Basics of Financial Accounting (Download: http://wp.me/p1z0VI-Y)

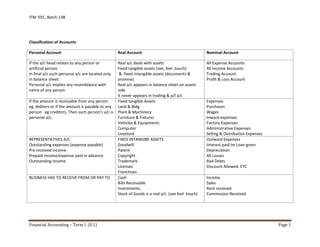

- 1. ITM EEC, Batch 13B Classification of Accounts Personal Account Real Account Nominal Account If the a/c head relates to any person or Real a/c deals with assets All Expense Accounts artificial person. Fixed tangible assets (see, feel ,touch) All Income Accounts In final a/c such personal a/c are located only & fixed intangible assets (documents & Trading Account in balance sheet. promise) Profit & Loss Account Personal a/c implies any resemblance with Real a/c appears in balance sheet on assets name of any person side. It never appears in trading & p/l a/c If the amount is receivable from any person Fixed tangible Assets Expenses eg debtors or If the amount is payable to any Land & Bldg Purchases person eg creditors, Then such person’s a/c is Plant & Machinery Wages personal a/c. Furniture & Fixtures Inward expenses Vehicles & Equipments Factory Expenses Computer Administrative Expenses Livestock Selling & Distribution Expenses REPRESENTATIVES A/C FIXED INTANGIBE ASSETS Outward Expenses Outstanding expenses (expense payable) Goodwill Interest paid on Loan given Pre received income Patent Depreciation Prepaid income/expense paid in advance Copyright All Losses Outstanding income Trademark Bad Debts Licenses Discount Allowed. ETC Franchises BUSINESS HAS TO RECEIVE FROM OR PAY TO Cash Income Bills Receivable Sales Investments. Rent received Stock of Goods is a real a/c (see feel touch) Commission Received Financial Accounting – Term I (0.1) Page 1

- 2. ITM EEC, Batch 13B Journal Entry Personal Account Real Account Nominal Account o Debit the Receiver o Debit what Comes in o Debit Expenses & Losses o Receivable from any Person that Person is o Credit what Goes Out o Credit Incomes & gains Debited (eg Debtors or Loan Given) o Debit means Increase Of Asset o Credit the Giver o Credit means Decrease of Asset o Payable To Any Person that Person is Credited (eg Capital ,Loan Taken,Creditors.) Date / Sr. no. Particulars LF Dr Cr 1 Cash A/c. Dr 5000 To Sales A/c. Cr 5000 (Being Sales made) 2 Purchase A/c Dr 5000 To Cash A/c Cr 5000 (Being cash purchase of goods) 3 Sale return a/c Dr 5000 To Cash a/c Cr 5000 (Being goods returned to us by customers & we paid tjhem Financial Accounting – Term I (0.1) Page 2

- 3. ITM EEC, Batch 13B cash back) 4 Cash a/c. Dr 5000 To Purchase return a/c Cr 50000 (Being purchased goods returned to supplier and recd cash back) 5 Purchase A/c Dr To Creditors a/c Cr (Being purchase of goods on credit from supplier) 6 Debtors a/c Dr To Sales a/c Cr (Being Credit sale of goods to customer) 7 Saurav a/c Dr To Sales a/c Cr (Being goods sold on credit to saurav) 8 Purchase a/c Dr To Amol a/c Cr (Being goods purchased from amul on credit) 9 Amul a/c Dr Financial Accounting – Term I (0.1) Page 3

- 4. ITM EEC, Batch 13B To Purchase Return a/c Cr (Being purchase return of the above goods to amul) 10 Sale return a/c Dr To Saurav a/c Cr Rule : Any exps incurred for purchase/construction/installation/acquisition of the asset is to be debited to that particular asset. Important 1 Plant & Machinery a/c Dr To cash a/c Cr (Being wages paid on installation of P & M) 2 Land & Building a/c Dr To Cash / Bank a/c Cr (Being stamp duty & registration paid on purchase of property) 3 Cash a/c Dr 4000 P & M a/c Dr 3000 Stock a/c Dr 2000 Bank a/c Dr 1000 Financial Accounting – Term I (0.1) Page 4

- 5. ITM EEC, Batch 13B To Capital / Owners Capital a/c Cr 10000 (Being Cash Rs 4000/-, P&M Rs 3000/-, Stock Rs 2000/- brought by owner & converted his savings a/c into current a/c Rs. 1000/- 4 Interest on Cap A/c Dr To owners cap. a/c Cr (Being interest on capital payable to owner) 5 Salary to Partner a/c Dr To owners / partners cap a/c Cr (Being salary payable to partner) 6 Interest on partners loan a/c Dr To Partners Loan a/c Cr (Being Interest on partners loan payable) 7 Commission to partner a/c Dr To Partners Cap a/c Cr (Being commission to partner payable) 8 Owners Drawing a/c Dr To Interest on Drawing a/c Cr Financial Accounting – Term I (0.1) Page 5

- 6. ITM EEC, Batch 13B (Being Interest on Drawing receivable) 9 Drawings a/c Dr 4000 Goods withdrawn a/c Dr 3000 Asset taken over a/c Dr 2000 LIC / Medical Dr 1000 To Cash / Bank a/c Cr 5000 To Goods a/c Cr 3000 To Asset a/c Cr 2000 (Being Cash withdrawn Rs. 4000/-, Goods withdrawn Rs. 3000/-, Asset taken over Rs. 2000/-, LIC/Mediclaim/Club bill/House Rent/I.T/ Sons Fees/Wifes Gift paid through chq. Rs. 1000/- from business) 1 Loss by fire a/c Dr To Goods Cr (Being Goods Loss by fire) 2 Loss by fire a/c Dr 2000 Financial Accounting – Term I (0.1) Page 6

- 7. ITM EEC, Batch 13B Insurance Claim a/c Dr 3000 To Goods loss by fire Cr 5000 (Being goods loss by fire Rs.5000/-, Insurance Claim admitted Rs. 3000/-) 3 Cash a/c Dr To Insurance Claim a/c Cr (Being above insurance claim recd) 4 Cash a/c Dr 4000 loss by fire a/c Dr 1000 To Goods Cr 5000 (Being goods lost by fire Rs. 5000/-, Ins. Co. settled for Rs. 4000/-) 5 Cash a/c Dr 4950 Discount a/c Dr 50 To Sales a/c Cr 5000 6 Purchase a/c Dr 5000 To Cash a/c Cr 4950 To Discount recd. a/c Cr 50 Financial Accounting – Term I (0.1) Page 7

- 8. ITM EEC, Batch 13B (Goods purchased for 5000/- & recd discount of Rs. 50/-) Closing Entries 1 Closing Stock a/c Dr To Trading a/c. Cr (Being Closing Stock valued at cost of market value whichever is lower) 2 Depreciation a/c Dr To Fixed Asset a/c Cr (Being Depreciation of fixed Tangible Asset) 3 Profit & Loss a/c Dr To Reserve for Doubtful Debts (R.D.D.) a/c Cr (Being R.D.D Created) 4 Expenses a/c Dr To expenses payable / outstanding exps a/c Cr (Being Outstanding Expenses payable) 5 Electricity a/c Dr To outstanding electricity a/c Cr Financial Accounting – Term I (0.1) Page 8

- 9. ITM EEC, Batch 13B (Being electricity bill payable) 6 Prepaid Salary a/c Dr To Salaries Cr (Being prepaid salaries) 7 Outstanding Rent a/c Dr To Rent a/c Cr (Being outstanding rent payable) 8 Commission a/c Dr To Pre received commission a/c Cr (Pre received commission from Amul) Financial Accounting – Term I (0.1) Page 9

- 10. ITM EEC, Batch 13B Trading Account Trading Account is prepared by the trader generally on the last date of any year to get either gross profit or gross loss. Trading Account is prepared from the trial balance. Trading Account is the mixture of goods account and factory related expenses. Goods when comes in are recorded on the Debit Side. Goods when goes out are recorded on the Credit Side. (Eg. Net Sales, Loss By Theft or Fire, Goods distributed as Free Samples). Closing Stock is valued at cost or market value, whichever is less. o Based on principle of Conservation which says “Provide for known losses, do not provide for known gains.” All the losses of goods & goods distributed as free samples are to be recorded at cost unless instructed otherwise. In Trading and Profit & Loss Account on the DEBIT side, Expenses & Losses are recorded and on the CREDIT side, Income & Gains are recorded. Therefore gross profit from Trading Account is transferred to Profit & Loss Account on CREDIT side, Therefore gross loss from Trading Account is transferred to DEBIT side. Financial Accounting – Term I (0.1) Page 10

- 11. ITM EEC, Batch 13B XYZ Corporation Trading Account for year ended 31 March 2008 Dr. Cr. Particulars Amount Total Particulars Amount Total To Opening Stock By Sales To Purchases (-) Less Sales Return (-) Less Purchase Return By Closing Stock To Factory Expenses To Wages / Salaries By Loss of Goods By Flood/Famine To Lightning & Heating By Loss of Goods by Theft To Buying Expenses By Loss of Goods by Fire To Import Duty By Goods Distributed As Free Sample To Clearing Charges To Custom Duty By Drawing of Goods By The Owner/Partner To Port Charges To Carriage Inward By Gross Loss (Balancing Figure) To Freight Inward To Octroi Duty To Unloading Charges To Inward Expenses To Primary Packing To Works Manager Salary To Factory Manager Salary To Royalty On Production To Motive Power To Consumables Or Stores (eg. Coal, Coke, Oil Gas) To Gross Profit (Balancing Figure) Total Total Financial Accounting – Term I (0.1) Page 11

- 12. ITM EEC, Batch 13B Profit & Loss Account Profit & Loss Account conceptually records payments related to third parties (not owners) for example Payments related to Auditors, Lawyers, Government, Suppliers (Interest on delay payment to suppliers), Electricity etc. Profit & Loss Account on the CREDIT side records all the incomes other than Sales Land Never depreciates but building does from day one. Profit & Loss Account – 3rd Party Related i.e. Non Owners Financial Accounting – Term I (0.1) Page 12

- 13. ITM EEC, Batch 13B XYZ Corporation Profit & Loss Account for year ended 31 March 2008 Dr. Cr. Particulars Amount Total Particulars Amount Total To Gross Loss B/D By Gross Profit B/D To Office & Admin Expenses By Bad Debts Recovered To Salaries (Office Staff) To Printing & Stationary To Staff Welfare To Postage / Telegram To Rent / Rates / Taxes To Repairs & Maintenance To Office Insurance To Telephone Expenses To General Expenses To Audit Charges To Legal Charges To Director Fees To Bank Charges To Bonus To Interest on loan taken To Interest on delay in payment to supplier To Selling & Distribution Expenses To Carriage outward To Discount Allowed To Travelling & Sales Conveyance To Salesman Salaries To Sales Manager Salaries To Sales Commission To Depreciation on Office Furniture Financial Accounting – Term I (0.1) Page 13

- 14. ITM EEC, Batch 13B To Depreciation on Fixed Assets To Provision for Taxation To Provision for Doubtful Debts To Provision for Reserve for Discount on Debtors. To Loss on Sale on Investment To Loss on Sale on Fixed Asset To Net Profit (Transfer to P&L Appropriations Account) Total Total Financial Accounting – Term I (0.1) Page 14

- 15. ITM EEC, Batch 13B XYZ Corporation Profit & Loss Appropriation Account Dr. Cr. Particulars Amount Total Particulars Amount Total To Drawings By Net Profit B/D (a) Partner 1 By Interest on Drawings (b) Partner 2 To Preference Dividend To Equity Dividend To Transfer To Reserves To Retained Earnings (Reserves & Surplus) To Interest on Capital (to Owner/Partner) To Salary to Owner / Partner To Commission to owners To Interest Paid on Partner Loan Taken Total Total Financial Accounting – Term I (0.1) Page 15

- 16. ITM EEC, Batch 13B XYZ Corporation Capital Account Dr. Cr. Particulars Amount Total Particulars Amount Total To Drawings By Balance B/D (Opening Capital) To Interest on Drawings By Profit To Additional Drawings By Interest on Capital Personal Expenses By Salary To Partner Personal Insurance By Brokerage / Commission to Partner (LIC/Mediclaim) Personal Expenses (Son’s Fees, Wife’s Gift) Income Tax To Balance Closing (Closing Captal) Total: Total: Financial Accounting – Term I (0.1) Page 16

- 17. ITM EEC, Batch 13B Trial Balance All Expenses & Assets – DEBIT BALANCE All Income & Liabilities – CREDIT BALANCE Trial Balance is the List of Balance Amount which is prepared from closing the ledger account. Closing Debit Balance of any account will be given DEBIT in the Trial Balance. Typically all the expenses & Assets will show debit balance. If any account shows closing credit balance in the ledger account it will be given CREDIT in trial balance. Any amount payable to any person will have CREDIT balance, while any amount receivable from any person will have DEBIT balance. Trial Balance MUST tally. RDD = Reserve for Doubtful Debts RFDD = Reserve for Discount on Debtors NRDD = New Reserve for Doubtful Debts ORDD = Old Reserve for Doubtful Debts RFDC = Reserve For Discount on Creditors DEBIT CREDIT Account Account Dr. Cr. Dr. Cr. Receivable Payable Expenses Income Assets Liabilities Debtors Creditors Drawings Capital Financial Accounting – Term I (0.1) Page 17

- 18. ITM EEC, Batch 13B XYZ Corporation Trial Balance as at 31 March 2008 Sr. No. Particulars Debit Amount Credit Amount Owner’s Capital Owner’s Drawings Furniture & Fixtures (Fixed Assets) Plant & Machinery (Fixed Assets) Loans Taken Carriage Inward Carriage Outward Discount Received Commission Received Discount Allowed Rent Received Purchase Sales Return Inward (Sale Return) Return Outward (Purchase Return) Investment Bank Overdraft Debtors Creditors Goodwill Financial Accounting – Term I (0.1) Page 18

- 19. ITM EEC, Batch 13B Cash Credit Cash In Hand Advertisement Prepaid Expenses Outstanding Expenses Pre-received Income Outstanding Income Investment in KVP / NSC Bills Payable Bills Receivable Bad Debts Recovered Bad Debts Profit from Sale of Investment or Fixed Asset Suspense Account Total Suspense Account on Debit Side means any asset or expense has been unrecorded. Suspense Account on Credit Side means any liabilities or income has been unrecorded. Financial Accounting – Term I (0.1) Page 19

- 20. ITM EEC, Batch 13B Balance Sheet Not an Account, Just a statement or Report as on a given Date or Time. Also known as financial statement. Will not have a Debit or Credit Side. Shows position of Assets or Liabilities. In India (Horizontal Format), Balance Sheet is divided into 2 sides I.e. Liabilities (LHS) and Assets (RHS) Asset = Receivable, Application of Fund, Funds Deployed. Liabilities = Payable Side, Source of Funds. Assets are depreciated every year from balance sheet. It is shown as fixed assets less depreciation. Classification Liabilities Assets Capital Fixed Assets Reserves & Surplus Investments Secured Loans Current Assets & Loans & Advances Unsecured Loans Miscellaneous Expenses Not Written Off Current Liabilities & Provisions Intangible Assets Capital for Ownership or Partnership firm Goodwill Opening Capital Patents o (+) Profits Copyrights o (+) Salary to owner Trademarks o (+) Brokerage to Owner Rights o (-) Drawings Franchise o (-) Personal Expenses Fixed Assets o (-) Losses Fixed assets are the long term assets which are used for Capital for Company (Pvt. Ltd. / Ltd. etc) production of goods & services for years to come Authorised capital/registered capital/nominal capital Land & building Equity share capital(issued ,subscribed & paid) Plant & machinery Preference share capital(issued ,subscribed & paid) Furniture & fixtures Reserves & Surplus for Company Vehicles & equipment Accumulated Profits Capital WIP (Work In Progress) Retained Earnings Computers Financial Accounting – Term I (0.1) Page 20

- 21. ITM EEC, Batch 13B Capital Reserves Books Securities Premium Loose tools Revaluation Reserves Car General Reserves Fan Secured Loan Cupboard Bank loan (secured against fixed assets) (-) Depreciation Mortgage loan Investments Unsecured Loan Investments in shares of other company Loan from friends Investment in debentures of other company Loan from relatives Investment in government securities Loan from wife Investment in mutual funds Current Liabilities Investment in bank fixed deposits Cash credit Investments in gold Bank overdraft Investment in postal schemes. Creditors Current Assets Suppliers Cash /Cash In Hand/Cash At Box Accounts payable Bank/ Bank Balance/Cash At Bank Suppliers ledger balance Debtors Bills payable A/C Receivable /Book Debts /Sales Ledger Balance Outstanding expenses Customer Account (Dr. Bal I.E. Receivable) Expense payable Bills Receivable Expenses due Outstanding Income/Income Receivable Expenses accrued Commission Receivable Pre-received income Prepaid Expenses/Expense Paid In Advance Income received in advance Advance Salaries ,Advance Tax Provisions Loan To Someone (For Less Than 12 Months) Provision for taxation Miscellaneous Expenses Not Written Off Provision for gratuity fund. Heavy advertisement expenses Preliminary exp not written off Formation exp not written off Underwriting commission not written off Heavy losses not written off Financial Accounting – Term I (0.1) Page 21

- 22. ITM EEC, Batch 13B Profit & Loss Account (Dr. Balance i.e. Profit) Financial Accounting – Term I (0.1) Page 22

- 23. ITM EEC, Batch 13B XYZ Corporation Balance Sheet As At 31 March 2008 Liabilities Assets Particulars Amount Total Particulars Amount Total Capital Fixed Assets (-) Drawings (-) Provision for Depreciation Reserves & Surplus Closing Stock (-) Stock Reserve Secured Loans Investments Unsecured Loans Current Assets & Loans & Advances Current Liabilities & Provisions Miscellaneous Expenses Not Written Off Creditors Debtors (-) Reserve for Discount on Creditors (-) Reserve for Doubtful Debts (-) Reserve for Discount on Debtors Total Total Financial Accounting – Term I (0.1) Page 23

- 24. ITM EEC, Batch 13B Cost Sheet Cost Account Financial Account In Books of Manufacturer In Books of Trader Manufacturer – Buys Raw Material & Sells Finished Goods Trader – Buys Finished Goods & Sells Finished Goods Cost Sheet Trading Account, Profit & Loss Account, Balance Sheet Prepared at the Start of the Year Prepared at the End of the Year To know selling price per unit (for that it is important to know cost per To determine profit. unit.) Factory, Admin, Sales & Distribution – Are ESTIMATED Factory, Admin, Sales & Distribution – Are ACTUALS Exclude Financial Income & Expenses Include All Financial Income & Expenses Prime Cost / Direct Cost = Direct Material + Direct Labour + Direct Expense Indirect Cost = Factory Overheads + Administrative Overheads + Selling & Distribution Overheads Factory (/Works) Cost = Prime Cost +Factory Overheads – Sale Of Scrap + Opening Stock WIP – Closing Stock WIP Cost Of Production = Factory Cost + Administrative Overheads Production Cost of Goods Sold = Cost Of Production + Opening Stock of Finished Goods – Closing Stock of Finished Goods Cost of Sales = Production Cost of Goods Sold + Selling and Distribution Cost Sales = Profit + Cost of Sales OR Profit = Sales – Cost of Sales From start (Direct Material) till cost of Production, all calculation will be made on Production Unit (Units Produced) AND Production Cost of Goods Sold (PCOGS) till Sales (End), all calculations will be based on Sales Unit (Units Sold). Financial Accounting – Term I (0.1) Page 24

- 25. ITM EEC, Batch 13B Factory Overheads are Calculated as % of Direct Wages Administrative Overheads are calculated as % of Factory Cost Sales & Distribution Overheads are calculated as % of Sales COP = Cost Of Production COPPU = Cost Of Production Per Unit Concept of Valuation of Closing Stock in the Cost Sheet o In the absence of Information, Closing stock of finished goods is to be valued at Cost Of Production Per Unit. o Based on FIFO Principle, Opening stock of Finished Goods is fully sold out. o Closing Stock of Finished Goods forms a part of current year’s production unit. o Current Year’s Production Unit is valued at Cost of Production Per Unit. o Closing Stock of Finished Goods is valued at Cost of Production Per Unit. Pure Financial Expenses are excluded/ignored i.e. Bad Debts Written Off, Interest on Capital, Dividends, Write Offs. Inward Expenses / Buying Expenses o Custom duty o Octori duty o Import duty o Unloading charges o Dock charges o Buying expness/Inward expenses o Clearing charges Factory Overheads o Supervisor salary o Machinery upkeep o Indirect wages o Oil/ grease/ coal/ crude oil/Coke/fuel/cotton. o Indirect labour o Depreciation on factory assets o Unproductive wages o Depreciation on plant and machinery o Unproductive labour o Manufacturing expness o Factory manager salary o Production expenses o Worker manger salary o Power / fuel/ motive power o Salary of watchman o Consumables & stores. o Indirect material o Factory cleaning o Indirect expness o Excise duty o Factory insurance o Research and laboratory expness Financial Accounting – Term I (0.1) Page 25

- 26. ITM EEC, Batch 13B o Repairs and maintenance of machinery o Employees state insurance corporation. o Factory lighting and heating Administrative Overheads o Office overheads o Depreciation on office building o Office on cost o Depreciation on office computer o General expenses o Rent and rates of offices o Legal expenses o Estimation expenses o Audit charges/ bank charges o Stationary and consumables o Salary on staff o Postage / fax / telex o Administration manager salary o Office upkeep o Director fees / remuneration o General office manager salary o Printing and stationary Selling & Distribution Overheads o Selling on- cost o Rent/repairs/lighting/depreciation of show room o Selling burden/ overheads o Depreciation of warehouse o Sales promotion expenses o Sales of sales office o Advertisement o Travelers salary o Depreciation on delivery vans/vehicles o Traveling and conveyance o Secondary packing o Loading expenses o Packing o Upkeep of delivery van o Packing material o Sales manager salary o Carriage/ freight outward o Donation of goods o Commission on sale o Discount allowed o Salary’s to sales staff o Rent of warehouse Financial Accounting – Term I (0.1) Page 26

- 27. ITM EEC, Batch 13B XYZ Corporation Cost Sheet Elements Units Amount Amount CostPerUnit Raw Material Consumed + Opening Stock of Raw Material + Purchase of Raw Material - Return of Raw Material + Inward Expenses - Closing Stock of Raw Material Direct Labour Direct Expenses (1) Prime Cost Factory Overheads + Factory Rent + Factory Insurance - Sale Of Scrap + Opening Stock of WIP - Closing Stock of WIP (2) Factory Cost Administrative Overheads + Bank Charges + Legal & Audit Charges (3) Cost of Production Opening Stock of Finished Goods - Closing Stock Of Finished Goods (4) Production Cost Of Goods Sold Selling & Distribution Financial Accounting – Term I (0.1) Page 27

- 28. ITM EEC, Batch 13B Cost of Sales Profit Sales Financial Accounting – Term I (0.1) Page 28