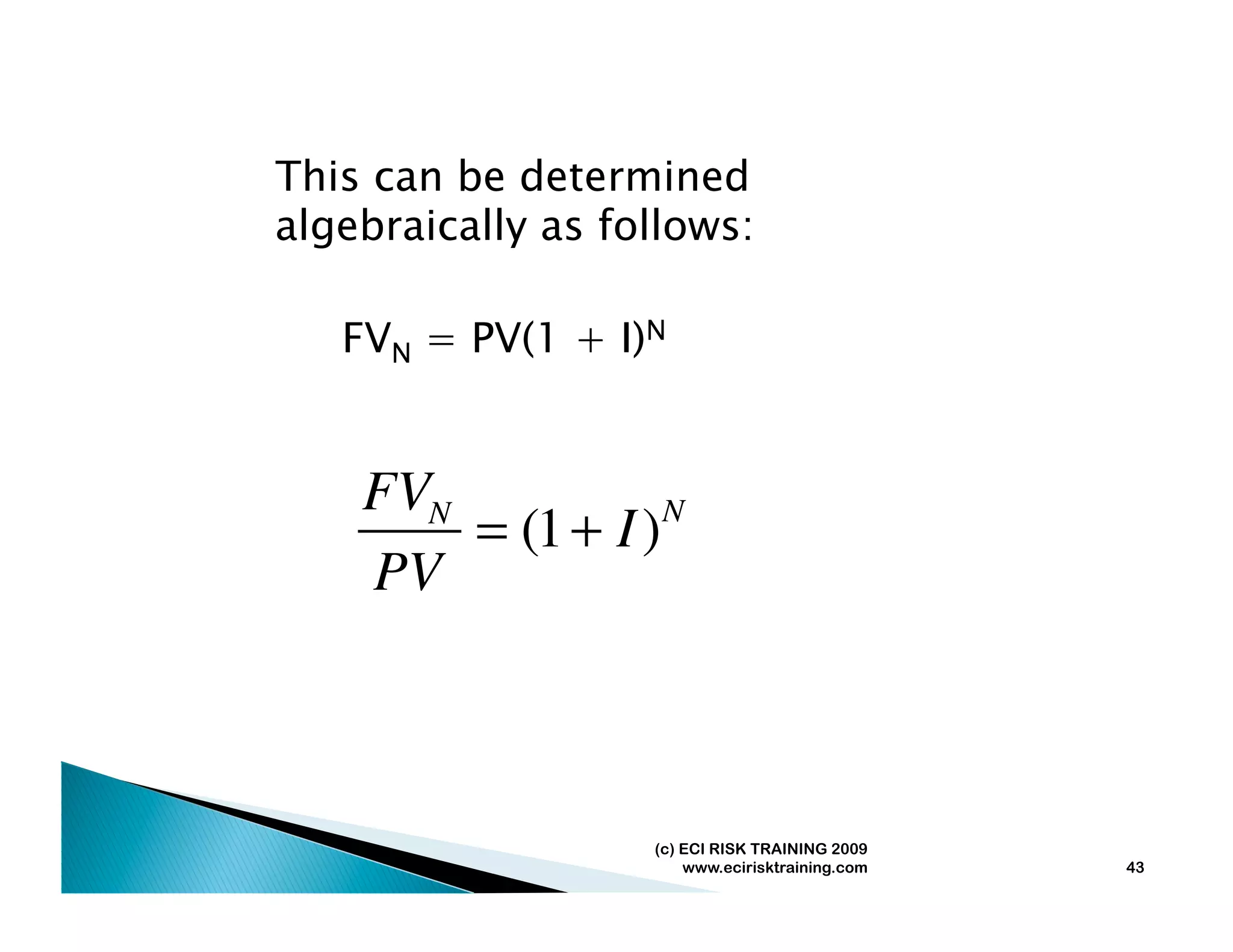

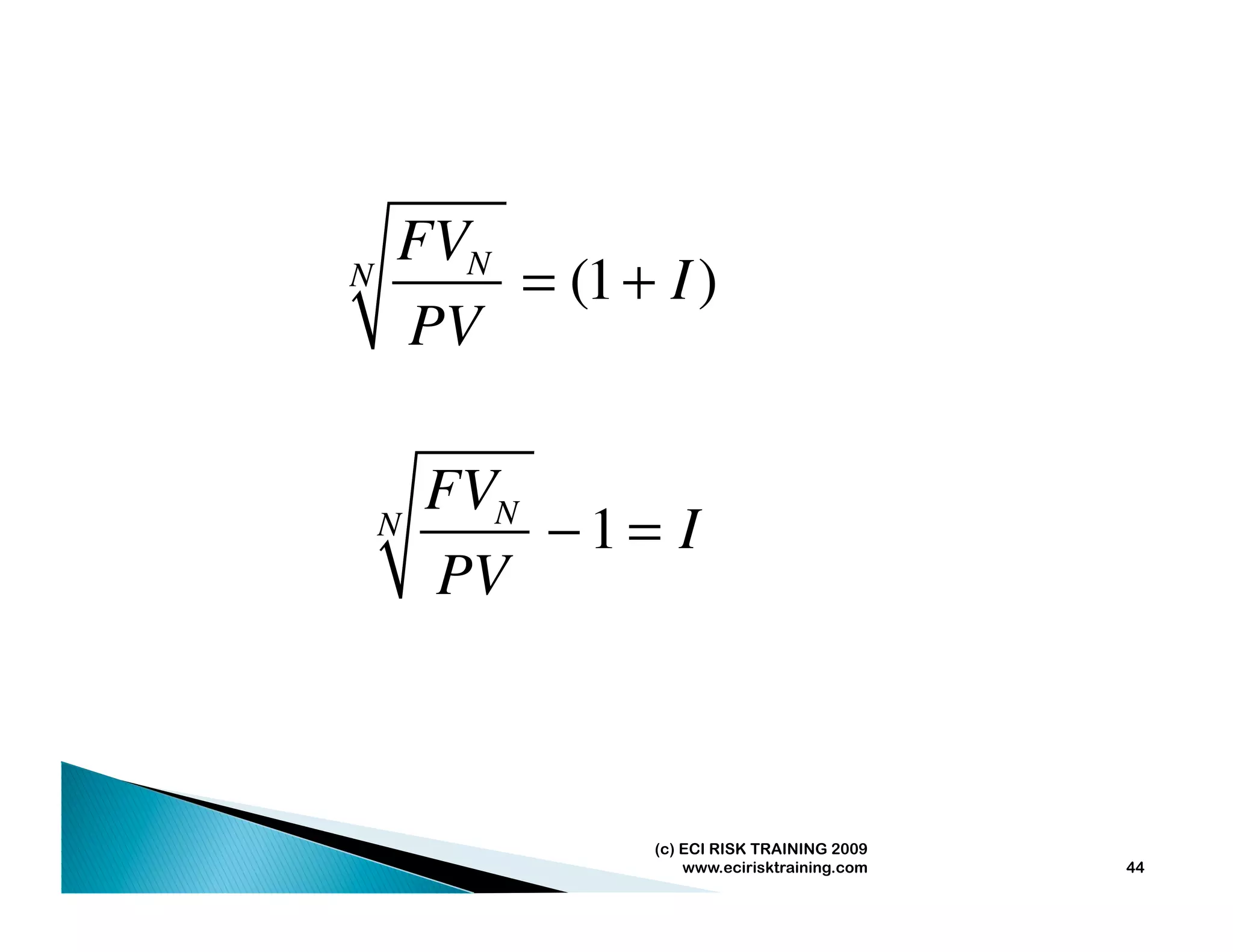

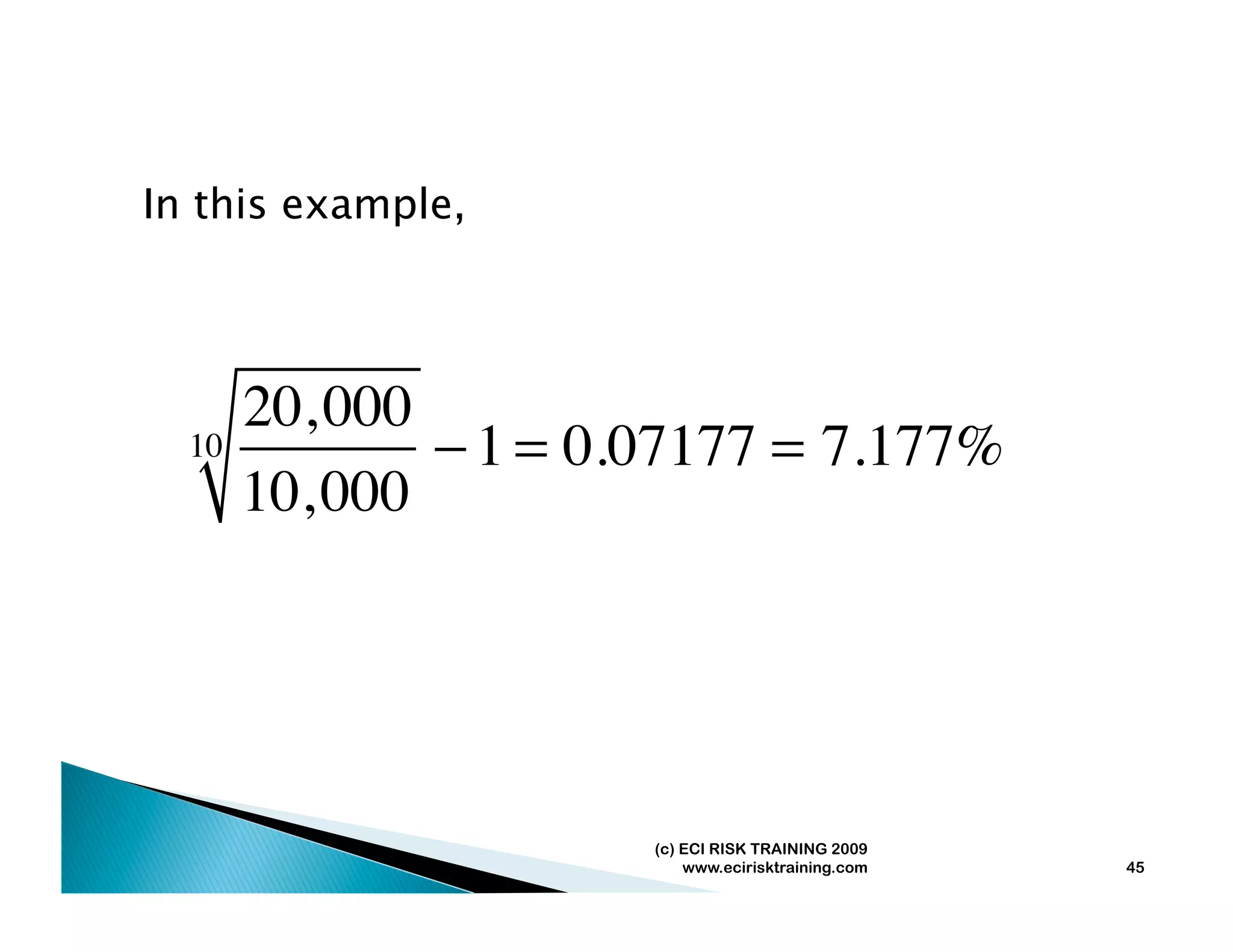

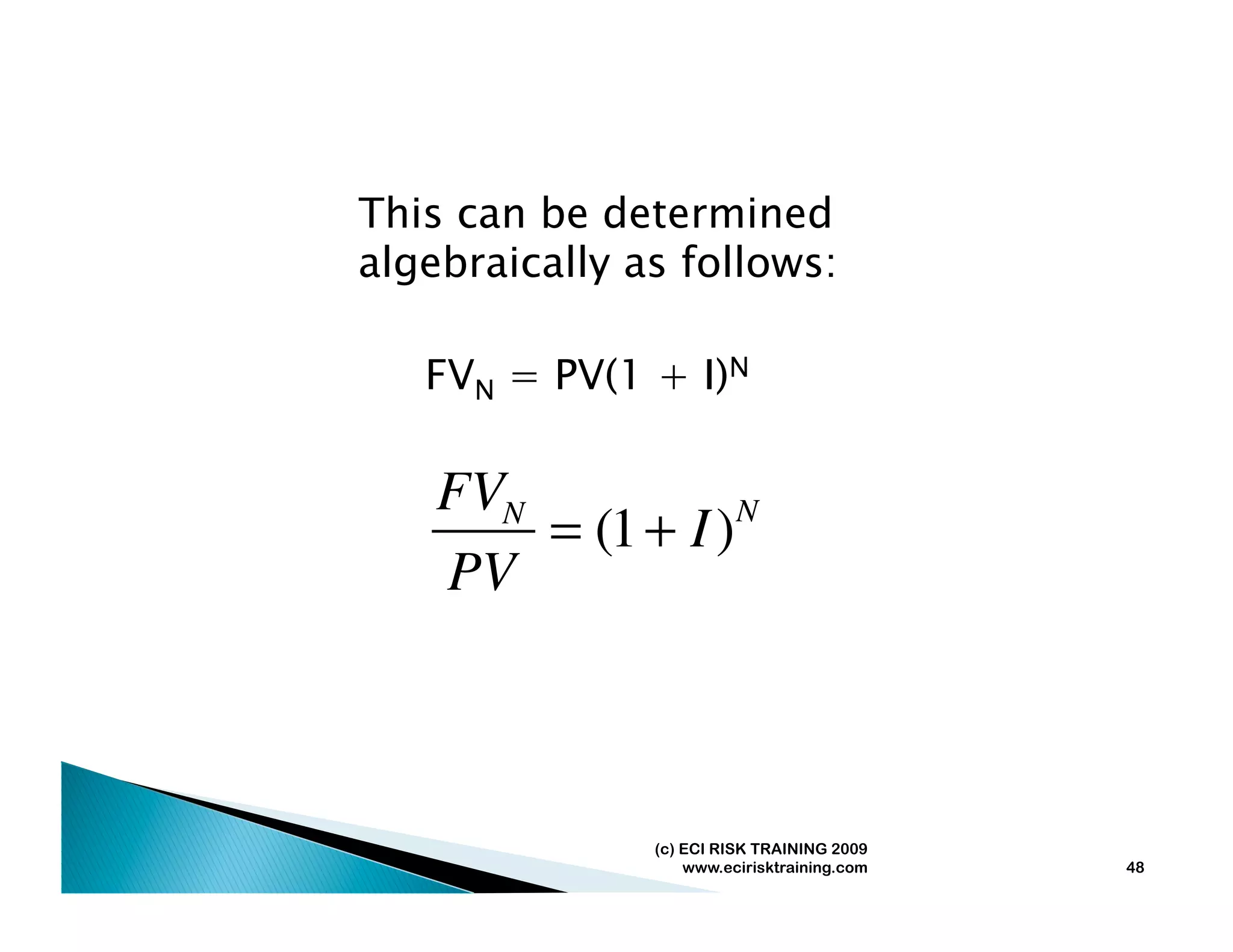

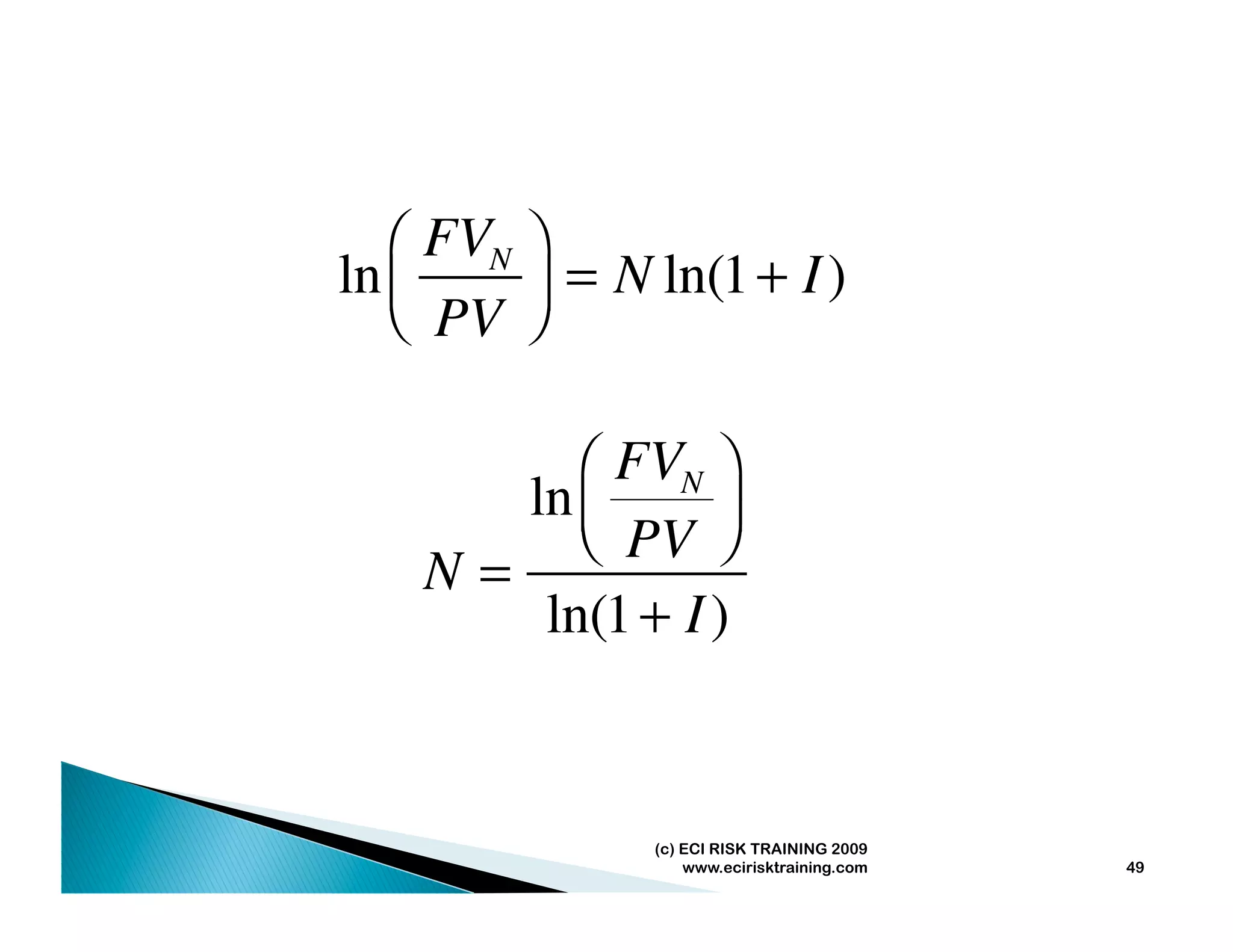

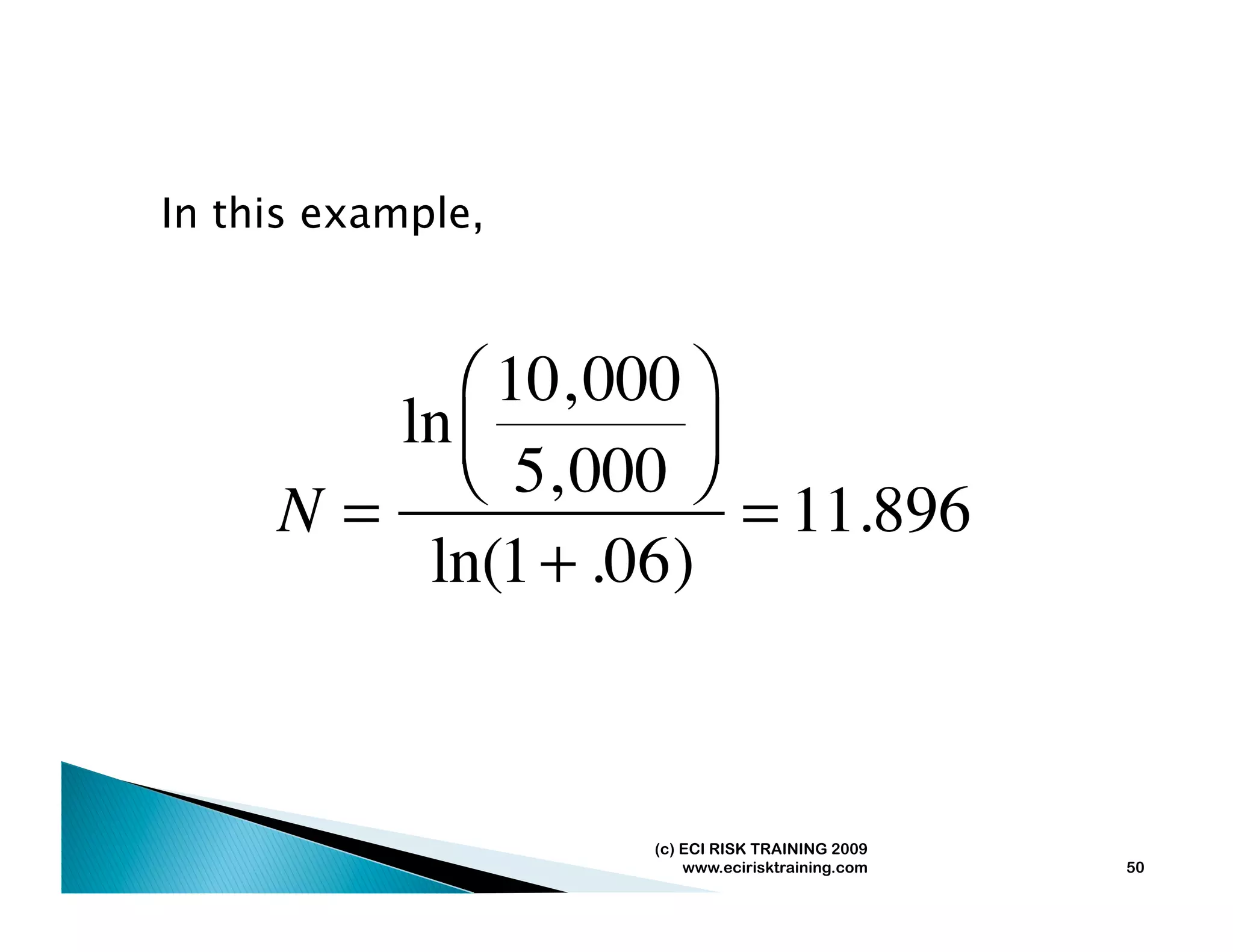

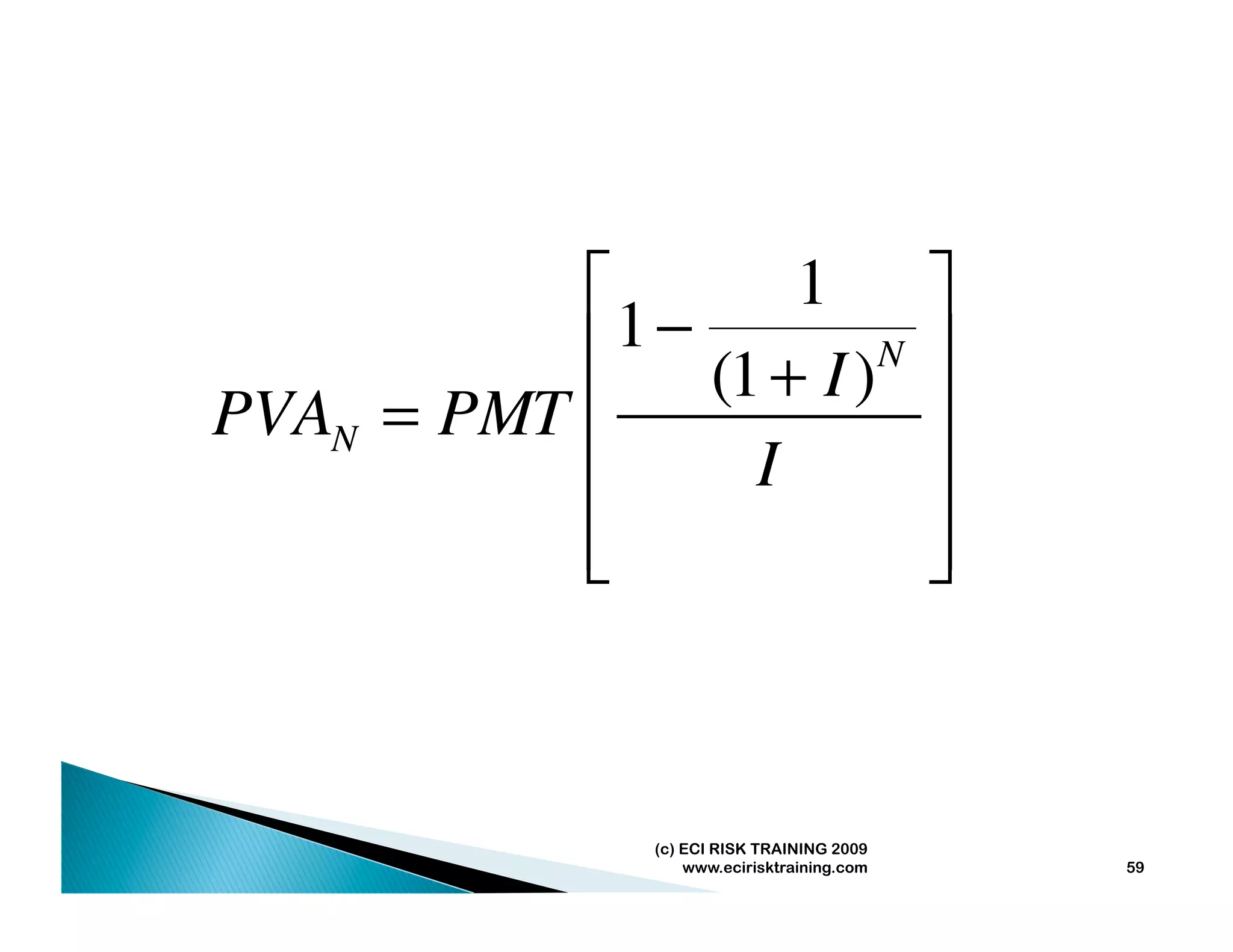

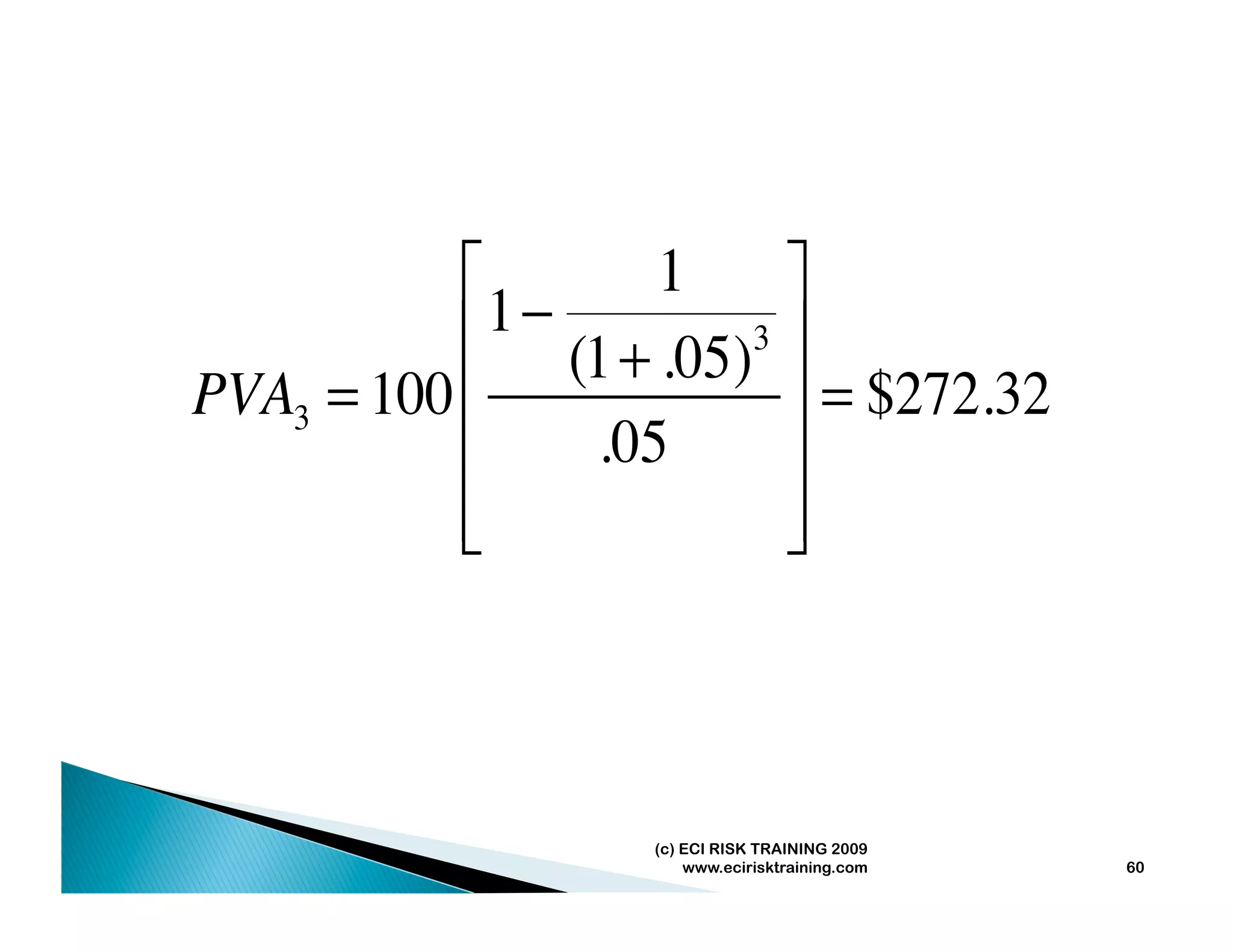

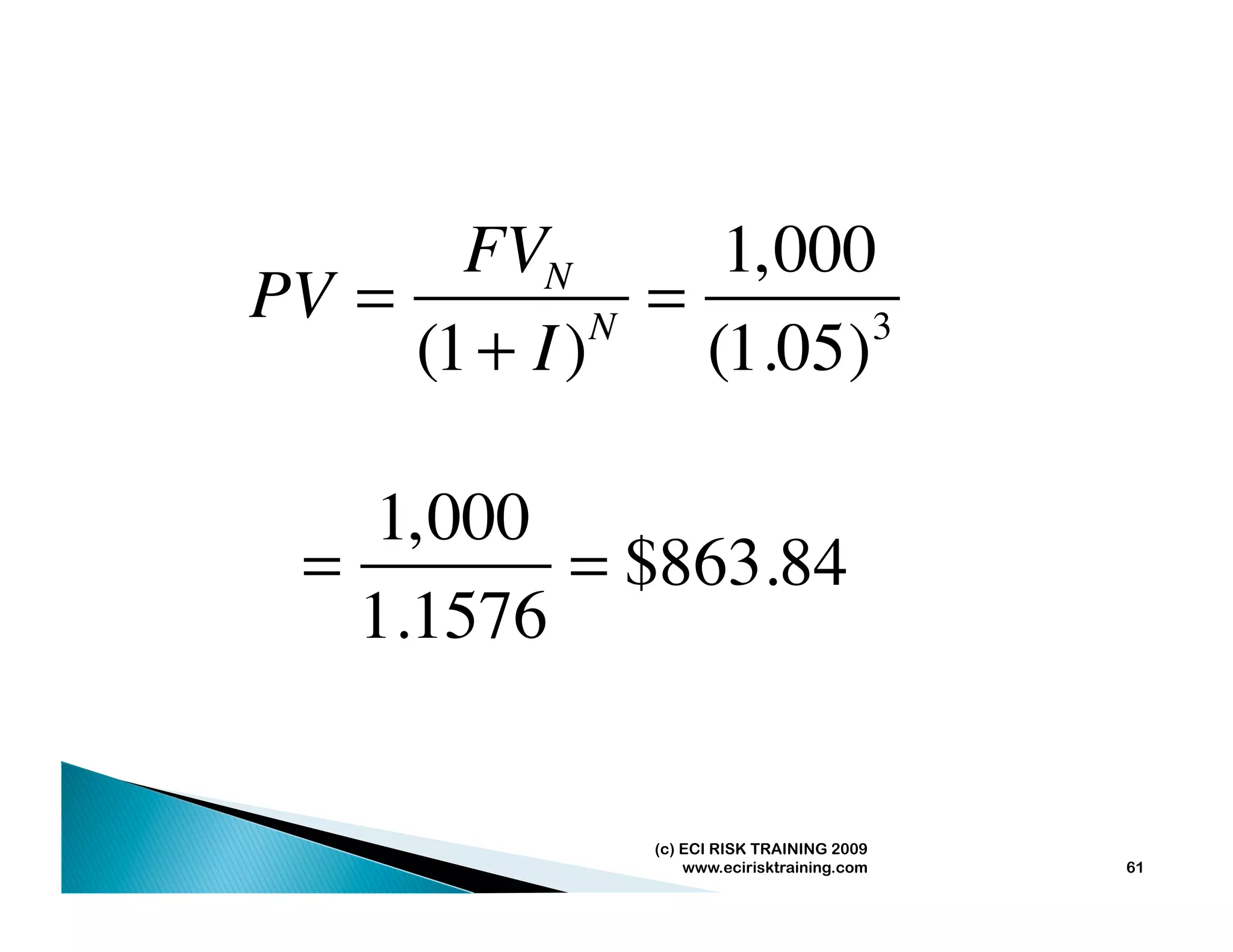

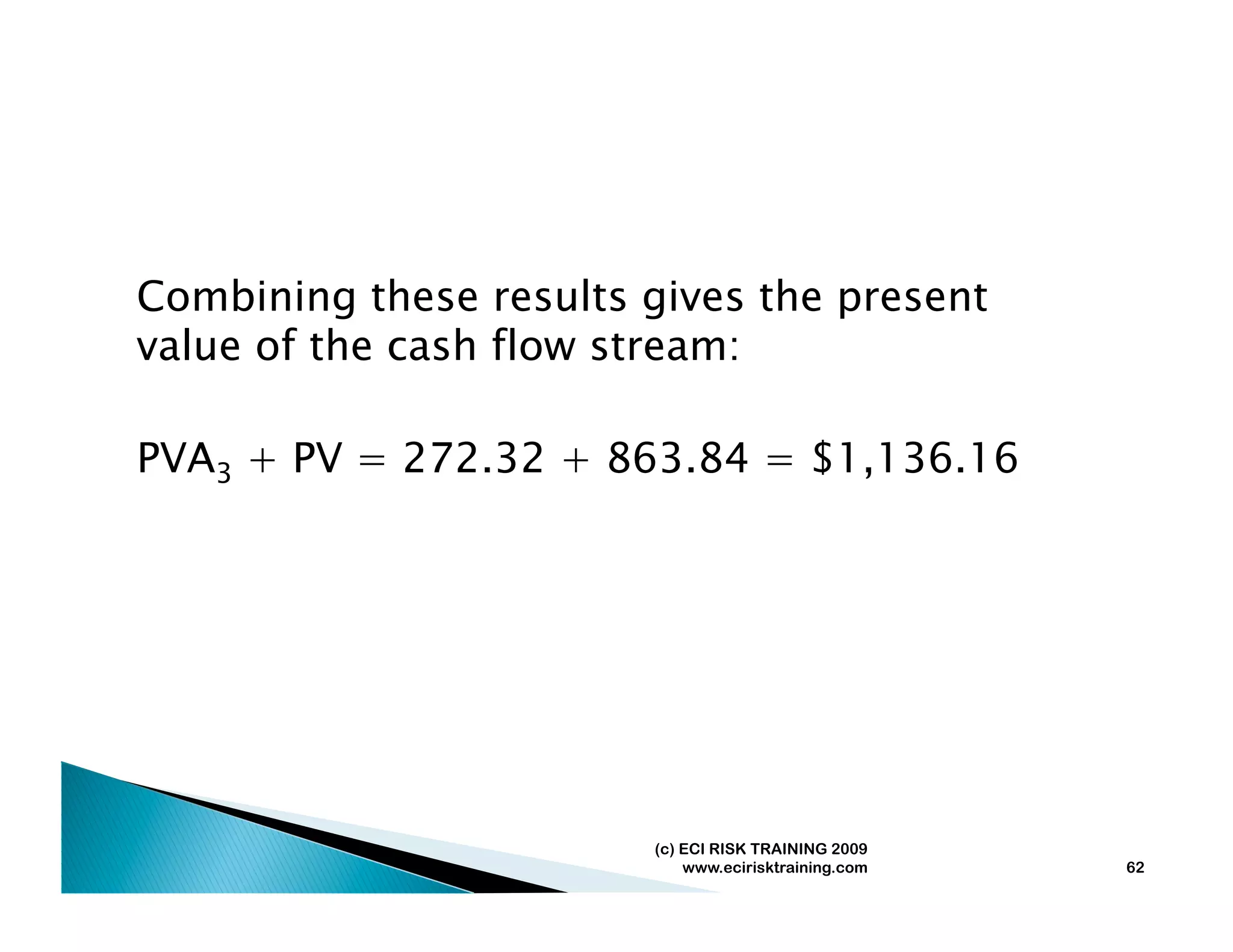

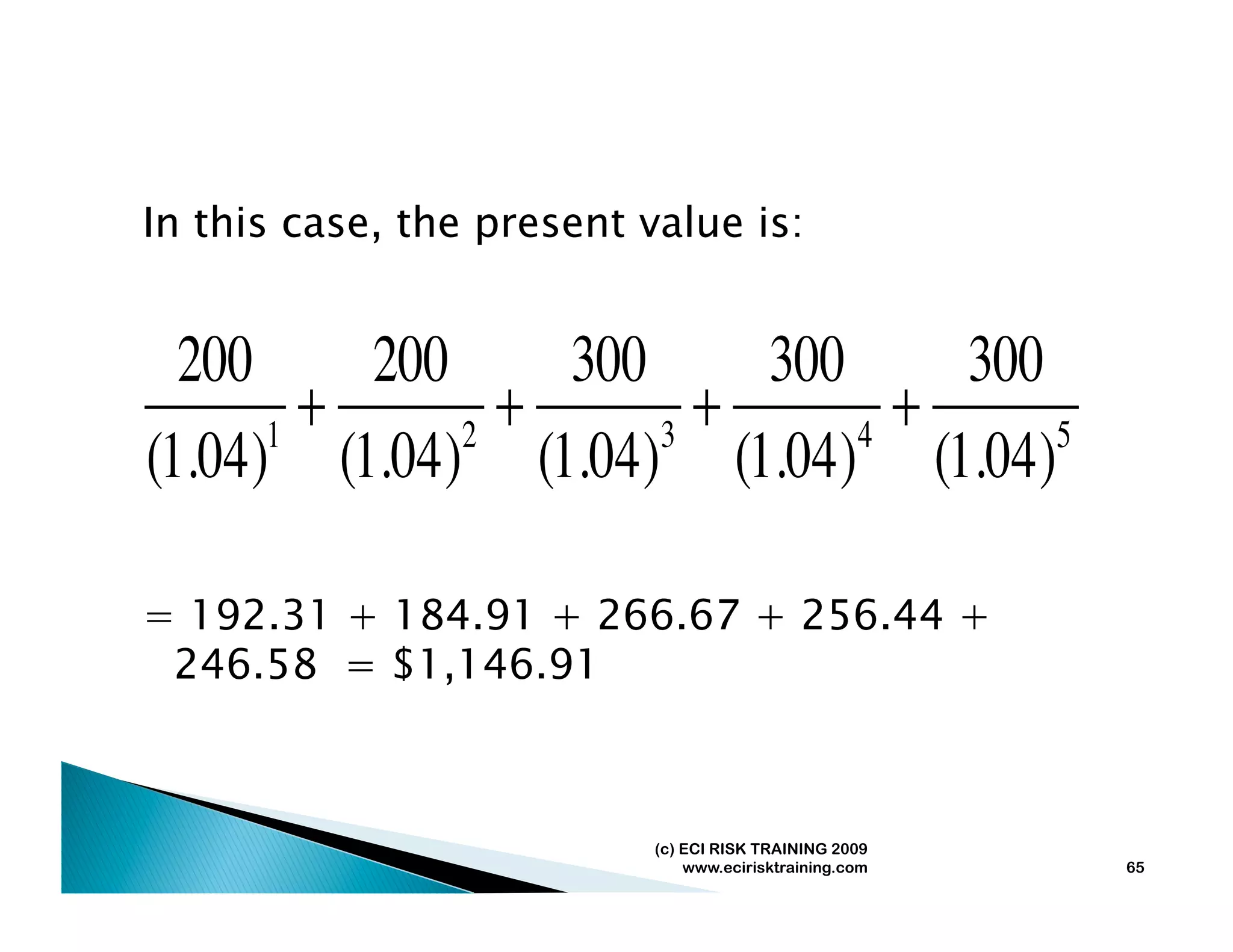

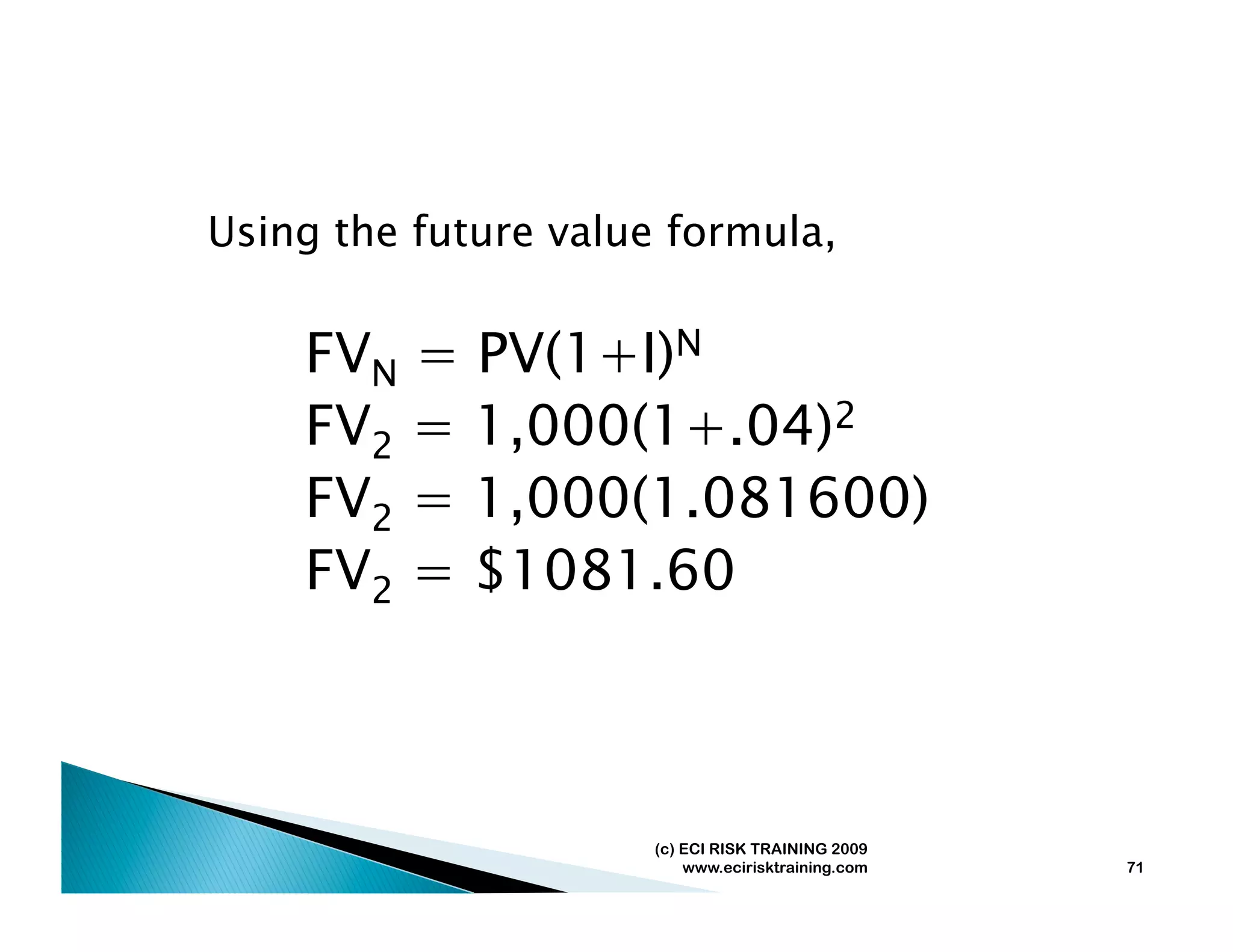

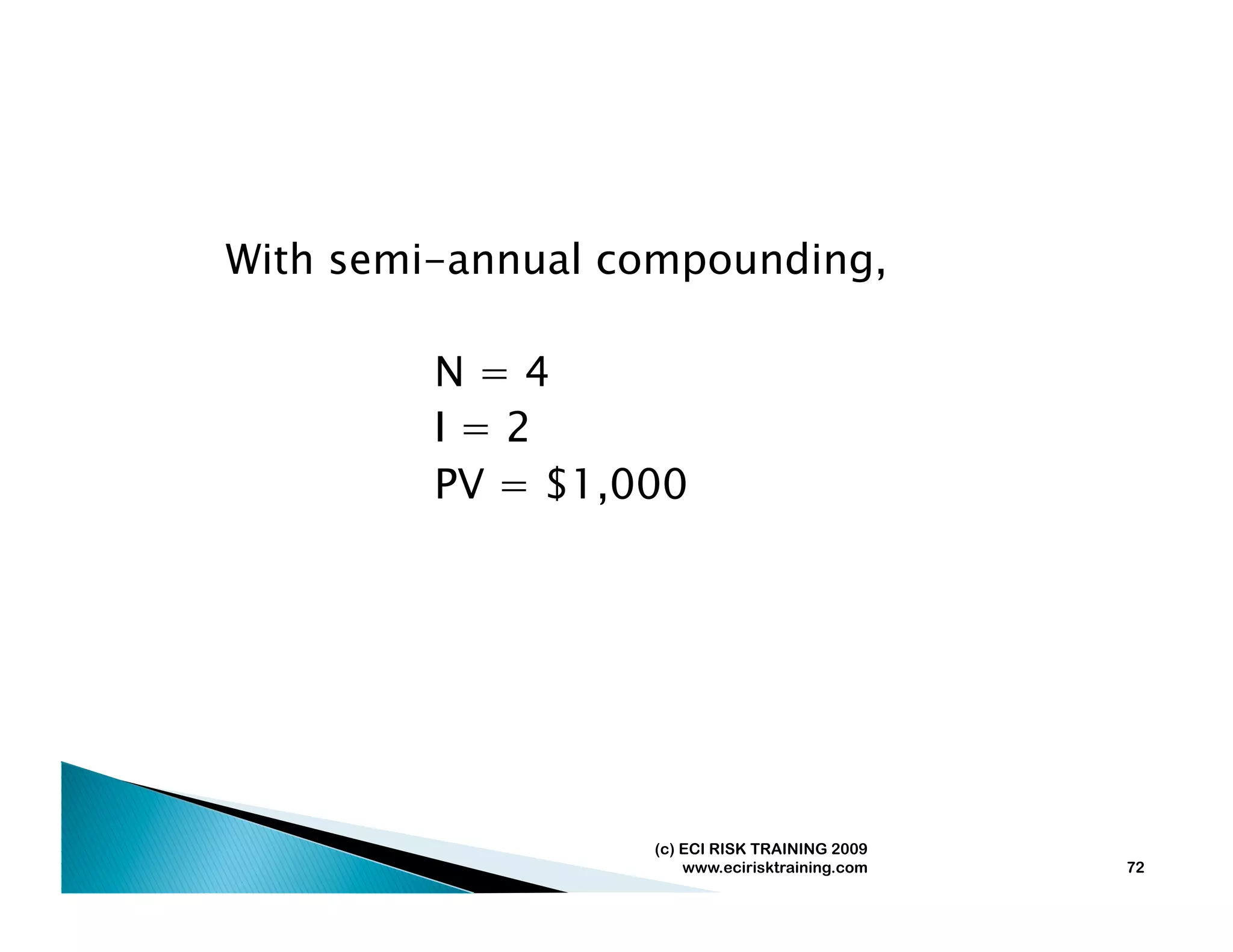

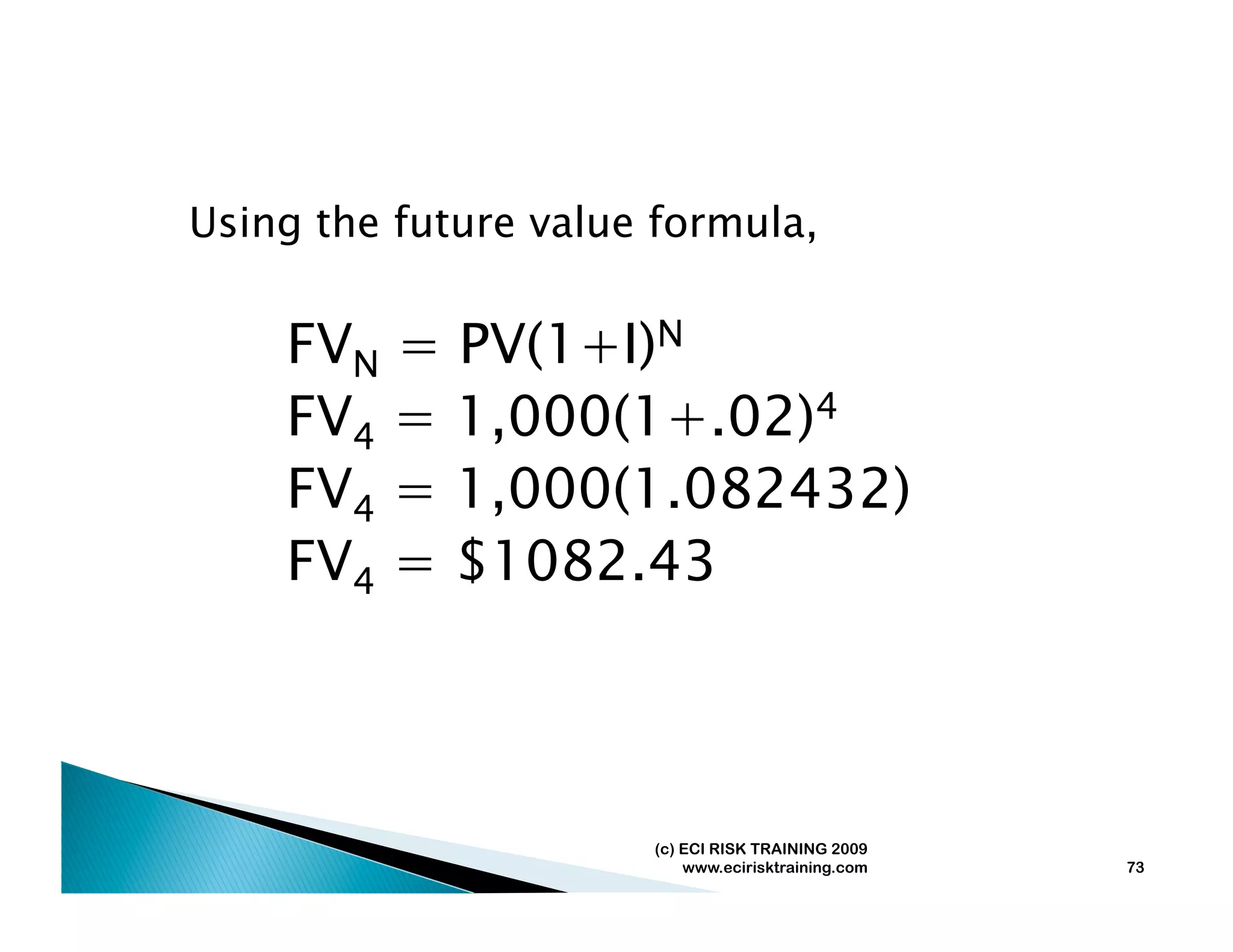

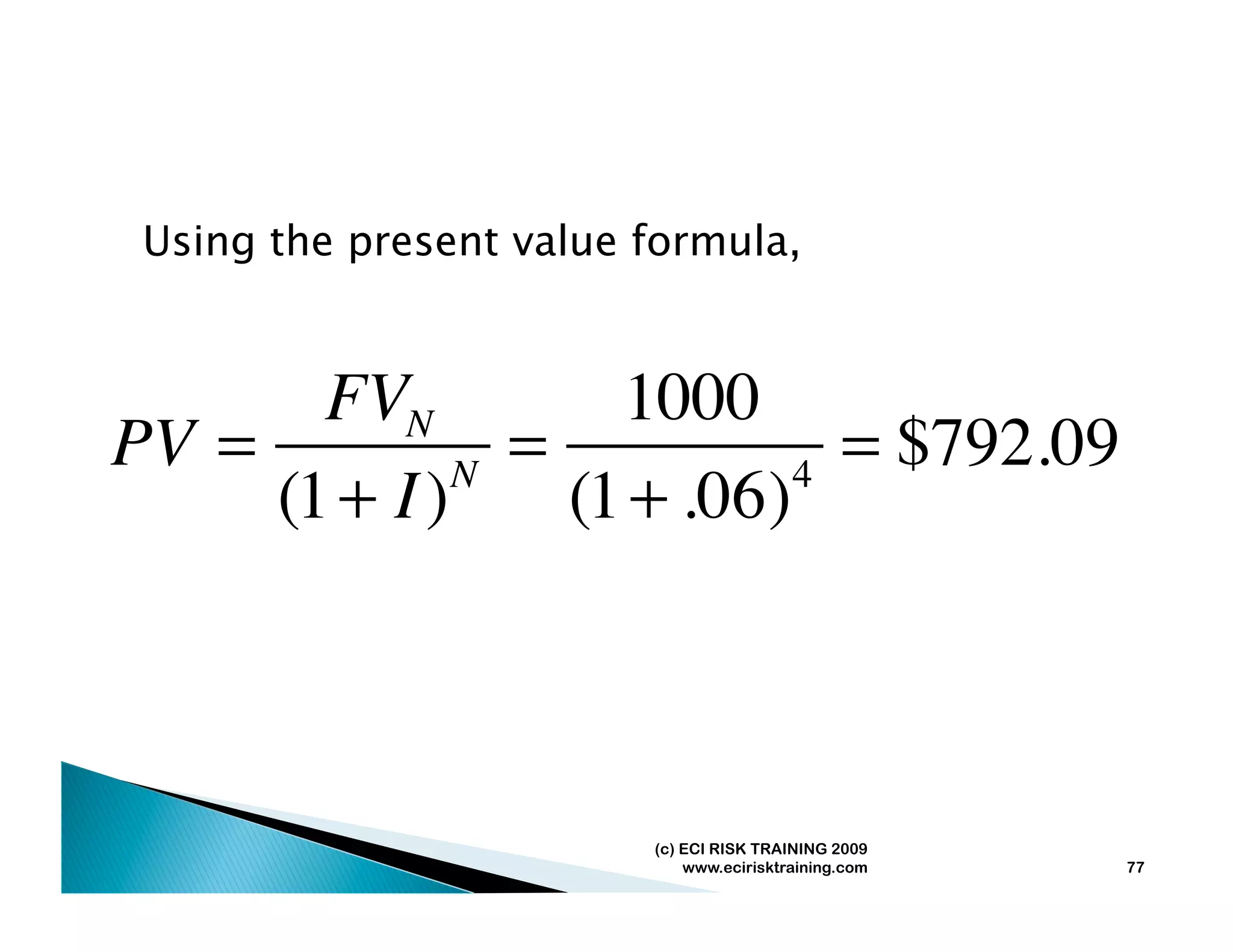

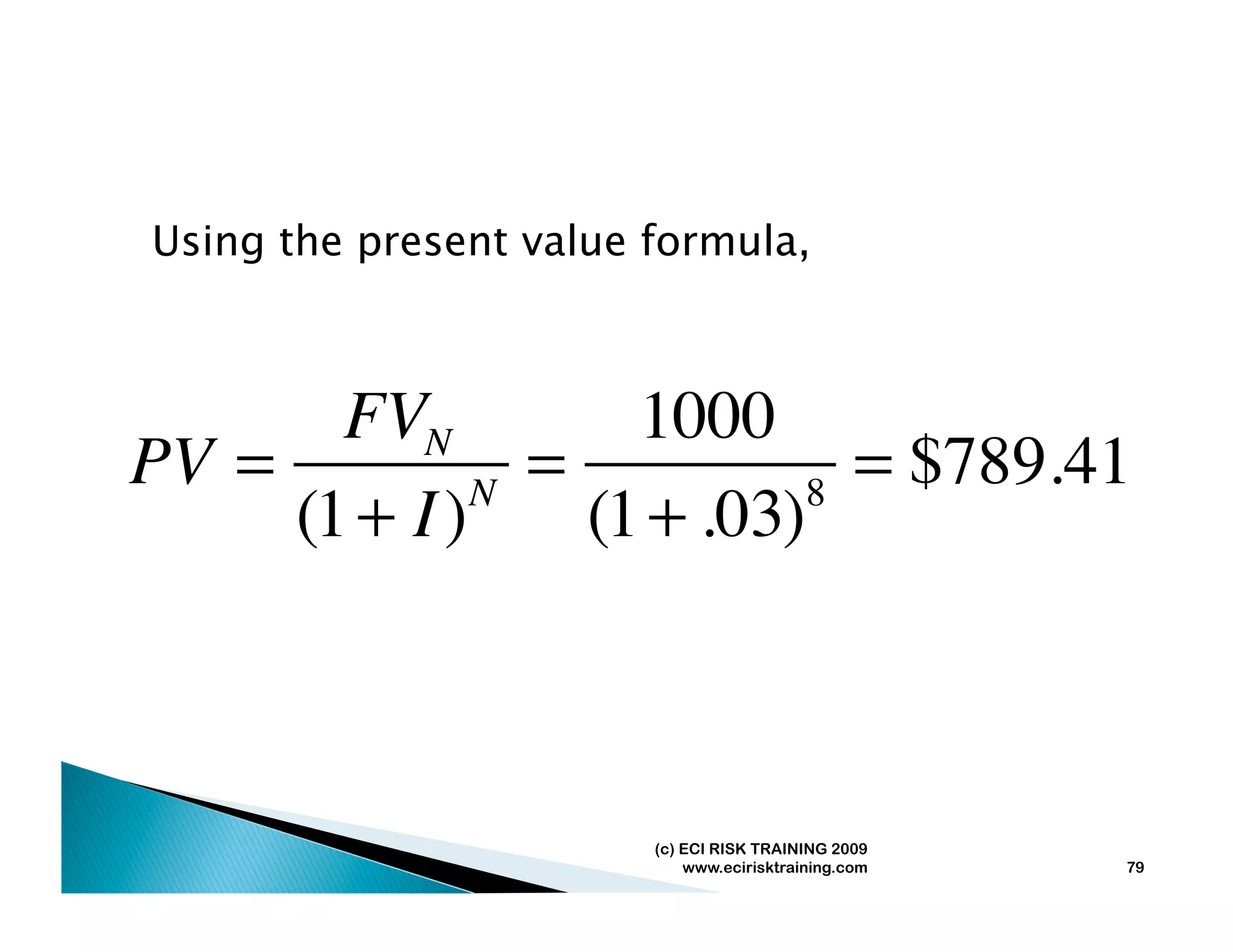

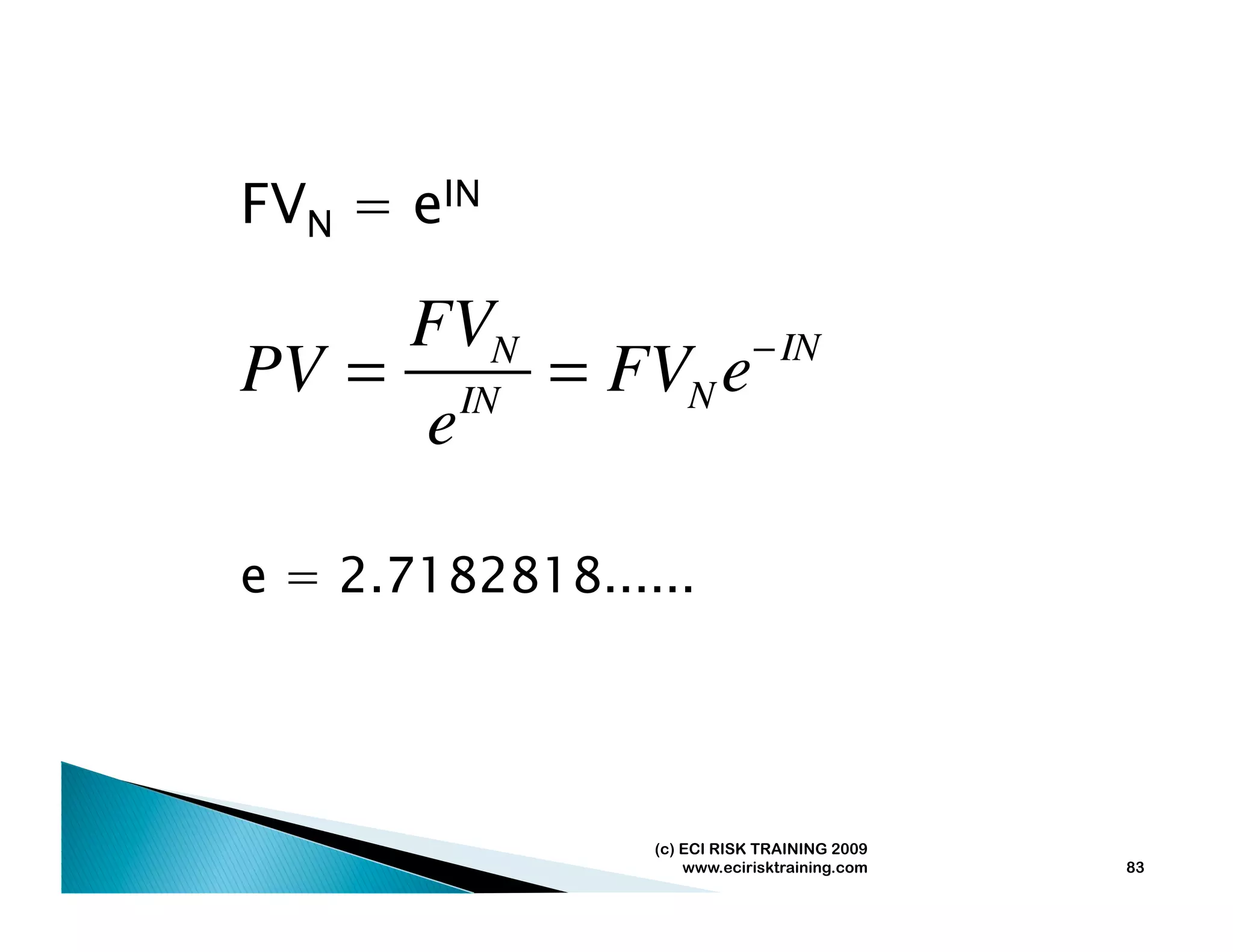

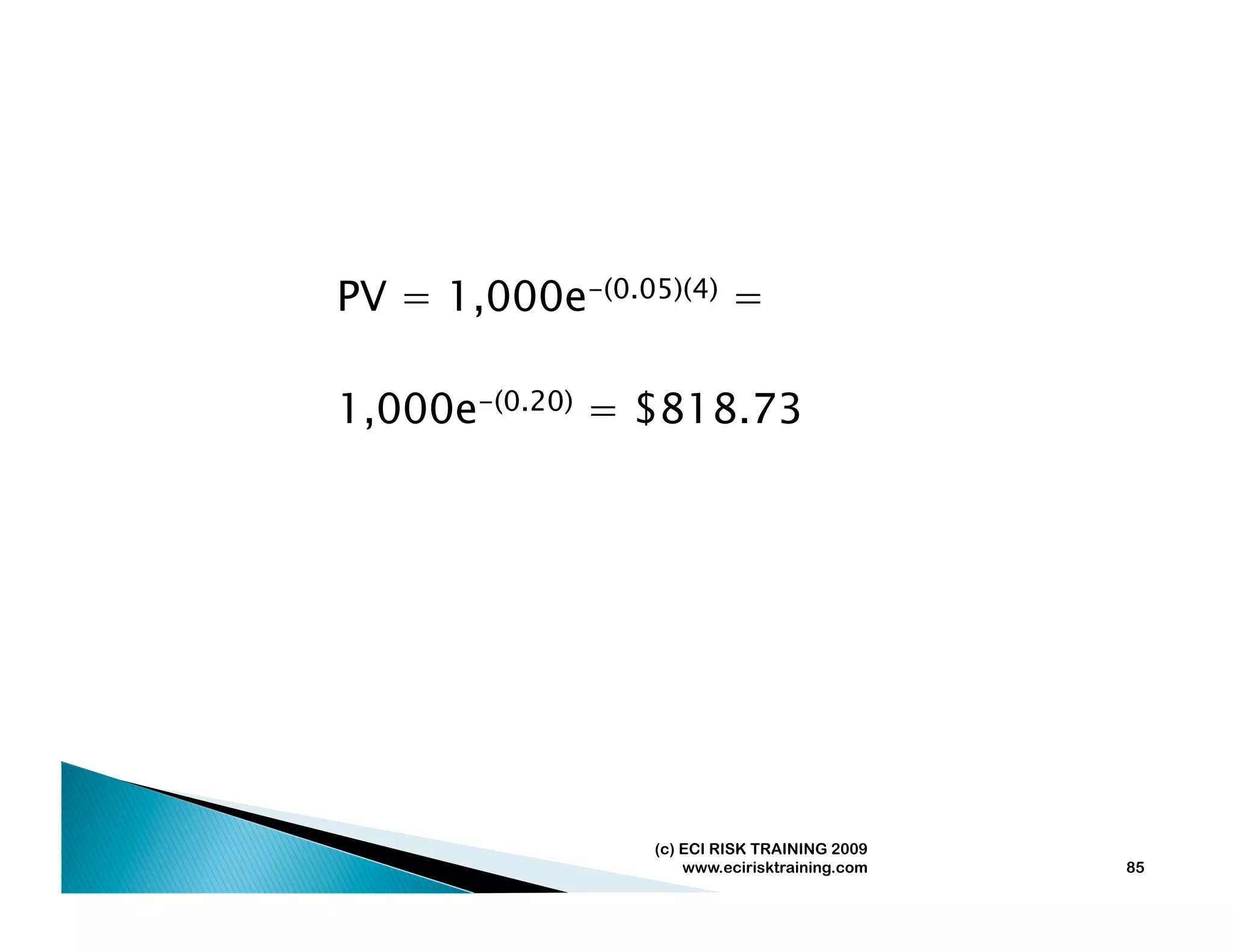

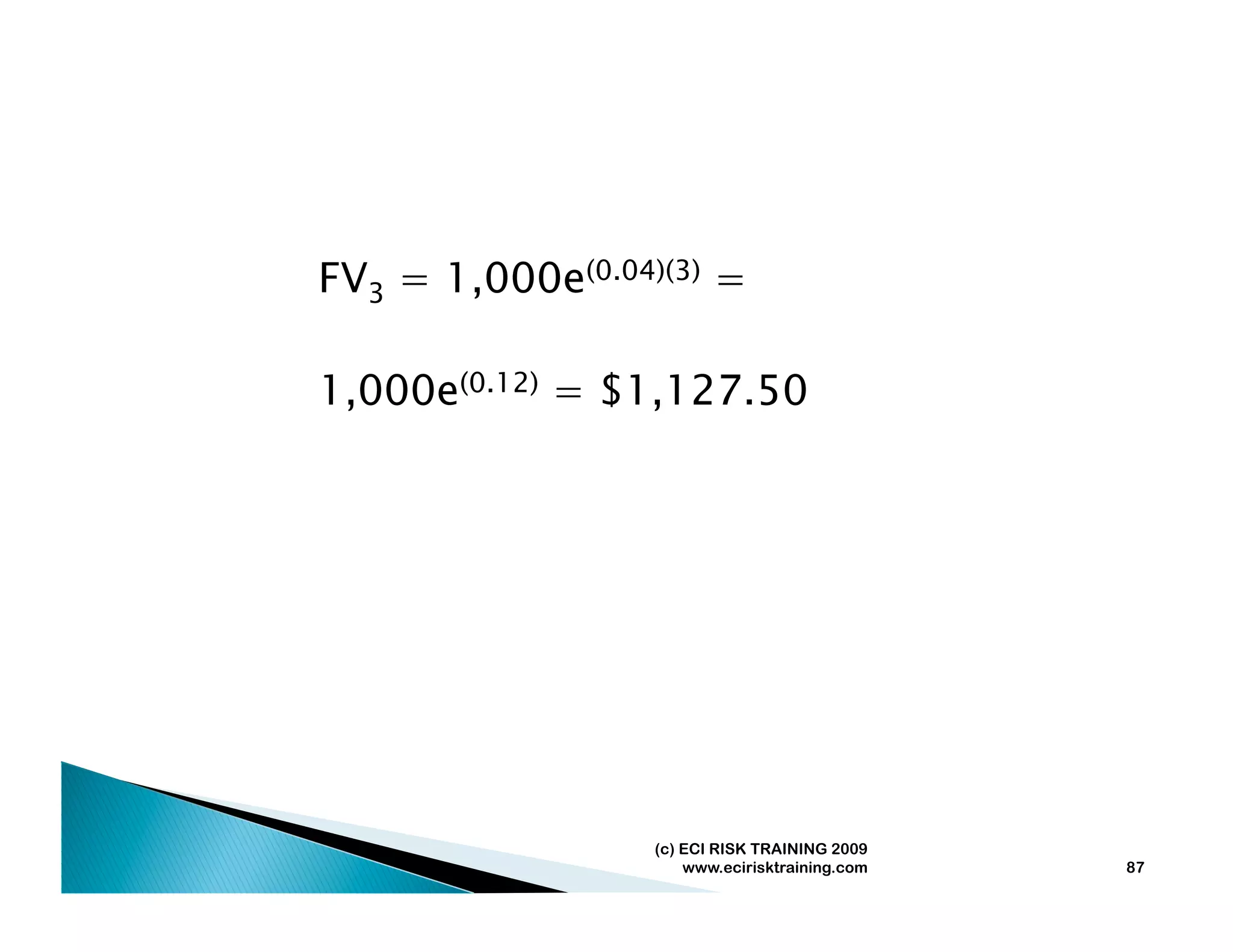

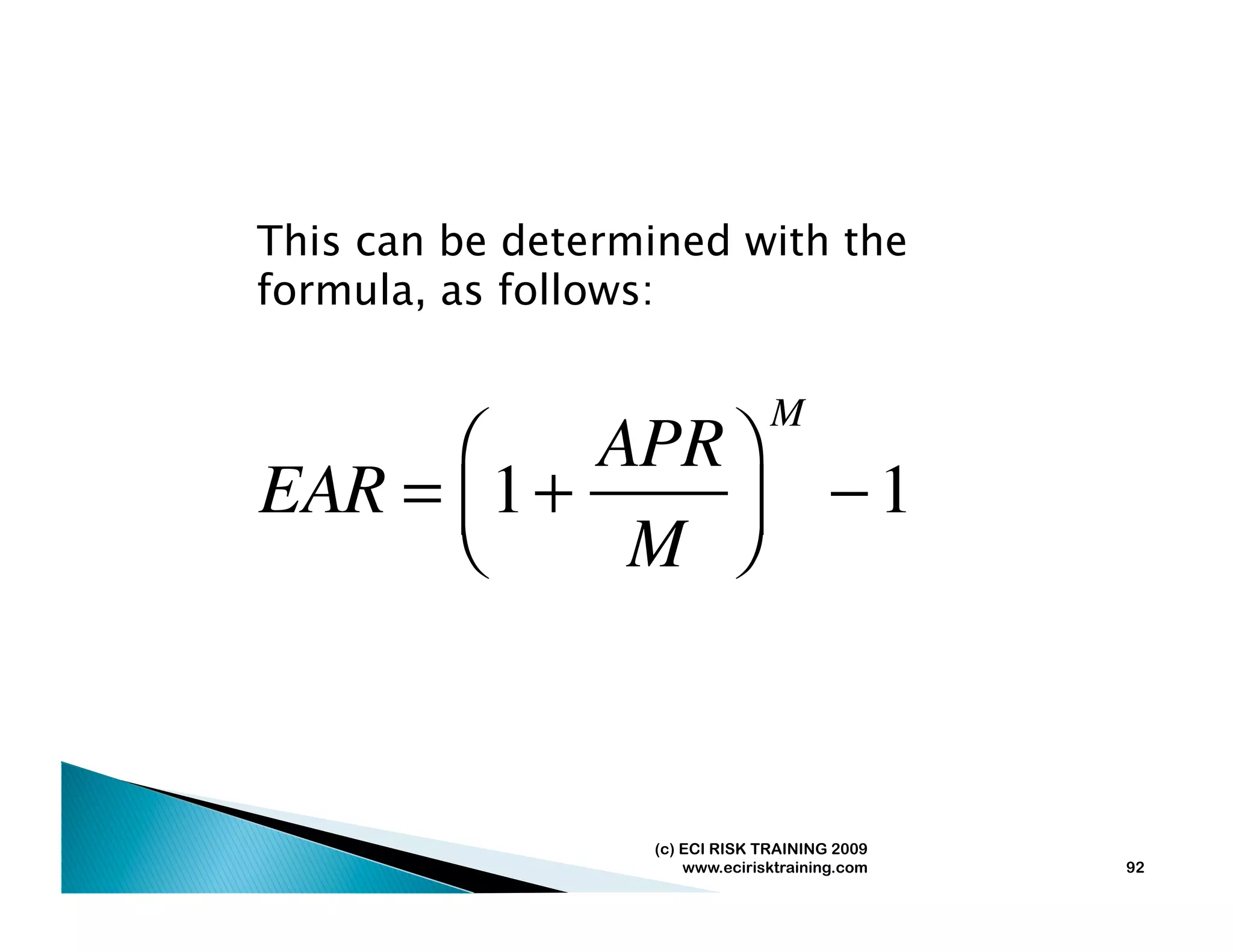

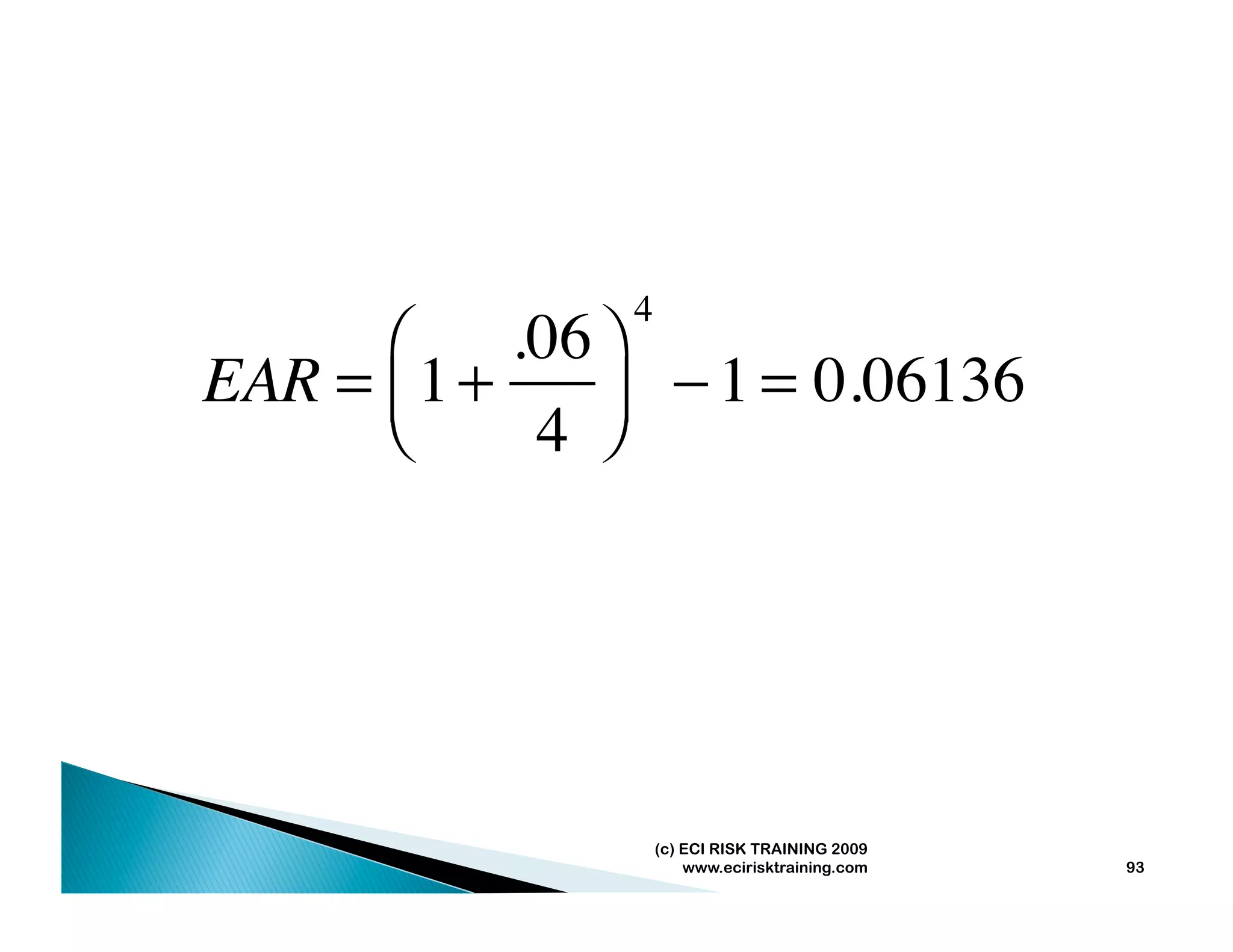

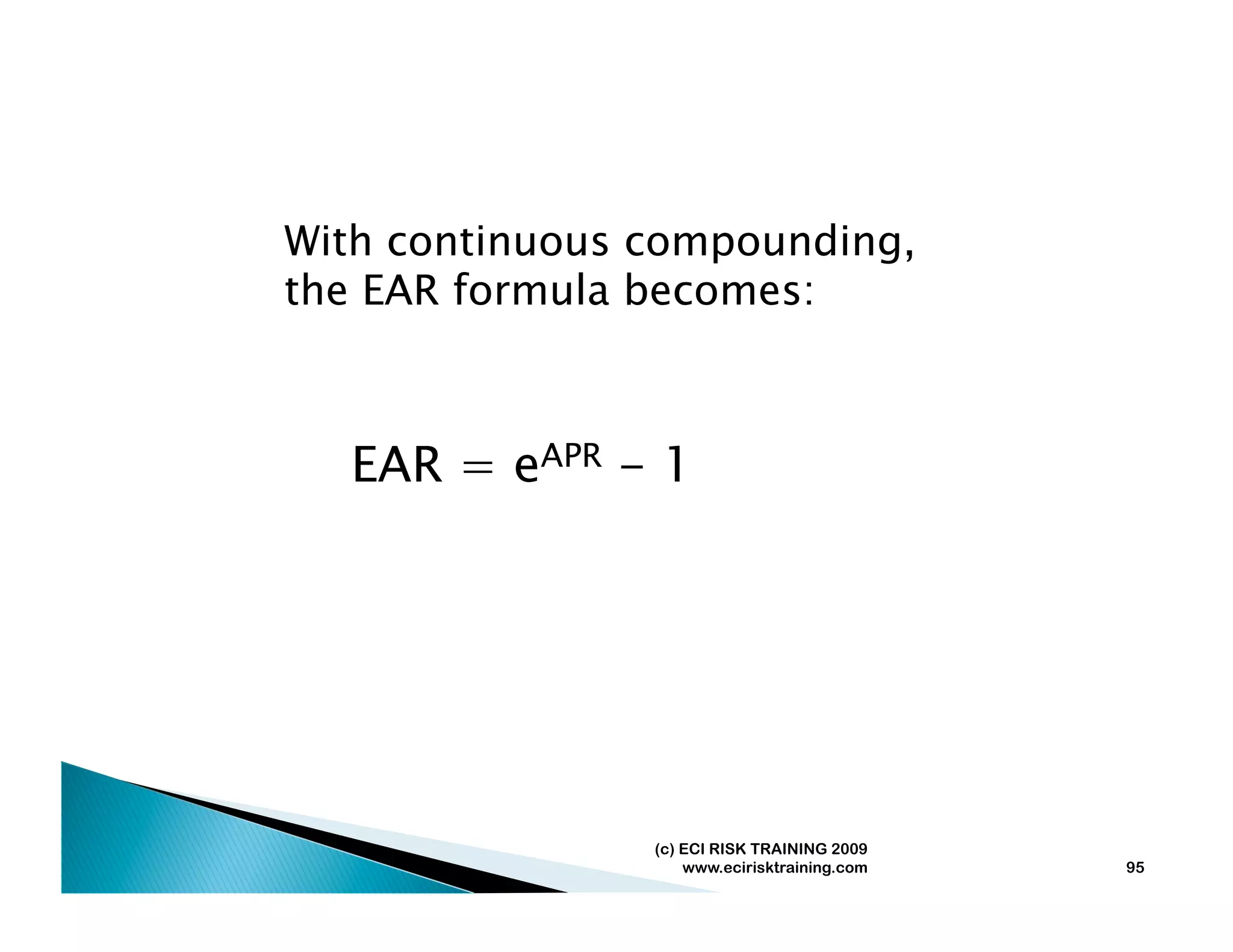

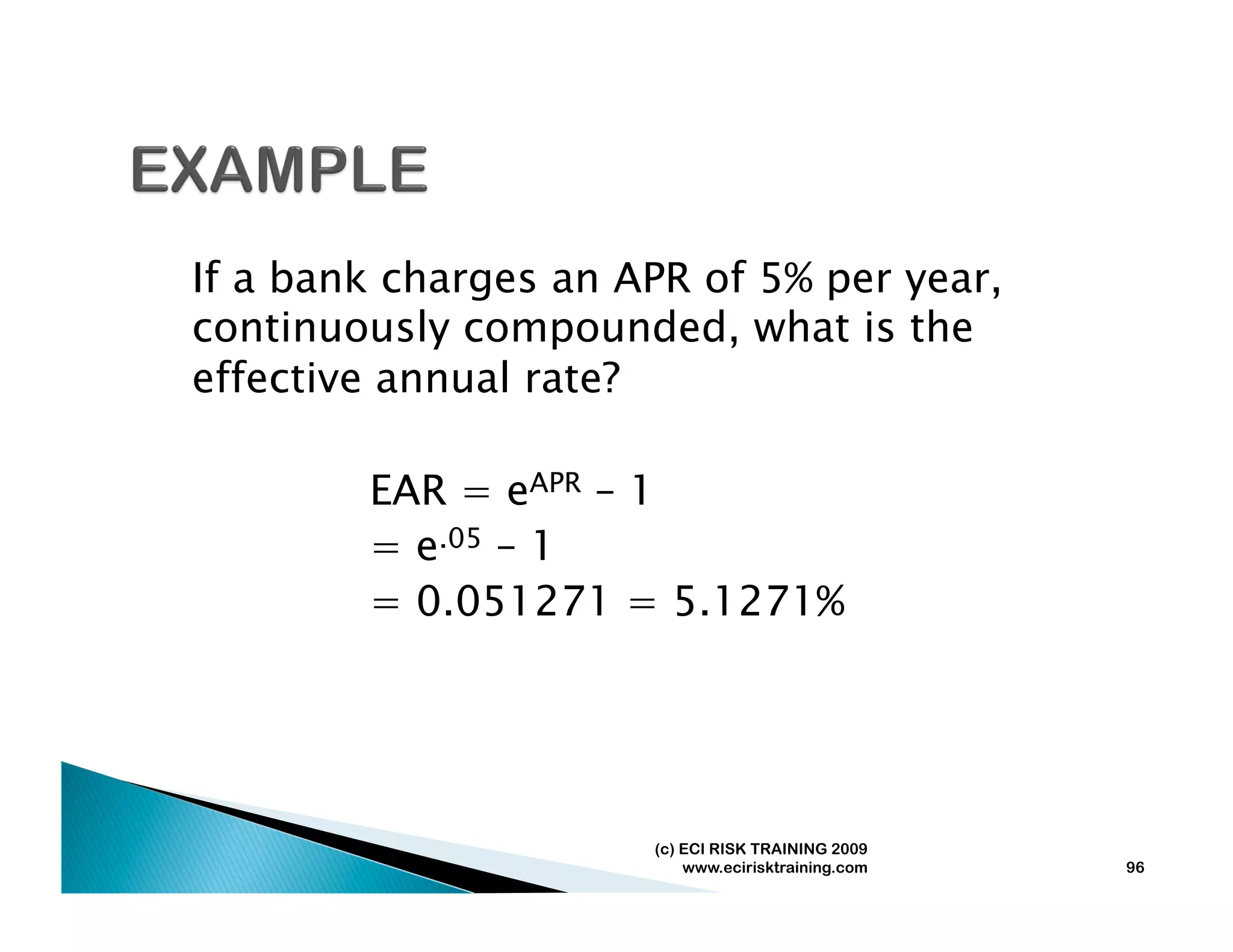

The document discusses time value of money concepts like present value, future value, interest rates, and time horizons. It provides examples of using formulas to solve for unknown variables in situations involving deposits, investments, and cash flows. The key formulas discussed are present value (PV), future value (FV), effective annual rate (EAR), and the Rule of 72 for approximations. Adjustments to the formulas for cases of interest compounded more frequently than annually are also covered.