Late Summer US Inflation Spike Ends, Deflation Expectations Nosedive

•Download as PPTX, PDF•

1 like•2,628 views

The late-summer spike in US CPI inflation ended in October. Deflation expectations fell sharply after the November election, and inflation expectations remain low

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Correlation of U.S. Gas Prices and National Oil Consumption

Correlation of U.S. Gas Prices and National Oil Consumption

Inflation about to become a massive headache for central bankers

Inflation about to become a massive headache for central bankers

OECD Green Talks LIVE - Investing in Climate, Investing in Growth

OECD Green Talks LIVE - Investing in Climate, Investing in Growth

Similar to Late Summer US Inflation Spike Ends, Deflation Expectations Nosedive

Similar to Late Summer US Inflation Spike Ends, Deflation Expectations Nosedive (20)

U.S. Inflation Indicators Come in Below Target as the Global Economy Begins t...

U.S. Inflation Indicators Come in Below Target as the Global Economy Begins t...

US Inflation Data: CPI Revisions Cut Volatility, January Inflation Up a Bit

US Inflation Data: CPI Revisions Cut Volatility, January Inflation Up a Bit

US Inflation Data: Seasonally Adjusted CPI Shows Zero Change in April

US Inflation Data: Seasonally Adjusted CPI Shows Zero Change in April

Latest GDP Revisions Carry Mixed Message for Elections

Latest GDP Revisions Carry Mixed Message for Elections

GDP Growth Remains Slow in Q1 2012, Corporate Profits Fall

GDP Growth Remains Slow in Q1 2012, Corporate Profits Fall

US Q3 GDP: Good News in the Headlines but Bad News in the Details

US Q3 GDP: Good News in the Headlines but Bad News in the Details

US Gross Domestic Income Growth Outpaces GDP Growth in Q4 2011

US Gross Domestic Income Growth Outpaces GDP Growth in Q4 2011

Quantitative Easing and the Fed 2008-2014: A Tutorial

Quantitative Easing and the Fed 2008-2014: A Tutorial

US Job Growth Weak in June, Unemployment Holds Steady

US Job Growth Weak in June, Unemployment Holds Steady

US Employment Data: Strong Jobs Report Leads Off the Election Season

US Employment Data: Strong Jobs Report Leads Off the Election Season

The continuing resolution fiscal alchemy in action

The continuing resolution fiscal alchemy in action

Debt dynamics, the primary deficit, and sustainability

Debt dynamics, the primary deficit, and sustainability

Deficit financing- Comparison among India, USA, China, Brazil & Italy with re...

Deficit financing- Comparison among India, USA, China, Brazil & Italy with re...

Us Economy Review And Forecast General Review 2012

Us Economy Review And Forecast General Review 2012

More from Ed Dolan

More from Ed Dolan (20)

Is the Federal Budget Out of Control? A Tutorial on Debt Dynamics

Is the Federal Budget Out of Control? A Tutorial on Debt Dynamics

How Liberals and Conservatives Can Talk About Climate change

How Liberals and Conservatives Can Talk About Climate change

US GDP Grows at 5 Percent in Q3 2014, Best of Recovery

US GDP Grows at 5 Percent in Q3 2014, Best of Recovery

As Exports Soar, US Economy Closes in on Fed's Targets

As Exports Soar, US Economy Closes in on Fed's Targets

Recently uploaded

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pills

Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pillsAbortion pills in Kuwait Cytotec pills in Kuwait

Recently uploaded (20)

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

Call Girls In DLf Gurgaon ➥99902@11544 ( Best price)100% Genuine Escort In 24...

KYC-Verified Accounts: Helping Companies Handle Challenging Regulatory Enviro...

KYC-Verified Accounts: Helping Companies Handle Challenging Regulatory Enviro...

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

MONA 98765-12871 CALL GIRLS IN LUDHIANA LUDHIANA CALL GIRL

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Regression analysis: Simple Linear Regression Multiple Linear Regression

Regression analysis: Simple Linear Regression Multiple Linear Regression

Grateful 7 speech thanking everyone that has helped.pdf

Grateful 7 speech thanking everyone that has helped.pdf

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pills

Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pills

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Call Girls Navi Mumbai Just Call 9907093804 Top Class Call Girl Service Avail...

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

Enhancing and Restoring Safety & Quality Cultures - Dave Litwiller - May 2024...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

Insurers' journeys to build a mastery in the IoT usage

Insurers' journeys to build a mastery in the IoT usage

Call Girls in Gomti Nagar - 7388211116 - With room Service

Call Girls in Gomti Nagar - 7388211116 - With room Service

Late Summer US Inflation Spike Ends, Deflation Expectations Nosedive

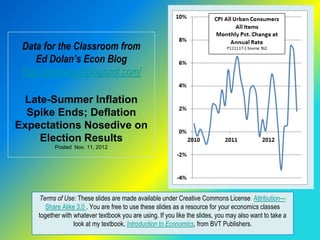

- 1. Data for the Classroom from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/ Late-Summer Inflation Spike Ends; Deflation Expectations Nosedive on Election Results Posted Nov. 11, 2012 Terms of Use: These slides are made available under Creative Commons License Attribution— Share Alike 3.0 . You are free to use these slides as a resource for your economics classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics, from BVT Publishers.

- 2. Late-Summer Inflation Spike Seems to Have Run its Course The all-items U.S. consumer price index rose at an annual rate of just 1.81 percent in October, down from a spike to 7.48 percent in August and 7.06 percent in September. Most of the slowdown came from a drop in energy prices, which had soared in the previous two months. New and used car prices also fell. Increases in the prices of food and apparel partly offset the decreases in energy and vehicles. Posted Nov. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 3. Core Inflation Remains Moderate Food and energy prices are volatile and usually account for much of the month-to-month change in the CPI Their effect can be removed by taking food and energy out of the CPI. The result is called the core inflation rate. Core inflation for October was 2.18 percent, about the average for the year Posted Nov. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 4. Trimmed Mean Inflation Also Remains Low Another way to remove volatility is the 16% trimmed mean CPI published by the Federal Reserve Bank of Cleveland. It removes the 8% of prices that increase most and the 8% that increase least in each month (or decrease most), whatever they are The 16 percent trimmed mean CPI slowed to an annual rate of 1.69 percent in October Posted Nov. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 5. Which Measure is Best? The CPI for all items gives the most accurate measure of current changes in the cost of living Economists at the Fed look closely at the core and trimmed mean CPIs to judge the effect of monetary policy on underlying inflationary trends The Fed considers inflation of about 2 percent to be consistent with prudent monetary policy. All three measures were close to that value in October. Posted Nov. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 6. The Longer Term Trend To see longer term trends in inflation, it is useful to look at year- on-year changes, which compare each month’s price level with that of the same month in the year before All y-o-y measures of inflation rates slowed during the global recession, then rose again for most of 2011. The three y-o-y series shown here are all now close to Fed’s 2 percent target Posted Nov. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 7. Deflation Probabilities The Atlanta Fed uses Treasury Inflation Protected Securities (TIPS) prices to calculate the probability of deflation over a given 5-year period This chart shows that the risk of deflation dropped sharply after the election Posted Nov. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 8. Expected Inflation The Cleveland Fed uses the same TIPS prices to estimate expected inflation over 5- and 10-year time horizons Inflation expectations have been trending downward for several years The most recent months show a moderate increase, perhaps reflecting an expectation that the Fed’s latest program of quantitative easing will have its intended effect of raising inflation close to the 2- percent target Posted Nov. 17, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com