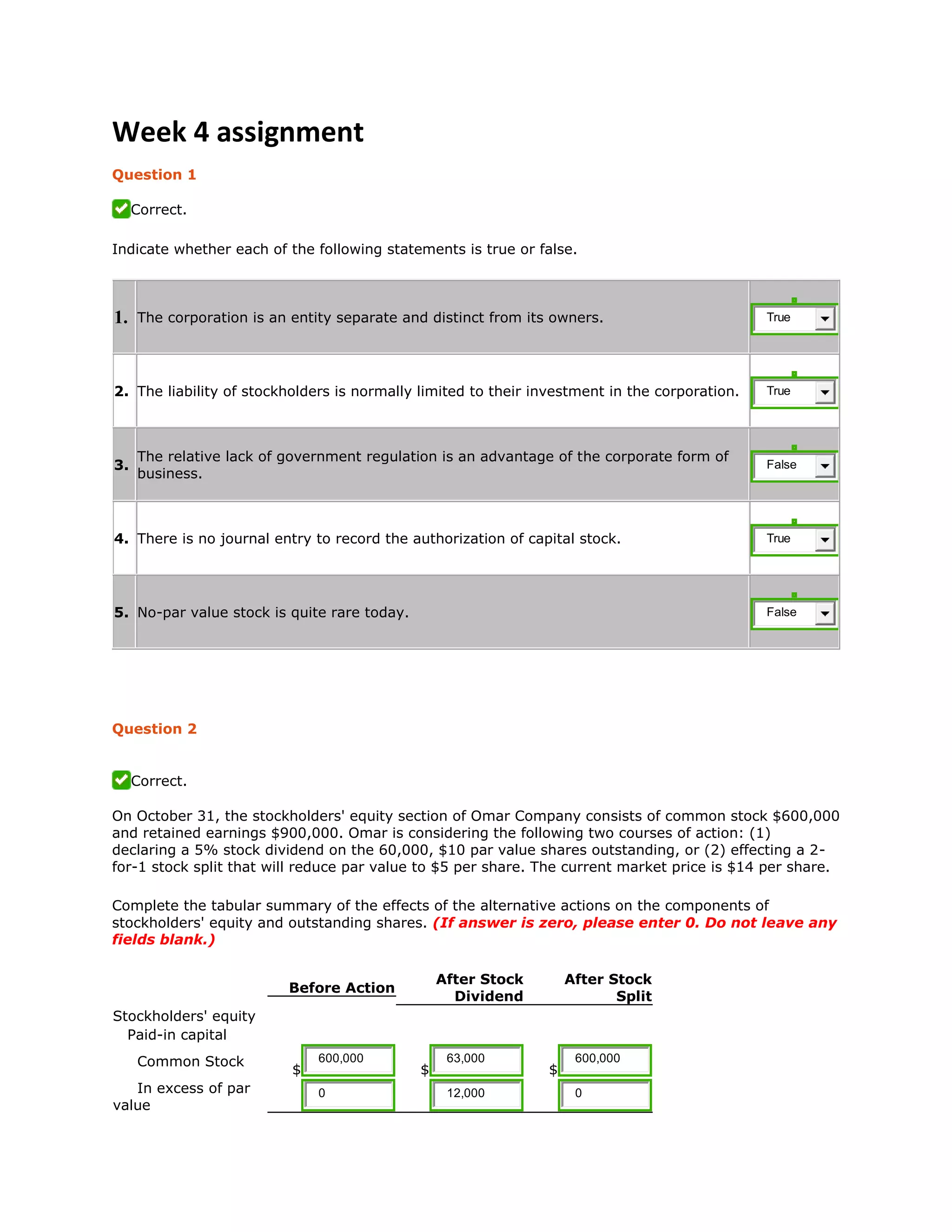

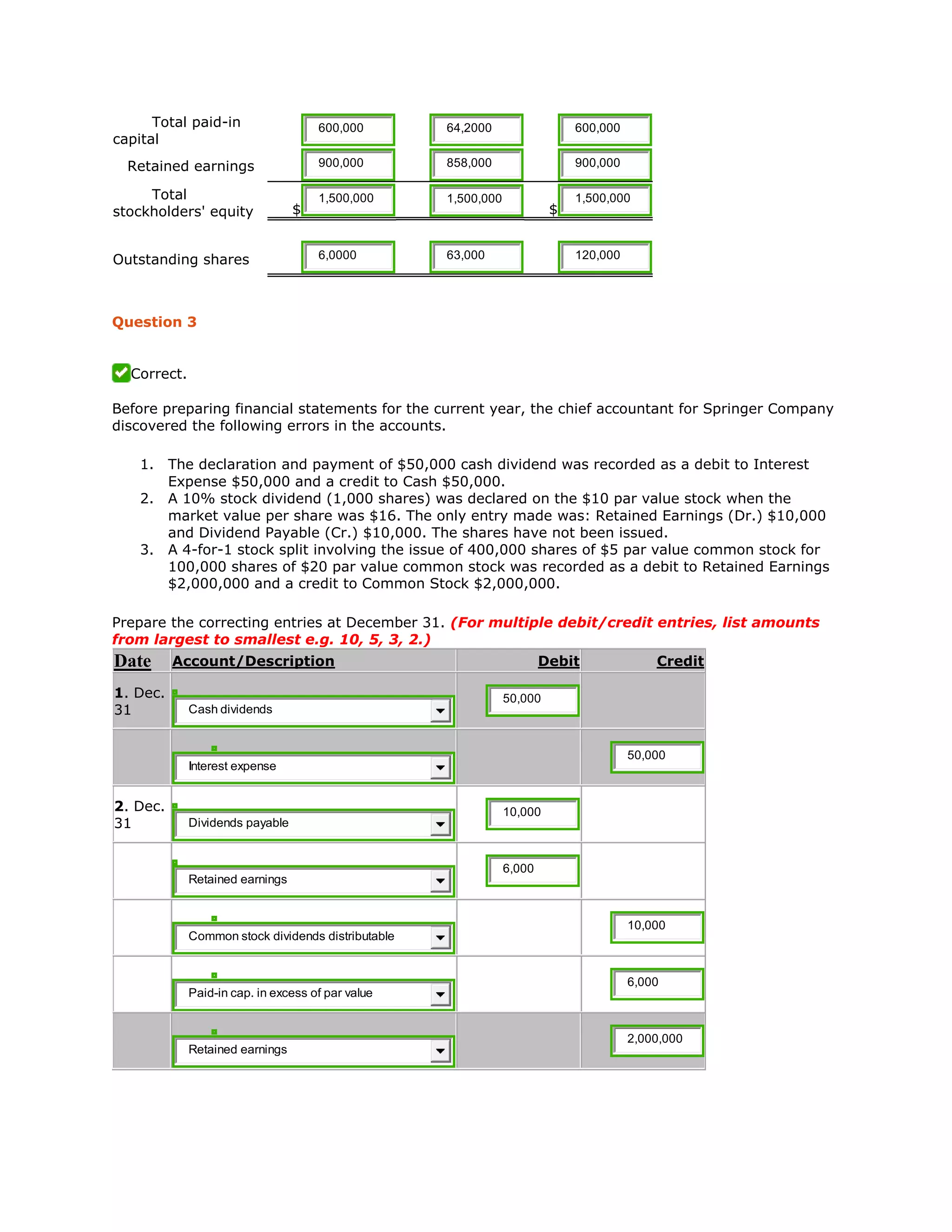

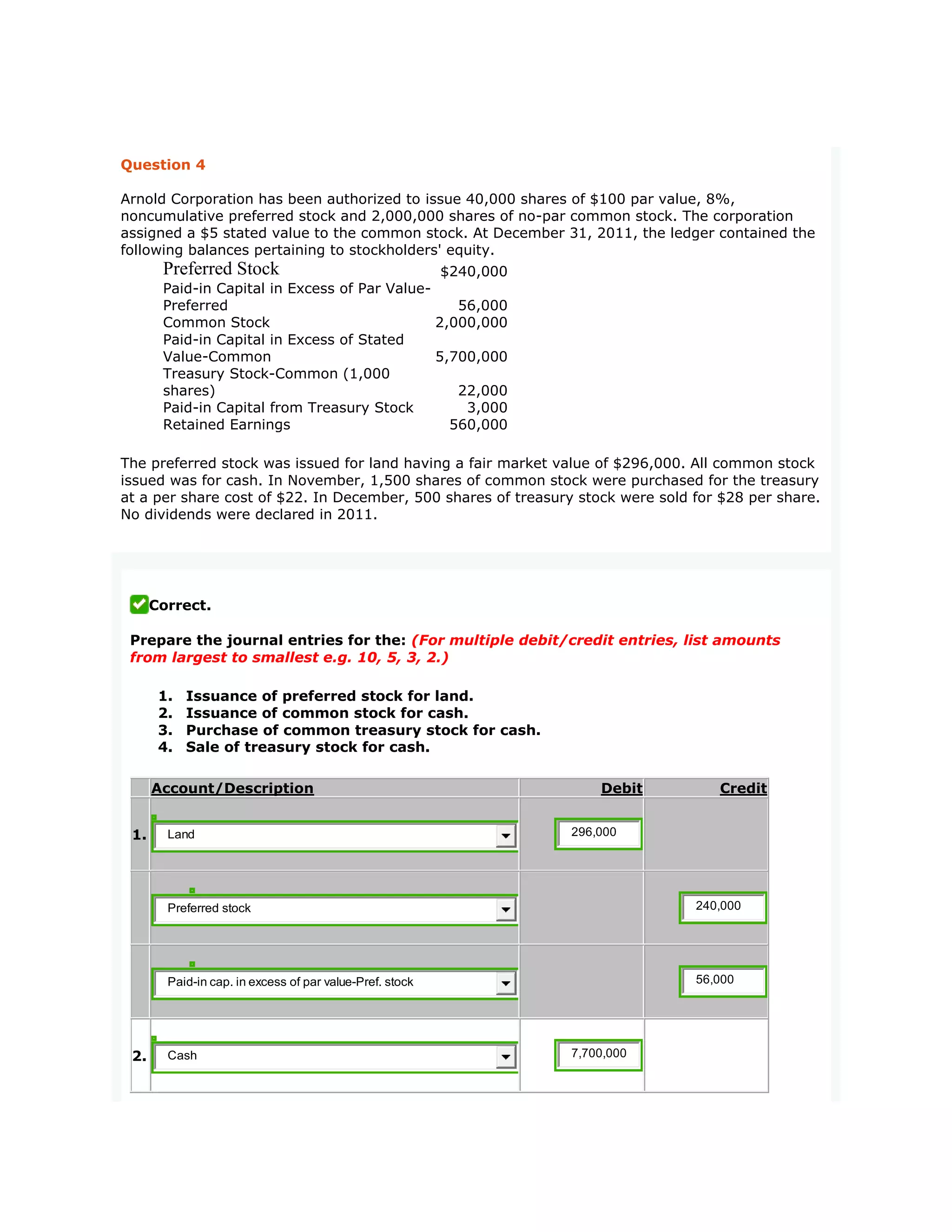

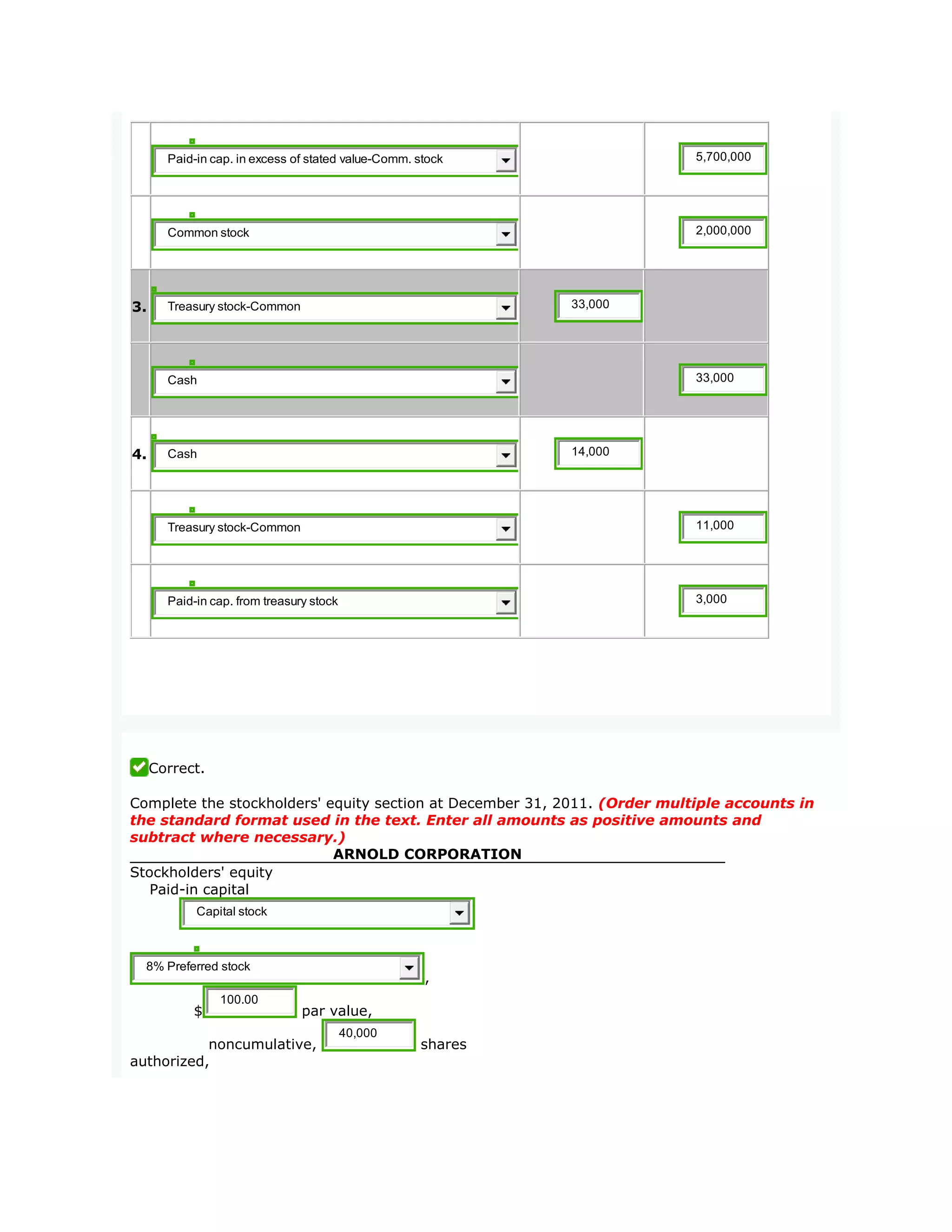

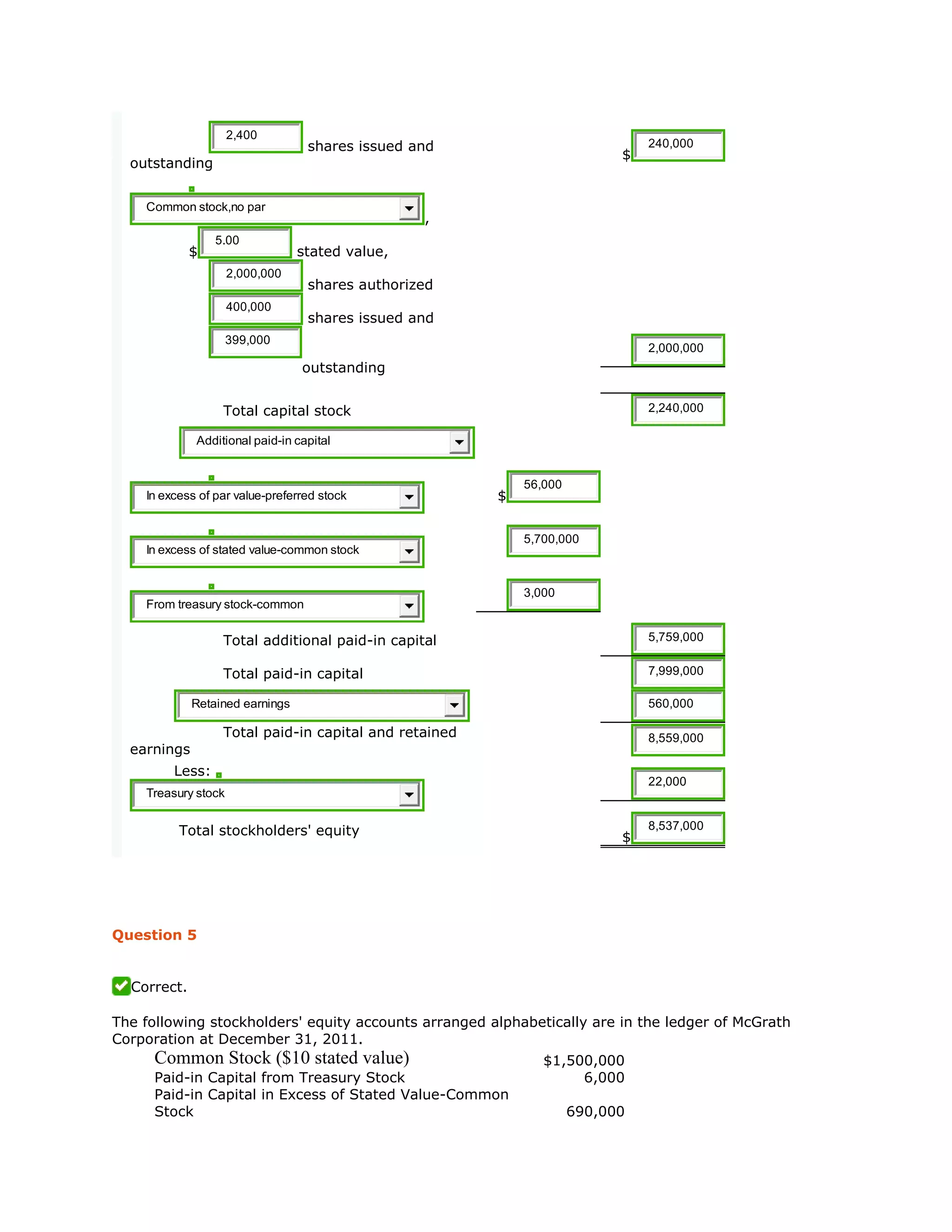

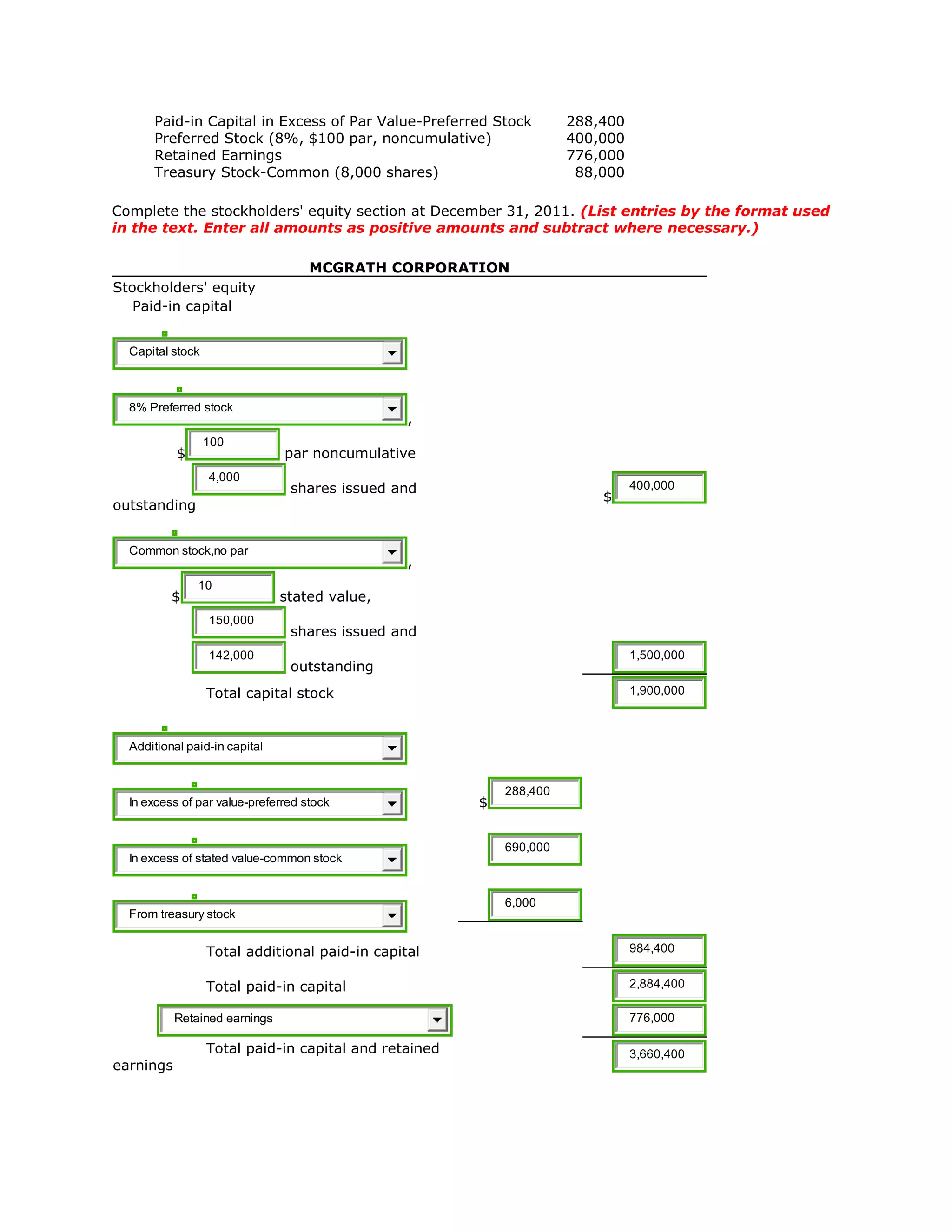

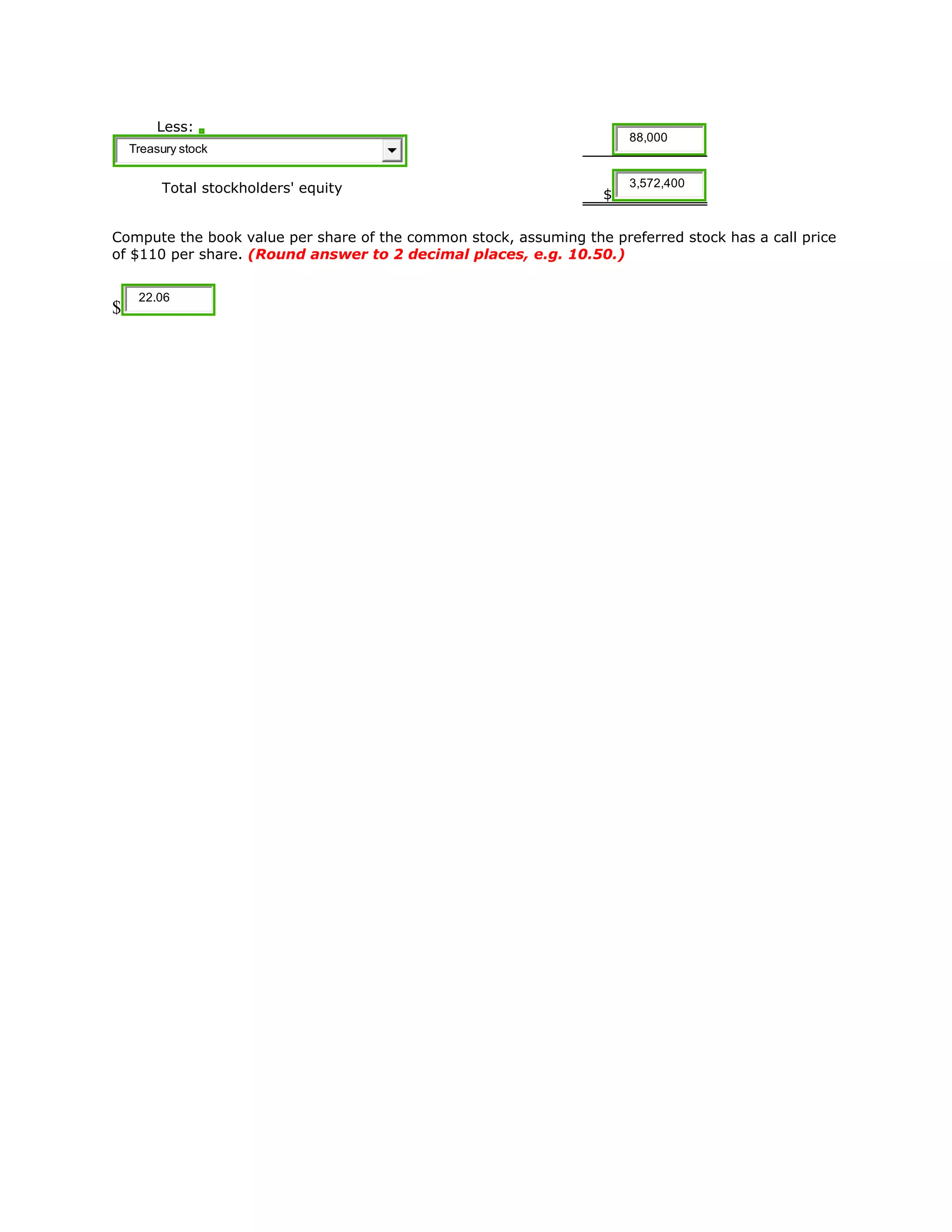

The document provides a series of accounting exercises focused on stockholders' equity, including determining the truth of several statements, analyzing stock dividends and splits, and preparing correcting journal entries for errors in accounting. It also discusses the issuance of preferred and common stock, the purchase and sale of treasury stock, and the completion of the stockholders' equity section for multiple companies. Finally, it calculates the book value per share of common stock, indicating the financial implications of preferred stock in the analysis.