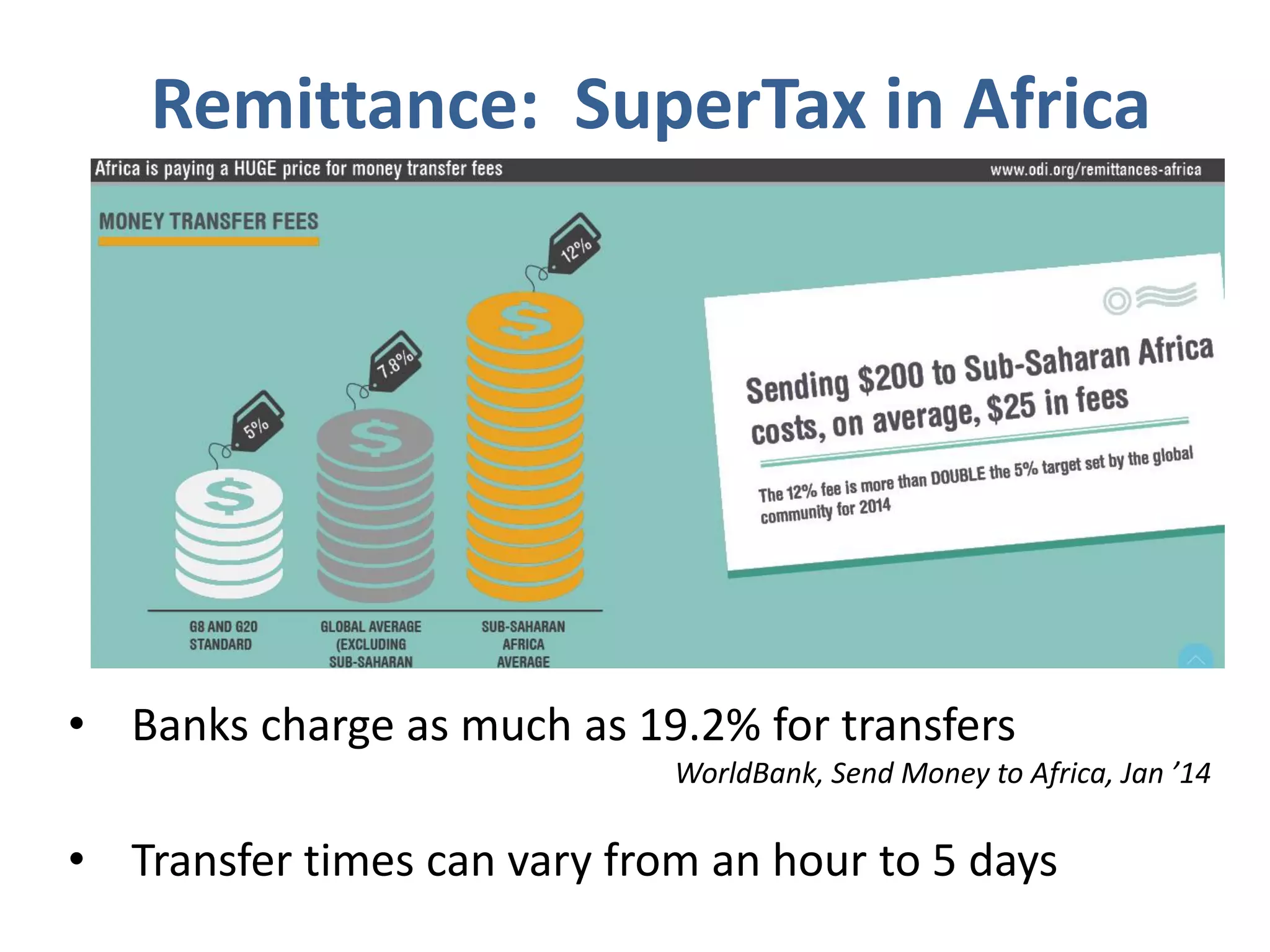

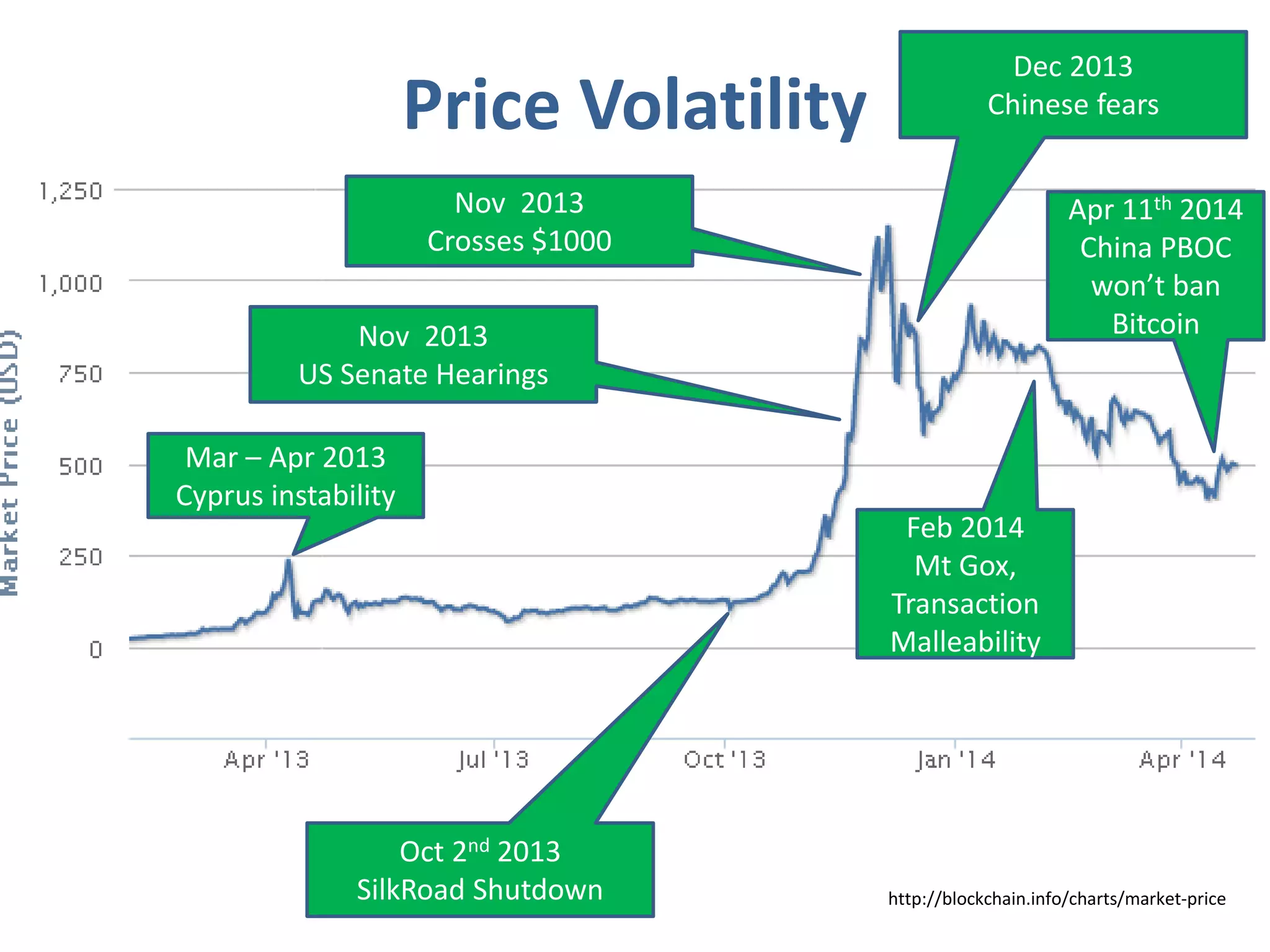

This document discusses digital currencies like Bitcoin and their potential applications and regulatory issues. It provides an overview of Bitcoin and how it works as a decentralized digital currency. It then discusses opportunities for Bitcoin in facilitating low-cost remittances and challenges around volatility, anonymity, and risks of financial crimes. The document advocates for multi-stakeholder engagement to better understand digital currencies and establish appropriate policies and regulations.