Major US Inflation Indicators Below Target in December

•Download as PPTX, PDF•

1 like•1,269 views

The document summarizes US inflation data for December 2012. It reports that the headline CPI showed little change, core inflation slowed slightly to 1.8%, and trimmed mean inflation remained moderate at 1.5%. All three major inflation indicators remained below the Fed's implicit 2% inflation target for December. The document also notes that economists look at core and trimmed mean inflation to judge underlying trends, and that longer-term year-over-year inflation rates are beginning to fall again.

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

US Data Show Inflation, Already Low, Slowed Further in July

US Data Show Inflation, Already Low, Slowed Further in July

US Inflation Data: Scant Fuel for Inflation Fears in September CPI Report

US Inflation Data: Scant Fuel for Inflation Fears in September CPI Report

Latest GDP Revisions Carry Mixed Message for Elections

Latest GDP Revisions Carry Mixed Message for Elections

GDP Growth Remains Slow in Q1 2012, Corporate Profits Fall

GDP Growth Remains Slow in Q1 2012, Corporate Profits Fall

US Employment Data: Strong Jobs Report Leads Off the Election Season

US Employment Data: Strong Jobs Report Leads Off the Election Season

US Job Growth Weak in June, Unemployment Holds Steady

US Job Growth Weak in June, Unemployment Holds Steady

How Chronic Budget Optimism Helped Dig The Hole We Are In

How Chronic Budget Optimism Helped Dig The Hole We Are In

US GDP Grows at 5 Percent in Q3 2014, Best of Recovery

US GDP Grows at 5 Percent in Q3 2014, Best of Recovery

As Exports Soar, US Economy Closes in on Fed's Targets

As Exports Soar, US Economy Closes in on Fed's Targets

US Jobs Data: Strong January Report Contiues Upward Trend

US Jobs Data: Strong January Report Contiues Upward Trend

5th CSBAG Response to the monthly Bank of Uganda Monetary Policy Statement

5th CSBAG Response to the monthly Bank of Uganda Monetary Policy Statement

FY 2013 R&D REPORT January 6 2014 - Executive Summary

FY 2013 R&D REPORT January 6 2014 - Executive Summary

Viewers also liked

Viewers also liked (6)

Why exchange rates matter in a crisis latvia vs czech republic

Why exchange rates matter in a crisis latvia vs czech republic

US Gross Domestic Income Growth Outpaces GDP Growth in Q4 2011

US Gross Domestic Income Growth Outpaces GDP Growth in Q4 2011

Similar to Major US Inflation Indicators Below Target in December

March 2013 World Economic Situation and Prospects

March 2013 World Economic Situation and ProspectsDepartment of Economic and Social Affairs (UN DESA)

February 2013 World Economic Situation and Prospects

February 2013 World Economic Situation and ProspectsDepartment of Economic and Social Affairs (UN DESA)

Similar to Major US Inflation Indicators Below Target in December (20)

US Q3 GDP: Good News in the Headlines but Bad News in the Details

US Q3 GDP: Good News in the Headlines but Bad News in the Details

February 2013 World Economic Situation and Prospects

February 2013 World Economic Situation and Prospects

Deficit financing- Comparison among India, USA, China, Brazil & Italy with re...

Deficit financing- Comparison among India, USA, China, Brazil & Italy with re...

US GDP Grows 2.4% in Q1, but Government and Export Sectors Weaken

US GDP Grows 2.4% in Q1, but Government and Export Sectors Weaken

Us Economy Review And Forecast General Review 2012

Us Economy Review And Forecast General Review 2012

Will the Momentum coming out of 2013 Carry Our Growth Through 2014?

Will the Momentum coming out of 2013 Carry Our Growth Through 2014?

More from Ed Dolan

More from Ed Dolan (20)

Is the Federal Budget Out of Control? A Tutorial on Debt Dynamics

Is the Federal Budget Out of Control? A Tutorial on Debt Dynamics

How Liberals and Conservatives Can Talk About Climate change

How Liberals and Conservatives Can Talk About Climate change

Quantitative Easing and the Fed 2008-2014: A Tutorial

Quantitative Easing and the Fed 2008-2014: A Tutorial

US Unemployment Rate falls to 7.5 percent in April; Job Gains Revised Up

US Unemployment Rate falls to 7.5 percent in April; Job Gains Revised Up

US GDP Falls in Q4. How to Interpret the Bad News?

US GDP Falls in Q4. How to Interpret the Bad News?

Recently uploaded

Call Us ➥9319373153▻Call Girls In North Goa

Call Us ➥9319373153▻Call Girls In North GoaCall girls in Goa, +91 9319373153 Escort Service in North Goa

Recently uploaded (20)

NewBase 19 April 2024 Energy News issue - 1717 by Khaled Al Awadi.pdf

NewBase 19 April 2024 Energy News issue - 1717 by Khaled Al Awadi.pdf

Global Scenario On Sustainable and Resilient Coconut Industry by Dr. Jelfina...

Global Scenario On Sustainable and Resilient Coconut Industry by Dr. Jelfina...

Ms Motilal Padampat Sugar Mills vs. State of Uttar Pradesh & Ors. - A Milesto...

Ms Motilal Padampat Sugar Mills vs. State of Uttar Pradesh & Ors. - A Milesto...

Islamabad Escorts | Call 03070433345 | Escort Service in Islamabad

Islamabad Escorts | Call 03070433345 | Escort Service in Islamabad

Independent Call Girls Andheri Nightlaila 9967584737

Independent Call Girls Andheri Nightlaila 9967584737

8447779800, Low rate Call girls in Rohini Delhi NCR

8447779800, Low rate Call girls in Rohini Delhi NCR

MAHA Global and IPR: Do Actions Speak Louder Than Words?

MAHA Global and IPR: Do Actions Speak Louder Than Words?

Contemporary Economic Issues Facing the Filipino Entrepreneur (1).pptx

Contemporary Economic Issues Facing the Filipino Entrepreneur (1).pptx

Digital Transformation in the PLM domain - distrib.pdf

Digital Transformation in the PLM domain - distrib.pdf

8447779800, Low rate Call girls in Tughlakabad Delhi NCR

8447779800, Low rate Call girls in Tughlakabad Delhi NCR

Major US Inflation Indicators Below Target in December

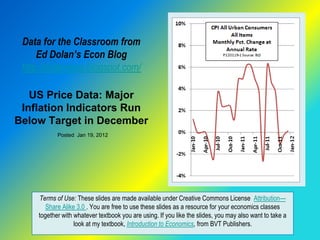

- 1. Data for the Classroom from Ed Dolan’s Econ Blog http://dolanecon.blogspot.com/ US Price Data: Major Inflation Indicators Run Below Target in December Posted Jan 19, 2012 Terms of Use: These slides are made available under Creative Commons License Attribution— Share Alike 3.0 . You are free to use these slides as a resource for your economics classes together with whatever textbook you are using. If you like the slides, you may also want to take a look at my textbook, Introduction to Economics, from BVT Publishers.

- 2. Headline CPI Shows Little Change in December The US all-items CPI showed little change in December, as the World Bank released a new forecast of slowing global economic growth The December headline inflation rate from the Bureau of Labor Statistics showed zero change Unrounded, December inflation stated as an annual rate was 0.12% For the third month in a row, falling prices for gasoline and other forms of energy helped keep inflation low Posted January 19, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 3. Core Inflation Slows Slightly Food and energy prices are highly volatile and account for much of the month-to-month variation in the CPI Their effect can be removed by taking food and energy out of the CPI The result is called the core inflation rate, which was 1.8% in December (monthly change stated as annual rate), down slightly from November Rising prices for medical goods and services made the largest contribution to core inflation Posted January 19, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 4. Trimmed Mean Inflation Remains Moderate Another way to remove volatility is the 16% trimmed mean CPI published by the Federal Reserve Bank of Cleveland. It removes the 8% of prices that increase most and the 8% that increase least in each month, whatever they are Trimmed mean inflation was a moderate 1.5% annual rate in December, up just slightly from its November low for the year Posted January 19, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 5. Which Measure is Best? The CPI for all items gives the most accurate picture of current changes in the cost of living Economists at the Fed look closely at the core and trimmed mean CPIs to judge the effect of monetary policy on underlying inflationary trends The Fed considers inflation of about 2 percent to be consistent with prudent monetary policy All three measures of inflation were below the Fed’s implicit 2% target in December Posted January 19, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com

- 6. The Longer Term Trend To see longer term trends in inflation, it is useful to look at year- on-year changes, which compare each month’s price level with that of the same month in the year before All y-o-y measures of inflation rates slowed during the global recession. They rose for most of 2011, but are now beginning to fall again as the base for y-o-y comparisons moves away from the extremely low monthly rates of 2010 Posted January 19, 2012 on Ed Dolan’s Econ Blog http://dolanecon.blogspot.com