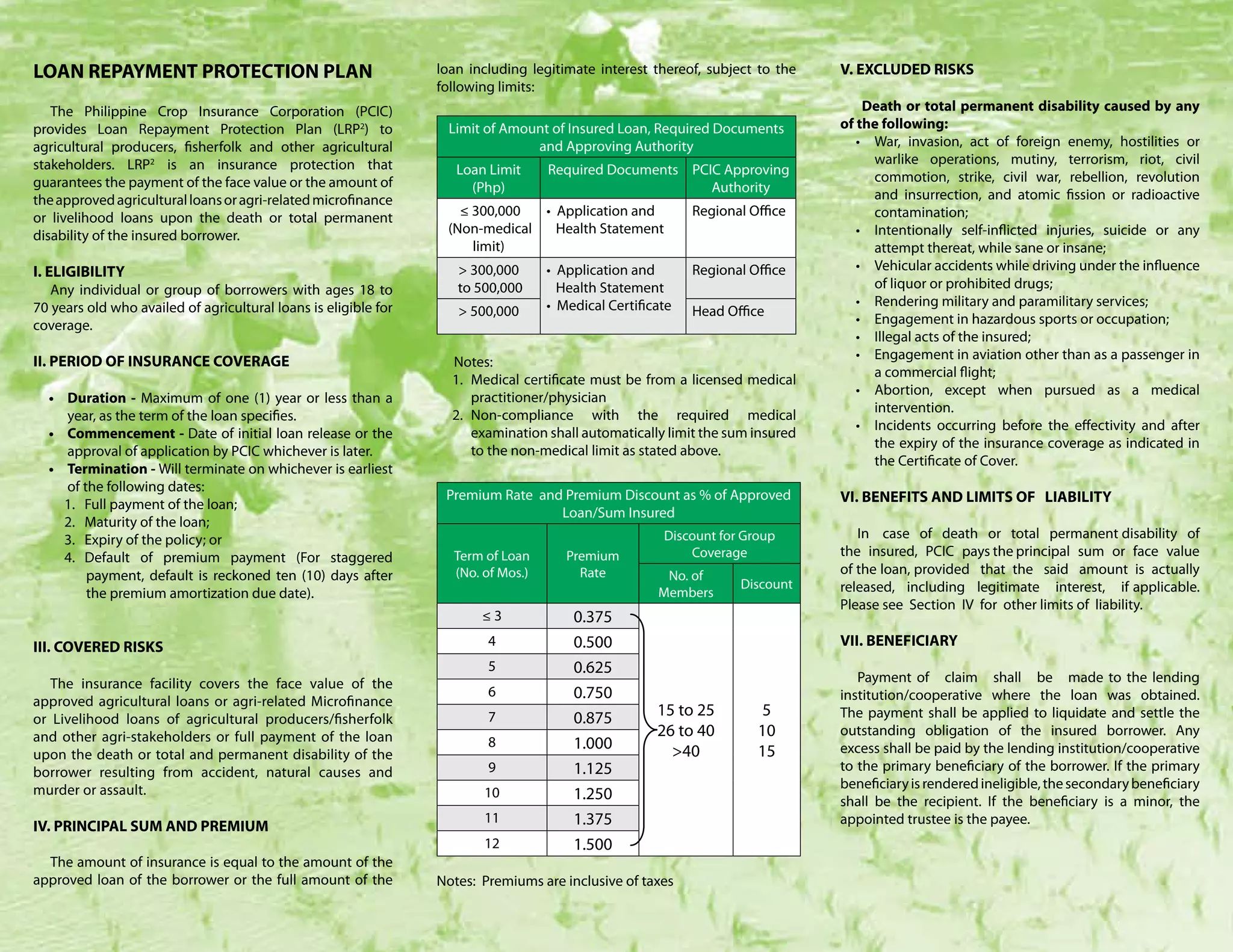

The Loan Repayment Protection Plan (LRP2) provides insurance protection that guarantees payment of approved agricultural loans upon the death or total permanent disability of insured borrowers. It covers loans up to PHP500,000 with premium rates from 0.375% to 1.5% depending on loan term. Benefits pay the full loan amount upon death or disability. Claim documents must be filed within 90 days and will be settled within 30 days of receipt. Excluded risks include war, suicide, driving under influence, and illegal acts.