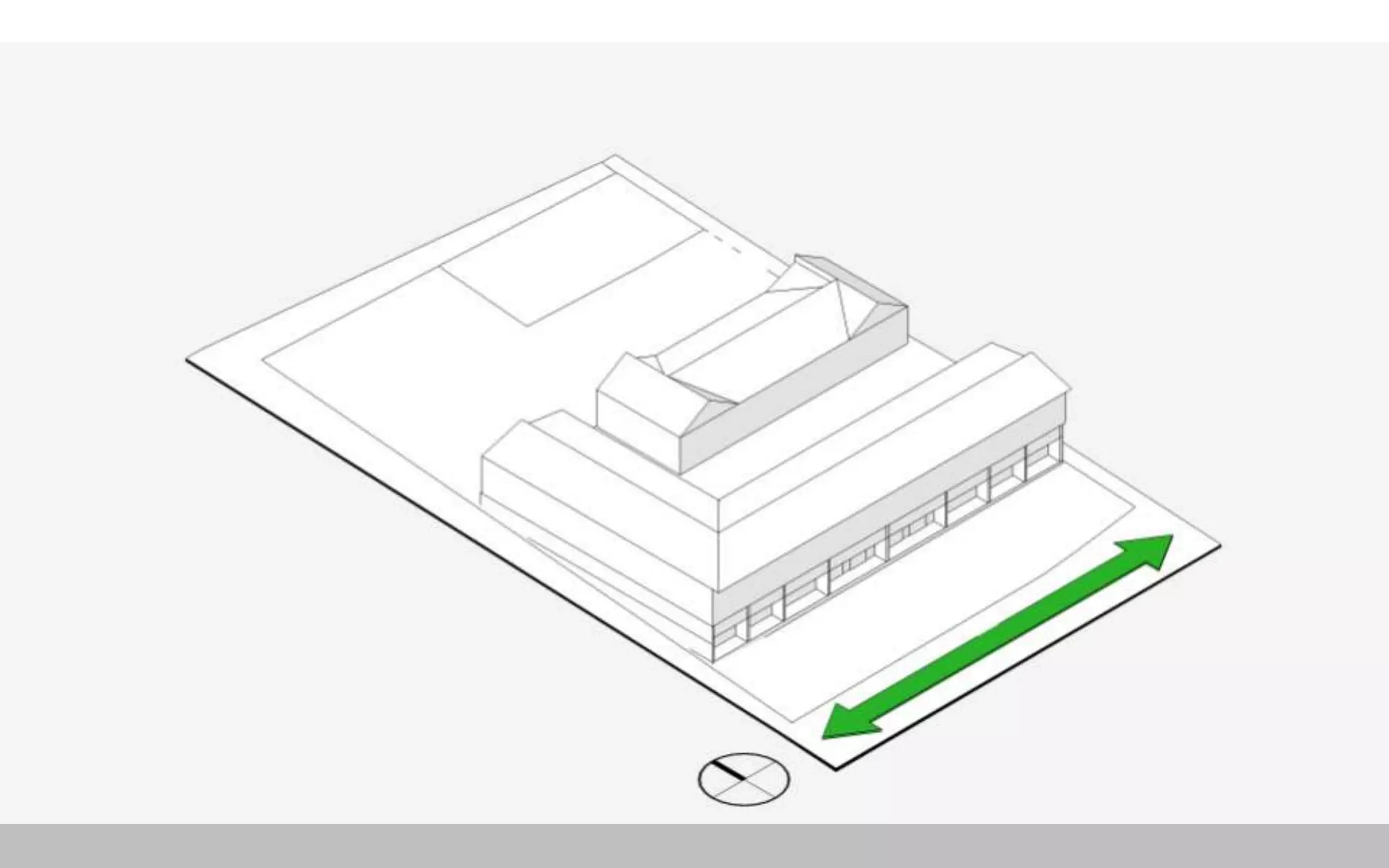

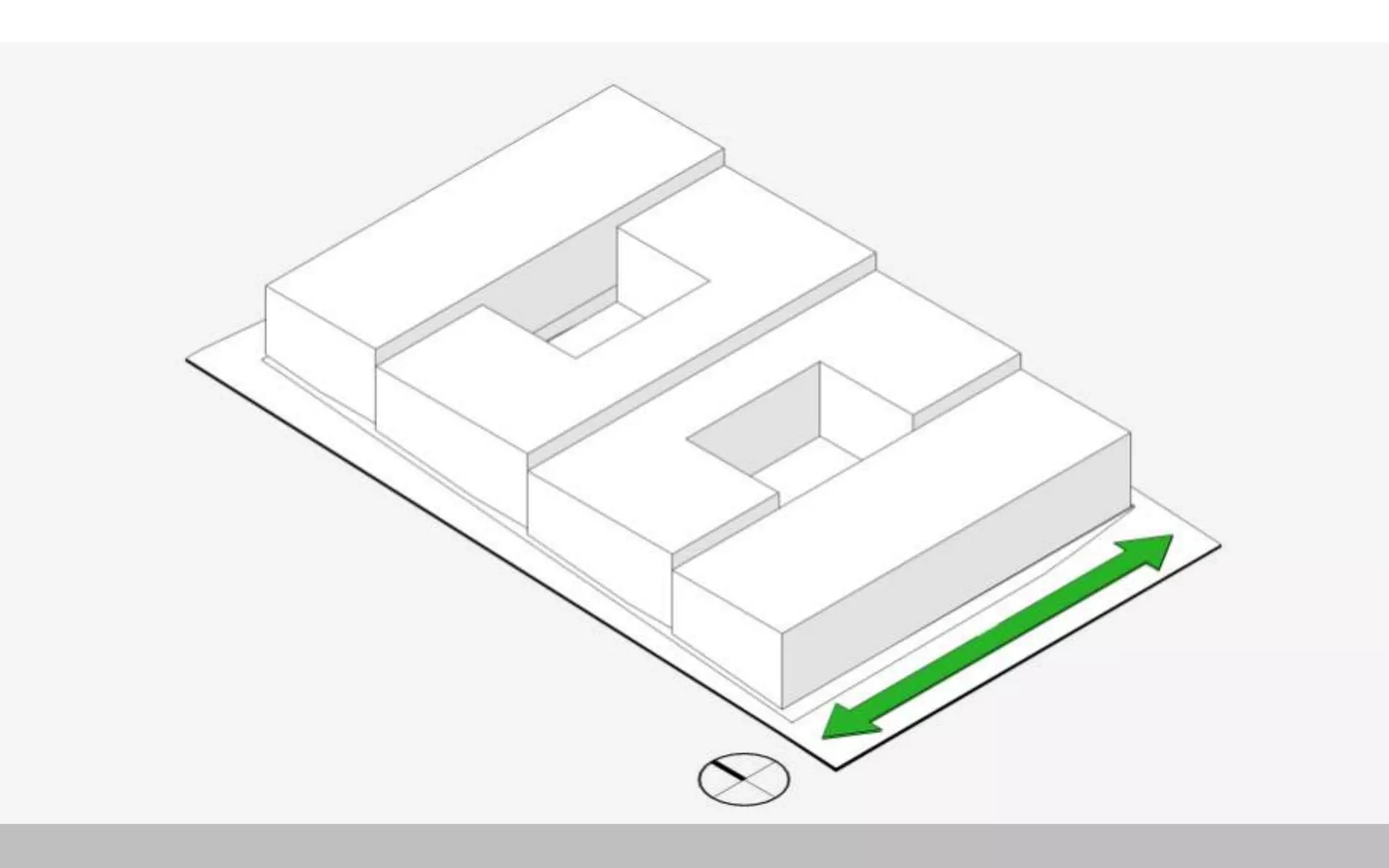

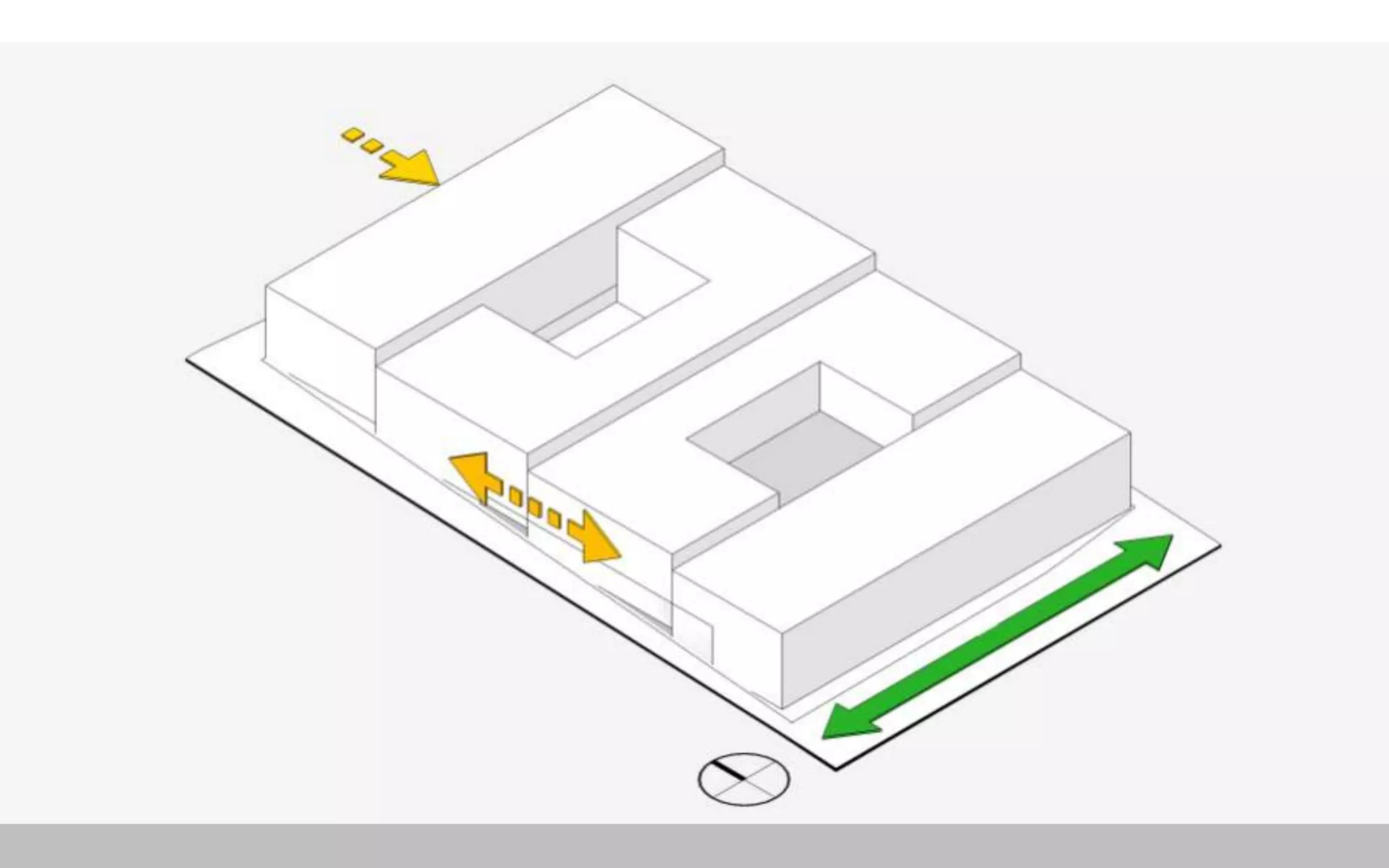

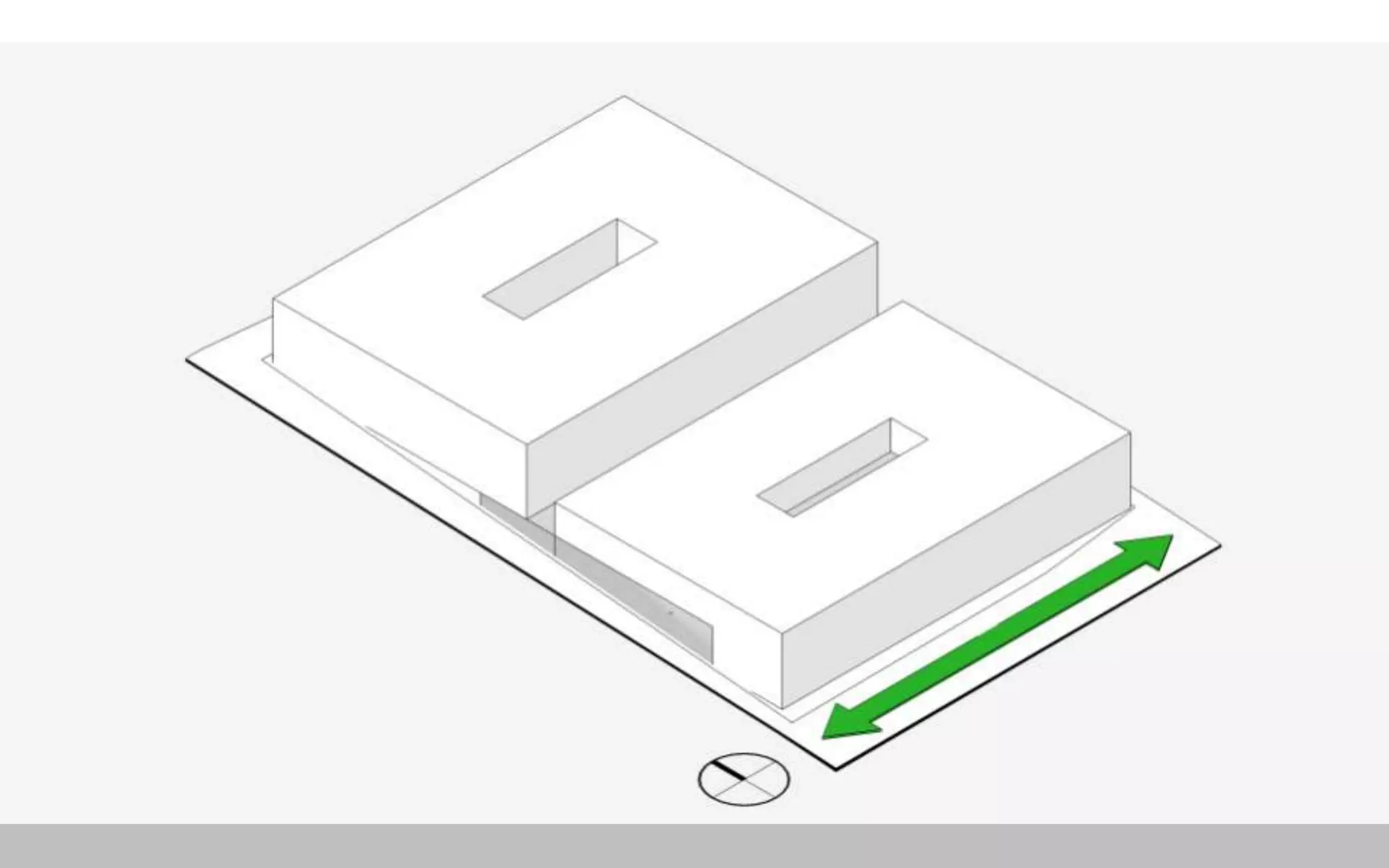

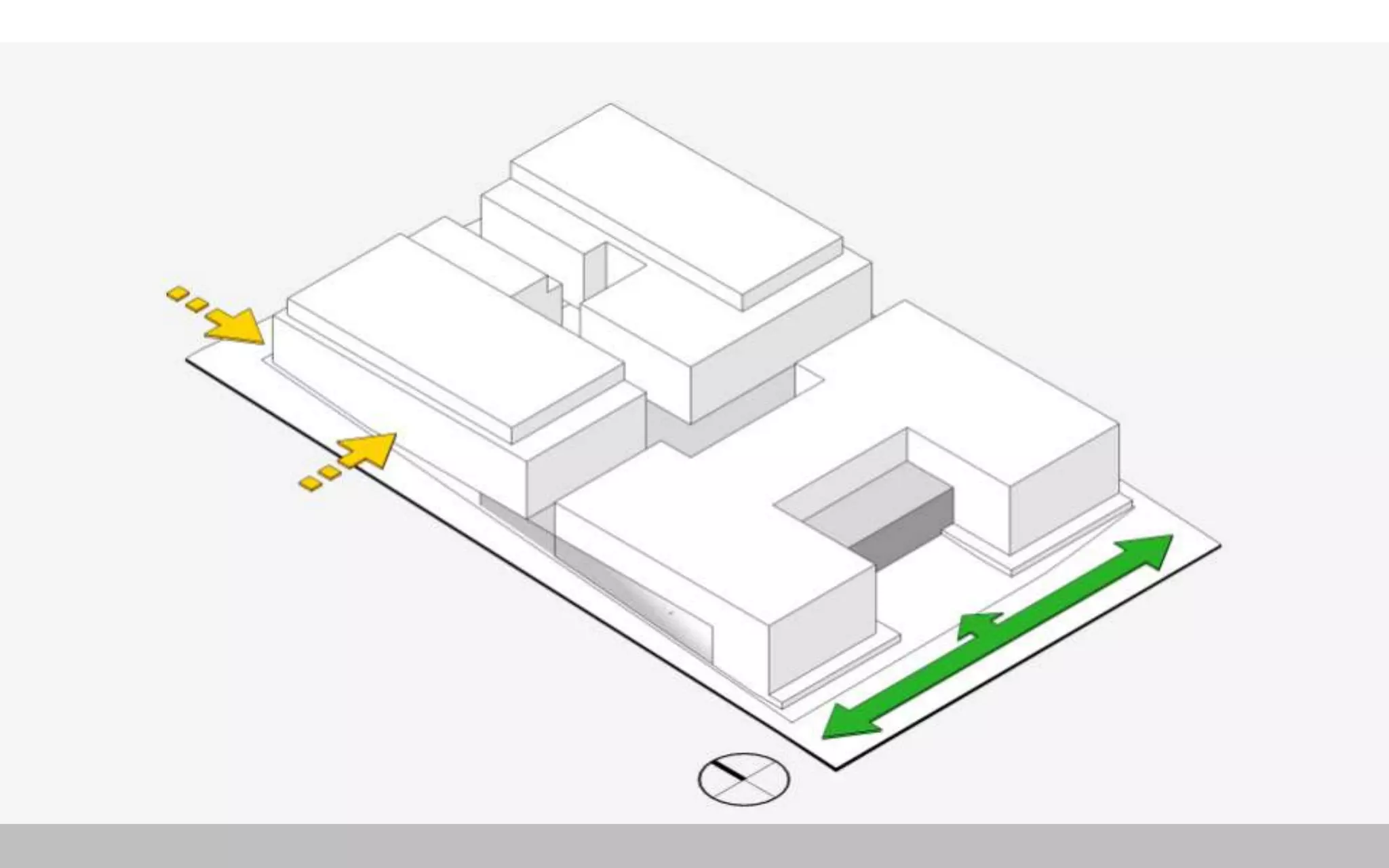

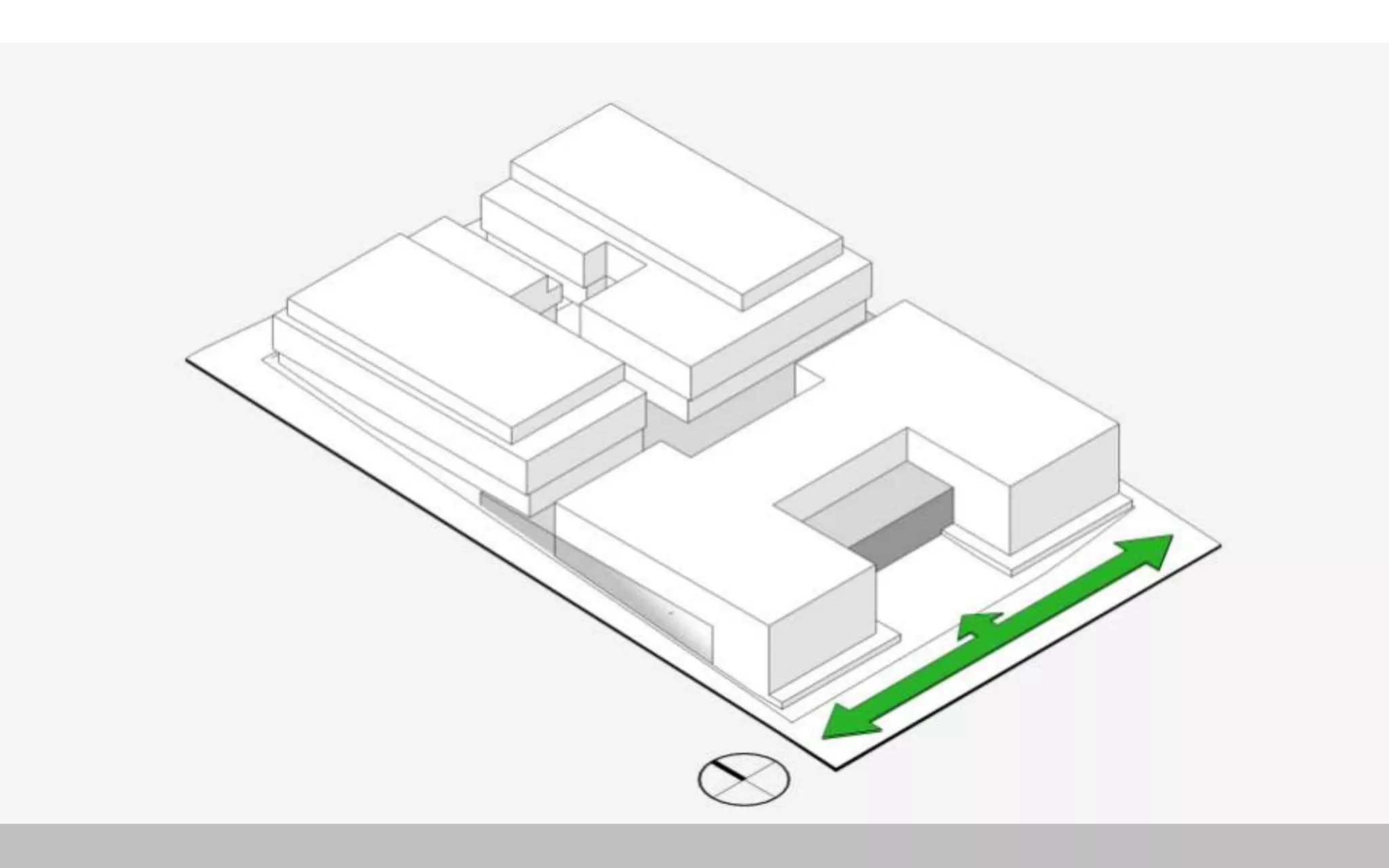

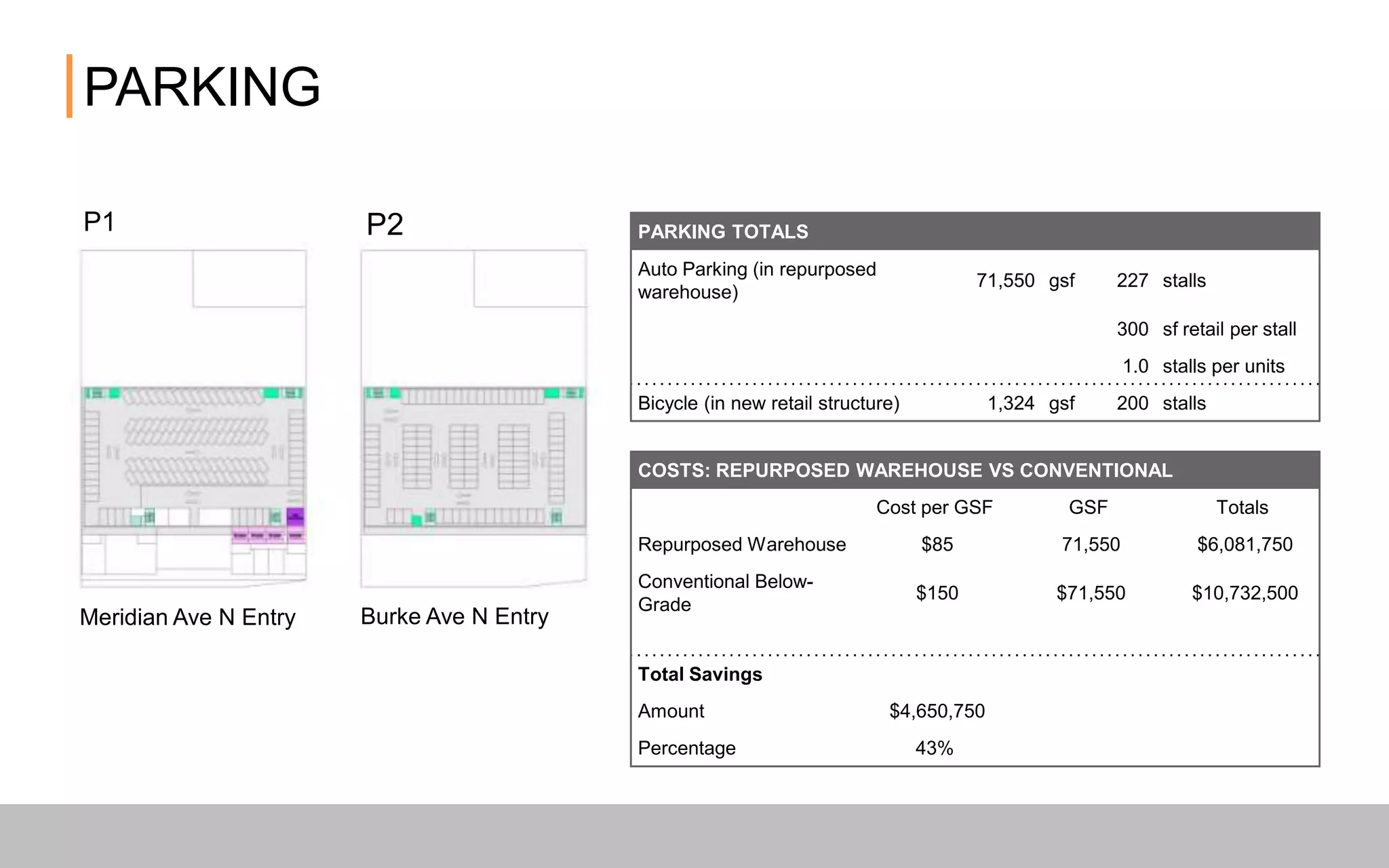

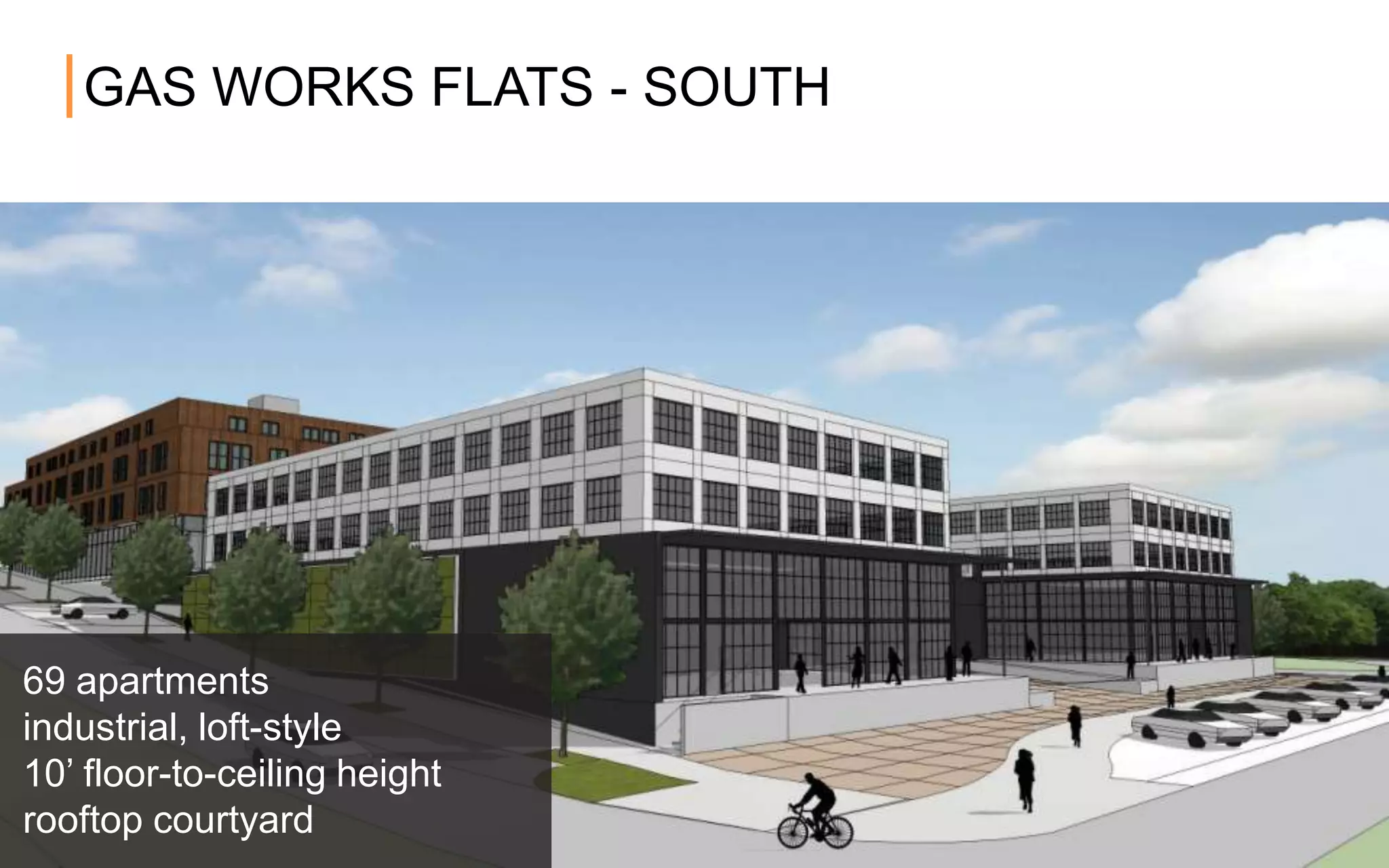

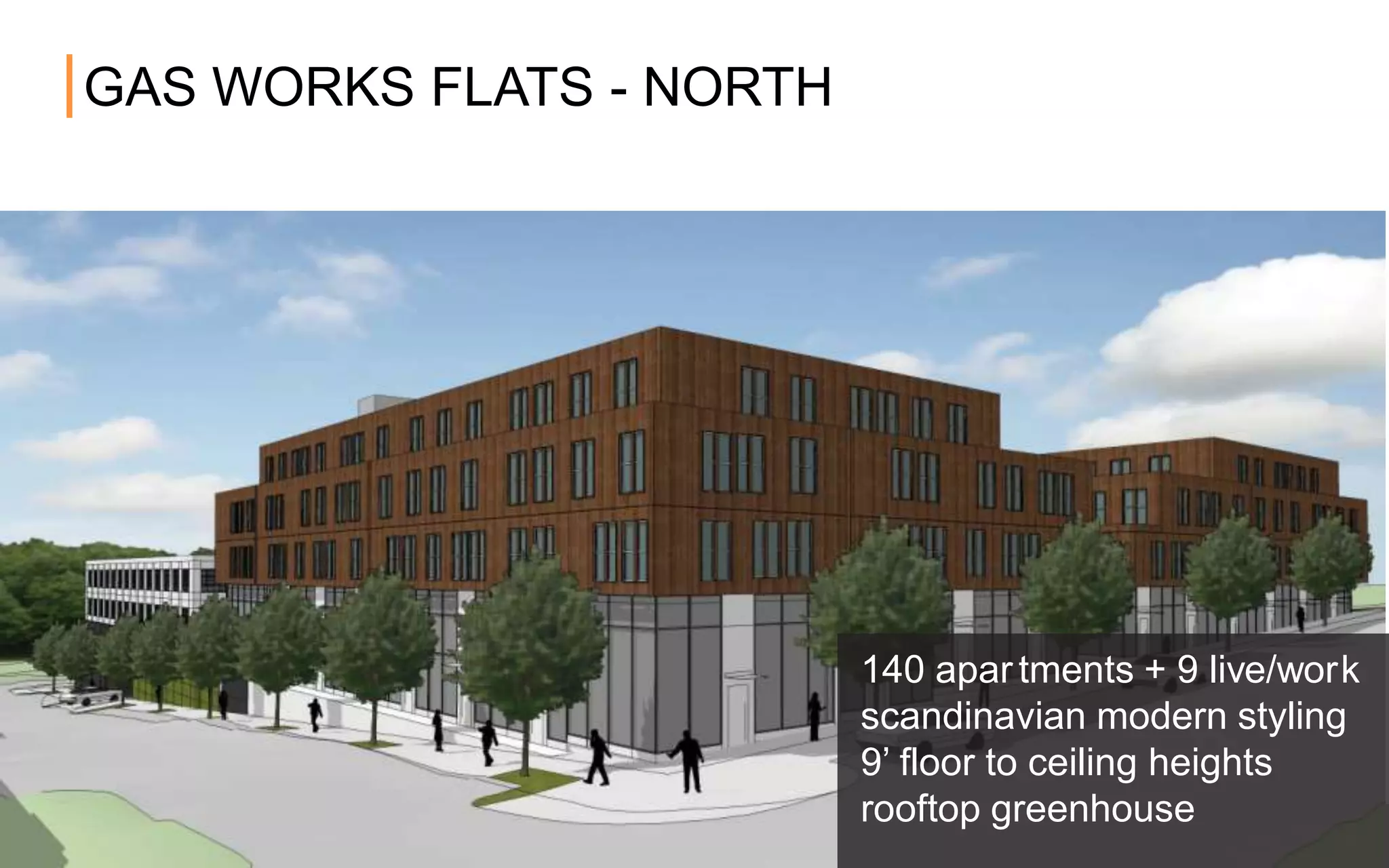

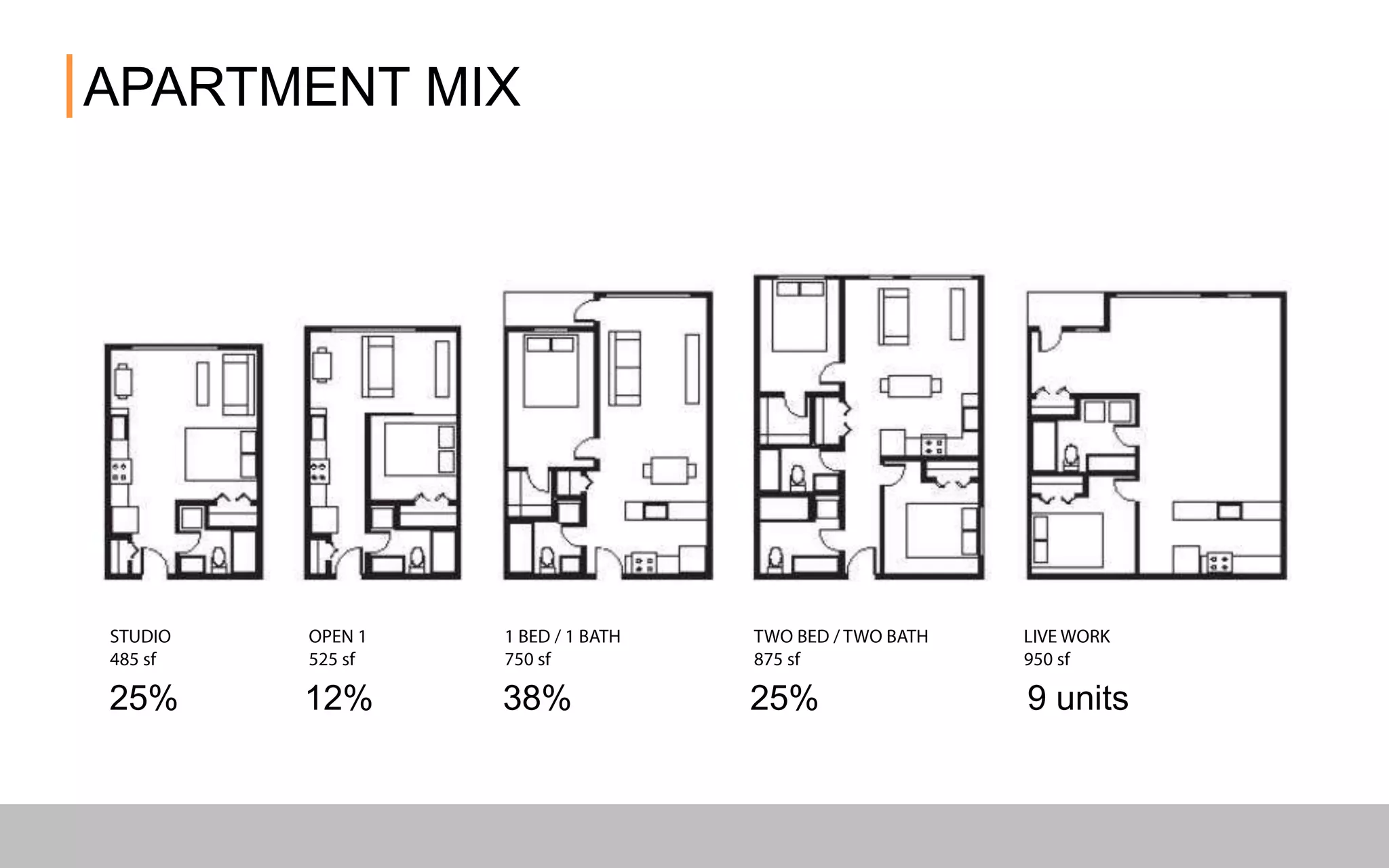

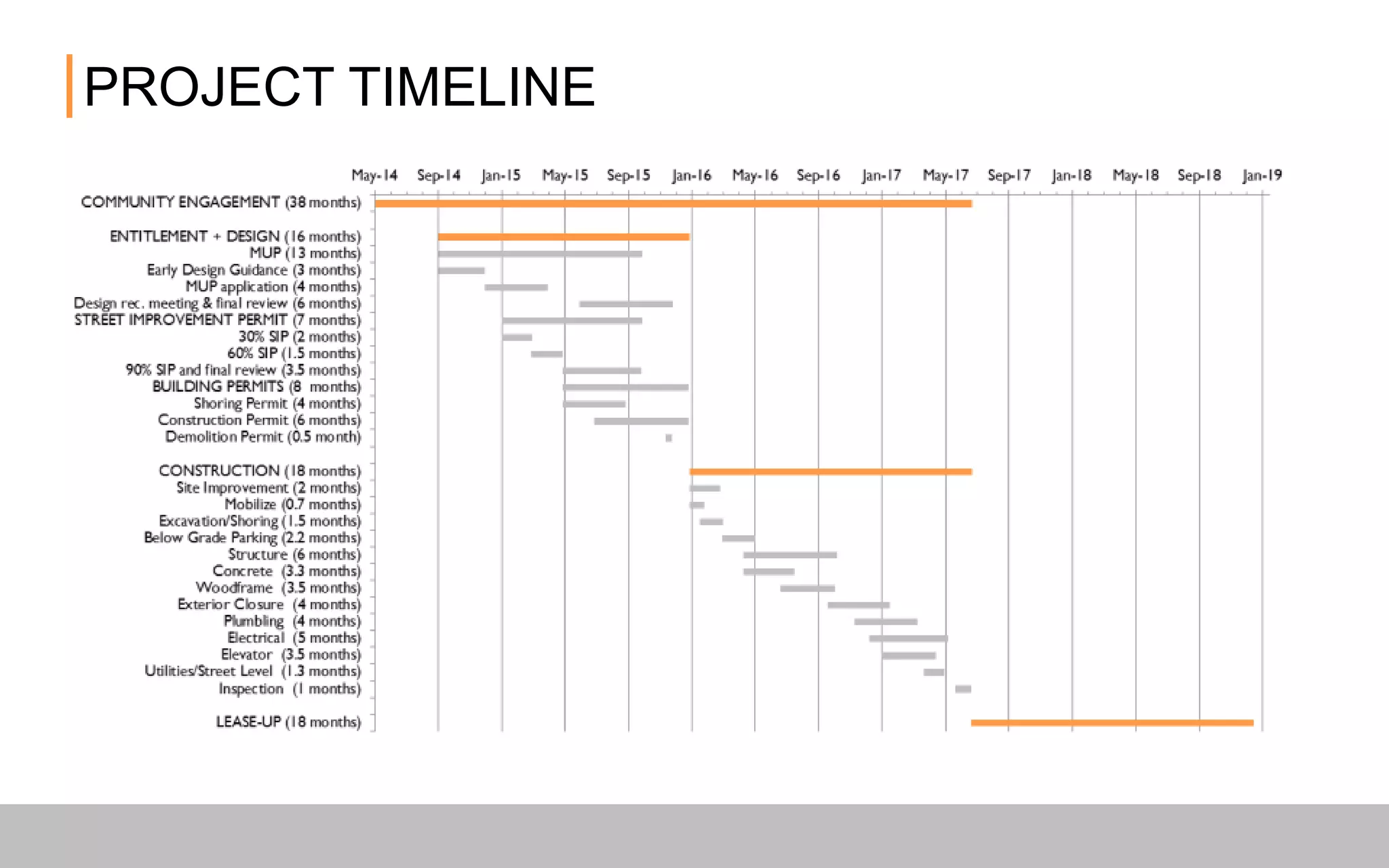

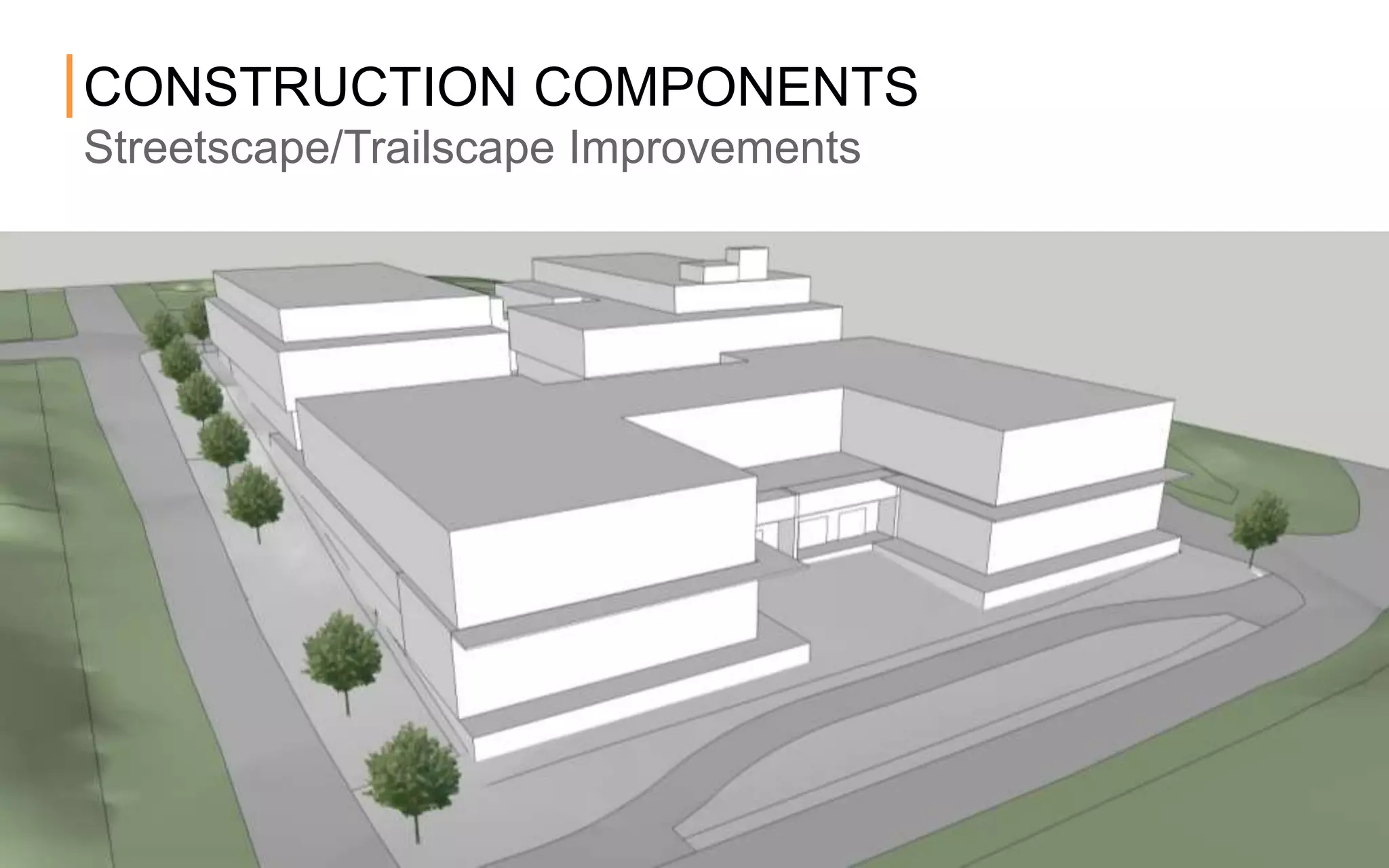

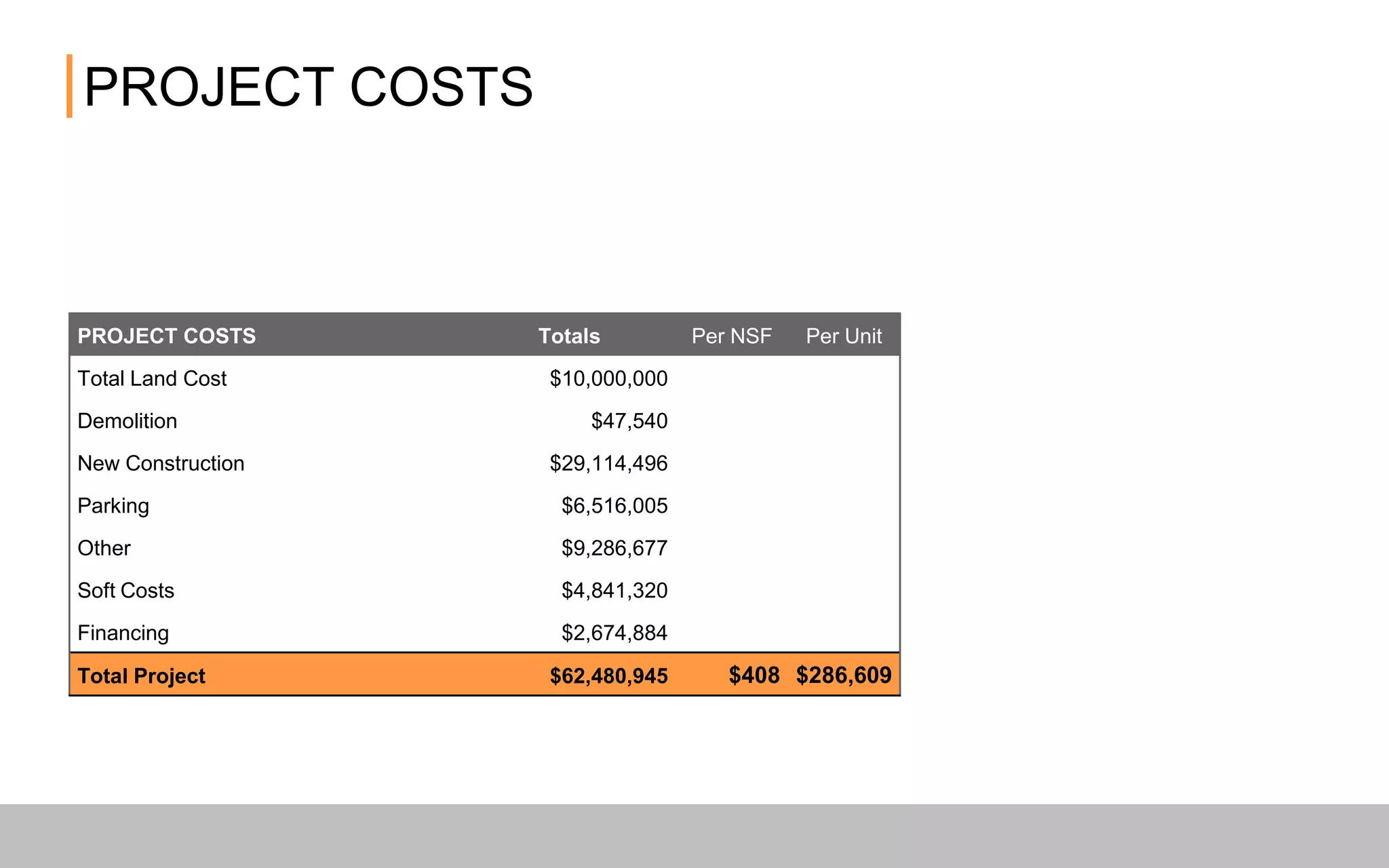

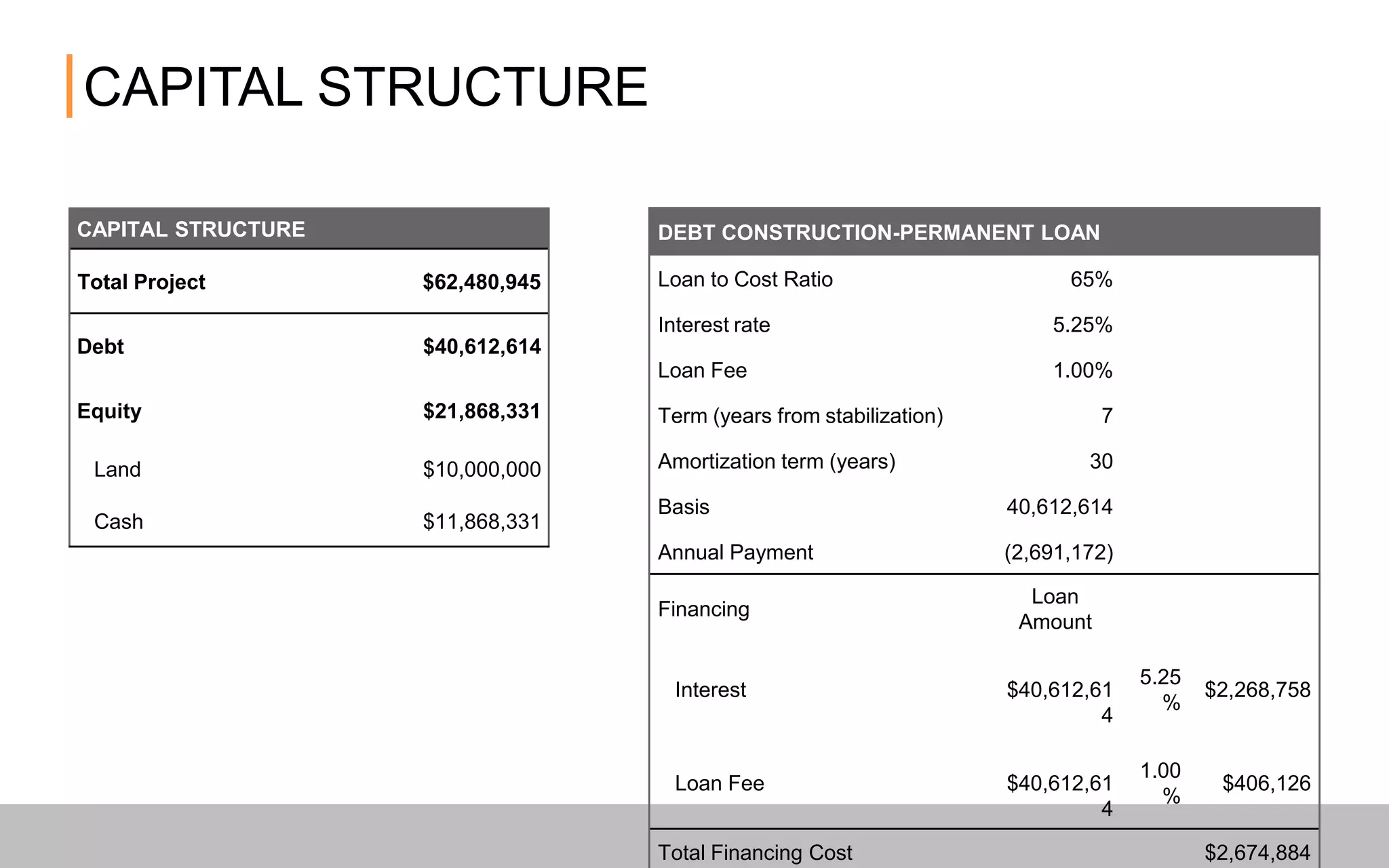

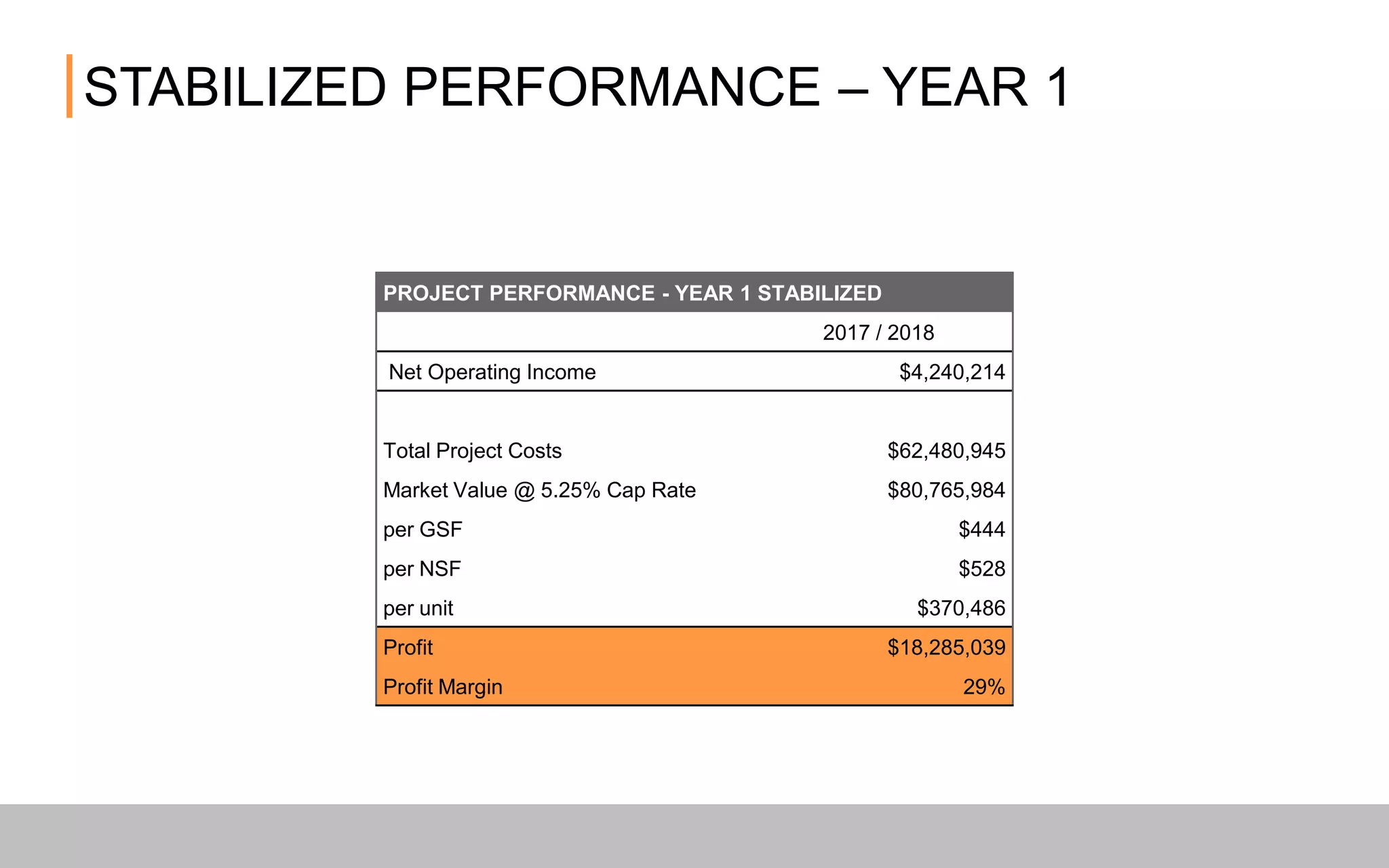

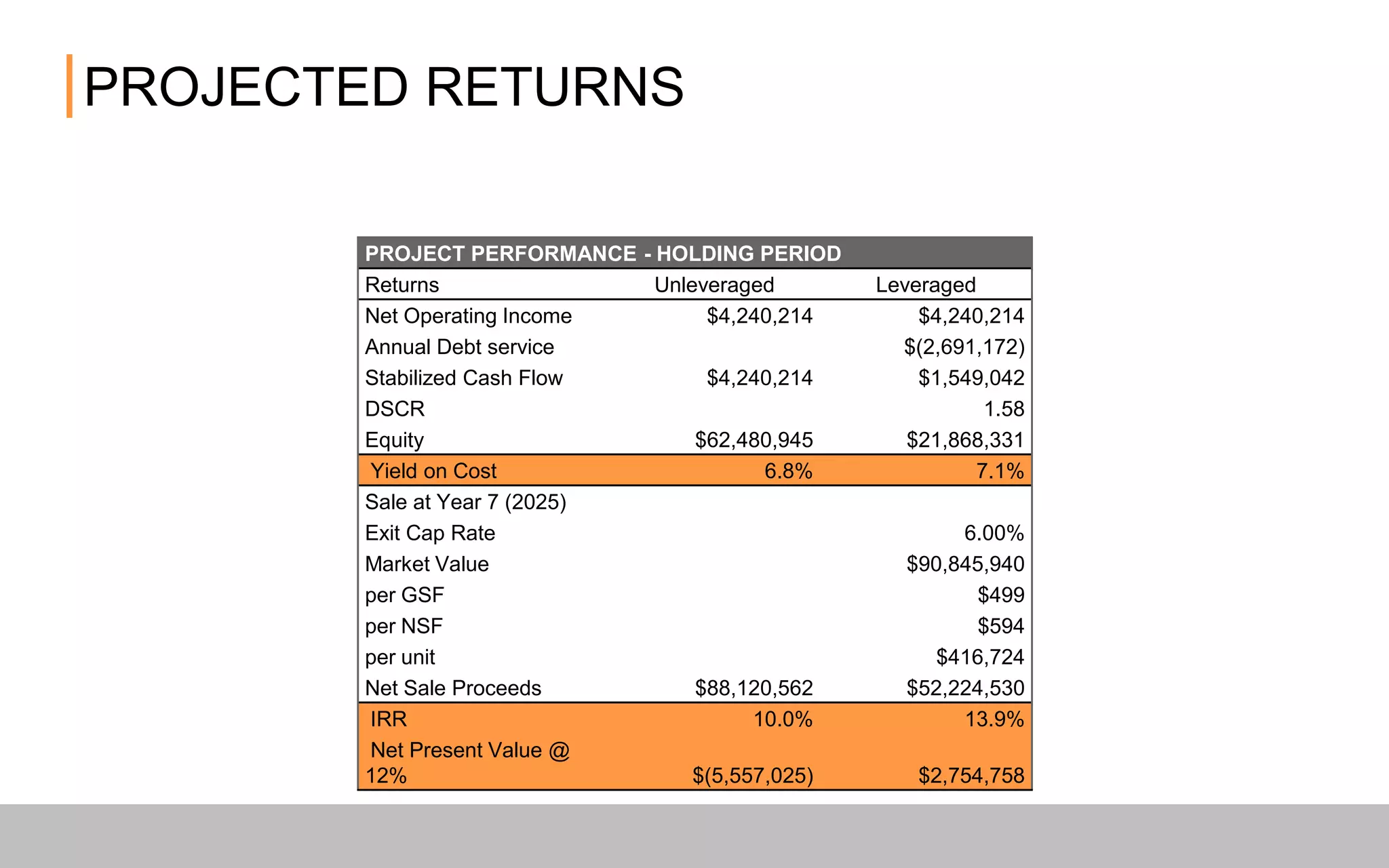

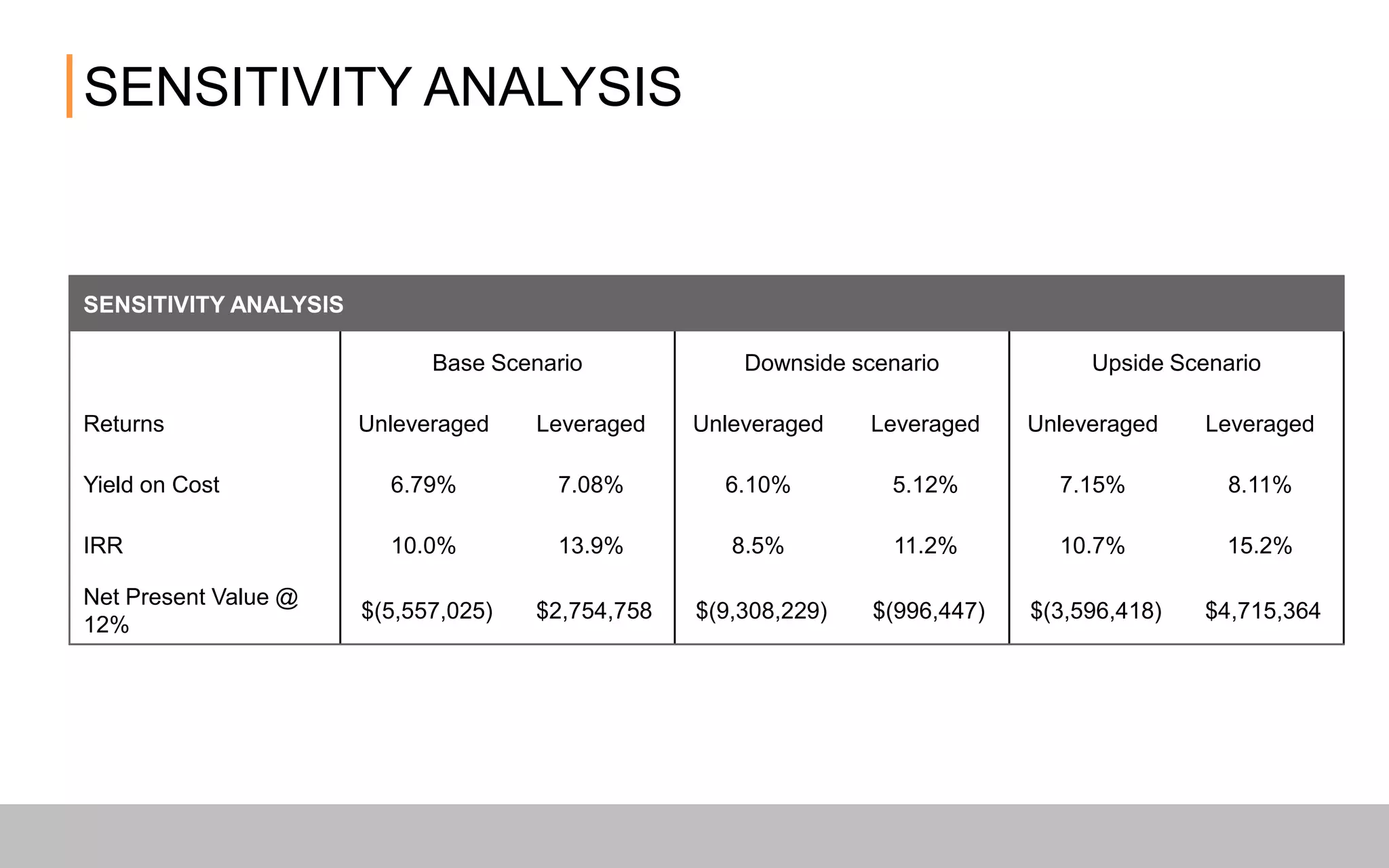

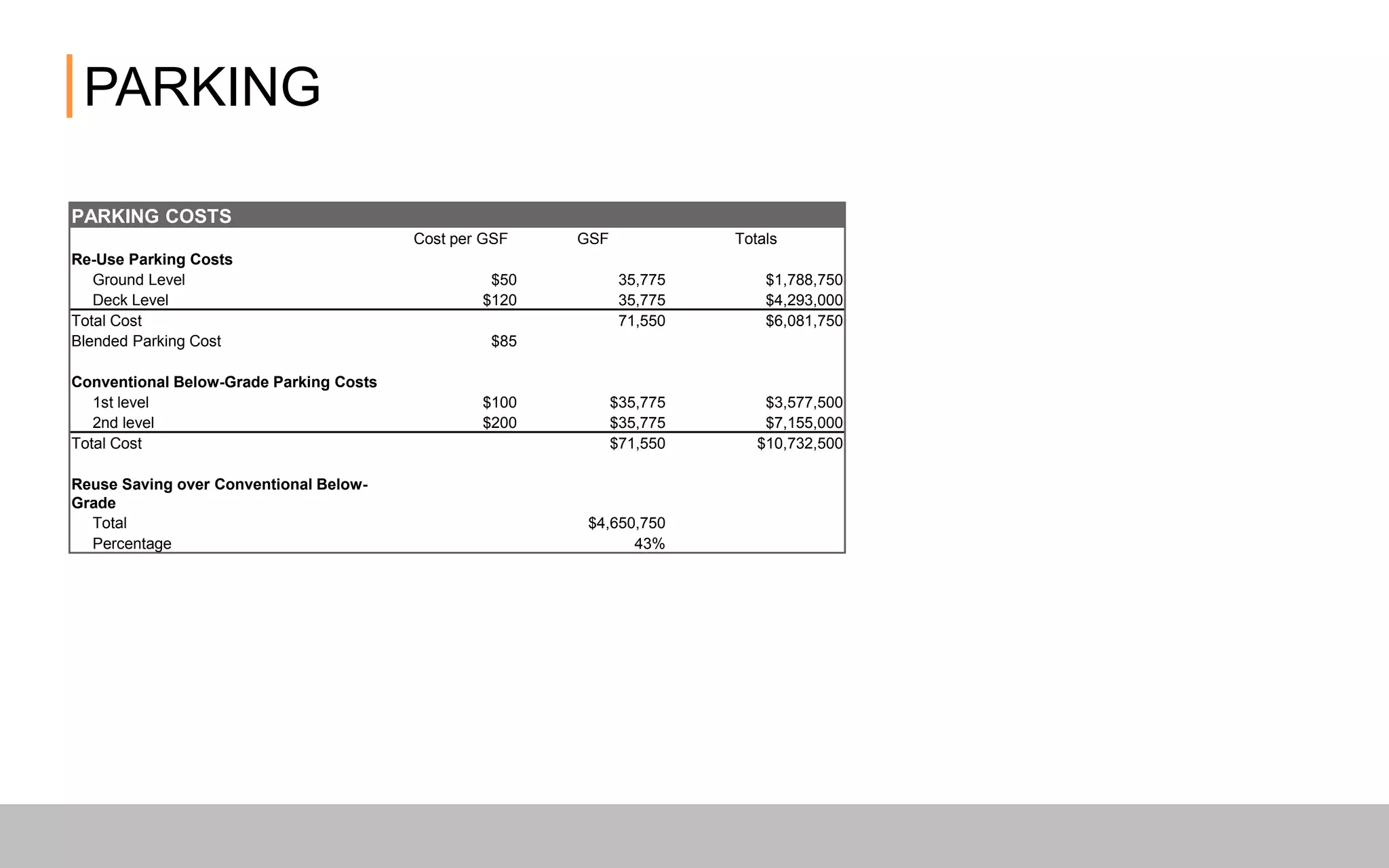

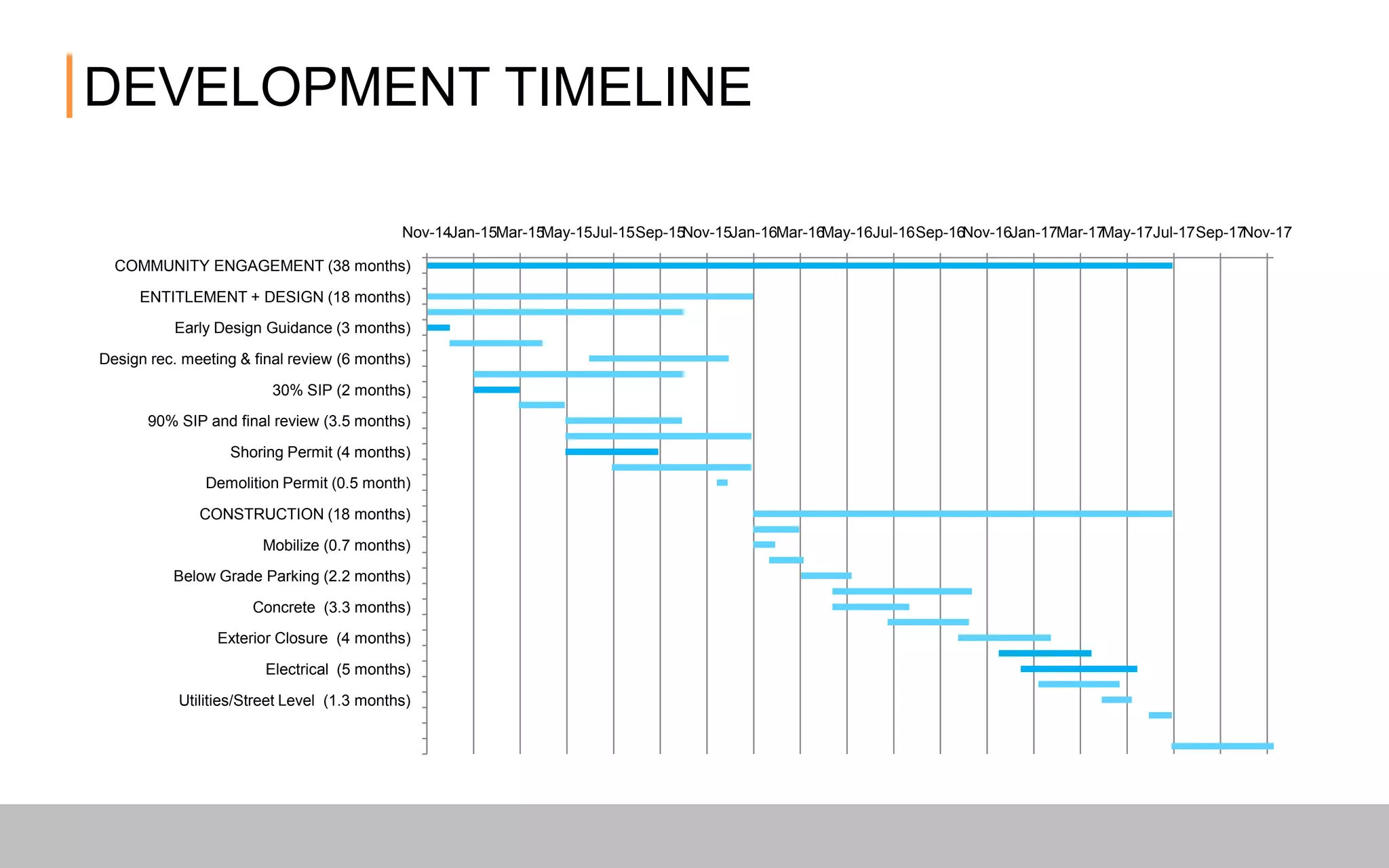

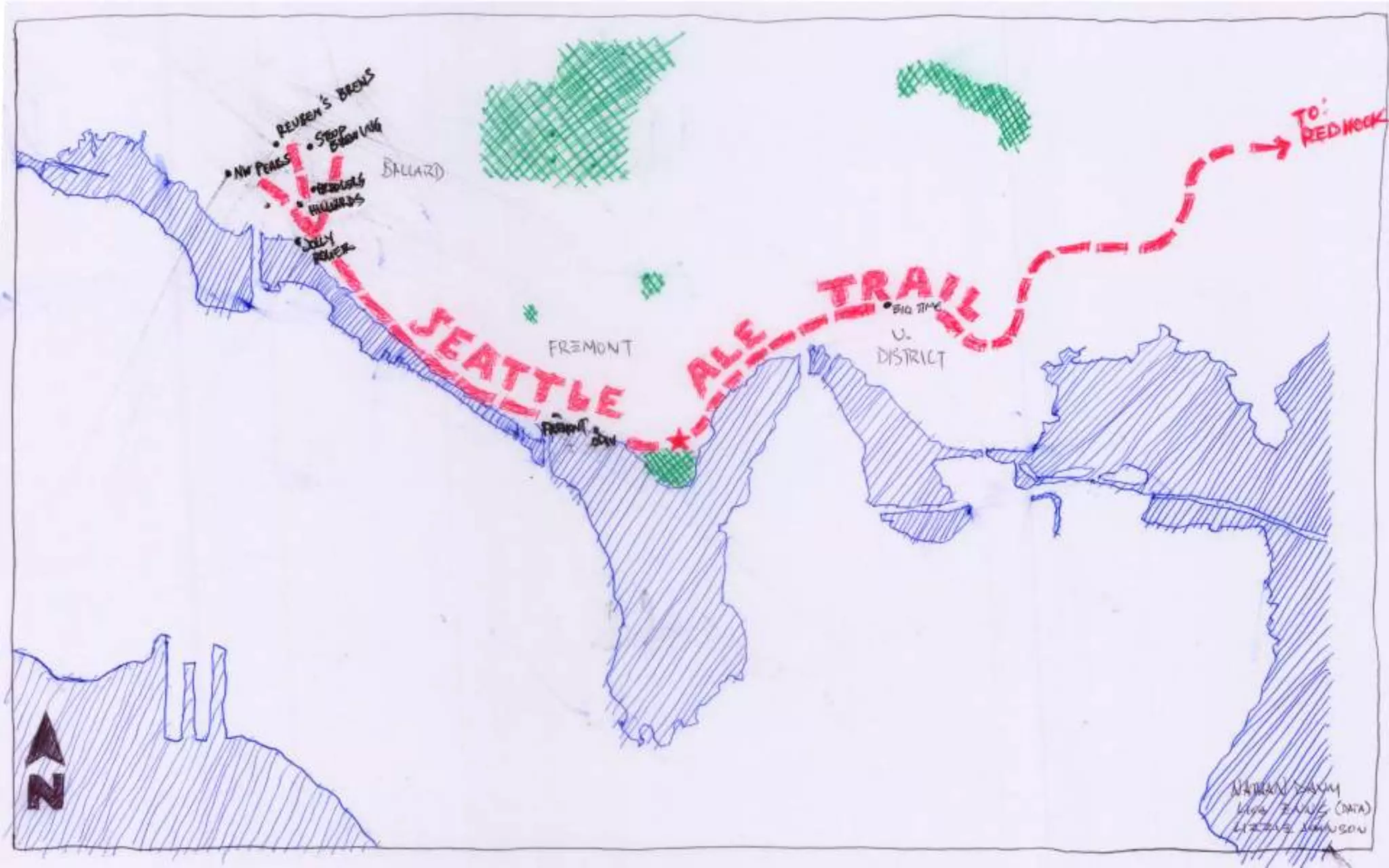

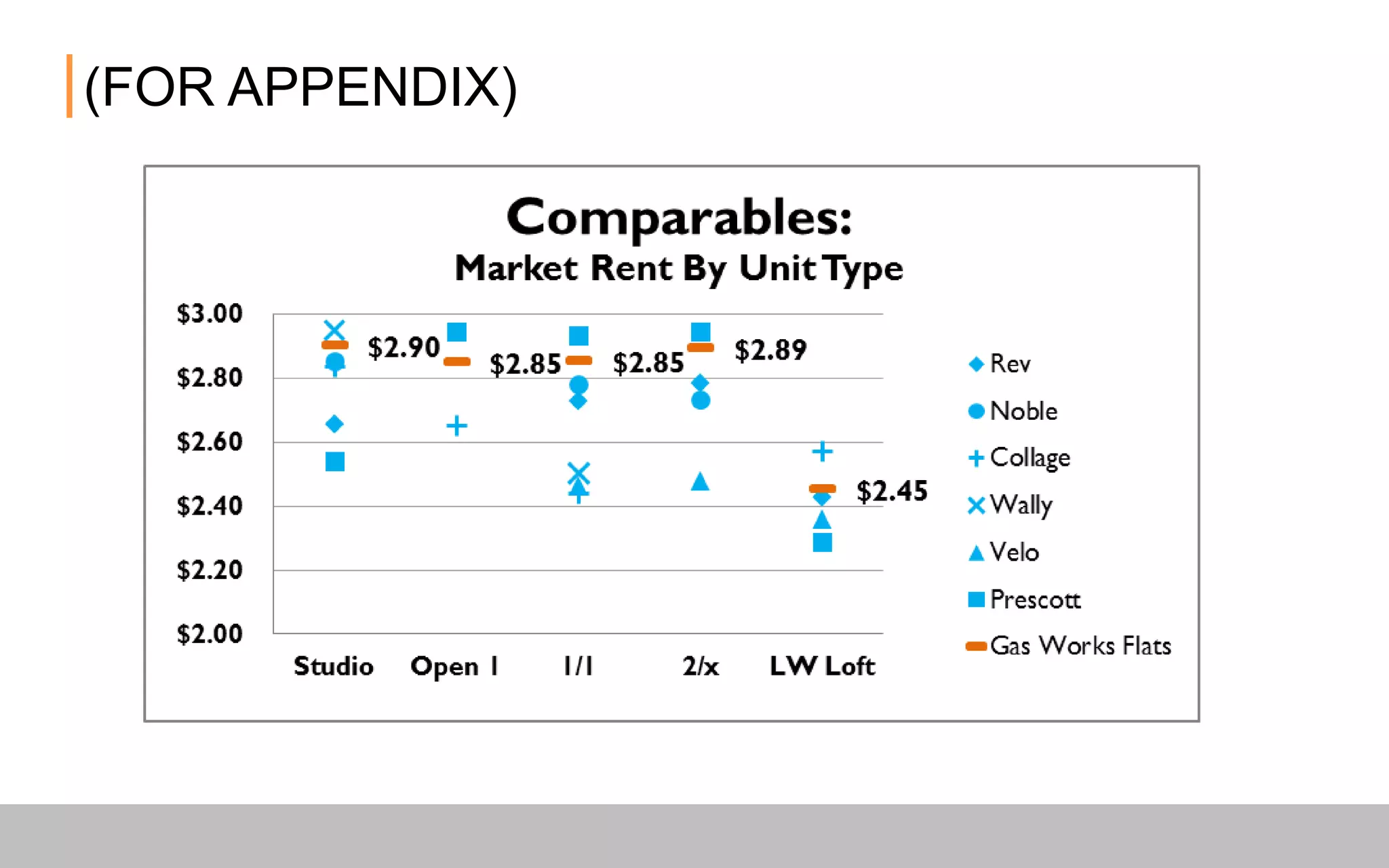

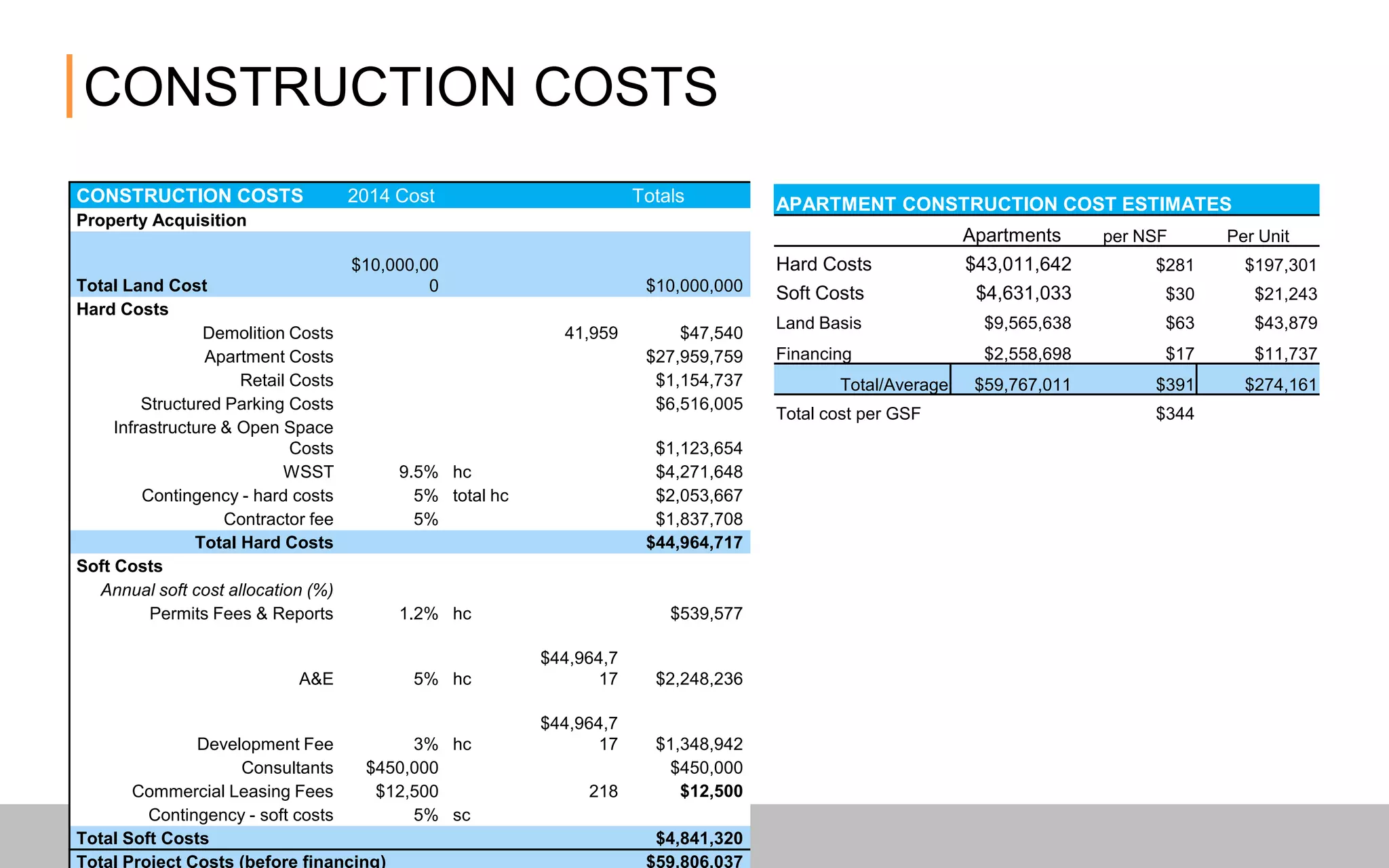

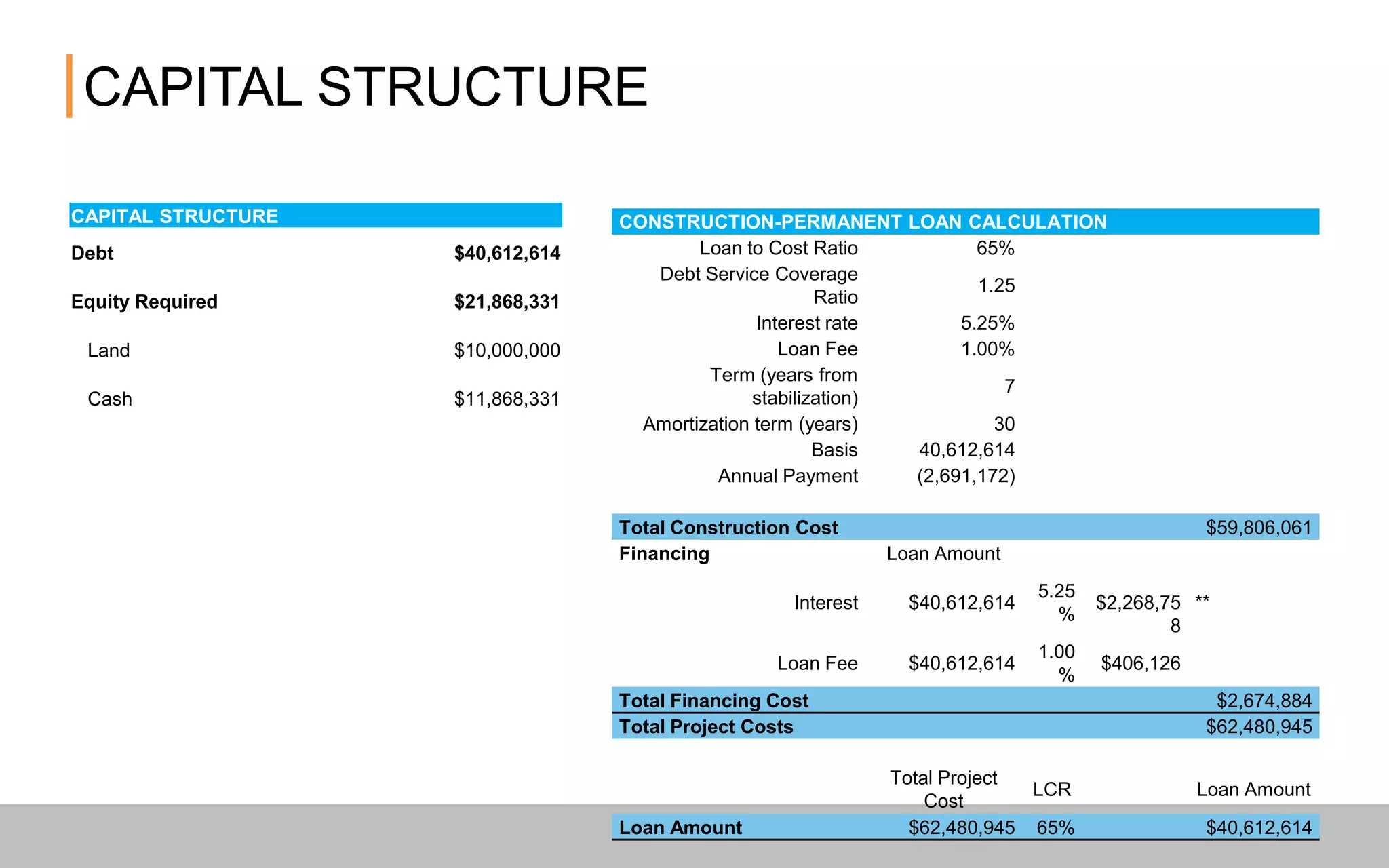

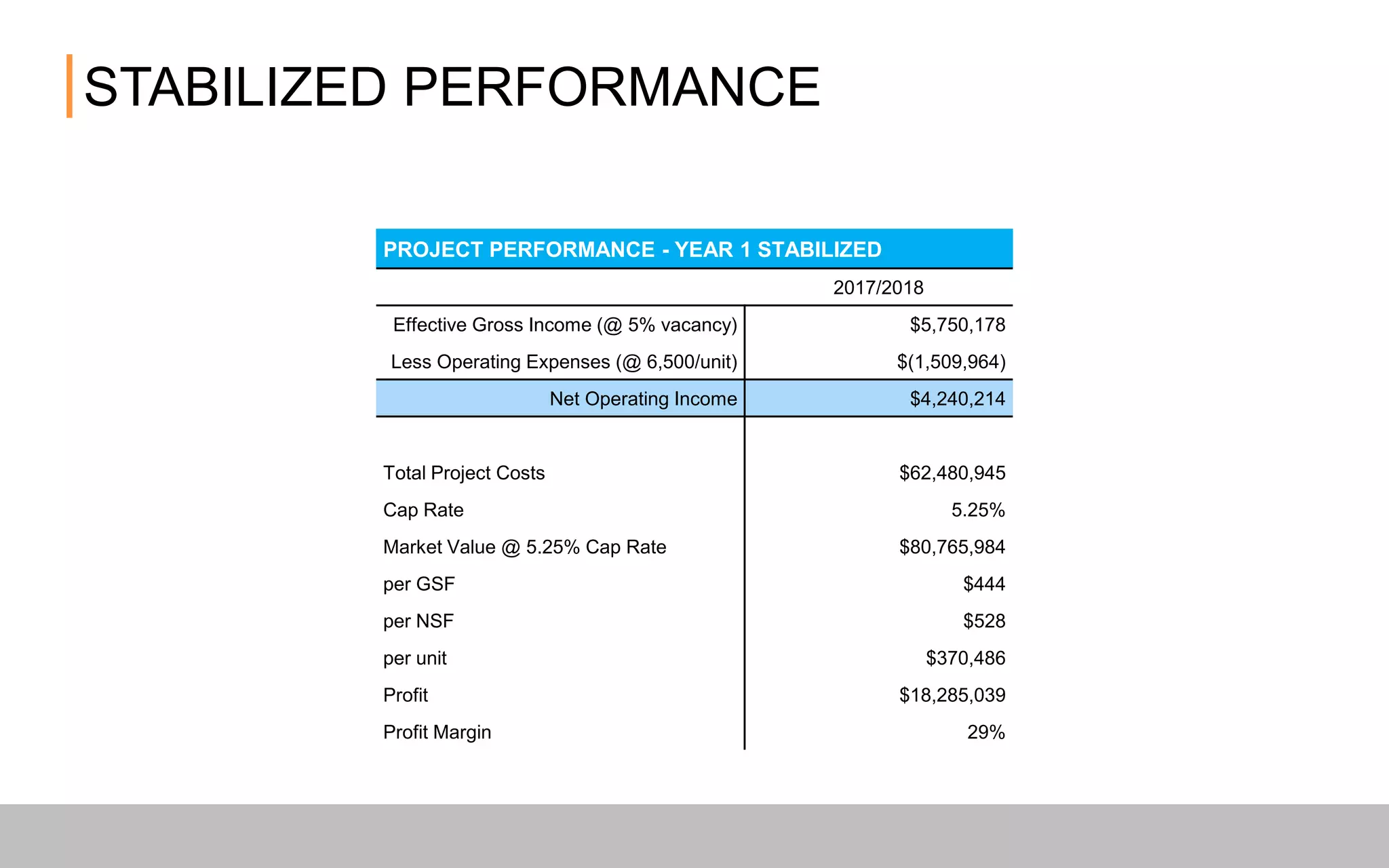

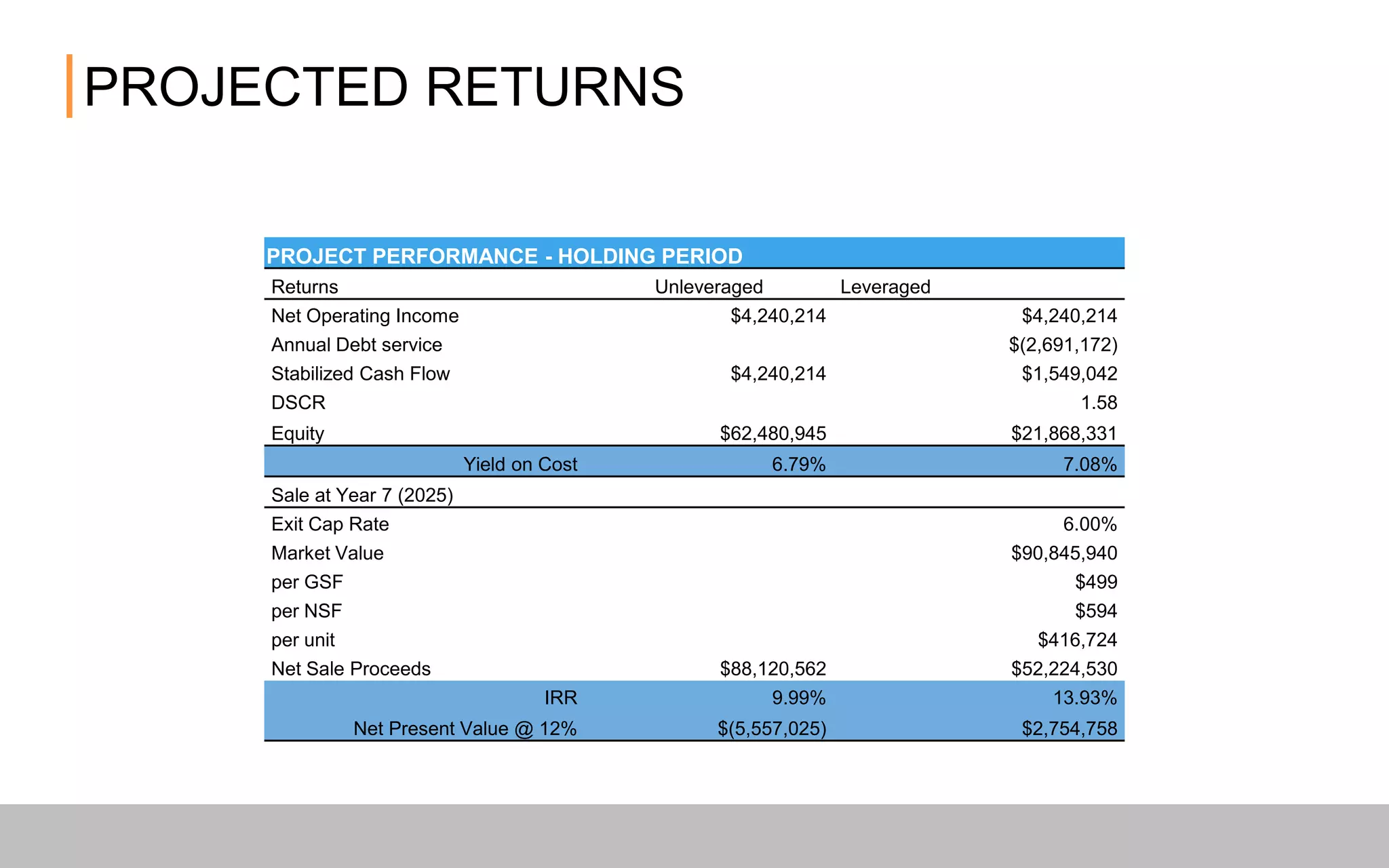

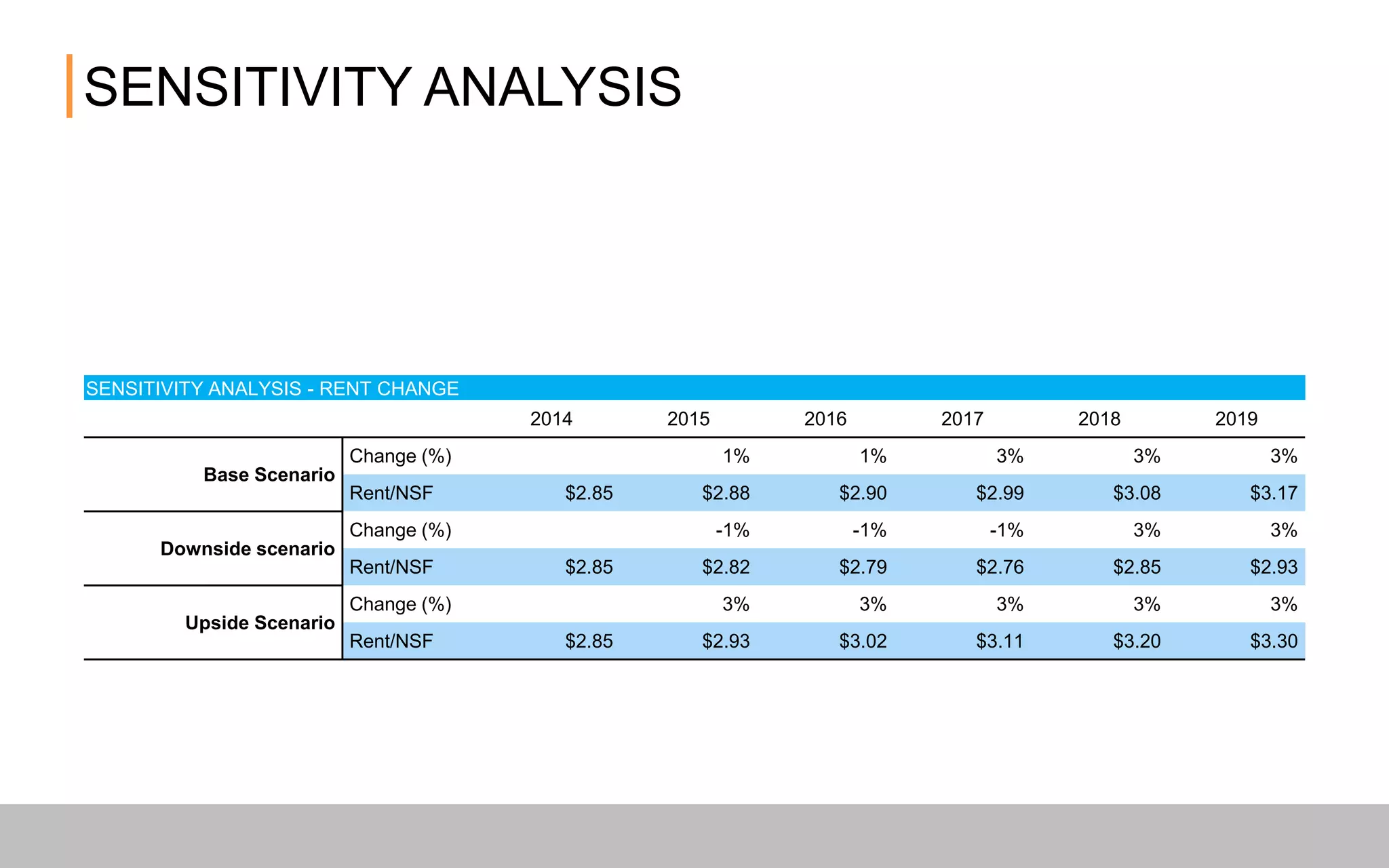

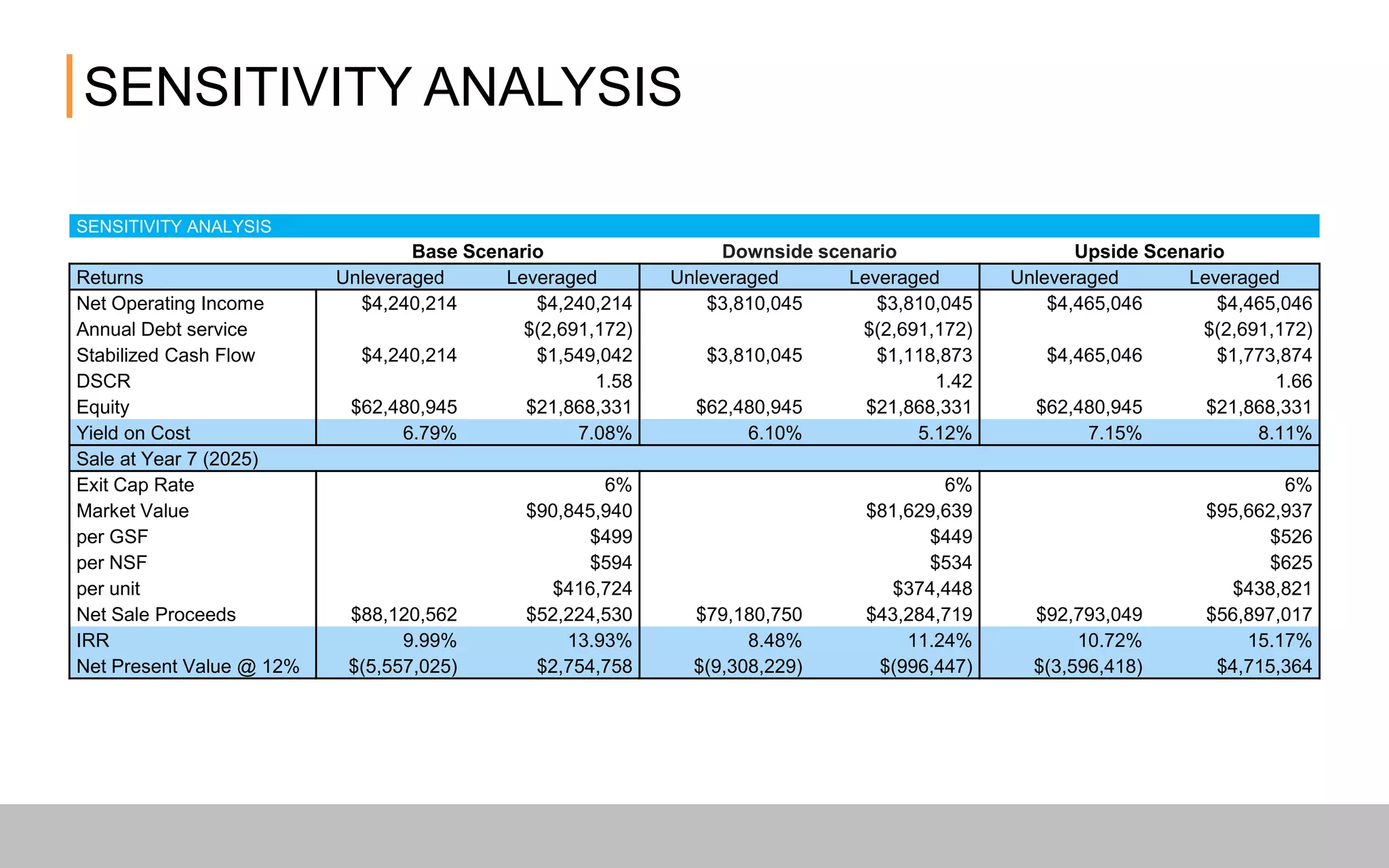

The document outlines a development proposal for Gas Works Flats, featuring 209 apartments and 6,100 square feet of retail space, with completion expected in summer 2017. It discusses the project's financials, including a yield on cost of 7.1% and an internal rate of return (IRR) of 13.9%, while detailing market context, design goals, costs, and a timeline. The adaptive reuse approach emphasizes maintaining neighborhood character and leveraging existing structures to minimize costs and maximize community engagement.