Recommended

Recommended

More Related Content

Viewers also liked

Viewers also liked (8)

Repo, Security, Collateral Management –are we on the right track? - Godfried ...

Repo, Security, Collateral Management –are we on the right track? - Godfried ...

Basel iii and its impact on banking system in india

Basel iii and its impact on banking system in india

Financial Risk Management Framwork & Basel Ii Icmap

Financial Risk Management Framwork & Basel Ii Icmap

Similar to 6. corporate training (putonghua)

Similar to 6. corporate training (putonghua) (20)

2012 erm frameworks, fundamentals and cultures--new views

2012 erm frameworks, fundamentals and cultures--new views

Why Contact Centers in Growing Markets needs a Capability Maturity Model

Why Contact Centers in Growing Markets needs a Capability Maturity Model

More from crmbasel

More from crmbasel (20)

6. corporate training (putonghua)

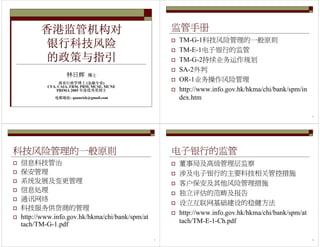

- 1. 香港监管机构对香港监管机构对香港监管机构对香港监管机构对 银行科技风险银行科技风险银行科技风险银行科技风险 的政策与指引的政策与指引的政策与指引的政策与指引 林日林日林日林日辉辉辉辉 博士博士博士博士 商业行政学博士商业行政学博士商业行政学博士商业行政学博士 (金融专业金融专业金融专业金融专业) CFA, CAIA, FRM, PRM, MCSE, MCNE PRIMA 2005 年度优秀奖得主年度优秀奖得主年度优秀奖得主年度优秀奖得主 电邮地址电邮地址电邮地址电邮地址: quanrisk@gmail.com 2 监管手册 TM-G-1科技风险管理的一般原则 TM-E-1电子银行的监管 TM-G-2持续业务运作规划 SA-2外判 OR-1业务操作风险管理 http://www.info.gov.hk/hkma/chi/bank/spm/in dex.htm 3 科技风险管理的一般原则 信息科技管治 保安管理 系统发展及变更管理 信息处理 通讯网络 科技服务供货商的管理 http://www.info.gov.hk/hkma/chi/bank/spm/at tach/TM-G-1.pdf 4 电子银行的监管 董事局及高级管理层监察 涉及电子银行的主要科技相关管控措施 客户保安及其他风险管理措施 独立评估的范畴及报告 设立互联网基础建设的稳健方法 http://www.info.gov.hk/hkma/chi/bank/spm/at tach/TM-E-1-Ch.pdf