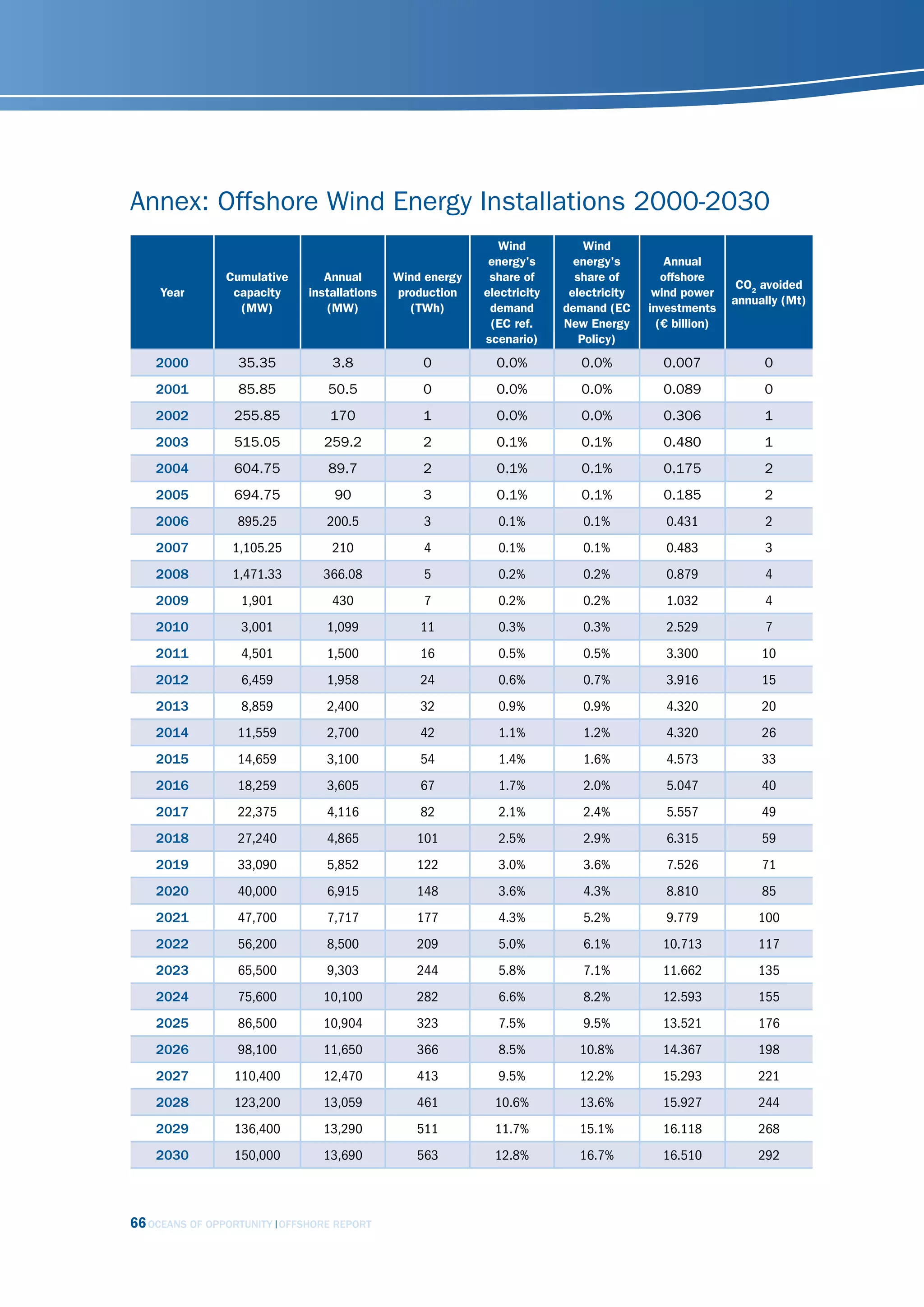

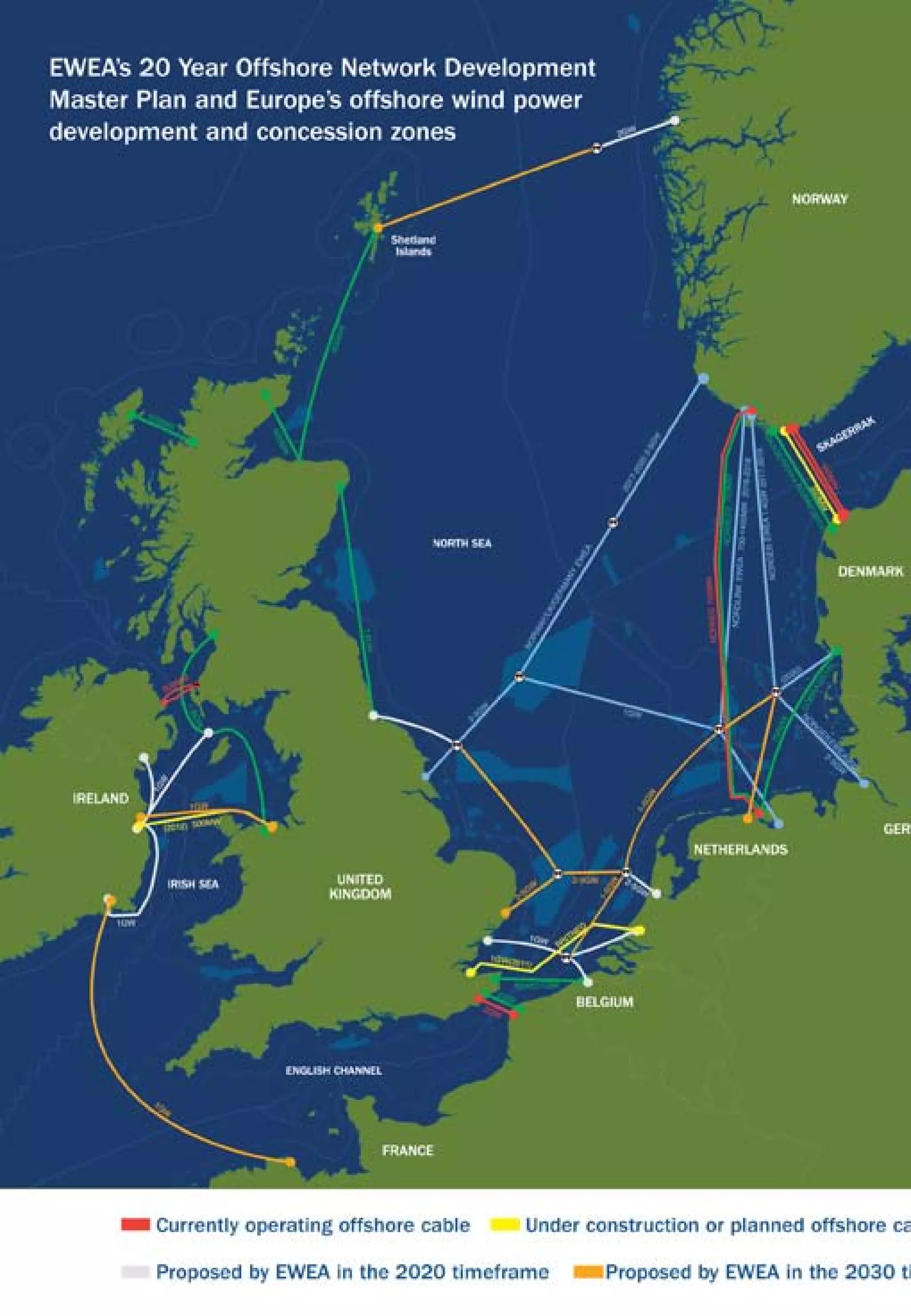

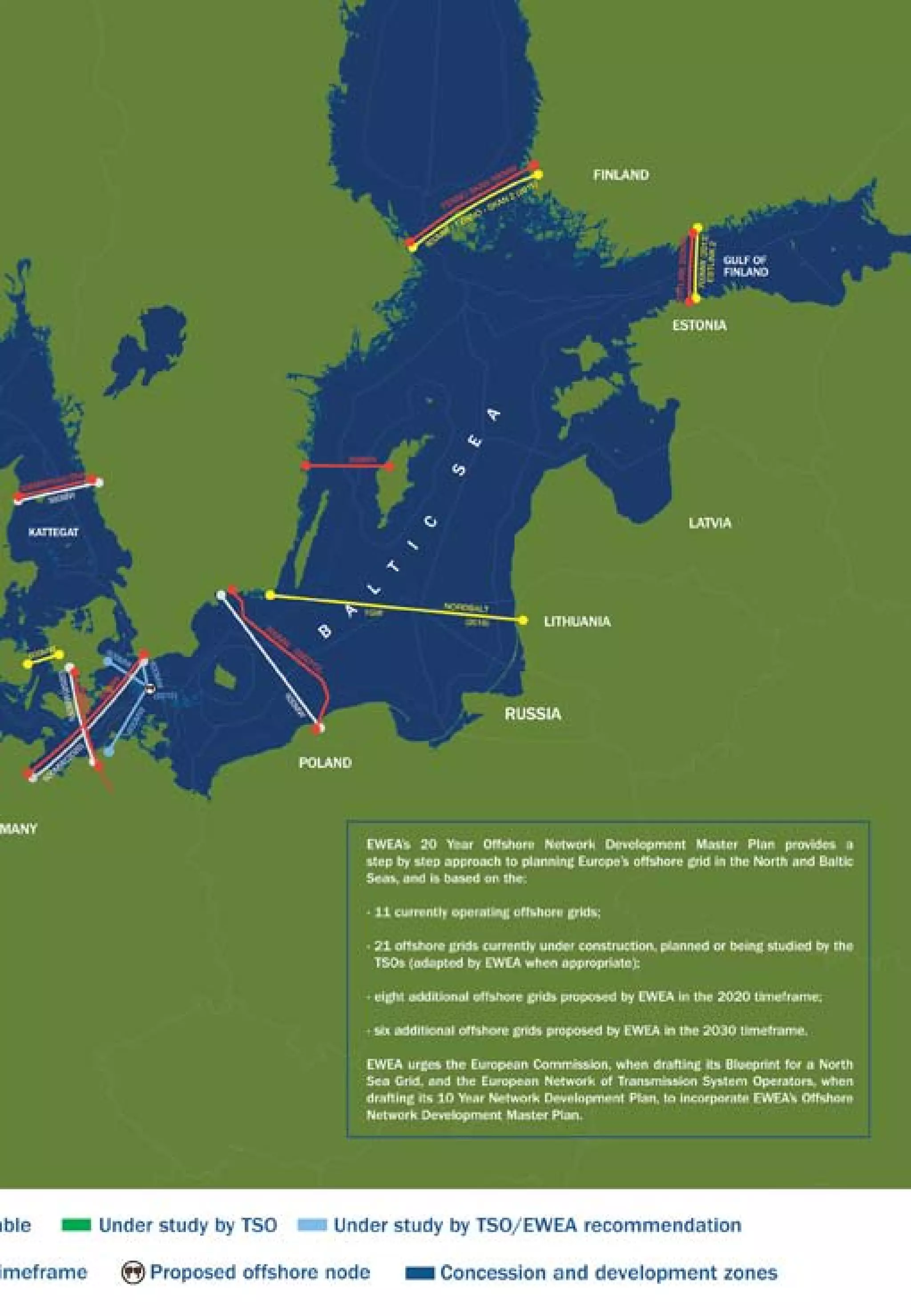

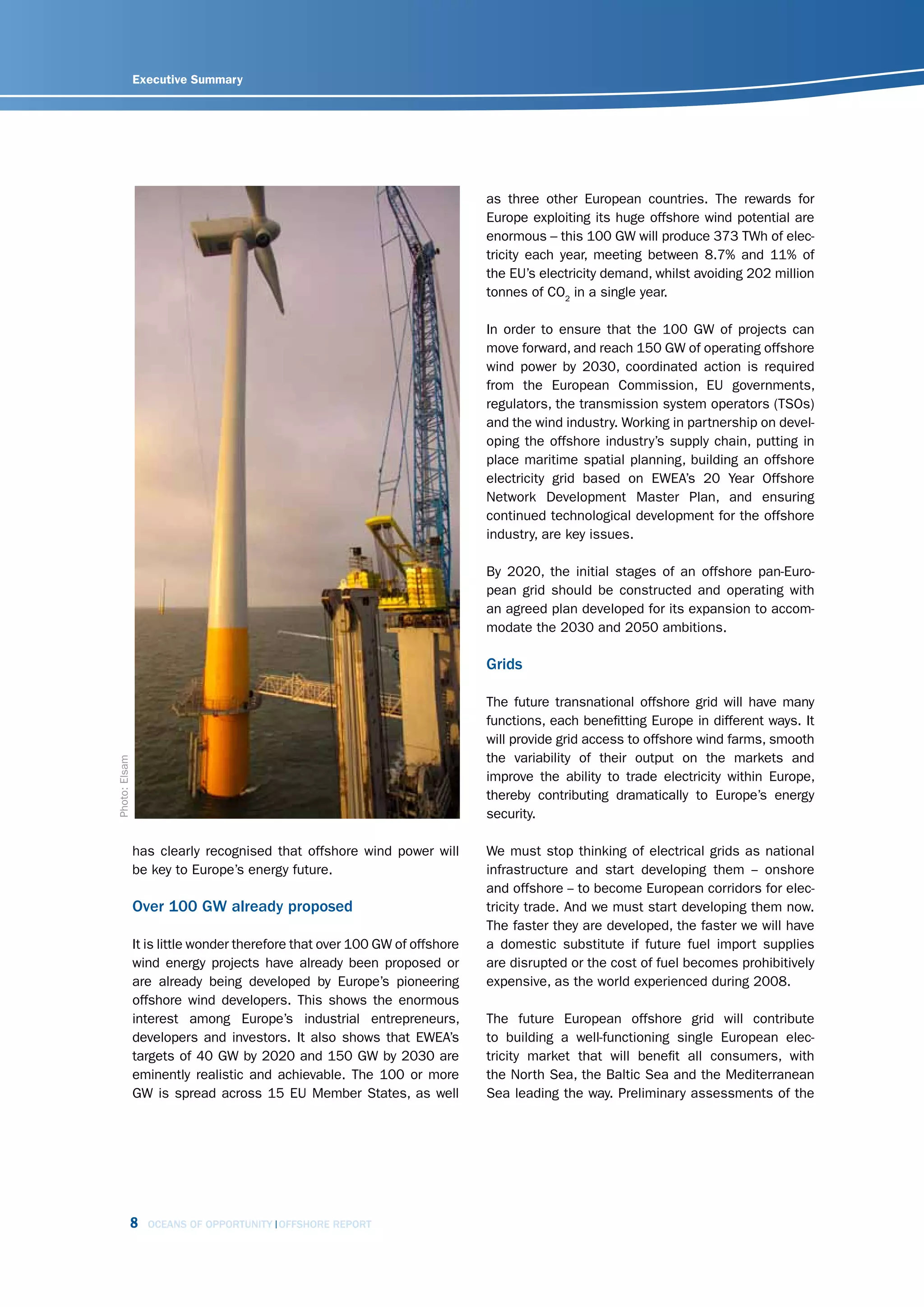

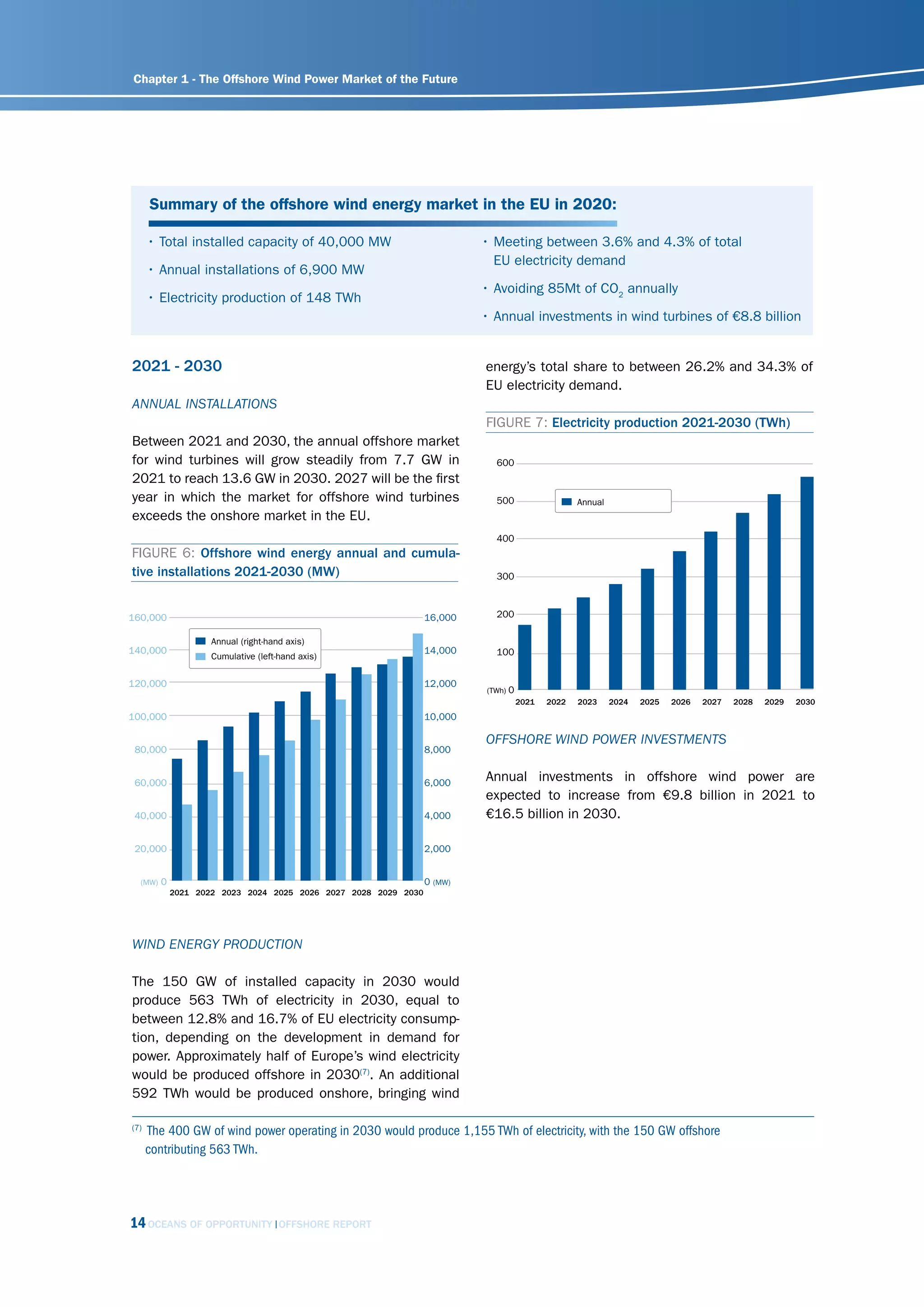

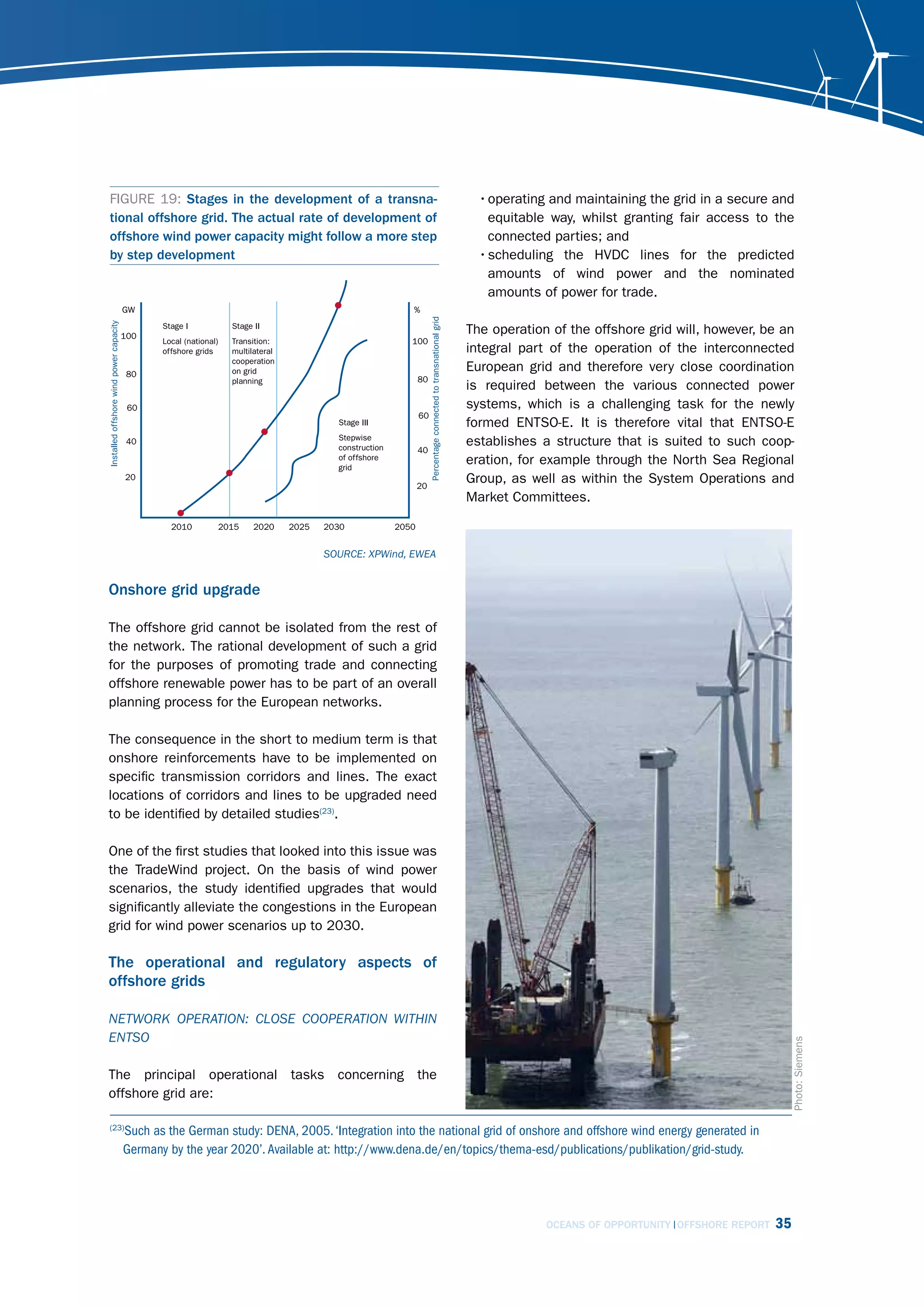

The document discusses the potential for offshore wind power in Europe. It notes that Europe's offshore wind potential could power the continent seven times over. Currently over 100 GW of offshore wind projects are planned, which could produce 10% of the EU's electricity while avoiding 200 million tons of CO2 emissions per year. The document advocates for building an offshore grid to connect offshore wind farms and transmit wind power across borders, noting that the EU's offshore grid plans could give Europe a pan-European electricity superhighway. It argues that strong policy support is needed to realize offshore wind power's potential and build a new multi-billion euro industry that delivers green jobs and establishes Europe as a leader in offshore wind technology.

![Investments and financing

invEstmEnt cost EstimAtEs

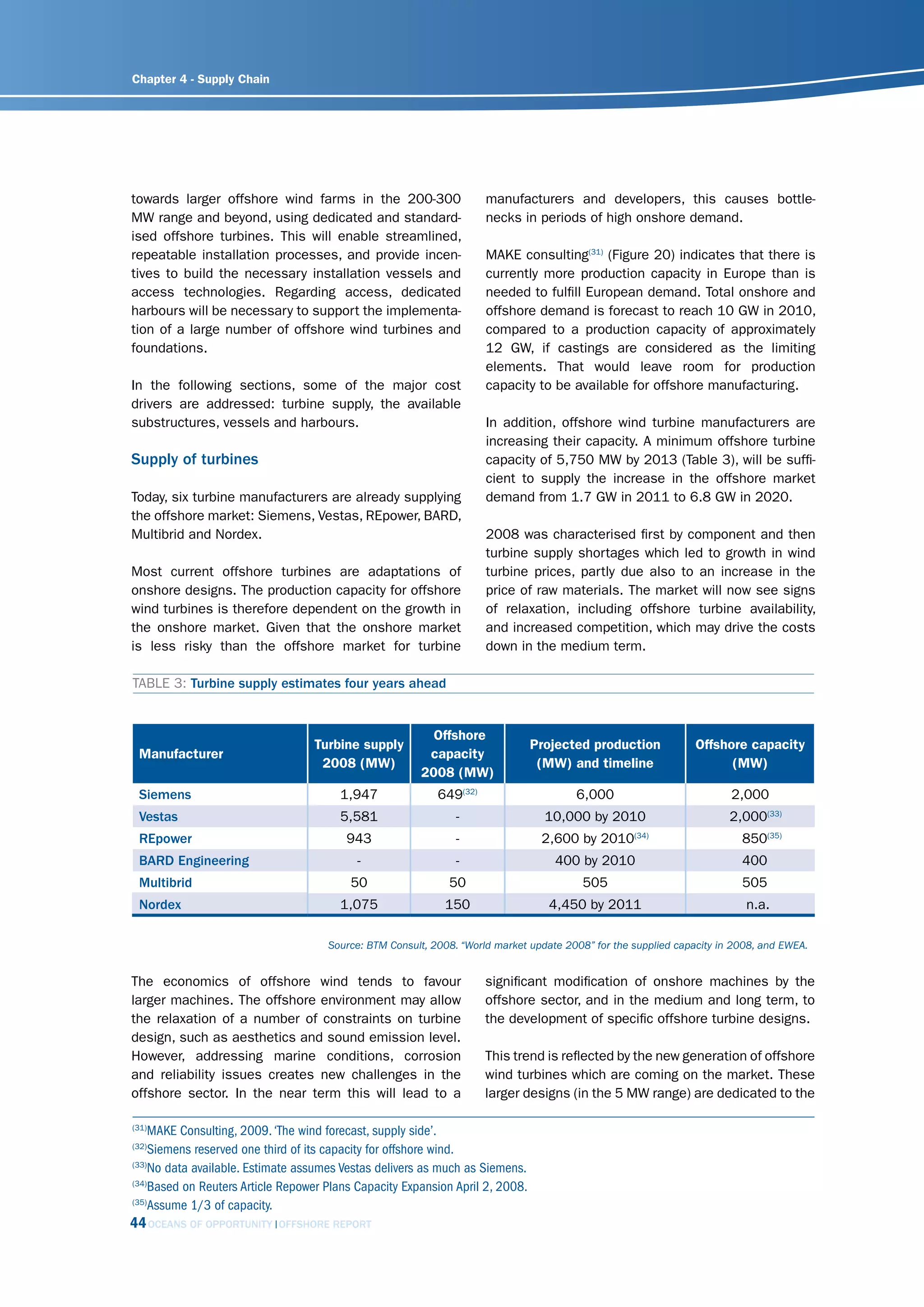

Until now, few studies have published estimates on

investment costs for a Europe-wide offshore grid. Two

recent reports made some preliminary calculations

which allow ballpark figures to be estimated for the

total investment cost of a transnational offshore grid.

• Greenpeace(27): this study proposed a grid in the

North Sea for 68 GW of offshore wind power, to

be in place by around 2025. The topology consid-

ered for the study has a total single line length of

6,200 km. Assuming 1 GW capacity per line, the

proposed grid would cost €15-20 billion;

• TradeWind(28): the additional investment costs were

estimated for a meshed offshore grid connecting

the “far” offshore wind farm clusters with a total

installed capacity of 80 GW in the North Sea to

those in the Baltic Sea, according to the 2030 high

scenario. The additional investment costs for the

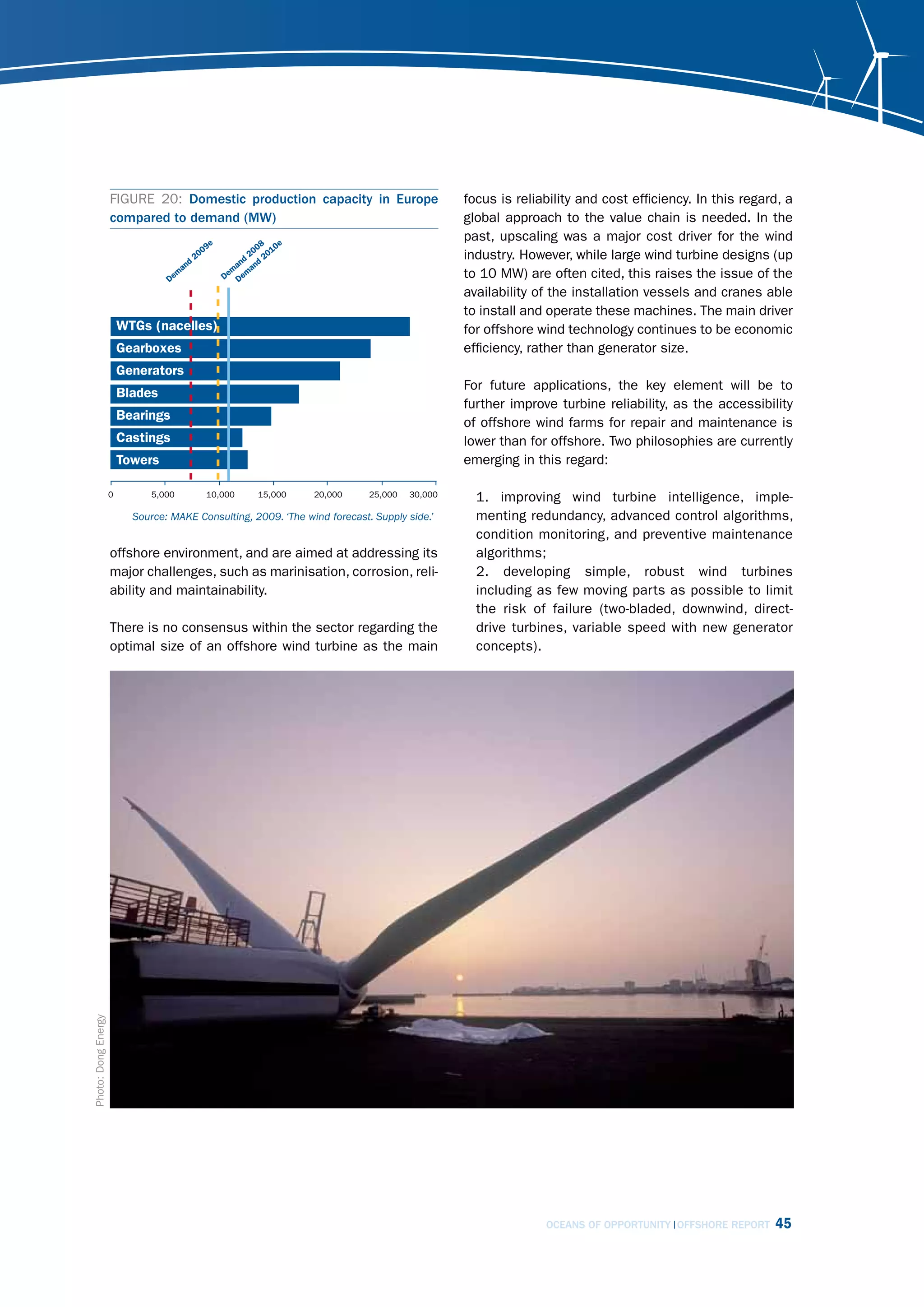

topology were estimated to be around €9 billion,

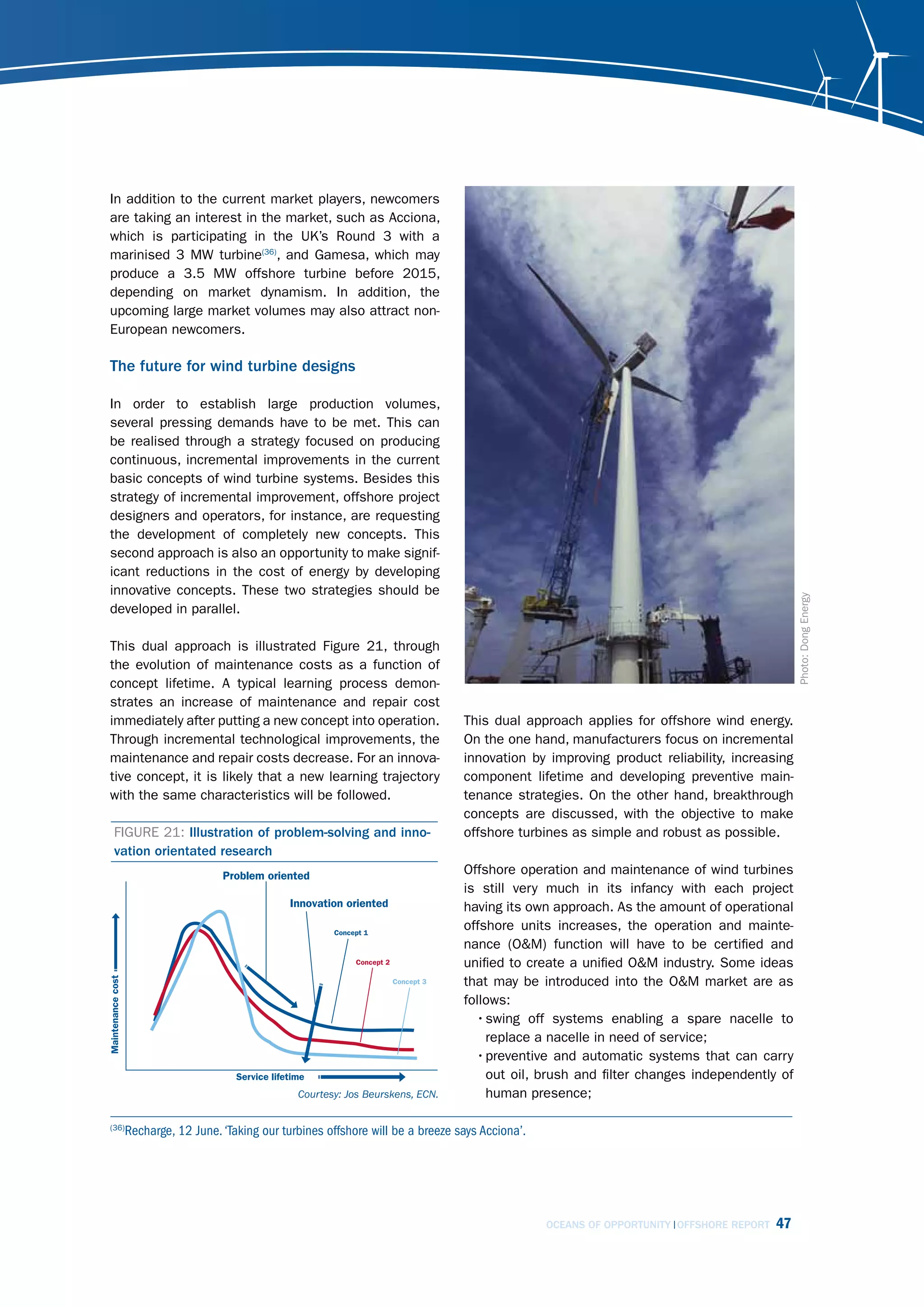

taking into account specific cable lengths and

transmission capacities (not including the costs

of the interconnectors envisaged already now for

trading purposes);

• for comparison purposes: the UK’s East Coast

Transmission study(29) looked at an offshore

network along the east coast of GB linking in the

Shetland and Orkney Islands in 2020. It estimated

a total investment cost of €5.5 billion.

Taking into account the fact that the offshore network

discussed in this chapter is more extensive than the

topologies used in the studies mentioned above, a safe

reduction in the operational costs of power generation bottom line assumption for investments in offshore

caused by dedicated grid upgrades. transmission up to 2030 is in the range of €20-30

billion. This number would include both the ‘trade’

For TradeWind’s 2020 grid and wind power scenario, interconnectors and the dedicated lines for wind power

the savings in operational costs amount to €1.5 connection. For comparison, the International Energy

billion per year, allowing for an average investment Agency (IEA) estimates total investments in European

cost of €490 million for each of the 42 transmis- electricity transmission grids of €187 billion in the

sion upgrade projects that were proposed, including period 2007-2030(30). The economic projections and

several offshore HVDC lines. Because this estimate budgeting should be made within the framework of a

assumed a less strong interconnection between total upgrade of the European transmission network,

the countries around the North Sea than the one which also comprises the required onshore upgrades.

proposed in this report, it should be considered as It is evident that a detailed assessment has to be

conservative. based on detailed network designs. Furthermore in

(27)

Greenpeace, 2008. ‘A North Sea Electricity Grid [R]evolution’. Available at: http://www.greenpeace.org/belgium.

(28)

TradeWind, 2009. ‘Integrating Wind - Developing Europe’s power market for the large-scale integration of wind power.’

Available at: http://www.trade-wind.eu.

(29)

Seanergy: East Coast Transmission (January 2008).

(30)

International Energy Agency, 2008. ‘World Energy Outlook’.

OCEANS OF OPPORTUNITY OFFSHORE REPORT 39](https://image.slidesharecdn.com/offshorereport2009-091021100454-phpapp02/75/Offshore-Report-2009-EWEA-41-2048.jpg)